Black Diamond Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Diamond Group Bundle

Black Diamond Group demonstrates a robust market position bolstered by strong brand recognition and a loyal customer base, representing significant strengths. However, understanding the full scope of their competitive landscape and potential threats requires a deeper dive. Our comprehensive SWOT analysis unveils the nuanced opportunities for expansion and the critical areas where strategic mitigation is essential for sustained growth.

Want the full story behind Black Diamond Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Black Diamond Group boasts a robust portfolio of diversified services, encompassing modular building rentals and sales, comprehensive workforce accommodation solutions, and specialized energy services. This broad spectrum of offerings enables the company to serve a wide array of client needs across different industries.

The company benefits from multiple revenue streams, notably including consistent recurring rental income from its modular buildings, which significantly bolsters its financial stability. This multifaceted approach to revenue generation is a key strength.

This diversification acts as a crucial risk mitigation strategy, reducing the company's vulnerability to downturns in any single market segment. For instance, in Q1 2024, Black Diamond Group reported a 14% increase in total revenue, with its rental segment showing particular strength, highlighting the benefit of its varied service model.

By not relying on a singular product or service, Black Diamond Group can adapt more effectively to changing market conditions and economic fluctuations, securing a more resilient business model for the future.

Black Diamond Group's financial performance has been exceptionally strong, showcasing impressive growth. In the fourth quarter of 2024, the company reported a significant 28% increase in revenue and a substantial 43% rise in Adjusted EBITDA, highlighting efficient operations and increasing profitability. This positive momentum carried into the first quarter of 2025, with revenue climbing by another 39%.

Black Diamond Group's strength lies in its substantial contracted future rental revenue, which stood at an impressive $161.6 million as of the first quarter of 2025. This figure represents an 18% surge compared to the same period in the prior year, highlighting robust demand for their services.

This significant backlog of contracted revenue provides exceptional visibility into future earnings and offers a high degree of financial stability. It clearly demonstrates the ongoing and consistent market appetite for Black Diamond Group's modular space solutions and workforce accommodation offerings.

Geographic and Sectoral Diversification

Black Diamond Group's operational footprint spans Canada, the United States, and Australia, a key strength that underpins its business model. This broad geographic presence inherently diversifies risk, insulating the company from the impact of localized economic slowdowns or sector-specific disruptions. For instance, in 2024, the company continued to see robust demand in its Canadian oil and gas services segment while also experiencing growth in its US industrial services.

Furthermore, the company's engagement with a wide array of industries, including oil and gas, mining, construction, education, financial, and government sectors, significantly bolsters its resilience. This sectoral diversification means that a downturn in one industry doesn't cripple the entire organization. As of early 2025, Black Diamond reported that its industrial services segment, which serves a broad base of sectors, was a primary driver of revenue growth, demonstrating the benefit of this varied market exposure.

The advantages of this strategic diversification are evident:

- Reduced Economic Sensitivity: Operates across multiple economies, mitigating the impact of single-region downturns.

- Industry Stability: Serves diverse sectors, preventing over-reliance on any one industry's performance.

- Enhanced Revenue Streams: Multiple geographic and sectoral markets provide varied and consistent income opportunities.

- Mitigated Operational Risk: Spreading operations geographically and across industries lessens the impact of localized operational disruptions.

Innovation in Workforce Solutions (LodgeLink)

Black Diamond Group's LodgeLink platform is a significant strength, acting as a digital marketplace for business-to-business workforce accommodation and travel. This proprietary technology streamlines the booking and management of workforce travel, giving the company a competitive edge. LodgeLink's gross bookings saw a substantial increase of 21% in 2024, underscoring its growing market penetration and client value.

The innovation embodied by LodgeLink provides tangible benefits to clients by simplifying complex logistics. This focus on efficiency and value-added services differentiates Black Diamond Group in the workforce solutions market. Its success in 2024, with a 21% rise in gross bookings, demonstrates the platform's increasing adoption and effectiveness.

- LodgeLink is a proprietary digital marketplace for workforce accommodation and travel.

- It streamlines booking and management, offering a competitive advantage.

- LodgeLink's gross bookings grew by 21% in 2024.

- This platform provides value-added services and simplifies logistics for clients.

Black Diamond Group demonstrates considerable financial strength, evidenced by its significant contracted future rental revenue, which reached $161.6 million in Q1 2025, an 18% year-over-year increase. This robust backlog provides excellent earnings visibility and financial stability, reflecting strong market demand for their modular space and workforce accommodation solutions.

The company's diversified service offerings, including modular building rentals, sales, workforce accommodation, and energy services, create multiple, stable revenue streams. This diversification, particularly the consistent recurring rental income, mitigates risks associated with any single market segment and contributed to a 14% revenue increase in Q1 2024.

Black Diamond Group's operational strength is amplified by its broad geographic footprint across Canada, the United States, and Australia, alongside its engagement with diverse industries like oil and gas, mining, and construction. This spread across regions and sectors reduces susceptibility to localized economic downturns or industry-specific challenges, as seen with growth in both Canadian oil and gas and US industrial services in 2024.

The LodgeLink platform is a key differentiator, acting as a digital marketplace for workforce accommodation and travel. Its proprietary technology streamlines operations, enhancing client value and driving growth, with gross bookings increasing by 21% in 2024, showcasing its effectiveness and market penetration.

| Metric | Q1 2025 | Q1 2024 | Year-over-Year Change |

|---|---|---|---|

| Contracted Future Rental Revenue | $161.6 million | $137.0 million | +18% |

| LodgeLink Gross Bookings | (Not specified for Q1 2025) | (21% increase in 2024) | N/A |

| Total Revenue Growth (Q1 2024) | N/A | +14% | N/A |

What is included in the product

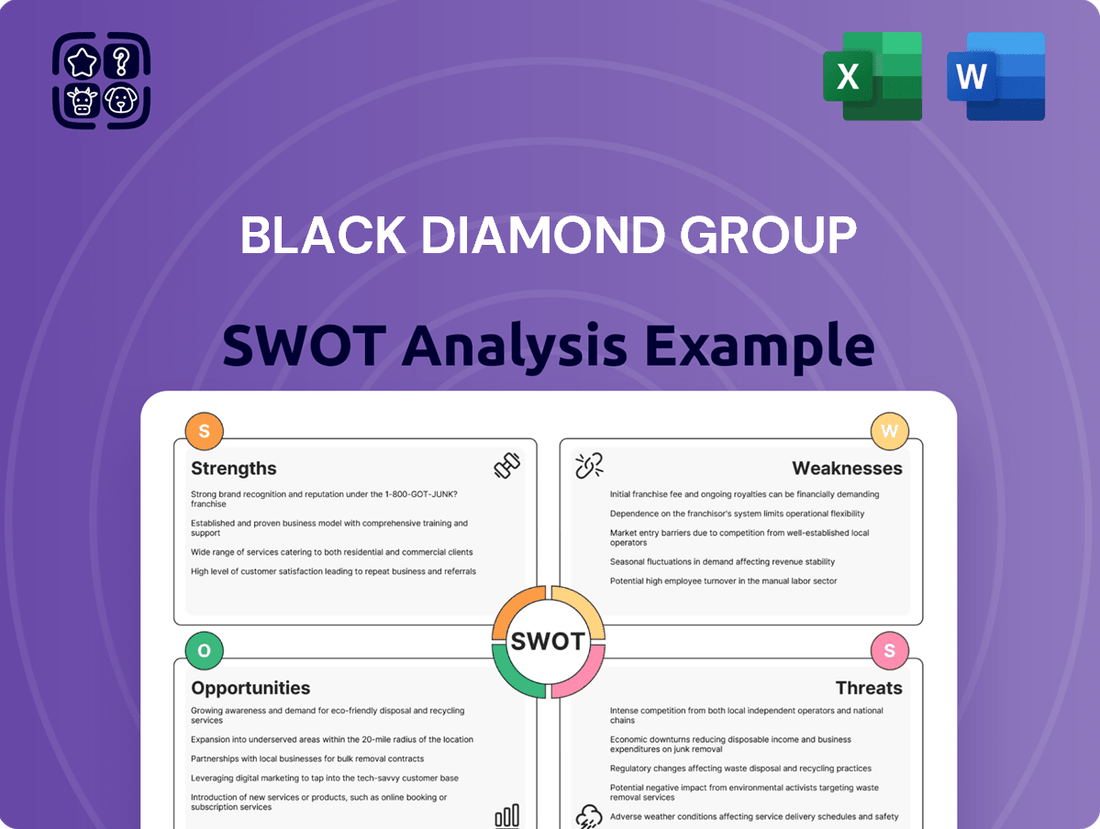

This SWOT analysis outlines Black Diamond Group's strengths, weaknesses, opportunities, and threats, providing a comprehensive view of its strategic position and the factors influencing its success.

Offers a structured framework to pinpoint and address Black Diamond Group's internal weaknesses and external threats, transforming strategic challenges into actionable solutions.

Weaknesses

Black Diamond Group's reliance on sectors like oil and gas and mining creates a vulnerability to economic downturns. When commodity prices dip or major projects conclude, demand for their services can fall sharply. For instance, the Workforce Solutions segment saw a 23% drop in rental revenue during the third quarter of 2024, directly linked to the completion of pipeline projects. This highlights how sensitive their earnings are to the cyclical nature of these core industries.

Black Diamond Group's reliance on a large rental fleet for its modular workspace and accommodation solutions makes it a capital-intensive business. This means significant upfront investment is needed just to operate. For example, in 2024, capital expenditures reached $109.2 million, a substantial 58% jump from the previous year, highlighting the ongoing need for fleet expansion and upkeep.

This high capital requirement can put a strain on the company's cash flow and liquidity. To fund these large purchases and maintenance, Black Diamond Group often needs to secure external financing. This borrowing can impact profitability due to interest expenses, potentially reducing the margins on their services.

Black Diamond Group's impressive revenue growth, reaching 28% for the full year 2024, is unfortunately overshadowed by a concerning 15% decline in net income during the same period. This widening gap suggests a significant profit margin squeeze.

This squeeze is likely attributable to substantial investments made in capital expenditures and crucial ERP system upgrades. While these investments are vital for long-term efficiency and scalability, they appear to be impacting short-term profitability.

The situation highlights potential execution risks for Black Diamond Group as it navigates aggressive growth strategies. The challenge lies in effectively managing these increased costs and ensuring that investments translate into sustainable profitability.

Effectively managing operational costs and optimizing investment returns will be critical for Black Diamond Group to reverse the trend of declining net income despite revenue expansion.

Operational Challenges in Specific Regions

Black Diamond Group's Workforce Solutions segment encountered notable operational headwinds in Australia during the first quarter of 2025. Utilization rates in this key region dipped to 67.2%, falling short of internal projections. This underperformance is attributed to shifts in project timelines, impacting the efficient deployment of the company's assets.

These localized challenges in Australia directly impede the segment's overall growth trajectory and profitability. Addressing these regional underperformance issues requires a strategic focus on optimizing asset allocation and proactively stimulating demand within the Australian market.

- Underutilization in Australia: Workforce Solutions segment utilization at 67.2% in Q1 2025.

- Cause: Project timing mismatches are the primary driver of this underperformance.

- Impact: Hinders overall segment growth and profitability.

- Strategic Need: Requires targeted strategies for asset deployment and demand generation in specific regions.

Potential Impact of Tariffs and Input Costs

Black Diamond Group faces a significant headwind from ongoing macroeconomic uncertainty, particularly concerning global tariffs and trade wars. This situation creates a tangible risk of increased input costs for acquiring new modular assets, which is crucial for fleet expansion and maintenance. For instance, the price of steel, a key component in modular construction, saw a notable increase in early 2024, driven by supply chain disruptions and geopolitical factors. This could directly impact Black Diamond's ability to maintain competitive pricing for its rental services.

The potential for rising input costs directly threatens the company's profitability and its capacity to execute strategic growth plans. If the cost of procuring new modules escalates, it could squeeze profit margins on existing contracts or necessitate higher rental rates, potentially deterring new business. This vulnerability could be exacerbated if competitors are less exposed to these cost pressures or can absorb them more readily. For example, during periods of heightened trade tensions in 2023, some construction material prices saw double-digit percentage increases year-over-year.

- Increased cost of new asset procurement due to tariffs and global trade disputes.

- Potential squeeze on profit margins if higher input costs cannot be fully passed on to customers.

- Risk of reduced competitiveness if pricing strategies are negatively impacted by rising operational expenses.

- Challenges in maintaining fleet modernization and expansion due to escalating capital expenditure requirements.

The company's profitability is being squeezed, with net income declining 15% in 2024 despite 28% revenue growth. This is largely due to significant investments in capital expenditures and crucial ERP system upgrades, which, while important for the future, are impacting current earnings. Managing these increased costs effectively is key to ensuring that investments translate into sustainable profits rather than just short-term growth.

What You See Is What You Get

Black Diamond Group SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis of the Black Diamond Group covers its Strengths, Weaknesses, Opportunities, and Threats. It provides actionable insights to help you understand the company's strategic position. You'll receive the complete, professionally formatted document immediately after purchase.

Opportunities

The market for modular and flexible workspaces is experiencing robust growth, with projections indicating a significant expansion in the coming years. This surge is directly fueled by the widespread adoption of hybrid and remote work arrangements, fundamentally altering how businesses utilize physical space. In 2024, the global modular construction market was valued at approximately USD 120 billion and is expected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, highlighting a strong trend towards adaptable building solutions.

Businesses are actively seeking solutions that offer greater adaptability, cost efficiency, and improved operational effectiveness. Modular buildings, with their inherent flexibility and speed of deployment, directly address these evolving needs. This creates a substantial market opportunity for Black Diamond Group's Modular Space Solutions segment, as companies increasingly prioritize agile and responsive infrastructure to support their changing workforce dynamics.

Black Diamond Group is well-positioned to capitalize on the increasing demand for infrastructure development and government-led projects. For instance, the Canadian federal budget for 2024 announced significant investments in public transit and green infrastructure, expected to stimulate demand for modular solutions and workforce housing. This trend extends globally, with many countries prioritizing disaster recovery and humanitarian aid, creating a consistent need for Black Diamond's rental services.

The LodgeLink digital platform is poised for significant growth, offering opportunities to expand its reach beyond existing operations. By increasing room nights sold, which saw a notable rise in recent periods, and integrating more industries and partners across North America and Australia, LodgeLink can solidify its position as a premier B2B travel tech ecosystem. This expansion directly enhances Black Diamond Group's market standing and creates new revenue streams.

Focus on Sustainability and ESG Practices

The increasing global emphasis on environmental, social, and governance (ESG) factors presents a significant opportunity for Black Diamond Group. There's a palpable surge in market demand for building practices and accommodations that are not only functional but also sustainable and eco-friendly. This trend is driven by both consumer preference and regulatory pressures, pushing companies to adopt more responsible operations.

Black Diamond Group's proactive stance in reducing its emissions intensity and its commitment to incorporating sustainable materials into its projects directly tap into this growing market. By highlighting these efforts, the company can attract a segment of clients who prioritize environmental responsibility. This focus can serve as a key differentiator in a competitive landscape, aligning Black Diamond Group with broader industry movements and corporate social responsibility objectives.

For instance, the global sustainable construction market was valued at approximately USD 281.2 billion in 2023 and is projected to reach USD 869.7 billion by 2033, growing at a CAGR of 11.9% from 2024 to 2033. This substantial growth underscores the commercial viability of ESG-focused strategies. Companies that can demonstrate tangible progress in sustainability are better positioned to secure contracts and build long-term client relationships.

- Growing Client Preference: An increasing number of businesses and organizations are setting their own sustainability targets, making eco-friendly suppliers a preferred choice.

- Enhanced Brand Reputation: Demonstrating a commitment to ESG can significantly bolster Black Diamond Group's brand image and attract talent.

- Regulatory Compliance and Anticipation: Aligning with ESG principles helps ensure compliance with current environmental regulations and prepares the company for future, potentially stricter, mandates.

- Access to Green Financing: Financial institutions are increasingly offering preferential terms for companies with strong ESG credentials, potentially lowering the cost of capital.

Strategic Acquisitions and Organic Fleet Growth

Black Diamond Group's strategy to pursue both organic fleet expansion and targeted acquisitions is a significant opportunity. This dual approach, bolstered by strong liquidity and a robust balance sheet, enables the company to actively grow its asset base and explore new market entries. For instance, in the first quarter of 2024, the company reported a strong financial position, which is crucial for funding these growth initiatives.

This strategic flexibility allows Black Diamond to not only increase its rental revenue potential but also to solidify its market standing.

- Acquisition Potential: The company's financial strength supports the acquisition of complementary businesses or fleets, expanding its reach and service offerings.

- Organic Expansion: Investing in new assets and technologies fuels internal growth, ensuring a modern and competitive fleet.

- Market Consolidation: Strategic moves can lead to greater market share and improved operational efficiencies by integrating acquired entities.

- Revenue Growth: A larger, more diverse asset base directly translates to increased opportunities for rental income.

The growing demand for modular and flexible workspaces, driven by hybrid work trends, presents a significant opportunity. The global modular construction market, valued around USD 120 billion in 2024, is expected to expand, aligning with Black Diamond's Modular Space Solutions segment. Furthermore, government infrastructure projects and a global focus on disaster recovery create a consistent need for Black Diamond's rental services.

Threats

Economic uncertainties and downturns in Black Diamond Group's core markets, such as oil and gas, mining, and construction, pose a significant threat. A slowdown in these sectors, which are often cyclical, can directly reduce demand for the company's modular space and workforce accommodation services.

For instance, a prolonged slump in oil prices, a key driver for the energy sector, could lead to project cancellations or delays, impacting rental revenue. In 2023, global economic growth projections were tempered by inflation and geopolitical instability, highlighting the sensitivity of these industries to broader economic conditions.

A substantial contraction in these commodity-dependent industries could directly translate to lower rental income and diminished overall profitability for Black Diamond Group. This cyclicality means revenue streams are not always stable, requiring careful financial management and diversification strategies.

The modular building and workforce accommodation sector is highly competitive, with many companies actively seeking contracts. This crowded marketplace can create significant pricing pressure, potentially forcing Black Diamond Group to lower rental rates or accept less favorable contract terms. For instance, in 2023, the Canadian modular construction market saw a notable increase in bids for large-scale projects, intensifying competition among established providers and new entrants alike.

Black Diamond Group's reliance on long-term debt exposes it to the volatility of interest rates. An upward trend in rates, as seen in the tightening monetary policy through 2024 and into 2025, directly escalates borrowing expenses. This increase in debt servicing costs can compress profit margins, diminishing the company's overall financial health and operational efficiency.

While the company secured an extended credit facility, the persistence of elevated interest rates throughout 2024 and projected into 2025 poses a significant challenge. These higher costs could strain Black Diamond Group's capacity to finance crucial capital expenditures and support its organic growth strategies, potentially slowing down expansion plans.

Regulatory and Environmental Policy Changes

Changes in government regulations concerning environmental standards, land use, or labor practices within Black Diamond Group's operational sectors present a significant threat. For instance, stricter emissions standards, like those being considered or implemented in various regions impacting the mining and resources sector, could necessitate substantial capital expenditure for compliance.

Compliance with evolving policies, such as new waste disposal regulations or carbon pricing mechanisms, may require significant investments in new technologies or operational overhauls. The cost of adapting to these changes could directly impact profitability. For example, if new environmental reporting requirements are introduced, the Group might need to invest in advanced monitoring systems and personnel to ensure adherence.

- Increased operational costs due to stricter environmental compliance, potentially impacting profit margins.

- Risk of penalties or fines for non-compliance with new or updated regulatory frameworks.

- Need for capital investment in new technologies or processes to meet evolving environmental and labor standards.

- Potential disruption to operations if regulatory changes restrict certain activities or require significant adjustments to business models.

Supply Chain Disruptions and Material Cost Volatility

Black Diamond Group's reliance on procuring materials for its modular units and services presents a significant threat. Disruptions in the global supply chain, which have been a persistent issue in recent years, could lead to increased operational expenses and project delays. For instance, the cost of steel, a key component in modular construction, saw considerable fluctuations in 2024, impacting project budgets across the industry.

Volatility in material costs directly affects Black Diamond Group's profitability. If the company cannot pass these increased costs onto its customers, margins will shrink. This risk is further amplified by the potential impact of global tariffs, which can unpredictably raise the cost of imported materials, further squeezing margins and potentially impacting the competitiveness of their offerings.

- Supply Chain Vulnerability: The company is exposed to global supply chain bottlenecks that can affect the timely delivery of essential materials, potentially delaying project completion.

- Material Cost Fluctuations: Significant swings in the price of key commodities like steel and lumber can directly impact cost of goods sold and overall profitability.

- Tariff Impact: Imposed tariffs on imported goods could increase the cost of raw materials, negatively affecting operational expenses and pricing strategies.

- Project Timeline Delays: Material shortages or cost escalations can lead to extended project timelines, potentially incurring penalties and reducing revenue recognition.

Escalating interest rates throughout 2024 and into 2025 directly increase Black Diamond Group's debt servicing costs, potentially squeezing profit margins and hindering capital expenditures. Furthermore, intense competition within the modular space can lead to pricing pressures, forcing the company to accept less favorable contract terms.

SWOT Analysis Data Sources

This Black Diamond Group SWOT analysis is built upon a robust foundation of diverse data, including detailed financial statements, comprehensive market research reports, and invaluable expert opinions from industry leaders.