Bouygues Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bouygues Bundle

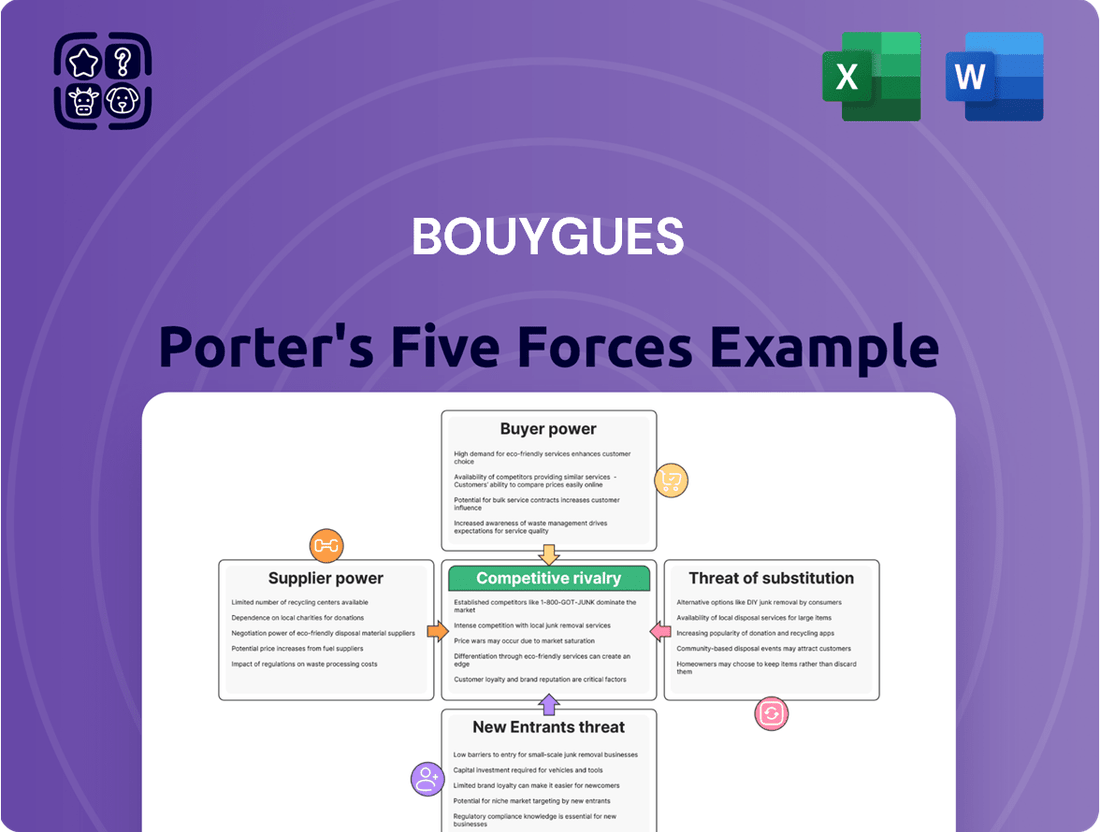

Bouygues operates within a dynamic industry, facing significant competitive pressures. Understanding the intensity of rivalry among existing players, the bargaining power of buyers, and the threat of new entrants is crucial for strategic planning. The influence of suppliers and the availability of substitute products also play a vital role in shaping Bouygues's market landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bouygues’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bouygues' construction arms, Bouygues Construction and Colas, are significantly dependent on key raw materials such as cement, aggregates, steel, and energy.

The bargaining power of suppliers in these sectors can be substantial, especially when prices are volatile or supply chains experience disruptions, directly affecting Bouygues' project expenses and profitability.

In 2024, the French construction sector, a primary market for Bouygues, continued to grapple with elevated material costs and persistent supply chain challenges, underscoring the potent influence of these suppliers.

For instance, steel prices saw fluctuations throughout 2024, and energy costs remained a significant factor, creating an environment where raw material suppliers could exert considerable leverage.

For Bouygues Telecom, specialized equipment and technology providers wield considerable bargaining power. This is particularly evident in the realm of 5G infrastructure, where companies like Ericsson, a key partner for Bouygues Telecom's 5G SA core deployment, represent a critical supplier. The high costs associated with switching network equipment vendors, coupled with the intricate technical expertise needed to integrate new systems, create significant switching barriers.

TF1, a prominent media entity within Bouygues, relies heavily on external content creators like production studios, sports rights holders, and news agencies. The exclusivity and significant demand for certain programming, such as major sporting events or highly-rated television series, can significantly bolster the negotiating leverage of these suppliers.

In 2024, TF1 experienced an uptick in its content acquisition expenses. This rise was directly influenced by a more robust advertising market and the strategic introduction of its new streaming platform, TF1+.

Skilled Labor and Expertise

Bouygues' reliance on a highly skilled workforce across its diverse sectors, from construction to telecommunications, significantly influences supplier bargaining power. Shortages of specialized talent, such as experienced engineers and certified construction professionals, can empower labor suppliers. For instance, in 2024, reports indicated persistent shortages in skilled trades within the French construction industry, potentially driving up labor costs for Bouygues.

The availability and cost of specialized expertise directly impact Bouygues' operational efficiency and project timelines. When specific skills are scarce, the suppliers of that labor or expertise can command higher rates. This dynamic is particularly relevant in complex infrastructure projects and advanced technological deployments within Bouygues' portfolio.

- Skilled Workforce Dependency: Bouygues requires engineers, technicians, and specialized construction personnel for its various business units.

- Labor Shortages Impact: Scarcity of skilled labor, especially in construction, can elevate employee and contractor bargaining power.

- Specialized Expertise Premium: Access to niche technical skills, critical for advanced projects, allows specialized suppliers to negotiate more favorable terms.

- 2024 Labor Market Trends: Observations in 2024 highlighted ongoing challenges in sourcing skilled trades, particularly impacting sectors like construction in France.

Energy Providers

The bargaining power of energy providers is a significant factor for Bouygues, particularly given its substantial energy needs in construction and telecommunications. The volatile global energy market means that price swings and supply availability directly impact Bouygues' operational costs. For instance, Bouygues Telecom's advantageous low-price energy hedges secured in 2020 and 2021 are set to expire in 2025, potentially leading to increased expenditures for the company.

This shift in energy cost structure for Bouygues Telecom highlights the increasing leverage of energy suppliers. As the company no longer benefits from those favorable, pre-arranged rates, it faces the prospect of higher energy bills. This situation underscores the need for Bouygues to actively manage its energy procurement strategies to mitigate the impact of rising energy costs from its suppliers.

- Bouygues' substantial energy consumption across construction and telecom sectors.

- Global energy market volatility impacting pricing and availability.

- Expiration of favorable energy price hedges for Bouygues Telecom in 2025.

- Potential for increased operational costs due to renewed supplier negotiations.

Suppliers of raw materials like cement, steel, and aggregates hold significant sway over Bouygues' construction businesses, impacting project costs. In 2024, the French construction sector continued to face high material expenses and supply chain disruptions, a testament to supplier leverage.

For Bouygues Telecom, specialized technology providers such as Ericsson, crucial for 5G deployment, exhibit strong bargaining power due to high switching costs and technical integration complexities. TF1's reliance on exclusive content from production studios and sports rights holders also grants these suppliers considerable influence, especially with rising content acquisition costs observed in 2024.

Furthermore, shortages of skilled labor in sectors like construction, noted in 2024, empower workers and specialized recruitment agencies. Bouygues' substantial energy needs make it susceptible to energy provider influence, particularly as favorable hedges for Bouygues Telecom expire in 2025, signaling potential cost increases.

| Supplier Type | Bouygues Business Unit | Key Factors Influencing Bargaining Power | 2024 Impact/Observation |

|---|---|---|---|

| Raw Materials (Cement, Steel, Aggregates) | Bouygues Construction, Colas | Price volatility, supply chain disruptions | Elevated material costs in French construction sector |

| Specialized Technology (5G Infrastructure) | Bouygues Telecom | High switching costs, technical integration | Reliance on key vendors like Ericsson |

| Content Providers (Studios, Sports Rights) | TF1 | Content exclusivity, demand for programming | Increased content acquisition expenses for TF1 |

| Skilled Labor | All Units | Labor shortages, specialized expertise | Persistent shortages in French construction trades |

| Energy Providers | Bouygues Construction, Bouygues Telecom | Energy market volatility, contract expirations | Expiration of Bouygues Telecom's energy hedges in 2025 |

What is included in the product

Analyzes the competitive landscape for Bouygues by dissecting the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse operational sectors.

Easily identify and quantify competitive pressures, allowing for proactive strategy adjustments and mitigation of potential threats.

Customers Bargaining Power

Bouygues' construction arms deal with substantial public and private entities for significant infrastructure and building ventures. These clients wield considerable sway because of the sheer size of the projects, their capacity to solicit competitive bids, and their impact on securing future work.

The impressive €32.2 billion backlog in Bouygues' construction operations as of December 2024 suggests robust demand. While this high demand could marginally lessen customer leverage in the immediate future, the fundamental power of these large clients remains a key consideration.

Bouygues Telecom's individual and business subscribers wield considerable bargaining power, primarily due to low switching costs in the mobile sector and fierce competition within the French telecommunications landscape. This is evident in the ongoing price wars and promotional offers common in the market.

While switching providers is relatively easy, the increasing demand for value-added services like bundled packages and high-speed connectivity, such as 5G and Fiber-to-the-Home (FTTH), offers Bouygues some leverage. These services can create stickiness, making it less likely for customers to switch solely on price.

The French telecom market is dominated by a few key players, including Orange, SFR, and Bouygues Telecom itself, all vying for market share. This oligopolistic structure intensifies competition and amplifies customer bargaining power as they can easily move between providers offering similar core services.

Advertisers hold significant bargaining power over TF1, primarily due to the diversifying media landscape. The proliferation of digital platforms and streaming services offers advertisers a wider array of choices beyond traditional television, allowing them to seek out more cost-effective and targeted advertising solutions. This increased competition puts pressure on TF1 to demonstrate the value and reach of its advertising inventory.

In 2023, digital advertising spending in France continued to grow, reaching an estimated €7.6 billion according to IAB France, indicating a strong shift in advertiser preference towards digital channels. This trend directly impacts TF1's ability to command premium pricing for its television advertising slots, as advertisers can reallocate budgets to platforms offering more precise audience segmentation and measurable results.

TF1 is actively addressing this by enhancing its own digital offerings, such as the TF1+ platform. By focusing on targeted ad insertion and expanding its digital marketing capabilities, TF1 aims to provide advertisers with the data-driven solutions and granular control they increasingly demand, thereby mitigating some of the bargaining power exerted by these crucial customers.

Real Estate Developers and Homebuyers (Bouygues Immobilier)

Both individual homebuyers and professional developers wield considerable influence over Bouygues Immobilier. This is especially evident in the current economic climate, marked by a slowdown in new construction and elevated borrowing costs, which has directly impacted residential property bookings. For instance, in 2024, Bouygues Immobilier experienced a downturn in its residential property sales, a testament to buyer hesitancy and increased negotiation leverage.

The bargaining power of customers is amplified by market conditions that favor buyers. When demand softens and inventory rises, buyers can demand better pricing and more favorable contract terms. This dynamic forces developers like Bouygues Immobilier to be more competitive in their offerings and pricing strategies to secure sales.

- Challenging Market Conditions: Falling building permits and high interest rates in 2024 negatively impacted residential property reservations for Bouygues Immobilier.

- Buyer Hesitancy: Economic uncertainty leads individual homebuyers to postpone purchases or demand concessions, increasing their bargaining power.

- Developer Influence: Professional developers, as bulk purchasers, can negotiate significant discounts and customized terms.

- Sales Decline: Bouygues Immobilier's reported decline in residential property sales in 2024 underscores the heightened customer bargaining power.

Government and Regulatory Bodies

Government and regulatory bodies act as significant power players impacting Bouygues, particularly in its construction and telecommunications segments. For instance, ARCEP, the French telecom regulator, plays a crucial role in spectrum allocation and pricing, directly influencing Bouygues Telecom's competitive landscape and revenue potential. In 2024, the ongoing evolution of 5G spectrum policies and potential regulatory adjustments on wholesale access fees could significantly shape Bouygues Telecom's profitability.

These entities hold sway over permits, environmental standards, and operational frameworks, essentially dictating the terms of engagement for Bouygues' diverse operations. For example, in construction, adherence to stringent building codes and planning permissions, enforced by local and national authorities, can affect project timelines and costs. Changes in environmental regulations, such as those pertaining to carbon emissions in construction materials or infrastructure projects, can necessitate costly adaptations, thereby shifting the bargaining power towards these regulatory bodies.

- Regulatory Influence: Government bodies dictate operating licenses and standards in sectors like telecommunications and construction.

- Spectrum Allocation: ARCEP's decisions on 5G spectrum directly impact Bouygues Telecom's market position and investment strategies.

- Environmental Standards: Evolving green building codes and emission regulations can increase operational costs for Bouygues' construction division.

- Permitting Processes: The speed and conditions of obtaining permits for infrastructure projects represent a key area of government leverage.

Bouygues Immobilier's customers, both individual buyers and professional developers, exert significant bargaining power, particularly in the challenging real estate market of 2024. This leverage is amplified by economic uncertainties and rising interest rates, which have led to buyer hesitancy and a greater demand for favorable pricing and contract terms. Professional developers, acting as bulk purchasers, can negotiate substantial discounts, further pressuring Bouygues Immobilier's margins.

The bargaining power of Bouygues Telecom's subscribers is substantial, driven by low switching costs and intense competition among major French operators. While value-added services create some stickiness, customers can readily switch providers for better deals, as evidenced by ongoing price wars and aggressive promotional offers in the market. This dynamic forces Bouygues Telecom to continuously innovate and offer competitive pricing to retain its customer base.

Advertisers hold considerable sway over TF1 due to the fragmented media landscape and the growing appeal of digital advertising platforms. With digital ad spending in France reaching an estimated €7.6 billion in 2023, advertisers can easily shift budgets towards channels offering more precise targeting and measurable results, thereby reducing TF1's pricing power for traditional television advertising slots.

| Customer Segment | Bargaining Power Factors | Impact on Bouygues |

|---|---|---|

| Bouygues Immobilier Buyers | Economic slowdown, high interest rates, buyer hesitancy in 2024 | Reduced sales volume, pressure on pricing, demand for concessions |

| Bouygues Telecom Subscribers | Low switching costs, intense competition, price wars | Pressure on ARPU, need for competitive pricing and value-added services |

| TF1 Advertisers | Rise of digital platforms, fragmentation of media, shift in ad spend | Decreased pricing power for TV ads, need for enhanced digital offerings |

Preview Before You Purchase

Bouygues Porter's Five Forces Analysis

This preview showcases the complete Bouygues Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. You are viewing the exact document you will receive immediately after purchase, ensuring no surprises or missing sections. This professionally compiled analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. The insights provided are ready for immediate use, offering a comprehensive understanding of Bouygues' strategic landscape.

Rivalry Among Competitors

The French construction market is highly fragmented, featuring a multitude of local and international companies vying for projects. This intense rivalry means that companies like Bouygues Construction and Colas must constantly innovate and manage costs effectively to secure contracts and maintain profitability.

In 2024, the French construction industry faced significant challenges, including the impact of high interest rates which dampened demand, and persistent labor shortages that constrained capacity. Despite these headwinds, opportunities emerged from substantial government investments in infrastructure development and a growing emphasis on green building initiatives.

The overall French construction sector experienced a downturn in 2024. Data from the French building federation Fédération Française du Bâtiment (FFB) indicated a contraction in activity, particularly in residential construction, reflecting the broader economic slowdown and increased financing costs.

The French telecom sector is a battlefield dominated by a few giants, including Orange, SFR, Iliad (Free Mobile), and Bouygues Telecom itself. This high concentration means rivalry among these players is fierce, constantly pushing innovation and pricing. Bouygues Telecom is actively working to boost its sales and EBITDA after Leases in 2024, directly reflecting the pressure to compete effectively.

The competition is further amplified by significant investments in next-generation technologies like 5G and fiber optics. Companies are locked in aggressive pricing wars to win and keep customers, making subscriber acquisition and retention a continuous challenge. This dynamic environment necessitates strategic agility and substantial capital expenditure to remain relevant.

TF1 navigates a fiercely competitive media environment. Traditional rivals like France Télévisions and M6 continue to vie for eyeballs and advertising spend. However, the real disruptors are global giants such as Netflix and Amazon Prime Video, alongside a host of other digital platforms.

In response, TF1 has launched its own digital streaming service, TF1+, aiming to capture a share of the growing digital audience and secure vital advertising revenue in this evolving space. This strategic pivot underscores the shift in viewer habits and the need for traditional broadcasters to adapt.

Despite the intense competition, TF1 has demonstrated resilience, with its advertising revenue showing a positive trend, especially within its digital operations. This growth in digital advertising is a critical factor for TF1 as it continues to adapt to the changing media consumption landscape.

Pressure on Margins Across Sectors

Bouygues faces significant pressure on its profit margins across its diverse business segments. In the construction sector, factors like escalating material expenses and a scarcity of skilled labor, combined with aggressive bidding processes, inherently compress profitability. This competitive landscape makes it challenging to maintain healthy margins.

The telecommunications industry, a key area for Bouygues, is also characterized by intense competition. Ongoing price wars and the substantial capital required for continuous network infrastructure upgrades directly impact the margins achievable in this segment. These ongoing investments are necessary to stay competitive.

For 2025, Bouygues has set a strategic goal to achieve a modest increase in its overall sales. Alongside this, the company is targeting a slight rise in its current operating profit, indicating an awareness of and a response to the margin pressures it encounters.

- Construction: Rising material costs and labor shortages contribute to margin squeeze.

- Telecommunications: Price wars and high infrastructure investment negatively affect margins.

- 2025 Outlook: Bouygues anticipates a slight increase in sales and current operating profit.

Innovation and Technological Advancement

Competitive rivalry in sectors like telecommunications and construction is intensely fueled by the imperative for ongoing innovation. Bouygues, to remain competitive, must consistently invest in next-generation technologies. This includes expanding its 5G network coverage and enhancing its fiber-to-the-home (FTTH) infrastructure.

The company's strategic focus on FTTH is evident in its continued efforts to grow its customer base and extend its geographical presence. For instance, as of the first quarter of 2024, Bouygues Telecom reported a significant increase in its FTTH subscriber numbers, demonstrating a commitment to this growth area.

Furthermore, advancements in construction, such as smart building technologies and Building Information Modeling (BIM), are critical for differentiation and efficiency. These technological investments are not merely about keeping pace but are essential for carving out a distinct market position and attracting clients seeking cutting-edge solutions.

- Investment in 5G and fiber optics is key for Bouygues Telecom's competitive edge.

- Bouygues Telecom is actively expanding its FTTH customer base and geographical reach in 2024.

- Smart building technologies and BIM are crucial for differentiation in the construction sector.

The competitive rivalry within Bouygues' key sectors, particularly telecommunications and construction, is a significant force shaping its strategy and profitability. In telecommunications, the French market is dominated by a few major players, leading to intense competition on pricing and service innovation. Bouygues Telecom actively works to grow its sales and EBITDA, a clear indicator of the pressure to gain market share. This rivalry necessitates continuous investment in advanced technologies like 5G and fiber optics to attract and retain customers, often resulting in price wars and requiring substantial capital expenditure.

In construction, Bouygues faces a fragmented market with numerous local and international competitors. This intense rivalry demands constant innovation and rigorous cost management to secure contracts and maintain profitability, especially given rising material costs and labor shortages. For instance, the French construction sector experienced a contraction in 2024, with residential construction particularly affected by economic slowdowns and higher financing costs, further intensifying competition for available projects.

| Sector | Key Competitors | Competitive Dynamics | 2024 Impact |

| Telecommunications | Orange, SFR, Iliad (Free Mobile) | Aggressive pricing, 5G/Fiber investment, subscriber acquisition/retention | Pressure on margins, high CAPEX |

| Construction | Colas, numerous local firms | Price bidding, cost management, innovation (BIM, smart building) | Margin squeeze due to material costs & labor shortages, market downturn |

SSubstitutes Threaten

The threat of substitutes in construction is intensifying, particularly from modular and prefabricated building methods. These approaches promise faster project completion, reduced labor costs, and less material waste. For example, the global modular construction market was valued at approximately $101.4 billion in 2023 and is projected to reach $178.5 billion by 2030, demonstrating significant growth and adoption.

The threat of substitutes for Bouygues Telecom's traditional voice and messaging services is substantial, primarily driven by Over-The-Top (OTT) applications. Services like WhatsApp, Telegram, and Zoom allow users to communicate via voice and video calls, as well as text messaging, often at no extra cost beyond their existing internet subscription.

These digital communication platforms leverage the internet infrastructure, bypassing traditional telecom networks for core communication functions. This shift directly impacts the revenue streams from voice and SMS, forcing telecom operators to adapt their pricing and service offerings. For example, in 2023, a significant portion of global mobile traffic shifted to data-based communication, highlighting the growing reliance on these substitute services.

The threat of substitutes for Bouygues' traditional television broadcasting is significant, primarily from the proliferation of streaming services. Platforms like Netflix, Disney+, and Amazon Prime Video offer a vast library of on-demand content, directly competing for viewer attention and time. In 2023, the global SVOD market was valued at over $100 billion, showcasing the immense consumer shift towards these alternatives.

Social media platforms and user-generated content also present a substitute threat, as they offer a constant stream of easily accessible and often free entertainment. This fragmentation of media consumption means TF1 must innovate to retain its audience share. TF1's own launch of the streaming platform TF1+ in late 2023 aims to address this by offering a mix of free, ad-supported content and premium subscriptions, mirroring industry trends.

DIY and Self-Service Solutions

The threat of substitutes in the construction sector, particularly for smaller projects, is amplified by the rise of DIY and self-service solutions. Homeowners and small businesses may opt to manage their own renovations or minor construction tasks, bypassing larger contractors like Bouygues Construction.

This trend is supported by the increasing availability of online tutorials, readily accessible building materials, and a growing desire for cost savings. For instance, the home improvement market has seen significant growth, with many consumers undertaking projects themselves.

The ability for individuals to directly hire specialized independent contractors for specific trades, such as plumbing or electrical work, further erodes the need for a single, large construction firm for smaller jobs. This fragmentation of services presents a viable alternative for many customers.

- DIY Home Improvement Spending: In 2023, the global DIY home improvement market was valued at over $800 billion, indicating a substantial consumer inclination towards self-managed projects.

- Online Resource Availability: Platforms like YouTube host millions of DIY construction and renovation tutorials, democratizing access to technical knowledge.

- Gig Economy Impact: The growth of the gig economy has made it easier for individuals to find and contract independent tradespeople directly, bypassing traditional project management.

- Cost Sensitivity: For smaller projects, the cost differential between hiring a full-service construction company and managing the project independently or with direct contractor hires can be a significant deciding factor.

Virtual and Augmented Reality in Design/Planning

While not a direct replacement for physical building, the increasing sophistication of virtual and augmented reality (VR/AR) in architectural design and project planning presents a potential threat. These technologies can reduce the necessity for certain physical models and early-stage construction prototyping, thereby impacting the demand for traditional related services. For instance, the global AR/VR market was projected to reach $27 billion in 2024, indicating a significant investment and adoption rate that could reshape design workflows.

This shift could indirectly affect companies like Bouygues by diminishing the need for some physical mock-ups or preliminary construction phases that might have previously been outsourced or required specific on-site expertise. As VR/AR tools become more integrated into the design and planning lifecycle, they offer cost-effective and time-efficient alternatives for visualizing and testing designs before physical execution. This trend is expected to accelerate, with projections suggesting the VR/AR market could surpass $200 billion by 2028.

- Reduced Demand for Physical Models: VR/AR can create immersive digital twins, lessening the need for costly physical prototypes in early design stages.

- Streamlined Project Planning: Collaborative VR environments allow stakeholders to review and refine plans virtually, potentially reducing the need for some on-site pre-construction meetings.

- Technological Advancement: The rapid evolution and adoption of VR/AR technologies across industries, including construction and real estate, indicate a growing capacity to substitute traditional methods.

- Cost and Efficiency Gains: Early adopters of VR/AR in design report significant savings in time and material costs associated with physical model creation and revisions.

The threat of substitutes for Bouygues' services is multifaceted, impacting both its construction and telecommunications businesses. In construction, modular and prefabricated building methods offer faster, cheaper alternatives, with the modular construction market expected to reach $178.5 billion by 2030. For Bouygues Telecom, Over-The-Top (OTT) applications like WhatsApp and Zoom provide free communication channels, reducing reliance on traditional voice and messaging services, with a significant shift to data-based communication observed in 2023.

The threat extends to Bouygues' media operations, where streaming services like Netflix, valued at over $100 billion in 2023, are directly competing with traditional broadcasting. Even social media and user-generated content pose a challenge, prompting TF1 to launch its own streaming platform, TF1+, in late 2023 to stay competitive.

| Business Segment | Threat of Substitute | Market Growth/Impact (Approximate) |

|---|---|---|

| Construction | Modular & Prefabricated Buildings | Global modular construction market projected to reach $178.5 billion by 2030. |

| Telecommunications | OTT Communication Apps (WhatsApp, Zoom) | Significant shift to data-based communication in 2023. |

| Media (TF1) | Streaming Services (Netflix, Disney+) | Global SVOD market valued over $100 billion in 2023. |

Entrants Threaten

The threat of new entrants in the telecommunications industry, particularly for a company like Bouygues, is significantly dampened by substantial capital requirements. Building out a robust network, including the deployment of 5G and fiber optic infrastructure, demands billions of euros. For instance, spectrum auctions alone can cost operators hundreds of millions, as seen in various European auctions throughout the 2020s.

Furthermore, regulatory complexities act as a formidable barrier. Authorities like ARCEP in France impose stringent licensing, service quality, and competition rules that new players must navigate. These regulatory hurdles, coupled with the need for extensive retail and distribution networks, create a challenging environment for any potential newcomer aiming to challenge established giants such as Bouygues Telecom.

The construction sector, particularly for massive civil engineering projects and intricate architectural builds, demands deep expertise, a history of successful deliveries, and considerable financial resources. Newcomers find it incredibly difficult to match the operational efficiency, established safety protocols, and existing client networks of incumbents like Bouygues Construction and Colas.

These established firms benefit from decades of experience in managing complex logistics, coordinating diverse workforces, and navigating intricate supply chains, which are significant barriers to entry. For instance, securing the necessary certifications and demonstrating compliance with stringent building codes and environmental regulations are time-consuming and capital-intensive hurdles for any new competitor.

Furthermore, the reputational capital built over years of consistent performance and client satisfaction is a powerful deterrent. Clients commissioning large-scale projects, often worth billions, prioritize reliability and a proven ability to execute, making it challenging for unproven entities to win bids, even if they offer competitive pricing.

For traditional media companies like TF1, the threat of new entrants is significantly mitigated by the immense cost of acquiring premium content, such as exclusive sports broadcasting rights. For instance, securing rights for major football leagues can run into hundreds of millions of euros annually, a barrier that is difficult for newcomers to overcome. Furthermore, cultivating a loyal and large audience, a hallmark of established players, requires decades of investment in brand building and consistent programming quality.

However, the digital landscape presents a contrasting scenario. The barriers to entry for content *distribution* have dramatically lowered with the rise of streaming platforms and social media. A new digital-native service can launch with relatively modest initial investment compared to building a terrestrial broadcast network. For example, companies like Netflix or Disney+ initially leveraged existing digital infrastructure to reach global audiences without the need for expensive physical distribution networks.

Brand Loyalty and Bundling (Telecom)

Existing telecom operators like Bouygues benefit from established brand loyalty, a significant barrier for new entrants. The ability to offer comprehensive bundled services, such as mobile, broadband, and television packages, further solidifies this advantage by increasing customer stickiness and perceived value. This makes it challenging for standalone or unbundled services from newcomers to compete effectively.

Bouygues Telecom has demonstrated strong performance in its fixed-line offerings, particularly with its Fiber-to-the-Home (FTTH) deployments. As of the first quarter of 2024, Bouygues Telecom reported a 6.8% increase in its fixed-line revenue year-on-year, reaching €1.05 billion. The company's continued investment in FTTH infrastructure directly enhances its competitive position and makes it more difficult for new entrants to replicate the quality and breadth of its service offerings.

- Brand Loyalty: Established operators have cultivated customer relationships over years, making switching less appealing for many consumers.

- Bundling Advantage: Offering combined mobile, internet, and TV services creates a one-stop-shop for consumers, increasing switching costs.

- FTTH Investment: Bouygues Telecom's focus on fiber optic networks provides superior internet speeds and reliability, a key differentiator.

- Market Penetration: Existing players have widespread network coverage, a significant hurdle for new entrants to overcome quickly.

Intense Competition and Market Saturation

The threat of new entrants for Bouygues, particularly in its construction and telecommunications sectors, is moderate to high due to significant capital requirements and established brand loyalty. Existing players like Vinci and Eiffage in construction, and Orange and SFR in telecom, have strong market positions.

New entrants would face substantial hurdles in matching the scale, infrastructure, and service offerings of these incumbents. For instance, a new telecom operator would need billions of euros to build out a 5G network, a cost that deters many potential challengers.

However, niche markets or innovative service models could still attract new, agile competitors. In 2024, the construction industry saw continued consolidation, making it harder for smaller firms to scale, but digital construction technologies offer potential entry points for tech-focused entrants.

- High Capital Requirements: Building infrastructure for telecommunications or large-scale construction projects demands significant upfront investment, acting as a barrier.

- Established Brand Loyalty: Customers in both construction and telecom often stick with known, reliable providers, making it difficult for new brands to gain traction.

- Regulatory Hurdles: Obtaining necessary licenses and permits in sectors like telecommunications can be a complex and time-consuming process for new companies.

- Economies of Scale: Incumbents benefit from lower per-unit costs due to their large operational scale, a cost advantage new entrants would struggle to replicate initially.

The threat of new entrants for Bouygues is generally moderate, primarily due to the high capital investment required and the established brand loyalty of existing players in its core sectors. Building comprehensive telecommunications networks or undertaking large-scale construction projects demands substantial financial resources, making it challenging for newcomers to compete effectively.

However, the digital media landscape presents a lower barrier to entry for content distribution, although Bouygues' TF1 benefits from exclusive content rights that are costly for new players to acquire. In construction, while consolidation in 2024 made it harder for smaller firms to scale, digital construction technologies offer potential entry points for tech-focused entrants.

| Sector | Barrier to Entry Factor | Example Data (2024/Latest) |

|---|---|---|

| Telecommunications | Capital Investment (5G/Fiber) | Spectrum auctions cost hundreds of millions. Bouygues Telecom FTTH revenue grew 6.8% to €1.05 billion in Q1 2024. |

| Telecommunications | Regulatory Hurdles | ARCEP licenses and service quality rules. |

| Construction | Expertise & Track Record | Need for certifications, safety protocols, and proven delivery on large projects. |

| Media (TF1) | Content Acquisition Costs | Sports broadcasting rights can cost hundreds of millions annually. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bouygues leverages a comprehensive dataset including Bouygues' annual reports, financial statements, and investor presentations. This is supplemented by industry-specific market research reports and data from reputable financial databases to provide a thorough understanding of the competitive landscape.