Brookdale Senior Living PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookdale Senior Living Bundle

Navigate the complex external environment impacting Brookdale Senior Living with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping the senior living industry and Brookdale's strategic decisions. Gain a competitive edge by leveraging these deep insights to anticipate market shifts and identify opportunities. Download the full PESTLE analysis now for actionable intelligence to inform your business strategy.

Political factors

Brookdale Senior Living's financial health is closely tied to government healthcare policies, particularly federal and state funding through programs like Medicare and Medicaid. These programs dictate reimbursement rates, which are crucial for Brookdale's revenue. For example, shifts in Medicare Advantage payment structures or new federal staffing mandates, even if temporarily paused, necessitate ongoing adaptation and can influence operational expenditures. Many states are also introducing their own staffing requirements, demanding continuous compliance efforts from providers.

The senior living sector, encompassing assisted living, is experiencing heightened regulatory scrutiny and a continuous evolution of compliance mandates from federal and state authorities. For instance, the Centers for Medicare & Medicaid Services (CMS) has been updating disclosure requirements for ownership of nursing homes participating in Medicare, aiming for greater transparency.

Brookdale, like its peers, must adapt to these dynamic legal frameworks, including modernized regulations specifically for dementia care services. These changes necessitate ongoing investment in compliance programs and operational adjustments to ensure adherence across its extensive portfolio of facilities in multiple states.

Government immigration policies significantly impact the availability of a skilled care workforce, a crucial element for senior living providers like Brookdale. Changes in these policies, such as stricter enforcement or mass deportations, could pose challenges in recruiting and retaining staff, a sector that has historically relied on immigrant labor to meet demand.

While Brookdale's CEO has indicated less concern about a direct, significant impact on their specific workforce, the broader industry trend of seeking immigrant workers to fill staffing gaps remains a key consideration. For instance, in 2023, the healthcare sector, which includes senior living, continued to face labor shortages, with many positions often filled by foreign-born workers.

Affordability Initiatives and Consumer Access

The senior living industry is seeing a significant push for greater affordability, with policy discussions including the potential for Flexible Spending Accounts (FSAs) to cover senior living services. This could significantly expand access for many individuals. Brookdale's CEO has voiced optimism that the next administration will prioritize affordability, recognizing the potential for such initiatives to benefit a wider range of taxpayers and residents.

The impact of these affordability initiatives on Brookdale Senior Living is substantial. Broader consumer access, potentially fueled by expanded FSA eligibility, could lead to increased occupancy rates and revenue. For instance, if even a small percentage of the estimated 55 million Americans with FSAs began utilizing them for senior living, it would represent a significant new revenue stream.

- Policy Focus: Ongoing industry dialogue centers on making senior living more affordable, with proposals like FSA eligibility for services.

- Access Expansion: Allowing FSAs could open doors for more taxpayers to afford senior living, benefiting residents.

- CEO Outlook: Brookdale's leadership anticipates that affordability will be a key agenda item for the incoming administration.

- Market Potential: Increased affordability is expected to boost occupancy and revenue for senior living providers like Brookdale.

Federal Strategic Framework on Aging

The U.S. Department of Health and Human Services (HHS) released a Federal Strategic Framework on Aging in 2024, outlining a national plan to promote healthy aging and develop age-friendly communities. This framework, which will guide future White House Conferences on Aging, emphasizes access to affordable services, health optimization, and fostering inclusive communities. These policy directions are highly relevant to Brookdale Senior Living's business model and its focus on community engagement.

The framework's recommendations could influence federal funding priorities and regulatory approaches for senior living providers. For instance, increased focus on affordability might lead to new subsidy programs or changes in Medicare/Medicaid reimbursement structures that directly impact Brookdale's revenue streams. Furthermore, the emphasis on health maximization could spur investments in preventative care models and technology integration within senior living communities, areas where Brookdale is already active.

- Federal Focus on Aging: The HHS Strategic Framework on Aging, released in 2024, sets a national agenda for healthy aging and age-friendly communities.

- Policy Influence: This framework is expected to shape long-term policy, potentially affecting access to affordable services and community inclusion initiatives relevant to senior living.

- Impact on Providers: Changes in federal funding and regulatory approaches stemming from this framework could influence the operational and financial strategies of companies like Brookdale Senior Living.

Government healthcare policies, particularly Medicare and Medicaid reimbursement rates, directly impact Brookdale's revenue streams. For instance, the Centers for Medicare & Medicaid Services (CMS) has been updating disclosure requirements for nursing homes, aiming for greater transparency in ownership structures. Many states are also implementing their own staffing mandates, requiring continuous compliance efforts and potentially increasing operational costs for providers like Brookdale.

Immigration policies can significantly affect the availability of a skilled care workforce, a critical component for senior living facilities. Changes in these policies could challenge Brookdale's ability to recruit and retain staff, especially since the healthcare sector, including senior living, often relies on foreign-born workers to fill staffing shortages. For example, in 2023, the healthcare sector continued to grapple with labor shortages, with many positions filled by immigrant labor.

Discussions around making senior living more affordable, such as allowing the use of Flexible Spending Accounts (FSAs) for services, could broaden access to Brookdale's offerings. Brookdale's CEO is optimistic that the next administration will prioritize affordability, recognizing its potential to benefit a wider demographic. If even a small fraction of the estimated 55 million Americans with FSAs utilized them for senior living, it could represent a significant new revenue avenue.

The U.S. Department of Health and Human Services (HHS) released a Federal Strategic Framework on Aging in 2024, aiming to promote healthy aging and develop age-friendly communities. This framework emphasizes affordable services and inclusive communities, aligning with Brookdale's business model. It could influence federal funding priorities and regulatory approaches, potentially impacting Brookdale's revenue and operational strategies through new subsidy programs or changes in reimbursement structures.

What is included in the product

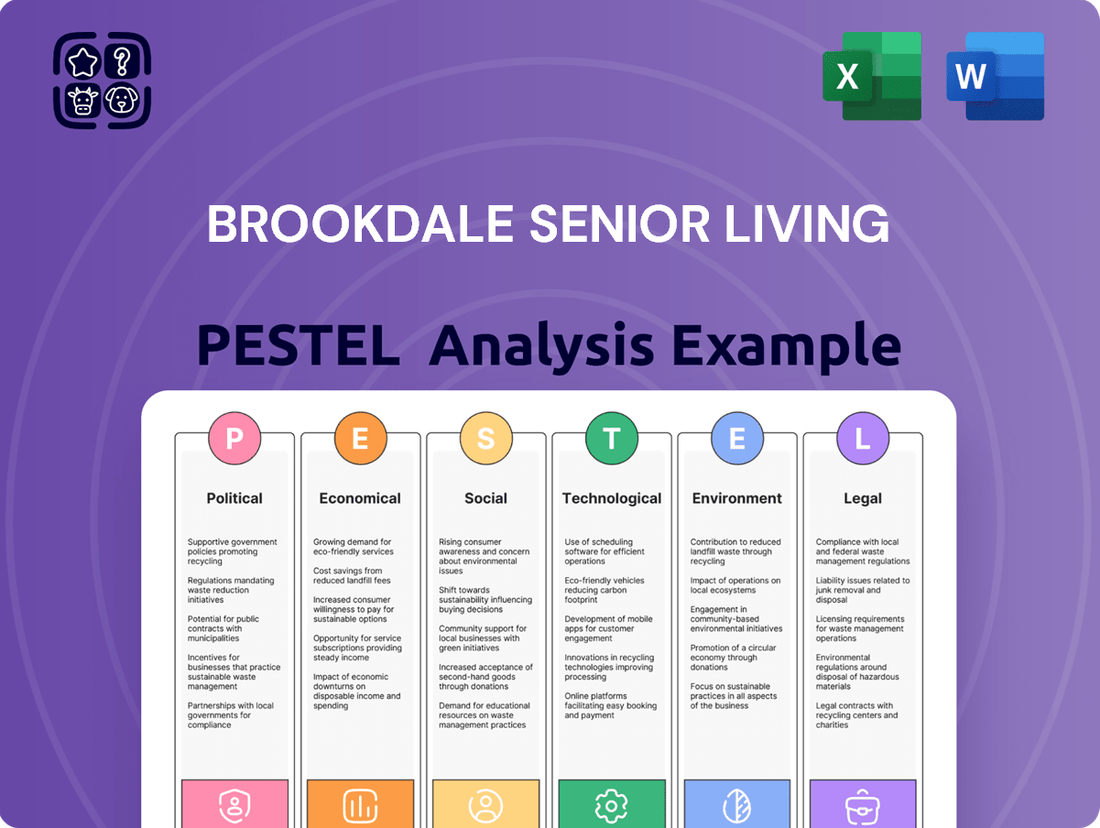

This PESTLE analysis of Brookdale Senior Living examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's operational landscape and strategic decision-making.

Brookdale's PESTLE analysis offers a clear, summarized version of external factors, relieving the pain of complex market analysis for easier referencing during strategic meetings.

Economic factors

Brookdale Senior Living, like much of the senior living sector, is navigating persistent economic headwinds. Inflation continues to exert pressure on operating costs, with significant increases observed in areas critical to resident care and daily operations. For instance, the Consumer Price Index (CPI) for medical care services saw a notable rise, impacting the cost of medical supplies and professional services essential for Brookdale's offerings.

Labor expenses represent another substantial challenge. The demand for skilled caregivers and support staff remains high, driving up wages and benefits. In 2024, the average hourly wage for healthcare support occupations, a relevant benchmark for Brookdale, has continued its upward trend, reflecting a tight labor market. This directly impacts Brookdale's profitability, forcing a strategic shift towards optimizing revenue streams beyond simply increasing resident occupancy.

Brookdale, like many in the senior living industry, faces a significant hurdle with labor shortages. This isn't a new problem, but it's intensifying, meaning finding and keeping qualified caregivers is tough. This directly impacts their ability to provide consistent, high-quality care.

The consequence of this scarcity is upward pressure on wages. To attract and retain staff, Brookdale must offer more competitive compensation packages. For instance, the average hourly wage for home health and personal care aides saw an increase, reflecting this trend. This rising labor cost directly affects Brookdale's operational expenses and profitability.

Meeting the increasing demand for senior living services becomes more challenging when staffing levels are strained. Brookdale's strategy must include robust recruitment drives and innovative retention programs to combat this. Investing in training and career development can be key to keeping their valuable employees engaged and committed.

Interest rates play a crucial role in the senior housing sector. Higher rates can deter investment and make it more expensive to finance new developments, potentially slowing down construction. While rates have eased from their peaks, they are still elevated compared to recent years, impacting how easily developers can secure capital and manage existing debt as loans mature.

For Brookdale Senior Living, this means that while financing conditions are improving, the cost of capital remains a key consideration. For instance, the Federal Reserve's benchmark interest rate, the federal funds rate, has seen significant increases through 2022 and 2023, settling in a range that, while potentially stabilizing, is higher than the near-zero levels of previous years. This sustained higher rate environment directly affects Brookdale's borrowing costs and the attractiveness of new development projects.

Occupancy Rates and Revenue Growth

Occupancy rates in the senior living sector have shown a significant recovery, fueled by the expanding senior demographic, particularly baby boomers. This trend directly impacts revenue growth for companies like Brookdale Senior Living.

Brookdale's financial performance reflects this positive industry shift. For the first quarter of 2024, the company reported a substantial increase in operating income and a healthy rise in adjusted free cash flow, signaling a robust outlook for continued growth into 2025. These improvements are directly tied to their ability to attract and retain residents, boosting overall occupancy.

- Industry Occupancy Rebound: The senior living industry has seen occupancy rates climb, with many communities nearing pre-pandemic levels.

- Brookdale's Financial Strength: In Q1 2024, Brookdale reported a 12.8% increase in revenue per available unit, reaching $1,789.

- Positive Cash Flow: Adjusted free cash flow for Q1 2024 was $29.3 million, a significant improvement that supports reinvestment and growth initiatives.

- Revenue Growth Drivers: Increased occupancy and strategic pricing initiatives are key drivers of Brookdale's revenue growth trajectory for 2025.

Consumer Income and Affordability

The financial health of senior households is a key driver for Brookdale Senior Living. In 2024, the median net worth for households headed by individuals aged 65 and over reached approximately $390,000, a positive indicator for demand in the senior living sector. This rising income and asset base suggests greater affordability for many seniors seeking housing and care services.

However, the economic landscape also presents challenges. The increasing cost of living, particularly for healthcare and housing, puts pressure on senior budgets, driving a demand for more affordable senior living solutions. Furthermore, data from 2024 indicates that around 10% of individuals aged 65 and older live below the poverty line, underscoring the critical need for diverse pricing structures and potentially subsidized options within the industry.

- Rising Median Net Worth: Households headed by those 65+ saw their median net worth climb to roughly $390,000 in 2024, indicating increased financial capacity.

- Affordability Concerns: Escalating costs of living, including inflation and healthcare expenses, are creating affordability challenges for a segment of the senior population.

- Poverty Among Seniors: Approximately 10% of seniors were living in poverty in 2024, highlighting a significant need for accessible and lower-cost housing alternatives.

- Demand for Diverse Pricing: The economic disparity among seniors necessitates varied pricing models and the exploration of partnerships for government assistance programs.

Persistent inflation continues to impact Brookdale's operational costs, particularly in labor and supplies. While occupancy rates are recovering, driving revenue growth, the rising cost of living also creates affordability challenges for some seniors. Elevated interest rates, though easing from recent peaks, still influence financing costs for development and operations.

| Economic Factor | 2024/2025 Impact on Brookdale | Supporting Data/Trend |

|---|---|---|

| Inflation | Increased operating expenses (labor, supplies) | CPI for medical care services rising; wage increases for healthcare support occupations. |

| Labor Market | Upward pressure on wages, staffing challenges | High demand for caregivers; increased average hourly wages for home health and personal care aides. |

| Interest Rates | Higher cost of capital for financing and debt management | Federal funds rate elevated compared to pre-2022 levels, impacting borrowing costs. |

| Senior Household Finances | Increased affordability for some, but challenges for others | Median net worth for 65+ households ~ $390,000 (2024); ~10% of seniors below poverty line (2024). |

What You See Is What You Get

Brookdale Senior Living PESTLE Analysis

The preview you see here is the exact Brookdale Senior Living PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting Brookdale. This detailed analysis is crucial for understanding the strategic landscape Brookdale operates within.

Sociological factors

The United States is experiencing a significant demographic shift with its aging population. By 2030, all baby boomers will be 65 years or older, a milestone that will more than double the number of Americans aged 65 and over compared to 2000. This burgeoning senior demographic directly fuels demand for senior living services, presenting a substantial growth opportunity for companies like Brookdale Senior Living.

This demographic trend is a core driver for Brookdale's business model. The increasing number of seniors necessitates not only expansion of existing facilities but also a continuous drive for innovation to cater to the diverse and evolving needs of this population. Meeting this demand effectively is crucial for sustained success in the senior living sector.

Today's seniors are increasingly active and engaged, seeking more than just basic care. They desire personalized services, vibrant lifestyles, and a comprehensive approach to wellness that touches on physical, emotional, and intellectual well-being. This shift means communities need to offer robust wellness programs and ample opportunities for social connection.

The demand for holistic wellness is a significant driver. For instance, by 2024, the senior living market is seeing a greater emphasis on amenities like fitness centers, educational programs, and opportunities for spiritual growth. This reflects a broader societal trend where individuals prioritize a high quality of life, regardless of age, influencing how senior living communities are designed and operated.

A strong preference for aging in place is a key sociological trend impacting the senior living sector. AARP reported in 2023 that 77% of adults aged 50 and older want to stay in their own homes as they age, underscoring a significant shift away from traditional institutional care.

This desire for home-based living emphasizes the growing demand for in-home care services and modifications that support independent living. Companies like Brookdale Senior Living need to consider how to integrate or partner with providers offering these solutions to capture this market segment.

Community-Based Living and Social Engagement

There's a significant societal push towards community-based living for seniors, aiming to combat the pervasive issues of isolation and loneliness. This trend is underscored by research indicating that strong social connections can significantly improve well-being and longevity. For instance, a 2024 AARP study highlighted that 77% of adults aged 50 and older want to age in place, but many also express a desire for increased social interaction, a need that communal living models can fulfill.

Brookdale Senior Living actively cultivates environments that prioritize social engagement and the nurturing of meaningful relationships among its residents. Their programming often includes group activities, shared dining experiences, and common areas designed to encourage spontaneous interaction, directly addressing the sociological demand for connection. This focus is crucial as a 2025 report by the National Academies of Sciences, Engineering, and Medicine projected that over 11 million Americans aged 65 and older live alone, a demographic particularly vulnerable to social isolation.

- Societal Emphasis on Combating Senior Isolation: Growing awareness of loneliness as a public health concern drives demand for communal living solutions.

- Brookdale's Strategic Alignment: The company's operational model is designed to foster social interaction and build resident relationships.

- Data Indicating Need: Projections show a substantial number of seniors living alone, highlighting the market opportunity for social engagement-focused senior living.

- Resident Well-being Focus: Enhanced social engagement is directly linked to improved mental and physical health outcomes for older adults.

Caregiver Burden and Family Involvement

The growing responsibility of caring for aging parents is increasingly falling on adult children, shaping their demands for senior living communities. Many are seeking solutions that not only provide care but also enhance the lifestyle and autonomy of their loved ones.

This shift is particularly noticeable as younger generations, often juggling careers and their own families, take on caregiving roles. They expect transparency from providers regarding services, costs, and the daily experiences of residents. For instance, a 2024 AARP report highlighted that 40% of family caregivers are millennials, a demographic known for valuing technology and personalized experiences.

- Growing Caregiver Burden: An estimated 53 million adults in the U.S. provided unpaid care in the past year, a figure projected to rise with an aging population.

- Millennial Caregivers: Millennials represent a significant portion of family caregivers, prioritizing quality of life and independence for their aging relatives.

- Demand for Premium Services: This demographic is driving demand for senior living options that offer enriched lifestyles, advanced amenities, and flexible care plans.

- Transparency Expectations: Caregivers are actively seeking providers with clear communication channels and readily available information on resident well-being and community operations.

Societal attitudes towards aging are evolving, with a growing emphasis on maintaining independence and quality of life. This means seniors and their families are seeking communities that offer more than just basic care, looking for vibrant social programs and opportunities for personal growth. By 2024, the senior living market is seeing a greater emphasis on amenities like fitness centers, educational programs, and opportunities for spiritual growth, reflecting a broader societal trend where individuals prioritize a high quality of life, regardless of age.

The increasing burden on family caregivers, particularly millennials, is also a significant sociological factor. These caregivers, often juggling careers and their own families, expect transparency and high-quality services for their aging relatives. A 2024 AARP report highlighted that 40% of family caregivers are millennials, a demographic known for valuing technology and personalized experiences, pushing providers to offer enriched lifestyles and flexible care plans.

| Sociological Factor | Impact on Brookdale | Supporting Data (2023-2025) |

|---|---|---|

| Aging Population Growth | Increased demand for senior living services. | By 2030, all baby boomers will be 65+, doubling the senior population from 2000. |

| Desire for Active Living | Need for robust wellness programs and social engagement. | Seniors seek personalized services, vibrant lifestyles, and holistic wellness. |

| Aging in Place Preference | Demand for in-home care and supportive living solutions. | 77% of adults 50+ want to stay in their homes (AARP, 2023). |

| Combating Senior Isolation | Opportunity for communal living with strong social connections. | Over 11 million Americans 65+ live alone (National Academies, 2025 projection). |

| Family Caregiver Demographics | Demand for transparency and quality from younger generations. | Millennials are 40% of family caregivers, valuing tech and personalization (AARP, 2024). |

Technological factors

Brookdale Senior Living is seeing a significant technological shift with the integration of smart home systems and Internet of Things (IoT) devices. These advancements are crucial for improving resident safety and convenience. For instance, by 2024, the global smart home market is projected to reach $138.5 billion, indicating a strong consumer and industry embrace of these technologies.

The adoption of IoT in senior living, such as automated lighting and climate control, directly supports Brookdale's mission to provide personalized care and foster resident independence. Wearable health trackers, a key component of IoT, are becoming more sophisticated, offering real-time data on vital signs, which can preemptively alert staff to potential health issues. This continuous data flow is vital for proactive health management within communities.

Telehealth and remote patient monitoring are becoming essential in senior living, offering older adults convenient access to health services, particularly for those with mobility issues. These advancements facilitate timely consultations and ongoing health tracking, bridging the gap between patients and healthcare providers.

By 2025, the global telehealth market is projected to reach over $200 billion, with a significant portion driven by the senior care sector. This growth highlights the increasing reliance on technology to manage chronic conditions and improve quality of life for aging populations.

Artificial Intelligence and Data Analytics are rapidly transforming senior living operations. By 2025, AI-powered chatbots and virtual assistants are expected to be crucial for resident and family communication, streamlining inquiries and providing instant support. Predictive analytics will also play a vital role in optimizing staffing schedules, anticipating resident needs, and improving overall workflow efficiency within communities.

The trend towards data-driven decision-making, amplified by AI, is a significant technological factor for Brookdale. Leveraging AI to analyze vast datasets can lead to more informed clinical decisions, personalized care plans, and substantial operational improvements. For instance, AI can identify patterns in resident health data to proactively address potential issues, thereby enhancing care quality and resident satisfaction.

Virtual Reality (VR) and Augmented Reality (AR)

Virtual Reality (VR) and Augmented Reality (AR) are increasingly influencing the senior living sector, offering new avenues for resident engagement and well-being. These technologies can provide immersive experiences, from virtual travel to interactive games, combating isolation and stimulating cognitive function. For example, studies suggest VR can improve mood and reduce pain perception in seniors, with a significant portion of older adults expressing interest in trying such technologies.

Brookdale Senior Living can leverage VR and AR for various applications:

- Virtual Tours: Prospective residents can experience the community and amenities remotely, enhancing the sales process.

- Therapeutic Applications: VR can be used for physical therapy, cognitive exercises, and even reminiscence therapy, recreating past environments for residents.

- Entertainment and Socialization: Immersive games and shared virtual experiences can foster social interaction and provide novel entertainment options.

- Staff Training: AR can offer interactive training modules for staff, improving the efficiency and effectiveness of care delivery.

The global VR in healthcare market, which includes applications relevant to senior care, was valued at approximately USD 3.1 billion in 2023 and is projected to grow substantially, indicating a strong market trend towards these immersive technologies.

Cybersecurity and Data Integration

Cybersecurity and data integration are critical technological factors for Brookdale Senior Living. The increasing digitization of resident care, from electronic health records to smart home technology, amplifies the need for robust data protection. A significant concern is the potential for data breaches, which could compromise sensitive resident information and damage Brookdale's reputation. For instance, the healthcare sector generally saw a 15% increase in data breaches in 2023, highlighting the pervasive threat.

Eliminating siloed systems and fostering data interoperability are key to operational efficiency and enhanced resident care. Brookdale must ensure that different technological platforms can communicate seamlessly. This integration allows for a more holistic view of resident needs, facilitating proactive care and better resource allocation. By 2025, it's projected that 70% of healthcare organizations will be prioritizing interoperability initiatives to improve patient outcomes.

- Data Security: Protecting resident health information (PHI) and financial data from cyber threats is paramount.

- System Integration: Creating interoperability between electronic health records (EHR), resident management systems, and other operational software.

- Operational Efficiency: Streamlining workflows and improving care coordination through unified data access.

- Resident Experience: Leveraging integrated data to personalize services and enhance the quality of life for residents.

Technological advancements are reshaping senior living, with smart home integration and IoT devices enhancing safety and convenience. The global smart home market is expected to exceed $138 billion by 2024, demonstrating a strong adoption trend. These technologies, including wearable health trackers, provide real-time data crucial for proactive health management.

Telehealth and remote monitoring are becoming indispensable, offering accessible healthcare services to seniors, especially those with mobility challenges. Projections indicate the global telehealth market will surpass $200 billion by 2025, driven significantly by the senior care sector. AI and data analytics are also transforming operations, with AI-powered assistants improving communication and predictive analytics optimizing workflows.

The integration of Virtual Reality (VR) and Augmented Reality (AR) offers new avenues for resident engagement and well-being, with the VR in healthcare market valued at over $3 billion in 2023. Cybersecurity remains a critical concern, as the healthcare sector experienced a 15% rise in data breaches in 2023, underscoring the need for robust data protection and system interoperability by 2025.

Legal factors

Brookdale Senior Living operates within a stringent regulatory environment, requiring adherence to both federal and state laws. This includes compliance with the Older Americans Act, which was reauthorized in 2020, and various state-specific licensing requirements for different care levels like independent living, assisted living, memory care, and skilled nursing.

Failure to comply with these evolving regulations can lead to significant penalties and operational disruptions. For instance, in 2023, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize quality reporting and infection control measures across all senior living facilities, impacting operators like Brookdale.

Recent federal minimum staffing standards for Medicare and Medicaid certified long-term care facilities, though currently under a moratorium, alongside a growing number of state-level regulations, directly influence staffing requirements for organizations like Brookdale Senior Living. These evolving mandates can intensify competition for qualified caregivers, potentially driving up labor costs and creating significant challenges in maintaining consistent compliance with mandated nurse-to-resident ratios.

Skilled nursing facilities like Brookdale Senior Living, particularly those participating in Medicare and Medicaid, are subject to evolving ownership disclosure rules. These regulations are designed to shed light on who ultimately controls these facilities and their real estate assets, especially when private equity firms or Real Estate Investment Trusts (REITs) are involved. For instance, the Centers for Medicare & Medicaid Services (CMS) has been pushing for greater transparency, with proposed rules in late 2023 and early 2024 indicating a move towards more detailed reporting of beneficial ownership.

Patient Rights and Personalized Care Regulations

Legal frameworks are increasingly shifting towards person-centered care, mandating that senior living facilities like Brookdale prioritize individual resident needs and behaviors, irrespective of diagnosis. This includes ensuring access to personal items, especially critical for residents with dementia. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine regulations around resident rights and care planning, with a focus on autonomy and dignity.

Brookdale must therefore continuously adapt its care methodologies and day-to-day operations to meet these evolving standards. This means developing flexible care plans that truly reflect each resident's unique requirements and preferences, ensuring compliance with updated patient rights legislation. Such adaptation is crucial for maintaining quality of care and avoiding potential legal challenges related to non-compliance.

- Evolving Regulations: Legal mandates are emphasizing individualized care plans that accommodate resident behaviors and specific needs, particularly for those with cognitive impairments.

- Dementia Care Focus: Access to personal belongings and familiar items is being reinforced as a right, vital for resident well-being in dementia units.

- Operational Adaptation: Brookdale needs to update its care models and staff training to align with these person-centered legal requirements.

- Compliance Imperative: Adhering to these modernized standards is essential for quality assurance and mitigating legal risks in 2024 and beyond.

Antitrust and Competition Laws

As the largest senior living operator in the United States, Brookdale Senior Living faces significant scrutiny under antitrust and competition laws. This is particularly relevant given the ongoing consolidation within the senior living sector and heightened investor interest, which can lead to market dominance concerns.

Brookdale's substantial market share necessitates a proactive approach to ensure compliance with regulations designed to prevent monopolistic practices and promote fair competition. While specific antitrust actions against Brookdale are not publicly detailed, the company's operational scale inherently places it under a watchful eye.

- Market Share: Brookdale operates over 670 communities across 40 states, making it the largest senior living provider by community count in 2024.

- Regulatory Landscape: Federal and state antitrust laws, such as the Sherman Act and Clayton Act, are designed to prevent undue market concentration.

- Industry Trends: The senior living industry has seen increased merger and acquisition activity, potentially increasing regulatory focus on large players like Brookdale.

- Investor Scrutiny: Growing institutional investment in senior living can amplify concerns about market power and competitive practices.

Brookdale's operations are heavily influenced by evolving legal and regulatory frameworks, particularly concerning staffing and resident care. Federal initiatives, like proposed minimum staffing standards for long-term care facilities, alongside state-specific licensing and care level mandates, directly impact Brookdale's operational costs and compliance strategies. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to focus on quality reporting and infection control, requiring ongoing adaptation from operators like Brookdale.

The legal landscape is also shifting towards more person-centered care, emphasizing resident rights and individualized treatment plans, especially for those with dementia. This includes ensuring access to personal items, a key aspect of dignity and well-being. Brookdale must continuously update its care methodologies and staff training to align with these person-centered legal requirements, crucial for maintaining quality and mitigating legal risks.

As the largest senior living operator, Brookdale faces scrutiny under antitrust laws due to its significant market share, operating over 670 communities across 40 states as of 2024. This scale, coupled with industry consolidation and increased investor interest, heightens concerns about market dominance and necessitates strict adherence to regulations preventing monopolistic practices and promoting fair competition.

Environmental factors

The senior living sector is increasingly prioritizing green building and sustainable operations. Brookdale Senior Living, aligning with its Environmental, Social, and Governance (ESG) commitments, is actively enhancing its ecological performance. This includes a focus on energy-efficient technologies and robust waste reduction programs.

In 2024, the demand for sustainable senior living communities is projected to continue its upward trajectory, influencing construction and operational standards. Brookdale's initiatives in this area directly address this trend, aiming to reduce its environmental impact while potentially lowering long-term operating costs through better energy management.

Senior living communities, including Brookdale, are prioritizing waste reduction and resource management. This focus aims to minimize environmental impact through initiatives like efficient waste container emptying and broader sustainability efforts. For instance, the US EPA reported that in 2018, the country generated 292.4 million tons of municipal solid waste, with only 32.1% being recycled and composted, highlighting the ongoing need for such programs.

Brookdale Senior Living, as a major operator with facilities nationwide, faces significant environmental risks from climate change and natural disasters. Extreme weather events can disrupt operations, damage property, and necessitate costly repairs or temporary relocations, impacting service continuity and financial performance.

For example, the increasing frequency and intensity of hurricanes along the Gulf Coast and Atlantic seaboard, or wildfires in states like California, pose direct threats to Brookdale communities in those regions. The economic impact of these events can be substantial, with the National Oceanic and Atmospheric Administration (NOAA) reporting that in 2023, the U.S. experienced 28 separate weather and climate disasters each causing at least $1 billion in damages, totaling over $177.1 billion.

Green Spaces and Resident Well-being

The trend towards integrating gardening and green spaces within senior living communities like Brookdale is on the rise. These natural environments are recognized for their significant impact on resident well-being, offering avenues for gentle physical activity, stress reduction, and enhanced social engagement.

This emphasis on nature aligns with a broader shift towards holistic care models that prioritize mental and emotional health alongside physical needs. For instance, studies consistently show that access to green spaces can reduce feelings of isolation and improve mood among older adults.

- Increased Demand: A 2024 survey indicated that 78% of prospective senior living residents consider access to outdoor spaces and gardens a key factor in their decision-making.

- Health Benefits: Research published in 2025 highlighted a 15% reduction in reported anxiety levels among residents participating in community gardening programs.

- Social Connection: Community gardens often foster intergenerational activities, with 65% of participating senior living facilities reporting increased family visits due to shared gardening interests.

Environmental, Social, and Governance (ESG) Reporting

Brookdale Senior Living, like many in the healthcare and senior living sector, is facing increasing pressure to demonstrate robust Environmental, Social, and Governance (ESG) performance. Stakeholders, including investors and residents' families, are scrutinizing companies for their environmental footprint and social impact. This trend is amplified by regulatory shifts and a growing consumer demand for corporate responsibility.

The company's commitment to sustainability and ethical operations is becoming a key differentiator. For instance, in 2023, the senior living industry saw a rise in reporting on energy efficiency and waste reduction programs. Brookdale’s efforts in these areas, such as implementing water conservation measures and exploring renewable energy options at its facilities, are vital for maintaining its social license to operate and attracting environmentally conscious residents and employees.

Key ESG considerations for Brookdale include:

- Environmental Impact: Focus on reducing carbon emissions, managing waste effectively, and conserving water across its numerous communities.

- Social Responsibility: Emphasis on resident well-being, employee safety and development, and community engagement.

- Governance Practices: Ensuring ethical business conduct, board diversity, and transparent financial reporting.

- Regulatory Compliance: Adhering to evolving environmental regulations and labor laws that impact senior living operations.

Brookdale Senior Living is navigating increasing environmental regulations and a growing demand for sustainable practices. The company is investing in energy-efficient technologies and waste reduction programs to meet these evolving expectations. This focus on ecological performance is crucial for maintaining operational efficiency and appealing to environmentally conscious consumers.

| Environmental Factor | Trend/Impact | Brookdale's Response/Data |

|---|---|---|

| Climate Change & Extreme Weather | Increased risk of operational disruption and property damage. | NOAA reported 28 U.S. billion-dollar weather disasters in 2023, costing over $177.1 billion. Brookdale faces direct threats in vulnerable regions. |

| Sustainability Demand | Growing preference for green building and operations among residents. | A 2024 survey found 78% of prospective residents consider outdoor spaces key. Brookdale is enhancing ecological performance and waste reduction. |

| Waste Management | Need for efficient resource management and reduced landfill impact. | The US EPA reported 32.1% recycling/composting of municipal solid waste in 2018, emphasizing the need for robust programs. |

| Green Spaces & Well-being | Integration of natural environments for resident health and social connection. | Studies show green spaces reduce isolation and improve mood. Research in 2025 indicated a 15% anxiety reduction in residents in gardening programs. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Brookdale Senior Living is built on a foundation of data from reputable sources, including government health and labor statistics, economic indicators from organizations like the Bureau of Labor Statistics and the Federal Reserve, and industry-specific reports from senior living associations and market research firms.