BigBear.ai Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BigBear.ai Bundle

BigBear.ai operates in a dynamic market where understanding the competitive landscape is crucial. Our Porter's Five Forces analysis reveals significant pressures from buyer bargaining power and the threat of substitutes, potentially impacting BigBear.ai's pricing and market share.

The complete report reveals the real forces shaping BigBear.ai’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BigBear.ai's reliance on foundational AI technologies, cloud infrastructure, and specialized hardware places it at the mercy of a few key technology providers. The significant market concentration among major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which together accounted for approximately 65% of the global cloud infrastructure market in 2023, grants them considerable bargaining power. This dominance means BigBear.ai has limited alternatives for essential hosting and core services, potentially leading to increased costs and less favorable terms.

The demand for AI and automation expertise is soaring, creating a significant talent deficit. This scarcity empowers skilled AI engineers and data scientists, allowing them to command higher salaries and better benefits, which directly impacts companies like BigBear.ai by increasing labor costs.

Suppliers of highly specialized or proprietary AI models and algorithms can wield considerable influence if BigBear.ai's core offerings are deeply reliant on these unique, hard-to-replicate components. The intricate development of cutting-edge AI often necessitates specific expertise and protected intellectual property, making alternatives scarce.

Data Providers and Integrators

BigBear.ai's reliance on data makes data providers significant. For instance, in 2024, the global data integration market was valued at approximately $12.3 billion, indicating a substantial ecosystem of suppliers.

The bargaining power of these suppliers hinges on the uniqueness and exclusivity of their data or integration capabilities. If BigBear.ai requires highly specialized datasets that few providers offer, those suppliers gain considerable leverage.

- Data Uniqueness: Suppliers offering proprietary or hard-to-acquire datasets can command higher prices.

- Integration Complexity: Providers with specialized data integration expertise for complex systems hold more sway.

- Market Concentration: If only a few providers offer essential data, their bargaining power increases.

Switching Costs for Core Infrastructure

BigBear.ai's reliance on cloud services for its core infrastructure, while offering flexibility, also introduces significant switching costs. Moving between major cloud providers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) isn't a simple matter of changing a subscription. It often involves substantial expense and effort in migrating vast amounts of data, which can take considerable time and resources.

The complexities extend to re-architecting existing solutions to be compatible with a new cloud environment and retraining personnel on different platforms and services. These hurdles create a degree of vendor lock-in, effectively increasing the bargaining power of the current cloud infrastructure suppliers. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, highlighting the immense scale and investment involved in these platforms.

- Data Migration Costs: Moving large datasets can incur significant bandwidth, storage, and labor expenses.

- Re-architecting Complexity: Adapting BigBear.ai's proprietary AI solutions to a new cloud stack requires substantial engineering effort.

- Personnel Retraining: Employees need to acquire new skills for operating and managing services on a different cloud platform.

- Vendor Lock-in: The cumulative effort and cost of switching make it challenging to change providers, strengthening supplier leverage.

BigBear.ai's suppliers, particularly those providing foundational AI technologies, cloud infrastructure, and specialized data, possess significant bargaining power. This leverage stems from market concentration, the uniqueness of offerings, and the high costs associated with switching providers, impacting BigBear.ai's operational flexibility and cost structure.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on BigBear.ai |

|---|---|---|

| Cloud Infrastructure (AWS, Azure, GCP) | Market concentration (65% market share in 2023), high switching costs, vendor lock-in | Increased costs, limited alternatives, potential service disruptions |

| Specialized AI Models/Algorithms | Uniqueness, proprietary nature, scarcity of alternatives | Higher licensing fees, dependence on specific providers |

| Data Providers | Data uniqueness, integration complexity, market concentration | Increased data acquisition costs, potential limitations in data scope |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to BigBear.ai's AI-powered decision intelligence sector.

Instantly identify and mitigate competitive threats with a dynamic, easy-to-understand visualization of BigBear.ai's Porter's Five Forces analysis.

Customers Bargaining Power

BigBear.ai's reliance on U.S. defense and intelligence agencies for a substantial portion of its revenue highlights the significant bargaining power held by these government clients. In 2023, approximately 60% of BigBear.ai's revenue was derived from government contracts, underscoring this concentration.

The intricate and often protracted nature of government procurement processes, coupled with potential budgetary fluctuations, further amplifies the leverage these large, consolidated customers possess. This is particularly true when BigBear.ai secures sole-source contracts, where the customer has limited alternatives.

As BigBear.ai increasingly targets the commercial sector, it encounters customers who are often more attuned to price and have a broader selection of AI solutions available. This heightened price sensitivity and the availability of alternatives directly amplify the bargaining power of these customers, compelling BigBear.ai to maintain competitive pricing structures and clearly articulate the tangible return on investment for its offerings. For instance, the global AI market, valued at approximately $200 billion in 2023, is projected to grow significantly, indicating a competitive landscape where pricing will be a key differentiator.

Large commercial clients or government agencies with substantial resources may explore developing their own AI capabilities. This move could lessen their dependence on external providers like BigBear.ai, thereby enhancing their bargaining leverage. For instance, a major defense contractor might invest in building an internal AI team to handle data analytics previously outsourced.

Contract Length and Renewals

BigBear.ai's reliance on multi-year contracts, while beneficial for revenue stability, also presents opportunities for customer leverage. These contracts often incorporate specific review clauses and renewal terms, allowing clients to reassess their relationship with BigBear.ai and potentially negotiate more favorable terms or seek alternative solutions. For instance, if a contract has a significant renewal option with a predetermined notice period, customers can use this window to exert pressure.

The company's success in mitigating this customer bargaining power hinges on its consistent delivery of demonstrable value and strong performance throughout the contract lifecycle. Proactive engagement and clear communication regarding the benefits BigBear.ai provides are crucial. Customers who perceive ongoing, tangible advantages are less likely to exercise their renewal leverage aggressively.

Consider the implications for BigBear.ai's 2024 performance. If a substantial portion of its revenue is tied to contracts up for renewal in the latter half of 2024, the company's ability to retain these clients will directly impact its financial trajectory. For example, a reported 15% of recurring revenue being subject to renewal in Q3 2024 would highlight the critical nature of customer satisfaction and value demonstration during that period.

- Contract Renewal Clauses: Many of BigBear.ai's multi-year agreements include provisions for periodic reviews and renewal options, granting customers a degree of control.

- Value Demonstration: The company's ability to consistently prove its worth and deliver measurable results is paramount to securing contract renewals and reducing customer power.

- Customer Retention Metrics: Monitoring key performance indicators related to customer satisfaction and contract renewal rates in 2024 will be vital for assessing the impact of customer bargaining power.

- Competitive Landscape: The presence of alternative solutions in the market can amplify customer bargaining power, especially during contract renewal discussions.

Availability of Alternative AI Solution Providers

Customers can easily switch to other AI solution providers, as the market is becoming increasingly crowded. This abundance of choice means clients can shop around for the best prices and features, directly impacting BigBear.ai's ability to dictate terms.

Major technology players and niche AI startups alike are expanding their offerings, providing a wide array of alternatives. For instance, in 2024, the global AI market size was estimated to be around $270 billion, with significant growth projected, indicating a robust competitive landscape.

- Increased Competition: A larger pool of AI providers intensifies competition, giving customers more leverage.

- Price Sensitivity: Customers can compare pricing models across multiple vendors, driving down costs.

- Feature Comparison: The availability of diverse AI solutions allows clients to select providers offering superior functionality or customization.

BigBear.ai faces substantial customer bargaining power, particularly from its significant government clients, which accounted for approximately 60% of its revenue in 2023. This leverage is amplified by the lengthy government procurement cycles and potential budget shifts, especially in sole-source situations where BigBear.ai has few alternatives.

The growing commercial sector presents customers who are highly price-sensitive and have access to a wider array of AI solutions. With the global AI market valued at around $270 billion in 2024, this competitive environment forces BigBear.ai to remain competitive on pricing and clearly demonstrate its value proposition.

Customers with significant resources may develop in-house AI capabilities, reducing their reliance on external providers like BigBear.ai and increasing their negotiating leverage. This trend is evident as major tech firms and startups alike expand their AI offerings, creating a crowded market.

| Customer Segment | Key Leverage Factors | Impact on BigBear.ai |

|---|---|---|

| Government Agencies (approx. 60% of 2023 revenue) | Procurement processes, budget fluctuations, sole-source contracts | High bargaining power, potential for price pressure and contract renegotiation |

| Commercial Clients | Price sensitivity, availability of alternative AI solutions, potential for in-house development | Need for competitive pricing, strong value demonstration, and differentiation |

Same Document Delivered

BigBear.ai Porter's Five Forces Analysis

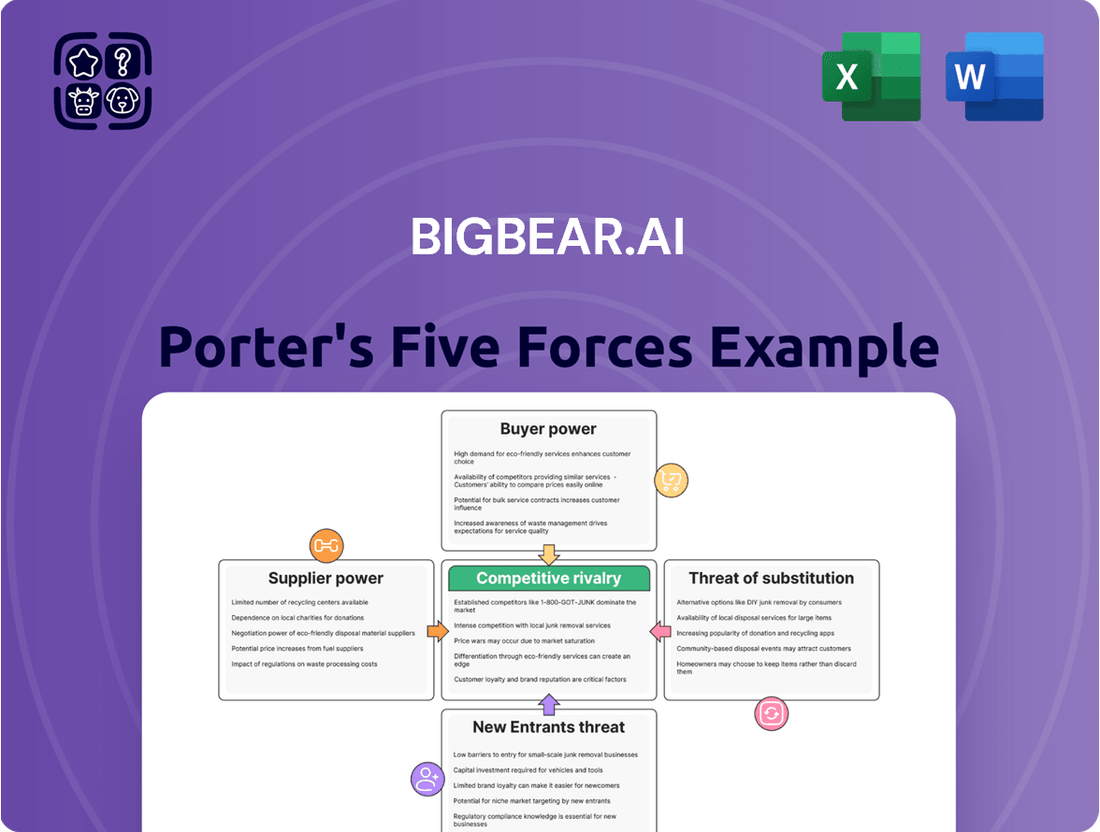

This preview shows the exact BigBear.ai Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're viewing the complete, professionally written document detailing the competitive landscape for BigBear.ai, including insights into supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry. This comprehensive analysis is ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

BigBear.ai faces significant competition from larger, more established companies such as Palantir Technologies and C3.ai. These incumbents often compete for the same government contracts, benefiting from their extensive market presence and greater financial backing.

These larger competitors can leverage their existing infrastructure and deep client relationships to secure new business. For instance, Palantir reported over $2.2 billion in revenue for 2023, showcasing its substantial scale compared to BigBear.ai.

Beyond the dominant tech giants, the artificial intelligence landscape is highly fragmented, populated by a multitude of specialized firms. These niche players often focus on specific AI applications, such as optimizing supply chains, bolstering cybersecurity defenses, or enhancing national security capabilities. BigBear.ai directly contends with these specialized providers in these very domains, highlighting the broad competitive spectrum it navigates.

The AI sector, including companies like BigBear.ai, is defined by relentless technological evolution. This necessitates substantial and ongoing investment in research and development to remain at the forefront.

This drive for innovation fuels fierce competition, as businesses race to deliver superior AI solutions and secure market leadership. For instance, in 2024, global AI market spending is projected to reach over $200 billion, underscoring the immense investment and competitive pressure.

Importance of Government Contracts

The competition for government contracts significantly fuels rivalry within the industry. These contracts are highly sought after due to their substantial revenue potential and the long-term stability they offer. For BigBear.ai, winning and growing its government contract portfolio is a key driver of its overall expansion and market position.

BigBear.ai's performance in the government sector is directly tied to its ability to secure and retain these vital agreements. In 2024, the company continued to focus on leveraging its advanced analytics and AI capabilities to meet the evolving needs of government agencies. For instance, securing contracts with entities like the U.S. Air Force for advanced data analysis tools highlights the importance of this segment.

- BigBear.ai's 2023 revenue from its Defense and Intelligence segment was a significant portion of its total, underscoring the importance of government contracts.

- The company's strategic focus includes expanding its footprint within federal agencies, aiming to capture a larger share of the government's digital transformation spending.

- Rival firms are also aggressively pursuing similar government opportunities, creating a highly competitive landscape where differentiation through technological superiority and reliable execution is paramount.

Pricing Pressure and Profitability Challenges

The artificial intelligence sector, including BigBear.ai's domain, faces intense competition. This leads to significant pricing pressure, especially as certain AI functionalities become more standardized, impacting overall profitability.

BigBear.ai's financial performance reflects these industry challenges. For instance, in the first quarter of 2024, the company reported a net loss of $23.2 million. This highlights the difficulty in maintaining healthy profit margins amidst aggressive market competition and the ongoing need for substantial investment in research and development.

- Intense Competition: The AI market is crowded with numerous players, both established tech giants and emerging startups, all vying for market share.

- Commoditization of AI: As AI tools and services mature, some capabilities are becoming more commoditized, leading to price erosion.

- Profitability Strain: BigBear.ai's Q1 2024 net loss of $23.2 million underscores the pressure on margins in this environment.

- R&D Investment: Continuous innovation is crucial, demanding significant R&D spending that can weigh on short-term profitability.

BigBear.ai operates in a highly competitive artificial intelligence market, facing pressure from both large incumbents and specialized niche players. This intense rivalry, particularly for lucrative government contracts, necessitates continuous innovation and can impact profitability.

| Competitor Type | Key Characteristics | Impact on BigBear.ai |

|---|---|---|

| Large Incumbents (e.g., Palantir) | Established market presence, significant financial backing, existing client relationships. | Direct competition for government contracts, leveraging scale and resources. Palantir's 2023 revenue exceeded $2.2 billion. |

| Specialized AI Firms | Focus on specific AI applications (e.g., supply chain, cybersecurity). | Contention in niche markets, requiring BigBear.ai to differentiate through specialized solutions. |

| Overall Market Dynamics | Rapid technological evolution, high R&D investment needs, commoditization of some AI services. | Pressure on pricing and profit margins; BigBear.ai reported a $23.2 million net loss in Q1 2024. Global AI market spending projected over $200 billion in 2024. |

SSubstitutes Threaten

For certain decision-making scenarios, particularly those involving less complex requirements, traditional data analytics and business intelligence (BI) tools can function as substitutes for advanced AI-driven solutions. These established platforms, often perceived as more cost-effective and familiar, may satisfy basic reporting and descriptive analysis needs.

The market for traditional BI tools remains substantial, with Gartner projecting worldwide revenue for analytics and BI platforms to reach $32.8 billion in 2024, an increase from $29.4 billion in 2023. This indicates a continued demand for these solutions, highlighting their role as potential substitutes, especially for organizations prioritizing budget constraints or ease of adoption over cutting-edge predictive power.

In specialized fields, the reliance on human expertise and manual processes can act as a substitute for AI solutions like those offered by BigBear.ai. For example, in complex legal analysis or intricate medical diagnostics, organizations might still prefer human judgment due to trust issues or the nuanced nature of the tasks, even as AI capabilities advance. This preference for established human-centric workflows can slow the adoption of new technologies.

The rise of accessible generic AI platforms and open-source models presents a significant threat of substitution for specialized AI providers like BigBear.ai. Companies can leverage these readily available tools, such as Google Cloud AI Platform or open-source libraries like TensorFlow, to develop their own AI functionalities, potentially bypassing the need for custom solutions. This trend is amplified by the growing ease of use and decreasing costs associated with these platforms, allowing even smaller organizations to build basic AI capabilities internally.

Consulting Services without AI Integration

Clients might choose traditional consulting firms that offer strategic guidance without the advanced AI capabilities BigBear.ai provides. This represents a substitute for the core intelligence BigBear.ai delivers.

These traditional services can fulfill a client's need for strategic planning and problem-solving, albeit without the predictive and prescriptive analytics that AI integration brings. For instance, many established consulting players continue to thrive by focusing on process improvement and organizational design, areas where AI is not always a prerequisite.

- Market Share of Traditional Consulting: In 2023, the global management consulting market was valued at approximately $300 billion, with a significant portion still dominated by firms not heavily reliant on advanced AI integration.

- Client Adoption of AI: While AI adoption is growing, a substantial segment of businesses, particularly smaller enterprises or those in more traditional sectors, may still prefer or be limited to consultants offering non-AI-centric solutions.

- Cost Sensitivity: Traditional consulting services may present a lower upfront cost compared to AI-integrated solutions, making them an attractive substitute for budget-conscious clients.

Basic Automation Tools

For tasks purely focused on operational efficiency, simpler automation tools and Robotic Process Automation (RPA) present a viable substitute. These solutions can automate repetitive, rule-based tasks without the need for advanced AI capabilities. For instance, the RPA market was valued at approximately $3.6 billion in 2023 and is projected to grow significantly, indicating a substantial availability of these alternatives.

Clients seeking basic automation for straightforward processes might opt for these less sophisticated tools if BigBear.ai's offerings, which often incorporate complex predictive analytics, exceed their specific requirements. The cost-effectiveness of RPA can be a major draw for businesses with budget constraints or less complex needs.

- RPA Market Growth: The global RPA market is expected to reach $13.07 billion by 2028, growing at a CAGR of 24.5% from 2023.

- Cost Advantage: Simpler automation tools often have a lower upfront cost and implementation complexity compared to AI-driven platforms.

- Task Specificity: For businesses needing to automate only very specific, non-analytical tasks, these substitutes can be perfectly adequate.

The threat of substitutes for BigBear.ai's advanced AI solutions comes from a range of established and emerging alternatives. Traditional business intelligence tools, while less sophisticated, cater to basic analytical needs and represent a significant market, with worldwide revenue projected to reach $32.8 billion in 2024. Furthermore, human expertise and manual processes remain viable substitutes in niche areas requiring nuanced judgment, such as complex legal or medical analysis, where trust and established workflows can outweigh the benefits of AI. The availability of accessible generic AI platforms and open-source models also allows companies to build their own AI capabilities, potentially circumventing the need for specialized providers.

Simpler automation tools, like Robotic Process Automation (RPA), offer another layer of substitution by automating repetitive, rule-based tasks without requiring advanced AI. The RPA market, valued at approximately $3.6 billion in 2023, is expected to grow substantially, indicating a strong demand for these more straightforward solutions. Additionally, traditional consulting firms that provide strategic guidance without advanced AI integration can serve as substitutes for clients prioritizing cost-effectiveness or familiarity over cutting-edge predictive analytics.

| Substitute Category | Description | Market Size/Growth (Approx. 2023/2024) | Key Differentiator |

| Traditional BI Tools | Established platforms for reporting and descriptive analysis. | 2024 Revenue: $32.8 billion | Cost-effectiveness, familiarity |

| Human Expertise/Manual Processes | Reliance on human judgment for complex tasks. | N/A (Qualitative) | Nuanced judgment, trust |

| Generic AI/Open-Source Models | Readily available AI tools and libraries. | N/A (Qualitative) | Accessibility, customization potential |

| RPA Tools | Automation of repetitive, rule-based tasks. | 2023 Market Value: $3.6 billion; Projected 2028: $13.07 billion | Simplicity, cost-effectiveness for basic automation |

| Traditional Consulting Firms | Strategic guidance without advanced AI integration. | 2023 Global Market Value: ~$300 billion | Lower upfront cost, focus on process/organization |

Entrants Threaten

Developing sophisticated AI decision intelligence solutions, like those offered by BigBear.ai, demands substantial upfront capital. This includes significant expenditure on research and development, building robust computing infrastructure, and attracting highly specialized AI talent, which can easily run into tens or hundreds of millions of dollars.

New companies entering the advanced analytics and AI space, particularly those targeting BigBear.ai's core markets like national security and supply chain optimization, face a significant hurdle in acquiring the deep domain expertise required. Understanding the intricate needs of government agencies or the complexities of global logistics demands years of specialized knowledge and practical application, which is difficult for newcomers to replicate quickly.

Furthermore, access to the highly sensitive and proprietary data sets that fuel BigBear.ai's solutions represents another substantial barrier. For instance, government contracts often necessitate stringent security clearances and established relationships, making it challenging for new entrants to gain the necessary data access to compete effectively. In 2024, the demand for AI solutions in defense and critical infrastructure continued to surge, with government spending on AI technologies projected to exceed $10 billion annually, highlighting the value and difficulty of entry into these data-rich sectors.

Entering the government contracting arena, particularly in defense and national security, presents significant challenges for newcomers. These often involve stringent security clearance processes and extensive compliance mandates, acting as substantial deterrents.

Established Relationships and Trust with Clients

BigBear.ai's established relationships and deep trust with its government and commercial clients present a significant barrier to new entrants. Years of successful project delivery have fostered strong partnerships, making it difficult for newcomers to gain a foothold.

New competitors would struggle to replicate the level of confidence and reliability BigBear.ai has cultivated. Securing initial contracts in this environment requires overcoming a substantial hurdle of established credibility and proven performance.

- Client Loyalty: BigBear.ai's long-standing client relationships, particularly within the defense sector, mean that existing contracts are not easily transferable.

- Reputational Capital: The company's track record of successful, mission-critical deployments builds a strong reputation that new entrants would need years to match.

- Incumbency Advantage: In many government contracts, there's a preference for existing vendors who understand the complex requirements and operational nuances.

Talent Acquisition and Retention Challenges

The high cost and scarcity of specialized AI talent pose a significant barrier to entry. New companies struggle to assemble a skilled workforce capable of competing with established players like BigBear.ai, which already possesses a seasoned team. For instance, in 2024, the demand for AI engineers continued to outstrip supply, with average salaries for experienced professionals often exceeding $150,000 annually, making it a substantial upfront investment for any new entrant.

Attracting and retaining top-tier AI professionals is a considerable challenge due to competitive compensation packages and the allure of working on cutting-edge projects. This intense competition for human capital means that new entrants face difficulties in quickly building the expertise necessary to develop and deploy advanced AI solutions.

- High Demand for AI Specialists: The market for AI talent remains exceptionally tight, driving up recruitment costs.

- Retention is Key: Companies like BigBear.ai invest heavily in retaining their AI talent through competitive benefits and challenging work.

- Barrier to Entry: New entrants must overcome significant financial and operational hurdles to attract and keep the necessary AI expertise.

The threat of new entrants for BigBear.ai is relatively low due to substantial capital requirements for AI development and infrastructure. New companies face immense challenges in acquiring the deep domain expertise and sensitive data necessary to compete in BigBear.ai's specialized markets.

Established client relationships, strong reputational capital, and the incumbency advantage in government contracts further solidify BigBear.ai's position. The high cost and scarcity of AI talent also create a significant barrier, as new entrants struggle to attract and retain the skilled workforce needed to match BigBear.ai's capabilities.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High R&D, infrastructure, and talent acquisition costs. | Significant financial hurdle, requiring substantial investment. |

| Domain Expertise | Years of specialized knowledge in national security, supply chains. | Difficult for newcomers to replicate quickly, hindering effective competition. |

| Data Access | Access to sensitive, proprietary datasets requiring security clearances. | Challenging for new entrants to obtain necessary data to build competitive solutions. |

| Client Relationships & Reputation | Established trust and proven performance with government clients. | New entrants face difficulty gaining initial contracts due to lack of credibility. |

| Talent Scarcity | High demand and cost for specialized AI professionals. | New companies struggle to assemble and retain the skilled workforce needed. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data, including proprietary market intelligence, publicly available financial statements, and industry-specific research reports. This ensures a robust and data-driven assessment of competitive dynamics.