Berlin Packaging Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berlin Packaging Bundle

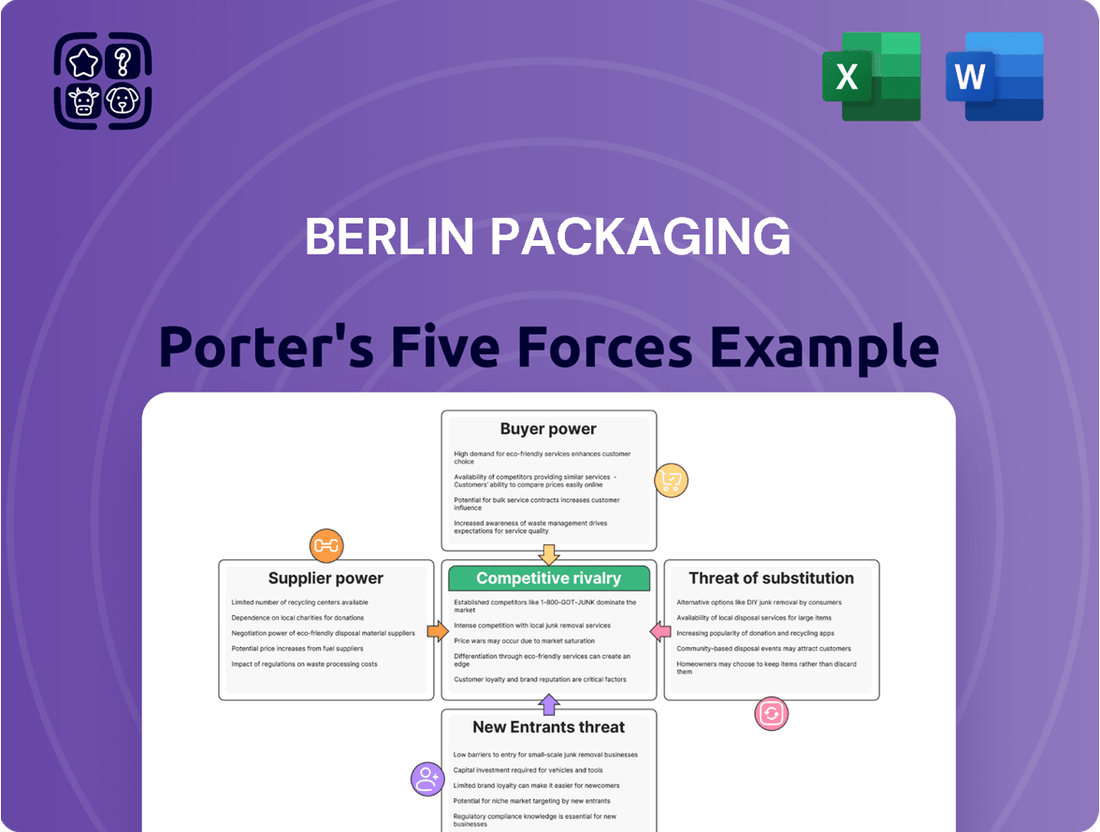

Berlin Packaging operates in a dynamic market shaped by several key competitive forces. Understanding the intensity of rivalry among existing competitors, the bargaining power of both buyers and suppliers, and the constant threat of new entrants and substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Berlin Packaging’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers to Berlin Packaging, a major player in glass, plastic, and metal containers and closures, can exert varying degrees of influence. For highly specialized or patented packaging components, where alternatives are scarce, supplier power tends to be elevated. This is particularly true for unique material formulations or proprietary closure technologies that Berlin Packaging might require for specific client needs.

Conversely, for more commoditized materials like general plastic resins or standard glass types, Berlin Packaging’s bargaining power is likely stronger due to the availability of multiple suppliers. In 2024, the global plastic resin market, for example, remained robust with numerous producers, giving buyers like Berlin Packaging leverage in price negotiations for bulk purchases of materials such as PET or HDPE.

Switching suppliers for Berlin Packaging can incur substantial costs. These expenses are particularly high when dealing with custom-designed packaging, intricately integrated supply chain solutions, or unique material specifications, directly amplifying supplier leverage.

For instance, if Berlin Packaging needs to change a supplier for a proprietary glass bottle mold, the expense of developing a new mold could range from tens of thousands to hundreds of thousands of dollars, depending on complexity and volume. This significant upfront investment acts as a powerful deterrent to switching, strengthening the original supplier's bargaining position.

Furthermore, Berlin Packaging's commitment to providing end-to-end supply chain management means that disruptions from changing a key supplier can ripple through their entire operation. The costs associated with re-tooling production lines, re-validating materials, and potentially delaying client orders can easily run into millions, making supplier loyalty a strategic imperative rather than a mere preference.

The threat of forward integration by suppliers, such as major chemical companies or glass manufacturers moving into packaging solutions, could significantly impact Berlin Packaging. If these suppliers were to offer their own packaging services, it could limit Berlin’s access to essential raw materials or drive up costs for them. While this is a potential risk, it's generally considered less common for large, diversified raw material producers to directly enter the complex packaging solutions market.

Importance of Supplier Inputs to Berlin Packaging's Product Quality

The quality of raw materials like glass, plastic, and metal directly impacts Berlin Packaging's final product. Suppliers of these critical inputs hold significant bargaining power if their materials are essential for performance or regulatory compliance. For instance, a specialized coating for a pharmaceutical bottle that ensures product integrity would give that supplier more leverage.

Berlin Packaging's 'best-in-class approach to sourcing' is a strategic move to counter this. By not relying on a single material or technology, they can diversify their supplier base and reduce dependence on any one provider. This allows them to negotiate more favorable terms and maintain flexibility.

- Supplier Leverage: When a supplier's product is a key component in a high-value or specialized packaging solution, their bargaining power increases.

- Material Dependency: Berlin Packaging's reliance on consistent, high-quality inputs for diverse packaging needs, from food and beverage to healthcare, underscores the importance of supplier relationships.

- Sourcing Strategy: A broad supplier network and a focus on multiple material types (glass, plastic, metal, etc.) helps mitigate the risk of any single supplier dictating terms.

Availability of Substitute Inputs for Suppliers

The availability of substitute inputs significantly impacts a supplier's bargaining power. If a company like Berlin Packaging can easily source a raw material from multiple providers, or if there are readily available alternative materials or manufacturing processes, the individual supplier's leverage is weakened. For instance, the abundance of standard plastic resin suppliers generally limits the power of any single resin producer.

However, emerging trends can shift this dynamic. The increasing demand for sustainable and innovative materials, such as biodegradable plastics or advanced recycled content, can empower niche suppliers who control these specialized inputs. For example, as of early 2024, the market for high-quality, certified recycled PET (rPET) is experiencing rapid growth, and suppliers with consistent, large-scale access to this material are finding themselves in a stronger negotiating position with packaging companies.

- Supplier Leverage Diminished by Substitute Availability: When numerous suppliers offer similar raw materials or manufacturing processes, individual suppliers have less power to dictate terms.

- Impact of Material Innovation: The emergence of new, sought-after materials can create powerful niche suppliers by limiting readily available alternatives.

- Example: Recycled Content Growth: The expanding market for recycled plastics like rPET in 2024 gives suppliers of this material increased bargaining power due to high demand and limited supply of certified sources.

Suppliers to Berlin Packaging hold significant power when their products are critical components for specialized or high-value packaging solutions, particularly if alternatives are scarce. This leverage is amplified by the substantial costs associated with switching, such as developing new molds, which can run into tens of thousands of dollars. For example, in 2024, the growing demand for sustainable materials like certified recycled PET (rPET) has empowered niche suppliers of these innovative inputs, as readily available alternatives are limited, giving them stronger negotiating positions.

| Factor | Impact on Supplier Bargaining Power | 2024 Relevance |

|---|---|---|

| Product Differentiation/Specialization | High for unique or patented components | Specialized coatings for pharmaceutical bottles enhance supplier leverage. |

| Switching Costs | High for custom-designed packaging or integrated solutions | Developing new glass bottle molds can cost $10,000s to $100,000s. |

| Availability of Substitutes | Low for commoditized materials, high for niche materials | Abundance of standard plastic resins limits individual supplier power; limited rPET sources increase power. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Berlin Packaging's position in the global packaging industry.

Easily identify and mitigate competitive threats with a clear visualization of industry power dynamics.

Customers Bargaining Power

Berlin Packaging's customer base spans a wide array of sectors, including food and beverage, pharmaceuticals, and personal care. This diversity is a strength, as it prevents over-reliance on any single industry.

However, if a few major clients represent a substantial percentage of Berlin Packaging's revenue, their bargaining power increases significantly. These large customers can leverage their volume to negotiate more favorable pricing, payment terms, and specialized service agreements, potentially impacting Berlin Packaging's profit margins.

For instance, if a single client were to account for 10% or more of Berlin Packaging's total sales, their ability to influence contract terms would be considerably higher than that of smaller, individual buyers.

Conversely, a broad and fragmented customer portfolio dilutes the influence of any single customer. In such a scenario, the bargaining power of individual customers is diminished, as their individual purchase volume is less critical to Berlin Packaging's overall business performance.

For Berlin Packaging's customers, the cost of switching packaging suppliers can be substantial. These costs include expenses related to re-designing packaging to meet new specifications, the time and resources spent on re-validating new packaging to ensure compliance and quality, and the necessary adjustments to their existing supply chains. These factors make it less appealing for customers to simply move to a competitor.

Berlin Packaging actively works to increase these switching costs through its comprehensive, integrated service offerings. By providing end-to-end solutions that encompass structural design, meticulous package development, and efficient supply chain management, they create a more cohesive and interdependent relationship with their clients. This integrated approach makes it more complex and costly for customers to extract themselves from Berlin's ecosystem, thereby diminishing the bargaining power of those customers.

Customers' sensitivity to packaging prices is a key factor in the bargaining power they hold against Berlin Packaging. This sensitivity is directly linked to how much of their total product cost is represented by packaging and how much value they believe that packaging adds to their brand. For instance, if packaging is a significant portion of a product's cost, customers will naturally focus more on price.

In markets where competition is fierce, such as the consumer packaged goods sector, customers are typically more inclined to exert pressure for lower packaging prices. This means Berlin Packaging may face demands for cost reductions from clients operating in highly competitive landscapes. For example, in 2024, many consumer goods companies reported increased pressure on margins, leading them to scrutinize all input costs, including packaging.

The ongoing growth of e-commerce further amplifies customer price sensitivity. Online retailers often prioritize packaging that is not only cost-effective but also lightweight to minimize shipping expenses. This trend pushes demand towards more economical and efficient packaging solutions, influencing how Berlin Packaging structures its offerings and pricing.

Threat of Backward Integration by Customers

The threat of customers integrating backward into packaging production is a significant consideration, particularly for large clients with substantial volume requirements. These customers, by manufacturing their own packaging, could potentially reduce their reliance on suppliers like Berlin Packaging and gain more control over their supply chain.

This threat is generally mitigated for Berlin Packaging due to its provision of complex and specialized packaging solutions. These often demand considerable capital outlay and technical know-how, which smaller or less specialized customers may find prohibitive. However, for standardized, high-volume packaging items, the allure of in-house production can be more pronounced, increasing the bargaining power of those specific customer segments.

- Customer Integration Risk: For high-volume, standardized packaging, customers may explore backward integration.

- Berlin's Advantage: Berlin Packaging's hybrid solutions and specialized expertise lower this risk for complex packaging needs.

- Volume Sensitivity: The threat is more pronounced for customers with significant packaging consumption, impacting their purchasing leverage.

- Capital & Expertise Barrier: Significant investment and specialized knowledge are required for effective backward integration, limiting its feasibility for many.

Customer Demand for Sustainable and Innovative Solutions

Customers increasingly seek packaging that aligns with environmental values, driving demand for sustainable materials like recycled content, biodegradables, and easily recyclable options. This shift is fueled by both consumer awareness and evolving governmental regulations worldwide, pushing companies to adopt greener practices. For instance, by mid-2024, several European Union member states have already implemented or are finalizing stricter rules on single-use plastics and packaging waste, directly impacting material choices.

Berlin Packaging’s capacity to provide innovative and sustainable packaging solutions, such as those incorporating smart technology for supply chain tracking or unique, custom-designed aesthetics, can significantly influence customer choices. By offering differentiated products that meet these growing demands for eco-friendliness and advanced features, Berlin Packaging can potentially lessen the direct price-based bargaining power of its customers, as the unique value proposition becomes a key differentiator.

- Growing Demand for Eco-Friendly Packaging: Reports from 2024 indicate a substantial increase in consumer preference for packaging made from recycled materials, compostable components, and those designed for easy recyclability.

- Regulatory Tailwinds: Global regulations, particularly in regions like the EU and North America, are increasingly mandating sustainable packaging practices, compelling customers to seek suppliers who can meet these compliance requirements.

- Innovation as a Differentiator: Berlin Packaging’s investment in smart packaging technologies and advanced custom design capabilities offers unique value, potentially shifting customer focus from pure cost to holistic solution benefits.

- Impact on Bargaining Power: By providing these sought-after sustainable and innovative solutions, Berlin Packaging can strengthen its position, reducing customers' ability to solely negotiate on price and instead focusing on the overall value and unique features offered.

The bargaining power of Berlin Packaging's customers is influenced by several key factors, including their size, price sensitivity, and the threat of backward integration. Large clients with significant purchasing volumes can exert considerable pressure on pricing and terms. For example, in 2024, many consumer goods companies faced margin pressures, leading them to scrutinize all input costs, including packaging, which intensified this dynamic.

Customers' switching costs are a crucial mitigating factor. The expenses and effort involved in re-designing, re-validating, and adjusting supply chains for new packaging suppliers make it less attractive for clients to switch. Berlin Packaging further strengthens its position by offering integrated, end-to-end solutions that embed clients deeper into its service ecosystem, thereby increasing these switching costs.

The demand for sustainable and innovative packaging also plays a role. By mid-2024, regulatory shifts and consumer preferences strongly favored eco-friendly materials. Berlin Packaging's ability to provide these solutions, such as those using recycled content or incorporating smart tracking, can shift customer focus from price alone to the overall value and unique features offered, thereby reducing price-based bargaining power.

| Factor | Impact on Customer Bargaining Power | Berlin Packaging Mitigation Strategy |

|---|---|---|

| Customer Size/Volume | High for large clients, enabling price negotiation. | Diversified customer base; integrated solutions increase switching costs. |

| Price Sensitivity | High in competitive markets (e.g., CPG in 2024). | Focus on value-added services; innovation in design and sustainability. |

| Switching Costs | Significant for re-design, validation, and supply chain changes. | Comprehensive, end-to-end service offerings create client dependency. |

| Sustainability Demand | Growing, pushing for eco-friendly materials. | Investment in sustainable packaging R&D and offerings. |

| Backward Integration Threat | Moderate for high-volume, standardized packaging. | Specialized, capital-intensive solutions create barriers to entry. |

Same Document Delivered

Berlin Packaging Porter's Five Forces Analysis

This preview showcases the complete Berlin Packaging Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the packaging industry. You're seeing the actual, professionally written document that will be instantly available to you upon purchase, ensuring no discrepancies or missing information. This detailed analysis will equip you with strategic insights into the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry. What you preview here is precisely the deliverable you will receive, ready for immediate application to your business strategy.

Rivalry Among Competitors

The global packaging market is quite crowded, featuring many companies, from massive multinational corporations to smaller, specialized regional ones. While Berlin Packaging holds a significant position as the world's largest Hybrid Packaging Supplier, it still contends with formidable competitors such as Amcor and Berry Global, both of which are major players in the industry.

These large competitors possess substantial resources and established market presences, making the competitive rivalry intense. For instance, Amcor reported revenues of approximately $15.0 billion in 2023, showcasing the scale of operations Berlin Packaging must navigate. Similarly, Berry Global, another key competitor, generated around $14.0 billion in revenue in 2023, highlighting the significant market share these entities command.

The global packaging market is on a solid growth trajectory. Projections indicate it will reach approximately $1.2 trillion by 2027, a considerable increase driven by a strong demand for sustainable packaging solutions and the continuous expansion of e-commerce. This expanding market size is a positive factor for Berlin Packaging, as it provides opportunities for growth without solely relying on intense competition for existing market share.

Berlin Packaging's competitive rivalry is significantly shaped by its unique 'hybrid packaging supplier' model. This approach goes beyond simply providing containers, encompassing crucial services like structural design, comprehensive package development, financial solutions, and sophisticated supply chain management. This broad spectrum of integrated offerings creates a strong value proposition for customers.

By focusing on complete solutions rather than just product sales, Berlin Packaging effectively minimizes direct competition based solely on price. This strategic differentiation fosters deeper customer relationships and cultivates loyalty, as clients rely on Berlin for a holistic service package that addresses multiple needs. For instance, in 2024, their integrated supply chain solutions have been particularly impactful in navigating global logistics complexities.

Switching Costs for Competitors' Customers

Customers who find it difficult or expensive to switch from Berlin Packaging to a competitor are less likely to do so. This is a significant factor in reducing competitive rivalry. High switching costs can stem from several sources, making it challenging for competitors to lure away Berlin Packaging's clientele.

Berlin Packaging cultivates these high switching costs through its integrated approach. By offering a full suite of services, from design and sourcing to logistics and inventory management, they embed themselves deeply within their clients' operations. This comprehensive model creates a sticky relationship, as a client would need to find and manage multiple new suppliers and service providers to replicate Berlin Packaging's offering.

- Established Relationships: Long-standing ties with Berlin Packaging’s sales and support teams foster loyalty and trust, making a switch disruptive.

- Custom Tooling and Molds: Investments in proprietary tooling or molds for specific packaging designs represent a sunk cost for clients, penalizing a change.

- Integrated Supply Chain Processes: When Berlin Packaging's systems are seamlessly integrated with a client's production and distribution, switching requires a significant overhaul.

- Brand Equity and Reputation: Berlin Packaging’s strong market presence and reputation for reliability can also act as a deterrent to switching, even if competitors offer lower prices.

Mergers and Acquisitions Activity

The packaging industry is experiencing significant consolidation, with mergers and acquisitions (M&A) actively reshaping the competitive environment. Berlin Packaging, a prominent player, has been a participant in this trend, notably acquiring companies like Rixius AG and Nissho Jitsugyo in 2024. This strategic M&A activity leads to the emergence of larger, more diversified entities within the sector.

This consolidation directly impacts competitive rivalry by reducing the number of independent players. As companies like Berlin Packaging grow through acquisitions, they gain greater market share and economies of scale. This can intensify pressure on smaller, less integrated competitors, potentially forcing them to seek partnerships or face increased challenges in competing effectively.

- Ongoing Consolidation: The packaging sector continues to see a high volume of M&A transactions.

- Berlin Packaging's Acquisitions: In 2024, Berlin Packaging expanded its reach by acquiring Rixius AG and Nissho Jitsugyo, among others.

- Impact on Competition: These deals result in fewer, but larger and more capable, competitors.

- Market Reshaping: The trend fosters diversification and can alter market dynamics significantly.

Competitive rivalry in the packaging sector is intense, with Berlin Packaging facing established giants like Amcor, which reported approximately $15.0 billion in revenue in 2023, and Berry Global, with revenues around $14.0 billion in the same year. Despite this, Berlin Packaging differentiates itself through its hybrid model, offering integrated design, development, financial, and supply chain services, which fosters customer loyalty and reduces price-based competition.

| Competitor | 2023 Revenue (approx.) | Key Differentiator |

|---|---|---|

| Amcor | $15.0 billion | Vast global presence, diverse product portfolio |

| Berry Global | $14.0 billion | Broad range of plastic packaging solutions |

| Berlin Packaging | N/A (Hybrid Supplier) | Integrated services, customer solutions |

SSubstitutes Threaten

The threat of substitutes for Berlin Packaging's offerings primarily stems from the availability of alternative packaging materials that can perform similar functions. While Berlin Packaging provides a range of traditional options like glass, plastic, and metal, the market is seeing a rise in innovative, sustainable alternatives.

These new materials include molded fiber, plant-based plastics like PLA, and novel options such as mushroom-based packaging and seaweed-based wraps. These emerging alternatives can directly replace conventional packaging in numerous sectors, posing a significant competitive threat.

For instance, the biodegradable packaging market is projected to grow significantly. Reports from 2024 indicate a compound annual growth rate (CAGR) exceeding 6% for biodegradable plastics, suggesting a substantial shift away from traditional petroleum-based plastics, which are a core offering for many packaging companies.

The attractiveness of packaging substitutes for Berlin Packaging hinges significantly on their performance characteristics, such as barrier properties and durability, alongside their overall cost-effectiveness. For instance, while traditional glass or metal containers offer robust protection, their weight and fragility can increase shipping costs, making them less appealing for certain applications.

Innovations are rapidly making sustainable alternatives, like advanced bioplastics and recycled content packaging, more competitive. These materials are not only improving in performance to match conventional options but also address growing environmental concerns, which is a key driver for their increasing adoption across various industries. By 2024, the global market for sustainable packaging was projected to reach hundreds of billions of dollars, indicating a strong shift in consumer and industry preference.

Customer propensity to switch to substitutes is significantly amplified by rising environmental consciousness and stricter regulations. Consumers are demonstrating a greater willingness to invest in eco-friendly alternatives, prompting brands to move away from conventional plastics. This societal trend directly elevates the threat of substitution for traditional packaging solutions.

Non-Packaging Solutions for Product Delivery

Beyond alternative materials, the threat of substitutes for traditional packaging also emerges from entirely different product delivery models. These models aim to reduce or even eliminate the need for conventional packaging. For instance, bulk dispensing systems in retail settings can significantly cut down on individual product packaging.

Refillable models, where consumers return containers for reuse, represent another potent substitute. This approach not only lessens packaging waste but also builds customer loyalty through a circular economy model. In 2024, the global market for refillable packaging solutions saw notable growth, driven by increasing consumer demand for sustainable options.

Localized production and direct-to-consumer delivery also pose a threat. By shortening supply chains, these models can minimize the packaging required for transit and handling. For example, the rise of subscription boxes that often utilize consolidated and optimized packaging demonstrates this trend. In 2023, the direct-to-consumer e-commerce market expanded by 15%, highlighting the shift in delivery methods and their potential impact on packaging needs.

- Bulk Dispensing Systems Reduce single-use packaging in retail environments.

- Refillable Models Promote reuse and circular economy principles, cutting down waste.

- Localized Production & Delivery Streamline supply chains, potentially lowering packaging demands.

- Direct-to-Consumer (DTC) Models Often feature consolidated and optimized packaging solutions.

Impact of Smart and Advanced Packaging Technologies

The threat of substitutes for Berlin Packaging's offerings is amplified by the rise of smart and advanced packaging technologies. While Berlin provides design and development, alternative solutions incorporating features like QR codes, RFID, or integrated sensors can directly substitute traditional packaging if they offer demonstrably better tracking, enhanced product safety, or more engaging consumer interaction capabilities that Berlin may not yet fully integrate or provide competitively.

For instance, the global smart packaging market was valued at approximately $30 billion in 2023 and is projected to reach over $70 billion by 2030, indicating a significant shift towards these advanced solutions. This growth suggests that companies seeking enhanced supply chain visibility or direct consumer engagement might opt for packaging solutions that natively embed these technologies, bypassing traditional packaging suppliers if they are slow to adapt.

- Increased Demand for Track-and-Trace: Supply chain disruptions and a focus on product authenticity are driving demand for integrated tracking, a feature readily available in smart packaging.

- Consumer Engagement Opportunities: Interactive packaging with QR codes or NFC tags offers direct-to-consumer marketing and information, potentially replacing static packaging designs.

- Food Safety and Shelf-Life Monitoring: Sensor-equipped packaging that monitors temperature or spoilage provides a critical substitute for traditional packaging in sensitive industries.

- Integration Challenges for Traditional Providers: Companies not investing in the development or integration of these smart features risk losing market share to packaging providers that offer end-to-end smart solutions.

The threat of substitutes for Berlin Packaging is significant, driven by evolving consumer preferences and technological advancements. Alternative materials like molded fiber and plant-based plastics are gaining traction, with the biodegradable packaging market projected for over 6% CAGR in 2024.

Beyond materials, alternative delivery models such as bulk dispensing and refillable systems directly reduce the need for traditional packaging. The DTC e-commerce market's 15% expansion in 2023 further highlights shifts in how products reach consumers, impacting packaging volume.

Smart packaging, valued at $30 billion in 2023, offers integrated tracking and consumer engagement, posing a direct challenge to conventional solutions. Companies failing to adopt these features risk ceding market share.

| Substitute Category | Key Drivers | Market Indicator (2023/2024) |

|---|---|---|

| Sustainable Materials | Environmental consciousness, regulatory pressure | Biodegradable plastics CAGR > 6% |

| Alternative Delivery Models | Waste reduction, convenience | DTC e-commerce growth 15% (2023) |

| Smart Packaging | Supply chain visibility, consumer engagement | Global smart packaging market $30 billion |

Entrants Threaten

Starting a business in the packaging solutions sector, particularly one that combines manufacturing with distribution like Berlin Packaging, demands a considerable upfront investment. This includes setting up advanced manufacturing plants, acquiring specialized equipment, funding research and development for innovative designs, and building robust warehousing and logistics networks. For instance, the global packaging market was valued at approximately $1.1 trillion in 2023 and is projected to reach over $1.4 trillion by 2028, indicating the scale of investment needed to compete.

Established players like Berlin Packaging leverage significant economies of scale across procurement, manufacturing, and distribution, a result of their extensive global footprint. This scale allows them to secure better pricing on raw materials and optimize production and logistics, creating a substantial cost advantage.

Furthermore, Berlin Packaging's broad product portfolio, encompassing glass, plastic, and metal containers, along with a wide array of services, generates economies of scope. This diversification makes it exceedingly challenging for new entrants to match both the cost-efficiency and the comprehensive offering that Berlin Packaging provides, thereby raising the barrier to entry.

The threat of new entrants to Berlin Packaging's market is significantly mitigated by the immense difficulty and cost associated with establishing robust distribution channels and supply chains. Building a global network for sourcing, warehousing, and logistics is a monumental task, requiring substantial capital investment and considerable time to develop the necessary infrastructure and relationships. Newcomers would find it incredibly challenging to match Berlin Packaging's established efficiency and reliability in these areas.

Berlin Packaging's competitive edge lies in its deeply entrenched global supply chain and its proven track record of on-time delivery, a critical factor for customers in the packaging industry. This operational excellence acts as a powerful deterrent, as potential new entrants would need to overcome significant hurdles in logistics management and supplier integration to even approach Berlin Packaging's capabilities. For instance, in 2023, Berlin Packaging reported a customer satisfaction rating of 95%, a testament to their supply chain's dependability.

Product Differentiation and Brand Loyalty

Berlin Packaging's established reputation as a hybrid supplier, prioritizing customer satisfaction through extensive services, design innovation, and quality assurance, cultivates significant brand loyalty. This deep customer trust makes it challenging for new entrants to replicate the same level of differentiation and commitment in a competitive landscape.

The company's approach, focused on "thrilling customers," fosters a strong bond that new competitors would struggle to forge quickly. Building a comparable level of brand recognition and customer loyalty requires substantial investment in service infrastructure, design capabilities, and a proven track record of advocacy.

- Brand Loyalty: Berlin Packaging's customer-centric model drives repeat business and advocacy, creating a barrier for new entrants.

- Service Integration: Offering a comprehensive suite of services, from design to supply chain management, differentiates Berlin Packaging.

- Market Saturation: The packaging industry is crowded, making it difficult for new players to gain market share without a unique value proposition.

- Investment Hurdle: Establishing a comparable reputation and service offering demands significant capital and time, deterring potential new entrants.

Regulatory and Sustainability Compliance

The packaging industry faces escalating regulatory hurdles and shifting sustainability expectations globally. New companies entering this space must contend with intricate environmental laws, material safety requirements, and directives on recyclability. These compliance efforts demand substantial time and financial outlay, creating a significant barrier that benefits established players already possessing the necessary expertise and resources.

For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR) is a prime example. While specific 2024 compliance costs are still being fully assessed across the industry, the directive aims for 100% of packaging to be reusable or recyclable by 2030. This imposes considerable upfront investment in adapting production processes and materials.

- Regulatory Complexity: Navigating diverse and evolving environmental laws (e.g., single-use plastic bans, recycled content mandates) requires specialized knowledge and ongoing adaptation.

- Sustainability Investment: Meeting new standards often necessitates significant capital expenditure in R&D for eco-friendly materials and redesigning packaging for circularity.

- Established Player Advantage: Incumbents like Berlin Packaging benefit from existing infrastructure, established supply chains, and proven compliance management systems, reducing their relative burden compared to newcomers.

- Market Access Barriers: Non-compliance can lead to product recalls or market exclusion, further deterring new entrants who lack the established relationships and risk mitigation strategies of existing firms.

The threat of new entrants into the packaging solutions market is considerably low due to the substantial capital investment required for advanced manufacturing facilities and global distribution networks. Berlin Packaging's established economies of scale in procurement and production offer a significant cost advantage that new players would find difficult to overcome. Furthermore, the complexity of navigating evolving environmental regulations and sustainability demands adds another layer of difficulty for potential newcomers, as compliance requires specialized expertise and financial resources.

Porter's Five Forces Analysis Data Sources

Our Berlin Packaging Porter's Five Forces analysis is built upon a foundation of reliable data, including industry-specific market research reports, financial filings from publicly traded competitors, and economic indicators relevant to the packaging sector.