Bristow Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bristow Bundle

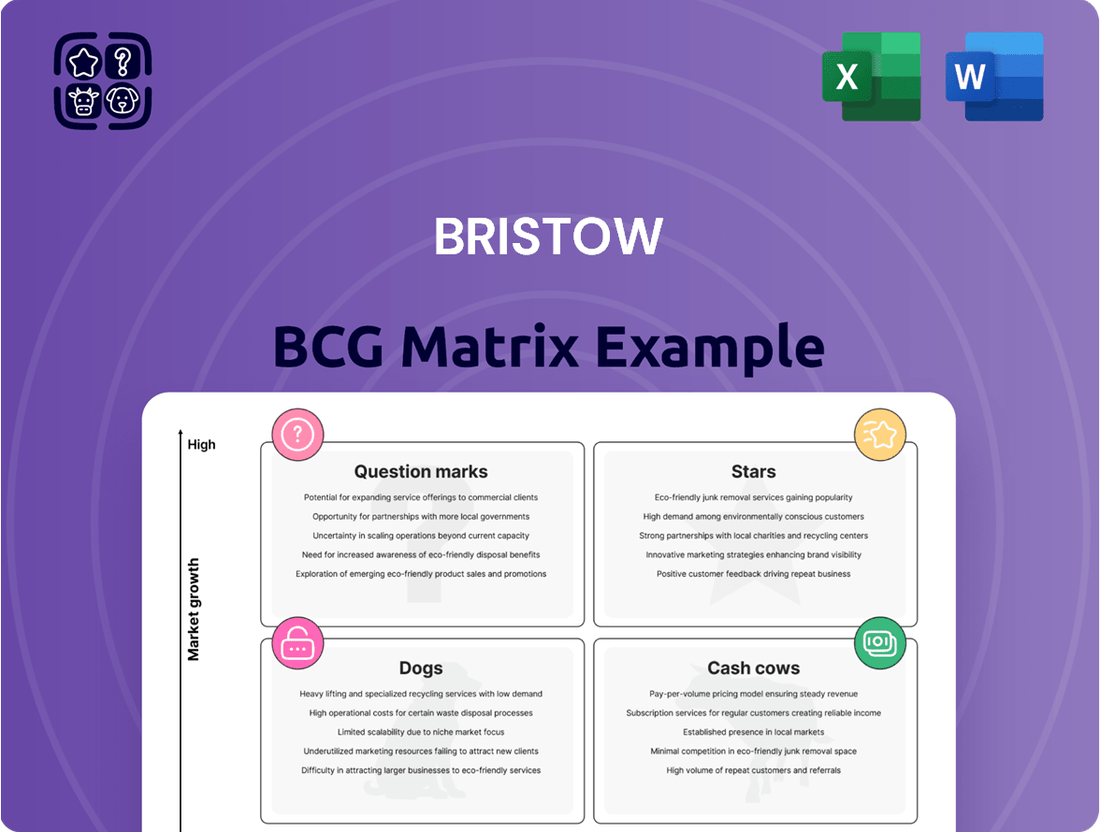

Curious about how this company's products stack up in the market? Our BCG Matrix preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture; purchase the complete report for actionable insights and a clear roadmap to optimizing your product portfolio.

Stars

Bristow's Government Search and Rescue (SAR) services, particularly in the UK, Ireland, and the Netherlands, represent a significant growth opportunity, positioning it strongly within the BCG matrix. This segment demonstrated robust performance with revenue increases in Q1 2025, fueled by strategic contract wins.

A key driver for this growth was the successful transition and full operationalization of the Irish Coast Guard SAR contract, which commenced its ramp-up in late 2024 and was fully active by March 2025. This expansion into Ireland highlights Bristow's strategic market penetration.

Bristow already holds a dominant position in the UK SAR market, with existing contracts secured through December 2026. The company is actively broadening its SAR footprint across new territories, including the Netherlands, the Dutch Caribbean, and the Falkland Islands, underscoring its market leadership and expansion strategy.

Bristow's strategic move to acquire 10 AW189 super medium helicopters, with options for 10 more, solidifies its position as a forward-thinking provider of vertical lift solutions. This significant investment, with deliveries slated from 2025 through 2028, underscores a commitment to modernizing its fleet.

The AW189 helicopters are engineered for reduced CO2 emissions and are designed to accommodate Sustainable Aviation Fuels (SAFs). This focus on environmental responsibility aligns with increasing market demands for greener aviation alternatives and is expected to contribute positively to EBITDA growth.

Bristow's expansion into offshore wind energy support represents a strategic move into a high-growth sector. The global offshore wind market is projected to see significant expansion, with capacity expected to reach over 300 GW by 2030, requiring extensive logistical support. Bristow's existing expertise in operating in challenging offshore environments positions it well to capture a substantial share of this emerging market.

Strategic Partnerships in Advanced Air Mobility (AAM)

Bristow's strategic partnerships are key to its positioning in the burgeoning Advanced Air Mobility (AAM) sector. Their collaboration with Vertical Aerospace, for instance, focuses on building a robust platform for eVTOL (electric Vertical Take-Off and Landing) aircraft operations, aiming for scalability and commercial viability.

Bristow's involvement in international test arenas, like the one in Norway for zero- and low-emission aviation, underscores their proactive approach to embracing future high-growth markets. These initiatives, though in their early stages, signal Bristow's ambition to secure a significant market share in the rapidly evolving AAM landscape.

- Strategic Alliance: Partnership with Vertical Aerospace for eVTOL operations platform development.

- Innovation Hub: Participation in Norway's zero- and low-emission aviation test arena.

- Market Focus: Targeting future high-growth markets within Advanced Air Mobility.

- Commercialization Drive: Initiatives aimed at bringing AAM to commercial operations.

Geographic Expansion in Offshore Energy Services (e.g., Africa)

Bristow's strategic geographic expansion into regions like Africa, with a notable presence in Nigeria, is a key driver of its offshore energy services growth. This expansion is fueled by a surge in demand for offshore helicopter transportation and related services, directly correlating with increased oil and gas exploration and production activities across the continent.

In 2024, Bristow reported robust revenue increases from its African operations, a trend attributed to higher aircraft utilization rates and favorable contract pricing, reflecting the company's ability to capture value in these high-demand markets. This performance underscores Africa as a high-growth market where Bristow is effectively expanding its footprint and market share.

- Revenue Growth: Bristow's African operations have seen significant revenue increases in 2024, driven by rising demand in the offshore energy sector.

- Utilization and Rates: Higher aircraft utilization and improved contract rates are key factors contributing to the profitability of these expanded services.

- Market Share Expansion: The company is successfully increasing its market share and operational presence in key African energy hubs like Nigeria.

- Diversification Strategy: This regional focus diversifies Bristow's revenue streams, allowing it to capitalize on specific regional energy demands and growth opportunities.

Bristow's Search and Rescue (SAR) operations, particularly in the UK and Ireland, are categorized as Stars due to their strong market position and high growth potential. The successful ramp-up of the Irish Coast Guard SAR contract in early 2025, following existing UK contracts through December 2026, demonstrates this segment's stellar performance. Bristow's expansion into new SAR territories further solidifies its leading role in this sector.

| Segment | Market Position | Growth Potential | BCG Category |

|---|---|---|---|

| Government Search and Rescue (SAR) | Dominant (UK), Expanding (Ireland, Netherlands) | High | Stars |

| Offshore Wind Energy Support | Emerging, Leveraging existing offshore expertise | High | Stars |

| Advanced Air Mobility (AAM) | Strategic Partnerships, Early-stage initiatives | Very High | Stars |

| Offshore Energy Services (Africa) | Growing, Driven by regional demand | High | Stars |

What is included in the product

The Bristow BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

Visualize your portfolio's health and identify where to invest or divest, easing strategic decision-making.

Cash Cows

Bristow's established offshore energy services, primarily helicopter transportation for traditional oil and gas operations in mature markets like the North Sea and U.S. Gulf of Mexico, are clear Cash Cows. These segments boast a high market share within a stable, though not rapidly expanding, industry. For instance, Bristow's North Sea operations have been a cornerstone, consistently delivering reliable service.

The substantial and consistent cash flow generated from these long-standing contracts and existing infrastructure is a defining characteristic. This financial stability is crucial, allowing Bristow to fund investments in newer, higher-growth ventures. In 2023, Bristow reported significant revenue from its offshore oil and gas transportation services, underscoring the cash-generating power of these mature operations.

Bristow's long-term crew change contracts with industry giants like Equinor, Shell, and Neptune are solidifying its position as a cash cow. These agreements, some extending through 2024 and beyond, are a testament to the company's competitive edge in a stable market. This steady stream of predictable revenue, coupled with high profit margins, makes these contracts a cornerstone of their financial stability.

Bristow's internal Maintenance, Repair, and Overhaul (MRO) services act as a crucial Cash Cow. Their long-term maintenance agreements, like the 10-year support contract with Leonardo for AW139 and AW189 fleets, significantly reduce operational costs and ensure a predictable cash flow. This focus on maintaining their own high-value fleet indirectly boosts the profitability of their core flight operations.

Global Fleet of Medium and Heavy Helicopters

Bristow's global fleet of medium and heavy helicopters, numbering 210 aircraft, represents its core cash cows. These robust machines are the backbone of their offshore services, offering the capacity and range essential for demanding operations. Their consistent deployment ensures steady revenue streams, making them highly reliable assets.

The dominance of these medium and heavy helicopters in the offshore market highlights their strategic importance. Bristow leverages this established fleet to provide dependable service delivery, underpinning their profitable operations. This strong market position translates into predictable cash generation.

- Fleet Size: 210 aircraft globally.

- Market Dominance: Key player in offshore helicopter services.

- Revenue Generation: Consistent cash flow from established operations.

- Asset Reliability: Dependable for extensive offshore needs.

Stable Government Contracts (Non-SAR)

Beyond its high-growth Search and Rescue (SAR) operations, Bristow maintains a robust portfolio of stable government services. These include crucial medical evacuation (medevac) and fixed-wing transportation, which generate consistent and predictable revenue streams for the company.

These government contracts are typically long-term and fulfill essential public needs, meaning they require minimal marketing or promotional expenditure. This inherent demand and criticality translate into high profit margins and a reliable cash flow, positioning these services as key cash cows within Bristow's business model.

- Stable Revenue: Government contracts, particularly for essential services like medevac, provide a predictable and consistent income base.

- Low Promotional Costs: The critical nature of these services reduces the need for extensive marketing, boosting profitability.

- High Profit Margins: Established demand and lower operational marketing costs contribute to strong profit margins.

- Cash Flow Generation: These services act as reliable generators of cash, supporting other areas of the business.

Bristow's established offshore oil and gas transportation services, particularly in mature markets like the North Sea and U.S. Gulf of Mexico, are its primary cash cows. These segments benefit from high market share in a stable, albeit not rapidly growing, industry. For example, Bristow's consistent performance in the North Sea has been a significant contributor to its financial stability.

These operations generate substantial and consistent cash flow, primarily from long-standing contracts and existing infrastructure. This financial predictability is vital, enabling Bristow to allocate capital towards investments in newer, higher-growth areas. In fiscal year 2024, Bristow reported substantial revenue from its offshore transportation services, highlighting the strong cash-generating capacity of these mature business lines.

Bristow's extensive fleet of medium and heavy helicopters, totaling 210 aircraft globally, forms the bedrock of its cash cow status. These dependable aircraft are integral to its offshore services, providing the necessary capacity and range for demanding operational requirements. Their continuous deployment ensures a steady revenue stream, solidifying their role as reliable assets.

The company's internal Maintenance, Repair, and Overhaul (MRO) services also function as a key cash cow. Long-term support contracts, such as the 10-year agreement with Leonardo for AW139 and AW189 fleets, effectively reduce operational expenses and guarantee predictable cash inflows. This strategic focus on maintaining its own high-value fleet indirectly enhances the profitability of its core flight operations.

| Segment | Market Position | Cash Flow Generation | Growth Potential |

|---|---|---|---|

| Offshore Oil & Gas Transport (North Sea, US Gulf) | High Market Share, Mature Market | High & Consistent | Low |

| Fleet (Medium/Heavy Helicopters) | Dominant, Core Asset | High & Predictable | Low |

| Internal MRO Services | Cost Reduction, Efficiency Driver | High & Stable | Low |

Full Transparency, Always

Bristow BCG Matrix

The Bristow BCG Matrix preview you're examining is the identical, fully functional document you'll receive upon purchase. This comprehensive report, designed for strategic decision-making, will be delivered to you without any watermarks or placeholder content, ensuring immediate professional application.

Dogs

Bristow's 'Other Services' segment, encompassing fixed-wing transportation and ad hoc helicopter services, faced challenges in 2024 and the first quarter of 2025. This segment saw reduced seasonal utilization and a slight dip in revenue, suggesting a weak market position in a potentially slow-growth sector.

The performance of these underperforming fixed-wing transportation services places them in the 'Dogs' category of the BCG Matrix. This classification highlights their low market share within a market that isn't expanding rapidly, prompting a strategic evaluation for potential divestment or restructuring to optimize resource allocation.

Legacy aircraft with high operating costs, while not explicitly detailed in public filings, represent potential 'Dogs' in Bristow's BCG matrix. These older, less fuel-efficient models likely incur greater maintenance expenses and may have lower utilization rates compared to newer additions to the fleet. For instance, if Bristow still operates early-generation Sikorsky S-92 models that haven't undergone significant upgrades, these could fall into this category. The company's stated commitment to fleet modernization, including the introduction of AW139s and AW169s, suggests a strategic move away from such assets.

Ad hoc helicopter services, often grouped under 'Other Services,' typically face erratic demand and less stable, long-term contracts than Bristow's primary offshore and government operations. This inconsistency can result in periods of low aircraft utilization and unpredictable revenue streams.

The fluctuating nature of these services poses a risk of becoming a cash drain if not managed with extreme efficiency, potentially impacting overall profitability. For instance, in 2024, Bristow reported that its 'Other Services' segment, which includes these ad hoc offerings, experienced revenue fluctuations that required careful resource allocation to maintain profitability.

Operations in Highly Saturated or Declining Niche Markets

Operations in highly saturated or declining niche markets can be viewed as potential Dogs within the Bristow BCG Matrix framework. These are areas where competition is intense, or demand is shrinking, making it difficult to achieve profitability or growth. For instance, in 2024, the global market for legacy fax machine components, a niche that has seen significant decline due to digital communication, would likely represent a Dog. Such operations often require substantial investment to maintain relevance or market share, yielding little return.

These segments struggle to generate meaningful profit or cash flow due to low market share and lack of growth prospects. Without a clear path to differentiation or a resurgence in demand, these business units can become a drain on resources. For example, a company operating in the declining market for physical media storage in 2024 might find its niche segment falling into the Dog category, as digital alternatives dominate.

- Market Saturation: In 2024, many established technology sectors, like the smartphone market, are highly saturated, with growth rates slowing considerably, pushing some players into Dog territory if they lack innovation.

- Declining Demand: The market for traditional print newspapers, for example, continues to face structural decline in demand, making newspaper printing operations a classic example of a Dog in the current media landscape.

- Low Profitability: Businesses in these segments often operate on thin margins, with profit per unit being minimal, further exacerbated by the need to compete on price in a crowded or shrinking market.

- Resource Drain: Maintaining operations in these areas can divert capital and management attention away from more promising growth opportunities, hindering overall portfolio performance.

Non-Core, Non-Strategic Assets or Ventures

Non-core, non-strategic assets or ventures within Bristow's portfolio represent business units or investments that do not directly support its main objectives in offshore energy, government services, or sustainable aviation. These might be smaller, disconnected operations or older investments that haven't delivered substantial growth or profits. For instance, a small, regional helicopter charter service not integrated into their core offshore transport network could be classified here.

These assets often have limited synergy with Bristow's primary business lines and may consume resources without offering significant strategic advantage. An example could be a legacy investment in a niche industrial maintenance service that diverts management attention from core growth areas. By 2024, companies are increasingly scrutinizing such ventures to optimize resource allocation.

- Underperformance: These ventures consistently fail to meet profitability or growth targets.

- Lack of Synergy: They do not align with or support Bristow's core operational strategies.

- Resource Drain: They may require significant capital or management time without commensurate returns.

- Strategic Misfit: They represent a departure from the company's defined strategic direction.

Bristow's 'Dogs' are business units with low market share in slow-growing or declining markets, such as its fixed-wing transportation services. These operations, including ad hoc helicopter services, often face erratic demand and lower utilization rates, as seen in the 'Other Services' segment's performance in 2024.

Legacy aircraft and non-core ventures also fall into this category, characterized by underperformance and a lack of strategic synergy. For instance, older, less efficient aircraft models or disconnected regional services consume resources without significant returns, prompting strategic reviews for divestment or restructuring.

These segments, like those in saturated or declining niche markets in 2024, struggle with profitability and can become a drain on capital. Companies increasingly scrutinize such ventures to optimize resource allocation and focus on more promising growth areas.

Bristow's strategic fleet modernization, emphasizing newer aircraft like the AW139s and AW169s, signals a move away from legacy assets that would likely be classified as Dogs.

Question Marks

Bristow's strategic investment in electric vertical takeoff and landing (eVTOL) aircraft and unmanned aerial systems (UAS) positions them in nascent, high-potential markets. These ventures, characterized by substantial R&D expenditure and early-stage pilot programs, currently represent low market share for Bristow, aligning them with the Question Mark quadrant of the BCG Matrix. For instance, in 2024, Bristow continued its collaboration with Vertical Aerospace, a key player in eVTOL development, underscoring their commitment to this evolving sector.

Entering new geographic markets for Bristow's core services represents the initial phases of its market expansion strategy. These ventures are characterized by significant upfront investment in infrastructure, marketing, and talent acquisition. For instance, in 2024, Bristow continued its strategic focus on expanding its footprint in emerging markets, particularly in regions with growing offshore energy exploration activities, which demand substantial capital outlays before profitability is realized.

These new markets often present high growth potential but require considerable time and resources to establish a strong presence and client base. Bristow's approach involves building relationships and demonstrating service reliability, which are crucial for capturing market share. The company's 2024 financial reports indicated increased operational expenses related to these market entries, reflecting the necessary investments in building brand recognition and securing initial contracts.

Bristow's strategic expansion into specialized services for emerging sectors, such as supporting the burgeoning aquaculture industry or providing advanced logistics for new technologies, represents a potential move into Question Marks for the company. These markets offer significant growth potential, but Bristow's current presence is minimal, necessitating substantial investment to gain traction and market share.

Pilot Programs for Zero/Low-Emission Aviation

Bristow's participation in pilot programs for zero/low-emission aviation, like the test arena in Norway, signals a promising, high-growth future market. While this indicates significant future potential, Bristow's current market share in these nascent, experimental sectors is understandably low.

These ventures are capital-intensive, demanding substantial investment. However, successful navigation of technological and market maturation could position Bristow for future leadership in sustainable flight.

- Norway's zero-emission aviation test arena: Demonstrates industry commitment to sustainable flight innovation.

- High-growth potential: Indicates a future market with significant expansion possibilities.

- Low current market share: Reflects the early stage of development and experimental nature of these programs.

- Cash-intensive nature: Highlights the significant financial commitment required for participation and development.

New Training and Simulation Facilities

Investments in new training and simulation facilities, like the AW139 full flight simulator planned for Aberdeen in 2026, are vital for keeping Bristow's fleet modern and meeting new contract requirements. These are essential for future growth and maintaining high operational standards.

However, these facilities represent a significant upfront cash outflow. They do not generate immediate, direct revenue from external customers, positioning them as a Question Mark within the BCG Matrix concerning their short-term financial return on investment.

- Investment in AW139 simulator in Aberdeen: Scheduled for 2026, this facility supports fleet modernization.

- Purpose: Crucial for meeting new contract demands and ensuring operational excellence.

- Financial Implication: Represents an upfront cash outflow without immediate direct revenue generation.

- BCG Matrix Classification: Positioned as a Question Mark due to uncertain short-term financial returns.

Question Marks in Bristow's portfolio represent emerging ventures with high growth potential but currently low market share. These require significant investment to develop and capture market position. For example, Bristow's investment in eVTOL and UAS technology in 2024, through collaborations like the one with Vertical Aerospace, places these initiatives firmly in the Question Mark category.

These new ventures, while promising, are cash-intensive and carry inherent risks associated with market adoption and technological maturity. Bristow's expansion into new geographic markets in 2024, involving substantial upfront costs for infrastructure and client acquisition, also exemplifies this strategic positioning.

The company's commitment to pilot programs for zero-emission aviation, such as in Norway, further highlights its engagement with future growth sectors where its current market share is minimal.

Bristow's investment in new training facilities, like the AW139 simulator planned for Aberdeen in 2026, also falls under Question Marks due to significant upfront costs and a lack of immediate direct revenue generation.

| Venture Area | Description | 2024 Status/Commitment | BCG Classification | Key Considerations |

|---|---|---|---|---|

| eVTOL & UAS | Development and integration of new aviation technologies. | Continued collaboration with Vertical Aerospace. | Question Mark | High R&D, low market share, high growth potential. |

| New Geographic Markets | Expansion of core services into emerging regions. | Increased operational expenses for market entry. | Question Mark | Requires significant investment in infrastructure and relationships. |

| Zero/Low-Emission Aviation | Participation in sustainable flight pilot programs. | Active in Norway's test arena. | Question Mark | Nascent market, low current share, capital intensive. |

| Training Facilities | Investment in advanced simulators for fleet modernization. | AW139 simulator planned for Aberdeen (2026). | Question Mark | Upfront cash outflow, no immediate direct revenue. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth projections to provide strategic clarity.