BigBear.ai Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BigBear.ai Bundle

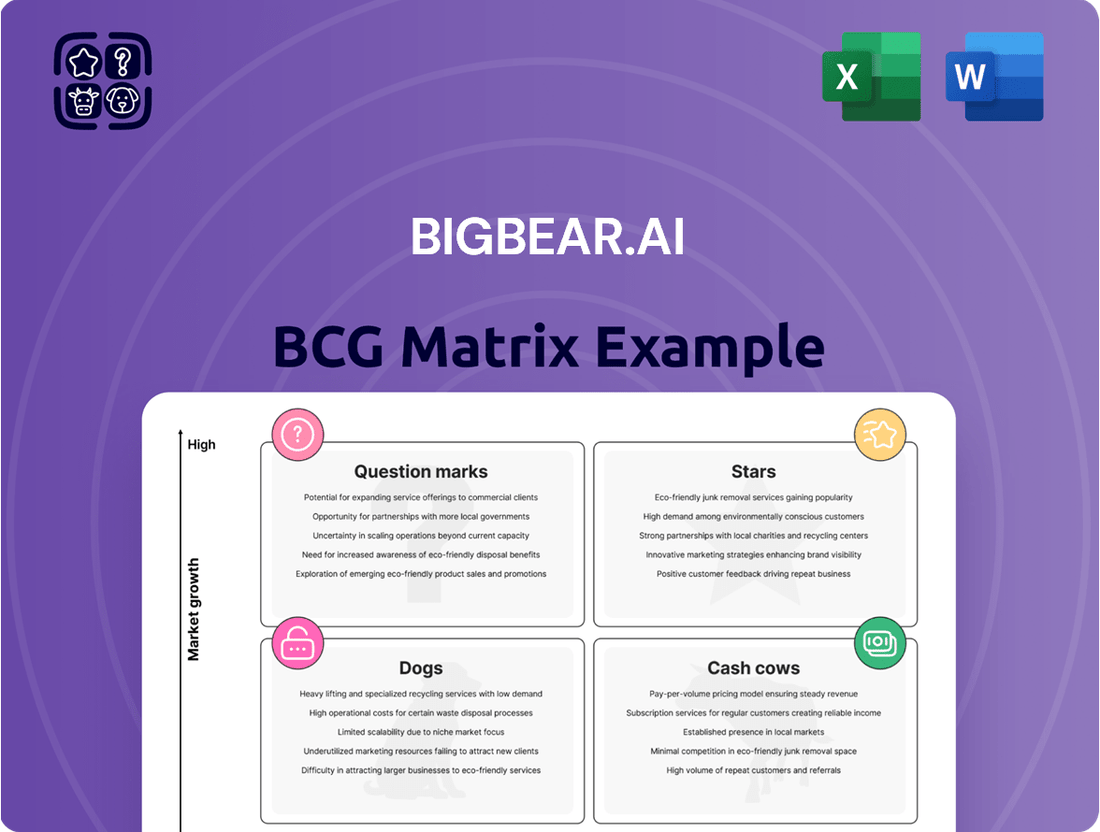

Curious about BigBear.ai's market position? Our BCG Matrix analysis reveals which of their offerings are thriving Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks. Don't miss out on the crucial strategic insights needed to navigate their portfolio.

Unlock the full potential of BigBear.ai's strategic landscape by purchasing the complete BCG Matrix. This detailed report provides the actionable intelligence you need to make informed decisions about resource allocation and future growth.

Gain a competitive edge with our comprehensive BigBear.ai BCG Matrix. Discover the precise quadrant placement for each product and receive data-driven recommendations to optimize your investment strategy.

Stars

BigBear.ai's Government AI Solutions segment is a Star in the BCG Matrix, driven by substantial U.S. government investment in AI for defense and national security. This high-growth market is fueled by increasing demand for advanced decision intelligence.

The company's specialized AI solutions for mission-critical government applications have secured a significant market share. In 2023, U.S. federal spending on AI was projected to exceed $3.3 billion, highlighting the robust market opportunity for BigBear.ai's offerings.

BigBear.ai's Pangiam Threat Detection, integrated with Analogic's CT scanners, is a strong contender in the aviation security sector. This advanced system significantly boosts the accuracy and speed of identifying threats, a critical need for international airports and ports. For instance, by mid-2024, numerous airports were actively upgrading their security screening technologies to meet evolving passenger and cargo demands.

The collaboration between BigBear.ai and Analogic showcases a strategic move into a high-growth, specialized market. This partnership is indicative of a significant market share capture in advanced aviation security solutions, a segment expected to see continued investment and innovation throughout 2024 and beyond as global travel rebounds.

BigBear.ai's Orion Decision Support Platform is a prime example of a Star in the BCG matrix, particularly for its work with the U.S. Army and Joint Chiefs of Staff.

This platform offers sophisticated analytics and automated force management, directly addressing crucial defense operational needs.

With substantial ongoing contracts and continuous modernization, Orion demonstrates both a strong existing market position and significant future growth potential within the military decision intelligence sector.

Virtual Anticipation Network (VANE)

The Virtual Anticipation Network (VANE) is a key Star within BigBear.ai's portfolio, reflecting its high growth and market share. Developed for the Department of Defense Chief Digital and Artificial Intelligence Office (CDAO), VANE is an AI platform designed for geopolitical risk analysis. It achieves this by monitoring and identifying trends within foreign media, providing crucial intelligence for national security decisions.

The successful transition of VANE from a prototype to an operational system highlights its significant market relevance and potential for continued expansion. This AI-powered capability addresses a critical need for timely and insightful geopolitical intelligence, positioning BigBear.ai strongly in the defense technology sector.

- VANE's Role: Geopolitical risk analysis for national security.

- Developer: BigBear.ai, for the DoD CDAO.

- Technology: AI-powered platform analyzing foreign media trends.

- Market Position: A Star in the BCG Matrix due to high growth and market importance.

GSA OASIS+ IDIQ Contract

Securing a position on the U.S. General Services Administration’s (GSA) OASIS+ contract is a significant achievement for BigBear.ai, highlighting its strong standing within the federal contracting ecosystem. This indefinite delivery/indefinite quantity (IDIQ) vehicle offers a streamlined pathway for all federal agencies to access BigBear.ai's advanced analytics and artificial intelligence solutions, indicating substantial and expanding market potential.

The OASIS+ contract, awarded in 2024, represents a crucial element in BigBear.ai's growth strategy, providing broad federal agency access. This contract is designed to simplify procurement for complex professional services, positioning BigBear.ai as a key provider for government modernization efforts.

- Federal Market Access: OASIS+ provides BigBear.ai with a broad base of potential federal clients across numerous agencies.

- Contract Value Potential: While specific BigBear.ai contract values under OASIS+ are not publicly detailed, the overall OASIS program has historically represented billions of dollars in federal spending.

- Strategic Importance: Inclusion signifies BigBear.ai's capability to meet rigorous government standards for technology and service delivery.

BigBear.ai's Government AI Solutions, including its Orion platform and VANE technology, are firmly positioned as Stars in the BCG Matrix. These offerings benefit from high market growth driven by significant U.S. government investment in AI for defense and national security. The company's ability to secure major contracts, such as its inclusion on the GSA's OASIS+ vehicle in 2024, underscores its strong market share and future growth prospects in these critical sectors.

| Segment | BCG Category | Key Offerings | Market Driver | 2024 Relevance |

|---|---|---|---|---|

| Government AI Solutions | Star | Orion Decision Support Platform, Virtual Anticipation Network (VANE) | U.S. Gov't AI Investment, National Security Needs | OASIS+ Contract Access, Operational VANE Deployment |

| Pangiam Threat Detection | Star | AI for Aviation Security | Airport Security Upgrades, Global Travel Rebound | Integration with Analogic CT Scanners, Airport Adoption |

What is included in the product

This BCG Matrix overview offers strategic insights into BigBear.ai's portfolio, guiding investment decisions.

A clear BCG Matrix visualization from BigBear.ai pinpoints strategic resource allocation, relieving the pain of uncertain investment decisions.

Cash Cows

The U.S. Army Global Force Information Management (GFIM) contract, valued at $165 million over five years, represents a significant cash cow for BigBear.ai. This contract focuses on modernizing legacy systems into a data-centric, intelligent automation platform, providing a stable and predictable revenue stream.

While the overall artificial intelligence market is experiencing rapid growth, the GFIM contract's emphasis on sustainment and modernization of existing infrastructure offers consistent cash flow. This long-term, high-value agreement requires relatively lower new investment for market penetration compared to chasing emerging AI opportunities.

BigBear.ai's long-term defense sustainment contracts are classic cash cows. These aren't the flashy growth areas, but they are the bedrock of predictable income, like ongoing support and maintenance for defense and intelligence agencies. Think of them as the reliable workhorses that keep the lights on.

These contracts benefit from deep, established relationships and a proven track record, ensuring steady cash flow. For instance, in 2023, BigBear.ai secured a significant multi-year contract extension for its AI-powered decision support capabilities with a key U.S. defense client, highlighting the enduring nature of these revenue streams.

BigBear.ai's Digital Identity and Biometrics Solutions, particularly those already implemented in established systems, function as cash cows. These aren't just about new sales; they represent a steady income stream from existing deployments. For instance, their biometric software for passenger processing at major international airports and ports of entry provides ongoing service and updates, ensuring a stable, high-margin revenue.

These established solutions operate within a mature context, meaning the initial heavy investment has been made, and the focus shifts to maintenance and incremental improvements. This allows for consistent, predictable revenue generation, a hallmark of cash cow businesses. The demand for secure and efficient passenger processing remains high, further solidifying the cash cow status of these already implemented biometric systems.

Core Data Ingestion and Processing Services

BigBear.ai’s core data ingestion and processing services are foundational to its AI offerings, acting as a stable revenue generator. These services are crucial for clients, ensuring a consistent demand that supports recurring revenue streams, much like a cash cow in the BCG matrix. Their essential nature makes them resilient to market shifts.

These services are integrated into long-term client contracts, providing a predictable and reliable income. For instance, BigBear.ai’s work with government agencies often involves continuous data management, which is vital for national security and operational efficiency. This ongoing need translates directly into a steady cash flow for the company.

- Foundational Data Services: BigBear.ai’s data ingestion, enrichment, and processing are essential building blocks for its advanced AI solutions.

- Recurring Revenue: These services are typically part of long-term client agreements, creating a consistent and predictable revenue base.

- Market Resilience: As critical infrastructure for clients, these offerings are less vulnerable to economic downturns, ensuring stable cash generation.

- Client Dependency: The indispensable nature of data processing for clients fosters strong relationships and reduces churn, solidifying their cash cow status.

Existing Government Agency Relationships

BigBear.ai's existing government agency relationships are a significant asset, acting as a stable foundation within its portfolio. These established connections with key departments, where the company has a proven history of delivering results, generate a reliable stream of revenue.

The continuity of work with these major government clients represents a substantial portion of BigBear.ai's stable income. These long-standing partnerships frequently result in follow-on projects and contract renewals, thereby ensuring a consistent and predictable cash flow for the company.

- Established Government Contracts: BigBear.ai has a history of successful engagements with multiple U.S. federal agencies.

- Revenue Stability: These relationships contribute a significant, predictable portion of the company's recurring revenue.

- Follow-on Opportunities: Past performance in these existing relationships often leads to expanded scope and new contract awards.

- Reduced Market Risk: The consistent demand from government entities mitigates some of the volatility seen in other market segments.

BigBear.ai's established defense sustainment contracts are prime examples of cash cows. These agreements, like the $165 million U.S. Army GFIM contract, provide a predictable and stable revenue stream by focusing on modernizing existing systems rather than high-risk new market ventures. These are the reliable income generators that support the company's overall financial health.

These long-term, high-value contracts require less new investment for market penetration, offering consistent cash flow. For instance, in 2023, BigBear.ai secured a significant multi-year contract extension for its AI-powered decision support capabilities with a key U.S. defense client, underscoring the enduring nature of these revenue streams.

BigBear.ai's Digital Identity and Biometrics Solutions, particularly those already deployed in established systems like airport passenger processing, function as cash cows. These provide ongoing service and updates, ensuring a stable, high-margin revenue from existing implementations. The demand for secure and efficient passenger processing remains robust, further solidifying their cash cow status.

| Contract Type | Estimated Value | Focus | Revenue Stability |

|---|---|---|---|

| U.S. Army GFIM | $165 million (5 years) | Modernizing legacy systems | High, predictable |

| Defense Sustainment | Ongoing | Support and maintenance | High, predictable |

| Digital Identity/Biometrics | Ongoing service/updates | Existing deployments | High, predictable |

What You’re Viewing Is Included

BigBear.ai BCG Matrix

The BigBear.ai BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no altered content, and no surprises – just the complete, analysis-ready BCG Matrix ready for your strategic planning needs. You can confidently use this preview to understand the depth and quality of the insights provided, knowing the purchased version will be identical and immediately available for your business operations. This ensures you're investing in a professional, actionable tool that directly reflects the strategic clarity BigBear.ai delivers.

Dogs

Underperforming legacy projects represent older or less strategic initiatives within BigBear.ai that continue to drain resources without delivering significant returns or supporting current growth objectives. These could be projects that have become outdated or no longer align with the company's evolving market focus.

While specific project details are not publicly disclosed, BigBear.ai's historical financial performance, including periods of net losses, suggests that the company has faced challenges with operational efficiency. For instance, in 2022, the company reported a net loss of $144.8 million, highlighting the need to optimize resource allocation and shed underperforming assets.

BigBear.ai operates in the broader AI security market, a space characterized by intense competition. This segment, where differentiation is challenging against larger, more established players, could potentially become a cash trap if BigBear.ai struggles to gain significant market share or establish a clear competitive advantage. For instance, in 2024, the global AI cybersecurity market was projected to reach over $30 billion, indicating a substantial but crowded landscape.

BigBear.ai's situation with the loss of a major client, which represented 19% of its 2022 revenue, strongly suggests a past 'Dog' in its BCG Matrix. This signifies a significant revenue stream that has now diminished, impacting the company's overall performance.

While BigBear.ai has been successful in acquiring new clients, the inability to retain such a substantial contract highlights potential weaknesses. These could stem from issues within specific client relationships or areas where their service offerings failed to maintain client satisfaction and long-term value.

Unprofitable Product Lines (if not strategic for future growth)

In the context of BigBear.ai's BCG Matrix, unprofitable product lines that lack strategic importance for future growth would be categorized as Dogs. These are segments that consistently consume resources without generating sufficient returns or demonstrating a clear path to future profitability. Identifying and managing these "Dogs" is crucial for optimizing resource allocation and focusing on areas with higher growth potential.

While BigBear.ai, as a growth-oriented company, may experience overall unprofitability, specific product lines that consistently underperform are a concern. For instance, if a particular software module or service offering shows persistent negative gross margins and is not integral to a future strategic pivot, it fits the Dog classification. Such offerings drain capital that could be better invested in high-potential areas.

- Persistent Negative Margins: Product lines consistently generating losses, even after accounting for direct costs.

- Lack of Strategic Alignment: Offerings not contributing to BigBear.ai's long-term vision or competitive advantage.

- Low Market Share/Growth: Segments with limited customer adoption and minimal potential for future expansion.

- Resource Drain: Product lines requiring significant investment for minimal or negative returns.

Stagnant Commercial Ventures

Stagnant commercial ventures within BigBear.ai's portfolio would be classified as Dogs in the BCG matrix. These are business units or product lines that exhibit low growth and low relative market share. For instance, if a new AI-powered logistics optimization platform, launched in late 2023, fails to attract significant enterprise clients by mid-2024, it could be categorized as a Dog. This scenario would be characterized by minimal revenue generation and a lack of competitive advantage.

Such ventures often require substantial ongoing investment to maintain operations, yet yield little return. BigBear.ai's focus on the defense sector means commercial ventures might struggle if they don't offer a clear, differentiated value proposition against established players or if market adoption is slower than anticipated. For example, a commercial predictive maintenance solution that doesn't achieve widespread adoption due to integration complexities or high costs would fit this description.

Key indicators for identifying these stagnant ventures include:

- Declining or flat revenue growth rates.

- Low or negative profitability.

- Minimal market share gains despite marketing efforts.

- High operational costs relative to revenue.

Dogs in BigBear.ai's BCG Matrix represent business segments or product lines with low market share and low growth potential. These are often legacy offerings or ventures that have failed to gain traction, consuming resources without contributing significantly to revenue or future growth. Identifying and managing these "Dogs" is crucial for optimizing capital allocation and focusing on more promising areas of the business.

The loss of a major client, representing 19% of 2022 revenue, strongly suggests a past "Dog" for BigBear.ai, indicating a significant revenue stream that has diminished. Furthermore, any unprofitable product lines that lack strategic importance for future growth would be classified as Dogs, as they consistently consume resources without generating sufficient returns or demonstrating a clear path to future profitability.

Stagnant commercial ventures, such as an AI-powered logistics optimization platform launched in late 2023 that fails to attract significant enterprise clients by mid-2024, would also fit the Dog classification. These ventures often require substantial ongoing investment for minimal return, especially if they don't offer a clear, differentiated value proposition or face slow market adoption.

BigBear.ai's financial performance, including a net loss of $144.8 million in 2022, underscores the importance of identifying and divesting underperforming assets. The company operates in a crowded AI security market, projected to exceed $30 billion in 2024, making differentiation and focus on high-potential segments critical.

| Category | Characteristics | Example for BigBear.ai | Financial Implication |

| Dogs | Low Market Share, Low Growth | Underperforming legacy software module; Stagnant commercial AI platform | Resource drain, negative ROI |

| Market Context (2024) | AI Security Market Size | Over $30 billion | Intense competition, need for differentiation |

| Historical Performance | Net Loss (2022) | $144.8 million | Highlights need for resource optimization |

Question Marks

BigBear.ai's move into the broader commercial sector is a classic Question Mark in the BCG matrix. While the AI market for commercial applications is booming, with projections suggesting it could reach over $1.5 trillion by 2030, BigBear.ai is entering this space with a relatively small footprint compared to established players. This means significant investment will be needed to build brand recognition and capture market share.

BigBear.ai's AI for commercial supply chain management operates in a burgeoning sector, ripe with opportunity. While the exact market share is difficult to pinpoint, it's understood to be nascent, indicating substantial room for expansion.

The company's predictive analytics hold immense potential for commercial clients, but realizing this requires a strategic push. Significant investment in marketing and sales is crucial to translate technological prowess into tangible market penetration and widespread adoption.

The broader AI in supply chain market was projected to reach $10.6 billion by 2024, highlighting the scale of the opportunity BigBear.ai is targeting. Capturing even a small fraction of this market represents a considerable growth trajectory.

BigBear.ai's new international market penetration, exemplified by its UAE partnership, signifies a strategic move into a high-growth region. This venture is positioned as a significant stride in global expansion, aiming to deploy AI solutions across diverse sectors within the UAE.

While the UAE presents a considerable market opportunity, BigBear.ai's current market share in this new territory and its associated sectors is minimal. This necessitates considerable investment and focused execution to establish a foothold and capture potential growth.

Commercial Cybersecurity AI Solutions

BigBear.ai's commercial cybersecurity AI solutions are a prime example of a Question Mark in the BCG matrix. While the company possesses robust cybersecurity capabilities, particularly within the government and defense sectors, its expansion into the broader commercial market presents a significant opportunity coupled with substantial challenges.

This segment of the cybersecurity AI market is experiencing rapid expansion, with projections indicating substantial growth in the coming years. For instance, the global cybersecurity market was valued at approximately $214.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 13.5% from 2024 to 2030. This high-growth potential makes it attractive, but BigBear.ai faces intense competition from numerous well-established players with significant market share and brand recognition.

- Market Growth: The commercial cybersecurity AI market is a high-growth sector, with the global market expected to reach over $400 billion by 2028.

- Competitive Landscape: BigBear.ai must contend with established cybersecurity giants like Microsoft, Palo Alto Networks, and CrowdStrike, which already hold significant commercial market share.

- Market Penetration: The company's current commercial market share in cybersecurity AI is relatively low, necessitating substantial investment in sales, marketing, and product development to gain traction.

- Strategic Focus: Success hinges on BigBear.ai's ability to differentiate its AI-driven solutions and effectively communicate their value proposition to a diverse commercial customer base.

ConductorOS and Shipyard.ai in New Commercial Applications

BigBear.ai is strategically positioning its ConductorOS and Shipyard.ai platforms for widespread commercial adoption. These advanced AI solutions are targeting high-growth sectors, including maritime domain awareness and the optimization of shipbuilding processes through AI. This move signifies a significant push to translate their established capabilities into tangible revenue streams beyond their initial government contracts.

The commercialization of ConductorOS and Shipyard.ai places BigBear.ai in dynamic markets with substantial growth potential. For instance, the global maritime surveillance market is projected to reach approximately $20 billion by 2027, driven by increasing concerns over security and illegal activities. Similarly, the adoption of AI in manufacturing, particularly in complex industries like shipbuilding, is expected to yield significant efficiency gains. However, these markets are also highly competitive, and BigBear.ai's offerings are likely in the nascent stages of commercial market penetration.

- ConductorOS: Targeting maritime domain awareness, a sector experiencing increased demand due to global trade and security challenges.

- Shipyard.ai: Aiming to revolutionize shipbuilding through AI, addressing a need for greater efficiency and cost reduction in a capital-intensive industry.

- Early Stage Commercialization: Both platforms require substantial investment for scaling, market penetration, and building a robust commercial customer base.

- Market Growth Potential: Operating in high-growth areas suggests significant upside, but market share acquisition will be a key challenge.

BigBear.ai's expansion into new commercial AI applications, such as those in supply chain management and cybersecurity, clearly positions them as Question Marks. These are markets with high growth potential, but BigBear.ai is a relatively new entrant aiming to capture market share from established players.

The company's strategy involves significant investment in sales and marketing to build brand awareness and penetrate these competitive landscapes. Success hinges on their ability to differentiate their AI solutions and demonstrate clear value to commercial clients.

The AI in supply chain market alone was projected to reach $10.6 billion in 2024, indicating the substantial revenue opportunities available. BigBear.ai's push into areas like maritime domain awareness and shipbuilding AI also targets sectors with significant projected growth, such as the maritime surveillance market expected to reach approximately $20 billion by 2027.

| Business Area | BCG Category | Market Growth Potential | Competitive Landscape | BigBear.ai's Position |

|---|---|---|---|---|

| Commercial Supply Chain AI | Question Mark | High (AI in Supply Chain market projected $10.6B by 2024) | Competitive, established players | Nascent market share, requires investment |

| Commercial Cybersecurity AI | Question Mark | High (Global Cybersecurity market ~$215B in 2023, 13.5% CAGR) | Intense competition from major tech firms | Low commercial market share, needs differentiation |

| ConductorOS/Shipyard.ai (Commercial) | Question Mark | High (Maritime Surveillance market ~$20B by 2027) | Growing but competitive | Early stage commercialization, requires scaling |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, market research reports, and industry performance metrics to provide actionable strategic insights.