Bouygues Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bouygues Bundle

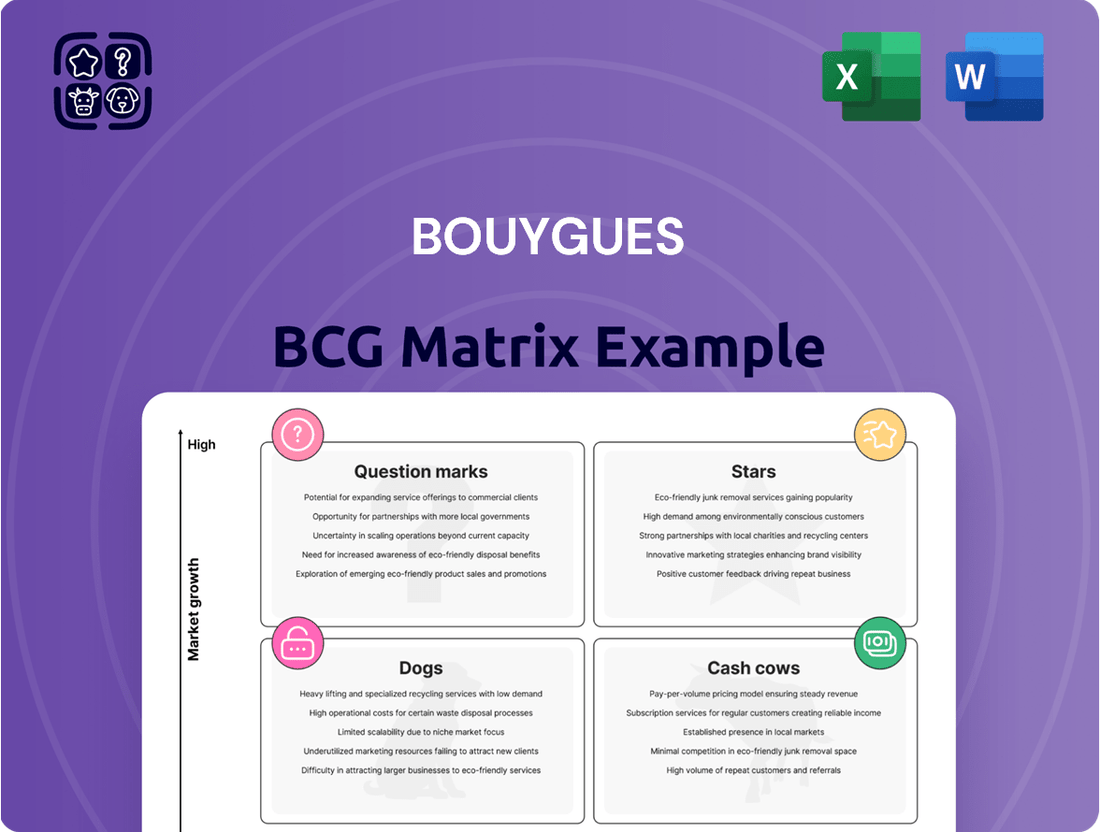

Wondering how Bouygues navigates the competitive landscape? This glimpse into their potential BCG Matrix hints at how they manage their diverse portfolio of businesses, from construction to telecommunications.

Understanding where each Bouygues venture falls – as a star, cash cow, dog, or question mark – is crucial for informed investment and strategic planning.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Bouygues.

The complete BCG Matrix reveals exactly how Bouygues is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Purchase now and get instant access to a beautifully designed BCG Matrix that’s both easy to understand and powerful in its insights—delivered in Word and Excel formats, ready for your strategic analysis of Bouygues.

Stars

Bouygues Telecom's aggressive FTTH expansion positions its connectivity services as a strong contender in the market. By the end of March 2025, they had brought nearly 39 million FTTH premises to market, with a clear goal of reaching 40 million by the close of 2026. This focus aligns with the substantial growth in the French FTTH sector, which saw subscriptions climb to 24.4 million by the end of 2024, representing a significant 75% of all internet subscriptions. The company's customer acquisition efforts are evident, with an addition of 148,000 new FTTH customers in the first quarter of 2025 alone, underscoring the strong demand for this high-speed service.

Bouygues Telecom's investment in 5G is a significant factor in its market position. By the end of 2024, France saw 24.3 million SIM cards utilizing 5G networks, indicating robust adoption. Bouygues Telecom's active development and deployment of this technology directly capitalize on this trend.

This strategic focus on 5G is crucial as it underpins the increasing demand for data-heavy applications and services. Bouygues Telecom's commitment to advanced mobile infrastructure places it in a prime position within a high-growth segment of the telecommunications industry.

Equans, a significant player within Bouygues, is strategically positioned to capitalize on the burgeoning energy transition market. Their focus on multi-technical services, particularly in decarbonization, is a core element of their growth strategy. The company aims for a current operating margin from activities approaching 4% by 2025, signaling a robust path toward enhanced profitability.

This targeted margin improvement is directly linked to Equans' commitment to organic sales growth, driven by increasing global demand for sustainable energy solutions. By 2027, they anticipate reaching a 5% operating margin, a testament to their successful execution of strategic initiatives in this high-growth sector.

The company's substantial backlog provides a strong foundation for future performance, indicating a clear trajectory for expansion. Equans' strategic plan is designed to leverage its expertise in energy transition services, ensuring continued relevance and profitability in a rapidly evolving market.

Bouygues Construction's Civil Works Segment

Bouygues Construction's Civil Works segment is performing exceptionally well, demonstrating significant momentum. By the end of March 2025, its backlog saw a substantial increase of 37% compared to the previous year, reflecting strong demand for its services.

This impressive growth is fueled by major infrastructure projects in France, including the ongoing Grand Paris Express development. Furthermore, increased government spending on transport and energy infrastructure across the nation provides a solid foundation for continued expansion.

Given its high market share within a growing segment of the construction industry, Bouygues Construction's Civil Works is strategically positioned as a Star in the BCG matrix.

- Robust backlog growth: 37% year-on-year increase by end-March 2025.

- Key growth drivers: Grand Paris Express and government infrastructure investments.

- Strategic positioning: Star in the BCG matrix due to high market share in a growing segment.

International Building Projects of Bouygues Construction

Bouygues Construction's international building segment is a significant growth driver. In Q1 2025, international building sales surged by an impressive 13% compared to the previous year, highlighting strong global demand for their expertise.

The company has been actively securing major contracts across various countries, showcasing its ability to compete and win in diverse international markets. This global footprint is crucial as it diversifies revenue streams and mitigates risks associated with domestic market fluctuations.

These international ventures are not just about expansion; they represent a strategic move into areas with high growth potential, particularly in regions experiencing robust infrastructure development. This outward focus is a key element in the company's overall growth strategy.

Bouygues Construction's international building projects are critical contributors to its consolidated revenue, demonstrating the success of its global expansion strategy and its capacity to adapt to varying market conditions.

- International Building Sales Growth: 13% year-on-year increase in Q1 2025.

- Global Contract Wins: Securing major projects in multiple countries.

- Market Diversification: Reduced reliance on the French domestic market.

- Revenue Contribution: Significant impact on overall company revenue growth.

Bouygues Construction's international building segment is a significant growth driver, with a 13% year-on-year increase in international building sales in Q1 2025. This growth is supported by the acquisition of major contracts in diverse global markets, contributing significantly to consolidated revenue and demonstrating adaptability to varied market conditions.

The company's commitment to expanding its international building operations is a strategic move into high-growth regions with strong infrastructure development. This global focus diversifies revenue streams and strengthens its overall market position.

Bouygues Construction's international building division is a prime example of a Star in the BCG matrix due to its strong revenue growth and expansion into promising global markets.

| Bouygues Segment | BCG Classification | Key Growth Drivers | Financial Snapshot (as of early 2025) |

|---|---|---|---|

| Bouygues Construction (International Building) | Star | Global infrastructure development, securing major international contracts | 13% YoY sales growth (Q1 2025) |

| Bouygues Construction (Civil Works) | Star | Grand Paris Express, increased government infrastructure spending | 37% backlog growth (by end-March 2025) |

| Bouygues Telecom (FTTH & 5G) | Star | High FTTH adoption, 5G network expansion, increasing data demand | Nearly 39 million FTTH premises by end-March 2025 |

| Equans (Energy Transition Services) | Star | Decarbonization services, sustainable energy solutions demand | Targeting ~4% operating margin by 2025 |

What is included in the product

Highlights which units to invest in, hold, or divest, by analyzing Bouygues' portfolio across Stars, Cash Cows, Question Marks, and Dogs.

A clear, visual Bouygues BCG Matrix eliminates the guesswork, simplifying strategic resource allocation.

Cash Cows

Bouygues Construction's French building activities are a prime example of a Cash Cow within the Bouygues BCG matrix. Despite a slight 1% year-on-year dip in sales for France Building in Q1 2025, the segment continues to benefit from a substantial market share and a robust backlog of €18.3 billion.

This strong order book ensures a predictable and consistent stream of revenue and cash flow, a hallmark of mature businesses with a dominant market position. The ability to generate significant cash from operations, even amidst broader market slowdowns in French construction, underscores its Cash Cow status.

Colas, a key part of Bouygues, is a significant contributor to the group's financial performance, particularly in the road construction and maintenance sector. The company's sales saw a healthy increase of 3% year-on-year in the first quarter of 2025, demonstrating its resilience and continued demand.

This business operates within a mature market, meaning growth isn't explosive. However, Colas benefits from its strong, established presence and the non-negotiable need for ongoing infrastructure maintenance. This consistent demand translates into a reliable stream of cash for Bouygues.

TF1's traditional linear TV channels are a clear cash cow within the Bouygues portfolio. In 2024, TF1 solidified its market leadership, achieving an impressive 18.7% overall audience share. This strong viewership, particularly within key commercial demographics, translates into consistent and substantial advertising revenue.

Despite the ongoing migration of audiences to digital platforms, TF1's linear channels continue to be a reliable profit generator. The established brand recognition and massive reach of its programming provide a stable income stream, effectively subsidizing the company's investments in newer, potentially higher-growth areas.

Bouygues Telecom's Established Mobile Customer Base

Bouygues Telecom's mobile operations, bolstered by strategic moves like the acquisition of La Poste Telecom, represent a significant Cash Cow. By the close of December 2024, the company commanded an impressive 18.3 million mobile plan customers. This substantial customer base, even within a mature market, translates into a consistent and considerable revenue stream.

The maturity of the mobile sector doesn't diminish the value of Bouygues Telecom's established position. Its high market share, a testament to its strong brand and competitive offerings, underpins a robust commercial performance. This consistent performance is key to its Cash Cow status, guaranteeing predictable and substantial cash inflows for the company.

- Established Market Position: Bouygues Telecom holds a significant share in the French mobile market.

- Customer Acquisition: The acquisition of La Poste Telecom further solidified its customer base, reaching 18.3 million mobile plan customers by end-December 2024.

- Revenue Stability: Despite market maturity, high customer numbers ensure a stable and significant revenue generation.

- Commercial Performance: Robust commercial strategies contribute to sustained profitability from its mobile segment.

Bouygues' Established Real Estate Development for Commercial Property

Bouygues' established real estate development for commercial property, while facing current market headwinds, functions as a cash cow within the Bouygues portfolio. Despite a general standstill in new project activity, the company leverages its existing, mature assets and secured long-term contracts to ensure consistent cash generation.

This segment benefits from Bouygues' substantial market footprint, enabling it to effectively extract value from its established investments. Even in a low-growth economic climate, the stable income streams from these properties allow Bouygues to 'milk' this business unit for reliable cash flow, supporting other ventures.

For instance, Bouygues Immobilier, a key subsidiary, reported a significant backlog of rental income from its commercial properties. In 2023, the rental income from commercial real estate contributed a steady stream to the group's overall financial performance, underscoring its cash cow status.

- Stable Rental Income: Continual cash flow from existing commercial property leases.

- Long-Term Contracts: Security of revenue through secured, long-duration agreements.

- Market Presence: Ability to leverage established assets for consistent yield.

- Resilience in Low Growth: Proven capacity to generate returns even during economic slowdowns.

Bouygues Construction's French building activities and Colas' road maintenance operations are strong Cash Cows. TF1's linear TV channels consistently generate advertising revenue, and Bouygues Telecom's mobile segment, with 18.3 million customers by end-2024, provides stable cash. Bouygues Immobilier's commercial property rentals also contribute reliably.

| Business Unit | 2024/Q1 2025 Data | Status |

| Bouygues Construction (France Building) | €18.3 billion backlog | Cash Cow |

| Colas | 3% sales increase (Q1 2025) | Cash Cow |

| TF1 (Linear TV) | 18.7% audience share (2024) | Cash Cow |

| Bouygues Telecom (Mobile) | 18.3 million customers (end-2024) | Cash Cow |

| Bouygues Immobilier (Commercial Property) | Steady rental income (2023) | Cash Cow |

What You’re Viewing Is Included

Bouygues BCG Matrix

The preview you are currently viewing is the exact Bouygues BCG Matrix report you will receive upon purchase, offering a clear and actionable strategic overview. This comprehensive document is fully formatted and ready for immediate application in your business planning and decision-making processes. No watermarks or demo content will be present; you'll get the complete, professionally designed analysis. This ensures you have a high-quality, ready-to-use tool for understanding Bouygues' market position and strategic direction.

Dogs

Bouygues Immobilier is navigating a tough French residential property market. Construction spending saw a steep 19.1% decrease in 2024, and forecasts suggest another 5.4% drop in 2025. This challenging landscape is reflected in their backlog, which was 11% lower as of March 2024 compared to the previous year.

This decline in backlog suggests Bouygues Immobilier holds a smaller share in an overall contracting market. The company's performance in residential development is therefore positioned as a potential 'Dog' within the BCG framework, given the shrinking market size and the company's reduced order book.

Bouygues Immobilier's commercial property activities are currently experiencing a significant downturn. The company's backlog in this sector has decreased, indicating a shrinking pipeline of future projects.

This segment operates within a low-growth market, further compounded by Bouygues Immobilier's relatively small market share. Consequently, it consumes valuable resources without generating substantial returns, placing it in a position that warrants careful consideration for reduction or sale.

Bouygues Telecom's legacy DSL broadband services are firmly positioned as Dogs in the BCG matrix. France's accelerated shift to fiber optics means these older technologies are rapidly being phased out. In 2024 alone, DSL plans saw a significant reduction, with 6.3 million subscriptions, a substantial drop of 2.6 million from the previous year.

This steep decline highlights a shrinking market where DSL's share is diminishing. As more consumers upgrade to faster fiber connections, the demand for DSL continues to wane. This trajectory clearly marks DSL broadband as a low-growth, low-market-share offering for Bouygues Telecom.

Certain Non-Strategic, Low-Margin Service Offerings within Equans

Certain non-strategic, low-margin service offerings within Equans, while not its primary focus, could represent areas that consume resources without contributing significantly to its growth objectives. These might include legacy services in mature markets or niche activities with limited scalability. For instance, if Equans has retained certain low-margin maintenance contracts in sectors not aligned with energy transition, these could be considered question marks. In 2024, for example, a hypothetical 5% of Equans’ revenue derived from such services, generating only a 2% profit margin, would highlight this category.

- Low Profitability: Services with margins below Equans' target for high-growth areas, potentially under 4% in 2024, would fit this description.

- Resource Drain: These offerings might tie up skilled labor and capital without offering substantial returns.

- Limited Strategic Alignment: Services not contributing to the energy transition or advanced multi-technical solutions are candidates.

- Market Saturation: Offerings in highly competitive, commoditized markets with little differentiation could also fall here.

Underperforming Small Subsidiaries or Niche Activities

Within Bouygues' vast conglomerate, certain smaller subsidiaries or specialized business units might be categorized as Dogs in the BCG Matrix. These are typically found in mature, low-growth sectors and possess minimal market share, struggling to contribute significantly to overall profitability. They often represent historical investments or niche operations that have not scaled effectively.

These underperforming units can drain resources and management attention that could otherwise be directed towards more promising ventures. For instance, a small, specialized construction service in a saturated regional market, or a niche media production unit with limited distribution, could fall into this category. While specific financial data for individual, minor subsidiaries is not publicly detailed by Bouygues, the presence of such entities is a common characteristic of large, diversified corporations.

Identifying and managing these Dogs is crucial for optimizing resource allocation and enhancing group-wide performance. Bouygues, like any diversified group, periodically reviews its portfolio to divest or restructure underperforming assets. In 2024, the focus for such entities would be on minimizing losses, exploring potential niche monetization, or considering divestment to free up capital.

- Low Growth Market: Operates in sectors with limited expansion potential.

- Small Market Share: Holds an insignificant position relative to competitors.

- Low Profitability: Fails to generate substantial returns or incurs losses.

- Resource Drain: Consumes management time and capital without commensurate strategic value.

Dogs in the Bouygues portfolio represent areas with low market share in low-growth industries. These segments consume resources without generating significant returns, often due to declining market relevance or intense competition. For example, Bouygues Immobilier's residential development faced a challenging French property market in 2024, with construction spending down 19.1%.

Similarly, Bouygues Telecom's legacy DSL broadband services are a clear example of a Dog. With France rapidly adopting fiber optics, DSL subscriptions saw a significant drop in 2024, reaching 6.3 million, down from 8.9 million the previous year, indicating a shrinking market and diminishing share.

These "Dog" segments require careful management, often involving divestment, restructuring, or a focus on minimizing losses. The objective is to reallocate capital and resources to more promising growth areas within the Bouygues conglomerate.

Identifying these underperforming units is key to optimizing the overall business portfolio. Bouygues' strategy likely involves a periodic review to prune these low-return assets.

| Bouygues Segment | BCG Category | Key Indicators |

|---|---|---|

| Bouygues Immobilier (Residential) | Dog | 19.1% decrease in construction spending (2024), 11% lower backlog (Mar 2024) |

| Bouygues Telecom (DSL Broadband) | Dog | 6.3 million DSL subscriptions (2024), down 2.6 million from previous year |

| Equans (Certain Legacy Services) | Potential Dog | Hypothetical 5% revenue from low-margin services (2024), profit margin of 2% |

| Niche Subsidiaries/Units | Potential Dog | Operate in mature, low-growth sectors with minimal market share |

Question Marks

TF1+ is positioned as a Question Mark in Bouygues' BCG Matrix. In 2024, it became France's top free streaming platform, attracting around 4 million daily users and achieving over 3.5 billion video views. This indicates strong growth and market traction, placing it in a high-growth industry.

The digital media market is expanding significantly, with a projected compound annual growth rate of 12.3% from 2024 to 2030. Despite TF1+'s impressive user numbers, it operates in a competitive landscape dominated by global players, necessitating ongoing substantial investment to secure and expand its market share.

Bouygues, via its ISAI Build Venture fund, is strategically positioning itself in the nascent but high-potential deep-tech sector by investing in companies like Carbyon, a pioneer in Direct Air Capture (DAC) of CO2. These investments fall into a high-risk, high-reward category, characterized by substantial initial capital outlay and a long gestation period before profitability, mirroring the characteristics of 'Question Marks' in a BCG matrix context. Carbyon's focus on DAC technology addresses a critical climate challenge, suggesting a future market need, but its current market share is negligible, demanding significant R&D and market development.

Bouygues Telecom is actively investing in new digital and Internet of Things (IoT) solutions, recognizing the significant growth potential driven by accelerating digital transformation. These emerging areas, while promising, likely represent smaller current market shares for the company, requiring substantial investment to secure future leadership positions.

In 2024, the company's focus on IoT solutions, particularly in areas like smart cities and connected industry, aims to tap into a market projected for robust expansion. For instance, the global IoT market was estimated to reach over $1.1 trillion in 2024, presenting a substantial opportunity for Bouygues Telecom to gain traction.

Innovative Construction Methods and Smart City Solutions

Bouygues is actively investing in research and development for innovative construction methods, including automated building and smart city solutions. These areas are poised for significant growth within the construction sector, signaling potential future revenue streams. However, Bouygues' current market share in these emerging technologies is relatively small, necessitating substantial investment to achieve scalability and broad market acceptance.

The company’s strategic focus on these nascent technologies aligns with the characteristics of a question mark in the BCG matrix. For instance, Bouygues Construction's commitment to digital transformation and sustainable building practices, such as prefabrication and modular construction, positions them to capture future market share. In 2024, the global smart city market was valued at over $400 billion, with an anticipated compound annual growth rate exceeding 20% in the coming years, highlighting the substantial growth potential.

- High Growth Potential: Smart city technologies and automated construction represent rapidly expanding markets driven by urbanization and technological advancements.

- Low Market Share: Bouygues' current penetration in these specialized, early-stage technology segments is limited, requiring strategic investment to build a stronger presence.

- Investment Needs: Significant capital expenditure is required to develop, scale, and market these innovative solutions, which is characteristic of question mark entities.

- Future Market Leadership: Successful development and adoption of these technologies could position Bouygues as a leader in the future construction landscape.

Bouygues Construction's Expansion into Specific High-Growth International Niches

Bouygues Construction's strategic focus on specific high-growth international niches, such as advanced data centers and specialized renewable energy infrastructure, positions these ventures as potential stars within its portfolio. For instance, the global data center construction market was projected to reach over $300 billion by 2026, with significant growth in regions like Europe and Asia. This highlights the substantial revenue potential in these areas.

These emerging markets demand considerable upfront capital for development and technological integration, characteristic of 'star' business units. Bouygues' commitment to these sectors reflects a forward-looking strategy, aiming to capture market share in areas poised for rapid expansion. In 2023, the company continued to secure contracts for major infrastructure projects, signaling ongoing investment in these high-potential segments.

- Data Center Growth: The global data center market is experiencing robust expansion, driven by cloud computing and AI, creating significant opportunities for construction firms like Bouygues.

- Renewable Energy Focus: Investments in renewable energy infrastructure, particularly in emerging markets, offer high growth potential as nations transition to cleaner energy sources.

- Capital Intensity: These niche sectors require substantial initial investment, which is a key characteristic of 'star' segments in a BCG matrix.

- Market Share Potential: Early and significant investment can secure a strong market position in these rapidly developing international markets.

Bouygues' investments in emerging digital technologies, such as IoT solutions and smart city infrastructure, are categorized as Question Marks. These areas exhibit high growth potential, with the global IoT market projected to exceed $1.1 trillion in 2024, yet Bouygues likely holds a relatively small market share in these nascent segments. Consequently, substantial investment is necessary to build market presence and achieve future leadership.

BCG Matrix Data Sources

Our Bouygues BCG Matrix is constructed from a blend of internal financial disclosures, external market research, and industry performance benchmarks to provide a comprehensive view of business unit standing.