Black Diamond Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Diamond Group Bundle

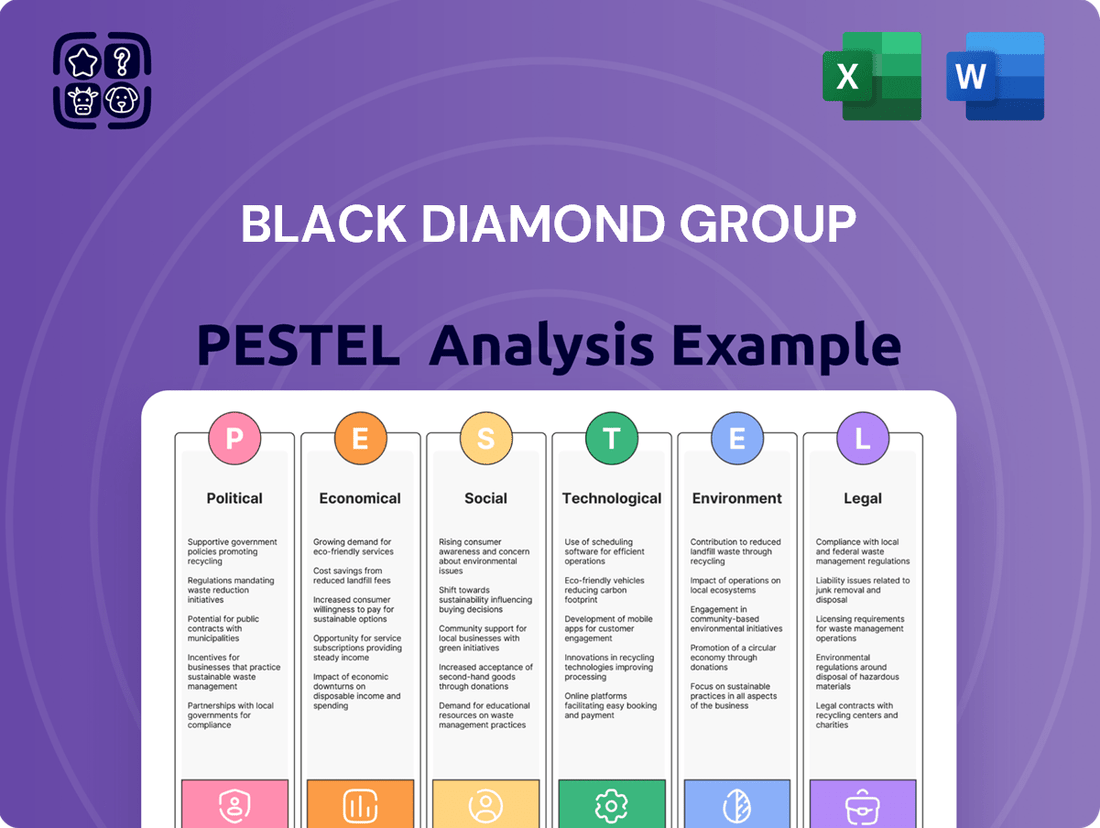

Navigate the complex external landscape affecting Black Diamond Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping their operational environment and future growth. This ready-to-use analysis provides actionable intelligence for strategic planning and competitive advantage.

Gain a critical edge by uncovering the key macro-environmental influences impacting Black Diamond Group. From evolving regulations to shifting consumer behaviors, our PESTLE analysis offers deep insights to inform your investment decisions and business strategies. Don't miss out on this essential market intelligence – download the full version now.

Political factors

Government investment in infrastructure, encompassing public transit, green initiatives, and social projects like affordable housing, directly impacts the demand for Black Diamond Group's modular workspaces and temporary housing. The Canadian federal government has allocated substantial funds, with infrastructure program spending expected to reach a high of $11.3 billion in 2027-28, notably including a new Canada Housing Infrastructure Fund. This ongoing commitment provides a supportive backdrop for the company's various business areas.

Government policies directly shape the operational landscape for Black Diamond Group's core clientele in the oil, gas, and mining sectors. Despite a global shift towards clean energy, Canadian oil and gas drilling activity is projected to reach its highest point in a decade in 2025, indicating sustained demand for essential services like workforce accommodation.

Furthermore, strategic government investment in critical minerals infrastructure, such as the Critical Minerals Infrastructure Fund, is creating new avenues for growth. This fund specifically targets clean energy and transportation projects, which are crucial for unlocking the potential of various mining operations.

Canada's evolving building codes, particularly those focused on environmental performance and energy efficiency, directly impact Black Diamond Group's modular construction designs. For instance, the push towards net-zero carbon goals, intensified in the 2024-2025 period, requires modular buildings to meet increasingly stringent insulation and ventilation standards.

Stricter energy efficiency thresholds and the introduction of mandatory energy reporting mechanisms mean that Black Diamond Group's modular solutions must demonstrably comply with these updated regulations. This regulatory environment is likely to stimulate demand for their more advanced, sustainable modular offerings as clients seek to meet compliance and environmental targets.

Trade Policies and Tariffs

Changes in international trade policies and the potential imposition of tariffs, especially those impacting goods flowing between Canada and the United States, represent a significant political factor for Black Diamond Group. These trade dynamics can directly influence the cost and availability of materials crucial to their operations and client projects within the energy sector. For instance, shifts in trade agreements or the introduction of new tariffs could disrupt established supply chains, leading to increased operational expenses. The U.S. enacted tariffs on certain steel and aluminum products in 2018, which, while not directly targeting energy equipment, created broader economic uncertainty that impacted cross-border business relationships.

The Canadian energy sector's growth trajectory in 2024 and projected into 2025 is sensitive to these cross-border trade relations. Threats of tariffs, even if not directly applied to energy commodities, can create a ripple effect, potentially dampening investment and slowing job creation within the sector. This, in turn, affects the economic climate for Black Diamond Group's clients. For example, a slowdown in U.S. demand for Canadian energy exports due to trade disputes could reduce capital expenditure by energy companies, impacting the demand for Black Diamond's services. Monitoring these evolving trade policies and tariff landscapes is therefore essential for strategic planning and risk mitigation.

- Tariff Impact: Potential tariffs on materials and equipment could increase Black Diamond Group's project costs and affect pricing strategies.

- Supply Chain Vulnerability: Reliance on cross-border supply chains makes the company susceptible to disruptions from new trade policies.

- Economic Climate: Trade disputes can negatively impact the overall economic health of the Canadian energy sector, influencing client investment and project pipelines.

- Job Growth Impact: Tariffs and trade tensions could hinder job growth within the energy sector, affecting the talent pool and market demand for services.

Indigenous Relations and Engagement

Government and corporate emphasis on Indigenous relations is a growing trend, particularly in resource-rich regions where Black Diamond Group (BDG) operates. This focus directly impacts project approvals and community buy-in for BDG's workforce accommodation services. For instance, in 2024, many resource projects across Canada saw increased scrutiny regarding Indigenous consultation and benefit agreements.

BDG's proactive approach to fostering strong Indigenous partnerships is a key strategic advantage. This commitment is often demonstrated through revenue generated from these collaborations, which can significantly smooth the path for operations. In 2023, BDG reported that a notable portion of its revenue streams were linked to projects involving Indigenous communities, underscoring the financial benefits of positive relations.

The company's alignment with government priorities on reconciliation and economic inclusion strengthens its social license to operate. This can translate into more streamlined permitting processes and reduced risks of project delays. BDG's strategy often includes local hiring and procurement from Indigenous businesses, further solidifying these vital relationships and contributing to their operational success.

- Government Focus: Increased regulatory and public pressure on companies to demonstrate meaningful Indigenous engagement in 2024.

- BDG's Strategy: Prioritizing Indigenous partnerships as a core component of business development and operational planning.

- Financial Impact: Significant revenue generation from Indigenous partnerships, as observed in BDG's 2023 financial reporting.

- Operational Benefits: Enhanced project approvals and community support in resource development areas due to strong Indigenous relations.

Government infrastructure spending, including the Canada Housing Infrastructure Fund, bolsters demand for Black Diamond Group's modular solutions, with significant allocations expected through 2027-28.

Policies supporting the oil and gas sector, even amidst clean energy transitions, sustain demand for workforce accommodation, as Canadian drilling activity is projected to reach a decade high in 2025.

Strategic investments in critical minerals infrastructure further open new growth avenues for the company.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting the Black Diamond Group, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by identifying key trends, threats, and opportunities relevant to the Black Diamond Group's operational landscape.

A concise PESTLE analysis for Black Diamond Group, highlighting external factors that can be leveraged to proactively address potential challenges and capitalize on emerging opportunities.

Economic factors

Fluctuations in global commodity prices, especially for oil, natural gas, and minerals, significantly impact investment in the energy and mining sectors. These sectors are key markets for Black Diamond Group. For instance, oil prices in early 2025 have shown volatility, with Brent crude trading around $80 per barrel, influencing client spending on essential services.

Looking ahead to 2025, projections suggest an uptick in Canadian oil sands production and a rise in drilling activity. This trend is expected to lead to sustained capital expenditures by Black Diamond Group's clients, thereby boosting demand for their modular workspace and accommodation solutions.

Black Diamond Group's performance is closely tied to overall economic expansion and the vitality of the construction sector. Robust economic growth typically fuels demand for new infrastructure and commercial spaces, directly benefiting companies like Black Diamond that provide modular building solutions.

The modular construction market itself is on an upward trajectory, with forecasts suggesting a significant increase. Projections show the market expanding from an estimated $101.67 billion in 2024 to $108.6 billion by 2025. This growth is largely propelled by increasing urbanization and a widespread need for faster, more economical construction methods.

These favorable market dynamics create a positive environment for both Black Diamond's rental and sales operations. As more projects commence and require efficient space solutions, the demand for their modular units is expected to rise, underpinning their revenue streams.

Fluctuations in interest rates directly impact Black Diamond Group's cost of capital for fleet expansion and influence the financing options available to its clients. For instance, if the Federal Reserve raised its benchmark interest rate in late 2024 or early 2025, borrowing costs would likely increase for companies like Black Diamond.

While precise figures on Black Diamond's borrowing cost changes weren't publicly disclosed, the company’s robust financial health, as evidenced by its consistent profitability and a share buyback program initiated in 2023, indicates adept capital management. This suggests they can likely navigate periods of rising rates more effectively than less financially sound competitors.

Inflation and Operational Costs

Inflationary pressures are a significant concern for Black Diamond Group, directly impacting operational costs. Rising prices for raw materials, skilled labor, and crucial transportation services can squeeze profit margins. For instance, global inflation rates, which saw an average of 5.9% in 2023 according to the IMF, continue to pose challenges in managing expenses for construction and accommodation sectors, key areas for Black Diamond.

Effectively managing these escalating costs is paramount to preserving profitability for Black Diamond Group. As demand for their services in construction and accommodation is projected to remain robust, maintaining healthy margins hinges on strategic cost control. This involves optimizing supply chains and exploring efficiencies in labor and logistics.

- Increased Material Costs: Global commodity prices, a key input for construction, have shown volatility. For example, lumber prices, while fluctuating, remain a significant cost factor compared to pre-pandemic levels.

- Rising Labor Expenses: Wage inflation, driven by labor shortages in skilled trades, directly adds to Black Diamond's payroll expenses. In many developed economies, wage growth has outpaced inflation in recent years.

- Elevated Transportation and Fuel Costs: The cost of moving materials and personnel is directly tied to energy prices. Fluctuations in oil and gas markets, which saw Brent crude averaging around $82 per barrel in 2023, directly impact logistical expenditures.

- Supply Chain Disruptions: Lingering effects of global supply chain issues can further inflate costs due to lead times and the need for alternative, potentially more expensive, sourcing.

Demand for Workforce Accommodation

The demand for workforce accommodation is a key economic driver for Black Diamond Group's Workforce Solutions business. This demand is closely tied to activity in sectors like construction, oil and gas, and mining, which often require housing for a mobile workforce.

The global market for workforce housing modular solutions is expected to grow substantially, reaching an estimated $13.9 billion by 2033. This growth is fueled by the need for quick and economical housing options for workers on temporary assignments.

North America represents a significant portion of this market. The region's ongoing industrial projects and resource extraction activities directly influence the need for modular workforce accommodations.

- Market Growth: Global workforce housing modular market projected to hit $13.9 billion by 2033.

- Key Drivers: Need for rapid, cost-effective housing for transient workers.

- Sector Reliance: Demand is strongest in construction, oil & gas, and mining.

- Geographic Focus: North America is a particularly strong market.

Economic expansion directly fuels Black Diamond Group's revenue, as growth in construction and resource sectors increases demand for their modular solutions. Projections for 2025 indicate continued capital expenditures in Canadian oil sands, a positive sign for client spending on essential services provided by Black Diamond.

Interest rate movements impact Black Diamond's capital costs and client financing. While specific rate impacts on the company are not detailed, their strong financial health suggests resilience. Inflationary pressures, however, remain a key challenge, raising operational costs for raw materials, labor, and transportation, with global inflation averaging 5.9% in 2023.

| Economic Factor | Impact on Black Diamond Group | Relevant Data (2024-2025) |

|---|---|---|

| Economic Growth & Sector Vitality | Drives demand for modular construction and accommodation. | Modular construction market projected to grow from $101.67 billion (2024) to $108.6 billion (2025). |

| Commodity Prices (Oil & Gas) | Influences client spending and operational costs. | Brent crude prices volatile, trading around $80/barrel in early 2025. |

| Interest Rates | Affects cost of capital and client financing. | Potential for Federal Reserve rate hikes in late 2024/early 2025. |

| Inflation | Increases operational expenses (materials, labor, transport). | IMF reported average global inflation of 5.9% in 2023, posing ongoing cost management challenges. |

Full Version Awaits

Black Diamond Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Black Diamond Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning. You'll find a detailed breakdown of each element, offering a clear understanding of the external forces shaping Black Diamond Group's business environment.

Sociological factors

Rapid urbanization and a growing global population are fueling a substantial demand for infrastructure that is not only quick to deploy but also cost-effective and adaptable. This trend directly benefits companies like Black Diamond Group, which specialize in modular construction solutions. The need for efficient building methods is paramount as cities expand and populations swell.

By 2050, it's projected that more than two-thirds of the world's inhabitants will reside in urban areas. This demographic shift underscores the critical importance of innovative and scalable building solutions. Black Diamond Group's modular approach is well-positioned to address the infrastructure challenges presented by this significant urbanization, offering a more streamlined and responsive method for development.

Workforce mobility is a defining characteristic of industries like construction, oil, gas, and mining, creating a consistent demand for flexible accommodation. Black Diamond Group’s focus on these sectors, offering workforce accommodation and the LodgeLink platform, directly addresses this trend by simplifying travel and lodging for nomadic workers.

The shift towards remote and hybrid work models, accelerated by events in recent years, also impacts workforce mobility, though perhaps differently. While some roles become more location-agnostic, the essential nature of on-site work in Black Diamond Group’s core industries ensures continued need for specialized accommodation solutions, with over 60% of workers in these sectors still requiring physical presence.

In 2024, North American workforce accommodation providers saw occupancy rates generally above 70%, a testament to the ongoing need for housing transient workers. Black Diamond Group’s strategic positioning within these project-driven markets, coupled with its digital platform, aligns it to benefit from this persistent demand for efficient lodging management.

Black Diamond Group, through its work with clients in resource-intensive industries, faces increasing scrutiny regarding its social license to operate. This means demonstrating to communities and stakeholders that its operations are beneficial and responsible. In 2024, for instance, major resource projects across Canada saw significant delays or outright cancellations due to community opposition, highlighting the tangible financial risks of neglecting social engagement.

Effective community engagement, particularly with Indigenous groups, is crucial for Black Diamond Group's clients to gain project approvals and maintain operational continuity. In 2025, reports indicate that companies with strong Indigenous partnership agreements experienced smoother project development timelines and reduced regulatory hurdles. This proactive approach not only bolsters a company's reputation but also fosters long-term relationships essential for sustainable business in the evolving landscape of responsible corporate citizenship.

Demand for Affordable Housing

The global push for affordable housing, particularly in bustling cities and areas with high demand, is a major force boosting the modular construction sector. Black Diamond Group is well-positioned to address the critical need for more housing options. For instance, in 2024, the global affordable housing market was valued at approximately USD 700 billion, with projections indicating continued growth driven by urbanization and economic development.

Modular construction provides a quicker, less expensive, and more sustainable approach compared to conventional building techniques. This makes it an attractive solution for governments and developers aiming to alleviate housing shortages. In the UK alone, the government has set targets to deliver 300,000 new homes annually, with modular solutions expected to play a significant role in meeting these goals by 2025.

- Growing Urbanization: By 2050, it's estimated that 68% of the world's population will reside in urban areas, increasing pressure on existing housing infrastructure and driving demand for efficient construction methods.

- Cost-Effectiveness: Modular construction can reduce building costs by up to 20% compared to traditional methods, a crucial factor for the affordable housing segment.

- Speed of Delivery: Projects can be completed up to 50% faster with modular construction, allowing for quicker deployment of much-needed housing units.

- Sustainability Benefits: Reduced waste and improved energy efficiency in modular homes align with increasing environmental consciousness and regulatory demands.

Worker Well-being and Quality of Life

There's a growing emphasis on ensuring remote and transient workers have a good quality of life and feel well-supported. This isn't just a nice-to-have; it's becoming a key factor for businesses needing skilled workers.

Companies are realizing that offering comfortable, safe, and well-maintained accommodations is vital for attracting and keeping talented employees, especially in sectors relying on a mobile workforce. This directly impacts the demand for specialized accommodation providers like Black Diamond Group.

For instance, in 2024, the labor shortage in sectors like mining and construction, which heavily utilize transient workforces, continued to be a significant challenge. Reports from industry bodies indicated that improved worker welfare, including accommodation, was cited by over 60% of surveyed companies as a critical factor in recruitment and retention efforts. This trend is projected to intensify through 2025 as competition for skilled labor remains fierce.

- Worker well-being is a key recruitment driver.

- Demand for quality accommodation is linked to labor retention.

- Businesses increasingly view accommodation as a strategic advantage.

- Societal expectations for worker welfare are rising.

Societal expectations regarding responsible business practices are increasingly influencing demand for companies that prioritize community engagement and ethical operations. Black Diamond Group's clients, particularly in resource sectors, must demonstrate a strong social license to operate, a factor that can impact project timelines and financial viability, with notable delays in 2024 due to community opposition.

The growing emphasis on worker well-being is a significant sociological driver, directly impacting the demand for quality accommodation solutions. Companies recognize that providing comfortable and supportive living arrangements is crucial for attracting and retaining skilled labor in industries reliant on mobile workforces, with over 60% of companies in 2024 citing accommodation as key to recruitment.

The global push for affordable housing, fueled by rapid urbanization, presents a substantial market opportunity for modular construction. Black Diamond Group is positioned to benefit from this trend, as modular solutions offer cost-effectiveness and speed, aligning with governmental targets and market valuations, such as the USD 700 billion global affordable housing market in 2024.

| Sociological Factor | Impact on Black Diamond Group | Relevant Data/Trend |

|---|---|---|

| Urbanization & Housing Demand | Increases need for efficient construction solutions | 68% of global population to live in urban areas by 2050 |

| Worker Welfare Expectations | Drives demand for quality workforce accommodation | 60%+ companies cite accommodation as critical for recruitment (2024) |

| Social License to Operate | Requires clients to demonstrate community responsibility | Project delays in 2024 due to community opposition |

| Affordable Housing Initiatives | Creates market opportunities for modular building | USD 700 billion global affordable housing market (2024) |

Technological factors

Technological leaps in modular construction, including refined manufacturing, innovative materials, and digital design software, are significantly boosting efficiency, quality, and eco-friendliness. These improvements translate to quicker project timelines, less material waste, and superior building performance, making modular options a stronger contender against conventional building methods. For instance, advancements in prefabrication have been shown to reduce construction waste by up to 90% compared to traditional on-site building.

The adoption of Building Information Modeling (BIM) and other digital tools is streamlining the design and planning phases, allowing for greater precision and fewer errors. This digital integration not only speeds up the construction process but also enhances the final product's structural integrity and energy efficiency, contributing to lower long-term operational costs. The global modular construction market was valued at approximately $100 billion in 2023 and is projected to reach over $150 billion by 2028, underscoring the impact of these technological drivers.

Smart building technologies, such as advanced insulation and automated energy management, are revolutionizing operational efficiency. Black Diamond Group can integrate these systems into their modular units, leading to significant reductions in utility consumption for clients. For instance, smart HVAC systems can optimize energy use based on occupancy and external conditions, potentially cutting energy bills by 15-20% in commercial buildings.

Remote monitoring capabilities offer real-time insights into building performance, allowing for proactive maintenance and further efficiency gains. This technological advancement supports Black Diamond Group's commitment to environmental sustainability by minimizing waste and carbon footprint. The global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, indicating strong client demand for these features.

The construction industry is rapidly embracing digitalization, which is fundamentally changing how projects are managed and how logistics, especially for modular solutions, are handled. This shift is driven by the need for greater efficiency and transparency.

Black Diamond Group's LodgeLink platform is a prime example of this technological evolution. It acts as a digital marketplace specifically for workforce travel and accommodation needs. This platform streamlines the entire process, from initial booking and ongoing management to final payment, making it significantly easier for companies to manage their remote workforce logistics.

By digitizing these critical functions, LodgeLink enhances operational efficiency for Black Diamond Group's clients. For instance, in 2023, the platform facilitated millions of bookings, demonstrating its scalable impact. This digital approach reduces administrative burdens and improves the overall experience for both the service providers and the end-users.

The ongoing digitalization trend in project management and logistics is expected to continue driving innovation in the modular construction sector. This includes the adoption of AI for predictive logistics and advanced data analytics for optimizing resource allocation, further enhancing efficiency and cost-effectiveness.

Sustainable Materials Innovation

The construction sector is increasingly embracing innovative, sustainable materials. This includes advancements in low-carbon concrete, green steel, and bio-based alternatives, driving a significant shift towards environmental responsibility.

Black Diamond Group can leverage these developments by integrating them into their modular construction projects. This strategy not only helps reduce the embodied carbon footprint but also addresses the growing pressure from regulatory bodies and clients for greener building practices.

- Growing Market Demand: The global green building materials market was valued at approximately USD 250 billion in 2023 and is projected to grow significantly, with projections reaching over USD 500 billion by 2030, indicating strong client and regulatory push.

- Carbon Reduction Potential: Utilizing materials like low-carbon concrete can reduce construction-related CO2 emissions by up to 40% compared to traditional concrete.

- Supply Chain Evolution: Companies are investing heavily in R&D for sustainable materials; for example, major steel producers are aiming for net-zero emissions by 2050, impacting the availability and cost of green steel.

- Regulatory Tailwinds: Many governments are introducing stricter building codes and incentives for sustainable construction, such as the EU's Green Deal, which will likely accelerate the adoption of these materials.

Automation in Manufacturing

Automation is significantly reshaping the manufacturing landscape for modular units, directly impacting companies like Black Diamond Group. This technological shift enhances production by increasing precision and accelerating output timelines. For instance, advancements in robotic assembly and automated quality control systems can reduce manufacturing defects by up to 30% in high-volume production environments.

The industrialization of prefabrication, driven by automation, enables the mass production of high-quality modular components. This scalability and cost-effectiveness are crucial for Black Diamond Group's growth strategy. By leveraging automated processes, manufacturers can achieve economies of scale, potentially lowering the per-unit cost of modular buildings by 15-20% compared to traditional construction methods. This efficiency translates to competitive pricing and improved profit margins.

- Increased Precision: Automated systems minimize human error, leading to more consistent and higher-quality modular components.

- Faster Production Cycles: Robotics and automated workflows can significantly reduce the time required to manufacture modular units, boosting throughput.

- Labor Cost Optimization: While requiring initial investment, automation can lead to reduced reliance on manual labor for repetitive tasks, potentially lowering long-term operational expenses.

- Enhanced Scalability: The ability to mass-produce standardized, high-quality components through automation allows companies to scale their operations more effectively to meet growing market demand.

Technological advancements in modular construction are driving efficiency and quality, with innovations in materials and digital design reducing waste by up to 90%. Building Information Modeling (BIM) and digital tools streamline planning, cutting errors and boosting energy efficiency, supporting a modular market projected to exceed $150 billion by 2028.

Smart building technologies, including advanced insulation and automated energy management, are enhancing operational efficiency, with smart HVAC systems potentially cutting energy bills by 15-20%. Remote monitoring capabilities further support proactive maintenance and environmental sustainability, in a smart building market expected to surpass $200 billion by 2030.

The digitalization of project management and logistics, exemplified by Black Diamond Group's LodgeLink platform, is transforming workforce travel and accommodation management. This digital shift enhances efficiency and transparency, with AI and data analytics poised to further optimize logistics in modular construction.

Automation is significantly reshaping modular unit manufacturing, increasing precision and speeding up production timelines, with robotic assembly potentially reducing defects by up to 30%. This industrialization drives scalability and cost-effectiveness, with automation potentially lowering per-unit costs by 15-20%.

Legal factors

Black Diamond Group’s modular building operations are significantly shaped by stringent building and construction codes, which are regularly updated to reflect evolving safety and performance expectations. These regulations dictate everything from the fundamental design and structural integrity of their units to the precise methods of installation, ensuring adherence to national and provincial standards.

Compliance is non-negotiable; for Black Diamond Group’s modular solutions to gain approval and be deployed, they must meet all relevant codes. This includes increasingly rigorous energy performance criteria, which in 2024 and 2025 are pushing for greater efficiency in building envelopes and HVAC systems, as well as comprehensive accessibility standards mandated for public and commercial spaces.

Environmental regulations, particularly those concerning greenhouse gas emissions, waste disposal, and energy efficiency, directly influence Black Diamond Group's operational strategies and the design of its products. Canada's evolving environmental legislation is strengthening its commitment to building environmental performance, introducing more rigorous standards for both new construction projects and retrofits.

This legislative push mandates more sustainable practices across the modular construction sector, which is Black Diamond Group's core business. For instance, upcoming federal regulations aiming to reduce building emissions by 2030, targeting a 38% reduction from 2005 levels, will necessitate greater adoption of energy-efficient materials and construction methods by companies like Black Diamond Group.

Labor laws and regulations significantly shape Black Diamond Group's operations, particularly concerning worker safety, living conditions, and employment standards in their remote camp services. For instance, in Australia, the Fair Work Act 2009 sets out minimum employment conditions, and specific state-based legislation often dictates accommodation and safety standards for remote work sites, impacting Black Diamond's compliance costs and operational flexibility.

Ensuring adherence to these frameworks is paramount for Black Diamond Group. In 2023, the Australian government continued to focus on improving working conditions in remote areas, with ongoing reviews of industrial relations and safety legislation, directly influencing the requirements for workforce accommodation providers in sectors like mining and construction.

Black Diamond's commitment to high accommodation standards, often exceeding minimum legal requirements, can be a competitive advantage. For example, robust safety protocols and comfortable living conditions contribute to higher worker retention and productivity, which is particularly valued in industries facing labor shortages, a trend observed in the Australian resources sector throughout 2024.

Land Use and Zoning Regulations

Land use and zoning regulations are critical for Black Diamond Group, directly influencing where and for how long their modular buildings and workforce accommodations can be utilized. Navigating these diverse municipal and regional bylaws is essential, as variations can significantly impact project feasibility and deployment timelines. For instance, many jurisdictions have specific zoning ordinances that dictate the types of structures permitted in certain areas, including restrictions on temporary or modular housing.

The ability to deploy workforce accommodations, particularly in remote or developing areas, hinges on understanding and complying with local zoning laws. These regulations can govern everything from setback requirements and building heights to the duration of temporary structures. In 2024, there's a growing trend of municipalities reviewing and updating their zoning codes to accommodate flexible housing solutions, but this process can be lengthy and unpredictable.

- Zoning Restrictions: Many areas have strict rules against non-permanent or modular structures in residential or commercial zones, impacting site selection.

- Permitting Timelines: Obtaining necessary land use and zoning permits can take months, adding significant lead time to projects.

- Temporary Use Clauses: Some regulations allow for temporary accommodations but impose limits on how long they can remain, requiring careful planning for project lifecycles.

- Community Input: Public hearings and community feedback are often part of the zoning approval process, which can introduce further delays or modifications.

Contract Law and Liability

Contract law is foundational for Black Diamond Group, governing everything from renting modular units to their sale, installation, and ongoing maintenance. Ensuring these contracts are robust and clearly define terms, responsibilities, and payment schedules is paramount to avoiding disputes. For instance, in 2024, the construction sector, which Black Diamond Group operates within, saw a significant number of contract disputes, highlighting the importance of meticulous legal drafting.

Managing liability effectively is equally critical. Black Diamond Group must consider potential liabilities arising from faulty installations, accidents on-site, or product defects. Industry standards and regulatory compliance, such as those related to workplace safety, directly impact liability exposure. Companies in the modular construction space are increasingly focused on comprehensive insurance and indemnification clauses to protect against unforeseen legal challenges.

- Contractual Clarity: Black Diamond Group must ensure all agreements for rental, sale, installation, and maintenance are legally sound and explicitly detail scope of work, timelines, and payment terms to prevent misunderstandings.

- Liability Mitigation: Proactive management of potential liabilities, including those related to safety, product quality, and performance, is essential to protect the company's assets and reputation.

- Regulatory Compliance: Adherence to all relevant building codes, safety regulations, and environmental laws is non-negotiable and directly impacts contractual enforceability and liability exposure.

- Dispute Resolution: Establishing clear mechanisms for dispute resolution within contracts can help Black Diamond Group manage and resolve disagreements efficiently, minimizing legal costs and operational disruptions.

Legal frameworks governing construction, environmental impact, and labor are critical for Black Diamond Group. Compliance with building codes, such as Canada's National Building Code, ensures structural integrity and safety, with ongoing updates in 2024 and 2025 emphasizing energy efficiency and accessibility. Environmental regulations, including those aimed at reducing greenhouse gas emissions by 38% from 2005 levels by 2030, influence material choices and construction methods.

Labor laws in regions like Australia, such as the Fair Work Act 2009, dictate employment standards and safety in remote workforces, impacting operational costs and worker retention. Land use and zoning regulations present challenges, with varying municipal bylaws affecting site selection and deployment timelines for modular units. Contract law underpins all transactions, requiring clarity in terms, liability management, and dispute resolution to prevent legal challenges, especially given the rise in contract disputes observed in the construction sector in 2024.

Environmental factors

Canada's ambitious target of achieving net-zero carbon emissions by 2050, alongside initiatives like the Canada Green Buildings Strategy, significantly shapes the market for companies like Black Diamond Group. These policies directly encourage the adoption of sustainable building materials and practices, aiming to lower the environmental footprint of the construction sector.

These governmental pushes create a clear demand for products and services that contribute to greenhouse gas emission reductions. For Black Diamond Group, this translates into opportunities and strategic imperatives to innovate in developing low-carbon construction solutions and to integrate sustainable practices throughout their operations.

The financial implications are substantial. For instance, the federal government's investment in green infrastructure, projected to be in the tens of billions of dollars through various programs, signals a strong market pull for environmentally conscious building materials and technologies, which Black Diamond Group can leverage.

Demand for sustainable building materials and practices is a significant environmental factor influencing companies like Black Diamond Group. There's a clear market trend towards construction methods that lessen environmental impact. For instance, the global green building materials market was valued at approximately USD 251.8 billion in 2022 and is projected to reach USD 495.9 billion by 2030, growing at a CAGR of 8.9%.

Modular construction, a key area for Black Diamond Group, inherently aligns with these sustainability demands. It typically reduces material waste by up to 30% compared to traditional on-site construction. Furthermore, integrating recycled materials and embracing circular economy principles are becoming essential for companies aiming to meet environmental, social, and governance (ESG) expectations. This shift directly impacts material sourcing and operational strategies for firms in the modular building sector.

The push for energy efficiency in buildings is a major environmental consideration, with governments worldwide implementing stricter performance standards. Black Diamond Group can leverage this by designing modular units with advanced insulation and high-efficiency HVAC systems. For instance, in 2023, the global energy efficiency market was valued at approximately USD 320 billion, showcasing significant demand for sustainable solutions.

Integrating renewable energy sources, such as solar panels, into Black Diamond Group's modular offerings presents a strategic opportunity. This not only reduces operational costs for end-users but also significantly lowers the carbon footprint of the units, aligning with corporate sustainability goals. By 2025, it's projected that renewable energy will account for a substantial portion of new power capacity additions globally, driven by climate change mitigation efforts.

Waste Management and Recycling in Construction

Environmental concerns are pushing the construction industry toward better waste management. This means more focus on reducing, reusing, and recycling materials. For Black Diamond Group, staying ahead of these trends is crucial.

Modular construction offers a significant advantage here. Because it’s done in a factory, waste is much lower compared to traditional on-site building. This approach aligns perfectly with the growing movement towards a circular economy, where resources are kept in use for as long as possible.

The UK government, for instance, has set ambitious targets. By 2030, they aim to reduce construction and demolition waste by 50%. This regulatory push makes sustainable practices like those offered by modular construction increasingly attractive for companies like Black Diamond Group.

- Reduced Waste: Modular construction can cut on-site waste by up to 90% compared to traditional methods.

- Circular Economy Alignment: Factory-controlled environments facilitate material segregation and reuse, supporting circular economy principles.

- Regulatory Compliance: Growing environmental regulations, like the UK's 2030 waste reduction targets, favor sustainable building solutions.

- Cost Savings: Efficient material use and reduced waste disposal fees can lead to significant cost efficiencies for construction projects.

Site Impact and Remediation

Environmental regulations are increasingly stringent, particularly concerning temporary structures and their impact on sensitive environments like those found in the resource extraction sector. Black Diamond Group’s modular and relocatable solutions can offer a significant advantage by minimizing land disturbance and the need for extensive site remediation post-use. For instance, the company’s focus on rapid deployment and removal reduces the footprint left behind, aligning with evolving environmental stewardship expectations. This approach directly addresses concerns about soil disruption and habitat impact, crucial for clients operating in ecologically sensitive regions.

The ability to offer easily relocatable or temporary structures can translate into substantial cost savings for clients by reducing end-of-lease remediation liabilities. Black Diamond Group’s modular designs facilitate efficient disassembly and transport, minimizing waste and the environmental impact associated with demolition and disposal. This operational efficiency is a key selling point, especially as companies face growing pressure to demonstrate sustainable practices. In 2024, many resource companies are actively seeking partners who can help them achieve their ESG (Environmental, Social, and Governance) targets, making Black Diamond’s offering highly relevant.

Key environmental considerations for Black Diamond Group include:

- Minimizing land disturbance: Modular designs reduce the permanent footprint on project sites.

- Facilitating site remediation: Ease of relocation simplifies the process of returning sites to their original or improved state.

- Reducing waste generation: Reusable and relocatable components lessen the need for new materials and disposal.

- Compliance with environmental standards: Adherence to regulations concerning noise, emissions, and waste management during deployment and operation.

Growing environmental awareness and regulatory pressure are fundamentally reshaping the construction industry. Companies like Black Diamond Group are increasingly expected to demonstrate a commitment to sustainability, impacting everything from material sourcing to waste management. This shift is driven by global initiatives aimed at reducing carbon footprints and promoting a circular economy, making environmentally conscious practices a key competitive differentiator.

The demand for green building solutions is robust. By 2025, the global green building materials market is projected to exceed USD 300 billion, reflecting a significant market opportunity for companies that can offer sustainable alternatives. Modular construction, a core offering of Black Diamond Group, inherently supports these trends by minimizing waste—often reducing it by up to 90% compared to traditional methods.

Governmental policies are actively promoting sustainability within the construction sector. Canada's net-zero by 2050 target, for example, incentivizes low-carbon building materials and practices. This creates a favorable market for companies like Black Diamond Group that can provide energy-efficient modular units and adopt circular economy principles in their operations. The federal investment in green infrastructure, projected in the tens of billions of dollars, further underscores this market pull.

Resource extraction clients are increasingly prioritizing ESG (Environmental, Social, and Governance) performance, seeking partners who can minimize environmental impact. Black Diamond Group's modular and relocatable solutions are well-suited to this need, as they reduce land disturbance and facilitate easier site remediation. This focus on minimizing ecological footprints is crucial for companies operating in sensitive environments.

| Environmental Factor | Impact on Black Diamond Group | Key Data/Trend |

| Demand for Green Building | Increased demand for sustainable materials and energy-efficient designs. | Global green building materials market projected to reach USD 495.9 billion by 2030 (CAGR 8.9%). |

| Waste Reduction & Circular Economy | Opportunity to leverage modular construction's inherent waste reduction capabilities. | Modular construction can reduce on-site waste by up to 90%. UK aims to reduce construction waste by 50% by 2030. |

| Energy Efficiency Standards | Advantage in offering modular units with high-performance insulation and HVAC. | Global energy efficiency market valued at approx. USD 320 billion in 2023. |

| Environmental Regulations & Site Impact | Benefit from offering solutions that minimize land disturbance and ease site remediation. | Resource companies increasingly seek partners aligned with ESG targets in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis draws on a diverse range of data sources, including reports from leading financial institutions like the IMF and World Bank, as well as government publications and reputable industry-specific research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the market.