Bharat Electronics Limited Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Electronics Limited Bundle

Bharat Electronics Limited (BEL) navigates a competitive landscape shaped by moderate buyer power and intense rivalry within the defense and electronics sectors. The threat of new entrants is somewhat mitigated by high capital requirements and specialized knowledge, while the bargaining power of suppliers is a key consideration for BEL's cost structure.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bharat Electronics Limited’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bharat Electronics Limited (BEL) faces significant supplier bargaining power due to its reliance on a narrow base of specialized vendors for critical defense-grade electronic components and raw materials. This dependency arises from the unique specifications and rigorous quality standards demanded by the defense sector, limiting the pool of capable suppliers.

For instance, in 2023, BEL's procurement of certain advanced semiconductor chips and specialized alloys for its radar and communication systems involved sourcing from a very limited number of global manufacturers who possess the proprietary technology and certifications required. This scarcity of alternatives directly strengthens the negotiating position of these suppliers, allowing them to potentially dictate terms and pricing.

Suppliers who possess proprietary technology or patents for specialized defense electronics components can wield considerable power over pricing and contractual conditions. Bharat Electronics Limited's (BEL) capacity to innovate and incorporate these critical technologies into its sophisticated defense systems is intrinsically linked to their accessibility and associated costs.

This leverage becomes particularly pronounced when BEL lacks readily available alternative suppliers or the internal capacity to manufacture these proprietary components. For instance, in 2023-24, BEL’s R&D expenditure was ₹2,467 crore, highlighting its commitment to technological advancement, but also its reliance on external technological inputs for certain specialized areas.

Bharat Electronics Limited (BEL) faces significant switching costs for its highly integrated and customized components. For instance, developing a new radar system might involve specialized electronic modules requiring extensive re-design, re-testing, and certification processes if a supplier change is mandated. These hurdles, potentially costing millions of dollars and months of delay, make it challenging for BEL to switch even if a competitor offers a slightly lower price.

Limited Supplier Base for Defense Grade Materials

The global market for defense-grade materials and sub-systems often features a concentrated supplier base. This is due to significant barriers to entry, including stringent regulatory compliance, substantial capital investment, and the need for specialized technical expertise. For a company like Bharat Electronics Limited (BEL), this limited pool of qualified suppliers for critical components can translate into considerable leverage for these suppliers, potentially influencing procurement costs and extending lead times.

This supplier concentration can directly impact BEL's operational efficiency and cost structure. For instance, in 2023, the global defense market saw continued demand for advanced materials, with specialized suppliers often commanding premium pricing due to their unique capabilities and the rigorous qualification processes involved. BEL's reliance on these few specialized providers means they have less bargaining power, as alternative sourcing options are scarce.

- High Barriers to Entry: Regulatory hurdles, capital intensity, and advanced technical know-how limit the number of defense-grade material suppliers.

- Supplier Leverage: A concentrated supplier base grants significant bargaining power to suppliers, impacting pricing and delivery schedules for buyers like BEL.

- Impact on Procurement: Limited supplier options can lead to higher procurement costs and extended lead times for BEL, affecting project timelines and profitability.

- Strategic Sourcing Challenges: BEL must navigate these constraints by fostering strong supplier relationships and exploring long-term supply agreements to mitigate risks.

Threat of Forward Integration by Suppliers

The threat of suppliers engaging in forward integration, meaning they start manufacturing the final defense electronics systems themselves, is generally low for Bharat Electronics Limited (BEL).

While theoretically possible, the immense complexity involved in BEL's product lines, which demand significant research and development, intricate system integration, and stringent government certifications, presents a substantial barrier.

Most component suppliers are content to focus on their specialized manufacturing expertise rather than venturing into the highly competitive and regulated system manufacturing arena, which is BEL's core strength.

- Low Likelihood of Supplier Forward Integration: The defense electronics sector’s high entry barriers, including R&D intensity and regulatory hurdles, deter suppliers from integrating forward.

- Complexity of BEL's Products: BEL's sophisticated systems require deep expertise in integration and government liaison, areas where component suppliers typically lack capacity.

- Supplier Focus on Core Competencies: Most suppliers concentrate on component production, finding it more profitable and less risky than direct competition with established system integrators like BEL.

Bharat Electronics Limited (BEL) faces considerable supplier bargaining power due to the specialized nature of its components and the limited number of qualified vendors. This is exacerbated by high switching costs and the concentration of suppliers in the defense sector, which often involves proprietary technology and stringent quality requirements. For example, in 2023, BEL's reliance on a few global manufacturers for advanced semiconductor chips for its radar systems meant these suppliers could dictate terms.

The concentration of suppliers in the defense industry, driven by high barriers to entry such as regulatory compliance and capital investment, significantly amplifies supplier leverage. This situation can lead to increased procurement costs and extended lead times for BEL, impacting project timelines. For instance, in 2023-24, BEL's R&D expenditure of ₹2,467 crore underscored its need for advanced external inputs, further cementing supplier influence in specific niches.

| Factor | Impact on BEL | 2023-24 Data/Context |

|---|---|---|

| Supplier Concentration | Increases supplier leverage, potentially raising costs and lead times. | Limited pool of qualified vendors for specialized defense components. |

| Switching Costs | Makes it difficult and expensive for BEL to change suppliers. | High costs associated with re-design, re-testing, and certification for integrated components. |

| Proprietary Technology | Suppliers with unique tech can dictate pricing and terms. | Scarcity of alternative sources for advanced materials and sub-systems. |

What is included in the product

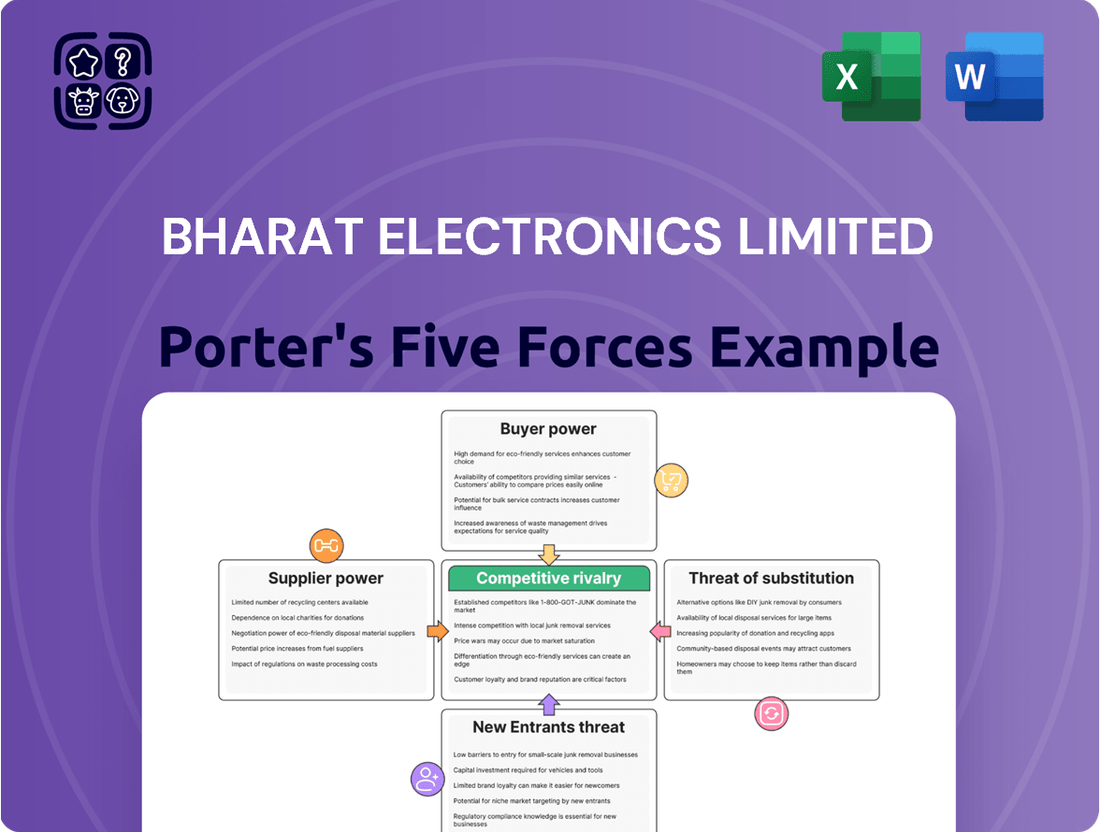

This analysis unpacks the competitive forces shaping Bharat Electronics Limited's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly grasp the competitive landscape of Bharat Electronics Limited with a clear, one-sheet Porter's Five Forces analysis, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Bharat Electronics Limited (BEL) faces significant bargaining power from its primary customer, the Indian Government, particularly the Ministry of Defence. This concentrated buyer base dictates terms, specifications, and pricing for a substantial portion of BEL's revenue, directly impacting its profitability and operational flexibility.

In fiscal year 2023-24, defence orders constituted a major share of BEL's revenue, highlighting the government's pivotal role. The government's procurement policies, driven by national security priorities and budgetary allocations, exert considerable influence over BEL's business, from product development to pricing negotiations.

The bargaining power of customers for Bharat Electronics Limited (BEL) is significantly shaped by the strategic importance of its defense products. The Indian government, as BEL's primary customer, prioritizes national security, indigenization, and long-term reliability over mere cost. This strategic alignment grants the government considerable leverage, allowing them to dictate specific features, stringent quality standards, and demand technology transfer, ensuring their needs are met comprehensively.

The Indian government's procurement policies, like the 'Make in India' initiative and rigorous competitive tendering, significantly bolster customer bargaining power. These frameworks encourage multiple domestic and international suppliers to bid, fostering an environment where the government can compare offerings and drive down prices, directly impacting Bharat Electronics Limited's (BEL) pricing power.

This competitive landscape necessitates that BEL consistently proves its value proposition and cost-effectiveness to secure government contracts. For instance, in the fiscal year 2023-24, BEL secured new orders worth ₹26,200 crore, underscoring the ongoing need to win bids in a market shaped by these government-driven procurement strategies.

Existence of Alternative Suppliers (Domestic & International)

While Bharat Electronics Limited (BEL) enjoys a strong market presence, the Indian government, as a key customer, has increasing options for defense electronics. These alternatives include emerging domestic private sector players, strategic joint ventures, and international suppliers, particularly for specialized or high-end systems.

The presence of these alternative vendors, even if the range of choices varies by product segment, inherently empowers the government as a customer. This competitive landscape allows them to negotiate terms and pricing more effectively with BEL, thereby increasing customer bargaining power.

- Increased Competition: The Indian defense sector is seeing growth in private players, potentially offering alternatives to BEL.

- International Sourcing: For certain advanced technologies, international vendors can provide competitive options, limiting BEL's pricing leverage.

- Government Procurement Strategy: The government's policy of encouraging domestic manufacturing and strategic partnerships diversifies its supplier base.

Demand for Customization and Long-Term Support

Defense customers, a key segment for Bharat Electronics Limited (BEL), often necessitate highly customized solutions. These aren't off-the-shelf products; they are intricate systems designed to meet very specific operational requirements. This demand for bespoke engineering inherently grants these clients substantial bargaining power.

Beyond initial customization, the requirement for extensive long-term support is a critical factor. This includes ongoing maintenance, crucial upgrades to keep pace with evolving threats, and a reliable supply of spare parts. This continuous dependency throughout the product's lifecycle significantly enhances the customer's leverage.

- Customization Needs: Defense clients require tailored solutions, not standardized products.

- Long-Term Support: Ongoing maintenance, upgrades, and spare parts create customer reliance.

- Lifecycle Leverage: This dependency gives customers significant power throughout the product's lifespan.

- BEL's Obligation: BEL must provide comprehensive post-sale services and continuous technological advancements to retain these customers.

Bharat Electronics Limited's (BEL) bargaining power with its customers, particularly the Indian government, is influenced by the highly specialized nature of its defense products and the extensive long-term support required. The government's demand for customized solutions and continuous lifecycle support, including maintenance and upgrades, grants them significant leverage in negotiations.

The government's procurement strategy, emphasizing indigenization and competitive tendering, further amplifies customer bargaining power. This approach encourages a diverse supplier base, allowing the government to secure favorable terms and pricing. BEL's ability to secure new orders, such as the ₹26,200 crore in fiscal year 2023-24, hinges on its capacity to meet these stringent government demands and maintain cost-effectiveness.

The growing presence of private sector players and international suppliers in the defense electronics market provides the government with alternative sourcing options. This diversification of the supplier landscape means BEL must consistently demonstrate its value and technological superiority to maintain its competitive edge and secure future contracts.

| Customer Influence Factor | Impact on BEL | Example/Data Point |

|---|---|---|

| Customization Requirements | Increases customer leverage, necessitates tailored R&D | Defense systems often require unique specifications |

| Long-Term Support Needs | Creates customer dependency, impacts pricing of services | Ongoing maintenance, upgrades, and spare parts for defense equipment |

| Government Procurement Policies | Drives competition, influences pricing | 'Make in India' initiative, competitive bidding |

| Alternative Suppliers | Limits BEL's pricing power, necessitates value demonstration | Emerging domestic private players, international vendors |

What You See Is What You Get

Bharat Electronics Limited Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Bharat Electronics Limited, detailing the competitive landscape, supplier power, buyer bargaining power, threat of new entrants, and the intensity of rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides critical insights into the strategic positioning and potential challenges faced by BEL in the defense and electronics sectors.

Rivalry Among Competitors

The Indian defense electronics landscape is heating up with private sector companies increasingly entering the fray. This surge is fueled by the government's 'Make in India' initiative and its focus on boosting private sector involvement in defense manufacturing. For instance, in 2023, private players secured a significant portion of defense production orders, signaling a shift from BEL's historical near-monopoly in several areas.

This intensified competition means Bharat Electronics Limited (BEL) faces greater challenges in securing new contracts. Private firms are actively forming joint ventures and pouring investment into research and development, directly targeting segments where BEL has traditionally held strong positions. This dynamic domestic ecosystem is creating a more vigorous rivalry for market share and government defense orders.

Bharat Electronics Limited (BEL) navigates a competitive landscape marked by global defense giants. Major international players, including Lockheed Martin, Boeing, and Thales, are actively pursuing opportunities in India, often through joint ventures and technology transfer agreements with Indian firms. This influx of foreign competition, particularly in advanced defense electronics, necessitates continuous innovation and R&D investment from BEL to maintain its market position.

The defense electronics sector, where Bharat Electronics Limited (BEL) operates, is defined by substantial fixed costs. These stem from significant investments in research and development (R&D), the establishment of specialized manufacturing infrastructure, and rigorous testing protocols. For instance, BEL's R&D expenditure in FY23 stood at INR 1,039 crore, highlighting the ongoing commitment required to stay competitive.

This capital-intensive environment necessitates securing large, long-term defense contracts to achieve economies of scale and justify these upfront investments. Consequently, competition intensifies as companies vie for a limited number of high-value projects, often involving complex technological requirements and stringent performance standards.

Product Differentiation and Technological Edge

Competitive rivalry for Bharat Electronics Limited (BEL) often hinges on technological superiority, reliability, and customization rather than solely on price. BEL's deep-seated expertise in critical areas like radar, communication, and electronic warfare systems forms a robust competitive advantage.

However, the landscape demands relentless innovation and differentiation to counter rivals who may offer advanced or specialized niche solutions. For instance, in 2023-24, BEL reported a revenue of INR 20,441 crore, showcasing its significant market presence, yet the need to stay ahead technologically remains paramount.

- Technological Superiority: BEL's competitive edge is built on its advanced technological capabilities in defense electronics.

- Reliability and Customization: The company's reputation for dependable products and tailored solutions strengthens its market position.

- Innovation Imperative: Continuous investment in R&D is crucial to counter emerging threats and maintain differentiation.

- Market Dynamics: Rivals offering specialized or cutting-edge technologies present a constant challenge, necessitating strategic product development.

Government Procurement and Policy Influence

The Indian government's defense procurement policies are a major driver of competitive rivalry for Bharat Electronics Limited (BEL). These policies often prioritize indigenous manufacturing and research and development, creating opportunities and challenges for domestic players. For instance, the Ministry of Defence's 'Make in India' initiative and the Defence Acquisition Procedure (DAP) continually evolve, influencing which companies get contracts and how they position themselves.

This policy environment can intensify competition as companies like BEL strategically align their product development and business strategies with national defense priorities. Companies that demonstrate strong indigenous capabilities and contribute to self-reliance are often favored, leading to a dynamic race for preferred supplier status in various defense programs. This directly impacts market access and growth prospects for BEL and its competitors.

In 2023-24, India's defense budget saw an increase, with a significant portion earmarked for capital outlay, signaling continued government focus on modernization and indigenous sourcing. BEL, as a key player, actively participates in tenders and collaborations driven by these policies. For example, BEL secured significant orders in FY23, including for advanced electronic warfare systems and radar, underscoring the impact of government procurement on its order book.

- Policy Influence: Indian defense procurement policies, like the Defence Acquisition Procedure (DAP), significantly shape market entry and competitive dynamics, often favoring indigenous solutions.

- Indigenous Focus: Initiatives promoting 'Make in India' in defense encourage domestic players, including BEL, to invest in R&D and manufacturing capabilities, intensifying competition.

- Strategic Alignment: Companies must align with national defense priorities to gain preferred status, impacting tender wins and market share.

- Budgetary Impact: India's defense budget allocation, with a substantial capital outlay for modernization, directly influences the volume and type of contracts available, benefiting companies like BEL that align with policy goals.

Bharat Electronics Limited (BEL) faces intense rivalry from both domestic private players and global defense manufacturers, driven by India's 'Make in India' initiative and increased defense spending. The company's traditional dominance is being challenged by new entrants and established international firms forming joint ventures, all vying for lucrative government defense contracts. This dynamic environment necessitates continuous innovation and strategic alignment with national defense priorities to maintain market share and technological leadership.

| Competitor Type | Key Players | Impact on BEL |

|---|---|---|

| Domestic Private Sector | Adani Defence & Aerospace, L&T Defence, Tata Advanced Systems | Increased competition for government orders, pressure on margins |

| Global Defense Majors | Lockheed Martin, Boeing, Thales, Raytheon | Competition in advanced technology segments, need for strategic partnerships |

| Key Competitive Factors | Technological advancement, R&D investment, reliability, customization, policy alignment | Drives innovation, requires significant capital expenditure, influences contract wins |

SSubstitutes Threaten

For Bharat Electronics Limited's (BEL) core defense electronics, like sophisticated radar and electronic warfare systems, direct technological substitutes are scarce. These highly specialized products are designed for unique military operational needs, making simple replacements impractical. In 2023-24, BEL's focus on these complex systems contributed to its significant order book, reflecting the demand for such integrated solutions.

The increasing prevalence of software-defined and modular systems poses a significant threat of substitution for Bharat Electronics Limited (BEL). These technological shifts can lessen the demand for BEL's traditionally integrated hardware solutions by offering more adaptable and potentially cost-effective alternatives.

For instance, the defense sector is increasingly exploring software-defined radio (SDR) technologies, which allow for greater flexibility and upgradability compared to fixed-function hardware. This evolution could reduce the need for specialized, purpose-built hardware that BEL has historically supplied, impacting its market share in those segments.

Modular open-architecture systems further exacerbate this threat by enabling the integration of components from various suppliers, potentially bypassing the need for proprietary, integrated systems. This trend, observed across defense and aerospace, suggests a future where customized solutions can be built from interchangeable modules, directly substituting complete system offerings.

While India champions domestic manufacturing, foreign defense imports and readily available off-the-shelf military technologies from international vendors pose a threat of substitution for Bharat Electronics Limited (BEL). These foreign solutions can offer compelling advantages in cost-effectiveness, technological superiority, or faster deployment timelines, potentially diverting demand from BEL's indigenous products for specific defense needs.

Shifting Warfare Paradigms and Disruptive Technologies

The evolving landscape of warfare, with a growing emphasis on asymmetric threats and cyber operations, poses a significant threat of substitutes for Bharat Electronics Limited (BEL). New defense solutions emerging from these shifts, particularly those leveraging autonomous systems or advanced cyber capabilities, could render existing electronic warfare and communication systems less relevant. For instance, the increasing sophistication of state-sponsored cyberattacks, which can disrupt command and control networks without traditional weaponry, represents a direct substitute for some of BEL's established offerings.

Disruptive technologies that offer fundamentally different and superior methods for achieving military objectives present a potent substitute threat. Consider the potential of quantum computing to break current encryption standards, directly impacting the security of communication systems BEL provides. As of early 2024, global defense spending on cyber capabilities alone has seen substantial increases, indicating a market shift towards these alternative solutions.

- Asymmetric Warfare: Focus on non-traditional tactics and unconventional forces can bypass conventional electronic defenses.

- Cyber Warfare: The ability to disable or manipulate electronic systems remotely offers a direct substitute for physical electronic countermeasures.

- Autonomous Systems: Drones and AI-powered platforms can perform surveillance and strike missions, potentially replacing manned systems and their associated electronic support.

- Quantum Computing: Future advancements in quantum computing could render current cryptographic technologies obsolete, impacting secure communication systems.

Cost-Performance Trade-offs of Alternatives

The threat of substitutes for Bharat Electronics Limited (BEL) is significantly shaped by the cost-performance trade-offs of alternative solutions. If a substitute technology or approach can offer similar or better operational effectiveness at a notably lower price, it presents a substantial challenge.

For instance, while commercial off-the-shelf (COTS) components might offer cost savings, their integration into highly specialized defense systems requires rigorous testing and validation to ensure reliability, often negating initial cost advantages. BEL's focus on robust, mission-critical systems means that performance and dependability are paramount.

- Defense Systems Prioritize Reliability: In the defense sector, the cost of failure in critical systems can be catastrophic, making proven performance and reliability more important than marginal cost savings from substitutes.

- COTS Integration Challenges: While commercial off-the-shelf technology can be cheaper, adapting it for defense applications involves significant R&D and testing, often increasing the total cost of ownership and posing integration risks.

- BEL's Strategic Advantage: BEL's expertise in developing and customizing solutions for specific defense needs creates a barrier for substitutes that may not offer the same level of tailored performance or long-term support.

The threat of substitutes for Bharat Electronics Limited (BEL) is evolving with advancements in software-defined and modular systems, offering greater flexibility and potential cost efficiencies. These technologies can challenge BEL's traditional integrated hardware solutions by enabling adaptable and upgradable alternatives.

The increasing adoption of software-defined radio (SDR) and open-architecture systems allows for component integration from various vendors, potentially bypassing proprietary solutions. This trend, evident across the global defense sector, suggests a shift towards modular, customized systems that could substitute complete offerings.

While BEL focuses on reliability, the cost-performance trade-off remains critical. If substitutes offer comparable effectiveness at lower prices, they pose a significant challenge, though defense sector demands for proven performance often outweigh marginal cost savings.

The rise of asymmetric warfare and cyber operations presents new substitute threats, with autonomous systems and advanced cyber capabilities potentially diminishing the relevance of existing electronic systems. For instance, cyberattacks can disrupt networks, acting as a direct substitute for traditional electronic countermeasures.

Entrants Threaten

The defense electronics sector, where Bharat Electronics Limited (BEL) operates, presents formidable barriers to entry due to exceptionally high capital investment needs. Establishing state-of-the-art manufacturing facilities, advanced research and development (R&D) infrastructure, and specialized testing equipment requires billions of dollars. For instance, BEL’s own capital expenditure in the fiscal year 2023-24 was ₹1,160 crore, highlighting the scale of investment in the sector.

Furthermore, the imperative for continuous R&D to maintain technological superiority acts as a significant deterrent. Companies must invest heavily in innovation to develop next-generation defense systems, ensuring they remain competitive against established players like BEL, which consistently allocates a substantial portion of its revenue to R&D. This ongoing commitment to technological advancement creates a high barrier for any new entity looking to enter the market.

Stringent regulatory and certification hurdles significantly deter new entrants into Bharat Electronics Limited's (BEL) operating environment. The defense sector, BEL's primary domain, mandates an intricate web of licenses, security clearances, and specialized certifications from various defense authorities. For instance, obtaining necessary approvals for sensitive defense technologies can take years and involve extensive testing and validation, a process that new, unproven entities find exceedingly difficult to navigate.

Bharat Electronics Limited (BEL) benefits from deeply entrenched relationships and trust with its primary customer, the Indian armed forces, built over decades of reliable service as a state-owned enterprise. New entrants face a significant hurdle in replicating this established credibility and the confidence that comes with a proven track record, especially for critical defense systems where dependability is non-negotiable.

Proprietary Technology and Intellectual Property

Bharat Electronics Limited (BEL) benefits from a substantial portfolio of proprietary technologies and patents, particularly in specialized defense electronics. For instance, BEL's significant R&D expenditure, which was ₹1,997.15 crore in FY2023-24, fuels this innovation, making it difficult for new entrants to replicate such advanced capabilities without considerable investment and time.

The high barriers to entry are further reinforced by the extensive intellectual property accumulated over decades. This deep well of knowledge and patented processes creates a formidable challenge for newcomers aiming to compete in BEL's core segments, requiring them to either undertake costly independent research or seek costly technology acquisition.

Consequently, new companies often find it more feasible to enter through strategic alliances or technology transfer agreements rather than attempting to develop comparable indigenous technology from the ground up. This strategic reliance on existing players like BEL limits the direct threat of entirely new, self-sufficient competitors emerging rapidly.

- Proprietary Technology: BEL holds a vast array of unique technologies developed in-house.

- Intellectual Property: A significant patent portfolio acts as a strong deterrent.

- High R&D Investment: BEL's ₹1,997.15 crore R&D spend in FY24 highlights the capital required to match its innovation.

- Barriers to Entry: Replicating BEL's technological depth necessitates substantial time and financial resources, discouraging new, independent entrants.

Economies of Scale and Experience Curve Benefits

Bharat Electronics Limited (BEL) enjoys significant advantages from economies of scale in its production and procurement processes. This allows BEL to spread its fixed costs over a larger output, leading to lower per-unit costs. For instance, in FY 2023-24, BEL reported a revenue of INR 19,000 crore, demonstrating its substantial operational scale.

Furthermore, BEL has accumulated an extensive experience curve in the design, manufacturing, and integration of complex defense systems. This deep-seated knowledge translates into improved efficiency, reduced waste, and enhanced product quality over time. New companies entering the defense electronics sector would face a considerable hurdle in matching BEL's cost structure and operational expertise.

- Economies of Scale: BEL's large-scale operations in FY 2023-24, with revenues of INR 19,000 crore, create a cost advantage.

- Experience Curve: Decades of experience in complex defense systems allow BEL to optimize design, manufacturing, and integration.

- Cost Disadvantage for New Entrants: New players would start with lower volumes and less accumulated experience, resulting in higher per-unit costs.

- Competitive Barrier: The combined effect of scale and experience makes it challenging for new entrants to compete effectively on price or efficiency in the defense electronics market.

The threat of new entrants for Bharat Electronics Limited (BEL) is considerably low due to the sector's inherent characteristics. The defense electronics industry demands massive capital investment for advanced manufacturing and R&D, with BEL's FY2023-24 capital expenditure reaching ₹1,160 crore. Furthermore, stringent regulatory approvals and the need for deep customer trust, especially with the Indian armed forces, create high entry barriers.

Proprietary technology and extensive intellectual property, fueled by BEL's ₹1,997.15 crore R&D spend in FY2023-24, also deter new players. Economies of scale, evidenced by BEL's INR 19,000 crore revenue in FY 2023-24, and a steep experience curve in complex defense systems further solidify BEL's competitive position, making it difficult for newcomers to match its cost structure and operational efficiency.

| Factor | Impact on New Entrants | BEL's Advantage |

|---|---|---|

| Capital Investment | Extremely High | Established infrastructure and scale |

| R&D and Technology | Requires significant, sustained investment | Proprietary IP and continuous innovation (₹1,997.15 crore R&D in FY24) |

| Regulatory & Certifications | Lengthy and complex approval processes | Existing licenses and established relationships with authorities |

| Customer Relationships | Difficult to build trust and credibility | Decades-long partnership with Indian armed forces |

| Economies of Scale | Higher per-unit costs initially | Lower costs due to large-scale production (INR 19,000 crore revenue in FY24) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bharat Electronics Limited leverages data from annual reports, investor presentations, and industry-specific market research reports. This ensures a comprehensive understanding of competitive dynamics within the defence and electronics sectors.