Builders FirstSource Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Builders FirstSource Bundle

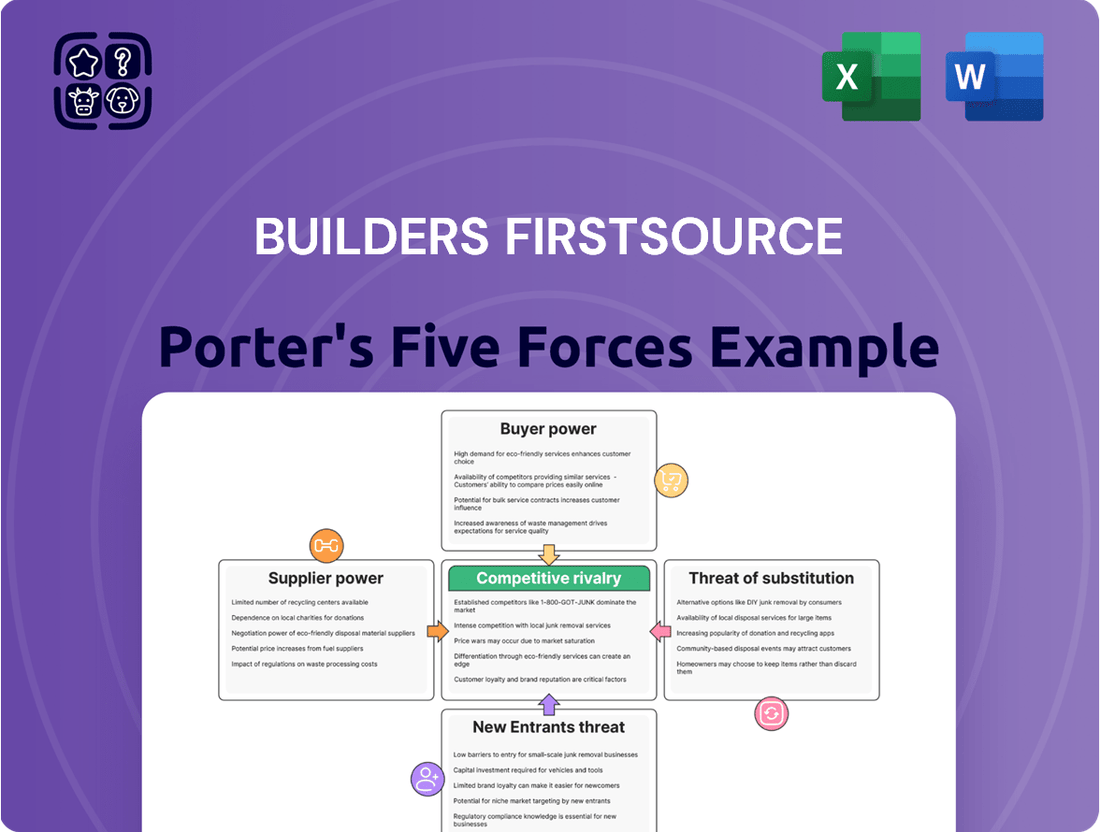

Builders FirstSource faces a dynamic competitive landscape, with moderate buyer power and significant rivalry from established players and emerging businesses. Understanding the intensity of these forces is crucial for navigating the construction supply industry.

The complete report reveals the real forces shaping Builders FirstSource’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The building materials sector, encompassing items like lumber and engineered wood, typically has many suppliers, which generally weakens any single supplier's bargaining power. However, if a supplier offers unique or patented materials, their influence can increase significantly.

Builders FirstSource's substantial purchasing volume and broad supplier relationships in 2024 likely allowed them to secure competitive pricing and favorable terms, mitigating supplier leverage. Their ability to source from multiple vendors for most standard materials further dilutes individual supplier power.

For Builders FirstSource, the bargaining power of suppliers is influenced by switching costs. For standard commodities like lumber, these costs are generally low, as many suppliers offer similar products. This means Builders FirstSource can readily shift between providers for these basic materials, limiting supplier leverage.

However, the picture changes for more specialized or manufactured components. If Builders FirstSource relies on suppliers for custom-designed trusses or integrated software systems, the cost and effort to switch can be substantial. This includes potential costs for retooling, requalifying new suppliers, and integrating new systems, thereby increasing supplier bargaining power in these areas.

In 2023, the construction industry, which Builders FirstSource serves, saw lumber prices fluctuate significantly, impacting material costs. For instance, the U.S. sawmills produced approximately 34.9 billion board feet of lumber in 2023, a figure that highlights the scale of the commodity market where switching is easier. Conversely, specialized manufactured components represent a smaller, yet critical, portion of the supply chain where switching costs become a more significant factor.

While it's a less frequent concern, significant raw material suppliers for the construction industry could theoretically move into distribution or even manufacturing of fundamental building products. This would put them in direct competition with companies like Builders FirstSource. For example, a large lumber producer might consider opening its own distribution centers.

However, the substantial capital investment needed for such a move, coupled with the need to establish robust logistics and distribution channels, presents a considerable hurdle. Builders FirstSource, as of its 2024 reports, benefits from an extensive network of over 500 distribution locations across the United States, a significant barrier for any supplier looking to replicate this reach.

Importance of Supplier's Input to Builders FirstSource

The bargaining power of suppliers for Builders FirstSource is influenced by the nature of the materials they provide. For common items like lumber, which Builders FirstSource uses extensively, the availability of multiple suppliers generally limits any single supplier's power. In 2024, lumber prices, while volatile, saw fluctuations influenced by housing market demand and supply chain conditions, meaning Builders FirstSource could often source from various providers.

However, for more specialized or manufactured building components, a supplier's input can be significantly more critical. If Builders FirstSource relies on a specific type of advanced roofing system or unique structural component that only a few manufacturers produce, those suppliers would hold greater bargaining power. This is because switching to an alternative could involve significant retooling, certification, or design changes, making it costly and time-consuming.

- Lumber: Generally low supplier bargaining power due to multiple sourcing options.

- Specialized Components: Higher supplier bargaining power when inputs are unique or difficult to substitute.

- Impact of Innovation: Suppliers offering proprietary or technologically advanced solutions may command stronger negotiation positions.

- Market Conditions: Broader economic factors and construction demand can shift the balance of power between Builders FirstSource and its suppliers.

Availability of Substitute Inputs for Builders FirstSource

The availability of substitute inputs significantly impacts the bargaining power of suppliers for Builders FirstSource. For instance, the presence of alternative wood species or the increasing adoption of composite materials can provide builders with choices, thereby reducing their reliance on any single supplier or material type. This diversification of material options limits the leverage suppliers can exert.

Builders FirstSource benefits from its capacity to source materials from diverse geographical regions and its flexibility in utilizing different types of materials. This strategic approach acts as a buffer against excessive supplier power. In 2024, the construction industry continued to see fluctuations in lumber prices, with key softwood lumber futures experiencing volatility. For example, CME Group’s Western Spruce-Pine-Fir lumber futures saw significant price swings throughout the year, underscoring the importance of diversified sourcing for companies like Builders FirstSource.

- Availability of Alternatives: Builders FirstSource can mitigate supplier power by sourcing from multiple suppliers and exploring alternative materials like engineered wood products or recycled composites.

- Geographic Diversification: Sourcing from various regions reduces dependence on any single supplier's location, especially important given regional supply chain disruptions or price disparities.

- Material Flexibility: The ability to utilize different grades or types of wood, or to substitute with non-wood materials, provides leverage in negotiations with traditional wood suppliers.

For Builders FirstSource, the bargaining power of suppliers is generally moderate, influenced by the commodity nature of many building materials. While numerous suppliers exist for standard items like lumber, limiting individual supplier leverage, the power shifts for specialized components. In 2024, the company’s vast purchasing volume and extensive supplier network, including over 500 distribution locations, provided significant negotiation strength. However, reliance on unique or proprietary materials from a limited number of manufacturers can increase supplier influence.

| Factor | Impact on Builders FirstSource | 2024 Data/Context |

|---|---|---|

| Number of Suppliers | Lowers supplier power for standard materials. | Many suppliers for lumber, drywall, etc. |

| Switching Costs (Standard Materials) | Low, enabling easy supplier changes. | Low for commodities like dimensional lumber. |

| Switching Costs (Specialized Components) | High, increasing supplier power. | High for custom-engineered wood products or proprietary fasteners. |

| Builders FirstSource's Purchasing Volume | Increases buyer power, allowing for better terms. | Significant scale across diverse product categories. |

| Supplier Integration/Backward Integration Threat | Low due to high capital requirements for distribution. | Builders FirstSource's 500+ locations create a barrier. |

What is included in the product

This analysis evaluates the competitive forces impacting Builders FirstSource, including supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the building materials industry.

Builders FirstSource's Five Forces analysis offers a clear, one-sheet summary of all competitive pressures—perfect for quick, informed strategic decision-making.

Customers Bargaining Power

Builders FirstSource caters to a broad customer spectrum, from individual homeowners to large professional builders. This diversity generally limits the power of any single customer. For instance, in 2024, while national homebuilders represent a significant portion of revenue for many building material suppliers, their individual share of Builders FirstSource's total sales is often manageable, preventing any one entity from dictating terms.

However, the sheer volume purchased by large national homebuilders does grant them considerable leverage. These clients can negotiate for lower prices, extended credit terms, or specialized delivery and service agreements. Builders FirstSource must balance these demands against the overall profitability and strategic importance of these high-volume customers.

Customers possess significant power due to their ability to substitute materials. They can readily source building supplies from a wide array of competitors, ranging from other large distributors and specialized local suppliers to, in some cases, directly from manufacturers. This readily available alternative sourcing significantly limits Builders FirstSource's pricing flexibility, as customers can easily switch if prices are perceived as too high.

Professional homebuilders, particularly when facing market headwinds and shrinking profit margins, exhibit a strong inclination towards cost-effective solutions. This price sensitivity means they actively seek suppliers offering the best value. For instance, during the first quarter of 2024, the U.S. housing market saw a slight slowdown in new home sales compared to the previous year, intensifying pressure on builder margins.

Builders FirstSource can effectively counter this customer price sensitivity by emphasizing its value-added services and the cost efficiencies derived from its manufactured components. By offering integrated solutions that streamline the building process and reduce waste, the company can demonstrate a total cost advantage that transcends the simple unit price of materials.

Threat of Backward Integration by Customers

Large homebuilders, a key customer segment for Builders FirstSource, possess the potential to engage in backward integration. This involves them developing their own capabilities for sourcing and distributing building materials, thereby bypassing suppliers like Builders FirstSource.

While the upfront capital expenditure and operational expertise required for such an endeavor are substantial, this latent threat can exert downward pressure on Builders FirstSource's pricing power. For instance, if a major builder like Lennar (which reported $33.4 billion in revenue in 2023) were to explore internalizing some of its material supply chain, it could signal a shift in negotiation leverage.

- Potential for backward integration by large homebuilders.

- Significant investment and expertise are barriers to integration.

- Threat influences Builders FirstSource's pricing strategies.

Information Availability to Customers

Customers, especially professional builders, possess significant knowledge regarding current market prices and the availability of building materials. This informed position directly strengthens their bargaining power.

The digital landscape has dramatically increased market transparency. Platforms allowing easy comparison of pricing and product offerings empower customers to negotiate more effectively with suppliers like Builders FirstSource.

- Informed Buyers: Professional builders often have deep insights into material costs and supplier options.

- Digital Price Comparison: Online marketplaces and industry portals facilitate easy price and availability checks, leveling the playing field.

- Negotiating Leverage: This readily available information allows customers to demand better terms and pricing, increasing their bargaining power.

Customers, particularly large professional builders, wield considerable bargaining power. Their ability to easily switch suppliers due to readily available alternatives and increased market transparency, fueled by digital platforms, significantly constrains Builders FirstSource's pricing flexibility.

The threat of backward integration by major builders, while requiring substantial investment, also pressures pricing. For instance, if a builder like D.R. Horton, which reported $32.2 billion in revenue for fiscal year 2023, were to consider internalizing material sourcing, it would amplify their negotiation leverage.

Builders FirstSource counters this by emphasizing value-added services and integrated solutions, aiming to demonstrate a total cost advantage beyond unit prices, especially as market conditions in 2024, like the slight slowdown in new home sales, increase builder price sensitivity.

| Customer Segment | Bargaining Power Drivers | Builders FirstSource Response |

| Large National Homebuilders | Volume purchasing, price sensitivity, potential backward integration | Value-added services, integrated solutions, cost efficiencies |

| Individual Homeowners | Lower volume, less price sensitivity (often influenced by contractor) | Broad product availability, accessible service |

| Professional Builders (Mid-size) | Price comparison, material substitution, market knowledge | Competitive pricing, reliable supply chain, product expertise |

Full Version Awaits

Builders FirstSource Porter's Five Forces Analysis

This preview displays the complete Builders FirstSource Porter's Five Forces Analysis, offering a comprehensive examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, allowing you to leverage its insights immediately.

Rivalry Among Competitors

The building materials supply sector is populated by a substantial number of competitors, both large national entities and smaller, localized operations. This extensive presence, encompassing everything from national giants like Builders FirstSource to niche distributors and local lumberyards, naturally fuels a competitive environment.

The construction and building materials industry's growth rate significantly fuels competitive rivalry. When the market expands, companies are more focused on capturing new opportunities. However, in slower growth environments, the fight for existing market share becomes much more intense.

For 2025, the industry faces a challenging landscape. Projections indicate a mid-single-digit percentage decline in the single-family housing market. Additionally, the multifamily sector is expected to continue experiencing weakness. This slowdown naturally intensifies competition among players like Builders FirstSource as they vie for a smaller pool of available business.

Builders FirstSource actively combats commoditization by focusing on value-added services and product differentiation. While basic lumber can be price-sensitive, the company distinguishes itself through the production of engineered components like roof trusses and wall panels, which require specialized manufacturing and offer greater value to builders.

Beyond manufactured goods, Builders FirstSource provides integrated construction services and digital solutions. These offerings, such as design software and project management tools, create a stickier customer relationship and reduce the reliance on pure price competition. For instance, in 2023, the company reported that its value-added products and services contributed significantly to its overall revenue, demonstrating the effectiveness of this strategy in mitigating direct rivalry.

Exit Barriers

Builders FirstSource, like many in the building materials sector, faces substantial exit barriers. High fixed costs tied to extensive manufacturing facilities, a widespread distribution network, and significant inventory levels mean that shutting down operations is incredibly expensive. These costs can trap companies in the market even when profitability is low, intensifying competitive rivalry as firms strive to cover their overheads.

For instance, the capital expenditure required for specialized equipment and warehousing represents a considerable sunk cost. In 2023, Builders FirstSource reported capital expenditures of $490 million, reflecting ongoing investment in its operational infrastructure. This substantial commitment makes exiting the market a financially daunting prospect, as these assets often have limited resale value outside the industry.

- High Fixed Costs: Significant investment in manufacturing plants and distribution centers creates a strong disincentive to exit.

- Inventory Management: Carrying costs for large inventories further contribute to the financial burden of ceasing operations.

- Asset Specificity: Specialized machinery and facilities have limited alternative uses, reducing their salvage value.

- Sustained Competition: The inability to easily exit forces companies to compete aggressively, even in challenging economic conditions.

Mergers and Acquisitions Activity

The building materials supply industry has experienced considerable consolidation through mergers and acquisitions. Builders FirstSource has actively participated in this trend, completing several strategic acquisitions to expand its footprint and capabilities. For instance, in 2023, Builders FirstSource acquired multiple businesses, including Alliance Door & Hardware, further integrating its supply chain and product portfolio.

This wave of M&A activity reshapes the competitive landscape. While it can decrease the sheer number of independent players, it simultaneously gives rise to larger, more powerful competitors. These consolidated entities often possess enhanced economies of scale, broader geographic coverage, and more diversified product and service offerings, intensifying competition for remaining market participants.

- Industry Consolidation: Significant M&A activity is a hallmark of the building materials sector.

- Builders FirstSource Acquisitions: The company has been an active acquirer, notably in 2023, to bolster its market position.

- Impact on Competition: Consolidation can lead to fewer but larger, more formidable rivals with expanded reach and offerings.

Competitive rivalry within the building materials sector is robust, influenced by a fragmented market structure and the industry's cyclical nature. Builders FirstSource faces intense competition from both national players and local suppliers, a dynamic exacerbated by the sector's high fixed costs and significant exit barriers.

The industry's growth rate directly impacts rivalry; a slowing market, such as the projected mid-single-digit decline in single-family housing for 2025, forces companies to fight harder for market share. Builders FirstSource mitigates this by focusing on value-added services and product differentiation, moving beyond basic commodities.

Consolidation through mergers and acquisitions, which Builders FirstSource actively participates in, also intensifies competition by creating larger, more capable rivals. For example, Builders FirstSource's 2023 acquisitions aimed to strengthen its market position and integrated offerings.

| Factor | Impact on Builders FirstSource | 2023 Data/Projections |

|---|---|---|

| Number of Competitors | High | Fragmented market with national and local players |

| Industry Growth Rate | Intensifies rivalry in slow periods | Projected mid-single-digit decline in single-family housing (2025) |

| Exit Barriers | Traps firms, sustains competition | High fixed costs in manufacturing and distribution |

| M&A Activity | Creates larger, stronger rivals | Builders FirstSource made multiple acquisitions in 2023 |

SSubstitutes Threaten

The threat of substitutes for traditional building materials like lumber, plywood, and concrete is a significant factor for Builders FirstSource. Alternatives such as steel framing, advanced composites like fiber-reinforced polymers (FRPs), and increasingly, sustainable options like bamboo and recycled materials, offer competitive performance and can sometimes present cost advantages. The market for these substitutes is growing, with the global market for engineered wood products, a direct competitor to traditional lumber, projected to reach $95.4 billion by 2028, indicating a substantial and expanding alternative landscape.

The construction industry is seeing a significant shift towards modular and prefabricated building techniques. These methods, which often involve off-site assembly and can utilize different material forms, offer a viable alternative to traditional on-site construction. This evolution directly impacts demand for conventional building materials, potentially diverting business from established suppliers.

The cost-effectiveness of substitutes is a significant hurdle for Builders FirstSource. While materials like engineered wood or advanced composites might boast superior performance or environmental advantages, their often higher price point restricts their appeal, particularly within the cost-conscious residential construction sector.

For instance, while sustainable building materials are gaining traction, a study in early 2024 indicated that the upfront cost premium for some eco-friendly alternatives could be as high as 15-20% compared to traditional lumber, making them less viable for large-scale, budget-driven projects.

Performance Advantages of Substitutes

Substitutes can indeed present performance advantages that draw customers away from traditional building materials. For instance, innovations like self-healing concrete offer enhanced durability and a longer lifespan, potentially reducing long-term maintenance costs for builders and property owners. Similarly, advancements in materials science have led to energy-efficient alternatives, such as advanced insulation or smart glass technologies, which can significantly lower operational expenses for buildings.

These performance benefits can translate into tangible value propositions for customers. Consider the impact of faster installation times offered by pre-fabricated components or modular building systems. This can lead to quicker project completion, reduced labor costs, and less disruption on job sites. Furthermore, materials designed for reduced waste, such as those with optimized cutting patterns or recycled content, appeal to a growing segment of the market focused on sustainability and cost efficiency.

The threat from substitutes is amplified when these performance advantages are coupled with competitive pricing or unique features. For example, if a new composite material offers superior strength-to-weight ratios alongside easier handling, it could disrupt the market for traditional lumber or steel. As of late 2024, the construction industry is increasingly exploring these advanced materials, with a notable uptick in pilot projects utilizing engineered wood products and high-performance concrete formulations, signaling a growing awareness of the potential benefits offered by substitutes.

- Enhanced Durability: Innovations like self-healing concrete promise longer structural lifespans.

- Energy Efficiency: Advanced insulation and smart glass reduce building operational costs.

- Faster Installation: Pre-fabricated and modular systems expedite construction timelines.

- Reduced Waste: Materials optimized for minimal offcuts appeal to sustainability-focused projects.

Customer Acceptance and Regulatory Landscape

Customer acceptance of new building materials and methods is a significant factor influencing the threat of substitutes for traditional construction materials. In 2024, the residential construction sector continued to see a growing interest in sustainable and prefabricated building solutions. For instance, the market for modular construction in the US was projected to reach $13.7 billion by 2024, indicating a substantial shift in how homes are built and a potential substitution for site-built methods.

The regulatory landscape plays a critical role in either promoting or restricting the adoption of substitute materials and construction techniques. Building codes and industry standards, which are regularly updated, can create barriers if they are slow to incorporate innovative materials or methods. Conversely, forward-thinking regulations can accelerate the acceptance of substitutes, particularly those offering improved energy efficiency or reduced environmental impact. For example, changes to energy codes in various states in 2023 and 2024 have encouraged the use of advanced insulation and window technologies, which can be considered substitutes for traditional building envelopes.

- Builder Adoption: Builders' willingness to embrace new materials and methods, often driven by cost, efficiency, and labor availability, directly impacts substitute threat.

- Consumer Demand: End-user preferences for aesthetics, performance, and sustainability can create pull for substitute products.

- Regulatory Hurdles: Building codes and zoning laws can either impede or facilitate the introduction and widespread use of alternative construction materials and techniques.

The threat of substitutes for Builders FirstSource's core products, such as lumber and traditional building materials, is influenced by evolving customer preferences and technological advancements. In 2024, the demand for sustainable and energy-efficient building solutions continued to rise, pushing the adoption of alternatives like engineered wood and advanced composites. The acceptance of these substitutes is also tied to their perceived performance benefits, such as enhanced durability and faster installation times, which can outweigh initial cost premiums for certain projects.

The market for substitutes is dynamic, with innovations constantly emerging. For instance, the global market for engineered wood products, a direct substitute for traditional lumber, was projected to reach $95.4 billion by 2028, highlighting a significant and growing competitive landscape. Furthermore, the increasing focus on reducing construction waste and improving building performance is driving interest in materials that offer these advantages, potentially diverting market share from conventional offerings.

| Substitute Material | Key Advantage | Market Trend (2024) | Potential Impact on Builders FirstSource |

| Engineered Wood Products | Strength, consistency, reduced waste | Growing demand, projected market expansion | Direct competition for lumber sales |

| Steel Framing | Durability, fire resistance, pest resistance | Steady adoption in commercial and some residential | Alternative to wood framing solutions |

| Advanced Composites (e.g., FRPs) | Lightweight, high strength, corrosion resistance | Niche but growing applications, particularly in infrastructure | Potential for specialized project substitution |

| Modular/Prefabricated Systems | Speed of construction, cost predictability | Significant growth in residential sector (US market projected $13.7 billion in 2024) | Shifts demand from on-site material sales to system components |

Entrants Threaten

Builders FirstSource operates in an industry where significant capital is a major hurdle for newcomers. Establishing the necessary infrastructure, including distribution centers, manufacturing plants, and a robust transportation network, demands millions, if not billions, of dollars. For instance, in 2024, the average cost to build a new, medium-sized distribution facility in the construction supply sector can easily exceed $10 million, not including the vast sums needed for inventory and specialized equipment.

Established players like Builders FirstSource leverage significant economies of scale in their operations. This means they can purchase materials, manufacture components, and distribute finished goods at a lower cost per unit compared to smaller, newer companies. For instance, in 2023, Builders FirstSource reported net sales of $17.7 billion, reflecting a vast operational footprint that inherently drives down per-unit costs.

These scale advantages create a substantial barrier for potential new entrants. A new company would struggle to match the purchasing power and logistical efficiencies that Builders FirstSource has built over time, making it difficult to compete on price. This cost disadvantage can deter new businesses from entering the market, thereby protecting the market share of existing large players.

New entrants to the building materials sector would find it difficult to replicate Builders FirstSource's established distribution network. Securing access to the vast array of suppliers and building strong, long-term relationships with a diverse customer base, from large builders to individual contractors, represents a significant hurdle. In 2024, Builders FirstSource continued to leverage its extensive network of over 550 locations across the United States, a scale that new competitors would struggle to match efficiently.

Product Differentiation and Brand Loyalty

While basic building materials can be commoditized, Builders FirstSource's offering of manufactured components, like trusses and wall panels, and value-added services, such as design and installation support, provides a degree of differentiation. This focus on integrated solutions and customer relationships fosters loyalty, making it harder for new entrants to compete solely on price. For instance, in 2024, a significant portion of Builders FirstSource's revenue is derived from these value-added services, which carry higher margins than raw materials.

This differentiation creates switching costs for customers who rely on Builders FirstSource for a comprehensive suite of products and services. New entrants would need substantial investment not only in raw material supply but also in manufacturing capabilities and service infrastructure to replicate this integrated offering. Builders FirstSource's established network and reputation further solidify its position, presenting a formidable barrier to entry for newcomers.

- Product Differentiation: Builders FirstSource offers manufactured components like roof trusses and wall panels, moving beyond basic commodity building materials.

- Value-Added Services: The company provides design assistance, installation support, and project management, enhancing customer value and loyalty.

- Customer Loyalty: These differentiated offerings and services create switching costs, making it difficult for new entrants to attract customers solely on price.

- Competitive Barrier: New entrants would require significant investment in manufacturing and service infrastructure to match Builders FirstSource's integrated approach.

Regulatory Hurdles and Permits

The building and construction sector faces significant regulatory complexity. New entrants must contend with a labyrinth of zoning laws, building codes, and environmental regulations that vary by jurisdiction. Navigating these requirements demands specialized knowledge and can incur substantial upfront costs and delays, effectively acting as a barrier to entry.

For instance, obtaining the necessary permits for a new construction project can be a lengthy and intricate process. In 2024, the average time to secure building permits in major U.S. metropolitan areas often extended several months, depending on the project's scale and location. This administrative burden can deter smaller or less experienced companies from entering the market.

Furthermore, compliance with evolving safety standards and licensing requirements adds another layer of difficulty. Builders FirstSource, as an established player, benefits from existing relationships with regulatory bodies and a deep understanding of compliance procedures. New companies must invest heavily in legal counsel and compliance officers to ensure they meet all legal obligations.

- Permitting Complexity: New construction projects require multiple permits, often involving local, state, and federal agencies.

- Zoning and Land Use: Strict zoning laws dictate what can be built where, limiting development opportunities for new firms.

- Compliance Costs: Adhering to building codes, safety regulations, and environmental standards incurs significant financial investment.

- Time Delays: The bureaucratic process for approvals can lead to extended project timelines and increased operational costs for new entrants.

The threat of new entrants for Builders FirstSource is considered moderate. Significant capital investment is required for infrastructure, and established players benefit from economies of scale and existing distribution networks, creating substantial barriers.

New companies would struggle to match the purchasing power and logistical efficiencies of established firms like Builders FirstSource, which reported net sales of $17.7 billion in 2023. The company's network of over 550 locations in 2024 also presents a formidable challenge for newcomers aiming to replicate its reach.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront costs for facilities, equipment, and inventory. | Deters new entrants due to substantial financial needs. |

| Economies of Scale | Lower per-unit costs for established players due to large-scale operations. | New entrants face higher costs, making price competition difficult. |

| Distribution Network | Extensive established network of locations and supplier relationships. | New entrants need significant time and investment to build comparable reach. |

| Product Differentiation & Services | Value-added components and customer services create switching costs. | New entrants must offer similar integrated solutions to attract customers. |

Porter's Five Forces Analysis Data Sources

Our Builders FirstSource Porter's Five Forces analysis is built upon a robust foundation of data, including Builders FirstSource's own annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista. We also incorporate macroeconomic data and competitor announcements to provide a comprehensive view of the competitive landscape.