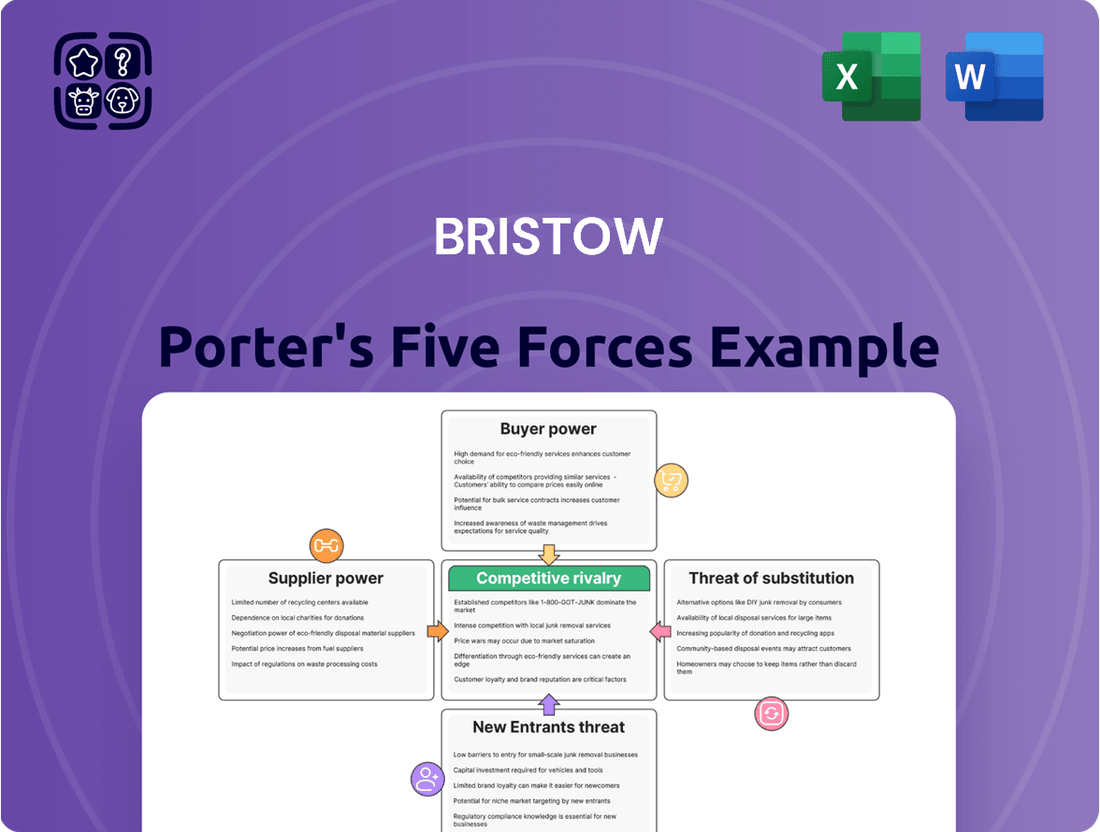

Bristow Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bristow Bundle

Bristow's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for navigating the industry. Ready to move beyond the basics? Get a full strategic breakdown of Bristow’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The helicopter manufacturing sector is notably concentrated, dominated by a handful of major players. Companies like Airbus Helicopters, Leonardo, and the Bell Textron and Sikorsky (Lockheed Martin) joint venture control a significant portion of the global market. This limited supplier base means Bristow, like other operators, faces manufacturers with substantial leverage.

This concentration grants these manufacturers considerable power in dictating terms for new aircraft purchases and the supply of essential spare parts. For instance, in 2023, Airbus Helicopters delivered 336 civil and public helicopters, highlighting their production capacity and market presence. Bristow's reliance on these specific manufacturers for its varied fleet, which includes models from these key producers, inherently strengthens the suppliers' bargaining position.

Suppliers of specialized components like advanced avionics and turbine engines wield significant bargaining power over Bristow. This strength stems from their proprietary technology and the scarcity of viable alternatives for these critical parts. For instance, a single-source provider for a specific helicopter's engine control system can dictate terms due to the absence of other qualified suppliers.

Bristow's reliance on these highly specialized components for safe and efficient fleet operations means these suppliers have considerable leverage. The inherent complexity and substantial cost associated with acquiring and maintaining such advanced parts further solidify the suppliers' influential position in the market.

The bargaining power of highly skilled labor, such as experienced pilots and aircraft maintenance technicians, is significant. The scarcity of these individuals, coupled with the extensive training and certifications they require, allows them to negotiate for higher wages and better working conditions. For instance, in 2024, the average salary for a commercial airline pilot in the US was around $200,000, reflecting this demand.

Bristow, like other aviation companies, faces intense competition to attract and retain this specialized talent. This competition directly impacts operational costs, as companies must offer competitive compensation packages to secure the necessary human resources. The need for specialized engineers, crucial for aircraft upkeep and technological advancements, further amplifies this supplier power within the labor market.

Fuel and Energy Providers

Fuel and energy providers, particularly jet fuel suppliers, wield significant bargaining power over Bristow. Jet fuel is a substantial operational expense, and its price volatility directly impacts Bristow's profitability. The limited number of major global fuel distributors further concentrates this power, allowing them to influence pricing and supply terms.

The bargaining power of fuel suppliers is a critical factor for Bristow's cost management. For instance, in 2024, global oil prices experienced fluctuations, directly affecting jet fuel costs. Bristow's reliance on a few large-scale distributors means these entities can negotiate terms that may not always favor the company, impacting operational efficiency.

- Jet fuel costs represent a significant portion of Bristow's operating expenses.

- Global oil price volatility directly influences jet fuel prices, impacting Bristow's bottom line.

- A concentrated market of large-scale fuel distributors enhances supplier bargaining power.

Switching Costs for Aircraft and Parts

The bargaining power of suppliers for Bristow is significantly influenced by switching costs associated with aircraft and MRO (Maintenance, Repair, and Overhaul) parts. Switching helicopter models or changing MRO parts suppliers can involve substantial expenses for Bristow. These costs include retraining pilots and maintenance crews, reconfiguring existing maintenance facilities to accommodate new equipment, and navigating complex recertification processes for both aircraft and parts. This inherent expense limits Bristow's ability to easily change suppliers, thereby increasing its reliance on current providers and strengthening the suppliers' leverage.

These high switching costs directly empower incumbent manufacturers and parts providers. For instance, a major helicopter manufacturer like Leonardo, which supplies Bristow with models such as the AW139, benefits from the significant investment required for Bristow to transition to a different platform. Similarly, specialized MRO parts suppliers for these aircraft also hold considerable sway. In 2024, the global aerospace MRO market was valued at approximately $90 billion, indicating the scale of operations and the established nature of many supplier relationships, where breaking these ties is not a simple undertaking.

- High Retraining Costs: Transitioning to new helicopter models necessitates extensive and costly training for pilots and mechanics.

- Facility Reconfiguration: Adapting maintenance hangars and equipment for different aircraft types represents a considerable capital expenditure.

- Recertification Hurdles: Obtaining necessary certifications for new aircraft and parts involves lengthy and expensive regulatory processes.

- Supplier Dependence: These combined costs foster a dependency on existing suppliers, granting them greater bargaining power over pricing and terms.

The bargaining power of suppliers in the helicopter industry is substantial, driven by market concentration and high switching costs. Key manufacturers like Airbus Helicopters and Leonardo hold significant leverage, influencing terms for new aircraft and spare parts. For example, in 2023, these major players delivered hundreds of aircraft, underscoring their market dominance and Bristow's reliance on them.

Specialized component providers, such as those for avionics and engines, also exert considerable influence due to proprietary technology and limited alternatives. Bristow's need for these critical parts for safe operations amplifies the suppliers' power. Furthermore, the scarcity of highly skilled labor, like pilots and technicians, with average pilot salaries around $200,000 in the US in 2024, forces companies to offer competitive compensation, increasing operational costs.

Fuel suppliers, particularly for jet fuel, represent another powerful supplier group. The concentrated nature of global fuel distributors and the significant portion jet fuel represents in operating expenses, impacted by price volatility in 2024, grants them considerable negotiation power. High switching costs, encompassing retraining, facility reconfiguration, and recertification, further entrench Bristow's dependence on existing suppliers, especially within the $90 billion global aerospace MRO market in 2024.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Bristow |

|---|---|---|

| Aircraft Manufacturers | Market concentration, proprietary technology, high switching costs | Dictate terms for new aircraft and parts, limit sourcing options |

| Specialized Component Suppliers | Proprietary technology, single-sourcing, high complexity of parts | Influence pricing and availability of critical avionics and engine parts |

| Skilled Labor (Pilots, Technicians) | Scarcity of qualified personnel, extensive training requirements | Increased labor costs due to competitive hiring, potential operational disruptions |

| Fuel & Energy Providers | Concentrated market, price volatility of commodities (e.g., oil) | Significant impact on operating expenses, potential for unfavorable pricing |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Bristow's helicopter services industry.

Pinpoint and address competitive threats with a dynamic, interactive dashboard that visualizes all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Consolidation among major offshore energy companies, Bristow's key clients, significantly amplifies customer bargaining power. These larger, integrated entities wield substantial procurement budgets, enabling them to negotiate more advantageous terms, such as lower pricing and more demanding service level agreements. For instance, the 2020 merger of Transocean and Songa Offshore created a more concentrated customer base for offshore service providers.

Bristow's services are absolutely critical for offshore oil and gas operations, ensuring personnel and essential equipment reach remote locations safely. However, customers often perceive these services as a fundamental operating cost, similar to fuel or maintenance, rather than a strategic differentiator. This perspective naturally drives their focus towards securing the most cost-effective contracts available.

In 2023, the offshore helicopter services market saw intense competition, with operators like Bristow, CHC Helicopter, and PHI Aviation vying for contracts. Customers, particularly large energy companies, leveraged this competition to negotiate favorable terms, often prioritizing price over premium service features. This dynamic puts pressure on providers to maintain efficiency and manage costs meticulously.

Despite the cost-centric view, the highly specialized nature of vertical flight solutions, coupled with stringent safety and regulatory requirements, grants Bristow a degree of counter-leverage. The significant investment in pilot training, aircraft maintenance, and compliance means customers cannot easily switch providers without incurring substantial transition costs and potential operational disruptions.

Bristow's major clients, such as government bodies and large oil and gas firms, frequently enter into extended contracts. These agreements typically follow rigorous bidding procedures, enabling customers to secure fixed pricing and service standards.

This practice grants Bristow predictable revenue streams, but the initial contract negotiations are often intense. Customers utilize their significant purchasing power and long-term commitment to negotiate favorable terms, directly impacting Bristow's profit margins.

Customer Sophistication and Industry Knowledge

Bristow's customers, particularly in the oil and gas sector, exhibit a high degree of sophistication and industry knowledge. This means they are not easily swayed by superficial offerings and possess a deep understanding of market dynamics, pricing, and service quality expectations. For instance, major oil companies routinely benchmark helicopter service providers against global standards, making them acutely aware of prevailing rates and operational efficiencies. This informed stance empowers them to negotiate aggressively, demanding the best possible value for their expenditure.

Their expertise extends to understanding operational best practices and the intricacies of helicopter maintenance and deployment. Consequently, Bristow's clients can critically evaluate proposals, scrutinizing every aspect from fleet age and technical specifications to crew experience and safety records. This deep-seated knowledge directly translates into increased bargaining power, compelling Bristow to consistently demonstrate superior service delivery and cost-effectiveness to secure and retain business.

- Informed Negotiation: Customers can leverage their understanding of market rates to push for lower prices.

- Demand for Excellence: Sophisticated clients expect high operational standards and safety protocols.

- Benchmarking Power: Industry knowledge allows customers to compare Bristow's offerings against competitors and global benchmarks.

- Value-Driven Decisions: Customers prioritize demonstrable value, forcing providers to optimize efficiency and service.

Potential for In-house Capabilities (Limited)

While it's highly uncommon and requires significant investment, extremely large clients could, in theory, explore developing basic in-house helicopter transport for very specific operational needs. This theoretical, albeit unlikely, option can slightly enhance their negotiating leverage by presenting a potential alternative, even if not actively pursued.

More realistically, customers can bolster their bargaining power by diversifying their helicopter service providers. This strategy reduces dependence on any single company, thereby intensifying competitive pressure on Bristow. For instance, a large oil and gas operator might split its contract across two or three providers to secure better terms and service levels.

- Theoretical In-house Capability: Though capital-intensive and rare, very large customers might consider limited in-house helicopter transport for niche requirements, providing a subtle negotiation tool.

- Provider Diversification: Customers actively seek multiple service providers to mitigate reliance on a single vendor, thereby increasing competitive pressure on existing players like Bristow.

- Market Concentration: The helicopter services market, particularly for offshore transport, often features a limited number of major players, which can influence customer bargaining power depending on the specific region and service type.

Customers possess significant bargaining power when they represent a large portion of a company's revenue, can easily switch providers, or when the cost of switching is low. For Bristow, major oil and gas companies often fall into these categories, especially with the ongoing consolidation in the energy sector. For example, in 2023, the offshore helicopter market remained highly competitive, with customers leveraging this to secure favorable pricing, as demonstrated by contract negotiations where price often outweighed premium service features.

The ability of customers to switch providers is influenced by the switching costs involved. While Bristow's specialized services and stringent safety requirements create some barriers, the overall market dynamics and the potential for customers to diversify their supplier base can still exert considerable pressure. In 2024, many large energy firms continued to actively manage their supplier relationships, seeking to optimize costs through multi-vendor strategies.

Customers' bargaining power is also amplified by their informed nature and the commoditized perception of helicopter services. Major clients, possessing deep industry knowledge, can effectively benchmark Bristow's offerings against global standards and competitors, demanding demonstrable value and cost-effectiveness. This informed negotiation stance, coupled with the potential for provider diversification, means Bristow must consistently deliver superior service and competitive pricing to retain its client base.

| Factor | Impact on Bristow | Example/Data Point |

|---|---|---|

| Customer Concentration | High | Consolidation among major offshore energy companies increases the purchasing power of remaining clients. |

| Switching Costs | Moderate | While specialized services exist, customers can diversify providers, reducing dependence and increasing competitive pressure. |

| Customer Sophistication | High | Clients benchmark services against global standards, demanding value and efficiency, as seen in 2023 contract negotiations prioritizing price. |

| Price Sensitivity | High | Helicopter services are often viewed as an operating cost, driving customers to seek the most cost-effective contracts. |

Preview Before You Purchase

Bristow Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Bristow, offering a detailed examination of industry competition, supplier power, buyer power, threat of new entrants, and threat of substitutes. The document you see here is precisely the same professionally formatted and ready-to-use analysis you'll receive immediately after purchase, ensuring no surprises and instant access to valuable strategic insights.

Rivalry Among Competitors

The helicopter services industry, including players like Bristow, faces intense competition partly due to its high fixed costs. Acquiring and maintaining a fleet of helicopters, along with the necessary specialized infrastructure, represents a significant capital investment, often running into millions of dollars per aircraft.

This asset intensity compels companies to operate their aircraft at maximum utilization rates. When demand dips, such as in 2023 and early 2024 with fluctuating oil and gas sector activity, the pressure to cover these substantial fixed overheads intensifies, leading to aggressive bidding and price wars among established operators.

For instance, in 2024, the ongoing need to absorb these high operational costs means that even a slight downturn in contract awards can trigger a more aggressive pricing stance from competitors aiming to secure market share and maintain fleet productivity.

The inherent cyclicality of the offshore energy market profoundly shapes competitive rivalry within the helicopter services sector. When oil and gas prices surge, driving increased exploration and production, demand for Bristow's services escalates, often leading to a focus on fleet expansion and securing new contracts. Conversely, during periods of depressed energy prices, demand plummets, creating overcapacity and triggering aggressive price competition as companies fight for fewer available projects.

This volatility means that companies like Bristow must navigate boom-and-bust cycles. For instance, during the downturns experienced in the mid-2010s and again in 2020, the industry saw significant consolidation and intense bidding wars. In 2020, for example, global oil prices briefly turned negative, severely impacting offshore activity and, consequently, the demand for offshore helicopter transport, forcing operators to compete fiercely on price to maintain any level of utilization.

The intense competition during these downturns can lead to a significant erosion of profit margins. As companies scramble for work, they may accept contracts at rates that barely cover operating costs. This dynamic forces a constant strategic evaluation of fleet size, operational efficiency, and cost management to remain competitive and resilient through the market's inherent ups and downs.

Bristow operates in a competitive environment marked by both large, global players and smaller, regionally specialized firms. While Bristow competes head-to-head with other major international helicopter service providers, it also encounters intense rivalry from niche companies deeply entrenched in specific geographic markets. This dynamic necessitates a dual strategy: maintaining a vast operational network while also cultivating strong local knowledge and capabilities.

For instance, in 2024, the offshore helicopter market, a key sector for Bristow, saw continued consolidation among major players. However, regional operators often leverage lower overheads and tailored services to capture market share in their specific territories. This means Bristow must not only match the global scale and efficiency of its largest competitors but also demonstrate the agility and localized understanding that smaller, regional specialists offer.

Differentiation Through Safety, Technology, and Service

Companies in the offshore helicopter services sector actively differentiate themselves by emphasizing exceptional safety records, leveraging cutting-edge helicopter technology, and offering a broad spectrum of services. This includes vital maintenance, repair, and overhaul (MRO) capabilities, alongside critical search and rescue (SAR) operations. Bristow's commitment to an unwavering safety culture, strategic investments in modernizing its fleet, and its capacity to deliver integrated solutions are key differentiators in this competitive landscape.

However, the intensity of competition means rivals also pour significant resources into these same areas, making sustained differentiation a challenging endeavor. For instance, in 2024, the global helicopter market saw continued investment in advanced avionics and safety systems, with major players like Leonardo and Airbus Helicopters showcasing new technologies aimed at enhancing operational safety and efficiency. This constant innovation cycle means that maintaining a competitive edge requires continuous adaptation and investment.

- Safety Culture: Companies prioritize rigorous training and adherence to strict safety protocols to minimize incidents, a critical factor for clients in high-risk environments.

- Technological Advancement: Investment in newer, more fuel-efficient, and technologically advanced helicopters (e.g., those with advanced navigation and communication systems) is crucial for operational superiority.

- Service Integration: Offering end-to-end solutions, including MRO, pilot training, and specialized mission support, provides added value and customer loyalty.

Industry Consolidation and Mergers

The helicopter services industry has seen a significant trend toward consolidation. Bristow's own merger with Era Group in 2020 is a prime example, reducing the number of major operators. This consolidation, while creating larger entities, often intensifies competition among the remaining significant players as they vie for contracts, market share, and valuable assets.

This strategic consolidation reshapes the competitive landscape. The remaining large companies are compelled to compete more aggressively for contracts, key personnel, and strategic market positions. For instance, as of early 2024, the combined Bristow Group operates a fleet of over 300 helicopters, making it a dominant force, and its rivalry with other major players like CHC Helicopter and Babcock International is keenly felt across various operational regions.

- Consolidation Trend: The helicopter services sector is experiencing a wave of mergers and acquisitions, exemplified by Bristow's acquisition of Era Group.

- Reduced Player Count: This consolidation shrinks the number of major competitors in the market.

- Intensified Rivalry: Fewer, larger players often lead to more aggressive competition for contracts, market share, and talent.

- Market Dynamics: Companies are not just competing on service price but also on fleet size, technological capabilities, and geographic reach, as seen in the ongoing competition for offshore oil and gas contracts.

Competitive rivalry in the helicopter services sector, exemplified by Bristow, is fierce due to high fixed costs and asset intensity, forcing operators to maximize fleet utilization. This pressure intensifies during demand downturns, such as those seen in early 2024, leading to aggressive pricing strategies as companies fight to cover substantial overheads.

The cyclical nature of the offshore energy market further fuels this rivalry; periods of low oil prices, like those experienced in 2020, severely contract demand, creating overcapacity and driving price wars. Companies must constantly adapt to these boom-and-bust cycles to maintain profitability.

Players differentiate through safety, technology, and service integration, but rivals also invest heavily in these areas, making sustained competitive advantage a continuous challenge. For instance, ongoing investments in advanced avionics by manufacturers like Leonardo and Airbus Helicopters in 2024 highlight this constant innovation race.

Consolidation, such as Bristow's 2020 merger with Era Group, has reduced the number of major players but intensified competition among the remaining large entities like CHC Helicopter and Babcock International. As of early 2024, Bristow's fleet of over 300 helicopters positions it as a major competitor, vying for contracts based on fleet size, technology, and geographic reach.

| Competitor | Fleet Size (Approx.) | Key Markets | Notes |

|---|---|---|---|

| Bristow Group | 300+ | Offshore Energy, SAR, Government | Global presence, post-Era Group merger |

| CHC Helicopter | 200+ | Offshore Energy, SAR | Significant global operator |

| Babcock International | 150+ | Defense, Critical Services, SAR | Strong in UK and Europe |

SSubstitutes Threaten

Fixed-wing aircraft present a potential substitute for Bristow's long-haul transport needs, particularly for inter-continental travel or journeys not directly to offshore platforms. These aircraft can manage personnel and equipment movements that might otherwise require a blend of air and sea transport.

However, their fundamental limitation is the inability to land on oil rigs or similarly remote, unprepared sites. This critical constraint means fixed-wing aircraft cannot directly replace Bristow's specialized offshore helicopter services, thereby limiting their direct substitutability for the company's core operations.

Marine vessels, such as supply boats and crew transfer vessels, represent a significant threat of substitutes for Bristow's offshore helicopter services. These vessels are a common alternative for transporting personnel and cargo to offshore platforms, especially for less time-sensitive operations or when carrying bulkier equipment. For instance, in 2024, the maritime logistics sector supporting offshore energy continued to be robust, with many companies utilizing a mix of vessel types for their logistical needs, often prioritizing cost-effectiveness for routine movements.

While helicopters offer unparalleled speed and access to remote or difficult-to-reach locations, marine vessels are typically more economical, particularly for moving heavier cargo or larger groups of personnel over moderate distances. The slower transit times and susceptibility to weather disruptions are trade-offs that many operators accept to reduce costs. Bristow's competitive advantage hinges on its ability to provide rapid response and enhanced safety, which substitutes like vessels cannot fully match, but the cost differential remains a persistent challenge.

The threat of substitutes is emerging from advanced drone technology, particularly in niche areas like infrastructure inspection and environmental monitoring. While drones are not yet a viable substitute for Bristow's core helicopter services in passenger transport or heavy lifting, their capabilities are expanding. For instance, in 2024, the global drone services market was valued at approximately $25 billion, with significant growth projected in industrial applications.

Currently, drones complement rather than replace helicopter operations for Bristow. Their limitations in payload capacity and flight range prevent them from undertaking the complex, long-distance missions that helicopters handle. However, ongoing research and development, with significant venture capital investment in the drone sector, suggest future advancements could broaden their application scope.

Advanced Communication and Remote Operations

Advancements in digital communication and remote sensing technologies present a potential threat of substitution for traditional vertical flight services in certain industrial applications. As these technologies mature, the need for physical personnel presence in some offshore or remote settings could diminish. For example, enhanced remote monitoring systems could reduce the frequency of crew transfers to offshore platforms.

However, critical maintenance, emergency response, and complex operational tasks will likely continue to necessitate human intervention and specialized vertical flight solutions. The inherent limitations of remote operations in handling unforeseen issues or highly intricate procedures mean that helicopters and other VTOL aircraft will retain their importance. For instance, in 2024, the offshore oil and gas industry, a major user of helicopter services, continued to rely heavily on these aircraft for personnel transport and emergency medical services, highlighting the ongoing need for physical presence in demanding environments.

- Remote monitoring capabilities are expanding, potentially reducing routine personnel transfers.

- Complex maintenance and emergency response remain key drivers for physical presence.

- The offshore oil and gas sector's continued reliance on helicopters underscores the persistence of demand for physical operations.

Alternative Energy Sources and Project Locations

A significant threat to Bristow's business comes from alternative energy sources and shifts in project locations. If the global energy sector increasingly favors renewable sources like offshore wind farms, or if exploration moves to more accessible onshore locations, the fundamental demand for specialized offshore helicopter transport will likely decline. This strategic shift represents a powerful substitute for Bristow's core services, potentially diminishing the need for helicopters to service remote oil and gas platforms.

For instance, the offshore wind sector, while still requiring specialized logistics, often utilizes different transportation methods for personnel and equipment compared to traditional oil and gas operations. By 2024, the global offshore wind capacity reached over 75 GW, a substantial increase that signifies a growing segment of the energy market potentially less reliant on Bristow's traditional helicopter model. This trend could gradually erode the market share for offshore helicopter transportation.

- Growing Offshore Wind Capacity: Global offshore wind capacity is expanding rapidly, potentially diverting investment and focus away from traditional offshore oil and gas.

- Onshore Exploration Trends: A move towards more onshore energy exploration reduces the necessity for remote offshore logistics, including helicopter services.

- Technological Advancements: Innovations in alternative transport methods for offshore energy projects could offer cost-effective substitutes for helicopter services.

Marine vessels remain a primary substitute for Bristow's offshore transport needs, especially for non-urgent cargo and personnel movements where cost efficiency is paramount. In 2024, the maritime logistics sector continued to offer a cost-effective alternative, with many operators balancing vessel usage against the speed of helicopters. While helicopters provide critical speed and access, the lower operating costs of vessels for routine transfers present a persistent competitive challenge.

| Substitute Type | Key Characteristics | Impact on Bristow | 2024 Relevance |

|---|---|---|---|

| Marine Vessels | Lower cost, higher capacity for bulk cargo, slower transit times | Threatens routine personnel and cargo transport; cost-sensitive operations | Continued robust utilization for cost-effective logistics in offshore support |

| Fixed-Wing Aircraft | Higher speed for long distances, limited to prepared landing sites | Limited direct substitution for offshore platform access; serves inter-continental needs | Remains a viable alternative for non-platform specific long-haul transport |

| Drone Technology | Emerging capabilities for inspection, monitoring, limited payload | Potential for niche applications; not yet a direct substitute for core services | Global drone services market valued around $25 billion in 2024, indicating growth |

| Remote Monitoring | Digital communication, remote sensing reducing physical presence needs | May reduce frequency of routine crew transfers; critical tasks still require physical presence | Offshore energy sector continued reliance on helicopters for critical operations in 2024 |

Entrants Threaten

The sheer cost of building and maintaining a modern helicopter fleet is a massive hurdle for any newcomer. We're talking about hundreds of millions, even billions, of dollars just to get a basic, operational fleet in the air. For instance, a single heavy-lift helicopter can cost upwards of $30 million, and that's before you even consider the specialized maintenance, training, and support infrastructure required.

This enormous capital investment acts as a formidable moat, effectively deterring most potential competitors from entering the market. The financial commitment is simply too great for all but the most well-funded organizations, significantly limiting the number of credible new entrants who could challenge established players like Bristow.

The vertical flight industry faces significant barriers to entry due to extensive regulatory hurdles and the need for numerous certifications. New companies must navigate complex global aviation regulations, securing approvals from bodies like the FAA and EASA, a process that can take years and millions of dollars. For instance, obtaining a type certificate for a new aircraft design is a lengthy and costly undertaking, often exceeding $100 million, which deters many potential entrants.

Meeting stringent safety standards and compliance requirements is paramount. This includes rigorous testing, maintenance protocols, and pilot training programs, all of which demand substantial investment and expertise. In 2024, the emphasis on safety continues to grow, with evolving regulations for advanced air mobility (AAM) and electric vertical takeoff and landing (eVTOL) aircraft, further raising the bar for new market participants.

The aviation industry, especially for services like offshore transport, places an immense premium on safety. A new company entering this market without a long-standing, proven safety record faces a significant hurdle. Customers, particularly those in the critical offshore energy sector and government operations, often make safety their absolute top priority when selecting a service provider.

New entrants simply do not possess the decades of operational data and the established trust that legacy companies like Bristow have built. This lack of a tangible safety history and a recognized, reliable brand name makes it exceedingly difficult for them to secure the high-value contracts that are essential for profitability and growth in this specialized field.

Access to Specialized Personnel and Training

New entrants face significant hurdles in acquiring and retaining a highly specialized workforce, particularly in aviation. The demand for experienced pilots, certified maintenance engineers, and skilled operational staff often outstrips supply, making recruitment a competitive and costly endeavor. For instance, the global shortage of qualified airline pilots was projected to reach over 200,000 by 2024, a figure that directly impacts new airlines needing to staff their operations.

The extensive training, unique skill sets, and rigorous certifications required for aviation roles represent a substantial barrier. New entrants must invest heavily in developing these capabilities, often taking years to build a competent team. Established players, however, benefit from existing, well-funded training programs and established talent pipelines, giving them a distinct advantage in securing and developing the necessary human capital. This disparity in human resource capacity creates a formidable entry barrier.

- Specialized Skills Gap: The aviation industry requires highly specific skills that are not easily transferable or readily available in the general labor market.

- Training Investment: New entrants must commit substantial financial resources and time to train personnel to meet stringent safety and operational standards.

- Retention Challenges: Attracting and retaining top talent is difficult for newcomers when established companies offer competitive compensation, benefits, and career progression opportunities.

Development of Global Operational Infrastructure

The necessity of a comprehensive global operational infrastructure, encompassing maintenance bases, robust logistics networks, and dedicated regional support teams, is paramount for serving a diverse worldwide client base. This intricate and expansive network requires substantial capital investment and considerable time to establish from the ground up.

Building such a complex global operational infrastructure presents a significant barrier to entry for new competitors. The sheer cost and time involved in replicating Bristow's established network of maintenance facilities, supply chains, and localized support personnel are prohibitive.

Bristow's existing global footprint acts as a formidable competitive advantage. For instance, as of late 2024, Bristow operates a fleet of over 200 aircraft across more than 20 countries, supported by a network of strategically located maintenance and operational hubs. This extensive infrastructure allows for efficient service delivery and rapid response times, elements that are exceptionally difficult and expensive for newcomers to match.

- Significant Capital Investment: Establishing a global network of maintenance facilities and logistics requires hundreds of millions, if not billions, in upfront capital.

- Time to Market: Developing the necessary certifications, partnerships, and operational expertise across multiple jurisdictions takes years.

- Economies of Scale: Bristow's established scale allows for cost efficiencies in procurement, maintenance, and operations that new entrants would struggle to achieve initially.

The threat of new entrants in the helicopter services industry, particularly for established players like Bristow, is significantly mitigated by several formidable barriers. These include the immense capital required for fleet acquisition, the stringent regulatory environment, the critical importance of an unblemished safety record, the specialized nature of the workforce, and the necessity of a robust global operational infrastructure.

The cost of acquiring and maintaining a modern helicopter fleet is a major deterrent, with individual heavy-lift helicopters costing upwards of $30 million in 2024. Navigating complex aviation regulations, such as obtaining type certificates which can exceed $100 million, further elevates entry costs. New entrants also struggle to match the decades of proven safety records and established trust that legacy operators possess, a crucial factor for securing high-value contracts in sectors like offshore energy.

Furthermore, the industry faces a shortage of specialized aviation personnel, with a global pilot shortage projected to exceed 200,000 by 2024, making recruitment and training a significant challenge for newcomers. Replicating the extensive global operational infrastructure of established firms, including maintenance bases and logistics networks, demands prohibitive investment and time. Bristow's operational scale, with over 200 aircraft in more than 20 countries as of late 2024, exemplifies the advantage of established infrastructure and economies of scale.

| Barrier | Estimated Cost/Impact | Relevance to New Entrants |

| Capital Investment (Fleet) | $30M+ per heavy-lift helicopter | Prohibitive upfront cost for new entrants |

| Regulatory Compliance | $100M+ for type certification | Lengthy and expensive process, requires extensive expertise |

| Safety Record & Trust | Years to build reputation | Crucial for securing contracts, difficult for newcomers to establish |

| Skilled Workforce | Global pilot shortage > 200,000 by 2024 | High recruitment and training costs, retention challenges |

| Global Operational Infrastructure | Hundreds of millions to billions | Requires extensive time and capital to replicate established networks |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company annual filings, and reputable financial news outlets to capture the competitive landscape.