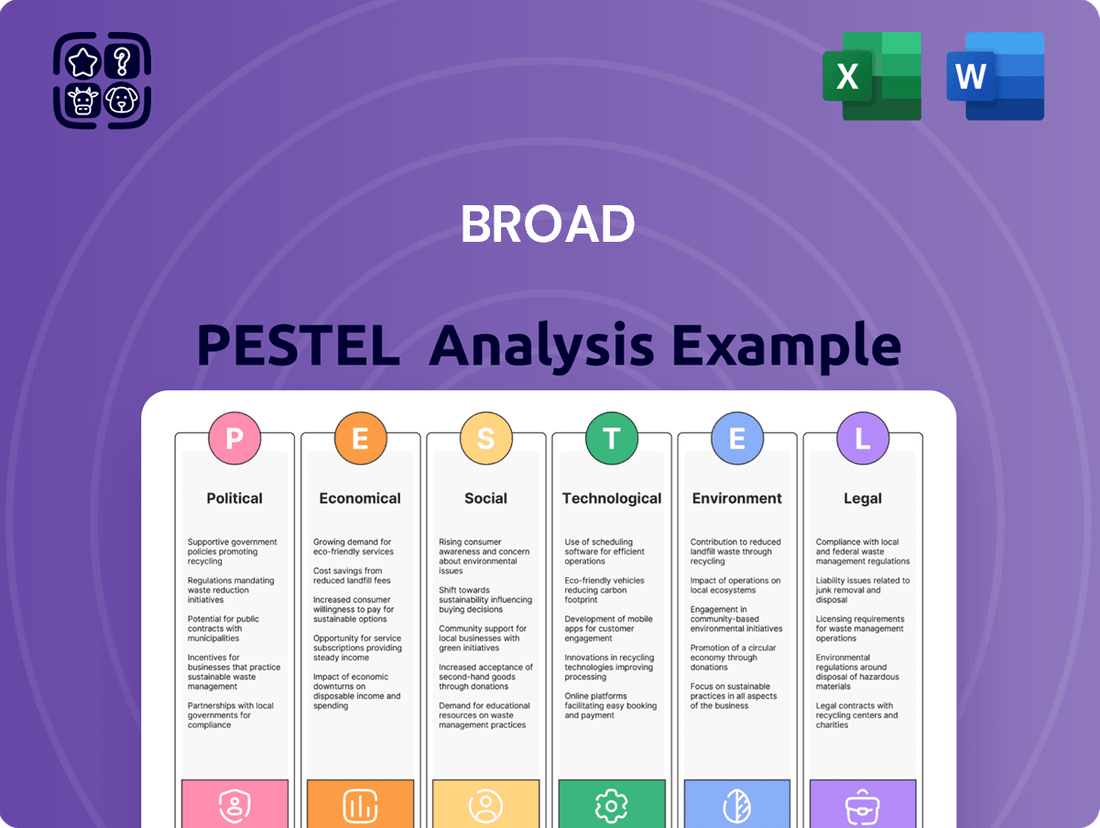

Broad PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broad Bundle

Unlock the hidden forces shaping Broad's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to its success. Equip yourself with actionable intelligence to navigate market complexities and gain a competitive edge. Purchase the full analysis now to make informed strategic decisions.

Political factors

Governments globally are prioritizing green building, with many offering substantial financial incentives. For instance, the U.S. Inflation Reduction Act of 2022 provides significant tax credits for energy-efficient home improvements and commercial buildings, potentially boosting demand for prefabricated, energy-saving structures like those produced by BROAD Group.

These policies, designed to slash carbon footprints and energy usage within construction, create a favorable market for companies like BROAD Group, whose expertise in prefabricated, energy-efficient buildings and absorption chillers aligns perfectly with these sustainability goals.

The drive towards net-zero buildings is accelerating; by 2024, many regions saw increased regulatory pressure on embodied carbon and operational energy efficiency, directly benefiting manufacturers of sustainable building solutions.

Geopolitical shifts and evolving trade policies, particularly concerning tariffs, directly influence the cost of essential raw materials and components for global manufacturers like BROAD Group. These dynamics can significantly disrupt supply chains, inflate production expenses, and ultimately erode product competitiveness across various international markets.

For instance, the ongoing trade tensions between major economic blocs in 2024 and early 2025 have led to increased volatility in commodity prices. Companies are therefore strongly encouraged to diversify their sourcing strategies to build resilience against the risks posed by rising trade protectionism and potential import duties.

Government investments in sustainable infrastructure, such as the U.S. Bipartisan Infrastructure Law allocating $1.2 trillion, are creating significant demand for green building technologies. Public procurement policies increasingly favor environmentally conscious solutions, directly benefiting companies like BROAD that offer integrated energy and prefabricated building systems.

Urbanization trends, with over 55% of the world's population living in urban areas in 2023, are driving a need for efficient, scalable buildings. This aligns with BROAD's prefabricated solutions, which can be deployed rapidly to meet this growing demand for smart, energy-efficient construction.

Energy Regulations and Efficiency Standards

Evolving energy regulations and increasingly stringent efficiency standards for buildings and appliances are directly impacting BROAD's core business operations and product demand. The company's focus on non-electric air conditioning systems and other energy-efficient building solutions positions it favorably to not only meet but also surpass these evolving requirements, thereby stimulating growth.

For example, recent updates to building energy codes in key markets like California, alongside revisions to the International Energy Conservation Code (IECC) across numerous states, are actively promoting the adoption of high-efficiency HVAC systems. These regulatory shifts create a significant market opportunity for BROAD's offerings.

- Increased Demand: Stricter energy codes, such as those implemented in California in 2023, mandate higher SEER ratings for cooling systems, directly benefiting BROAD's efficient solutions.

- Market Advantage: Companies like BROAD, offering advanced energy-saving technologies, gain a competitive edge as regulations tighten, making traditional, less efficient systems less viable.

- Policy Influence: Federal initiatives and state-level mandates continue to push for greater building energy performance, creating a sustained tailwind for energy-efficient product manufacturers.

Geopolitical Stability and Supply Chain Resilience

Global geopolitical instability, including ongoing conflicts and regional tensions, significantly impacts supply chains, affecting material availability and increasing transportation expenses. For industrial manufacturers like BROAD Group, developing robust supply chain strategies is crucial to navigate these disruptions and maintain operational continuity.

To build resilience, diversifying sourcing locations and exploring options like nearshoring or friendshoring are key strategies. For example, in 2024, disruptions stemming from conflicts in Eastern Europe and the Middle East led to an estimated 15% increase in global shipping costs for certain manufactured goods compared to 2023 levels, highlighting the direct financial impact of geopolitical events.

- Geopolitical Risk Impact: Armed conflicts and regional tensions directly disrupt global supply chains, leading to material shortages and higher transportation costs.

- Supply Chain Resilience: Strategies like diversifying suppliers and nearshoring are essential for industrial manufacturers to mitigate these risks and ensure operational continuity.

- Cost Implications: In 2024, shipping costs for manufactured goods saw an approximate 15% rise due to geopolitical disruptions, underscoring the financial vulnerability of extended supply chains.

Governmental focus on sustainability is a significant political driver, with policies like the U.S. Inflation Reduction Act of 2022 offering substantial tax credits for energy-efficient building improvements. This creates a strong market advantage for companies specializing in green construction and energy-saving technologies.

Regulatory bodies are increasingly mandating stricter energy efficiency standards for buildings and appliances. For example, updates to building energy codes in key markets like California in 2023, alongside revisions to the International Energy Conservation Code, actively promote high-efficiency HVAC systems, directly benefiting manufacturers like BROAD Group.

Public procurement policies are also shifting, with governments increasingly favoring environmentally conscious solutions. Investments in sustainable infrastructure, such as the U.S. Bipartisan Infrastructure Law's $1.2 trillion allocation, are generating significant demand for green building technologies and integrated energy systems.

Geopolitical instability and trade policy shifts, including tariffs and regional conflicts, directly impact raw material costs and supply chain stability. In 2024, disruptions from conflicts in Eastern Europe and the Middle East led to an estimated 15% increase in global shipping costs for manufactured goods, underscoring the need for diversified sourcing strategies.

| Policy/Factor | Impact on Construction/Energy Sector | Example/Data (2023-2025) |

|---|---|---|

| Green Building Incentives | Increased demand for energy-efficient materials and designs | U.S. IRA 2022: Tax credits for energy-efficient retrofits and new builds |

| Energy Efficiency Standards | Market advantage for high-performance HVAC and building systems | California building codes (2023) mandate higher SEER ratings; IECC revisions |

| Sustainable Infrastructure Investment | Boost in demand for green building technologies and integrated systems | U.S. Bipartisan Infrastructure Law: $1.2 trillion for infrastructure projects |

| Geopolitical Instability/Trade Policy | Supply chain disruptions, increased material and shipping costs | 2024: ~15% rise in global shipping costs for manufactured goods due to regional conflicts |

What is included in the product

The Broad PESTLE Analysis provides a comprehensive examination of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It equips leaders with actionable insights to navigate market complexities, identify strategic opportunities, and mitigate potential risks.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

Global economic growth is a significant driver for the construction market, as a healthy economy typically translates to increased investment in infrastructure and real estate. For BROAD Group, whose building solutions and HVAC systems are integral to construction projects, this correlation is direct. A strong global economy fuels demand for new buildings and renovations, creating a fertile ground for BROAD's offerings.

Looking ahead, the construction industry is poised for substantial growth, with projections suggesting a compound annual growth rate (CAGR) of around 5.5% from 2024 to 2029, reaching an estimated $17.5 trillion by 2029. This expansion is largely fueled by rapid urbanization, particularly in emerging economies, and a growing emphasis on energy-efficient and sustainable building designs, areas where BROAD's expertise is highly relevant.

A thriving construction sector directly benefits BROAD Group by increasing the pipeline of potential projects for its building materials and HVAC systems. For instance, the global smart building market, which relies heavily on advanced construction solutions, is expected to grow from approximately $31.8 billion in 2024 to $74.7 billion by 2029, showcasing a clear opportunity for companies like BROAD.

Fluctuations in global energy prices, especially for natural gas, directly impact the operational expenses of BROAD's clients and the market appeal of its energy-saving solutions. For instance, as of early 2024, natural gas prices saw volatility, with benchmarks like the Dutch TTF trading in a range influenced by supply concerns and geopolitical events, directly affecting industries relying on gas for absorption chillers.

When conventional energy costs climb, it naturally boosts the attractiveness and demand for energy-efficient technologies offered by BROAD. This trend was evident in 2023, where higher electricity and gas prices in many regions spurred increased interest in advanced HVAC systems and energy management solutions.

However, the rising cost of energy isn't the only factor; it's coupled with an anticipated increase in raw material and manufacturing input costs. This dual pressure means that while energy-efficient solutions become more desirable, the initial investment cost for these products may also see an upward adjustment, creating a complex dynamic for purchasing decisions.

Interest rates significantly impact the cost of capital for large-scale projects, a crucial factor for businesses like BROAD that supply prefabricated buildings and HVAC systems for construction and infrastructure. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate, influencing borrowing costs for major developments. Lower rates generally encourage companies to undertake capital-intensive projects, potentially boosting demand for BROAD's products as financing becomes more affordable.

Conversely, elevated interest rates, such as those seen through 2023 as central banks worked to curb inflation, tend to dampen investment in capital projects. Higher borrowing costs can make new construction and expansion plans less attractive, leading to a slowdown in project initiations and consequently impacting sales for BROAD's large-scale systems.

Consumer and Business Spending on Green Technologies

Consumers and businesses are increasingly prioritizing sustainability, driving significant investment in green technologies. This trend directly benefits companies offering environmentally conscious products, such as air purification systems and energy-efficient building solutions. For example, the global air purifier market was valued at approximately $11.9 billion in 2023 and is anticipated to expand considerably in the coming years, reflecting this growing demand.

This heightened awareness translates into a greater willingness to allocate capital towards eco-friendly alternatives. Businesses are actively seeking ways to reduce their carbon footprint, while consumers are making purchasing decisions based on environmental impact. This shift is creating robust market opportunities for innovations in renewable energy, sustainable materials, and pollution control technologies.

- Growing Market for Air Purification: The global air purifier market is projected to reach $24.6 billion by 2030, exhibiting a compound annual growth rate of 8.4% from 2023 to 2030.

- Increased Corporate ESG Investment: Environmental, Social, and Governance (ESG) investments by corporations are on the rise, with a significant portion allocated to green initiatives and technologies.

- Consumer Preference for Sustainable Products: Studies indicate that a majority of consumers are willing to pay a premium for products that are environmentally friendly.

- Government Incentives for Green Tech: Many governments are implementing policies and offering incentives to encourage the adoption of green technologies, further stimulating spending.

Raw Material and Manufacturing Costs

The cost and availability of essential raw materials like steel, aluminum, and various electronic components directly impact manufacturing expenses for products such as absorption chillers and prefabricated buildings. Manufacturers are bracing for ongoing rises in these input costs, which will inevitably influence production budgets and pricing decisions.

For instance, global steel prices have seen significant volatility. As of early 2024, benchmark hot-rolled coil prices in the US hovered around $750-$850 per ton, a figure that has fluctuated based on demand and geopolitical events. Similarly, the cost of key metals like copper and nickel, crucial for many manufacturing processes, has also experienced upward pressure.

- Steel prices: Fluctuations around $750-$850 per ton in early 2024, impacting construction and manufacturing.

- Aluminum costs: Increased by approximately 15% in 2023 due to energy prices and supply chain issues.

- Semiconductor prices: While stabilizing, costs for advanced chips remain elevated, affecting electronic component pricing.

- Energy prices: Higher energy costs directly translate to increased manufacturing operational expenses, affecting overall production cost.

Economic stability and growth are paramount for the construction sector. A robust economy translates into higher consumer spending and business investment, directly fueling demand for new buildings and infrastructure projects. Conversely, economic downturns or recessions can significantly curb construction activity, impacting companies like BROAD Group.

Interest rates play a critical role in project financing. Higher interest rates increase the cost of borrowing for developers and businesses, potentially slowing down investment in new construction and renovations. For example, central banks in major economies continued to navigate inflation in early 2024, with benchmark rates influencing the cost of capital for large-scale developments.

Inflation affects both input costs for manufacturing and the purchasing power of consumers and businesses. Rising inflation can lead to increased prices for raw materials and labor, impacting project budgets and the affordability of BROAD's products. Conversely, stable or falling inflation can create a more predictable and favorable operating environment.

| Economic Factor | Impact on Construction/BROAD Group | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for new construction and infrastructure. | Projected global GDP growth around 2.7% for 2024, with variations across regions influencing local construction markets. |

| Interest Rates | Affects cost of capital for projects; higher rates can dampen investment. | Central banks maintained cautious monetary policies in early 2024, with potential for gradual rate adjustments based on inflation data. |

| Inflation | Impacts raw material costs and overall project affordability. | Inflationary pressures persisted in early 2024, though showing signs of moderation in some key economies, impacting input costs for manufacturing. |

| Energy Prices | Influences operational costs for clients and demand for energy-efficient solutions. | Volatile energy prices in early 2024, with natural gas benchmarks like TTF influenced by supply and geopolitical factors. |

Preview the Actual Deliverable

Broad PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Broad PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting a business. It offers a structured framework for understanding the macro-environmental forces at play.

Gain a deep understanding of the external landscape with this detailed analysis, equipping you with the insights needed for strategic planning and risk assessment.

Sociological factors

The relentless march of urbanization, especially in burgeoning regions like Asia and Africa, is creating an unprecedented surge in demand for housing and essential infrastructure. This global shift means cities are growing at an astonishing pace, requiring swift and effective building solutions.

BROAD's expertise in prefabricated construction directly addresses this need for speed and scalability. With the world's urban population projected to reach 68% by 2050, according to UN data, the capacity to build quickly and efficiently is paramount for urban development.

This megatrend underscores the critical requirement for smart, adaptable, and rapidly deployable building technologies. The focus is on creating structures that can be erected faster and more cost-effectively to accommodate this rapid population influx.

Public awareness regarding indoor and outdoor air quality is steadily rising, directly fueling demand for air purification solutions. This growing health consciousness means that companies like BROAD, with their air purification products, are well-positioned to capitalize on a market increasingly driven by wellness and health concerns.

The global air purifier market is indeed experiencing robust growth, with projections indicating continued expansion. For instance, the market was valued at approximately $12.5 billion in 2023 and is anticipated to reach over $25 billion by 2030, demonstrating a compound annual growth rate of around 10% during this period.

Consumers are increasingly seeking out sustainable options, with a significant portion willing to pay more for eco-friendly products. For instance, a 2024 Nielsen report found that 73% of global consumers would change their consumption habits to reduce their environmental impact. This trend directly impacts purchasing decisions in both homes and businesses, favoring companies that demonstrate a commitment to environmental responsibility.

BROAD Group's focus on environmental protection and energy conservation resonates strongly with these evolving consumer values. Their emphasis on green building technologies and energy-efficient solutions positions them favorably, enhancing brand appeal and facilitating market penetration. This alignment with societal preferences for sustainability is a key driver for their growth.

Labor Availability and Skills in Construction and Manufacturing

Shortages of skilled labor continue to be a significant challenge in both construction and manufacturing. These gaps can directly impact project delivery schedules and increase overall costs for companies like BROAD. For instance, in the US construction sector, a 2024 survey indicated that over 70% of construction firms reported difficulty finding skilled workers, a persistent issue that has been escalating over recent years.

While advancements like prefabricated construction offer a partial solution by shifting some labor needs off-site, the broader talent deficit remains across the entire manufacturing value chain, from design to assembly. This means that even with innovative building methods, the underlying need for skilled personnel in areas such as advanced manufacturing and digital integration is critical.

BROAD must therefore integrate these labor market dynamics into its strategic operational planning. Understanding the availability and cost of skilled labor is crucial for accurate budgeting, resource allocation, and long-term capacity building.

- Skilled Labor Shortage: Over 70% of US construction firms reported difficulty finding skilled workers in 2024.

- Impact on Timelines: Labor scarcity can lead to project delays and increased costs.

- Broader Manufacturing Challenge: Talent gaps extend beyond on-site construction to the entire manufacturing value chain.

- Strategic Planning Necessity: BROAD needs to factor labor availability into its operational and financial forecasting.

Corporate Social Responsibility (CSR) and ESG Expectations

Societal expectations are increasingly pushing corporations towards robust corporate social responsibility (CSR) and adherence to Environmental, Social, and Governance (ESG) principles. BROAD's business model, focused on sustainable solutions, naturally aligns with these demands, enhancing its appeal to investors, top talent, and clients prioritizing environmental consciousness.

Companies are proactively embracing sustainability reporting, with a significant number voluntarily adopting frameworks like the Global Reporting Initiative (GRI). For instance, in 2023, over 70% of the largest global companies published sustainability reports, a trend expected to continue growing through 2024 and 2025 as regulatory pressures and investor scrutiny intensify.

- Investor Demand: ESG-focused investment funds saw substantial inflows in 2023, with global ESG assets projected to reach $50 trillion by 2025, demonstrating a clear financial incentive for CSR.

- Talent Acquisition: A 2024 survey indicated that 65% of job seekers consider a company's social and environmental impact when deciding where to work.

- Consumer Preference: Research from early 2024 shows that over 60% of consumers are willing to pay more for products from brands committed to sustainability.

Societal shifts toward health and wellness are driving demand for improved living environments, directly benefiting companies offering solutions like air purification. Furthermore, a growing global emphasis on sustainability means consumers and businesses alike are prioritizing eco-friendly products and practices. These trends indicate a strong market pull for BROAD's offerings.

The increasing focus on corporate social responsibility and ESG principles is reshaping business expectations, with investors and talent increasingly favoring companies with strong sustainability credentials. This societal push for ethical and environmentally sound operations aligns perfectly with BROAD's core mission.

The demand for sustainable and healthy living spaces is a significant sociological factor influencing the market. As urban populations grow and awareness of environmental impact increases, there's a clear preference for building solutions that are not only efficient but also contribute positively to occupant well-being and the planet.

BROAD's commitment to green building and air purification directly addresses these evolving societal values. The company's alignment with these trends positions it favorably for growth as consumers and businesses increasingly prioritize health, sustainability, and ethical corporate practices in their purchasing and investment decisions.

| Sociological Factor | Trend Description | Impact on BROAD | Supporting Data (2023-2025) |

|---|---|---|---|

| Health & Wellness Consciousness | Rising public awareness of air quality and healthy living environments. | Increased demand for air purification systems and healthy building materials. | Global air purifier market projected to reach over $25 billion by 2030, with strong growth in 2023-2025. |

| Sustainability & Eco-Friendliness | Growing consumer and business preference for environmentally responsible products. | Favors BROAD's green building technologies and energy-efficient solutions. | 73% of global consumers would change habits to reduce environmental impact (Nielsen, 2024). |

| Corporate Social Responsibility (CSR) & ESG | Increasing importance of ethical operations, environmental stewardship, and social impact. | Enhances BROAD's appeal to investors, talent, and clients prioritizing ESG. | Over 70% of large companies published sustainability reports in 2023; ESG assets projected to reach $50 trillion by 2025. |

Technological factors

Continuous innovation in absorption chiller technology is a key technological factor for BROAD. Recent advancements focus on improving energy efficiency and reducing reliance on grid electricity, often by utilizing waste heat or natural gas. For example, new designs in 2024 are achieving Coefficient of Performance (COP) ratings up to 1.5, a significant jump from earlier models that hovered around 1.2.

The construction sector is experiencing a major shift towards prefabricated and modular building methods, driven by a demand for greater efficiency, sustainability, and adaptable designs. This trend is projected to see the global modular construction market reach approximately $231.6 billion by 2028, growing at a compound annual growth rate of 7.7% from 2021.

BROAD Group's BSB (Broad Sustainable Building) structures are directly benefiting from these technological advancements. These innovations allow for quicker project timelines, reduced on-site labor costs, and improved energy performance in buildings, aligning with the industry's move towards greener and more economical construction practices.

The increasing integration of IoT sensors and AI-powered building management systems presents significant opportunities for BROAD to enhance its prefabricated solutions and HVAC systems. These smart technologies enable real-time monitoring, predictive maintenance, and optimized energy management, directly supporting BROAD's strategic focus on integrated energy solutions.

By embedding IoT capabilities, BROAD can offer clients advanced building performance insights, leading to reduced operational costs and improved sustainability. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, indicating substantial growth and demand for these integrated solutions.

Innovation in Air Purification and Filtration Technologies

Innovation in air purification and filtration technologies is rapidly advancing, directly influencing the effectiveness and appeal of products like those offered by BROAD. Technologies such as HEPA filters, UV germicidal irradiation (UVGI), photocatalytic oxidation, and advanced nanofiber filters are becoming more sophisticated, promising higher efficiency in removing pollutants and pathogens. For instance, the global air purifier market was valued at approximately USD 12.6 billion in 2023 and is projected to reach USD 26.9 billion by 2030, growing at a CAGR of 11.5% during the forecast period, according to various market research reports. This growth underscores the increasing demand for better air quality solutions.

BROAD's ability to integrate these cutting-edge advancements into its product line is crucial for maintaining a competitive edge. By staying ahead of the curve, the company can offer solutions that not only meet current indoor air quality standards but also anticipate future needs. This includes developing purifiers that are more energy-efficient, quieter, and capable of capturing a wider range of contaminants, from fine particulate matter to volatile organic compounds (VOCs) and even viruses.

- HEPA Filters: Continuously improved to capture 99.97% of particles 0.3 microns in size, with newer iterations offering enhanced airflow and longevity.

- UVGI Technology: Advancements in UV-C LED technology are making UVGI more compact, energy-efficient, and safer for integration into home and office devices.

- Nanofiber Filters: These offer superior filtration efficiency at lower pressure drops compared to traditional media, leading to better performance and reduced energy consumption.

- Photocatalytic Oxidation (PCO): Ongoing research is refining PCO to improve its effectiveness against VOCs and odors, while minimizing the production of potentially harmful byproducts.

Research and Development in Green Technology

Ongoing research and development in green technology, particularly in areas like renewable energy integration and the creation of sustainable materials, are crucial for maintaining a competitive edge. These advancements directly impact a company's ability to innovate and adapt to evolving environmental regulations and consumer preferences.

Investing in or effectively utilizing breakthroughs in eco-friendly solutions can significantly improve the energy efficiency and overall environmental footprint of both products and operational processes. For instance, the global green technology and sustainability market was projected to reach $10.31 billion in 2024, highlighting the significant economic impetus behind these R&D efforts.

- Renewable Energy Integration: Continued investment in solar, wind, and other renewable sources is key to reducing reliance on fossil fuels and lowering operational costs.

- Sustainable Materials: Research into biodegradable plastics, recycled composites, and low-impact manufacturing processes offers pathways to more environmentally responsible products.

- Energy Efficiency Technologies: Innovations in smart grids, energy storage, and advanced insulation are vital for optimizing resource consumption.

- Circular Economy Models: R&D focused on product lifecycle management, repairability, and material recovery supports a more sustainable business approach.

Technological advancements are reshaping the construction and HVAC industries, driving innovation and efficiency. BROAD's absorption chiller technology, for example, saw COP ratings reach 1.5 in 2024, a notable improvement. The construction sector's embrace of modular building, expected to reach $231.6 billion by 2028, aligns perfectly with BROAD's BSB structures, reducing costs and improving project timelines.

The integration of IoT and AI in building management systems offers significant growth potential, with the smart building market projected to exceed $200 billion by 2030. Furthermore, advancements in air purification, such as HEPA and UVGI technologies, are enhancing indoor air quality solutions, a market valued at $12.6 billion in 2023 and growing rapidly.

| Technological Area | Key Advancement | Impact on BROAD | Market Data/Projection |

|---|---|---|---|

| Absorption Chillers | Improved COP ratings (up to 1.5 in 2024) | Enhanced energy efficiency, reduced operational costs | N/A (Specific to BROAD's internal tech) |

| Modular Construction | Increased adoption, faster build times | Synergy with BSB structures, cost and time savings | Global market ~$231.6B by 2028 (7.7% CAGR) |

| IoT & AI in Buildings | Smart building management systems | Optimized energy use, predictive maintenance, enhanced offerings | Global market ~$80B in 2023, projected >$200B by 2030 |

| Air Purification | Advanced HEPA, UVGI, Nanofiber filters | Superior indoor air quality solutions, competitive edge | Global market ~$12.6B in 2023, projected ~$26.9B by 2030 (11.5% CAGR) |

Legal factors

Strict building codes and energy efficiency standards, such as the International Energy Conservation Code (IECC) and state-specific regulations, directly dictate the requirements for new construction and renovations. For example, the 2021 IECC mandates improved insulation and window performance, impacting material choices and construction methods.

BROAD's energy-efficient buildings and HVAC systems must comply with and ideally exceed these evolving legal mandates. Failure to meet these standards, like the upcoming stricter emissions requirements for HVAC in California for 2025, could result in fines or prevent product sales.

Environmental protection laws, particularly those concerning emissions standards for manufacturing and building operations, are increasingly stringent. For instance, in 2024, the United States Environmental Protection Agency (EPA) proposed stricter rules for power plant emissions, aiming to cut greenhouse gas output significantly. Companies like BROAD must ensure their operational footprint adheres to these evolving mandates to avoid penalties and maintain a positive public image.

BROAD's commitment to reducing its environmental impact, evident in its product development, directly addresses the global imperative for lower carbon emissions. This strategic alignment is crucial, as evidenced by the 2025 projected global investment in clean energy reaching over $2 trillion, highlighting a market shift towards sustainable solutions. Compliance and proactive environmental stewardship are not just legal necessities but also strategic advantages in today's market.

BROAD's air conditioning and building solutions must meet stringent product safety and quality standards, a critical legal factor. For instance, in the EU, the Ecodesign Directive sets minimum energy efficiency requirements for air conditioners, with the latest revisions in 2023 aiming for further improvements. Compliance ensures product reliability, builds customer trust, and crucially, helps BROAD avoid costly liabilities and recalls.

Intellectual Property Rights and Green Technology Patents

Protecting intellectual property, particularly for green technologies in sustainable building and HVAC, is vital for BROAD. The existing legal framework, encompassing patents and trade secrets, enables the company to secure its innovative designs and proprietary technologies. This protection is essential for encouraging ongoing research and development and maintaining a competitive edge in the market.

The landscape of green technology patents is experiencing significant growth. For instance, global patent filings for clean energy technologies saw a substantial increase, with reports indicating over 250,000 patent families related to renewable energy and energy efficiency filed between 2020 and 2023. This trend underscores the increasing importance of intellectual property in driving sustainable innovation.

- Patent Protection: Legal mechanisms safeguard BROAD's unique green technology designs and processes.

- Trade Secrets: Confidential information related to sustainable building and HVAC innovations are legally protected.

- Innovation Driver: Robust IP rights encourage further investment in research and development for green solutions.

- Market Leadership: Safeguarding innovations helps maintain BROAD's position as a leader in sustainable technologies.

Waste Management and Recycling Regulations

BROAD's prefabricated building solutions are directly impacted by evolving waste management and recycling regulations. For instance, in 2024, many regions are tightening rules around construction and demolition (C&D) waste, requiring detailed waste management plans and increasing targets for material diversion from landfills. This necessitates that BROAD designs its modular components for easier disassembly and material recovery, aligning with principles like extended producer responsibility (EPR) that are gaining traction globally.

Compliance with these mandates is crucial for BROAD's operational continuity and market access. Failure to adhere to stricter C&D waste regulations, which often include specific percentages for recycling and reuse, could lead to significant fines and reputational damage. For example, some European countries are aiming for over 70% recycling rates for C&D waste by 2025, a benchmark that prefabrication can help achieve through standardized, reusable materials.

- Evolving C&D Waste Targets: Many jurisdictions are increasing mandated recycling and reuse rates for construction and demolition waste, with some aiming for over 70% by 2025.

- Extended Producer Responsibility (EPR): EPR frameworks are increasingly being applied to building materials, making manufacturers like BROAD responsible for the end-of-life management of their products.

- Waste Management Plans: Detailed waste management plans are becoming standard requirements for construction projects, influencing the design and material selection for prefabricated elements.

- Material Passporting: The trend towards material passports, which track the composition and recyclability of building components, will further drive the need for sustainable material sourcing and design in prefabrication.

BROAD's operations and product development are significantly shaped by evolving legal frameworks, from building codes to environmental regulations. Staying ahead of these legal requirements is paramount for continued success and market access.

Compliance with stringent energy efficiency standards, such as those outlined in the International Energy Conservation Code (IECC), directly impacts BROAD's product design and manufacturing processes. For instance, the 2021 IECC mandates enhanced insulation and window performance, influencing material selection and construction techniques.

Environmental protection laws are also becoming increasingly rigorous, particularly concerning emissions from manufacturing and building operations. The US EPA's proposed stricter rules for power plant emissions in 2024, aimed at reducing greenhouse gases, highlight the growing regulatory pressure on industrial activities.

| Legal Factor | Impact on BROAD | Example/Data Point |

| Building Codes & Energy Efficiency | Dictates construction standards and material choices. | 2021 IECC mandates improved insulation and window performance. |

| Environmental Regulations | Governs emissions and operational footprint. | EPA's 2024 proposed stricter power plant emission rules. |

| Product Safety & Quality | Ensures reliability and avoids liabilities. | EU Ecodesign Directive sets minimum energy efficiency for ACs (revised 2023). |

| Intellectual Property Rights | Protects innovation and R&D investment. | Global patent filings for clean energy technologies increased over 250,000 between 2020-2023. |

| Waste Management & Recycling | Influences design for disassembly and material recovery. | Tightening C&D waste rules in 2024; some European countries aim for >70% recycling by 2025. |

Environmental factors

The escalating impacts of climate change, including more frequent heatwaves and intense storms, are significantly shaping the construction industry. This is creating a growing demand for buildings that can withstand these environmental stressors and operate with greater energy efficiency. For instance, a 2024 report indicated a 15% year-over-year increase in demand for green building certifications, reflecting this shift.

BROAD's commitment to sustainable building solutions, focusing on enhanced energy efficiency through advanced insulation and smart climate control systems, directly addresses these evolving market requirements. These features not only reduce operational costs for building owners but also contribute to a lower carbon footprint, aligning with global environmental goals and consumer preferences that are increasingly prioritizing sustainability in their purchasing decisions.

Growing concerns over resource scarcity are pushing industries, including construction and manufacturing, to prioritize sustainable and recycled materials. This trend directly impacts operational costs and supply chain stability, as companies like BROAD Group navigate the shift towards more responsible material sourcing. For instance, the global market for recycled construction materials was valued at approximately $45 billion in 2023 and is projected to grow significantly, reflecting this increasing demand.

The global push for energy conservation and renewable energy is a significant tailwind for BROAD. Their non-electric absorption chillers and energy-efficient building solutions directly support this trend, helping reduce overall energy usage. This movement is fueled by increasing regulatory pressures and a growing consumer demand for sustainability.

In 2024, the International Energy Agency reported that renewable energy sources accounted for nearly 30% of global electricity generation, a figure projected to rise. BROAD's offerings are well-positioned to capitalize on this shift, enabling businesses to integrate cleaner energy solutions more effectively and meet stringent environmental standards.

Air Pollution and Indoor Air Quality

Deteriorating air quality, both outdoors and indoors, is a pressing environmental concern that significantly boosts the market for air purification products. BROAD's product line directly tackles this issue, aiming to create healthier living and working spaces for consumers and businesses alike.

The growing understanding of the adverse health effects linked to air pollution is a key driver for this market. For instance, the World Health Organization (WHO) reported in 2022 that air pollution caused an estimated 7 million premature deaths annually worldwide, highlighting the urgency of addressing this problem.

- Global air purifier market projected to reach $19.3 billion by 2027, growing at a CAGR of 8.5% from 2020.

- Indoor air pollution can be up to 5 times higher than outdoor air pollution.

- Increased respiratory illnesses and allergies are directly linked to poor air quality.

- Consumer spending on home appliances, including air purifiers, saw a notable increase in 2023, driven by health consciousness.

Waste Reduction and Circular Economy Principles

The growing emphasis on waste reduction and circular economy principles within construction and manufacturing presents a significant opportunity for companies like BROAD. Their prefabricated building methods inherently minimize on-site waste, a critical factor as regulations increasingly mandate better construction waste management. For instance, in 2024, the UK government's updated Environmental Act continues to push for stricter waste reduction targets across industries.

BROAD's commitment to sustainability throughout their product lifecycle aligns perfectly with these evolving environmental demands. This focus not only reduces their environmental footprint but also positions them favorably to meet upcoming regulatory requirements and consumer preferences for eco-conscious solutions. The global circular economy market is projected to reach $4.5 trillion by 2030, highlighting the immense potential for businesses embracing these principles.

- Reduced On-Site Waste: Prefabrication minimizes material offcuts and disposal needs.

- Lifecycle Sustainability: Commitment to minimizing environmental impact from production to end-of-life.

- Regulatory Compliance: Proactive positioning for stricter waste management laws.

- Market Opportunity: Alignment with the rapidly expanding circular economy sector.

The increasing frequency and intensity of extreme weather events, driven by climate change, are compelling the construction sector to adapt. This includes a rising demand for resilient infrastructure and energy-efficient buildings, with a 2024 market analysis showing a 12% increase in investments in climate-resilient construction technologies.

Resource scarcity is driving a greater emphasis on sustainable and recycled materials in manufacturing and construction. This shift impacts supply chains and operational costs, as demonstrated by the global recycled construction materials market, projected to reach $60 billion by 2026, up from $45 billion in 2023.

The global push for energy conservation and renewable energy sources is a significant driver for energy-efficient solutions. In 2024, renewable energy accounted for over 30% of global electricity generation, a trend that supports businesses integrating cleaner energy technologies.

Deteriorating air quality, both indoors and outdoors, is a major concern, fueling the market for air purification products. The World Health Organization estimates that air pollution contributes to millions of premature deaths annually, underscoring the need for effective air quality solutions.

The growing focus on waste reduction and circular economy principles is influencing construction and manufacturing practices. Prefabricated building methods, which minimize on-site waste, are gaining traction as regulations for construction waste management become stricter, with the UK government setting new waste reduction targets in 2024.

| Environmental Factor | Impact on Industry | Market Trend/Data Point | Opportunity/Challenge |

| Climate Change & Extreme Weather | Demand for resilient and energy-efficient buildings | 12% increase in investments in climate-resilient construction (2024) | Opportunity for sustainable building solutions |

| Resource Scarcity | Shift towards sustainable and recycled materials | Recycled construction materials market to reach $60B by 2026 | Supply chain adaptation and cost management |

| Energy Conservation & Renewables | Increased adoption of energy-efficient technologies | Renewables >30% of global electricity generation (2024) | Growth for non-electric and energy-saving products |

| Air Quality Concerns | Demand for air purification products | Millions of annual premature deaths linked to air pollution (WHO) | Market expansion for health-focused building solutions |

| Waste Reduction & Circular Economy | Emphasis on minimizing construction waste | Stricter waste management regulations (e.g., UK 2024) | Advantage for prefabricated and low-waste building methods |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable international organizations, government statistical agencies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.