Builders FirstSource Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Builders FirstSource Bundle

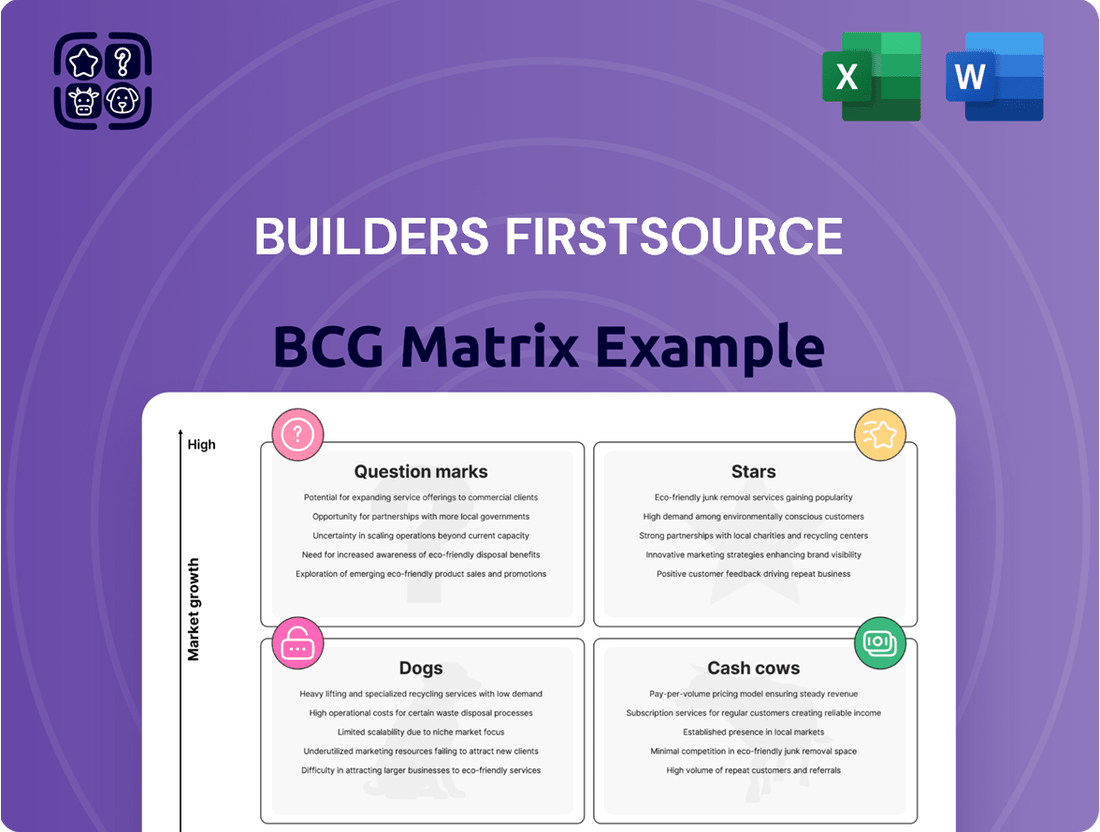

Builders FirstSource's BCG Matrix provides a crucial snapshot of its product portfolio's market share and growth potential. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is vital for informed investment decisions.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Builders FirstSource's manufactured components, such as trusses and wall panels, are showing robust growth. These products are in high demand because they significantly cut down on-site labor and material waste, appealing to builders prioritizing efficiency and cost reduction. The company's strategic investments in modern manufacturing facilities underscore its commitment to leading this expanding market segment.

Builders FirstSource's investment in digital tools, exemplified by the myBLDR.com platform launched in February 2024, underscores its strategic move to lead in contractor process streamlining. This platform offers features like 3D home previews and online ordering, significantly enhancing the customer journey.

The impact of these digital initiatives is substantial, having already generated $153 million in cumulative incremental sales by Q1 2025. Projections indicate continued strong performance, with an additional $200 million in incremental sales anticipated for 2025, highlighting rapid digital adoption and market penetration.

Builders FirstSource is enhancing its offerings by moving beyond basic material supply to include design assistance, installation, and project management. This strategic shift aims to solve customer challenges and boost profitability.

These value-added services are key to the company's organic growth strategy, helping them capture a larger share of customer spending. For example, in 2024, the company reported a significant increase in revenue from these integrated solutions, demonstrating their growing importance.

Strategic Acquisitions

Builders FirstSource's strategic acquisition program is a cornerstone of its growth, focusing on expanding market reach and product portfolios. This disciplined approach has been instrumental in bolstering its industry leadership and accessing new capabilities.

In 2024, the company executed thirteen acquisitions, integrating businesses that generated $420 million in prior year sales. These acquisitions are projected to contribute meaningfully to net sales growth in 2025, underscoring their strategic importance.

- Market Expansion: Acquisitions allow Builders FirstSource to enter new geographic regions and strengthen its presence in existing ones.

- Product Enhancement: The company targets businesses that complement its existing product offerings, broadening its value proposition to customers.

- Synergistic Growth: Acquired companies often provide operational efficiencies and cross-selling opportunities, driving integrated growth.

- Industry Consolidation: Builders FirstSource leverages acquisitions to consolidate fragmented markets, increasing its competitive advantage.

Sustainable Building Products and Practices

Builders FirstSource is making significant strides in sustainable building products and practices, a key factor in its market positioning. The company's commitment is evident in its sourcing, with approximately 89% of its wood coming from certified vendors, ensuring responsible forestry. This dedication not only meets the rising consumer demand for green building but also yields substantial environmental benefits, such as conserving millions of trees annually.

This strategic focus on sustainability places Builders FirstSource in a strong growth area within the construction industry. The market increasingly values eco-friendly solutions, and the company's proactive approach ensures it remains competitive and relevant. Furthermore, these practices often translate into operational efficiencies and cost savings, reinforcing its market standing.

- Sourcing: Approximately 89% of wood sourced from certified vendors.

- Environmental Impact: Contributes to saving millions of trees.

- Market Alignment: Addresses growing demand for environmentally conscious construction.

- Strategic Advantage: Positions the company favorably in an increasingly important market segment.

Builders FirstSource's manufactured components, like trusses and wall panels, are stars in the BCG matrix due to their high growth and market share. These products are in demand for their efficiency and cost savings. The company's investment in modern manufacturing facilities supports this segment's leadership, with strong demand driven by builders seeking to reduce labor and waste.

| Product Segment | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Manufactured Components (Trusses, Wall Panels) | High | High | Star |

| Digital Solutions (myBLDR.com) | High | Growing | Potential Star/Question Mark |

| Value-Added Services (Design, Installation) | Moderate | Moderate | Cash Cow/Average |

| Sustainable Building Products | High | Emerging | Question Mark/Star |

What is included in the product

This BCG Matrix overview details Builders FirstSource's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This BCG Matrix provides a clear, actionable overview of Builders FirstSource's portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Traditional lumber and plywood distribution is a cornerstone for Builders FirstSource, contributing a substantial chunk to their overall revenue, especially from single-family home construction. This segment, though mature and sensitive to lumber price swings, benefits from the company's vast distribution network and strong ties with professional builders, leading to predictable, high-volume cash generation.

In 2024, Builders FirstSource reported continued strength in its lumber and building materials distribution segment. Despite facing some commodity deflation and a normalization of sales trends following a period of heightened demand, this business line maintained its position as a high-market-share generator. The company's ability to leverage its scale and established customer base helps to mitigate the impact of market volatility, ensuring it remains a reliable cash source.

Engineered wood products, such as I-joists and laminated veneer lumber, represent a mature and stable segment for Builders FirstSource. These are crucial for modern building, offering excellent structural integrity and efficiency for construction projects. In 2024, Builders FirstSource continued to leverage its strong market position in this established category, contributing significantly to consistent revenue streams.

The Windows, Doors, and Millwork segment represents a significant and reliable pillar for Builders FirstSource, acting as a classic Cash Cow within its product portfolio. These items are fundamental to every building project, guaranteeing a steady demand in a well-established market.

In 2024, Builders FirstSource continued to see strong performance in this category. The company's extensive product selection and robust distribution network in windows, doors, and millwork are key drivers of its high profit margins and consistent cash generation, reinforcing its Cash Cow status.

Repair and Remodel (R&R) Segment

The Repair and Remodel (R&R) segment for Builders FirstSource, while not as large as new construction, offers a dependable source of income. This market tends to be more stable, weathering economic downturns better than the new housing sector. Builders FirstSource leverages its extensive network and diverse product range to serve remodelers and contractors effectively.

This segment acts as a Cash Cow for Builders FirstSource, generating consistent revenue and cash flow. The company's strong foothold in the mature R&R market allows it to maintain a solid market share. In the first quarter of 2025, the R&R segment experienced a modest uptick in sales, underscoring its reliable performance.

- Stable Demand: R&R demand is less volatile than new construction, providing a consistent revenue stream.

- Market Share: Builders FirstSource holds a significant position in this mature market.

- Q1 2025 Performance: The segment saw a slight increase in sales during the first quarter of 2025.

Large-Scale Professional Homebuilder Relationships

Builders FirstSource's deep-rooted connections with a substantial number of professional homebuilders nationwide solidify its position as a cash cow. These enduring alliances guarantee consistent, high-volume purchases of diverse building supplies and related services.

The company's role as a dependable, all-in-one provider for major construction firms generates a reliable and predictable income stream, offering resilience against market volatility. For instance, in 2023, Builders FirstSource reported net sales of $16.7 billion, with a significant portion attributable to its strong builder relationships.

- Established Network: Builders FirstSource maintains long-standing relationships with thousands of professional homebuilders throughout the United States.

- Recurring Revenue: These partnerships translate into consistent, large-volume orders for a broad spectrum of building materials, from lumber to windows.

- Integrated Solutions: The company acts as a trusted, single-source supplier, offering a comprehensive suite of products and services that streamline the building process for its clients.

- Market Stability: This predictable revenue base provides a stable foundation, even when the broader housing market experiences fluctuations.

The company's core distribution of lumber and plywood, along with engineered wood products, consistently generates substantial cash flow due to high volumes and established customer relationships.

These mature segments benefit from Builders FirstSource's extensive distribution network, ensuring predictable revenue streams even amidst market fluctuations.

In 2024, the company's strong market share in these areas continued to translate into reliable cash generation, reinforcing their Cash Cow status.

| Segment | BCG Classification | 2024 Performance Highlight |

|---|---|---|

| Lumber & Plywood Distribution | Cash Cow | High-volume, predictable cash generation |

| Engineered Wood Products | Cash Cow | Stable revenue streams from essential building components |

| Windows, Doors, Millwork | Cash Cow | Consistent cash generation driven by extensive product selection |

| Repair & Remodel (R&R) | Cash Cow | Dependable income, modest sales uptick in Q1 2025 |

What You See Is What You Get

Builders FirstSource BCG Matrix

The preview of the Builders FirstSource BCG Matrix you are currently viewing is the exact, unwatermarked, and fully formatted document you will receive immediately after purchase. This comprehensive report has been meticulously prepared to offer clear strategic insights, mirroring the professional quality and analytical depth of the final deliverable. You can confidently use this preview to understand the value and immediate applicability of the full BCG Matrix analysis for your business planning needs.

Dogs

Underperforming legacy distribution branches, particularly those in areas experiencing a downturn in new home construction or facing heightened local competition, can be categorized as Dogs within the Builders FirstSource BCG Matrix. These branches often grapple with limited growth potential and demand significant investment to merely hold onto their market share, resulting in meager returns.

While Builders FirstSource does not disclose granular performance data for individual branches, a segment exhibiting persistent low organic sales growth within a stagnant regional market would exemplify this category. For instance, if a particular state saw housing starts decline by, say, 5% in 2024 compared to 2023, and a local branch within that state failed to achieve even that modest growth, it would likely fall into the Dog quadrant.

While lumber sales are generally a strong performer for Builders FirstSource, certain highly commodity-dependent lumber and lumber sheet goods can exhibit volatility. These products, especially during periods of sharp price deflation, can tie up capital in inventory and see reduced margins. For instance, commodity deflation impacting sales in 2024 and early 2025 highlighted this potential challenge, where significant price drops could temporarily diminish profitability on these specific items.

Product lines that don't align with current market demands for efficiency, sustainability, or advanced features, or those with slow-moving inventory, would be classified as Dogs within Builders FirstSource's BCG Matrix.

These could encompass older, less efficient building materials or components being replaced by newer manufactured alternatives, resulting in reduced sales and the necessity for markdowns to clear stock. For instance, if a particular type of lumber, previously a staple, is now outperformed by engineered wood in terms of durability and sustainability, it would likely become a Dog. Builders FirstSource reported in their 2023 annual report that inventory turnover days increased slightly, suggesting a potential for some product lines to slow down.

Segments Heavily Reliant on Deeply Contracted Markets (e.g., specific Multi-Family sub-segments)

Certain multi-family sub-segments, particularly those facing prolonged market contractions, could be classified as Dogs within the Builders FirstSource BCG Matrix. These areas, characterized by significant and persistent declines, may represent a drag on the company's overall growth and profitability. For example, the multi-family construction sector experienced a notable downturn in 2024, with continued softness projected into Q1 2025.

If specific niches within the multi-family market, such as those reliant on certain types of development or in geographically challenged areas, continue to struggle with severe headwinds and show no immediate prospects for recovery, they would fit this category. Builders FirstSource's exposure to these specific, deeply contracted markets could negatively impact its performance metrics.

- Market Contraction: Multi-family sales saw a significant decline in 2024, impacting specific sub-segments.

- Lack of Recovery Signs: Certain project types within multi-family continue to face headwinds with no clear recovery path.

- Performance Drag: Exposure to these deeply contracted markets can act as a drag on overall company performance.

- Strategic Re-evaluation: These segments may require a strategic re-evaluation to mitigate potential losses.

Non-Strategic or Underutilized Assets from Past Acquisitions

Builders FirstSource's acquisition-driven growth strategy means some inherited assets may not align perfectly with current core operations. These underperforming units, characterized by low market share and limited growth prospects, could be categorized as Dogs in a BCG matrix analysis. For instance, a small regional lumber yard acquired in a past consolidation might not benefit from the company's broader supply chain efficiencies or national branding efforts.

These assets can tie up valuable capital and management attention that could be better directed towards higher-growth segments. Builders FirstSource regularly reviews its portfolio to identify and address such underutilized components. As of the first quarter of 2024, the company reported total assets of $13.7 billion, with ongoing efforts to ensure capital is allocated to areas with the greatest strategic return.

- Underperforming acquired assets: Units with low market share and minimal growth potential.

- Capital allocation: Potential for divestiture or restructuring to free up resources.

- Portfolio optimization: Continuous evaluation to align with core strategy.

Underperforming legacy distribution branches, particularly those in areas experiencing a downturn in new home construction or facing heightened local competition, can be categorized as Dogs within the Builders FirstSource BCG Matrix. These branches often grapple with limited growth potential and demand significant investment to merely hold onto their market share, resulting in meager returns.

While Builders FirstSource does not disclose granular performance data for individual branches, a segment exhibiting persistent low organic sales growth within a stagnant regional market would exemplify this category. For instance, if a particular state saw housing starts decline by, say, 5% in 2024 compared to 2023, and a local branch within that state failed to achieve even that modest growth, it would likely fall into the Dog quadrant.

Product lines that don't align with current market demands for efficiency, sustainability, or advanced features, or those with slow-moving inventory, would be classified as Dogs within Builders FirstSource's BCG Matrix. These could encompass older, less efficient building materials or components being replaced by newer manufactured alternatives, resulting in reduced sales and the necessity for markdowns to clear stock. Builders FirstSource reported in their 2023 annual report that inventory turnover days increased slightly, suggesting a potential for some product lines to slow down.

Certain multi-family sub-segments, particularly those facing prolonged market contractions, could be classified as Dogs within the Builders FirstSource BCG Matrix. These areas, characterized by significant and persistent declines, may represent a drag on the company's overall growth and profitability. For example, the multi-family construction sector experienced a notable downturn in 2024, with continued softness projected into Q1 2025.

| BCG Category | Builders FirstSource Segment Example | Characteristics | 2024 Data Context |

|---|---|---|---|

| Dogs | Underperforming legacy distribution branches | Low growth, high investment to maintain share, low returns | Areas with declining new home construction (e.g., state housing starts down 5% in 2024) |

| Dogs | Certain obsolete product lines | Lack of market demand, slow inventory turnover | Commodity deflation impacting lumber margins in 2024; inventory turnover days increased slightly in 2023 |

| Dogs | Struggling multi-family sub-segments | Severe headwinds, no immediate recovery prospects | Multi-family construction downturn in 2024, projected softness into Q1 2025 |

Question Marks

Builders FirstSource is actively exploring and investing in emerging technologies, particularly advanced robotics in component manufacturing. This strategic focus aligns with high-growth potential sectors where the company currently holds a relatively low market share, indicating a significant opportunity for expansion and disruption.

These new ventures, such as implementing robotic automation, demand substantial investment in research and development, alongside dedicated efforts for adoption and integration. While the potential to revolutionize homebuilding processes is immense, the immediate returns on these investments remain uncertain, characteristic of a 'Question Mark' in a BCG matrix.

The construction industry, in general, saw a significant push towards automation, with reports in 2024 indicating a growing interest in robotics for tasks like bricklaying and framing. For instance, some estimates suggested the global construction robotics market could reach tens of billions of dollars by the late 2020s, highlighting the long-term growth trajectory Builders FirstSource is targeting.

Builders FirstSource's ventures into new geographic markets or specialized niche segments currently represent question marks in their BCG matrix. These areas, characterized by low current market share but high growth potential, demand significant upfront investment in infrastructure and tailored market penetration strategies. The success of these expansions remains uncertain, requiring careful evaluation and execution.

For instance, in 2024, Builders FirstSource continued to explore opportunities in emerging regions and specific product categories where their presence is minimal but market demand is projected to rise. The company's financial reports for 2024 indicated ongoing capital allocation towards market research and initial setup for potential new market entries, underscoring the strategic importance and inherent risk associated with these question mark initiatives.

New digital tool features or platforms with limited adoption at Builders FirstSource would fall into the question mark category of the BCG matrix. These represent investments that have the potential for growth but are not yet proven market leaders. For example, a newly launched mobile app feature designed for streamlined project quoting, currently being piloted with a select group of contractors, would fit this description.

These nascent digital offerings require careful nurturing and strategic marketing to gain traction. Builders FirstSource is actively investing in user education and promotional campaigns to highlight the benefits of these tools. The company's 2024 digital initiatives are focused on enhancing customer experience, and these question mark products are a key part of that strategy, aiming to become future stars if adoption rates increase significantly.

Innovative, Highly Efficient Manufactured Products in Early Stages of Market Penetration

Innovative, highly efficient manufactured products, such as advanced insulation materials or pre-fabricated components designed for reduced embodied carbon, are currently in the early stages of market penetration for Builders FirstSource. These offerings, while boasting significant advantages like potential CO2e reduction, are still building momentum and market share as builders become more aware and adopt these new solutions.

These products represent a potential growth area, aligning with the Stars or Question Marks in the BCG matrix, depending on their specific market growth rate and relative market share. For instance, a new line of low-carbon concrete alternatives, while promising, might still be establishing its footprint. The market for sustainable building materials is projected to see substantial growth, with some reports indicating a compound annual growth rate (CAGR) of over 10% for green building materials through 2028, underscoring the high-growth potential.

- High Growth Potential: Driven by increasing demand for sustainable and efficient building solutions.

- Low Market Share: Adoption is still building among a diverse range of construction professionals.

- Investment Needs: Continued investment in marketing, sales, and education is vital for market expansion.

- Market Opportunity: Capturing a significant share of the growing green building market is a key objective.

Sustainability Solutions Requiring Significant Builder Education and Investment

Builders FirstSource, while a proponent of green building, faces challenges with certain sustainability solutions that fall into the Question Mark category of its BCG Matrix. These are offerings with high market growth potential due to increasing environmental awareness and regulations, but they often demand significant upfront investment or a considerable change in traditional building methods from their builder customers. For instance, advanced energy-efficient building envelope systems or the widespread adoption of low-carbon concrete mixes require substantial education and capital outlay from builders, potentially slowing their uptake despite their long-term benefits.

The adoption curve for these advanced sustainability solutions can be slow. Builders may hesitate due to the perceived risk, the need for specialized training, or simply the lack of immediate return on investment compared to conventional materials. Builders FirstSource needs to invest heavily in marketing and educational programs to bridge this knowledge and cost gap. For example, demonstrating the lifecycle cost savings of high-performance insulation or the reduced carbon footprint of alternative materials is crucial. In 2024, the demand for sustainable building materials is projected to grow significantly, with the green building market expected to reach over $370 billion globally by 2026, highlighting the potential, but also the challenge of bringing builders along.

- High Growth Potential, Low Market Share: Advanced sustainable building technologies like passive house components or smart home energy management systems exhibit strong market growth trends but may currently have limited penetration among Builders FirstSource's customer base.

- Significant Upfront Investment Barrier: Solutions such as high-performance, triple-glazed windows or geothermal heating and cooling systems require substantial initial capital from builders, which can deter adoption even with available financing options.

- Need for Extensive Builder Education: Builders require comprehensive training on the installation, integration, and benefits of complex sustainable solutions, including advanced framing techniques or the use of novel bio-based materials.

- Marketing and Sales Investment Required: To move these offerings from Question Marks to Stars, Builders FirstSource must dedicate significant resources to marketing campaigns, case studies, and direct sales support to educate and convince builders of the value proposition.

Builders FirstSource's ventures into emerging technologies like advanced robotics in component manufacturing are classic Question Marks. These areas offer high growth potential, mirroring the broader construction industry's increasing adoption of automation, with the global construction robotics market projected to reach tens of billions by the late 2020s. However, Builders FirstSource currently holds a low market share in these segments, necessitating substantial investment in R&D and integration, with uncertain immediate returns.

| BCG Category | Builders FirstSource Example | Market Growth | Market Share | Investment Rationale |

|---|---|---|---|---|

| Question Mark | Robotics in Component Manufacturing | High (Industry-wide trend) | Low (Currently) | High potential for disruption and efficiency gains; requires significant upfront investment and R&D. |

| Question Mark | New Geographic Markets/Niche Segments | High (Projected for specific regions/products) | Low (Minimal presence) | Opportunity for expansion; requires tailored market penetration strategies and infrastructure investment. |

| Question Mark | Nascent Digital Tool Features (e.g., mobile quoting app) | High (Potential for improved customer experience) | Low (Limited adoption) | Aims to become a future Star; requires nurturing, user education, and strategic marketing. |

BCG Matrix Data Sources

Our Builders FirstSource BCG Matrix is informed by robust financial disclosures, comprehensive market analytics, and strategic industry research to ensure accurate business insights.