Bonduelle Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bonduelle Bundle

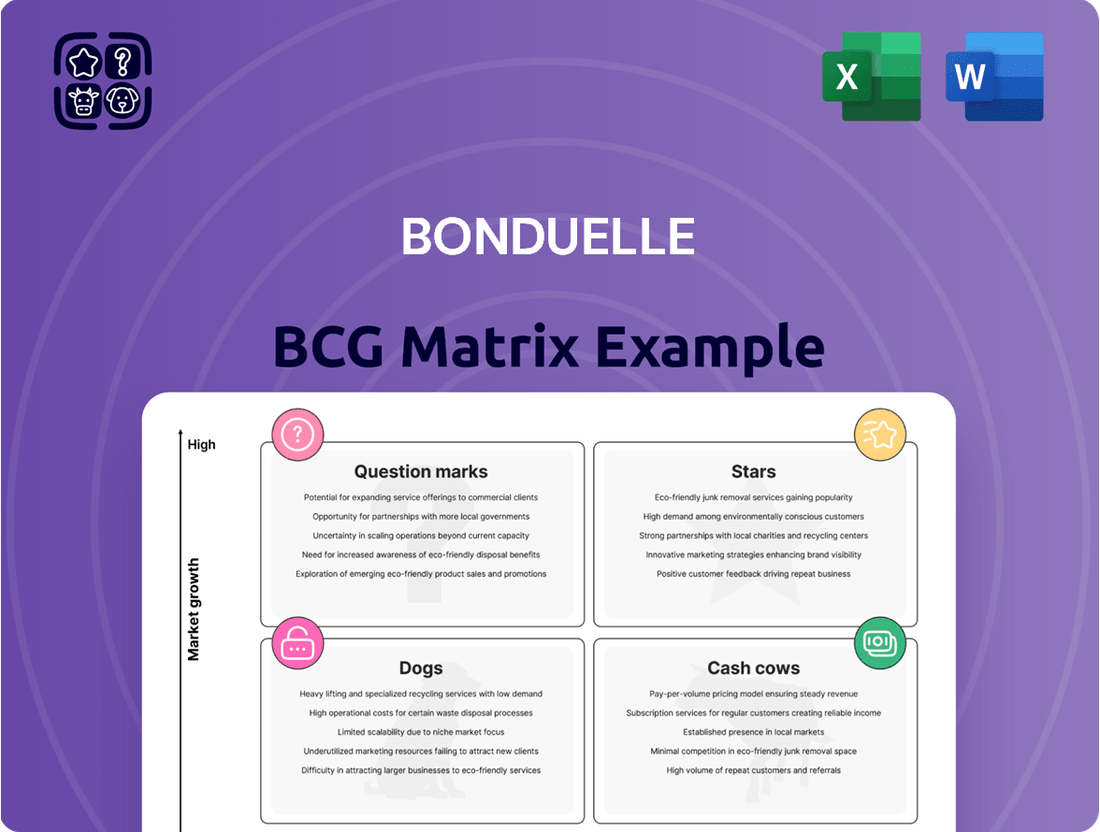

Explore the strategic positioning of Bonduelle's product portfolio with our insightful BCG Matrix preview. Understand which of their offerings are market leaders and which require careful consideration. Ready to unlock the full strategic advantage and make informed decisions about resource allocation and future growth? Purchase the complete Bonduelle BCG Matrix for a comprehensive breakdown and actionable insights to drive your business forward.

Stars

Bonduelle's plant-based ready-to-eat Lunch Bowls, introduced in early 2025, are a prime example of a Star in the BCG Matrix. These meals, packed with over 10 grams of protein, are specifically designed for time-pressed consumers, with a particular focus on Gen Z. Their rapid adoption in North America underscores a significant market opportunity and Bonduelle's successful entry into the burgeoning natural foods sector.

Bonduelle and Globus branded products have demonstrated robust performance in the Eurasian market, encompassing both Russia and the CIS countries, during the initial half of fiscal year 2024-2025. This positive trajectory highlights their strong market standing and significant growth prospects within these key territories.

Despite some minor sales declines in other global segments, the strong showing of Bonduelle and Globus in Eurasia positions them as crucial contributors to the company's overall expansion efforts. For instance, the company reported a 4.6% increase in sales for its Ready-to-eat segment in the first half of FY24-25, with Eurasia being a notable contributor to this growth.

Bonduelle's commitment to innovation within its retained fresh-cut and prepared vegetable segments, notably in France and Italy, is driving substantial growth in both volume and value. This focus taps directly into consumer preferences for convenient, healthy, and minimally processed foods.

The company's strategic push into the fresh delicatessen market across Europe, a segment experiencing robust demand, highlights its ambition to capture a larger market share in this high-potential area. For instance, Bonduelle's fresh prepared segment in France saw a notable increase in sales in the first half of fiscal year 2023-2024, reflecting successful product development and market penetration.

B Corp Certified Products and Sustainable Offerings

Bonduelle's commitment to sustainability is a key growth driver, with over 80% of its operations B Corp certified as of 2024, aiming for full group certification by 2025. This focus on responsible practices appeals to a growing consumer base actively seeking ethical and environmentally friendly food options. Products that embody this B Corp ethos are well-positioned to capture market share in this expanding segment.

The increasing consumer demand for sustainable and ethically produced food directly benefits Bonduelle's B Corp certified offerings. This trend is particularly strong among health-conscious and environmentally aware demographics. Bonduelle's proactive approach to certification in 2024 positions it favorably to meet this evolving market preference.

Bonduelle's B Corp certified products represent a significant competitive advantage. By 2025, the company plans for its entire group to achieve this certification, signaling a deep integration of sustainability into its business model. This strategic alignment with consumer values is expected to fuel growth for these product lines.

Key aspects of Bonduelle's sustainable offerings:

- B Corp Certification: Over 80% of operations certified in 2024, with full group certification targeted for 2025.

- Consumer Demand: Growing consumer preference for sustainable and ethical food choices.

- Market Differentiation: B Corp status serves as a key differentiator in the food market.

- Target Audience Appeal: Resonates strongly with health-conscious and environmentally aware consumers.

North American Retail Sales of Complete Meal Solutions and Salad Kits

Bonduelle Americas is experiencing a resurgence in the North American retail sales of complete meal solutions and salad kits. This segment, which had seen declines in prior years, began to show renewed growth in the second quarter of fiscal year 2024-2025. This positive trend is a strong indicator of their strategic success in a market segment that is experiencing high growth.

The company's performance is being driven by an increase in both the volume and value of sales. Specifically, bowls and salad kits are performing exceptionally well, contributing significantly to this turnaround. This suggests Bonduelle is effectively capturing a larger share of this competitive and evolving market.

- Return to Growth: Retail sales of complete meal solutions and salad kits in North America saw a return to growth in Q2 FY 2024-2025.

- Market Segment Strength: This growth is occurring in a high-growth market segment within North America.

- Volume and Value Increase: Positive trends in both volumes and value are fueling this expansion, particularly with bowls and salad kits.

- Market Share Gains: The performance indicates an increasing market share for Bonduelle in this dynamic sector.

Bonduelle's plant-based Lunch Bowls, launched in early 2025, are a prime example of a Star. These meals, with over 10 grams of protein, target time-pressed consumers, especially Gen Z, and their rapid adoption in North America highlights a significant market opportunity in the natural foods sector.

The Bonduelle and Globus brands in Eurasia showed strong performance in the first half of fiscal year 2024-2025, contributing to a 4.6% sales increase in the Ready-to-eat segment. This growth in a key territory underscores their status as Stars within the company's portfolio.

Bonduelle Americas' retail sales of complete meal solutions and salad kits in North America returned to growth in Q2 FY 2024-2025. This resurgence, driven by increased volume and value, particularly in bowls and salad kits, signals strong market share gains in a high-growth segment.

Bonduelle's B Corp certified products are well-positioned as Stars due to increasing consumer demand for sustainable and ethical food. With over 80% of operations certified in 2024 and a group-wide target for 2025, these offerings appeal to a growing segment of health-conscious and environmentally aware consumers.

| Product Category | Market Performance | Growth Driver | BCG Matrix Status |

| Plant-based Lunch Bowls | Rapid adoption in North America | Targeting Gen Z, high protein content | Star |

| Eurasian Brands (Bonduelle & Globus) | Strong sales in H1 FY24-25 | Key contributor to Ready-to-eat segment growth | Star |

| North American Meal Solutions & Salad Kits | Return to growth in Q2 FY24-25 | Increased volume and value, market share gains | Star |

| B Corp Certified Products | Growing consumer demand for sustainability | Ethical sourcing, environmental focus | Star |

What is included in the product

The Bonduelle BCG Matrix analyzes its product portfolio's market share and growth potential.

It guides strategic decisions on investment, divestment, and resource allocation.

The Bonduelle BCG Matrix offers a clear, visual overview of their portfolio, simplifying complex strategic decisions.

Cash Cows

Canned vegetables, especially those under the core Bonduelle brand, are a significant revenue driver, accounting for 47.2% of sales as of June 2024. This segment operates within a mature market, characterized by stable demand and established brand loyalty.

Despite a slight dip in European private label canned sales due to logistical issues, the Bonduelle and Cassegrain brands in ambient and frozen categories demonstrate a strong, consistent market share. This resilience highlights their position as reliable performers.

These products function as cash cows because they consistently generate substantial cash flow. Their established market presence and reduced need for heavy promotional spending in a low-growth environment contribute to their profitability.

Bonduelle's frozen vegetables, representing 12.8% of total sales as of June 2024, operate within a mature market, mirroring the dynamics of their canned counterparts. This segment, particularly under the core Bonduelle and Cassegrain brands, demonstrates a robust market standing.

Despite occasional regional fluctuations, the frozen vegetable business has exhibited resilience, achieving growth in both sales volume and value. Market share gains in Europe further underscore its stable cash-generating capabilities, requiring minimal incremental investment for sustained market presence.

Cassegrain's performance in France is a prime example of a cash cow within Bonduelle's portfolio. The brand has demonstrated consistent growth, especially in its ambient and frozen product lines, indicating a strong hold in a mature market. This sustained progression, coupled with the return to normal volumes for private label goods, highlights Cassegrain's role as a reliable generator of stable cash flow for the company.

Established Foodservice Vegetable Supply

Bonduelle's established foodservice vegetable supply operates as a Cash Cow within the BCG matrix. This segment leverages its global reach and long-standing relationships to secure substantial, stable demand from foodservice clients worldwide. The consistent revenue streams generated here are a testament to its high market share in a mature, predictable sector.

The operational efficiency and robust supply chain inherent in serving large-volume foodservice contracts contribute significantly to the segment's profitability. While specific financial breakdowns for this channel are not publicly detailed, its role as a dependable cash generator is clear, underpinning other strategic initiatives.

- Global foodservice presence: Serving diverse markets with consistent demand.

- Stable revenue streams: Driven by large volume, predictable contracts.

- Operational efficiency: Optimized supply chain for high-volume delivery.

- Mature market leadership: Implies a strong, established market share.

Existing International Branded Portfolio (excluding high-growth areas)

Bonduelle's existing international branded portfolio, outside of its high-growth segments, likely comprises brands with a strong, established market presence in mature regions. These offerings leverage Bonduelle's extensive experience and leadership in the vegetable sector, generating stable income and consistent profitability with minimal need for significant reinvestment. The group's broad geographical reach and the enduring strength of its brands across diverse markets underscore the resilience of this portfolio.

These established brands function as cash cows within the Bonduelle portfolio, providing a reliable stream of earnings. For instance, in its 2022-2023 fiscal year, Bonduelle reported a net sales increase of 6.8% to €2.45 billion, with its established brands contributing significantly to this overall performance by maintaining market share in their respective categories.

- Strong Market Share: Brands in mature markets typically hold a dominant position, ensuring consistent sales volume.

- Stable Profitability: These products benefit from economies of scale and brand recognition, leading to predictable profit margins.

- Low Investment Needs: Continued success requires less capital expenditure compared to developing new or high-growth products.

- Revenue Generation: They are the backbone of the company's financial stability, funding other strategic initiatives.

Bonduelle's canned and frozen vegetable segments, particularly under well-established brands like Bonduelle and Cassegrain, represent key cash cows. These products benefit from mature markets with stable demand and strong brand loyalty, ensuring consistent revenue generation. Their established market presence means they require minimal incremental investment to maintain their position, thereby contributing significantly to the company's overall profitability and funding other strategic ventures.

| Category | Brand Focus | Market Maturity | Cash Flow Generation |

| Canned Vegetables | Bonduelle, Cassegrain | Mature | High, Stable |

| Frozen Vegetables | Bonduelle, Cassegrain | Mature | High, Stable |

| Foodservice Vegetable Supply | Global Brands | Mature | High, Stable |

What You’re Viewing Is Included

Bonduelle BCG Matrix

The Bonduelle BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no incomplete sections – just a professionally formatted and meticulously analyzed report ready for your strategic decision-making. You can be confident that the insights and visual representation of Bonduelle's product portfolio within the BCG Matrix are exactly as they will be delivered, allowing you to assess Stars, Cash Cows, Question Marks, and Dogs with complete accuracy.

Dogs

Bonduelle's packaged salad operations in France and Germany are classified as Dogs in the BCG matrix. These segments have experienced a decade of declining performance, signaling a low market share within a mature or shrinking market. The planned divestment of these businesses, with the German sale finalized in March 2025 and the French in July 2025, underscores their status as underperforming assets that are no longer strategically viable.

Bonduelle's private label canned activities in Europe are currently positioned as a Dog in the BCG Matrix. This is largely due to a significant sales drop observed in this segment. For instance, in the first half of the 2023-2024 fiscal year, Bonduelle reported a notable decline in its European canned vegetable sales, directly impacted by major clients delaying contracted volume deliveries.

This downturn suggests a low market share within a mature and likely competitive European market for canned goods. While private label strategies can offer profitability, this marked decline points to a struggling business unit. The segment is likely experiencing low demand or intense price competition, characteristic of a Dog that may barely break even or even drain resources.

Within Bonduelle's vast processed vegetable offerings, some older product lines might be struggling. These are likely items that haven't kept pace with consumer trends or innovation, leading to a diminished market presence. They probably occupy low market share in markets that aren't growing, or are even shrinking.

Revitalizing these underperforming legacy products would likely demand substantial, potentially unrewarding, investment. Consequently, they often become candidates for divestment or a gradual phasing out of the product portfolio. While specific examples aren't publicly disclosed, it's a common challenge for large, diversified companies like Bonduelle to manage such product lines.

Products with High Production Costs and Low Profitability

Bonduelle's 'Dogs' would represent product lines where high production expenses, perhaps stemming from outdated manufacturing methods or expensive ingredient procurement, significantly squeeze profit margins. These items, even if they hold a small market share, consume valuable company capital without generating substantial returns.

For instance, if a specific ready-to-eat salad line in 2024 faced rising costs for organic vegetables and specialized packaging, pushing its gross margin below 5%, it would likely be classified as a Dog. This scenario, where operational inefficiencies meet premium input costs, is a classic recipe for low profitability.

- High Production Costs: Products burdened by inefficient supply chains or costly raw materials.

- Low Profitability: Margins that fail to cover operational expenses and contribute meaningfully to the bottom line.

- Resource Drain: These items consume capital and management attention without delivering proportionate financial benefits.

- Potential for Divestment: Companies often consider divesting or restructuring 'Dog' products to reallocate resources more effectively.

Regional Segments with Persistent Sales Decline and Low Market Share

Certain regional segments within Bonduelle may be categorized as Dogs. These are areas where sales have consistently fallen and the company holds a small piece of the market. Without a clear path to improvement or significant strategic value, these segments can consume resources without generating substantial returns.

Bonduelle's ongoing portfolio review is designed to identify and address these underperforming units. For instance, if a specific country or a niche product line shows declining sales for multiple consecutive reporting periods and its market share remains in the low single digits, it would fit this classification. Such segments often operate in low-growth markets where Bonduelle's competitive advantage is not strong enough to drive significant recovery.

- Persistent Sales Decline: For example, a region reporting a year-over-year sales decrease of over 5% for three consecutive years.

- Low Market Share: A market share below 3% in a mature or declining industry segment.

- Resource Drain: These segments may require ongoing investment in marketing, distribution, or operational support without yielding proportional revenue growth.

- Strategic Re-evaluation: Bonduelle's 2024 strategic initiatives likely include assessing the viability of divesting or restructuring such low-performing regional operations to focus resources on more promising areas.

Bonduelle's packaged salad operations in France and Germany are classified as Dogs. These segments have experienced a decade of declining performance, signaling a low market share within a mature or shrinking market. The planned divestment of these businesses, with the German sale finalized in March 2025 and the French in July 2025, underscores their status as underperforming assets that are no longer strategically viable.

Bonduelle's private label canned activities in Europe are currently positioned as a Dog. This is largely due to a significant sales drop observed in this segment. For instance, in the first half of the 2023-2024 fiscal year, Bonduelle reported a notable decline in its European canned vegetable sales, directly impacted by major clients delaying contracted volume deliveries.

This downturn suggests a low market share within a mature and likely competitive European market for canned goods. While private label strategies can offer profitability, this marked decline points to a struggling business unit. The segment is likely experiencing low demand or intense price competition, characteristic of a Dog that may barely break even or even drain resources.

Certain regional segments within Bonduelle may be categorized as Dogs. These are areas where sales have consistently fallen and the company holds a small piece of the market. Without a clear path to improvement or significant strategic value, these segments can consume resources without generating substantial returns.

| Business Segment | BCG Classification | Key Indicators | Strategic Outlook |

|---|---|---|---|

| Packaged Salads (France) | Dog | Declining performance for 10 years, low market share in mature market | Planned divestment (July 2025) |

| Packaged Salads (Germany) | Dog | Declining performance for 10 years, low market share in mature market | Divested (March 2025) |

| Private Label Canned Goods (Europe) | Dog | Significant sales drop (e.g., H1 2023-2024), low market share in competitive market | Under review, potential restructuring or divestment |

Question Marks

Bonduelle is actively exploring groundbreaking plant-based innovations that extend beyond current market staples, aiming to lead in nascent categories. These emerging products, such as advanced fermentation-derived proteins or novel plant-based seafood alternatives, represent significant future growth potential. The global plant-based food market is projected to reach $46.09 billion by 2033, highlighting the immense opportunity in these early-stage ventures.

Bonduelle's expansion into new geographic markets with untapped potential would classify these ventures as Dogs in the BCG Matrix, at least initially. These are markets where Bonduelle has a minimal presence, but with significant projected growth in processed or plant-based vegetables. This requires substantial investment in marketing and distribution to establish a foothold.

Bonduelle's exploration of advanced agri-food technologies and vertical farming positions these initiatives as potential question marks within its BCG matrix. These sectors represent high-growth opportunities, with the global vertical farming market projected to reach $32.7 billion by 2030, according to Grand View Research. However, Bonduelle's current market penetration in these emerging areas is likely minimal, reflecting their nascent stage for the company.

These ventures demand substantial research and development expenditure, alongside significant capital investment, mirroring the characteristics of question mark products. For instance, establishing a commercial-scale vertical farm can cost millions of dollars in infrastructure and technology. While the future returns are uncertain, the potential for disruption and market leadership in sustainable food production is considerable.

Premium or Niche Fresh-Cut Product Lines with Limited Current Reach

Bonduelle's premium or niche fresh-cut product lines, such as organic or pre-seasoned meal kits, would likely be classified as '?' in the BCG Matrix. These innovative offerings cater to specific consumer demands within the burgeoning fresh vegetables market, which is projected to reach $957.38 billion by 2034.

While these specialized products tap into a growing segment, their initial market penetration may be limited, necessitating targeted marketing and distribution strategies to build brand awareness and drive sales volume. Investment will be crucial to scale these ventures and achieve profitability.

- Niche Market Focus: Products like gourmet salad blends or ready-to-cook vegetable skewers target consumers seeking convenience and premium ingredients.

- Growth Potential: The overall fresh vegetables market is expanding, offering significant room for specialized products to gain traction.

- Investment Needs: Developing and marketing these niche lines requires substantial investment in product innovation, branding, and distribution channels.

- Market Penetration Strategy: Success hinges on effectively reaching and educating target consumer segments about the unique value proposition of these premium offerings.

Direct-to-Consumer (D2C) Offerings and E-commerce Expansion

As consumer purchasing habits rapidly shift towards online channels, Bonduelle's exploration of direct-to-consumer (D2C) offerings or a more robust e-commerce expansion represents a strategic move into a high-growth area. The global online grocery market, valued at approximately $1 trillion in 2023 and projected to reach $2.5 trillion by 2028, presents a significant opportunity. However, Bonduelle would likely face a low initial market share in this competitive landscape, requiring substantial investment.

Establishing a strong D2C presence necessitates considerable capital outlay. This includes building out sophisticated logistics networks, implementing targeted digital marketing campaigns, and developing robust customer service infrastructure. For instance, companies entering the D2C food space often see initial marketing costs exceeding 20% of revenue. Bonduelle's success in this segment will hinge on its ability to navigate these investment requirements effectively.

- Growing Online Food Market: The global online food market is experiencing substantial growth, indicating a favorable environment for e-commerce expansion.

- Low Initial Market Share: Bonduelle would likely start with a limited share of the D2C and e-commerce food market, necessitating strategic efforts to gain traction.

- Significant Investment Required: Heavy investment in logistics, digital marketing, and customer service is crucial for building a competitive D2C channel.

- Competitive Landscape: The online food sector is highly competitive, demanding a well-defined strategy to capture and retain market share.

Bonduelle's investments in advanced agri-food technologies and vertical farming are prime examples of Question Marks. These areas offer substantial growth potential, with the vertical farming market expected to reach $32.7 billion by 2030. However, Bonduelle's current market presence in these nascent sectors is minimal, demanding significant capital and R&D to establish a foothold and potentially disrupt the market.

| Initiative | Market Potential | Current Market Share | Investment Needs | Strategic Focus |

| Advanced Agri-Food Tech | High (e.g., fermentation proteins) | Low | High (R&D, capital) | Innovation & Disruption |

| Vertical Farming | High (projected $32.7B by 2030) | Low | High (infrastructure, tech) | Market Entry & Scaling |

| Niche Fresh-Cut Products | Growing ($957.38B for fresh veg by 2034) | Limited | Moderate (product dev, marketing) | Targeted Consumer Reach |

| D2C/E-commerce Expansion | Very High ($1T in 2023, $2.5T by 2028) | Low | High (logistics, digital marketing) | Market Share Acquisition |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.