Berlin Packaging PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berlin Packaging Bundle

Gain a competitive edge with our in-depth PESTLE Analysis of Berlin Packaging. Understand how political stability, economic fluctuations, and evolving social trends are shaping the packaging giant's future. Our expert-crafted report dives deep into technological advancements and environmental regulations impacting the industry. Download the full version now to unlock actionable intelligence and refine your own market strategy.

Political factors

Berlin Packaging, operating globally, is highly sensitive to changes in international trade policies and tariffs impacting key raw materials like glass, plastic, and metal. For instance, the United States' imposition of a 25% tariff on certain imported packaging materials significantly raises production expenses and can disrupt the company's supply chain. These evolving trade landscapes, often shaped by geopolitical tensions and trade disagreements, compel Berlin Packaging to adopt adaptable and varied sourcing approaches to effectively manage potential risks and ensure continuity of operations.

Governments globally are tightening rules on packaging waste, pushing for a circular economy. This is particularly evident in regions like the EU and the US, where new policies are shaping how businesses operate.

The EU's Packaging and Packaging Waste Regulation (PPWR), set to be fully in effect by February 2025, is a prime example. It mandates reduced use of virgin materials, requires packaging to be recyclable, and sets specific targets for recycled content. For Berlin Packaging, this means a direct impact on product development, with an increased focus on sustainable materials and designs that facilitate recycling.

Extended Producer Responsibility (EPR) schemes are increasingly shaping the packaging landscape globally, placing the onus of waste management squarely on companies like Berlin Packaging. These regulations are designed to incentivize producers to design more sustainable packaging and to fund collection and recycling systems. As of 2024, over 40 US states have introduced or are considering EPR legislation for packaging, with states like California and Colorado already having passed laws requiring producer fees and investment in recycling infrastructure.

Navigating these diverse EPR requirements across different jurisdictions presents a significant operational challenge for Berlin Packaging. For instance, European Union member states have long-established EPR frameworks, each with specific targets and fee structures that Berlin Packaging must adhere to. The complexity of complying with these varying mandates, which often include reporting obligations and material-specific contributions, necessitates robust internal compliance processes and potentially higher operational costs.

Political Stability and Geopolitical Dynamics

Global political stability and geopolitical dynamics significantly impact Berlin Packaging's supply chain reliability and cost. For instance, ongoing geopolitical tensions in Eastern Europe, as seen in the continued conflict in Ukraine, have led to increased energy prices and shipping disruptions throughout 2024, directly affecting the cost of plastics and glass production for packaging. Maintaining a resilient global network necessitates constant vigilance regarding political shifts in key regions where raw materials are sourced or finished goods are manufactured.

Disruptions stemming from political unrest or conflicts directly translate into tangible operational challenges for Berlin Packaging. These can manifest as shortages of essential raw materials, such as petrochemical derivatives used in plastic packaging, or create significant logistical hurdles, increasing transportation times and expenses. For example, trade disputes or sanctions imposed on certain nations can disrupt established supply routes, forcing companies like Berlin Packaging to seek alternative, potentially more expensive, sourcing options.

- Supply Chain Vulnerability: Geopolitical events in 2024, like the redrawing of trade alliances, have highlighted the vulnerability of global supply chains, impacting the availability and cost of key packaging materials.

- Logistical Costs: Increased fuel surcharges and port congestion, often exacerbated by political instability in key transit regions, added an estimated 5-10% to global shipping costs in early 2025 compared to pre-pandemic levels.

- Regulatory Uncertainty: Shifting political landscapes can introduce new trade regulations or tariffs, creating uncertainty for international operations and potentially increasing compliance costs for Berlin Packaging.

- Resource Access: Political stability in resource-rich regions is crucial for ensuring consistent access to raw materials like aluminum for cans or specialized resins for flexible packaging, with price volatility directly linked to regional political climates.

Government Incentives for Sustainable Packaging

Governments worldwide are actively encouraging sustainable practices, and this trend is particularly strong in developed economies. For instance, the European Union's Green Deal aims to make the region climate-neutral by 2050, which includes significant support for circular economy initiatives and sustainable packaging. In 2023 alone, various member states launched new grant programs and tax relief measures specifically targeting businesses investing in eco-friendly materials and production. Berlin Packaging can strategically utilize these financial incentives, such as tax credits for adopting recycled content or grants for investing in energy-efficient machinery, to offset upfront costs and speed up its sustainability roadmap.

These government initiatives not only reduce the financial burden of transitioning to greener operations but also signal a favorable regulatory environment for sustainable businesses. For example, the US Inflation Reduction Act of 2022 offers substantial tax credits for clean energy and manufacturing, which can be applied to upgrades in packaging production facilities. By aligning its investments with these government-backed programs, Berlin Packaging can significantly enhance its financial performance while simultaneously strengthening its brand image as a responsible corporate citizen. This proactive approach can lead to a tangible competitive advantage in a market increasingly prioritizing environmental, social, and governance (ESG) factors.

- European Union Green Deal: Aims for climate neutrality by 2050, boosting sustainable packaging investments.

- US Inflation Reduction Act (2022): Provides tax credits for clean energy and manufacturing, applicable to production facility upgrades.

- Accelerated Transition: Incentives can lower the cost barrier for adopting eco-friendly materials and energy-efficient processes.

- Enhanced Competitive Advantage: Aligning with government sustainability goals strengthens market position and brand reputation.

Government policies and regulations significantly shape Berlin Packaging's operational landscape, particularly concerning environmental standards and trade. The increasing focus on Extended Producer Responsibility (EPR) schemes, with over 40 US states considering or having passed such legislation by 2024, places direct responsibility for packaging waste management on companies. Furthermore, the EU's Packaging and Packaging Waste Regulation (PPWR), fully implementing by February 2025, mandates reduced virgin material usage and increased recycled content, directly influencing product design and material sourcing strategies.

What is included in the product

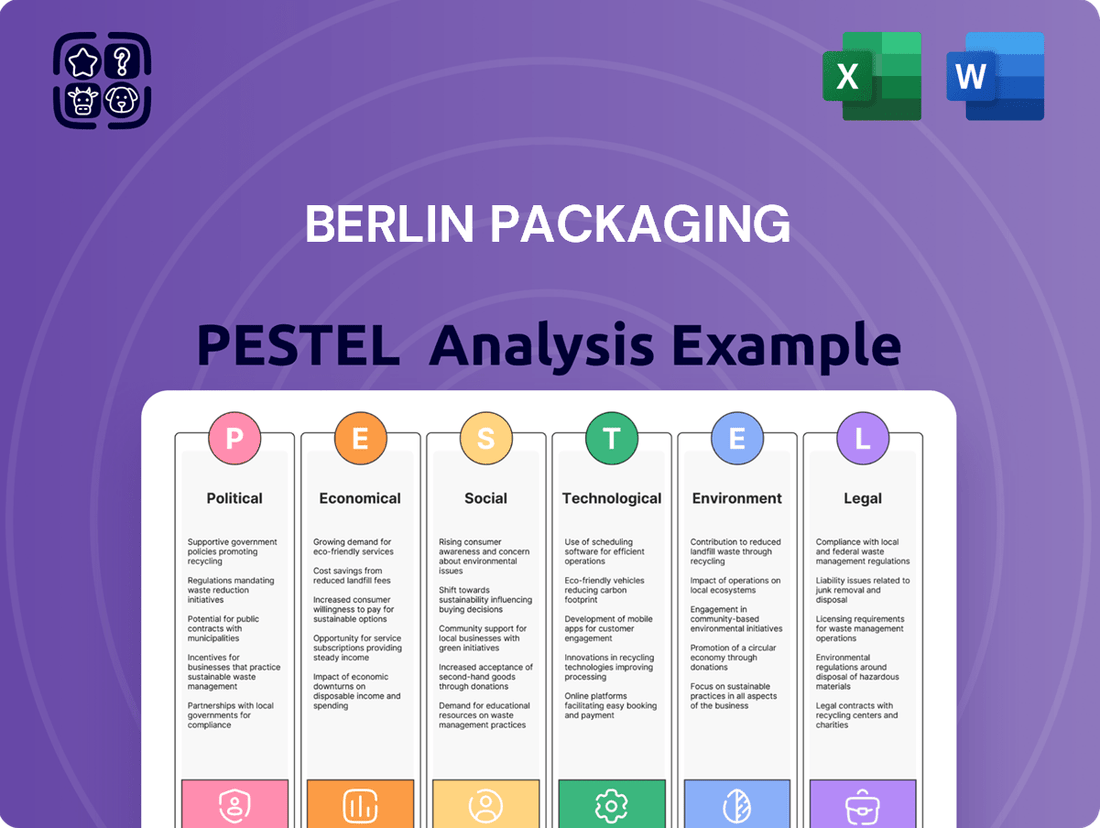

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Berlin Packaging, providing a strategic overview of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick overview of Berlin Packaging's external landscape to address potential challenges and inform strategic decisions.

Economic factors

The health of the global economy directly influences demand for Berlin Packaging's products. Robust economic growth typically translates to increased consumer spending, which in turn drives demand for packaged goods in sectors like food, beverage, and personal care. For instance, the International Monetary Fund (IMF) projected global growth to be 3.1% in 2024, a slight uptick from 2023, suggesting a generally supportive environment for consumer-facing industries.

However, economic headwinds such as inflation and potential recessions can dampen consumer spending power. Higher inflation erodes purchasing power, leading consumers to cut back on discretionary spending, which can impact sales volumes for packaging. As of early 2024, many regions are still navigating persistent inflationary pressures, posing a challenge to sustained demand growth for packaged goods.

The packaging market itself is expected to see continued expansion, with projections often citing Compound Annual Growth Rates (CAGRs) in the mid-single digits. For example, some market research indicated a CAGR of around 5.0% for the global rigid packaging market between 2024 and 2029. Yet, the stability of this growth is intrinsically linked to broader economic stability and consumer confidence.

Raw material price volatility presents a significant challenge for Berlin Packaging. The costs of glass, plastic resins, and metals, essential for their packaging solutions, are highly susceptible to global supply and demand shifts, energy price fluctuations, and geopolitical events. For example, the price of polyethylene terephthalate (PET) resin, a key component for plastic bottles, saw considerable swings throughout 2023 and early 2024, influenced by crude oil prices and manufacturing capacity adjustments.

Successfully navigating these price fluctuations is paramount for Berlin Packaging to safeguard its profit margins and maintain competitive pricing across its extensive product catalog. The company's ability to forecast and hedge against such volatility directly impacts its financial performance and its capacity to offer stable pricing to its diverse customer base, which includes industries from food and beverage to pharmaceuticals.

High inflation, touching around 3.5% in the Eurozone as of early 2024, directly escalates Berlin Packaging's operational expenses. This surge in costs affects everything from the raw materials used in packaging production to transportation and wages, squeezing profit margins.

Simultaneously, the European Central Bank's interest rate hikes, with the main refinancing operations rate standing at 4.50% in early 2024, increase the cost of capital. This makes it more expensive for Berlin Packaging to finance crucial investments in automation, sustainable materials, or strategic acquisitions, potentially slowing growth.

These combined economic forces demand robust financial management. Berlin Packaging must focus on efficient cost control, exploring long-term supply contracts to mitigate price volatility, and potentially passing some increased costs to customers while maintaining competitive pricing.

E-commerce Growth and Logistics Costs

The ongoing surge in e-commerce significantly boosts demand for specialized packaging that ensures product safety during transit, a core offering of Berlin Packaging. This trend, however, concurrently escalates logistics expenses, encompassing shipping and storage, which directly influences product pricing.

The necessity to adapt packaging for online retail is paramount. Lightweight and appropriately sized packaging solutions are crucial for cost management. For instance, the growth of e-commerce in 2024 is projected to continue its upward trajectory, with global online retail sales expected to reach over $7 trillion, according to Statista projections. This expansion directly translates to increased demand for packaging but also puts upward pressure on shipping costs, which saw a notable rise in 2023 due to fuel prices and labor shortages.

- E-commerce Sales Growth: Global e-commerce sales are anticipated to exceed $7 trillion in 2024, fueling demand for packaging.

- Logistics Cost Inflation: Transportation and warehousing costs have been impacted by rising fuel prices and labor availability issues.

- Packaging Optimization: Focus on lightweight and right-sized packaging is essential for mitigating increased logistics expenses.

- Berlin Packaging's Role: The company is positioned to supply the growing need for protective and efficient e-commerce packaging solutions.

Market Consolidation and Competition

The packaging sector is seeing significant consolidation, with companies merging and acquiring others. This trend is fueled by shrinking profit margins and the growing demand for businesses that can serve customers globally. For instance, the global packaging market was valued at approximately $1.1 trillion in 2023 and is projected to reach over $1.4 trillion by 2030, indicating a strong drive for scale.

Berlin Packaging has actively participated in this consolidation, making strategic acquisitions to broaden its geographic reach and diversify its product portfolio. This expansion strengthens its competitive standing, but it also means facing more robust competition from other large, consolidated players. The company's acquisition strategy, including its deals in 2024, directly contributes to this intensifying competitive landscape.

- Increased M&A Activity: Driven by margin pressures and the need for global reach.

- Berlin Packaging's Role: Active acquirer, enhancing market position and product breadth.

- Competitive Intensification: Consolidation leads to larger, more formidable competitors.

- Market Growth: Global packaging market expected to exceed $1.4 trillion by 2030.

Global economic conditions significantly impact Berlin Packaging. A growing global economy, projected at 3.1% for 2024 by the IMF, generally supports demand for packaged goods. However, persistent inflation, around 3.5% in the Eurozone in early 2024, can reduce consumer spending power and increase operational costs for Berlin Packaging.

Raw material price volatility, exemplified by fluctuations in PET resin costs in 2023-2024, directly affects Berlin Packaging's profit margins. The company must manage these costs alongside rising interest rates, such as the European Central Bank's 4.50% rate in early 2024, which increases the expense of capital investments.

The booming e-commerce sector, with global sales projected to exceed $7 trillion in 2024, drives demand for specialized packaging. This growth, however, also elevates logistics expenses, making optimized, lightweight packaging solutions critical for cost control.

The packaging market is experiencing consolidation, with a global valuation of approximately $1.1 trillion in 2023. Berlin Packaging's strategic acquisitions contribute to this trend, intensifying competition while expanding its market reach and product offerings.

| Economic Factor | Impact on Berlin Packaging | Supporting Data/Trend (2024) |

|---|---|---|

| Global Economic Growth | Influences demand for packaged goods. | IMF projects 3.1% global growth for 2024. |

| Inflation | Increases operational costs; reduces consumer spending. | Eurozone inflation ~3.5% in early 2024. |

| Raw Material Prices | Affects production costs and profit margins. | Volatile PET resin prices influenced by energy and capacity. |

| Interest Rates | Impacts cost of capital for investments. | ECB main refinancing rate at 4.50% in early 2024. |

| E-commerce Growth | Boosts demand for specialized packaging; increases logistics costs. | Global e-commerce sales projected over $7 trillion in 2024. |

What You See Is What You Get

Berlin Packaging PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis for Berlin Packaging. This detailed breakdown explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the market landscape and potential challenges with this complete, ready-to-deploy analysis.

Sociological factors

Sociologically, there's a powerful and expanding shift towards sustainable and eco-friendly packaging. Consumers are actively seeking out products that utilize recyclable, biodegradable, or reusable materials, even demonstrating a willingness to pay more for them. This trend directly influences Berlin Packaging to prioritize innovation in developing and offering a broader spectrum of these environmentally conscious packaging solutions.

For instance, a 2024 NielsenIQ report indicated that 73% of global consumers say they would change their consumption habits to reduce their environmental impact. This strong consumer sentiment is a key driver for packaging manufacturers like Berlin Packaging to invest in and promote sustainable materials and designs to meet market demand and maintain a competitive edge.

Modern lifestyles increasingly prioritize convenience, driving a significant demand for packaging that is portable, easy to handle, and often designed for single use. This trend is particularly evident in the food and beverage industry, where consumers seek quick and simple solutions for on-the-go consumption. For instance, the global market for ready-to-eat meals, a prime example of convenience-driven food, was valued at approximately $160 billion in 2023 and is projected to grow steadily.

Berlin Packaging must strategically adapt its packaging designs and product portfolio to cater to these evolving consumer preferences for ease of use. This necessitates innovation in areas like resealable closures, lighter materials, and efficient portioning. Meeting these demands while simultaneously adhering to growing sustainability mandates presents a key challenge, requiring a delicate balance between user-friendliness and environmental responsibility.

Consumers are increasingly prioritizing health and wellness, directly affecting packaging decisions. This means a demand for packaging that clearly displays nutritional information, offers convenient single-serving options, and uses materials certified as safe for food contact. For instance, the global market for health and wellness packaging was projected to reach over $140 billion by 2024, highlighting this significant consumer shift.

This heightened awareness significantly influences Berlin Packaging's approach within the food, beverage, and pharmaceutical sectors. Companies are actively seeking packaging solutions that align with healthy living, pushing for transparency in ingredients and safety standards. In 2024, studies indicated that over 60% of consumers considered health and wellness factors when purchasing food products, a trend that directly translates to packaging requirements.

E-commerce Influence on Unboxing Experience

The explosive growth of e-commerce has elevated the unboxing experience from a mere necessity to a pivotal moment in customer interaction. For businesses like Berlin Packaging, this means packaging must now serve as a powerful marketing tool, extending the brand's appeal beyond the digital storefront. Consumers increasingly expect packaging that is not only protective but also visually appealing and reflects the brand’s identity, directly impacting their perception of product quality and the overall shopping journey.

This sociological shift is driven by consumers sharing their unboxing moments online, turning packaging into a social currency. Reports indicate that a significant majority of consumers feel that well-designed packaging enhances their perception of a brand. For instance, studies in 2023 showed that over 40% of consumers have shared images of product packaging on social media, highlighting its marketing potential.

- Brand Reinforcement Packaging design directly influences brand perception and customer loyalty in the digital age.

- Social Media Impact Positive unboxing experiences encourage user-generated content, acting as free advertising.

- Consumer Expectations Aesthetically pleasing and functional packaging is now a baseline expectation for online shoppers.

- E-commerce Growth The ongoing surge in online retail, projected to continue its upward trajectory through 2025, underscores the importance of this trend.

Public Perception of Packaging Waste

Public awareness regarding packaging waste, particularly plastic pollution, is significantly increasing. This heightened concern directly impacts consumer choices, pushing brands toward more sustainable packaging solutions. For Berlin Packaging, this means that demonstrating a commitment to waste reduction and circular economy principles is no longer just good practice; it's essential for maintaining brand reputation and attracting environmentally conscious customers.

The societal push for responsible packaging translates into tangible market shifts. For instance, a 2024 survey indicated that over 70% of consumers consider a brand's environmental impact when making purchasing decisions. This trend compels companies like Berlin Packaging to innovate in areas such as material reduction, recyclability, and the use of recycled content. Failing to adapt can lead to a loss of market share and damage to brand perception.

- Growing Consumer Demand for Sustainable Packaging: Studies in early 2025 show a consistent rise in consumer preference for products with eco-friendly packaging.

- Impact on Brand Reputation: Companies perceived as environmentally irresponsible face negative publicity, impacting sales and investor confidence.

- Regulatory Pressure and Market Incentives: Governments and industry bodies are increasingly mandating or incentivizing the use of sustainable packaging materials.

- Circular Economy Integration: Berlin Packaging is exploring strategies to incorporate more recycled content and design for recyclability to align with circular economy goals.

Societal shifts toward health and wellness are profoundly influencing packaging. Consumers demand clear nutritional labeling, convenient single-serving options, and food-safe materials, with the health and wellness packaging market projected to exceed $140 billion by 2024. Berlin Packaging must align with these preferences, emphasizing transparency and safety in its food, beverage, and pharmaceutical packaging solutions.

The rise of e-commerce has transformed packaging into a crucial brand touchpoint, necessitating visually appealing and protective designs that enhance the unboxing experience. Over 40% of consumers shared packaging images on social media in 2023, highlighting packaging's role as a marketing tool. Berlin Packaging must innovate to meet these evolving consumer expectations for online retail.

Growing consumer awareness of packaging waste, particularly plastic pollution, is driving demand for sustainable solutions. A 2024 survey revealed that over 70% of consumers consider environmental impact in purchasing decisions. Berlin Packaging's commitment to waste reduction and circular economy principles is vital for brand reputation and market competitiveness.

Technological factors

Technological advancements are dramatically increasing the availability and viability of sustainable packaging materials. Innovations include plant-based plastics, compostable mushroom packaging, and biodegradable seaweed wraps, alongside enhanced recycled content technologies. These developments offer alternatives to traditional glass, plastic, and metal, presenting new opportunities for eco-conscious product presentation.

Berlin Packaging's strategic imperative involves significant investment in research and development to explore and integrate these emerging materials. Collaborating closely with material science innovators and suppliers is crucial to staying ahead of the curve. By actively incorporating novel sustainable options, Berlin Packaging can expand its product portfolio and cater to a growing market demand for environmentally responsible packaging solutions, potentially capturing a larger share of the burgeoning sustainable packaging market, which was projected to reach over $300 billion globally by 2024.

Smart packaging, incorporating elements like QR codes, NFC tags, and sensors, is revolutionizing how consumers interact with products and how businesses track them. This technology allows for enhanced consumer engagement through direct links to product information or promotions. For Berlin Packaging, this translates into opportunities to offer clients more value-added packaging solutions that boost brand loyalty and provide critical data.

The ability to integrate sensors for temperature or humidity monitoring, coupled with RFID for inventory management, significantly improves product traceability and supply chain visibility. For instance, the global smart packaging market was valued at approximately $29 billion in 2023 and is projected to reach over $50 billion by 2029, indicating strong growth and adoption. Berlin Packaging can capitalize on this by offering packaging that ensures product integrity from production to the consumer, thereby reducing waste and enhancing customer trust.

Automation and AI are significantly reshaping the packaging sector. In 2024, advancements in AI are enabling predictive maintenance for machinery, cutting downtime and boosting operational efficiency. Companies are leveraging AI to optimize factory floor layouts and automate quality control checks, leading to substantial reductions in material waste and labor costs.

AI's impact extends to supply chain optimization, with algorithms predicting demand fluctuations and rerouting logistics in real-time. This is crucial for Berlin Packaging, as it allows for more responsive inventory management and faster delivery times. For instance, AI-powered route planning can reduce fuel consumption by up to 15%, directly impacting operational expenses and environmental footprint.

Furthermore, AI is instrumental in developing smarter packaging solutions. By analyzing vast datasets on consumer behavior and product performance, AI can inform the design of packaging that is not only functional but also appealing and sustainable. This predictive capability helps manufacturers like Berlin Packaging stay ahead of market trends and meet evolving consumer demands for eco-friendly options.

Digital Printing and Personalization

Digital printing advancements are revolutionizing packaging. These technologies offer unprecedented flexibility for customized and personalized designs, which is a significant advantage for brands looking to connect with specific consumer segments. This trend allows companies like Berlin Packaging to provide highly tailored solutions, boosting brand recognition and customer loyalty.

The ability to produce short runs with unique designs efficiently means that packaging can become a dynamic marketing tool. For instance, campaigns featuring personalized messages or variable data printing can significantly increase consumer engagement. In 2024, the global digital printing market for packaging was valued at approximately $17.5 billion, with projections indicating continued strong growth through 2025, driven by demand for customization.

- Enhanced Brand Differentiation: Digital printing allows for unique graphics and messaging on each package, setting brands apart.

- Niche Market Accessibility: Smaller, targeted print runs become economically viable, opening doors to specialized markets.

- Increased Consumer Engagement: Personalization fosters a stronger connection between the brand and the consumer, driving loyalty.

- Reduced Lead Times: Digital workflows often shorten production cycles compared to traditional printing methods.

Supply Chain Optimization Technologies

Technological advancements are fundamentally reshaping supply chain operations, with blockchain and predictive analytics emerging as key drivers for optimization. These technologies enhance traceability, allowing for real-time tracking of goods from origin to destination, thereby reducing the likelihood of counterfeit products and improving transparency. In 2024, the adoption of AI in supply chain management saw a significant uptick, with companies reporting an average efficiency gain of 15% through better demand forecasting and inventory management.

For a global entity like Berlin Packaging, which deals with intricate logistics and a vast network of suppliers and customers, these tools are indispensable. Predictive analytics, for instance, can anticipate potential disruptions, such as raw material shortages or transportation delays, enabling proactive mitigation strategies. This foresight is particularly critical given the ongoing volatility in global trade, with geopolitical tensions frequently impacting supply routes and material availability. Companies leveraging these technologies are better positioned to maintain consistent delivery schedules and manage inventory costs effectively.

- Blockchain for Enhanced Traceability: In 2024, the global blockchain in supply chain market was valued at approximately $1.2 billion, projected to grow significantly as more companies seek end-to-end visibility. This technology allows Berlin Packaging to verify the origin and authenticity of its packaging materials, ensuring quality and compliance across its diverse product lines.

- Predictive Analytics for Risk Mitigation: AI-driven predictive analytics tools are being deployed to forecast demand fluctuations and potential supply chain bottlenecks. For example, advanced algorithms can analyze weather patterns, economic indicators, and historical shipping data to predict potential delays, allowing for contingency planning.

- Automation in Warehousing and Logistics: Robotics and automated systems are increasingly integrated into warehousing operations, speeding up order fulfillment and reducing labor costs. Berlin Packaging can benefit from these advancements to improve the efficiency of its distribution centers.

- IoT for Real-time Monitoring: The Internet of Things (IoT) enables the real-time monitoring of environmental conditions during transit for sensitive products, such as those requiring specific temperature controls, ensuring product integrity throughout the supply chain.

Technological advancements, particularly in automation and AI, are significantly boosting efficiency in the packaging sector. By 2024, AI is enabling predictive maintenance for machinery, reducing downtime and improving operational output. These technologies also optimize factory layouts and automate quality control, leading to substantial reductions in both material waste and labor expenses.

AI's role in supply chain optimization is crucial, with algorithms predicting demand shifts and rerouting logistics in real-time, which is vital for Berlin Packaging's responsiveness and delivery speed. For instance, AI-powered route planning can achieve up to a 15% reduction in fuel consumption. Furthermore, AI helps design smarter, more sustainable packaging by analyzing consumer behavior data, allowing companies like Berlin Packaging to anticipate market trends and meet evolving eco-friendly demands.

Legal factors

The EU's Packaging and Packaging Waste Regulations (PPWR), set to take effect in February 2025, represent a crucial legal shift for companies like Berlin Packaging. This legislation will directly influence how packaging is designed, the materials used, and the recycling goals businesses must meet if they operate within or export to the European Union.

Berlin Packaging will need to rigorously adhere to PPWR mandates concerning the minimum percentage of recycled content in their packaging, the implementation of reusable packaging solutions, and overall waste reduction targets. Non-compliance could lead to substantial penalties and, more importantly, could jeopardize their access to the lucrative EU market.

Extended Producer Responsibility (EPR) laws are increasingly becoming a significant legal factor for companies like Berlin Packaging. These regulations, which are being enacted or expanded across numerous countries and even within several US states, legally hold producers accountable for the entire lifecycle of their packaging, including its end-of-life management. This means companies must actively participate in or fund collection, sorting, and recycling programs.

Compliance with these diverse and evolving EPR mandates represents a critical legal obligation. For Berlin Packaging, this can involve significant financial contributions towards recycling infrastructure development and strict adherence to various reporting requirements. For instance, as of early 2024, several European countries have updated their EPR schemes, increasing fees for non-recycled content. The complexity lies in the varying standards and implementation across different jurisdictions, requiring constant monitoring and adaptation of business practices.

Food contact material regulations are a critical legal factor for Berlin Packaging. These rules, like the EU's Regulation (EC) No 1935/2004, mandate that materials used in packaging food and beverages must not transfer their constituents to food in quantities that could endanger human health. For instance, specific migration limits for substances like Bisphenol A (BPA) in plastics are strictly enforced, with ongoing reviews and potential tightening of these limits in 2024 and 2025 based on new scientific evidence.

Berlin Packaging must ensure its entire product range, from glass jars to plastic bottles and metal cans, complies with these stringent national and international standards. The company's adherence to these regulations, including those from the FDA in the United States and equivalent bodies globally, is paramount for consumer safety and maintaining market access. Failure to comply can result in product recalls, hefty fines, and significant reputational damage, impacting the company’s bottom line, which in 2023 saw significant investment in compliance infrastructure.

Restrictions on Single-Use Plastics and Plastic Taxes

Many regions are enacting bans or restrictions on specific single-use plastics, alongside the introduction of plastic taxes, aiming to reduce environmental pollution. For Berlin Packaging, this means a strategic shift towards exploring and prioritizing alternative materials and innovative designs that minimize plastic consumption or boost the incorporation of recycled content. This proactive approach is crucial for managing potential tax liabilities and ensuring continued market acceptance of their products.

For instance, the European Union's Single-Use Plastics Directive, implemented in stages since 2021, has set ambitious targets for reducing plastic waste and promoting a circular economy. By 2025, member states are required to achieve a collection rate of 77% for plastic beverage bottles, increasing to 90% by 2029. Furthermore, many countries are introducing or escalating plastic taxes; the UK's Plastic Packaging Tax, introduced in April 2022, levies a charge of £200 per tonne on plastic packaging manufactured in or imported into the UK containing less than 30% recycled plastic, incentivizing higher recycled content.

- Regulatory Landscape: Jurisdictions worldwide are increasingly implementing legal frameworks to limit plastic pollution, including outright bans on certain single-use items and the imposition of financial penalties through plastic taxes.

- Impact on Berlin Packaging: These legal measures necessitate a strategic pivot for Berlin Packaging, compelling the company to accelerate its adoption of sustainable materials and product designs that reduce virgin plastic usage or integrate higher percentages of recycled plastics.

- Cost Mitigation and Market Access: By proactively adapting to these regulations, Berlin Packaging can mitigate the financial impact of plastic taxes and ensure its product offerings remain compliant and desirable in a market increasingly driven by environmental consciousness.

- Industry Trends: The global trend points towards stricter environmental regulations, with many governments setting ambitious targets for plastic reduction and recycling, indicating a long-term imperative for businesses like Berlin Packaging to innovate in material science and packaging solutions.

International Trade Laws and Compliance

Berlin Packaging, as a global supplier, operates within a dynamic international trade landscape. Navigating diverse customs regulations and import/export compliance across many nations is critical for seamless operations. For instance, as of early 2025, the World Trade Organization (WTO) continues to facilitate trade agreements, but regional variations in tariffs and documentation requirements remain significant. Failure to comply can lead to substantial fines and operational disruptions.

Key legal factors influencing Berlin Packaging's international trade include:

- Compliance with WTO Agreements: Adherence to global trade rules established by the WTO, aiming to liberalize trade and prevent protectionism.

- Tariff and Duty Regulations: Understanding and managing varying import duties and taxes imposed by different countries on packaging materials and finished goods.

- Sanctions and Embargoes: Monitoring and complying with international sanctions and embargoes that may restrict trade with specific countries or entities.

- Product Standards and Certifications: Meeting diverse product safety, labeling, and environmental standards required for market entry in different jurisdictions.

The EU's Packaging and Packaging Waste Regulations (PPWR), effective February 2025, mandates specific recycled content percentages and reusable packaging solutions, impacting Berlin Packaging's operations in the EU. Non-compliance carries penalties and market access risks.

Extended Producer Responsibility (EPR) laws across various regions hold producers accountable for packaging lifecycles, requiring Berlin Packaging to fund or participate in collection and recycling programs. For example, in early 2024, several European countries updated EPR schemes, increasing fees for non-recycled content, necessitating constant adaptation.

Food contact material regulations, such as EU's Regulation (EC) No 1935/2004, ensure packaging safety by limiting constituent transfer to food. Strict migration limits for substances like BPA are enforced, with potential tightening in 2024-2025. Berlin Packaging must ensure global compliance, as seen with FDA standards in the US, to avoid recalls and reputational damage.

Many regions are enacting single-use plastic bans and plastic taxes, pushing Berlin Packaging towards sustainable materials and designs. The UK's Plastic Packaging Tax, for instance, levies £200 per tonne on plastic packaging with less than 30% recycled content, incentivizing higher recycled material use.

Environmental factors

The growing emphasis on circular economy principles is a significant environmental factor for Berlin Packaging. This means designing packaging solutions that are easily reusable, refillable, and highly recyclable, thereby reducing reliance on virgin materials. For instance, by 2024, the European Union aims for 70% of all plastic packaging to be recyclable, pushing companies like Berlin Packaging to innovate in this space.

Optimizing material usage and promoting mono-material packaging are key strategies to align with these environmental shifts. Berlin Packaging's commitment to developing effective return and repurposing systems will be crucial for minimizing waste and maximizing resource efficiency. This aligns with global sustainability goals, as the Ellen MacArthur Foundation reported that adopting circular economy models could generate $4.5 trillion in economic benefits by 2030.

Berlin Packaging is prioritizing the reduction of its carbon footprint, a key environmental consideration for the packaging sector. This involves tackling emissions throughout its entire supply chain, from how products are made to how they are transported.

The company is specifically focused on lowering its Scope 1 and Scope 2 emissions. These are direct emissions from operations and emissions from purchased energy, respectively. By targeting these areas, Berlin Packaging is making a direct impact on its environmental performance.

Berlin Packaging has established climate progress goals, demonstrating a commitment to achieving greater sustainability. These targets are designed to align with broader, international efforts aimed at reaching climate neutrality.

For instance, many companies in the packaging industry are investing in renewable energy sources for their manufacturing facilities. In 2024, the global renewable energy capacity is projected to increase significantly, with solar and wind power leading the charge, offering opportunities for packaging firms like Berlin Packaging to reduce their reliance on fossil fuels.

The global challenge of plastic pollution demands innovation in waste reduction and material science. Berlin Packaging's commitment to offering glass and metal packaging, alongside advancements in recycled plastics and bioplastics, positions them to meet growing environmental regulations and consumer preferences for sustainable solutions. For instance, the European Union aims for all plastic packaging to be reusable or recyclable by 2030, a target Berlin Packaging's product diversification helps address.

Sustainable Sourcing and Biodiversity Protection

Responsible sourcing of raw materials, particularly for paper and wood-based packaging components, is a growing environmental imperative. Consumers and regulators alike are demanding transparency and assurance that these materials originate from sustainably and ethically managed forests, directly impacting biodiversity preservation. Berlin Packaging's proactive approach to supply chain management, including supplier audits and certifications, helps mitigate the risk of deforestation and promotes responsible forestry practices.

Berlin Packaging's commitment to responsible sourcing directly supports biodiversity protection by ensuring that its raw material procurement does not contribute to habitat destruction or the depletion of endangered species. For instance, many paper suppliers are increasingly adopting certifications like the Forest Stewardship Council (FSC), which guarantees that wood comes from responsibly managed forests. In 2024, the global demand for FSC-certified paper packaging continued its upward trend, with an estimated 20% increase in market share compared to 2023, reflecting industry-wide shifts.

- Sustainable Forestry: Emphasis on sourcing from forests managed to maintain biodiversity, water resources, and ecological processes.

- Ethical Labor Practices: Ensuring fair treatment and safe working conditions for all individuals involved in the supply chain.

- Reduced Environmental Footprint: Minimizing pollution, waste, and carbon emissions throughout the sourcing and manufacturing processes.

- Biodiversity Impact Assessments: Evaluating and mitigating the potential negative impacts of sourcing on local ecosystems and wildlife.

Water Usage and Waste Diversion

Water usage in manufacturing is a critical environmental consideration. Berlin Packaging is actively working to minimize its water consumption throughout its production processes. This focus on efficiency is not just about compliance but also about reducing operational costs and environmental impact.

Diversion of waste from landfills is another key environmental performance indicator for Berlin Packaging. The company has implemented waste reduction initiatives in its warehouses. These efforts are part of a broader strategy to improve sustainability across its operations.

Berlin Packaging has a clear goal of achieving zero-waste certifications for its facilities. This ambition underscores their commitment to environmental stewardship and responsible resource management. For instance, in 2023, the company reported a 15% increase in waste diversion rates across its North American operations compared to 2022.

- Minimizing Water Consumption: Berlin Packaging is implementing water-saving technologies in its manufacturing lines.

- Waste Diversion Initiatives: Pilot programs in warehouses focus on reducing packaging materials and improving recycling processes.

- Zero-Waste Certification Goal: The company aims for zero-waste certifications, indicating a significant commitment to landfill diversion.

- 2023 Performance: North American operations saw a 15% rise in waste diversion rates year-over-year.

The increasing global focus on sustainability and the circular economy directly impacts Berlin Packaging's operations and strategy. Stricter environmental regulations, such as the European Union's push for 70% recyclable plastic packaging by 2024, necessitate innovation in reusable, refillable, and recyclable solutions. By prioritizing mono-material designs and efficient return systems, Berlin Packaging aims to minimize waste and maximize resource efficiency, aligning with goals like the Ellen MacArthur Foundation's projection of $4.5 trillion in economic benefits from circular models by 2030.

Berlin Packaging is actively addressing its carbon footprint by targeting Scope 1 and Scope 2 emissions, reflecting a commitment to climate neutrality. The company's investment in renewable energy sources, like solar and wind power, is timely, as global renewable energy capacity is expected to see significant growth in 2024. This proactive approach to reducing energy-related emissions is crucial for meeting sustainability targets and improving environmental performance across its supply chain.

The company's commitment to responsible sourcing, particularly for paper and wood-based packaging, is vital for biodiversity preservation and combating deforestation. Adherence to certifications like the Forest Stewardship Council (FSC) is becoming standard, with global demand for FSC-certified paper packaging projected to increase by 20% in 2024 compared to the previous year. This ensures raw materials come from sustainably managed forests, minimizing ecological impact.

Berlin Packaging's efforts to minimize water consumption and divert waste from landfills are key environmental performance indicators. The company's goal of achieving zero-waste certifications for its facilities highlights a strong commitment to resource management. In 2023, a notable achievement was a 15% increase in waste diversion rates across North American operations, demonstrating tangible progress in reducing landfill contributions.

| Environmental Factor | Berlin Packaging's Approach | 2024/2025 Relevance/Data |

|---|---|---|

| Circular Economy | Focus on reusable, refillable, and recyclable packaging solutions. | EU target: 70% recyclable plastic packaging by 2024. Potential for $4.5T economic benefits by 2030 (Ellen MacArthur Foundation). |

| Carbon Footprint Reduction | Lowering Scope 1 & 2 emissions; investing in renewable energy. | Global renewable energy capacity growth in 2024. |

| Sustainable Sourcing | Prioritizing FSC-certified materials; ensuring no contribution to deforestation. | 20% projected increase in demand for FSC-certified paper packaging in 2024 vs. 2023. |

| Waste Management | Minimizing water use; diverting waste from landfills; aiming for zero-waste certification. | 15% increase in waste diversion in North America (2023 vs. 2022). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Berlin Packaging is built upon a comprehensive review of global economic indicators, regulatory updates from key markets, and industry-specific technological advancements. We also incorporate insights from market research firms and environmental policy reports to ensure a holistic view.