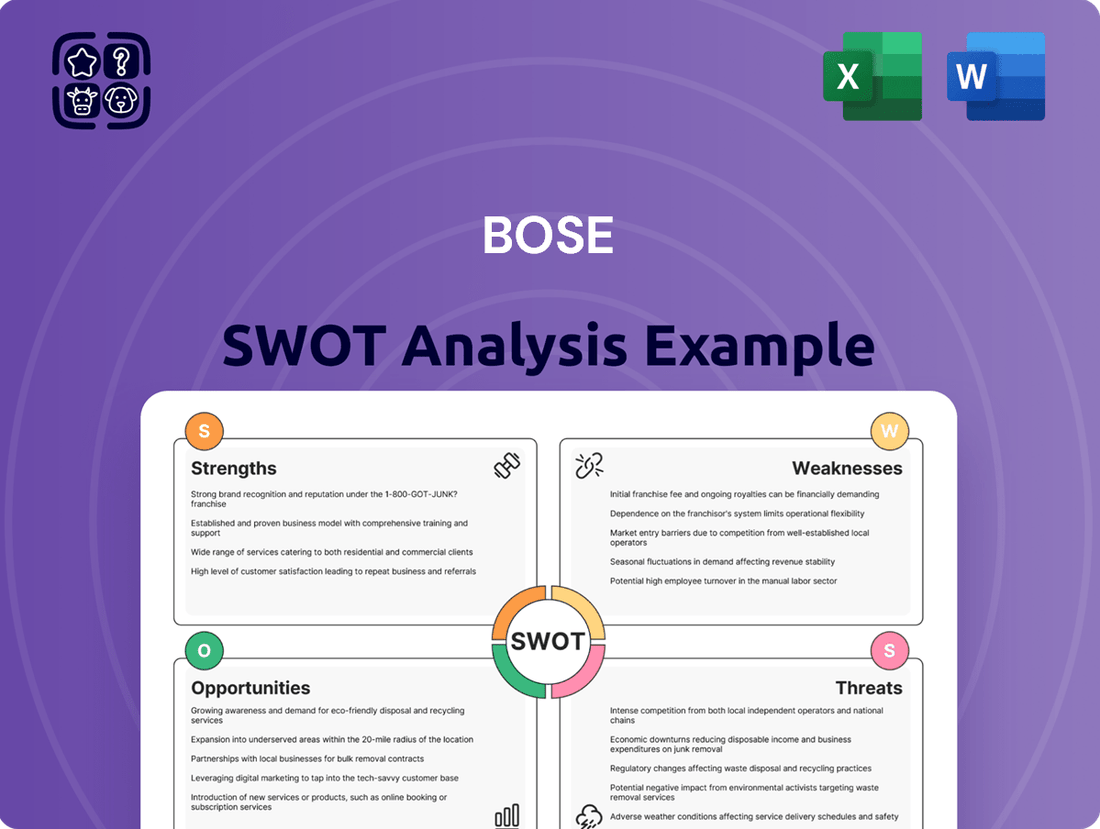

Bose SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bose Bundle

Bose, a leader in audio innovation, leverages its strong brand recognition and commitment to research and development to create premium sound experiences. However, it faces intense competition and the challenge of adapting to rapidly evolving consumer electronics trends.

Discover the complete picture behind Bose's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Bose boasts a powerful brand reputation, cultivated over six decades through relentless dedication to acoustics research and product innovation. This commitment has cemented its image as a purveyor of high-quality audio experiences, fostering deep customer loyalty and trust. Consumers consistently associate Bose with superior sound, a perception reinforced by their consistent delivery of exceptional audio for 60 years, from home entertainment to portable devices.

Bose stands out as a pioneer in noise cancellation technology, a feature highly sought after in audio products like headphones and earbuds. This expertise is a significant strength, differentiating them in a competitive market.

Their QuietComfort line consistently earns praise, with the QuietComfort Ultra Headphones notably receiving the CES 2024 'Best of Innovation' award. This recognition underscores Bose's ongoing commitment to and leadership in delivering superior noise-canceling experiences.

Bose boasts a remarkably diversified product portfolio, spanning consumer electronics such as home audio systems, loudspeakers, headphones, and soundbars. This breadth extends to professional audio solutions and even integrated automotive sound systems. This strategic diversification significantly reduces reliance on any single market segment, allowing Bose to cater to a wide array of customer preferences and needs across different industries.

Commitment to Innovation and Research

Bose demonstrates a significant commitment to innovation, consistently investing in research and development to push the boundaries of audio technology. This focus has led to the introduction of groundbreaking products and features, solidifying their position as a leader in the audio industry.

The company's dedication to acoustics research is evident in their continuous efforts to refine sound quality and user experience. For instance, the recent launch of the Ultra Open Earbuds showcases a novel design approach, aiming to provide a more natural listening experience.

Furthermore, Bose is actively developing advanced technologies like Perceptual Sound Rendering (PSR) for automotive audio systems. This technology aims to create more immersive and realistic soundscapes within vehicles, enhancing the overall passenger experience.

- Acoustics Research: Bose invests heavily in understanding and improving sound reproduction.

- Product Innovation: Continuous introduction of new designs and technologies, like the Ultra Open Earbuds.

- Advanced Technologies: Development of proprietary systems such as Perceptual Sound Rendering (PSR) for enhanced audio experiences.

Strategic Partnerships and Collaborations

Bose's strategic partnerships are a significant strength, allowing them to tap into new markets and enhance their product ecosystem. A prime example is their collaboration with Epson, which integrates Bose's renowned audio technology into Epson's projector offerings, creating a more immersive entertainment experience. This type of synergy not only broadens market reach but also diversifies revenue streams by leveraging complementary technologies.

Furthermore, Bose's continued investment in emerging players, like its stake in the Indian wearable brand Noise, demonstrates a forward-thinking approach. In 2024, the wearable technology market, particularly in India, continued its robust growth, with Noise being a prominent player. By aligning with such companies, Bose can gain insights into evolving consumer preferences and potentially integrate its audio expertise into a wider range of connected devices, thereby strengthening its competitive position.

These collaborations are not just about expanding reach; they are about co-creating value and staying ahead of technological trends. By strategically partnering, Bose can accelerate innovation and offer more comprehensive solutions to consumers, reinforcing its brand as a leader in premium audio and related technologies.

Bose's core strength lies in its deeply ingrained culture of innovation, consistently pushing audio boundaries. Their significant investment in research and development fuels the creation of proprietary technologies, like Perceptual Sound Rendering (PSR), enhancing user experiences across various product lines. This commitment is validated by accolades such as the CES 2024 'Best of Innovation' award for their QuietComfort Ultra Headphones, underscoring their leadership in noise-cancellation technology.

What is included in the product

Analyzes Bose’s competitive position through key internal and external factors, highlighting its strong brand reputation and innovation while also considering market saturation and emerging technologies.

Provides a clear, actionable framework for identifying and addressing potential market challenges and opportunities.

Weaknesses

Bose's premium pricing strategy, while bolstering its brand image, can be a significant weakness. Products are often positioned at the higher end of the audio market, which naturally excludes price-sensitive consumers. For example, Bose's flagship noise-canceling headphones typically retail for over $300, a price point that many potential buyers cannot afford.

This premium positioning can restrict market share, especially in segments where affordability is a key driver of purchasing decisions. While Bose maintains a strong brand, this can limit its ability to capture a broader customer base compared to competitors offering more budget-friendly alternatives. In 2024, the global audio market saw significant growth in mid-range and entry-level segments, areas where Bose's pricing might be less competitive.

The consumer electronics arena, especially for headphones and portable speakers, is fiercely contested. Giants like Apple, Sony, Samsung, JBL, and Logitech's Ultimate Ears are major players, making it tough for Bose to hold onto or expand its market share.

Bose's historical reliance on its specialized retail footprint, a key element in its brand experience, was significantly altered when the company closed its physical stores in 2020. This move, driven by a notable consumer shift towards online shopping, meant a departure from its established customer engagement strategy that often leveraged in-person product demonstrations and brand immersion.

While Bose has successfully transitioned to e-commerce, this strategic pivot may have diminished the impact of its once-potent word-of-mouth marketing, which was often fueled by positive in-store experiences. The absence of a physical retail presence means a potential challenge in replicating the tactile and auditory engagement that defined its traditional customer interaction model.

Lower Market Share in Broader Audio Equipment

While Bose excels in niche areas like noise-canceling headphones and smart speakers, its overall presence in the wider audio equipment market is less dominant. Compared to major electronics conglomerates, Bose's market share in broader audio categories is considerably smaller. For example, in 2024, Bose captured approximately 0.79% of the total audio equipment market, highlighting a significant gap in broader consumer electronics.

This limited market share in wider audio segments presents a challenge for Bose's overall growth trajectory. The company's strength remains concentrated in specific product lines, leaving opportunities unrealized in areas like home theater systems or professional audio installations where larger competitors often hold sway. This can limit brand visibility and customer acquisition beyond its core enthusiast base.

- Limited Market Penetration: Bose's share in the broader audio equipment market, standing at 0.79% in 2024, indicates a weaker competitive position outside its specialized segments.

- Diversification Gap: Compared to diversified electronics giants, Bose's product portfolio in audio is less comprehensive, impacting its ability to capture a larger overall market share.

- Brand Reach Constraints: The focus on specific product categories might restrict Bose's brand recognition and appeal to a wider consumer base interested in a full spectrum of audio solutions.

Potential for OEM Self-Development in Automotive Audio

While Bose has a strong reputation in automotive audio, a significant weakness lies in the growing trend of Original Equipment Manufacturers (OEMs) developing their own in-house audio solutions. This shift could reduce reliance on external suppliers like Bose. For instance, in 2024, several major automakers announced increased investment in their internal R&D for vehicle electronics, including audio systems, signaling a potential move towards proprietary technology rather than third-party integration.

This internal development by OEMs could lead to a significant challenge for Bose. As automakers aim for greater control over vehicle features and user experience, they may opt to design and implement their own audio systems, potentially bypassing established suppliers. This is particularly relevant as the automotive industry increasingly focuses on software-defined vehicles, where integrated audio experiences are a key differentiator.

- OEMs investing in in-house audio R&D: Many automakers are bolstering their internal engineering teams focused on vehicle acoustics and sound system design.

- Trend towards proprietary solutions: The automotive sector is seeing a push for unique, integrated features, which can extend to audio.

- Software-defined vehicles: The rise of software-centric automotive design allows for deeper integration of all vehicle systems, including audio.

- Potential market share erosion: If OEMs successfully develop competitive in-house audio, Bose could face reduced opportunities for new vehicle contracts.

Bose's premium pricing strategy, while reinforcing its brand prestige, can alienate budget-conscious consumers. This focus on the higher end limits market penetration, especially in price-sensitive segments. For example, Bose's flagship noise-canceling headphones, often exceeding $300, are inaccessible to a broad demographic, impacting its ability to capture a larger share of the growing mid-range audio market observed in 2024.

Same Document Delivered

Bose SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, ensuring transparency. The complete version of this Bose SWOT analysis becomes available immediately after purchase.

Opportunities

The automotive audio market is booming, with consumers increasingly prioritizing premium in-car sound experiences. This trend is further amplified by the rise of electric and autonomous vehicles, which often feature advanced infotainment systems and quiet cabins that highlight audio quality.

Bose is well-positioned to capitalize on this growth. The demand for personalized audio, seamless integration with AI, and sophisticated sound systems in vehicles presents a significant opportunity for Bose's automotive division to innovate and expand its market share.

Projections indicate the automotive audio market will reach $15.41 billion by 2029, growing at a compound annual growth rate of 8.6%. This robust expansion underscores the substantial potential for Bose to leverage its brand and technological expertise in this dynamic sector.

The growing adoption of smart home technology presents a significant avenue for Bose. As consumers increasingly integrate connected devices, the demand for seamless, high-quality audio experiences within these ecosystems is rising. This trend is underscored by the projected growth of the global smart home market, which was estimated to reach over $135 billion in 2023 and is expected to continue its upward trajectory through 2030.

Bose is well-positioned to capitalize on the demand for AI-powered audio optimization. Consumers are actively seeking wireless whole-house audio systems and immersive home theater setups, often controlled by voice. For instance, the global smart speaker market, a key component of AI-powered audio, saw shipments exceeding 150 million units in 2023, indicating strong consumer engagement with voice-activated audio solutions.

Leveraging its deep expertise in acoustics, Bose can integrate advanced AI to automatically analyze and adapt sound to specific room environments. This capability directly addresses consumer desires for personalized and superior audio quality, offering a distinct advantage in a competitive landscape where intelligent sound tuning is becoming a key differentiator.

Consumers are increasingly seeking out superior audio experiences, with a noticeable uptick in demand for premium audio products and sophisticated home theater setups. This trend is fueling significant growth within the high-end audio sector.

Bose's established brand recognition for delivering exceptional audio quality places it in a strong position to leverage this expanding market. The company's ability to integrate cutting-edge technologies, such as immersive 3D audio formats like Dolby Atmos, further enhances its appeal to this discerning customer base.

Emerging Markets and Digital Channels

Bose can capitalize on the growing disposable income in emerging markets, which is a significant driver for the home audio equipment sector. For instance, countries across Southeast Asia and Latin America are showing robust economic growth, leading to increased consumer spending on premium electronics. This presents a substantial opportunity for Bose to expand its customer base beyond traditional developed markets.

The rise of cloud-based distribution channels and e-commerce platforms offers Bose a direct pathway to these burgeoning consumer segments. By enhancing its online sales infrastructure and digital marketing efforts, Bose can effectively reach consumers in developing regions who are increasingly adopting digital purchasing habits. This strategic focus on online expansion and emerging markets is projected to be a key growth avenue for the company in the 2024-2025 period.

- Growing Disposable Income: Emerging economies are experiencing a steady rise in per capita income, boosting consumer purchasing power for high-quality audio products.

- Digital Adoption: Increased internet penetration and smartphone usage in developing nations facilitate online sales and digital marketing campaigns.

- Market Expansion: Targeting these underserved but rapidly growing markets can diversify Bose's revenue streams and reduce reliance on mature markets.

- E-commerce Growth: The global e-commerce market, projected to reach trillions in the coming years, offers a scalable platform for Bose to reach a wider audience efficiently.

Sustainability and Eco-Friendly Solutions

The increasing global focus on environmental responsibility presents a significant opportunity for Bose. Consumers are actively seeking out products that align with their values, and brands demonstrating a commitment to sustainability are gaining traction. Bose's existing efforts in reducing emissions and utilizing eco-friendly materials in packaging and products can be amplified to capture this growing market segment.

For instance, by highlighting their use of recycled plastics or energy-efficient manufacturing processes, Bose can differentiate itself. A recent survey indicated that over 60% of consumers are willing to pay more for sustainable products, a trend expected to continue through 2025. This consumer sentiment provides a clear pathway for Bose to enhance its brand image and potentially increase market share by emphasizing its green initiatives.

- Growing Consumer Demand: An increasing number of consumers are prioritizing environmentally conscious brands, creating a market for sustainable audio solutions.

- Brand Differentiation: Bose can leverage its existing sustainability efforts, such as reduced emissions and eco-friendly packaging, as a key differentiator against competitors.

- Market Expansion: By further developing and promoting eco-friendly product lines, Bose can tap into a rapidly expanding segment of the audio market.

- Enhanced Brand Reputation: A strong commitment to sustainability can bolster Bose's brand image, attracting environmentally aware customers and fostering loyalty.

The automotive sector's shift towards electric and autonomous vehicles presents a significant opportunity for Bose. These vehicles often feature advanced infotainment systems and quieter cabins, creating a heightened demand for premium in-car audio experiences. Bose's expertise in acoustic engineering positions it to integrate sophisticated sound systems, meeting consumer expectations for personalized and immersive audio in these new automotive platforms.

The global automotive audio market was valued at approximately $11.8 billion in 2023 and is projected to reach $15.41 billion by 2029, growing at a CAGR of 8.6%. This expansion highlights the substantial potential for Bose to capture market share by innovating and delivering superior audio solutions tailored for the evolving automotive landscape.

Bose can capitalize on the growing demand for AI-powered audio optimization and seamless integration within smart home ecosystems. The smart home market, valued at over $135 billion in 2023, is expanding rapidly, with smart speaker shipments exceeding 150 million units in the same year. Bose's ability to offer intelligent, adaptive sound solutions for both automotive and home environments aligns perfectly with these consumer trends.

Emerging markets represent a substantial growth avenue for Bose, driven by increasing disposable incomes and a growing adoption of digital commerce. As these economies develop, consumer spending on premium electronics, including high-quality audio equipment, is on the rise. Bose can leverage e-commerce platforms to efficiently reach these burgeoning consumer segments, diversifying its revenue streams and expanding its global footprint.

Threats

Bose confronts formidable competition from tech behemoths such as Apple, whose AirPods and Beats by Dre products dominate the premium wireless audio market, and from giants like Sony and Samsung, who leverage their extensive ecosystems and R&D capabilities. For instance, Apple's audio segment revenue reached approximately $39.3 billion in fiscal year 2023, underscoring their significant market presence.

Furthermore, the audio landscape is constantly challenged by agile niche players who frequently introduce disruptive, cost-effective innovations, forcing Bose to continually adapt and differentiate its premium offerings to maintain its market share and brand appeal.

Ongoing global supply chain issues, exacerbated by geopolitical events, continue to pose a significant threat to Bose's operations. These disruptions can lead to increased manufacturing costs and delays in product delivery, impacting the company's ability to meet consumer demand. For instance, the semiconductor shortage, which persisted into early 2024, directly affected the production of electronic components essential for Bose's audio and noise-canceling products.

Economic volatility, including rising inflation and potential recessions, creates a more cautious consumer environment. In 2024, many consumers tightened their budgets, leading to a slowdown in discretionary spending on premium electronics. This cautious market sentiment directly translates to a threat for Bose, as consumers may postpone or forgo purchases of higher-priced items like high-fidelity headphones and sound systems.

The audio industry's rapid pace of change, particularly in areas like AI-powered sound personalization and the emergence of new spatial audio formats, presents a significant threat to Bose. Competitors are quick to integrate cutting-edge features, making it crucial for Bose to stay ahead.

For instance, the growing adoption of lossless audio streaming and advanced noise-cancellation algorithms by rivals means Bose must invest heavily in R&D to prevent its product lines from becoming outdated. Failure to do so could lead to a loss of market share as consumers gravitate towards newer, feature-rich alternatives.

Changing Consumer Preferences and Commoditization

Bose faces a threat as consumer preferences evolve, potentially leading to the commoditization of certain audio product categories. This means consumers might increasingly prioritize price and basic functionality over brand prestige or advanced features, impacting Bose's premium positioning. For instance, the demand for portable Bluetooth speakers, a segment where Bose competes, has seen significant growth, but also intense price competition from numerous brands.

Shifting media consumption habits also present a challenge. As people consume more audio content on the go, there's a growing preference for more affordable, compact, and versatile audio solutions. This trend could potentially erode sales in Bose's traditional high-end headphone and home audio markets if consumers opt for cheaper alternatives that still meet their basic listening needs.

- Market Shift: The global portable Bluetooth speaker market alone was valued at approximately $15 billion in 2023 and is projected to grow, but this growth is accompanied by significant price pressures.

- Consumer Behavior: Younger demographics, in particular, often exhibit a greater willingness to trade down for audio devices if the core functionality is met at a lower cost.

- Competitive Landscape: The proliferation of brands offering feature-rich wireless earbuds at lower price points directly challenges Bose's premium pricing strategy in this segment.

Intellectual Property Infringement and Counterfeiting

Bose's position as an innovator in audio technology makes it a target for intellectual property infringement and the widespread availability of counterfeit goods. This poses a significant threat by potentially devaluing the Bose brand and directly impacting revenue streams. Protecting its patents and trademarks requires substantial investment in legal and enforcement efforts.

The market for counterfeit audio products is substantial. For instance, in 2024, global losses due to counterfeiting across various industries were estimated to be in the hundreds of billions of dollars, with electronics being a significant sector. This illicit trade can siphon sales away from legitimate Bose products, especially in emerging markets where enforcement may be less stringent.

- Brand Dilution: Counterfeit products often offer inferior quality, which can be mistakenly associated with the Bose brand, damaging customer perception.

- Lost Sales: The availability of cheaper, fake alternatives directly competes with genuine Bose products, leading to reduced sales volume and market share.

- Enforcement Costs: Bose must allocate considerable resources to monitor the market, pursue legal action against infringers, and educate consumers about genuine products.

- Reputational Damage: Poorly made counterfeit items can lead to negative customer experiences, tarnishing Bose's reputation for quality and reliability.

Bose faces intense competition from tech giants like Apple, whose audio revenue was approximately $39.3 billion in fiscal year 2023, and from established players such as Sony and Samsung. Agile niche competitors also frequently introduce disruptive, cost-effective innovations, forcing Bose to continuously differentiate its premium offerings.

Economic volatility, including rising inflation, creates a cautious consumer environment, impacting discretionary spending on premium electronics. The rapid pace of technological change, such as AI-powered sound personalization and new spatial audio formats, necessitates significant R&D investment to prevent product lines from becoming outdated, as seen with the growing adoption of lossless audio by rivals.

Shifting consumer preferences towards more affordable, compact, and versatile audio solutions, particularly in the growing portable Bluetooth speaker market (valued at approximately $15 billion in 2023), presents a threat to Bose's premium pricing strategy. Furthermore, the widespread availability of counterfeit goods, with global losses from counterfeiting in the hundreds of billions of dollars in 2024, poses a significant risk of brand dilution and lost sales.

SWOT Analysis Data Sources

This Bose SWOT analysis is built upon a foundation of credible data, including Bose's official financial reports, comprehensive market research from reputable firms, and insights from industry experts and analysts.