Bonduelle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bonduelle Bundle

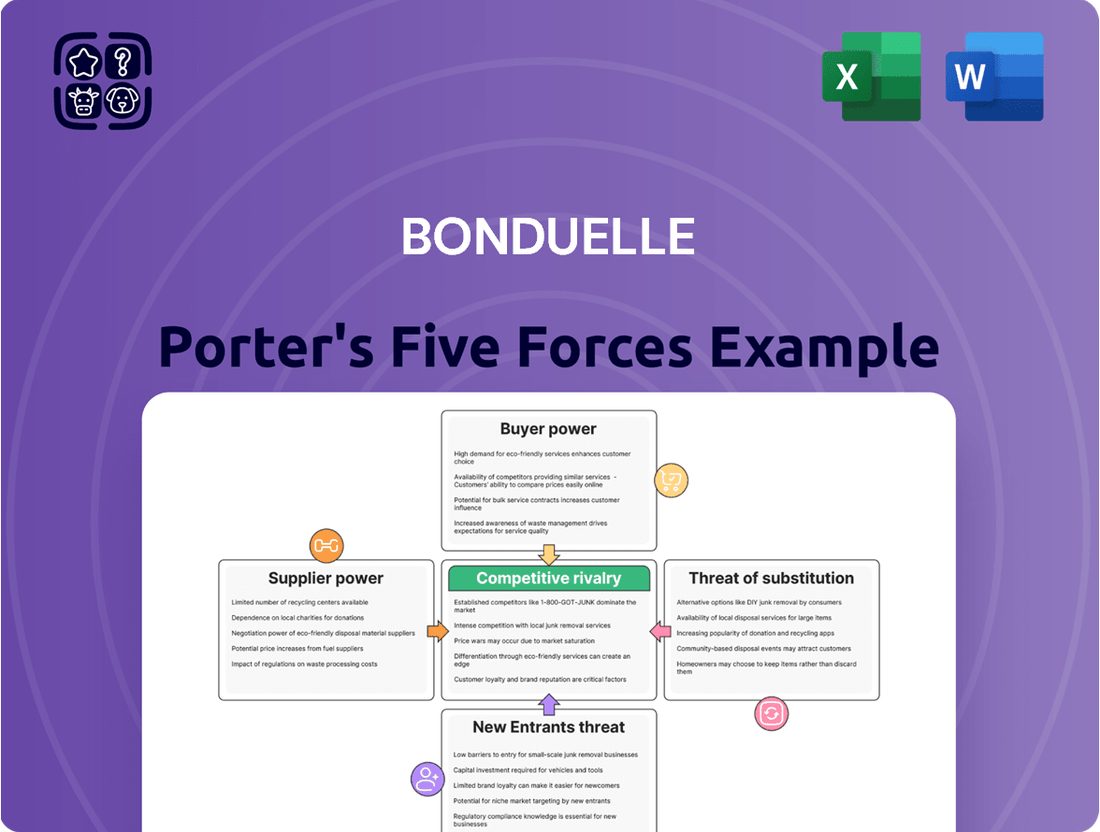

Bonduelle navigates a competitive landscape shaped by moderate buyer power and the ever-present threat of substitutes. Understanding the intensity of rivalry and the influence of suppliers is crucial for strategic planning.

The complete report reveals the real forces shaping Bonduelle’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bonduelle's reliance on a vast network of over 2,000 growers highlights a fragmented agricultural supplier base. This wide reach generally dilutes the bargaining power of individual farmers, as no single supplier can dictate terms due to the availability of alternatives. This structure is crucial for Bonduelle's ability to secure a consistent and varied supply of raw vegetables.

While the fragmented nature of its supplier relationships offers Bonduelle a degree of leverage, regional harvest variations can still introduce supply chain vulnerabilities and influence pricing. For instance, adverse weather events in a key growing region in 2024 could temporarily concentrate supply power among remaining unaffected growers, leading to price adjustments for specific vegetable types.

Poor agricultural harvests, like the one impacting Russia in the latter half of Bonduelle's 2024-2025 fiscal year, directly escalate supplier bargaining power. When raw material availability dwindles, suppliers can command higher prices, squeezing profitability. This situation underscores the critical need for Bonduelle to maintain agile supply chains and diversify sourcing strategies to mitigate such risks.

Bonduelle's long-standing partnerships with its agricultural suppliers, some dating back to 1853, significantly reduce the bargaining power of these suppliers. This deep integration, coupled with a shared focus on sustainable agriculture, creates a mutual dependency that discourages opportunistic price hikes or unfavorable terms. These enduring relationships foster loyalty and a collaborative approach to innovation, effectively mitigating supplier leverage.

Influence of Sustainability Commitments

Bonduelle's strong commitment to sustainable agriculture, aiming for 100% B Corp certification by the end of 2025, significantly influences its supplier relationships. By actively engaging with farmers on responsible practices, such as regenerative agriculture, Bonduelle fosters deeper partnerships.

This focus on shared values and long-term collaboration can mitigate the direct impact of supplier price power. As of early 2024, over 58% of Bonduelle's partner farmers were already committed to regenerative agriculture, demonstrating the tangible progress in building these more resilient supply chains.

- Sustainable Agriculture Focus: Bonduelle's goal for 100% B Corp certification by the end of 2025.

- Farmer Engagement: Over 58% of partner farmers committed to regenerative agriculture as of early 2024.

- Relationship Stability: Deep engagement leads to more stable, mutually beneficial supplier relationships.

- Mitigation of Price Power: Collaborative practices can offset direct price-based supplier leverage.

Commodity Price Volatility

The food sector, including companies like Bonduelle, is susceptible to fluctuating commodity prices. Geopolitical events and supply chain disruptions in 2024 continued to exert upward pressure on raw material costs, impacting packaging, logistics, and energy expenses for all suppliers.

This environment of rising input costs can significantly bolster the bargaining power of non-agricultural suppliers. When these suppliers face their own cost increases, they are more likely to pass those higher expenses onto their customers, such as Bonduelle, to maintain their own profit margins.

- Increased Input Costs: Global commodity markets in early 2024 saw continued volatility driven by factors like extreme weather events and ongoing geopolitical instability, leading to higher prices for essential inputs like fertilizers, fuel, and packaging materials.

- Supplier Cost Pass-Through: Suppliers of packaging, logistics, and energy, facing their own elevated operational expenses, are positioned to demand higher prices from food producers, thereby increasing their bargaining leverage.

- Impact on Food Producers: For companies like Bonduelle, this translates to a greater challenge in negotiating favorable terms with these critical suppliers, potentially squeezing profit margins if these cost increases cannot be fully recouped through product pricing.

Bonduelle's fragmented agricultural supplier base generally limits individual supplier bargaining power, as no single farmer can dictate terms. However, regional harvest variations in 2024, such as poor yields in Russia, can temporarily concentrate power among unaffected growers, leading to price increases for specific crops.

The company's long-standing partnerships, some dating back to 1853, and its commitment to sustainable, regenerative agriculture, with over 58% of partner farmers engaged by early 2024, create mutual dependency and reduce supplier leverage. This focus on shared values and collaborative innovation fosters loyalty, mitigating opportunistic price hikes.

Non-agricultural suppliers, such as those for packaging and logistics, experienced increased bargaining power in 2024 due to global commodity price volatility and geopolitical instability. These suppliers passed on higher input costs for energy, fuel, and materials, forcing Bonduelle to contend with elevated expenses and potentially reduced profit margins.

| Supplier Type | Key Factors Influencing Bargaining Power (2024) | Impact on Bonduelle |

|---|---|---|

| Agricultural (Farmers) | Fragmented base, regional harvest variations, long-term partnerships, sustainable agriculture commitment | Generally low, but can increase with crop-specific shortages. Strong relationships mitigate price power. |

| Non-Agricultural (Packaging, Logistics, Energy) | Global commodity price volatility, geopolitical instability, rising input costs (fuel, materials) | Increased leverage due to cost pass-through, potentially squeezing profit margins. |

What is included in the product

This analysis delves into the competitive intensity within the vegetable processing industry, examining Bonduelle's strategic positioning against rivals, buyer and supplier power, the threat of new entrants, and the impact of substitutes.

Instantly understand the competitive landscape and identify strategic advantages with a clear, visual representation of Bonduelle's Porter's Five Forces.

Customers Bargaining Power

Bonduelle's diverse distribution channels significantly dilute customer bargaining power. By serving both retail consumers and foodservice clients globally through numerous avenues, the company avoids over-reliance on any single buyer group.

This broad market penetration, reaching consumers through supermarkets, convenience stores, and direct foodservice contracts, creates a fragmented customer base. For example, in 2024, Bonduelle's retail segment continued to be a major revenue driver, alongside its robust foodservice operations, demonstrating this channel diversification.

Bonduelle's branded sales are showing robust growth, with a 1.9% increase in the first half of fiscal year 2024-2025. This upward trend for brands like Bonduelle, Cassegrain, Globus, and Ready Pac Foods suggests customers are more loyal to these offerings. This brand loyalty can translate to less bargaining power for customers, as they may be less inclined to switch based solely on price.

In contrast, the private label segment experienced a 6.9% decline during the same period. This significant drop in private label sales further highlights the strength of Bonduelle's brands. When customers actively choose and pay for branded products, their ability to negotiate lower prices or demand more concessions is diminished.

Consumers are increasingly seeking convenient and healthy food choices, driven by demanding schedules and a growing awareness of wellness. Bonduelle's diverse product portfolio, encompassing canned vegetables, frozen produce, and ready-to-eat salads, directly caters to this trend. This strong market pull for convenience can actually temper the bargaining power of individual customers, as they are often willing to pay a premium for products that simplify meal preparation.

Influence of Large Retailers

Large retail chains and supermarkets are significant players in Bonduelle's customer base. Their substantial order volumes grant them considerable bargaining power, allowing them to negotiate favorable pricing and terms. This leverage is amplified by their capacity to stock a wide array of competing brands, or even introduce their own private label products, directly challenging Bonduelle's market share and pricing flexibility.

This concentrated buyer power means that retailers can exert considerable pressure on Bonduelle's profit margins. For instance, in 2024, major European grocery chains reported strong sales growth, with some increasing their private label offerings by an average of 5% year-over-year, a trend that directly impacts branded food producers like Bonduelle.

- High Volume Purchases: Retailers buy in bulk, giving them leverage to demand lower prices.

- Private Label Competition: The ability to create store brands directly competes with Bonduelle's products.

- Brand Shelf Space: Retailers control product placement, influencing consumer visibility and sales.

- Price Sensitivity: Retailers often pass on cost savings to consumers, pressuring suppliers for competitive pricing.

Shifting Consumer Preferences

Consumers are increasingly seeking out products that offer more than just basic sustenance. They are actively looking for ingredients that boast enhanced health benefits, superior nutrition, undeniable freshness, and a commitment to natural sourcing. This shift is also evident in the growing demand for clean labels, meaning fewer, more recognizable ingredients.

Bonduelle's strategic positioning, with its emphasis on sustainable agriculture and healthy food choices, directly addresses these evolving consumer desires. By aligning its product offerings with these priorities, the company is better positioned to command premium pricing. This can, in turn, mitigate the direct bargaining power of customers who might otherwise focus solely on price competition.

- Health and Nutrition Focus: In 2024, the global market for health and wellness foods was projected to reach over $1 trillion, with plant-based and organic segments showing robust growth.

- Clean Label Trend: A 2024 survey indicated that over 60% of consumers are more likely to purchase products with simple, recognizable ingredient lists.

- Bonduelle's Alignment: Bonduelle's investment in innovative farming techniques and its expansion of plant-based product lines directly cater to these consumer demands, potentially strengthening its pricing power.

While Bonduelle's diverse distribution and strong brands generally reduce customer bargaining power, large retail buyers remain a significant counterforce. These retailers, by purchasing in high volumes and controlling shelf space, can negotiate favorable terms and introduce private labels, as seen with a 5% year-over-year increase in private label offerings by major European grocers in 2024. This concentrated buyer power pressures Bonduelle's margins, despite the growing consumer demand for healthy, branded options.

| Customer Segment | Bargaining Power Factors | Impact on Bonduelle |

|---|---|---|

| Retail Consumers (Broad Market) | Brand loyalty, demand for convenience and health | Lower individual bargaining power due to preference for Bonduelle's brands and product attributes. |

| Large Retail Chains (Supermarkets) | High volume purchases, private label capabilities, shelf space control | Significant bargaining power, leading to price pressure and negotiation on terms. |

| Foodservice Clients | Contractual agreements, volume commitments | Moderate bargaining power, often influenced by contract terms and market competition. |

Full Version Awaits

Bonduelle Porter's Five Forces Analysis

This preview showcases the complete Bonduelle Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the vegetable industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

Bonduelle, a major player in processed vegetables, navigates a highly competitive landscape. The global market for canned, frozen, and fresh-cut vegetables is mature, with many well-established companies offering comparable products. This intense rivalry means that price and product innovation are critical for market share.

The company's global reach, while a strength, also exposes it to competition across a multitude of distinct regional markets. For instance, in 2023, Bonduelle reported a revenue of €2.4 billion, indicating its significant scale, but this also means contending with local competitors in Europe, North America, and other key territories, each with unique consumer preferences and competitive dynamics.

Bonduelle's 'Transform to win' program, launched to boost growth and performance, directly addresses intense competitive rivalry by streamlining operations and focusing on core strengths. This strategic overhaul includes significant portfolio adjustments, a move likely aimed at shedding underperforming assets and concentrating resources on more profitable segments to better compete.

Bonduelle actively pursues innovation to differentiate its offerings, making it a cornerstone of its competitive strategy. For instance, the introduction of new Bistro Loaded Bowls in the United States exemplifies this approach, aiming to capture consumer interest through novel product formats.

By emphasizing health benefits, enhanced convenience, and superior taste, Bonduelle endeavors to carve out distinct market positions for its brands. This focus on tangible product advantages is crucial for standing out amidst intense competition within the food industry, where consumer preferences can shift rapidly.

Sales Performance and Market Dynamics

Bonduelle's competitive rivalry is shaped by its sales performance and the broader market dynamics within the vegetable sector. While the company reported a slight like-for-like sales decrease of 0.8% for Fiscal Year 2024-2025, its branded operations showed notable resilience, suggesting a strong competitive standing in its key branded product lines.

The processed and frozen vegetable market is experiencing growth, which naturally fuels intensified competition. Established players are actively vying for increased market share, putting pressure on all participants, including Bonduelle, to innovate and maintain strong customer relationships.

- Bonduelle's FY 2024-2025 like-for-like sales declined by 0.8%.

- Branded activities within Bonduelle showed resilience and growth.

- The processed and frozen vegetable market is expected to grow.

- This growth intensifies competition among existing market participants.

Sustainability as a Competitive Edge

Bonduelle's robust sustainability initiatives, including its B Corp certification for 80% of its operations and a target for 100% group certification by 2025, significantly set it apart from competitors. This focus resonates with a growing segment of consumers prioritizing environmental responsibility, bolstering brand loyalty and market position. The company's commitment translates into tangible benefits, attracting socially conscious investors and potentially leading to lower operational costs through resource efficiency.

This dedication to sustainability acts as a powerful competitive advantage, allowing Bonduelle to differentiate itself beyond mere product pricing. For instance, in 2023, Bonduelle reported a 3.5% increase in sales for its sustainable product lines, demonstrating direct consumer preference. This strategic alignment with consumer values can lead to premium pricing opportunities and a stronger, more resilient brand image in an increasingly conscious marketplace.

- B Corp Certification: 80% of Bonduelle's operations are B Corp certified, with a goal for full group certification by 2025.

- Consumer Appeal: Sustainability efforts attract environmentally conscious consumers, enhancing brand reputation.

- Market Differentiation: Provides a competitive edge beyond price, fostering customer loyalty.

- Financial Impact: Sustainable product lines saw a 3.5% sales increase in 2023.

Bonduelle operates in a mature global vegetable market characterized by intense competition from numerous established players. This rivalry necessitates continuous innovation and competitive pricing to maintain market share, as seen in the company's efforts with new product introductions like Bistro Loaded Bowls. Despite a slight like-for-like sales dip of 0.8% in FY 2024-2025, Bonduelle's branded segments demonstrated resilience, indicating a strong competitive footing in key areas.

| Metric | FY 2023-2024 (Approx.) | FY 2024-2025 (Approx.) |

|---|---|---|

| Bonduelle Like-for-Like Sales Growth | Not Specified | -0.8% |

| Sustainable Product Line Sales Growth | 3.5% | Not Specified |

| B Corp Certified Operations | 80% | Targeting 100% by 2025 |

SSubstitutes Threaten

Fresh, unprocessed vegetables are a significant substitute for Bonduelle's processed offerings. Consumers can opt for raw ingredients from grocery stores and farmers' markets, preparing meals entirely from scratch. This direct substitution caters to individuals who value ultimate freshness and complete control over their food preparation.

In 2024, the demand for minimally processed foods continued to rise, with a notable segment of consumers actively seeking out whole, unprocessed vegetables. This trend is partly driven by a growing awareness of health and wellness, making raw produce a compelling alternative to pre-packaged salads and meals, which often carry a premium price point.

The growing trend of home cooking, fueled by a desire for authentic cuisine and a return to basic ingredients, directly impacts Bonduelle. Consumers increasingly opt to prepare meals from scratch, reducing their reliance on processed and ready-to-eat vegetable products. This cultural shift represents a persistent threat of substitution.

Consumers looking for quick meal solutions have many options outside of processed vegetables. Meal kits, which saw significant growth, with the global meal kit delivery service market valued at approximately $15 billion in 2023 and projected to reach over $20 billion by 2028, offer pre-portioned ingredients and recipes, directly competing with Bonduelle's convenience proposition.

Restaurant take-out and delivery services, further fueled by a 12% year-over-year increase in online food ordering in 2024, also present a strong alternative. These services cater to the same demand for easy meal preparation that Bonduelle's products aim to satisfy, often with a wider variety of cuisines and immediate consumption options.

Consumer Focus on 'Clean Label' and 'Less Processed'

The growing consumer preference for 'clean labels' and a general aversion to 'ultra-processed foods' presents a significant threat to certain processed vegetable products. This trend can steer consumers towards fresh produce or items with minimal processing, directly impacting demand for Bonduelle's more processed offerings.

Bonduelle is actively addressing this by emphasizing its commitment to sustainability and the development of healthier, less processed options. This strategic shift aims to align with evolving consumer preferences and reduce the appeal of substitutes.

- Consumer Demand Shift: In 2024, surveys indicated that over 60% of consumers actively seek out products with shorter ingredient lists, signaling a clear move away from highly processed items.

- Market Growth in Fresh Alternatives: The global fresh produce market is projected for robust growth, with an estimated CAGR of 4.5% through 2028, indicating a strong substitute market.

- Bonduelle's Mitigation Strategy: Bonduelle's investment in plant-based and organic lines, which saw a 15% sales increase in their latest fiscal year, demonstrates their proactive approach to counter this threat.

Price-Performance Trade-off

The threat of substitutes for Bonduelle's processed vegetable products is significant, primarily driven by the price-performance trade-off. Consumers often weigh the convenience of processed options against the cost and perceived health benefits of fresh vegetables.

During economic downturns, this trade-off becomes even more critical. For instance, in 2024, inflation impacted grocery budgets, prompting many households to scrutinize spending on convenience foods. If the price difference between canned or frozen vegetables and fresh produce widens considerably, consumers may switch to fresh alternatives to stretch their budgets further.

- Convenience vs. Cost: Processed vegetables save preparation time but often come at a premium compared to raw produce.

- Economic Sensitivity: Consumer purchasing power directly influences the appeal of substitutes; higher inflation can accelerate shifts towards cheaper options.

- Perceived Value: If the added value of processing (e.g., longer shelf life, pre-cutting) doesn't justify the price difference, consumers will favor fresh alternatives.

The threat of substitutes remains a key consideration for Bonduelle, particularly as consumer preferences evolve. The increasing demand for minimally processed and fresh foods, coupled with the cost-effectiveness of home preparation, directly challenges Bonduelle's processed offerings.

In 2024, the market saw a continued surge in home cooking and a preference for 'clean labels,' pushing consumers towards raw ingredients. This trend is amplified by economic factors, where inflation can make fresh produce a more attractive, budget-friendly alternative to convenience-oriented processed vegetables.

Bonduelle's strategic pivot towards plant-based and organic options, which saw a 15% sales increase in their latest fiscal year, reflects an effort to mitigate this threat by aligning with these evolving consumer demands.

| Substitute Category | Key Driver | 2024 Consumer Trend Impact | Bonduelle's Response |

|---|---|---|---|

| Fresh Produce | Health consciousness, cost savings | 60%+ consumers seek shorter ingredient lists | Investment in organic lines |

| Meal Kits | Convenience, home cooking | Market valued at ~$15 billion (2023) | Focus on ready-to-eat solutions |

| Restaurant Take-out/Delivery | Convenience, variety | 12% YoY increase in online ordering (2024) | Streamlining supply chain for speed |

Entrants Threaten

The processed vegetable industry demands significant upfront capital. Think about the costs involved in setting up large-scale farming operations, advanced processing facilities, and a robust cold chain for distribution. These are not small expenses, and they create a substantial hurdle for anyone looking to enter the market.

Bonduelle, for instance, operates a vast global infrastructure, from farms to processing plants and distribution networks. This extensive network represents a massive investment that new competitors would need to replicate to even begin to compete effectively. In 2023, Bonduelle reported capital expenditures of €246.9 million, highlighting the ongoing investment required in this sector.

Established distribution networks present a significant barrier to new entrants in the food industry, particularly for companies like Bonduelle. Building a global presence requires immense investment and time to secure shelf space in major retailers and access foodservice providers worldwide. This is a hurdle that newcomers find incredibly difficult to overcome, as Bonduelle has spent decades cultivating these relationships.

Bonduelle possesses significant brand equity, with names like Bonduelle, Cassegrain, Globus, and Ready Pac Foods being household staples. This established recognition fosters deep consumer trust, a formidable barrier for newcomers.

New entrants must invest heavily in marketing and product quality to even approach Bonduelle's level of consumer loyalty. For instance, the global packaged food market, valued at over $1 trillion in 2024, demonstrates the scale of competition and the importance of established brands in capturing market share.

Economies of Scale

Established players like Bonduelle leverage significant economies of scale, particularly in agricultural sourcing and large-scale processing. This allows them to achieve lower per-unit costs for raw materials and manufacturing compared to potential new entrants who lack the purchasing power and optimized production facilities. For instance, in 2023, Bonduelle's global procurement volume for key vegetables likely reached tens of thousands of metric tons, a scale unattainable by a startup.

This cost advantage created by economies of scale acts as a substantial barrier. New companies entering the processed vegetable market would struggle to match Bonduelle's pricing power, making it challenging to gain market share without significant upfront investment in infrastructure and supplier relationships. The capital required to achieve comparable operational efficiencies is a major deterrent.

- Economies of scale in sourcing provide established companies with lower per-unit costs for raw agricultural products.

- Large-scale production facilities allow for greater efficiency and reduced manufacturing overhead for incumbents.

- Optimized distribution networks further lower logistical costs for established players like Bonduelle.

- New entrants face a significant cost disadvantage, making it difficult to compete on price with established firms.

Regulatory and Food Safety Compliance

The threat of new entrants in the food processing sector, particularly for companies like Bonduelle, is significantly impacted by regulatory and food safety compliance. New players must navigate a complex web of national and international regulations governing everything from ingredient sourcing and processing to labeling and distribution. For instance, in the European Union, regulations like the General Food Law (Regulation (EC) No 178/2002) and specific hygiene packages set high bars for food safety and traceability. Achieving certifications such as ISO 22000 or HACCP is often a prerequisite for market entry, demanding substantial investment in quality control systems and personnel.

These compliance demands act as a formidable barrier. New entrants face considerable costs and time commitments to understand, implement, and maintain adherence to these standards. This includes investing in specialized equipment, robust quality assurance protocols, and skilled staff capable of managing regulatory affairs. For example, the cost of implementing a comprehensive food safety management system can run into tens of thousands of dollars, a significant upfront expense for a nascent business. Furthermore, the rigorous inspection and auditing processes by regulatory bodies can delay market entry and add ongoing operational costs, thereby deterring potential competitors.

The stringent nature of these requirements means that only well-capitalized and strategically prepared companies can realistically enter the market. This selective entry process ultimately reduces the overall threat of new entrants, allowing established players like Bonduelle to benefit from a more stable competitive landscape. The ongoing evolution of food safety standards, driven by scientific advancements and consumer demand for transparency, further solidifies this barrier, requiring continuous adaptation and investment from all market participants.

- Regulatory Hurdles: New entrants must comply with diverse food safety laws, such as the Food Safety Modernization Act (FSMA) in the US, which mandates preventive controls and supply chain management.

- Certification Costs: Obtaining certifications like BRCGS or SQF can cost new companies between $5,000 to $20,000 annually, plus internal resource allocation.

- Investment in Quality Systems: Establishing robust quality assurance and control systems requires significant capital expenditure on technology and trained personnel.

- Market Access Restrictions: Failure to meet stringent food safety and labeling regulations can lead to product recalls, market exclusion, and severe reputational damage, deterring new entrants.

The threat of new entrants for Bonduelle is moderate to low due to substantial capital requirements for operations, processing, and distribution. Bonduelle's extensive global infrastructure, built over decades, represents a significant barrier, as new entrants would need to invest heavily to replicate it. For example, Bonduelle's capital expenditures in 2023 were €246.9 million, indicating the ongoing investment needed in this sector.

Established distribution networks and strong brand equity further deter new players. Bonduelle's long-standing relationships with retailers and its recognized brands like Cassegrain and Ready Pac Foods create deep consumer trust that is difficult for newcomers to penetrate. The global packaged food market, exceeding $1 trillion in 2024, highlights the intense competition and the advantage of established brands.

Economies of scale in sourcing and production provide Bonduelle with a significant cost advantage. Their large-scale procurement and optimized facilities allow for lower per-unit costs, a level that new entrants would struggle to match without immense upfront investment. Furthermore, stringent regulatory and food safety compliance, requiring substantial investment in quality systems and certifications, adds another layer of difficulty for potential competitors.

| Barrier Type | Description | Example for Bonduelle |

|---|---|---|

| Capital Requirements | High costs for farming, processing, and distribution infrastructure. | Bonduelle's 2023 CAPEX of €246.9 million. |

| Distribution Networks | Securing shelf space and access to foodservice globally. | Bonduelle's decades of cultivating retailer relationships. |

| Brand Equity | Established consumer trust and recognition. | Brands like Bonduelle, Cassegrain, and Ready Pac Foods. |

| Economies of Scale | Lower per-unit costs due to large-scale sourcing and production. | High procurement volumes of key vegetables. |

| Regulatory Compliance | Meeting stringent food safety and quality standards. | Costs for certifications like ISO 22000 or HACCP. |

Porter's Five Forces Analysis Data Sources

Our Bonduelle Porter's Five Forces analysis is built upon a foundation of robust data, including Bonduelle's annual reports, industry-specific market research from sources like Statista and IBISWorld, and relevant government agricultural and trade publications.