Brookdale Senior Living Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookdale Senior Living Bundle

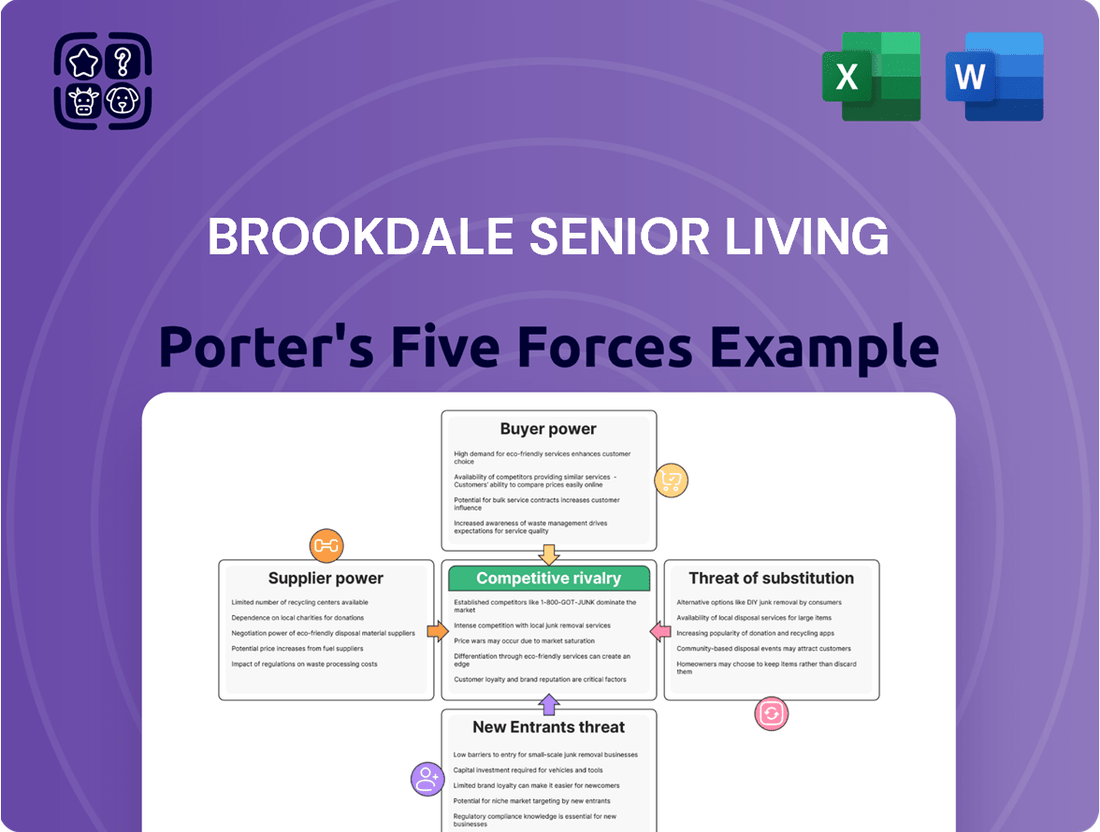

Brookdale Senior Living navigates a complex landscape shaped by significant buyer power and the constant threat of substitutes. Understanding these forces is crucial for anyone looking to grasp their competitive position.

The complete report reveals the real forces shaping Brookdale Senior Living’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The scarcity of qualified healthcare professionals, such as nurses and caregivers, significantly boosts their bargaining power with companies like Brookdale Senior Living. This means Brookdale needs to offer attractive compensation and benefits to secure and keep essential staff, which directly affects their operating expenses and overall profitability.

The demand for senior care is rising, and the healthcare workforce is aging, further intensifying this labor shortage. For instance, the U.S. Bureau of Labor Statistics projected a 23% growth for registered nurses between 2022 and 2032, much faster than the average for all occupations, highlighting the competitive landscape for talent.

Suppliers of specialized medical equipment, pharmaceuticals, and advanced care technology hold significant sway over Brookdale Senior Living. Their unique or proprietary products are crucial for delivering quality care and maintaining operational efficiency, leaving Brookdale with few viable alternatives. For instance, the demand for sophisticated resident monitoring systems and electronic health records, critical components in modern senior care, further strengthens these suppliers' negotiating positions and ability to influence pricing.

The bargaining power of real estate and property owners is a significant factor for Brookdale Senior Living. While many of its communities are owned, a portion are leased, granting landlords considerable leverage, particularly in sought-after or geographically constrained markets. This can translate into higher rental costs or less favorable lease terms for Brookdale.

The long-term commitment inherent in property leases, coupled with the substantial expenses and operational disruption involved in relocating or constructing new facilities, creates high switching costs for Brookdale. This makes it difficult and costly for the company to move to different properties if lease terms become unfavorable, thereby strengthening the suppliers' position.

Furthermore, this supplier power extends to property developers when Brookdale considers expansion through acquisition or new construction. Developers can command premium prices or dictate terms for new builds, especially if demand for senior living facilities in a particular area is high. For instance, in 2024, the average cost to build a senior living community can range from $15 million to $30 million, depending on size and amenities, giving developers considerable pricing power.

Food and General Consumables Vendors

Suppliers of everyday items like food, office supplies, and general consumables generally hold less sway. This is because there are so many vendors available, and Brookdale's significant purchasing volume allows it to negotiate better prices and terms. For instance, in 2024, the senior living industry continued to see a competitive landscape for food service providers, with many regional and national distributors vying for contracts.

Brookdale's scale is a key factor in mitigating supplier power. By consolidating purchases across its many facilities, the company can command discounts that smaller operators cannot. This purchasing power is crucial for managing operational costs effectively. In 2023, Brookdale reported significant procurement savings through strategic vendor relationships, contributing to its overall financial performance.

- Fragmented Market: The broad availability of multiple suppliers for food and general consumables limits individual vendor power.

- Purchasing Volume: Brookdale's size allows it to leverage bulk purchasing for better pricing and contract terms.

- Negotiating Leverage: The company actively negotiates with suppliers to secure cost advantages.

- Niche Exceptions: While generally low, power can increase for suppliers of specialized items like specific dietary foods.

Utility and Infrastructure Services

Utility providers like electricity, water, and internet services often hold significant sway due to their regional monopoly status. This means Brookdale Senior Living has limited options when it comes to negotiating prices or terms for these essential services. For instance, in 2024, average commercial electricity prices in the US saw an increase, directly impacting the operational costs for facilities like Brookdale's.

These utilities are fundamental to the daily operations of any senior living community, making Brookdale highly dependent on them. Consequently, Brookdale has little leverage to push back against rising costs or unfavorable contract conditions imposed by these providers. The essential nature of these services means Brookdale must accept their pricing and terms to maintain functionality.

- Monopolistic Tendencies: Regional utility providers often operate without significant competition, giving them pricing power.

- Essential Services: Electricity, water, and internet are non-discretionary for senior living operations, reducing Brookdale's ability to substitute.

- Cost Pass-Through: Fluctuations in energy markets or infrastructure upgrades by utilities can directly translate into higher operating expenses for Brookdale.

- 2024 Cost Pressures: Reports from the U.S. Energy Information Administration indicated continued volatility in energy prices throughout 2024, a trend likely affecting Brookdale's utility bills.

The bargaining power of suppliers for Brookdale Senior Living is multifaceted, with significant leverage held by those providing essential labor and specialized resources. The scarcity of qualified healthcare professionals, such as nurses and caregivers, significantly boosts their bargaining power with companies like Brookdale. This means Brookdale needs to offer attractive compensation and benefits to secure and keep essential staff, which directly affects their operating expenses and overall profitability. The demand for senior care is rising, and the healthcare workforce is aging, further intensifying this labor shortage. For instance, the U.S. Bureau of Labor Statistics projected a 23% growth for registered nurses between 2022 and 2032, much faster than the average for all occupations, highlighting the competitive landscape for talent.

Suppliers of specialized medical equipment, pharmaceuticals, and advanced care technology hold significant sway over Brookdale Senior Living. Their unique or proprietary products are crucial for delivering quality care and maintaining operational efficiency, leaving Brookdale with few viable alternatives. For instance, the demand for sophisticated resident monitoring systems and electronic health records, critical components in modern senior care, further strengthens these suppliers' negotiating positions and ability to influence pricing. The bargaining power of real estate and property owners is a significant factor for Brookdale Senior Living. While many of its communities are owned, a portion are leased, granting landlords considerable leverage, particularly in sought-after or geographically constrained markets. This can translate into higher rental costs or less favorable lease terms for Brookdale.

The long-term commitment inherent in property leases, coupled with the substantial expenses and operational disruption involved in relocating or constructing new facilities, creates high switching costs for Brookdale. This makes it difficult and costly for the company to move to different properties if lease terms become unfavorable, thereby strengthening the suppliers' position. Furthermore, this supplier power extends to property developers when Brookdale considers expansion through acquisition or new construction. Developers can command premium prices or dictate terms for new builds, especially if demand for senior living facilities in a particular area is high. For instance, in 2024, the average cost to build a senior living community can range from $15 million to $30 million, depending on size and amenities, giving developers considerable pricing power.

Suppliers of everyday items like food, office supplies, and general consumables generally hold less sway. This is because there are so many vendors available, and Brookdale's significant purchasing volume allows it to negotiate better prices and terms. For instance, in 2024, the senior living industry continued to see a competitive landscape for food service providers, with many regional and national distributors vying for contracts. Brookdale's scale is a key factor in mitigating supplier power. By consolidating purchases across its many facilities, the company can command discounts that smaller operators cannot. This purchasing power is crucial for managing operational costs effectively. In 2023, Brookdale reported significant procurement savings through strategic vendor relationships, contributing to its overall financial performance.

| Supplier Type | Bargaining Power Level | Key Factors | Impact on Brookdale |

|---|---|---|---|

| Healthcare Professionals | High | Labor shortage, aging workforce, specialized skills | Increased labor costs, retention challenges |

| Medical Equipment/Tech | High | Proprietary technology, essential for care quality | Higher procurement costs, limited alternatives |

| Real Estate/Property | Moderate to High | Lease terms, location desirability, switching costs | Rental expenses, lease negotiation leverage |

| General Consumables (Food, Office Supplies) | Low | Fragmented market, high purchasing volume | Ability to negotiate favorable pricing |

| Utility Providers | High | Regional monopolies, essential services | Direct impact on operating expenses, limited negotiation |

What is included in the product

This analysis dissects the competitive landscape for Brookdale Senior Living, examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Brookdale's Five Forces analysis provides a clear, actionable framework to navigate competitive pressures, helping leadership make informed strategic decisions to alleviate market-related anxieties.

Customers Bargaining Power

The significant financial outlay and deep emotional commitment involved in choosing senior living services inherently strengthen the bargaining power of customers. Families and prospective residents are compelled to thoroughly research and compare various providers, meticulously scrutinizing costs and demanding clear value for their substantial investment.

This high cost, coupled with the emotional weight of the decision, means customers are less likely to make hasty choices. Instead, they actively seek detailed justifications for pricing structures and service offerings, ensuring they receive the best possible care and value for their money.

The significant number of senior living options available, including those from competitors like Sunrise Senior Living and Atria, greatly enhances customer bargaining power. In 2024, the senior living sector continued to see robust development, with many markets offering dozens of communities. This abundance means residents can easily compare services, pricing, and quality of care, leading to greater negotiation leverage.

The rise of information transparency, particularly through online platforms and review sites, significantly bolsters the bargaining power of customers evaluating senior living options. Families can now access a wealth of data on reputation, care quality, and resident satisfaction, leveling the playing field and reducing information asymmetry. This readily available information allows potential residents and their families to compare Brookdale Senior Living offerings against competitors, armed with insights into pricing and service experiences, giving them more leverage in their decision-making process.

High Switching Costs (Post-Enrollment)

Once a senior resident has moved into a Brookdale community, the costs associated with switching become exceptionally high. These costs are not just financial but also deeply emotional and social, significantly diminishing a resident's leverage once they are settled. For instance, the sheer effort of relocating, re-establishing social connections, and navigating new administrative processes for services like healthcare and dining makes a move to a competitor a daunting prospect.

This inherent difficulty in switching communities creates a substantial "lock-in" effect for Brookdale's residents. The disruption involved in moving, which includes packing, unpacking, and the emotional toll of leaving a familiar environment, acts as a powerful deterrent. Furthermore, the process of building new relationships with staff and fellow residents means that leaving would mean abandoning an established social network.

The high switching costs directly translate to reduced bargaining power for customers post-enrollment. Brookdale Senior Living benefits from this as residents are less likely to demand concessions or switch providers once they have invested time and emotional energy into their current community. This stability is crucial for the company's revenue streams and operational planning.

- High Post-Enrollment Switching Costs: Logistical, emotional, and social barriers make it difficult for seniors to change communities after moving in.

- Disruption and Re-establishment: The effort involved in moving, adapting to a new environment, and forming new relationships discourages switching.

- Reduced Customer Bargaining Power: The "lock-in" effect limits residents' ability to negotiate terms or easily seek alternative senior living options.

- Operational Stability: These high switching costs contribute to predictable occupancy and revenue for Brookdale Senior Living.

Demand for Personalized Care and Outcomes

Customers are increasingly seeking personalized care plans and specific amenities for their loved ones. This demand for tailored services, such as specialized memory care or unique health support, can empower residents and their families to negotiate terms with providers like Brookdale. The perceived quality of life and tangible health improvements become critical factors influencing satisfaction and retention, giving customers more leverage.

- Demand for Tailored Services: Families expect individualized care strategies, not one-size-fits-all solutions.

- Focus on Outcomes: Demonstrable positive health and well-being results are key negotiation points.

- Negotiating Power: The ability to choose providers based on personalized offerings strengthens customer influence.

The bargaining power of customers in the senior living sector is substantial, driven by high initial costs and the emotional weight of the decision. In 2024, the availability of numerous senior living communities across many markets, including those offered by competitors like Sunrise Senior Living and Atria, provided residents with ample choices. This competitive landscape empowers consumers to meticulously compare services, pricing, and quality of care, thereby increasing their leverage when negotiating terms with providers like Brookdale Senior Living.

While switching costs are high once a resident is settled, diminishing their post-enrollment bargaining power, the initial research phase is critical. The increasing transparency of information through online reviews and platforms allows families to thoroughly vet providers, demanding clear value for their investment. This informed consumer base actively seeks personalized care plans and demonstrable improvements in quality of life, further strengthening their position to negotiate favorable terms.

| Factor | Impact on Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Availability of Competitors | Increases power | Many markets had dozens of senior living communities available in 2024. |

| Information Transparency | Increases power | Online review sites and consumer forums provide detailed comparative data. |

| Switching Costs (Post-Enrollment) | Decreases power | Logistical, emotional, and social barriers make moving difficult. |

| Demand for Personalization | Increases power | Families seek tailored memory care and specific health support services. |

Preview the Actual Deliverable

Brookdale Senior Living Porter's Five Forces Analysis

This preview showcases the comprehensive Brookdale Senior Living Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the senior living industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights without any placeholders or modifications.

Rivalry Among Competitors

Despite Brookdale Senior Living's position as the largest operator, the senior living sector remains notably fragmented. This means Brookdale contends with a vast array of competitors, ranging from national brands and regional providers to numerous independent communities, all vying for the growing senior demographic.

This intense competition forces companies like Brookdale to constantly innovate. Expect aggressive marketing campaigns, competitive pricing adjustments, and continuous enhancements to amenities and services as providers strive to attract and retain residents in this crowded landscape.

While the aging population, a significant demographic tailwind, promises sustained demand for senior living, Brookdale faces intense competition in localized markets. For instance, in 2024, certain metropolitan areas saw a surge in new senior living facilities, creating temporary over-supply. This dynamic forces operators to compete more aggressively on price and service to attract residents.

This localized over-supply directly impacts Brookdale's pricing power and occupancy rates. When more units are available than there are residents, the pressure to discount rates or increase marketing expenditures intensifies. The balance between these demographic tailwinds and the reality of local supply and demand is a critical factor influencing Brookdale's competitive landscape.

Senior living communities, including those operated by Brookdale, face significant competitive rivalry driven by high fixed costs. These costs, encompassing real estate, facility maintenance, and a consistent staffing model, remain substantial whether facilities are full or not. This financial reality places immense pressure on operators to maintain high occupancy rates to cover these overheads and achieve profitability.

The imperative to fill beds frequently translates into aggressive pricing strategies and promotional offers among competitors. For instance, in 2024, many senior living providers engaged in discounted move-in rates and waived fees to attract residents, directly intensifying the competitive landscape. This price sensitivity among consumers, coupled with the industry’s capital-intensive nature, fuels a dynamic where occupancy is paramount, and rivals constantly vie for market share through various incentives.

Differentiated Services and Niche Offerings

While assisted living and memory care are standard, competitors differentiate through specialized programs and unique amenities. Brookdale must innovate to capture market segments, as this pursuit intensifies rivalry.

- Specialized Programs: Competitors might offer unique therapy programs, like pet therapy or music therapy, to attract residents with specific needs.

- Niche Focus: Some communities target specific income brackets or cultural groups, creating a distinct market position.

- Amenity Differentiation: Offering enhanced amenities such as on-site spas, fine dining options, or advanced technology can set a community apart.

- Innovation Drive: The need to stand out fuels continuous innovation, as seen in the growing adoption of telehealth services and smart-home technology in senior living facilities. For instance, in 2024, many senior living providers are investing in integrated technology platforms to streamline resident care and communication.

Reputation and Quality of Care as Key Differentiators

In the senior living sector, a strong reputation for quality care, safety, and high resident satisfaction is a crucial differentiator. Brookdale, like its rivals, faces intense competition where positive word-of-mouth and demonstrable care standards directly influence occupancy rates and brand perception. For instance, in 2024, the senior living market continued to see a premium placed on facilities with proven track records of resident well-being and positive family experiences.

Competitors frequently highlight their achievements, such as superior staff-to-resident ratios and positive health outcomes, to attract new residents. This forces companies like Brookdale to consistently invest in staff training, rigorous quality assurance programs, and active community outreach to uphold its standing and maintain a competitive advantage in this critical area.

- Reputation is paramount: In 2024, senior living consumers prioritized facilities with strong reputations for care and safety.

- Negative publicity impact: Lapses in care can severely damage occupancy and brand image, a constant concern for operators.

- Competitor strategies: Rivals emphasize staff ratios and positive outcomes to attract residents.

- Brookdale's response: Continuous investment in training and quality assurance is necessary to stay competitive.

The senior living industry, despite its growth, is highly competitive, with Brookdale facing numerous rivals. This fragmentation means Brookdale must continually adapt through pricing, service enhancements, and marketing to attract residents. The pressure intensifies when new facilities open in specific markets, leading to temporary oversupply and forcing operators to compete more aggressively on value.

High fixed costs for senior living facilities necessitate high occupancy rates for profitability, driving competitive pricing and promotional activities. For instance, in 2024, many providers offered discounted move-in rates, a common tactic to fill beds. This constant need to maintain occupancy fuels rivalry as companies vie for market share.

Differentiation through specialized programs, niche market focus, and enhanced amenities is crucial. Brookdale must innovate in areas like telehealth and smart technology, as seen in 2024's trend of integrated care platforms. A strong reputation for quality care and resident satisfaction, often highlighted by competitors through metrics like staff-to-resident ratios, is also a key battleground, demanding continuous investment in quality assurance.

| Competitive Factor | Brookdale's Challenge | Industry Trend (2024) |

|---|---|---|

| Market Fragmentation | Contending with national, regional, and independent operators. | Continued presence of diverse competitors. |

| Pricing & Promotions | Pressure to offer competitive rates due to high fixed costs. | Prevalence of discounted move-in rates and waived fees. |

| Service & Amenity Differentiation | Need to innovate beyond standard offerings. | Increased adoption of specialized programs and technology. |

| Reputation & Quality of Care | Maintaining high standards to attract and retain residents. | Emphasis on positive health outcomes and staff ratios. |

SSubstitutes Threaten

The growing trend of seniors preferring to age in place, bolstered by an expanding range of in-home care services, presents a substantial threat to traditional senior living facilities like Brookdale. These services, which can include everything from medical support to help with daily tasks, enable seniors to stay in their own homes, often at a more attractive price point for certain care needs.

This shift directly challenges Brookdale's core business, especially for residents who might otherwise opt for independent or assisted living arrangements. For instance, the home healthcare market experienced significant growth, with the U.S. home healthcare services market size valued at approximately $346.2 billion in 2023 and projected to grow further. This indicates a strong and expanding alternative for seniors.

A significant number of seniors still prefer to receive care from family members or live in multigenerational households, a substitute that significantly lowers costs compared to senior living communities. This cultural and economic preference directly impacts the demand for services like those offered by Brookdale Senior Living.

The willingness and capacity of family members to provide care are crucial factors. For instance, a 2023 AARP report indicated that over 48 million Americans provided unpaid care to an adult or child, highlighting the prevalence of informal caregiving.

Technological advancements are increasingly offering viable alternatives to traditional senior living. Smart home devices, remote health monitoring, and telehealth services are making it easier and safer for seniors to remain in their own homes. For instance, the global smart home market, which includes many of these aging-in-place technologies, was projected to reach over $138 billion in 2024, indicating significant investment and adoption.

Adult Day Care and Community Programs

Adult day care centers and community programs present a notable threat of substitutes for Brookdale Senior Living, particularly for seniors who can manage at home with daytime support. These alternatives offer social engagement, cognitive activities, and crucial respite for family caregivers, addressing specific needs without the commitment of full-time residential care. For instance, the National Adult Day Services Association reports a growing demand for these services, with many centers expanding their offerings to cater to diverse senior needs.

These substitute options are often perceived as more affordable and less restrictive than traditional senior living facilities. Many seniors and their families weigh the cost-benefit of full-time care against the localized support provided by these community-based programs. In 2024, the average cost of adult day care can range from $70 to $150 per day, a significant difference compared to the monthly fees of assisted living facilities, which can exceed $5,000.

- Cost Savings: Adult day care is typically a fraction of the cost of full-time senior living.

- Flexibility: Programs offer flexible scheduling, catering to specific daily or weekly needs.

- Social Engagement: They provide vital social interaction and structured activities, combating isolation.

- Caregiver Respite: These services offer essential breaks for family members providing in-home care.

Hybrid Models and Niche Housing Options

The rise of hybrid care models, co-housing for seniors, and smaller, specialized residential care homes presents a growing threat of substitutes for Brookdale Senior Living. These alternative living arrangements can cater to specific needs or preferences, drawing potential residents away from larger, more generalized senior living communities. For instance, a senior seeking only memory care might opt for a dedicated facility, bypassing a larger community with multiple service levels.

These niche options often provide a more intimate setting or a specific focus, such as faith-based communities or specialized therapeutic programs, which can be highly appealing to seniors and their families. This can divert potential residents who might otherwise consider a broad-spectrum senior living provider like Brookdale. In 2023, the senior housing market saw continued growth in specialized care segments, with memory care units experiencing strong demand, indicating a clear shift towards tailored solutions.

- Hybrid Care Models: Blending independent living with assisted living or skilled nursing services within a single community or across affiliated facilities.

- Co-housing for Seniors: Communities where residents share common spaces and activities, fostering a strong sense of community and mutual support, often at a lower cost than traditional senior living.

- Specialized Residential Care Homes: Small, often home-like settings focusing on specific needs like dementia care, rehabilitation, or palliative care, offering a more personalized and less institutional experience.

- Market Trends: Reports from 2024 indicate a growing preference for smaller, more personalized care settings, with occupancy rates in specialized memory care units often outperforming those in traditional assisted living facilities.

The increasing availability and sophistication of in-home care services present a significant substitute for traditional senior living facilities like Brookdale. These services, encompassing everything from personal assistance to skilled nursing, allow seniors to remain in their familiar surroundings. The U.S. home healthcare market was valued at an estimated $346.2 billion in 2023, underscoring the substantial and growing demand for these alternatives.

Furthermore, the preference for aging in place, often supported by family caregivers, remains a powerful substitute. A 2023 AARP report highlighted that over 48 million Americans provided unpaid care, demonstrating the prevalence of informal support systems that reduce the need for senior living communities.

Technological advancements are also bolstering the threat of substitutes. Smart home devices and remote health monitoring are making it more feasible and safer for seniors to live independently, thereby bypassing traditional senior living. The global smart home market, projected to exceed $138 billion in 2024, reflects significant investment in technologies that support aging in place.

| Substitute Option | Key Benefits | Estimated Cost (2024) | Market Trend/Data Point |

| In-Home Care Services | Familiar environment, personalized care | Varies by service, can be $25-$75+/hour | U.S. home healthcare market valued at $346.2 billion in 2023 |

| Family Caregiving | Emotional support, cost savings | Unpaid labor (48 million+ Americans in 2023) | Cultural preference for remaining at home |

| Aging-in-Place Technology | Safety, independence, remote monitoring | One-time purchase + subscription fees | Global smart home market projected over $138 billion in 2024 |

| Adult Day Care | Socialization, respite for caregivers | $70 - $150 per day | Growing demand for community-based support |

Entrants Threaten

The sheer cost of building and equipping a senior living facility presents a formidable barrier. Developing a single, modern senior living community can easily run into the hundreds of millions of dollars, encompassing land acquisition, construction, and furnishing. This substantial capital outlay significantly restricts the number of entities capable of entering the market, thereby protecting established operators like Brookdale.

New entrants into the senior living sector, like Brookdale Senior Living, encounter significant regulatory challenges. Obtaining and maintaining state and federal licenses, adhering to strict health and safety standards, and meeting specific staffing mandates are complex and costly processes. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to enforce rigorous compliance measures across all healthcare facilities, including senior living communities, with potential fines for non-compliance reaching substantial amounts.

Established senior living providers like Brookdale have cultivated significant brand recognition and trust over many years. This deep-seated credibility with residents, families, and healthcare professionals presents a substantial barrier for newcomers. For instance, Brookdale's extensive network and long operational history in 2024 mean they've had ample opportunity to build loyalty and a reputation for quality care, something new entrants must painstakingly replicate.

Economies of Scale and Operational Expertise

Brookdale Senior Living, as a large operator, leverages significant economies of scale. This advantage is evident in their purchasing power for supplies, marketing reach, and investment in technology infrastructure. New entrants, typically smaller, struggle to match these cost efficiencies, creating an immediate hurdle.

The operational complexities of senior living, including managing various care levels and a substantial workforce, demand specialized expertise. Brookdale has cultivated this operational proficiency over time, a capability that is difficult for newcomers to replicate quickly. This expertise translates into smoother operations and potentially higher quality of care, further differentiating established players.

- Economies of Scale: Brookdale's size allows for lower per-unit costs in procurement and marketing compared to smaller, emerging competitors. For instance, in 2024, large senior living operators often negotiate bulk discounts on food, pharmaceuticals, and maintenance services that are unavailable to smaller entities.

- Operational Expertise: The intricate nature of senior care, from medical oversight to resident engagement, requires years of experience to master. New entrants must invest heavily in training and development to build a comparable level of operational know-how.

- Capital Investment: Establishing new senior living facilities involves substantial upfront capital for real estate, construction, and licensing. This high barrier to entry deters many potential new entrants who lack the necessary financial resources.

Access to Desirable Locations and Labor Pool

Securing prime real estate in desirable, accessible locations is a significant hurdle for new senior living operators. For instance, in 2024, the average cost per unit for new senior living construction continued to climb, particularly in high-demand metropolitan areas, making it difficult for newcomers to compete with established providers who may already own or have favorable leases on prime sites.

Established companies like Brookdale Senior Living benefit from existing portfolios and long-standing relationships with developers and real estate owners, which can streamline expansion and site acquisition. This often translates to better terms and faster development timelines compared to a new entrant needing to build these connections from the ground up.

Attracting and retaining a qualified workforce is another substantial barrier. The senior care industry faced ongoing labor shortages in 2024, with high turnover rates. New entrants must invest heavily in recruitment, training, and competitive compensation packages to build a competent staff, a challenge amplified by the need to establish themselves as an employer of choice without an established reputation.

- High real estate acquisition costs: New entrants face escalating prices for prime locations, a trend that persisted in 2024, impacting initial capital outlays.

- Established player advantages: Existing operators leverage their portfolios and relationships to secure favorable sites, creating an uneven playing field.

- Labor market challenges: The competitive and often understaffed senior care labor market requires significant investment in attracting and retaining qualified personnel for new businesses.

The threat of new entrants for Brookdale Senior Living is significantly mitigated by substantial capital requirements and stringent regulatory landscapes. For example, in 2024, the average cost to develop a new senior living community continued to be in the tens of millions of dollars, a figure that deters many smaller players. Furthermore, navigating complex licensing and compliance, such as adhering to updated health and safety protocols mandated by agencies like CMS, demands considerable expertise and financial resources.

Established brand loyalty and operational expertise also act as strong deterrents. Brookdale's long-standing reputation, built over years of service, fosters trust among residents and their families, a critical factor in this industry. Newcomers must invest heavily in marketing and training to build comparable credibility and operational efficiency, a process that is both time-consuming and costly, especially given the labor market challenges observed in 2024.

| Barrier to Entry | 2024 Impact on New Entrants | Brookdale's Advantage |

|---|---|---|

| Capital Investment | High, averaging tens of millions for new facilities | Established financial resources and access to capital markets |

| Regulatory Compliance | Complex and costly licensing, health, and safety standards | Existing infrastructure and expertise in navigating regulations |

| Brand Reputation & Trust | Requires significant time and marketing investment to build | Long-standing customer loyalty and established goodwill |

| Operational Expertise | Demands specialized knowledge in care, staffing, and management | Years of experience in managing diverse senior living operations |

| Real Estate Acquisition | Escalating costs for prime locations | Existing portfolio and established relationships with property owners |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brookdale Senior Living leverages data from Brookdale's SEC filings, investor relations materials, and industry-specific market research reports. We also incorporate insights from healthcare industry publications and government demographic data to understand competitive pressures.