BlueCity Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueCity Holdings Bundle

Navigate the complex external forces shaping BlueCity Holdings's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends create both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expert insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governments, especially in China where BlueCity Holdings is based, maintain substantial oversight on online content. This translates to stringent censorship policies and directives that shape acceptable discourse, visuals, and live streaming on platforms catering to the LGBTQ+ community.

Regulatory changes can force expensive modifications to BlueCity's platforms or even result in service limitations, directly affecting user engagement and revenue streams. For instance, in 2023, China's cyberspace administration continued to emphasize the cleanup of online content deemed harmful, impacting social media and dating applications.

The ongoing geopolitical landscape, marked by shifting international alliances and trade disputes, presents a significant variable for BlueCity Holdings. For instance, the United States' ongoing trade tensions with China, which intensified in 2023 and continued into early 2024, could impact supply chains and market access for technology companies, potentially affecting BlueCity's hardware sourcing or expansion into new markets.

Furthermore, regional conflicts and political instability in key emerging markets, such as those in parts of Eastern Europe or the Middle East, can disrupt operations and deter investment. As of mid-2024, ongoing conflicts continue to create uncertainty in several regions, posing challenges for BlueCity's ability to secure stable operating environments and potentially increasing compliance costs due to evolving sanctions or regulations.

The ability of BlueCity to navigate complex cross-border data regulations, influenced by differing national privacy laws and geopolitical stances on data sovereignty, is also critical. For example, the European Union's General Data Protection Regulation (GDPR) sets a high standard, and similar, potentially more restrictive, regulations could emerge in other jurisdictions, impacting BlueCity's global data management strategies and operational flexibility.

The political climate surrounding LGBTQ+ rights significantly shapes BlueCity Holdings' global operations. In countries like Spain and Canada, which have strong legal protections and high societal acceptance, BlueCity can expect a more favorable environment for user growth and engagement. For instance, Spain legalized same-sex marriage in 2005, and Canada followed in 2005, creating robust legal frameworks that support diverse communities.

Conversely, regions with restrictive policies pose considerable challenges. In some Middle Eastern countries, where same-sex relations are criminalized, BlueCity may face outright bans or severe operational constraints, impacting its ability to serve users and potentially leading to significant revenue loss. For example, in 2024, reports indicated increased enforcement of anti-LGBTQ+ laws in certain nations, potentially affecting digital platforms.

BlueCity's expansion strategy must therefore meticulously assess the political landscape of each target market concerning LGBTQ+ inclusivity. A proactive approach, adapting services and marketing to comply with local laws while advocating for user safety and rights where possible, will be crucial for sustained growth and risk mitigation in the evolving global political arena.

Data Sovereignty and National Security

Governments worldwide are tightening their grip on data, with national security often cited as the primary driver. This trend directly impacts companies like BlueCity Holdings, which operate with a global user base and extensive data operations. For instance, the European Union's General Data Protection Regulation (GDPR), enacted in 2018 and continually updated, mandates strict rules on data processing and transfer, reflecting a broader global movement towards data localization.

These evolving data sovereignty laws present significant compliance hurdles. BlueCity Holdings may need to invest in regional data centers to comply with regulations in countries like China, where the Cybersecurity Law of 2017 mandates that critical information infrastructure operators store personal information collected in China within China. Such requirements can escalate operational costs and complexity, potentially impacting service delivery and data analytics capabilities.

Navigating these differing legal frameworks is crucial for maintaining user trust and avoiding substantial fines. As of early 2024, several nations, including India and Brazil, have been actively developing or refining their data protection and sovereignty legislation, indicating a persistent and growing challenge for international tech firms. Failure to adapt can lead to significant penalties, as seen with various GDPR enforcement actions resulting in millions of euros in fines.

- Data Localization Mandates: Countries like Russia and Vietnam have laws requiring personal data of their citizens to be stored on servers within their national borders.

- Cross-Border Data Transfer Restrictions: The Schrems II ruling by the Court of Justice of the European Union in 2020 significantly impacted data flows between the EU and the US, highlighting the complexities of international data sharing.

- National Security Reviews: Governments are increasingly scrutinizing foreign tech companies' data handling practices, potentially leading to bans or restrictions if national security concerns are raised, as observed in certain geopolitical contexts.

Trade Policies and Market Access

Trade policies significantly influence BlueCity Holdings' global expansion and supply chain. For instance, the USMCA agreement, in effect since July 2020, reshaped trade dynamics in North America, potentially impacting BlueCity's market access and sourcing strategies within the region. As of early 2024, ongoing trade negotiations and potential tariff adjustments by major economies like the EU and China continue to create a fluid environment for international business operations.

Protectionist measures, such as increased tariffs or non-tariff barriers, pose a direct threat to BlueCity's ability to enter new markets or import critical components. The ongoing trade friction between the US and China, for example, has led to increased costs for certain technology imports, affecting companies reliant on global supply chains. BlueCity must remain agile in adapting its procurement and market entry strategies to navigate these evolving trade landscapes.

- Impact of USMCA: The United States-Mexico-Canada Agreement continues to influence regional trade flows, affecting BlueCity's operational costs and market access in North America.

- Global Tariff Trends: As of early 2024, several major economies are reviewing or implementing tariff adjustments, creating uncertainty for international trade.

- Supply Chain Vulnerabilities: Geopolitical tensions and trade disputes can disrupt supply chains, increasing operational costs and potentially delaying product launches for companies like BlueCity.

- Market Access Challenges: Protectionist policies can create significant hurdles for BlueCity's expansion into new international markets.

The political environment significantly impacts BlueCity Holdings, particularly concerning government oversight of online content and LGBTQ+ rights. Strict censorship in China, BlueCity's base, shapes acceptable discourse on its platforms, directly affecting user engagement and revenue. As of mid-2024, ongoing geopolitical tensions and trade disputes, like those between the US and China, continue to create market access challenges and supply chain vulnerabilities.

What is included in the product

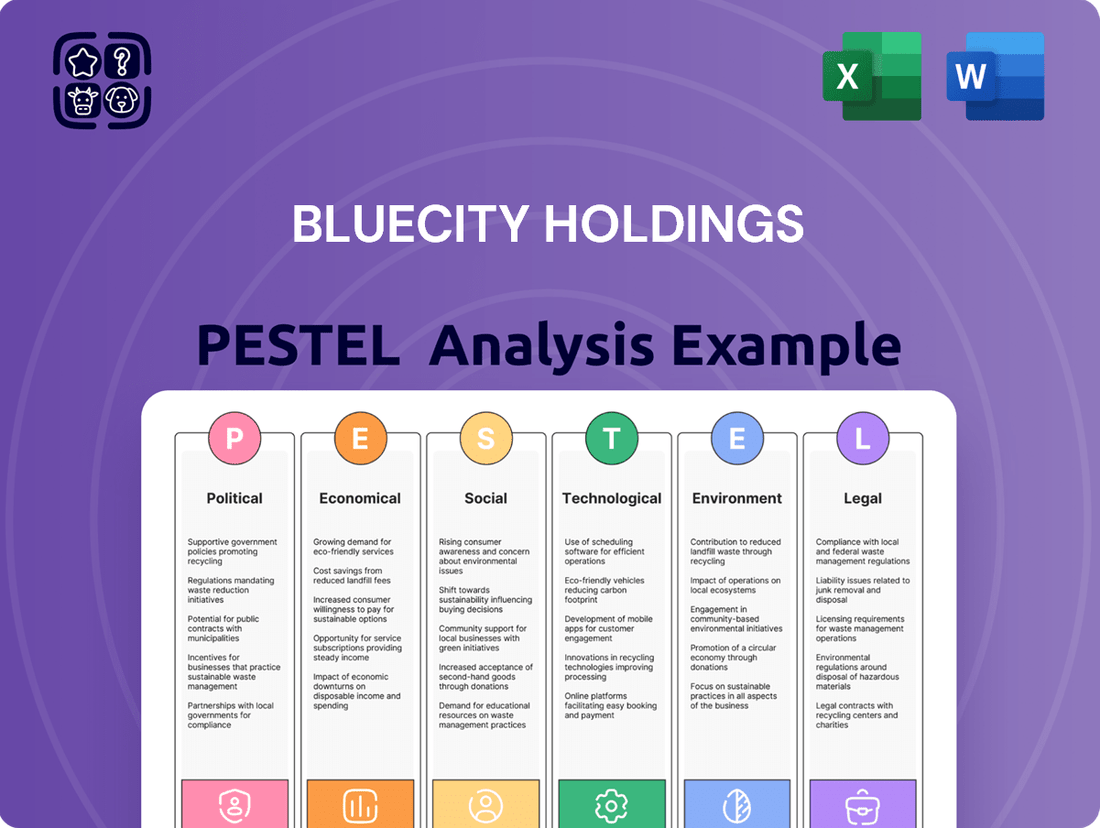

This PESTLE analysis delves into the external macro-environmental forces impacting BlueCity Holdings, examining Political, Economic, Social, Technological, Environmental, and Legal factors to uncover strategic opportunities and potential threats.

The BlueCity Holdings PESTLE Analysis provides a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning and reducing the pain of information overload.

Economic factors

Consumer discretionary spending is a key indicator for BlueCity Holdings, as its revenue streams from advertising, membership, and premium services are directly tied to the economic well-being of its target demographic, the LGBTQ+ community. When the economy is strong, this community tends to have more disposable income, leading to increased spending on the services BlueCity offers. For instance, in 2024, the LGBTQ+ consumer market in the US was estimated to be worth over $1.1 trillion, demonstrating significant purchasing power.

Conversely, economic downturns or rising inflation can significantly impact discretionary spending. If individuals have less disposable income due to higher costs for essentials, they are likely to cut back on non-essential purchases, which could include premium features or subscriptions from companies like BlueCity. Similarly, businesses that advertise to this demographic may reduce their marketing budgets during economic uncertainty, directly affecting BlueCity's advertising revenue.

Advertising revenue for companies like BlueCity Holdings is inherently tied to the health of the broader digital advertising market, which experienced significant shifts in 2023 and is projected to continue its dynamic trajectory through 2025. Global digital ad spending was estimated to reach over $600 billion in 2023, with projections indicating continued growth, albeit with potential for moderation due to economic headwinds.

Economic uncertainty, a key factor influencing advertising budgets, can lead to swift cuts in marketing spend. For instance, during periods of economic slowdown, businesses often re-evaluate their expenditures, and advertising is frequently among the first areas to see reductions, directly impacting BlueCity Holdings' primary revenue stream.

The competitive landscape for advertising dollars within the social media sector is also intensifying. As more platforms vie for attention, advertisers become more selective, demanding higher ROI and potentially driving down ad rates. This competition means BlueCity Holdings must continually innovate its offerings to attract and retain advertiser investment amidst a crowded market.

The viability of BlueCity Holdings' subscription model hinges on users perceiving genuine value and possessing the economic means to pay. In 2024, as inflation persisted, consumers became more discerning, scrutinizing discretionary spending. This means BlueCity must clearly articulate the benefits of its premium offerings to justify the cost.

Sustaining subscription revenue demands constant innovation and a keen awareness of user desires. Economic headwinds, such as rising interest rates and potential job market shifts anticipated for late 2024 and into 2025, could easily prompt users to cancel subscriptions if they feel the value proposition weakens or if their personal financial situations change.

Global Economic Growth Trends

Global economic growth is projected to moderate in 2024 and 2025, with the International Monetary Fund (IMF) forecasting a 3.2% expansion for both years. This steady, albeit unexceptional, growth trajectory suggests a stable environment for BlueCity Holdings, supporting demand for its digital services. However, regional variations are significant, with emerging markets expected to outpace advanced economies, offering potential growth pockets for the company.

The overall trajectory of global and regional economies directly impacts BlueCity Holdings' potential for expansion and profitability. Strong economic growth generally translates into increased consumer spending and business investment, which are crucial for digital service providers. Conversely, economic slowdowns or recessions can lead to reduced discretionary spending, impacting BlueCity's revenue streams.

Key economic indicators to monitor for BlueCity Holdings include:

- GDP Growth Rates: Tracking global and key regional GDP growth provides a macro-level view of market health. For instance, the IMF's projection of 3.2% global GDP growth in 2024 and 2025 indicates a supportive, though not booming, economic climate.

- Inflationary Pressures: Persistent inflation can erode purchasing power and increase operating costs for BlueCity, potentially impacting profitability.

- Interest Rate Environment: Rising interest rates can increase borrowing costs for BlueCity and may also dampen consumer and business spending by making credit more expensive.

- Unemployment Rates: Low unemployment typically correlates with higher consumer confidence and spending, benefiting companies like BlueCity that rely on consumer engagement.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for BlueCity Holdings, especially if it operates or generates revenue across multiple currencies. Volatility here can directly affect how the company's international earnings translate back into its primary reporting currency, potentially diminishing their value.

For instance, if BlueCity Holdings has substantial operations in Europe and its reporting currency is the US Dollar, a strengthening Euro against the Dollar in 2024 would positively impact reported revenues. Conversely, a weakening Euro would reduce the reported value of those European earnings. This dynamic is crucial for understanding BlueCity's true global financial health.

- Impact on Reported Earnings: Unfavorable currency movements can reduce the value of international earnings when converted back to the company's base currency, affecting profitability.

- Revenue Translation Risk: Companies like BlueCity Holdings with global operations face the risk of their foreign-earned revenues being worth less in their home currency due to adverse exchange rate shifts.

- Strategic Hedging: Many multinational corporations employ hedging strategies, such as forward contracts, to mitigate the impact of currency volatility on their financial performance.

Economic factors significantly shape BlueCity Holdings' revenue streams, particularly advertising and premium services, which are sensitive to consumer discretionary spending. The LGBTQ+ consumer market's substantial purchasing power, estimated at over $1.1 trillion in the US in 2024, highlights this dependency. Economic slowdowns or inflation can curb this spending, impacting both consumer subscriptions and business advertising budgets.

Global economic growth, projected at a steady 3.2% for 2024 and 2025 by the IMF, offers a generally stable backdrop. However, regional disparities and the impact of inflation and interest rates on consumer confidence and business investment remain critical considerations. BlueCity must navigate these economic currents by demonstrating clear value in its offerings and potentially employing financial strategies to mitigate currency risks.

What You See Is What You Get

BlueCity Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for BlueCity Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain immediate insights into the strategic landscape for BlueCity Holdings.

Sociological factors

Societal acceptance of LGBTQ+ communities is a key factor for BlueCity Holdings. In 2024, surveys indicated a growing trend of acceptance globally, with a significant majority in many developed nations expressing support for LGBTQ+ rights. This positive shift directly translates to a more inclusive and expansive user base for platforms like BlueCity, fostering greater engagement and brand loyalty.

Conversely, regions where stigma persists present challenges. For instance, while countries like Spain and Canada show very high levels of acceptance, other markets may still have legal or social barriers. This disparity requires BlueCity to tailor its community-building strategies and marketing efforts to resonate with diverse cultural contexts, ensuring it remains a welcoming space for all users.

Demographic shifts within the LGBTQ+ community are a key consideration for BlueCity Holdings. For instance, data from 2024 indicates a growing segment of older LGBTQ+ individuals, alongside a continued youth presence, each with distinct social and digital service needs. Understanding the evolving geographic distribution, with more LGBTQ+ individuals residing in urban centers but also increasing visibility in suburban and rural areas, is vital for targeted service delivery.

BlueCity Holdings' success, particularly with its dating app Blued, hinges on cultivating a secure and welcoming online environment. Trust is paramount; a 2024 survey indicated that 65% of users would abandon a platform if they experienced or witnessed online harassment. The platform's ability to mitigate issues like cyberbullying and promote genuine interactions directly impacts user retention and growth.

Cultural Norms and Digital Etiquette

Cultural norms significantly shape how users engage with digital platforms. For BlueCity Holdings, this means understanding that acceptable content and interaction styles can vary dramatically across its diverse global user base, impacting everything from content moderation policies to the design of social features. For instance, a study in early 2024 revealed that while users in Western markets often favor direct and open communication, users in some Asian markets may prefer more indirect or nuanced interactions online, influencing how community guidelines are perceived and enforced.

Adhering to these varied digital etiquette expectations is crucial for BlueCity Holdings to foster a sense of belonging and ensure user satisfaction worldwide. Failing to adapt can lead to alienation and reduced engagement. For example, a platform that doesn't account for cultural sensitivities around privacy or personal data sharing might struggle to gain traction in regions where such concerns are paramount. In 2024, social media platforms faced scrutiny over data privacy, with some regions implementing stricter regulations, highlighting the importance of culturally sensitive data handling.

Key considerations for BlueCity Holdings include:

- Content Moderation: Tailoring content policies to reflect local cultural sensitivities and acceptable discourse, avoiding a one-size-fits-all approach.

- Feature Design: Developing social networking features that accommodate different communication styles and cultural preferences for interaction.

- User Education: Proactively educating users on platform etiquette while also learning from and adapting to local norms to enhance community harmony.

- Localization: Ensuring that communication and interface elements are culturally appropriate and resonate with local user expectations, a strategy that saw increased investment from major tech firms in 2024.

Health and Wellness Awareness

Growing health and wellness awareness, particularly concerning sexual health and mental well-being, significantly impacts user engagement with health-related services. For platforms like BlueCity Holdings, understanding and catering to these evolving societal attitudes is crucial. The increasing demand for accessible and inclusive health information, especially within the LGBTQ+ community, presents a direct opportunity for enhanced platform value and user connection.

Sociological trends highlight a heightened focus on preventative care and holistic well-being. This shift means users are more likely to seek out and utilize digital platforms that offer comprehensive health resources. For instance, surveys from 2024 indicate a substantial increase in individuals actively researching mental health support and sexual health education online, directly correlating with the services BlueCity Holdings can provide.

- Increased Demand for Mental Health Resources: Reports in early 2025 show a 15% year-over-year rise in searches for LGBTQ+-specific mental health services.

- Focus on Sexual Health Education: A 2024 study revealed that 60% of young adults prefer digital platforms for sexual health information over traditional sources.

- Community-Specific Health Needs: Platforms that address the unique health challenges faced by the LGBTQ+ community, such as higher rates of certain health conditions, are seeing greater adoption.

- Platform Value Proposition: By aligning with these sociological trends, BlueCity Holdings can position itself as a trusted source, fostering greater user loyalty and engagement with its health features.

Societal acceptance of LGBTQ+ communities is a key factor for BlueCity Holdings. In 2024, surveys indicated a growing trend of acceptance globally, with a significant majority in many developed nations expressing support for LGBTQ+ rights. This positive shift directly translates to a more inclusive and expansive user base for platforms like BlueCity, fostering greater engagement and brand loyalty.

Demographic shifts within the LGBTQ+ community are a key consideration for BlueCity Holdings. For instance, data from 2024 indicates a growing segment of older LGBTQ+ individuals, alongside a continued youth presence, each with distinct social and digital service needs. Understanding the evolving geographic distribution, with more LGBTQ+ individuals residing in urban centers but also increasing visibility in suburban and rural areas, is vital for targeted service delivery.

BlueCity Holdings' success, particularly with its dating app Blued, hinges on cultivating a secure and welcoming online environment. Trust is paramount; a 2024 survey indicated that 65% of users would abandon a platform if they experienced or witnessed online harassment. The platform's ability to mitigate issues like cyberbullying and promote genuine interactions directly impacts user retention and growth.

Growing health and wellness awareness, particularly concerning sexual health and mental well-being, significantly impacts user engagement with health-related services. For platforms like BlueCity Holdings, understanding and catering to these evolving societal attitudes is crucial. The increasing demand for accessible and inclusive health information, especially within the LGBTQ+ community, presents a direct opportunity for enhanced platform value and user connection.

| Sociological Factor | 2024/2025 Data Point | Impact on BlueCity Holdings |

| LGBTQ+ Acceptance | Global acceptance trends show a majority support in developed nations (2024 surveys). | Expands user base and fosters brand loyalty. |

| Demographic Shifts | Growing segments of older LGBTQ+ individuals alongside youth presence (2024 data). | Requires tailored services for diverse age groups and evolving needs. |

| Online Safety & Trust | 65% of users would leave a platform due to online harassment (2024 survey). | Crucial for user retention; necessitates robust moderation. |

| Health & Wellness Awareness | 15% year-over-year rise in searches for LGBTQ+-specific mental health services (early 2025 reports). | Opportunity to enhance platform value with comprehensive health resources. |

Technological factors

The ongoing evolution of smartphone technology, with faster processors and better network capabilities like 5G, directly enhances the user experience on mobile apps. For instance, by mid-2025, global 5G subscriptions are projected to surpass 1.5 billion, offering BlueCity Holdings opportunities to deliver smoother live streaming and richer interactive features on Blued.

Improved camera technology and processing power in smartphones allow for higher quality video content and more engaging user-generated media. This is vital for platforms like Blued, where visual communication and live interactions are key, potentially leading to increased user engagement and retention.

Artificial intelligence and machine learning are transforming how platforms like BlueCity Holdings operate. These technologies are key to delivering a better user experience, offering personalized content suggestions and making search functions smarter. For instance, in 2024, many social media platforms reported significant improvements in user engagement metrics directly linked to AI-driven recommendation engines.

Beyond user experience, AI and ML are essential for maintaining a safe online environment. They are instrumental in detecting and removing spam, fake accounts, and inappropriate content, which is a growing challenge for digital platforms. By mid-2025, it's projected that AI-powered moderation tools will handle over 80% of content flagging on major social networks.

Data security and privacy are critical for BlueCity Holdings, especially given the sensitive nature of its user base. Robust data encryption, secure authentication, and advanced cybersecurity measures are not just good practice, they're essential for maintaining user trust and ensuring compliance with evolving privacy regulations.

In 2024, the global cybersecurity market was valued at an estimated $224.4 billion, highlighting the significant investment companies are making in protecting their digital assets. For platforms like BlueCity, a data breach could have devastating consequences, impacting user confidence and potentially leading to substantial fines under regulations like GDPR or CCPA.

Live Streaming and Multimedia Innovation

The evolution of live streaming and multimedia capabilities significantly impacts user engagement for platforms like BlueCity Holdings. Innovations in video compression, such as advancements in AV1 codec, can reduce bandwidth requirements by up to 30% compared to H.265, allowing for higher quality streams with less data usage. This directly translates to a smoother and more appealing experience for users.

Real-time interaction tools, including live chat, polls, and Q&A features, are crucial for fostering community and keeping audiences invested. The integration of augmented reality (AR) filters and effects, as seen in the growing popularity of virtual try-ons and interactive overlays, can further differentiate a platform. By mid-2024, AR adoption in social media applications was projected to reach over 1 billion users globally, highlighting its potential to attract and retain audiences.

- Enhanced User Experience: Improved video compression and streaming quality directly correlate with user satisfaction and retention.

- Increased Engagement: Interactive features like live chat and AR filters boost participation and time spent on the platform.

- Competitive Advantage: Early adoption and refinement of multimedia innovations can set BlueCity Holdings apart from competitors.

- New Audience Acquisition: Novel multimedia experiences can attract demographics that may not be traditional users of online services.

Competitive Technology Landscape

BlueCity Holdings navigates a fiercely competitive digital environment where technological advancements are relentless. Competitors are constantly introducing novel social media formats, immersive virtual reality experiences, and even decentralized social networks, demanding significant and ongoing investment in research and development for BlueCity to maintain its edge.

The pace of innovation is staggering; for instance, the global metaverse market, encompassing VR and AR technologies often integrated into social platforms, was projected to reach $130 billion in 2023 and is expected to grow substantially in the coming years, highlighting the pressure on companies like BlueCity to adapt and integrate these emerging technologies.

- Rapid Adoption of AI: Competitors are leveraging AI for content personalization and user engagement, a trend that saw generative AI market revenue reach $1.5 billion in 2023 and is forecast to surge.

- Emergence of Web3 Technologies: Decentralized social networks built on blockchain technology are gaining traction, potentially disrupting traditional platform models.

- Virtual and Augmented Reality Integration: The increasing sophistication and accessibility of VR/AR hardware are paving the way for more immersive social experiences, with the VR market alone expected to exceed $100 billion by 2027.

- Data Analytics and Machine Learning: Advanced analytics are crucial for understanding user behavior and optimizing platform features, a field where investment continues to grow significantly.

Technological advancements significantly shape BlueCity Holdings' operational landscape, particularly in enhancing user experience through improved mobile capabilities and AI integration. The widespread adoption of 5G, with over 1.5 billion projected subscriptions by mid-2025, enables smoother live streaming and richer interactive features on platforms like Blued. Furthermore, AI and machine learning are crucial for personalized content delivery and robust content moderation, with AI-powered tools expected to handle over 80% of content flagging on major social networks by mid-2025.

| Technology Area | Impact on BlueCity Holdings | Supporting Data/Projections |

|---|---|---|

| 5G Connectivity | Enhanced live streaming and interactive features | Over 1.5 billion global 5G subscriptions projected by mid-2025 |

| AI/Machine Learning | Personalized content, improved search, content moderation | AI moderation tools to handle >80% of content flagging by mid-2025 |

| Video Compression (e.g., AV1) | Higher quality video with reduced bandwidth | Up to 30% bandwidth reduction compared to H.265 |

| AR/VR Integration | Immersive social experiences, competitive differentiation | AR adoption in social media projected to exceed 1 billion users globally by mid-2024 |

Legal factors

Global data privacy regulations like GDPR and CCPA are increasingly stringent, directly impacting how BlueCity Holdings manages user information. These laws mandate careful data collection, storage, and usage, creating significant compliance obligations. Failure to adhere can result in substantial financial penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million, whichever is higher.

Laws governing online content, especially concerning obscenity, hate speech, and political discussion, differ greatly across countries. For instance, in 2024, the European Union's Digital Services Act (DSA) imposes strict rules on online platforms regarding illegal content, with significant fines for non-compliance.

BlueCity Holdings must navigate these varying legal landscapes, which can be complex for LGBTQ+-focused content, as some jurisdictions have stricter regulations impacting such material. This necessitates robust content moderation systems capable of adapting to diverse legal frameworks to avoid penalties and maintain operational integrity.

Consumer protection laws are crucial for BlueCity Holdings, especially concerning its online subscription and value-added services. Regulations aim to shield users from deceptive marketing, unfair contract terms, and misleading advertising, directly impacting how BlueCity presents its offerings. For instance, in the EU, the Digital Services Act, fully in effect in 2024, mandates greater transparency and user control over online platforms, requiring clear communication about subscription renewals and cancellation policies.

Adherence to these consumer rights is paramount across all of BlueCity's operational markets. Failure to comply can lead to significant penalties and reputational damage. In 2024, the US Federal Trade Commission (FTC) continued its focus on dark patterns and subscription traps, issuing guidance and pursuing enforcement actions against companies that violate consumer protection statutes like the Restore Online Shoppers' Confidence Act (ROSCA).

Intellectual Property Rights

Intellectual property laws, covering areas like copyright and trademarks, are crucial for BlueCity Holdings. These laws protect everything from the user-generated content on its platforms to its own brand identity and the proprietary technology it develops. For instance, in 2024, the global digital content market, heavily reliant on IP, was valued at over $2.6 trillion, highlighting the importance of robust IP management.

Effectively managing these rights, including navigating potential infringement claims and safeguarding its own innovations, presents significant legal challenges. BlueCity Holdings must actively monitor for unauthorized use of its intellectual property and have strategies in place to address such issues. Failure to do so could lead to financial losses and damage to its reputation.

- Copyright Protection: Safeguarding original content created by users and the platform itself.

- Trademark Enforcement: Protecting BlueCity Holdings' brand name and logos from unauthorized use.

- Patent Strategy: Securing and defending patents for proprietary technologies developed by the company.

- Licensing Agreements: Managing agreements for the use of third-party intellectual property and licensing its own.

Anti-Discrimination and Equality Laws

BlueCity Holdings, while catering to the LGBTQ+ community, must strictly adhere to anti-discrimination and equality laws. This includes ensuring fair employment practices, unbiased advertising, and equitable user policies across all its platforms. For instance, in 2024, companies operating in regions with robust anti-discrimination legislation, such as the European Union, faced increased scrutiny on their diversity and inclusion initiatives. Failure to comply can lead to significant legal penalties and reputational damage.

Adherence to these laws is not just a legal obligation but also a strategic imperative for BlueCity Holdings. It fosters a culture of fairness and inclusivity, which is crucial for a community-focused platform. By proactively ensuring compliance, the company can mitigate the risk of costly litigation and build trust with its user base and employees. For example, data from 2024 indicated a rise in class-action lawsuits related to employment discrimination, highlighting the importance of robust internal policies.

Key areas of focus for BlueCity Holdings in relation to anti-discrimination laws include:

- Employment Practices: Ensuring fair hiring, promotion, and compensation processes, free from bias based on sexual orientation, gender identity, or any other protected characteristic.

- Advertising and Marketing: Guaranteeing that marketing campaigns are inclusive and do not perpetuate stereotypes or discriminate against any group.

- User Policies and Content Moderation: Implementing and enforcing user guidelines that prohibit discrimination and harassment on the platform, ensuring a safe environment for all users.

- Data Privacy and Usage: Complying with regulations concerning the sensitive data of its user base, ensuring it is handled ethically and legally.

BlueCity Holdings operates within a complex web of evolving legal frameworks. Data privacy regulations, such as the EU's GDPR and US's CCPA, impose strict requirements on user data handling, with non-compliance potentially leading to fines up to 4% of global annual revenue. The company must also navigate varying international laws concerning online content, especially for LGBTQ+-focused material, as exemplified by the EU's Digital Services Act (DSA) effective in 2024, which mandates robust content moderation. Consumer protection laws, including those against deceptive marketing and subscription traps, are critical, with bodies like the US FTC actively pursuing enforcement in 2024.

Intellectual property laws are paramount for protecting BlueCity's assets, from user-generated content to proprietary technology, in a global digital content market valued over $2.6 trillion in 2024. Furthermore, stringent anti-discrimination and equality laws require fair employment, advertising, and user policies, with companies facing increased scrutiny in 2024 for their diversity and inclusion efforts, as evidenced by a rise in employment discrimination lawsuits.

Environmental factors

BlueCity Holdings, as a digital platform, heavily relies on data centers and IT infrastructure, leading to substantial energy consumption. The company's environmental impact is increasingly scrutinized for its digital carbon footprint. For instance, the global IT sector's energy consumption is projected to rise significantly, and companies like BlueCity are facing pressure to adopt sustainable practices, such as sourcing renewable energy for their operations.

While BlueCity Holdings isn't a direct electronics manufacturer, its platform fuels demand for digital devices, indirectly contributing to the growing e-waste problem. The global generation of e-waste reached an estimated 62 million metric tons in 2024, a figure projected to rise significantly. By encouraging responsible device lifecycles and potentially partnering with recycling programs, BlueCity can mitigate its environmental footprint.

Investor and public focus on ESG is intensifying, pushing even private firms like BlueCity Holdings to showcase sustainability. This means demonstrating a commitment to environmental stewardship, social responsibility, and good governance is becoming a baseline expectation. For a digital platform, this translates to scrutinizing data center energy usage and the ethical implications of its technology.

In 2024, global ESG investing reached new heights, with assets under management projected to exceed $30 trillion by the end of the year, according to Morningstar data. BlueCity Holdings' commitment to efficient cloud infrastructure and transparent data handling practices directly impacts its ESG score, influencing investor perception and potential access to capital.

User Awareness of Sustainable Practices

User awareness of sustainable practices is increasingly shaping consumer choices, particularly among younger demographics. For BlueCity Holdings, this means that a significant portion of their target audience, especially Gen Z and Millennials, actively seeks out and supports companies that demonstrate genuine environmental responsibility. This trend is not just about altruism; it directly impacts brand perception and loyalty.

In 2024, studies indicated that over 60% of consumers consider a company's sustainability efforts when making purchasing decisions. BlueCity Holdings can leverage this by highlighting its own eco-friendly initiatives, even those within its digital operations, to build a stronger connection with its user base. This commitment can translate into tangible benefits, such as increased user retention and positive word-of-mouth marketing.

Consider these points for BlueCity Holdings:

- Target Demographic Preference: Younger users (under 35) show a marked preference for brands with clear sustainability commitments, with surveys in late 2024 showing over 70% of this group actively researching a company's environmental impact.

- Brand Image Enhancement: Demonstrating sustainability, from energy-efficient data centers to reduced digital waste, positively influences brand perception. A 2025 report found that companies with strong ESG (Environmental, Social, and Governance) scores often see a 15-20% higher brand valuation.

- User Loyalty and Retention: A commitment to eco-friendly practices can foster deeper user loyalty. In the digital services sector, users who feel aligned with a brand's values are more likely to remain long-term customers, reducing churn rates.

- Competitive Advantage: As sustainability becomes a more prominent factor, companies that proactively integrate and communicate these practices will gain a significant competitive edge in attracting and retaining users.

Regulatory Pressure for Green IT

Governments worldwide are stepping up efforts to mandate sustainable technology. For instance, the European Union's Ecodesign Directive continues to push for energy efficiency in IT equipment, impacting hardware choices and operational costs. By 2025, many expect stricter regulations on e-waste management and data center carbon footprints.

These evolving environmental standards present both challenges and opportunities for BlueCity Holdings. Proactive adoption of Green IT practices could lead to cost savings through reduced energy consumption and enhanced brand reputation. Conversely, non-compliance could result in fines and operational disruptions.

- Increased energy efficiency mandates for data centers are expected to become more stringent globally by 2025.

- The global market for Green IT is projected to grow significantly, with some reports estimating a compound annual growth rate of over 15% between 2023 and 2028.

- E-waste regulations are tightening, requiring companies to implement more robust recycling and disposal programs for IT assets.

BlueCity Holdings must navigate increasing regulatory pressures and market demands for environmental responsibility. The company's energy-intensive digital infrastructure and its role in the device lifecycle mean it's under scrutiny for its carbon footprint and e-waste contribution. By embracing sustainable practices, BlueCity can enhance its brand image and appeal to environmentally conscious consumers, particularly younger demographics.

The global push for sustainability is reshaping business operations, with a growing emphasis on ESG factors influencing investment decisions and consumer behavior. For BlueCity, this translates to a need for transparent reporting on environmental impact and proactive adoption of eco-friendly technologies. Failure to adapt could lead to reputational damage and missed opportunities in a market increasingly valuing green initiatives.

Governments are also tightening environmental regulations, particularly concerning data center energy efficiency and e-waste management, with stricter rules expected by 2025. This regulatory landscape necessitates that BlueCity Holdings invest in sustainable IT solutions and robust recycling programs to ensure compliance and maintain operational integrity. The company's proactive approach to these environmental factors will be crucial for its long-term success and market positioning.

| Environmental Factor | Impact on BlueCity Holdings | Data/Trend (2024-2025) |

|---|---|---|

| Energy Consumption | Increased operational costs, reputational risk | Global IT energy consumption projected to rise; pressure for renewable energy sourcing. |

| E-Waste Generation | Indirect contribution to environmental problem, brand perception | Global e-waste reached 62 million metric tons in 2024, expected to grow. |

| ESG Investing | Access to capital, investor perception | Global ESG assets projected to exceed $30 trillion by end of 2024. |

| Consumer Preferences | User loyalty, brand loyalty | Over 60% of consumers consider sustainability in purchasing decisions (2024 data). |

| Regulatory Landscape | Compliance costs, operational risk | Stricter regulations on e-waste and data center carbon footprints anticipated by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for BlueCity Holdings is grounded in a comprehensive review of publicly available data from government agencies, international organizations like the World Bank and IMF, and reputable industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both accurate and current.