Bose Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bose Bundle

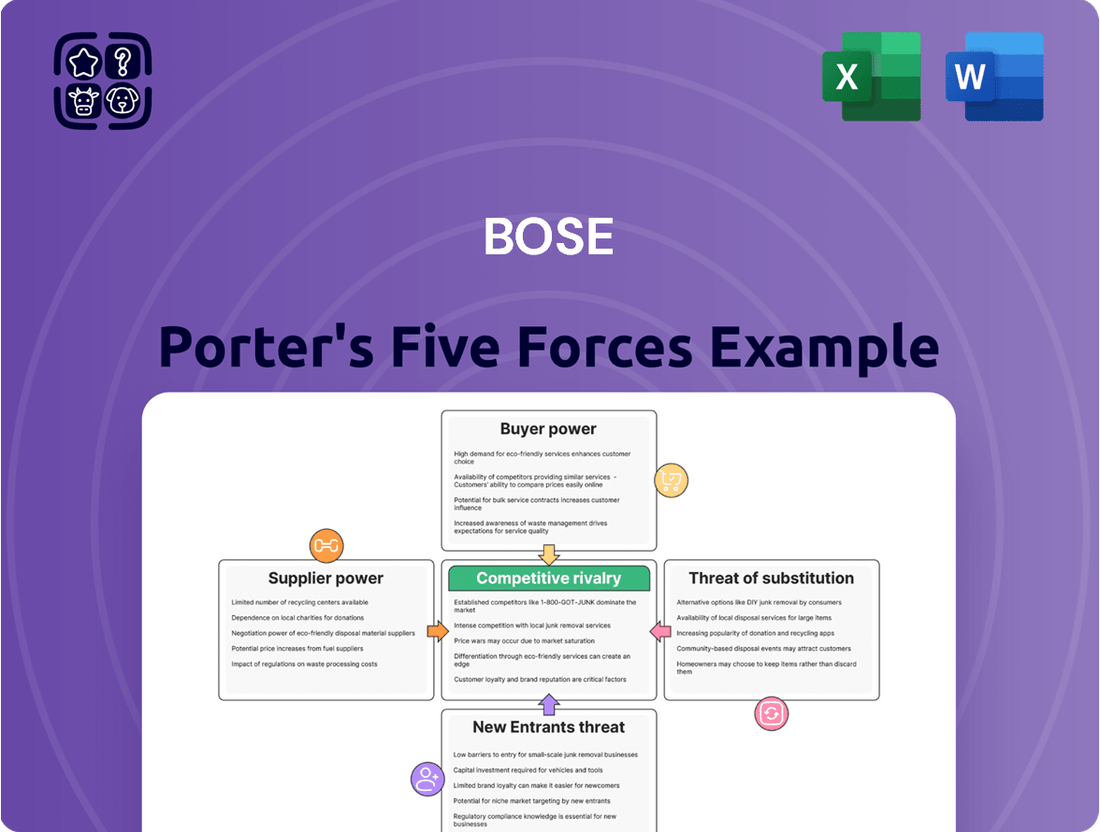

Porter's Five Forces Analysis reveals the competitive landscape Bose navigates, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the audio industry. Understanding these forces is crucial for any business aiming to thrive in a dynamic market.

The complete report reveals the real forces shaping Bose’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical audio components significantly influences their bargaining power. For instance, if only a handful of manufacturers produce advanced acoustic drivers or proprietary noise-cancellation chipsets, they can command higher prices and dictate terms to companies like Bose.

In 2024, the global market for audio components saw continued consolidation, with key players in specialized areas like high-fidelity speaker drivers and advanced microphone arrays holding substantial market share, potentially increasing their leverage over large buyers.

Conversely, a diverse and competitive supplier landscape for more commoditized parts, such as basic circuitry or housing materials, would empower Bose with greater negotiation flexibility and potentially lower input costs.

The bargaining power of suppliers for Bose is significantly influenced by the uniqueness and differentiation of the inputs they provide. When suppliers offer proprietary technology or highly specialized materials essential for Bose's product innovation and quality, their leverage grows. For instance, access to specific rare earth elements crucial for high-performance speaker magnets can give suppliers considerable power.

The electronics sector, including audio equipment manufacturing, frequently grapples with material shortages. In 2024, ongoing supply chain disruptions for components like advanced semiconductors and specialized acoustic materials continue to empower suppliers. This scarcity means Bose might face higher costs or limited availability if key suppliers have unique or difficult-to-substitute offerings, directly impacting Bose's production capabilities and cost structure.

The bargaining power of suppliers for Bose is significantly influenced by the switching costs involved. If Bose faces substantial expenses or delays in changing to a new supplier, current suppliers gain more leverage. This is particularly relevant for specialized components where finding and qualifying alternatives is a complex and costly undertaking.

For instance, consider the intricate acoustic drivers or advanced digital signal processing chips essential for Bose's premium audio products. The cost of retooling manufacturing lines, redesigning product interfaces, or conducting extensive quality assurance for new suppliers can be prohibitive. This integration means suppliers of such critical parts hold considerable sway, potentially dictating terms and pricing.

In 2024, the global semiconductor shortage, though easing, still presented challenges for electronics manufacturers, including Bose. This environment amplified the bargaining power of semiconductor suppliers, as demand often outstripped supply for advanced chips, forcing companies to accept less favorable terms or face production delays.

Supplier Power 4

The threat of suppliers integrating forward into Bose's audio equipment manufacturing market can significantly amplify their bargaining power. While less common for typical component suppliers, this risk is more pronounced for providers of highly specialized or proprietary technologies. For instance, a breakthrough in acoustic driver technology could empower its developer to consider direct market entry, bypassing Bose.

This potential for forward integration means suppliers hold leverage, as Bose must consider the possibility of facing direct competition from its own supply chain. In 2024, the semiconductor industry, crucial for advanced audio processing, saw several smaller firms innovating rapidly. Should one of these firms develop a significantly superior chip, their ability to dictate terms or even enter the market themselves would increase substantially, impacting Bose's cost structure and product development timelines.

- Forward Integration Threat: Suppliers might enter Bose's market, increasing their leverage.

- Specialized Technology Providers: This threat is higher for those offering unique or patented components.

- Market Dynamics (2024): Innovations in areas like semiconductor technology could empower component suppliers.

Supplier Power 5

The bargaining power of suppliers for Bose is influenced by how critical Bose is as a customer. If Bose accounts for a significant percentage of a supplier's total sales, that supplier might be more amenable to offering better pricing or terms. Conversely, if Bose is a small client for a supplier whose products are in high demand, the supplier holds more leverage.

Supply chain disruptions, a persistent issue in the electronics sector, continue to shape supplier power. In 2025, extended lead times and ongoing geopolitical tensions are creating challenges for component sourcing. For instance, the global semiconductor shortage, which began impacting industries in 2020, is still having ripple effects, potentially strengthening the position of chip manufacturers.

- Customer Dependence: Bose's impact on a supplier's revenue dictates their negotiation strength.

- Component Demand: High demand for a supplier's specific components increases their bargaining power.

- Supply Chain Volatility: Geopolitical instability and extended lead times in electronics components favor suppliers in 2025.

- Industry Trends: The ongoing semiconductor shortage exemplifies how market conditions can shift power dynamics towards suppliers.

The bargaining power of suppliers is a key factor in Bose's operational costs and product development. When suppliers offer unique, critical components with few alternatives, their ability to dictate terms and prices increases significantly. This is amplified by high switching costs for Bose, making it difficult and expensive to change suppliers for specialized parts.

In 2024, the electronics industry continued to experience supply chain pressures, particularly for advanced semiconductors and specialized acoustic materials. This scarcity bolstered the leverage of suppliers in these niche markets. For instance, if a supplier holds a patent for a crucial audio processing chip, Bose's reliance on that technology grants the supplier considerable negotiating power, potentially leading to higher component costs for Bose.

Furthermore, the threat of forward integration by suppliers, especially those with proprietary technology, poses a risk. Should a supplier develop a disruptive innovation, they might consider entering Bose's market directly. In 2024, the rapid innovation pace in areas like AI-driven audio processing chipsets meant that smaller, agile component developers could potentially gain significant leverage over established manufacturers like Bose.

| Factor | Impact on Bose | 2024 Trend Example |

|---|---|---|

| Supplier Concentration | High concentration increases supplier leverage. | Consolidation in advanced driver manufacturing. |

| Switching Costs | High costs empower existing suppliers. | Complex integration of proprietary DSP chips. |

| Input Uniqueness | Differentiated inputs give suppliers more power. | Access to rare earth elements for magnets. |

| Forward Integration Threat | Potential competition from suppliers. | Innovations in semiconductor tech by smaller firms. |

What is included in the product

Bose Porter's Five Forces Analysis examines the competitive landscape by evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

The bargaining power of customers for Bose is influenced by their price sensitivity, especially in the premium audio market. While Bose aims for a premium segment, if consumers perceive little difference between high-end audio brands, they might become more inclined to seek out better prices, thereby increasing their leverage. For instance, in 2024, the consumer electronics sector continued to see a strong demand for value, with many consumers actively seeking discounts and promotions, particularly during major shopping events like Black Friday and Cyber Monday.

The bargaining power of customers for Bose is significantly influenced by the wide availability of alternative audio products and brands. This competitive landscape, featuring numerous players offering diverse options from earbuds to home theater systems, grants consumers greater choice and leverage.

In 2024, the global audio equipment market is projected to reach approximately $120 billion, with a compound annual growth rate of around 6%. This robust market growth fuels innovation and product proliferation, further empowering buyers with more alternatives to Bose's offerings.

For Bose's business-to-consumer (B2C) market, individual customer purchase volumes typically don't wield substantial influence. However, in its business-to-business (B2B) sectors, such as automotive sound systems or professional audio solutions, large-volume orders can grant significant leverage to these corporate buyers.

Bose's direct-to-consumer online sales strategy, while enhancing brand control, also reflects a broader trend in how consumers are increasingly purchasing electronics, potentially shifting some power dynamics.

Buyer Power 4

The bargaining power of Bose customers is a significant factor in its competitive landscape. When customers can easily switch to rival products, their power increases. For instance, the audio market is flooded with alternatives, from budget-friendly earbuds to premium sound systems, making it relatively simple for consumers to change brands.

Bose actively works to mitigate this by building strong brand loyalty. This is achieved through a consistent focus on delivering superior sound quality, innovative features, and an exceptional customer experience. In 2023, Bose reported strong customer satisfaction scores, indicating success in retaining its user base despite the availability of numerous competitors.

- Low Switching Costs: The ease of moving between audio brands, like choosing a different pair of headphones, gives consumers leverage.

- Brand Loyalty Initiatives: Bose invests in product innovation and customer service to encourage repeat purchases and reduce churn.

- Competitive Market: The presence of numerous audio manufacturers, from established players to emerging brands, provides consumers with abundant choices.

- Customer Experience Focus: Bose's emphasis on a premium user experience aims to create a stickier customer relationship, lessening the impact of low switching costs.

Buyer Power 5

Customers today wield considerable influence, largely due to the vast amount of information readily available. Online reviews, detailed product comparisons, and readily accessible pricing data empower consumers to make highly informed decisions. This transparency directly translates into increased pressure on companies regarding both price and product features, as buyers can easily identify better alternatives.

The digital landscape has fundamentally shifted the balance of power towards the buyer. For instance, online sales are anticipated to constitute a substantial segment of the consumer electronics market by 2025, underscoring the importance of digital channels in meeting customer expectations and competitive pricing strategies.

- Informed Decisions: Consumers can easily compare prices and features across numerous brands, leading to more strategic purchasing.

- Price Sensitivity: Increased access to information makes customers more sensitive to price variations, forcing companies to remain competitive.

- Feature Demands: Buyers can readily identify and demand specific product features based on competitor offerings and peer reviews.

- Digital Dominance: The growing reliance on online channels for purchases amplifies customer reach and their ability to influence market trends.

The bargaining power of Bose's customers is amplified by the ease with which they can switch to competing brands, a factor driven by low switching costs and a highly competitive market. This leverage is further enhanced by the wealth of readily available information, allowing consumers to make informed price and feature comparisons. In 2024, the consumer electronics market saw continued emphasis on value, with many shoppers actively seeking deals.

| Factor | Impact on Bose | 2024 Context |

|---|---|---|

| Low Switching Costs | Increases customer leverage | Easy to choose alternative audio brands |

| Information Availability | Empowers informed purchasing | Online reviews and price comparisons are abundant |

| Competitive Landscape | Provides numerous alternatives | Global audio market projected ~$120 billion in 2024 |

| Price Sensitivity | Pressures pricing strategies | Consumers seek discounts, especially during sales events |

Full Version Awaits

Bose Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Bose's competitive landscape through a detailed Porter's Five Forces Analysis, covering industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. This professionally crafted analysis is ready for your immediate use upon purchase.

Rivalry Among Competitors

Competitive rivalry in the audio equipment market is intense, with Bose facing off against formidable global players. Companies like Sony, Samsung, and Apple are major competitors, each commanding significant market share across various audio product categories. For instance, in the competitive headphone market, Apple's AirPods Pro and Sony's WH-1000XM series are direct rivals to Bose's QuietComfort line, driving innovation and price sensitivity.

Competitive rivalry in the home audio equipment market is quite intense. When an industry's growth rate slows, companies tend to fight harder for the existing market share, and this dynamic is certainly at play here. Even though the home audio market is expected to grow, the sheer number of players vying for consumer attention means competition remains a significant force.

Competitive rivalry in the audio industry is intense, with companies like Bose leveraging product differentiation to stand out. Bose heavily invests in research and development, particularly in its proprietary noise-cancellation technology, which allows them to position their products as premium offerings in a crowded market.

This focus on innovation and unique features creates a strong competitive advantage, but it also means rivals are constantly striving to match or surpass Bose's technological advancements. For instance, in 2024, the premium headphone market saw significant innovation from competitors aiming to challenge Bose's dominance in noise cancellation and audio quality, indicating a dynamic and highly competitive landscape.

Competitive Rivalry 4

High exit barriers significantly intensify competitive rivalry. When companies have substantial investments in specialized assets or enjoy strong brand loyalty, they often remain in the market even when profitability dips, leading to prolonged competition. Bose's deep commitment to research and development, coupled with its well-recognized brand, creates these formidable barriers.

- High R&D Investment: Bose consistently allocates substantial resources to innovation, evident in its continuous product development cycles and patent filings, which are costly to replicate.

- Brand Loyalty: Bose commands a loyal customer base, built over decades, making it difficult for new entrants to capture market share without significant marketing spend and product differentiation.

- Specialized Assets: The company's proprietary audio technologies and manufacturing processes represent specialized assets that are not easily transferable or replicable by competitors.

- Sustained Rivalry: These factors collectively ensure that even during periods of slower market growth, Bose and its competitors remain engaged in fierce competition to maintain or expand their positions.

Competitive Rivalry 5

The audio industry is characterized by a diverse set of players, from established audio specialists to technology behemoths, all vying for market share. This mix of competitors, each with distinct strategic approaches and origins, fuels a highly competitive environment. For instance, companies like Apple, Google, and Amazon, with their vast ecosystems and software capabilities, present a formidable challenge to traditional audio brands like Bose.

Bose's strategy to counter the influence of 'Big Tech' centers on augmenting its research and development capabilities. This includes strategic investments in software development, recognizing the increasing importance of integrated audio experiences and smart features in consumer electronics. Furthermore, Bose actively explores mergers and acquisitions (M&A) as a means to accelerate innovation and enhance its competitive standing.

In 2024, the competitive landscape continues to intensify. For example, Apple’s AirPods Pro 2, released in late 2022, have maintained strong sales momentum, demonstrating the power of brand loyalty and ecosystem integration. Bose itself reported revenue of approximately $3.8 billion in 2023, indicating its significant presence but also highlighting the scale of competition it faces from companies with much larger overall revenues.

- Diverse Competitors: Traditional audio firms compete with tech giants like Apple, Google, and Amazon, each employing different strategies.

- Bose's Response: Investments in software and M&A are key to Bose's strategy for R&D efficiency against tech rivals.

- Market Dynamics: Strong product performance from competitors, such as Apple's AirPods Pro 2, underscores the intense rivalry.

- Financial Scale: Bose's 2023 revenue of around $3.8 billion demonstrates its market position amidst larger tech companies.

Competitive rivalry in the audio sector is fierce, with Bose facing robust challenges from global powerhouses like Sony, Samsung, and Apple. These companies compete aggressively on innovation and price, particularly in the premium headphone segment where Bose's QuietComfort line is a direct target for products like Apple's AirPods Pro and Sony's WH-1000XM series. This constant push for technological advancement means rivals are always striving to match or exceed Bose's audio quality and noise-cancellation capabilities.

The intense competition is further fueled by high exit barriers, such as substantial R&D investments and strong brand loyalty, which keep companies like Bose and its rivals deeply entrenched in the market. Even when market growth slows, these factors ensure sustained rivalry as firms fight to maintain their positions. For example, Bose's significant investment in proprietary noise-cancellation technology, a costly endeavor to replicate, exemplifies the barriers that intensify competition.

In 2024, the competitive landscape remains dynamic, with tech giants like Apple leveraging their vast ecosystems to challenge traditional audio brands. Bose's strategy involves bolstering its R&D, including software development and potential M&A, to keep pace. The continued success of products like Apple's AirPods Pro 2 highlights the effectiveness of ecosystem integration and brand loyalty in this market. Bose's reported revenue of approximately $3.8 billion in 2023 underscores its significant market presence, yet it also reflects the scale of competition it faces from companies with substantially larger overall revenues.

| Key Competitor | 2023 Revenue (Approx.) | Key Product Overlap with Bose | Competitive Strategy Highlight |

| Apple | $383.29 billion (Total Company) | AirPods Pro, AirPods Max | Ecosystem integration, brand loyalty |

| Sony | $76.1 billion (Total Company) | WH-1000XM series, WF-1000XM series | Technological innovation, diverse product portfolio |

| Samsung | $200.1 billion (Total Company) | Galaxy Buds series, Soundbars | Broad consumer electronics presence, feature-rich products |

| Bose | $3.8 billion (Audio Division) | QuietComfort series, SoundLink series | Premium audio quality, noise-cancellation leadership |

SSubstitutes Threaten

The threat of substitutes for Bose's audio products is significant, as consumers have numerous alternative ways to meet their audio needs. For instance, the audio capabilities integrated directly into smartphones, smart TVs, and even gaming consoles can reduce the demand for dedicated audio equipment like soundbars or separate home audio systems. This trend is amplified as device manufacturers increasingly focus on delivering high-quality built-in audio, potentially diminishing the perceived necessity of specialized audio hardware.

The threat of substitutes is a significant factor for Bose. If alternative audio solutions offer comparable sound quality and features at a much lower cost, consumers might opt for them. For example, the increasing quality and affordability of soundbars, which can range from under $100 to over $1000, present a direct substitute for Bose's home audio systems and even some of their portable speakers.

The threat of substitutes for traditional audio equipment is significant and growing, driven by evolving consumer tastes favoring convenience and portability. As of early 2024, the global wireless audio market, encompassing headphones, earbuds, and portable speakers, continued its robust expansion, with projections indicating further substantial growth throughout the year.

Wireless audio devices, offering seamless connectivity and enhanced user experience, are increasingly preferred over wired alternatives. This trend is further amplified by the rise of smart speakers, integrating audio playback with smart home ecosystems and voice-activated assistants, presenting a compelling substitute for standalone audio systems.

4

The threat of substitutes for Bose products is significant, largely driven by the increasing quality and affordability of alternative audio solutions. If consumers perceive that integrated audio systems in smartphones or lower-cost wireless earbuds offer comparable sound quality for their everyday listening needs, they are less likely to pay a premium for Bose. For instance, in 2024, the market for true wireless stereo (TWS) earbuds saw continued growth, with many brands offering feature-rich options at price points well below Bose's premium offerings. This accessibility makes it easier for consumers to switch if they believe the perceived value of a substitute meets their requirements.

The perceived value of these substitutes plays a crucial role in their threat level. When consumers find that alternatives provide 'good enough' sound quality, convenience, or specific features like active noise cancellation at a lower cost, the appeal of premium brands like Bose diminishes. Consider the widespread adoption of smart speakers and soundbars from various manufacturers, which offer integrated audio experiences that can replace dedicated home audio systems. In 2024, the smart home market continued its expansion, with a growing number of households integrating these devices, potentially reducing the demand for specialized audio equipment.

- Consumer Perception: If consumers believe substitutes offer satisfactory sound quality and features, they may switch from premium brands.

- Price Sensitivity: Lower price points of substitutes make them attractive alternatives, especially for budget-conscious consumers.

- Technological Advancements: Improvements in audio technology for mass-market products can narrow the perceived quality gap with premium brands.

- Market Trends: The rise of integrated audio solutions and affordable wireless options directly challenges traditional audio equipment sales.

5

The threat of substitutes for audio equipment, like Bose products, is a significant consideration. As technology evolves, new ways to experience audio emerge, potentially drawing consumers away from traditional hardware.

For instance, advancements in virtual reality (VR) and augmented reality (AR) are creating immersive audio experiences that could be seen as substitutes. Consumers might opt for integrated VR/AR headsets that offer spatial audio, reducing their need for separate high-fidelity headphones or speakers. This shift is not just theoretical; the global VR market was valued at approximately $28.2 billion in 2023 and is projected to grow significantly, indicating a growing consumer interest in these alternative audio delivery systems.

Furthermore, the increasing quality and accessibility of streaming services and personalized audio content delivered through various platforms also pose a substitute threat. Consumers may prioritize the convenience and breadth of content offered by these services over the specific hardware used for playback. The global music streaming market revenue was estimated to be around $30 billion in 2023, demonstrating the massive scale of digital audio consumption.

- Emerging Technologies: VR and AR audio offer immersive alternatives to traditional sound systems.

- Market Growth: The VR market's substantial growth signals increasing consumer adoption of alternative audio experiences.

- Digital Content: The vast and accessible digital music streaming market presents a convenience-based substitute.

- Consumer Behavior: Shifting preferences towards integrated digital experiences can reduce reliance on dedicated audio hardware.

The threat of substitutes for Bose's audio products is considerable, as consumers can fulfill their audio needs through various alternative means. Integrated audio in smartphones, smart TVs, and gaming consoles can lessen the demand for dedicated audio equipment. This is further amplified as device manufacturers enhance their built-in audio quality, potentially reducing the perceived necessity of specialized audio hardware.

The increasing quality and affordability of alternatives, such as soundbars and true wireless stereo earbuds, present a direct substitute for Bose's offerings. For instance, the true wireless stereo (TWS) earbuds market continued its robust growth in 2024, with many brands providing feature-rich options at significantly lower price points than Bose's premium products. This accessibility makes it easier for consumers to switch if they believe the perceived value of a substitute meets their requirements.

Emerging technologies like virtual reality (VR) and augmented reality (AR) also introduce immersive audio experiences that act as substitutes. Consumers might choose VR/AR headsets with spatial audio, lessening their need for separate high-fidelity headphones or speakers. The global VR market, valued at approximately $28.2 billion in 2023, indicates a growing consumer interest in these alternative audio delivery systems.

| Substitute Category | Key Features | 2023/2024 Market Data (Approx.) | Impact on Bose |

|---|---|---|---|

| Integrated Device Audio | Convenience, Cost-effectiveness | Smartphones and Smart TVs continue to improve built-in audio. | Reduces demand for entry-level Bose speakers and soundbars. |

| Soundbars | Improved home theater experience, Ease of use | Market expected to grow, with options ranging from under $100 to over $1000. | Direct competitor to Bose's home audio systems. |

| True Wireless Stereo (TWS) Earbuds | Portability, Wireless convenience, Active Noise Cancellation (ANC) | Global TWS market saw significant growth, with many affordable, feature-rich options available in 2024. | Challenges Bose's portable speaker and headphone market share. |

| Smart Speakers | Voice control, Smart home integration, Audio playback | Smart home market expansion in 2024 means more households integrating these devices. | Can substitute for standalone home audio systems. |

| VR/AR Audio | Immersive spatial audio | VR market valued at ~$28.2 billion in 2023, with projected growth. | Potential long-term threat to premium headphone market. |

Entrants Threaten

The threat of new entrants for Bose in the audio equipment market is generally moderate. High capital requirements are a substantial hurdle; establishing advanced research and development facilities, sophisticated manufacturing processes, and broad marketing campaigns demands significant investment. For instance, the global audio equipment market was valued at approximately $117.7 billion in 2023 and is projected to grow, indicating substantial upfront costs for any newcomer aiming for a significant market share.

Bose's established reputation and substantial investments in proprietary technologies, such as noise cancellation and acoustic engineering, create a strong competitive advantage. These innovations require considerable time and financial resources to replicate, effectively deterring many potential new players. The brand loyalty Bose commands also makes it difficult for new entrants to gain immediate traction without offering a demonstrably superior or significantly lower-cost alternative.

The threat of new entrants into the premium audio market, where Bose operates, is generally moderate. Established brands like Bose benefit significantly from economies of scale. For instance, their large-scale manufacturing and extensive global distribution networks allow them to spread fixed costs over a greater volume, leading to lower per-unit production costs. This cost advantage makes it challenging for newcomers to compete on price without sacrificing quality or profitability.

The threat of new entrants into the premium audio market, where Bose operates, is generally moderate. Bose's strong brand identity and a deeply ingrained customer loyalty built over decades present significant hurdles for newcomers. Replicating Bose's reputation for audio quality and innovative product development, which has been cultivated through consistent high performance and significant R&D investment, is a formidable challenge for any aspiring competitor.

4

The threat of new entrants for Bose is generally moderate, largely due to significant barriers to entry in the premium audio market. Establishing a brand recognized for quality and innovation, like Bose, requires substantial investment in research and development, marketing, and building a loyal customer base. New companies face the challenge of replicating Bose's established reputation and technological prowess.

Access to distribution channels presents a considerable hurdle for newcomers. Bose leverages a robust global retail footprint, direct online sales, and a network of authorized dealers. This integrated approach makes it difficult for new entrants to achieve widespread market penetration and visibility. For instance, securing shelf space in premium electronics retailers or building a comparable online sales infrastructure demands considerable capital and established relationships.

- Brand Loyalty: Bose enjoys high customer loyalty, built over decades of delivering quality audio products. This makes it challenging for new entrants to attract customers away from a trusted brand.

- Capital Requirements: Significant upfront investment is needed for R&D, manufacturing, marketing, and establishing a global distribution network, acting as a deterrent for many potential new players.

- Technological Expertise: Bose's proprietary technologies, particularly in noise cancellation and audio processing, are difficult and costly for new entrants to replicate, creating a competitive advantage.

- Economies of Scale: Bose's large-scale production allows for cost efficiencies that smaller, newer companies cannot easily match, impacting their ability to compete on price or maintain similar profit margins.

5

The threat of new entrants for Bose is relatively low, largely due to significant barriers to entry in the premium audio market. Bose's extensive portfolio of proprietary technology and patents, particularly in areas like advanced noise cancellation and acoustic engineering, presents a formidable legal and technological hurdle for newcomers. For instance, Bose has consistently invested heavily in R&D, securing patents that protect its unique sound profiles and innovative features.

These intellectual property rights make it difficult and costly for new companies to replicate Bose's product performance and brand reputation. The capital required to develop comparable technology and establish brand recognition in a market dominated by established players like Bose is substantial.

- Proprietary Technology: Bose holds a significant number of patents related to acoustic design and noise cancellation, making it challenging for competitors to match their product innovation.

- Brand Reputation: Bose has cultivated a strong brand image associated with high-quality audio and premium performance, requiring substantial marketing investment for new entrants to overcome.

- Capital Requirements: Entering the premium audio market necessitates significant investment in research and development, manufacturing, and marketing, creating a high capital barrier.

The threat of new entrants for Bose remains moderate, primarily due to substantial barriers to entry in the premium audio market. Significant capital investment is required for research and development, advanced manufacturing, and robust marketing efforts to build brand recognition. For example, the global consumer electronics market, which includes audio equipment, saw substantial investment in R&D by leading companies in 2024, highlighting the financial commitment needed to innovate and compete effectively.

Bose's established brand loyalty and proprietary technologies, such as its renowned noise-cancellation systems, present a significant challenge for newcomers. Replicating this level of technological sophistication and the trust consumers place in the Bose brand requires considerable time and financial resources. The market's reliance on established distribution channels also makes it difficult for new entrants to gain widespread market access and visibility.

Economies of scale further solidify Bose's position, allowing for more competitive pricing and efficient production. New entrants would struggle to match these cost advantages without compromising on quality or profitability. Consequently, while the audio market is attractive, the hurdles for new companies to successfully enter and compete with established players like Bose are considerable.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and marketing. | Deters potential entrants without substantial funding. |

| Brand Loyalty & Reputation | Decades of trust in quality and innovation. | Makes customer acquisition difficult for new brands. |

| Proprietary Technology | Patented noise cancellation and acoustic engineering. | Requires costly replication or avoidance by newcomers. |

| Economies of Scale | Lower per-unit costs due to large-scale production. | Challenges new entrants in competing on price. |

| Distribution Channels | Established global retail and online presence. | Limits market access and visibility for new companies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from industry-specific market research reports, financial statements of key players, and government economic indicators to provide a comprehensive understanding of the competitive landscape.