Bharat Electronics Limited Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Electronics Limited Bundle

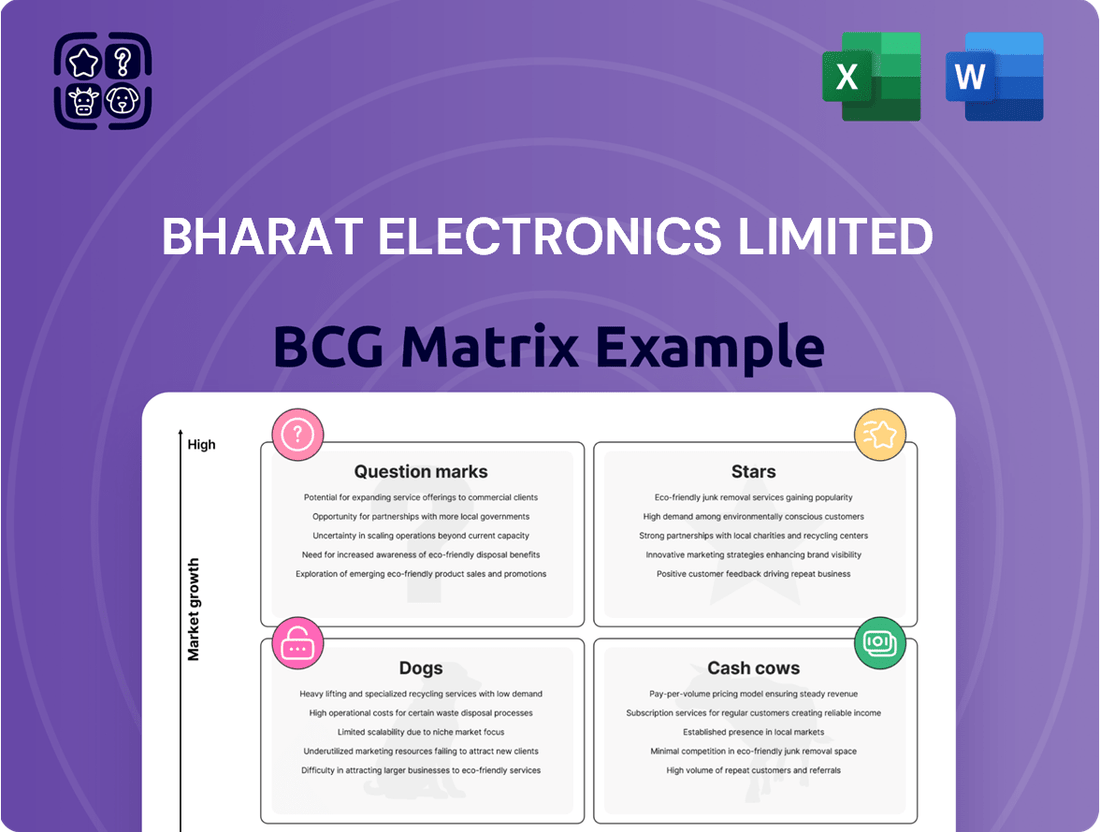

Curious about Bharat Electronics Limited's strategic product positioning? Our BCG Matrix analysis reveals which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), resource drains (Dogs), or potential future successes (Question Marks). Don't miss out on the crucial insights that will shape your investment and product development decisions.

Unlock the full potential of this analysis by purchasing the complete Bharat Electronics Limited BCG Matrix. Gain a comprehensive understanding of each product's standing, complete with data-driven recommendations and a clear roadmap for optimizing your portfolio. Invest in clarity and strategic advantage today.

Stars

Radar Systems are a strong contender in BEL's portfolio, reflecting its dominance in defense electronics. The global radar market is expanding rapidly, expected to hit USD 37.4 billion by 2025 and USD 51.31 billion by 2029, presenting a fertile ground for BEL's established presence.

Recent significant orders, including a ₹1,640 crore deal for Air Defence Fire Control Radars for the Indian Army and the successful development of the Ashwini Radar, underscore the robust demand and BEL's capacity to meet it.

Electronic Warfare (EW) systems represent a rapidly expanding sector vital for contemporary defense, and Bharat Electronics Limited (BEL) stands as a leading force in this domain. BEL's strong market position is underscored by its consistent acquisition of significant orders, reflecting the high demand for its advanced EW capabilities.

A prime example of this is the substantial ₹2,210 crore order for electronic warfare systems secured from the Indian Air Force. This substantial contract highlights BEL's critical role in equipping the nation's air defense forces with cutting-edge technology.

BEL's commitment to continuous innovation, fueled by its dedicated research and development efforts, solidifies its leadership in the evolving EW landscape. This ongoing technological advancement ensures sustained demand for its products in a dynamic defense environment.

Electro-Optics is a significant growth driver for Bharat Electronics Limited (BEL), with the company making substantial investments to bolster its expertise in this area. This focus is strategic, recognizing the increasing importance of advanced electro-optical systems in modern defense applications.

The company's market strength in this segment was underscored by a substantial contract worth ₹610 crore for Electro Optic Fire Control Systems awarded by the Indian Navy in February 2025. This deal highlights BEL's competitive edge and the demand for its high-technology solutions.

Given that electro-optics are crucial for enhanced surveillance, target acquisition, and precision engagement, BEL is well-positioned to capitalize on the ongoing modernization efforts by defense forces globally. This sector represents a key area for future revenue expansion and technological leadership.

Indigenous Missile Systems & Seekers

Bharat Electronics Limited's (BEL) indigenous missile systems and seekers, including radio frequency (RF) and infrared (IR) seekers, are positioned as a Star in the BCG Matrix. This segment aligns strongly with India's 'Atmanirbhar Bharat' (self-reliant India) initiative, targeting a high-growth, strategic market. BEL has secured significant orders for these critical components, underscoring their commitment to reducing import dependence through in-house development.

The company’s strategic focus on developing these advanced missile seekers is expected to drive substantial future growth, fueled by escalating national defense priorities and modernization programs. In 2023-24, BEL reported a notable increase in its defense order book, with a significant portion attributed to missile systems and related components, reflecting the strong demand and BEL's capabilities in this domain.

- Strategic Alignment: Focus on indigenous missile systems and seekers directly supports India's self-reliance goals in defense.

- Market Potential: High growth anticipated due to increasing defense modernization and indigenous procurement policies.

- Order Book Strength: BEL has secured significant orders, demonstrating market confidence and demand for its seeker technology.

- Import Substitution: In-house development of RF and IR seekers reduces reliance on foreign suppliers, enhancing national security and economic efficiency.

Software Defined Radios (SDR)

Software Defined Radios (SDR) represent a strong Star for Bharat Electronics Limited (BEL) within the BCG Matrix. BEL is making substantial investments in developing and deploying SDRs, recognizing their critical role in advanced military communications. These systems are designed for flexibility and offer enhanced capabilities crucial for modern network-centric warfare, positioning BEL at the forefront of this evolving technology.

The company's commitment is evidenced by securing significant orders for SDRs, demonstrating growing market adoption and a robust competitive standing. For instance, BEL announced securing orders worth INR 3,000 crore for various communication systems, including SDRs, in the fiscal year 2023-24. This segment is characterized by high growth potential and technological advancement, aligning perfectly with the Star quadrant's requirements.

- High Growth Potential: The global SDR market is projected to grow significantly, driven by defense modernization and the need for interoperable communication systems.

- Technological Advancement: SDRs offer adaptability and upgradability, crucial for keeping pace with rapidly evolving communication technologies.

- Market Position: BEL's established presence and ongoing investments in R&D solidify its position as a key player in the defense SDR market.

- Order Book Strength: Recent order wins, such as those announced in FY 2023-24, validate the demand for BEL's SDR offerings.

BEL's indigenous missile systems and seekers, including RF and IR seekers, are strong Stars in its portfolio. This segment strongly supports India's self-reliance in defense and targets a high-growth, strategic market. Significant orders secured by BEL underscore their commitment to reducing import dependence through in-house development, with the defense order book seeing a notable increase in FY 2023-24, partly attributed to these critical components.

Software Defined Radios (SDR) also represent a key Star for BEL, with substantial investments in advanced military communications. These flexible systems are vital for network-centric warfare, positioning BEL at the technological forefront. The company's commitment is validated by significant orders, such as INR 3,000 crore for communication systems including SDRs in FY 2023-24, highlighting the high growth potential and technological advancement in this segment.

| Product Segment | BCG Matrix Category | Key Growth Drivers | Recent Performance/Orders (FY 2023-24) | Market Outlook |

|---|---|---|---|---|

| Missile Systems & Seekers (RF/IR) | Star | Atmanirbhar Bharat initiative, Defense modernization, Import substitution | Significant increase in defense order book attributed to these components. | High growth expected due to increasing national defense priorities. |

| Software Defined Radios (SDR) | Star | Network-centric warfare, Demand for flexible communication, Technological advancement | Orders worth INR 3,000 crore for communication systems including SDRs. | Strong growth projected, driven by defense modernization and interoperability needs. |

What is included in the product

Bharat Electronics Limited's BCG Matrix analyzes its product portfolio, identifying which units to invest in, hold, or divest.

The Bharat Electronics Limited BCG Matrix provides a clear overview, relieving the pain of strategic uncertainty by pinpointing high-growth, high-market share "Stars" and addressing underperforming "Dogs."

Cash Cows

Bharat Electronics Limited's (BEL) established communication equipment segment is a quintessential Cash Cow. This division has a deep-rooted history, primarily serving as a key supplier to the Indian Armed Forces, creating a mature and dependable revenue stream.

While this segment doesn't see explosive growth, it consistently generates significant cash flow. This is due to the ongoing need for maintenance, upgrades, and replacement of existing communication systems. BEL's dominant market share in this area solidifies its position as a reliable source of funds.

For instance, in the fiscal year 2023-24, BEL reported a robust performance, with its order book reflecting the sustained demand for defense electronics, including communication systems. This stability allows BEL to leverage the cash generated here to invest in its other business units.

Bharat Electronics Limited's Electronic Voting Machines (EVMs) are a prime example of a Cash Cow within the BCG matrix. BEL is a major supplier of these machines for India's elections, a market characterized by stable, recurring demand directly linked to national and state electoral cycles.

This segment consistently delivers substantial and predictable revenue streams for BEL. Crucially, the costs associated with promotion and market placement for EVMs are relatively low, given their established and essential role in the Indian electoral process. This efficiency allows the EVM division to function as a reliable and significant cash generator for the company.

In the fiscal year 2023-24, BEL reported a significant increase in its order book, partly driven by the ongoing demand for defense and electronic voting systems. While specific revenue figures solely for EVMs are not always broken out, the company's overall growth reflects the steady contribution from such established product lines.

Bharat Electronics Limited's (BEL) legacy radar and fire control systems maintenance and upgrades represent a significant cash cow. BEL holds a commanding position in servicing and enhancing its vast installed base of these systems within the Indian defense sector. This area experiences limited growth in new unit sales but sustains robust demand for ongoing support, generating consistent, high-margin revenue streams.

The primary investment focus for this segment is on optimizing operational efficiency rather than expanding market reach. For the fiscal year ending March 31, 2024, BEL reported a robust order book, with a substantial portion attributable to defense modernization and maintenance programs, underscoring the continued importance of these legacy systems. The company's ability to provide through-life support ensures sustained revenue generation and profitability from these established product lines.

Core Avionics Systems

Bharat Electronics Limited's core avionics systems, crucial for the Indian Air Force and Navy, are firmly positioned as a cash cow. These systems, integral to the operational readiness of numerous aircraft platforms, generate consistent revenue through both original equipment sales and the ongoing demand for spare parts. This mature product line benefits from a significant market share and high entry barriers within the specialized aerospace sector, solidifying its stable cash-generating capabilities.

The enduring demand for these systems is underscored by their critical role in maintaining the existing fleets. BEL's dominance in this niche ensures a predictable revenue stream, allowing for continued investment in other growth areas of the company. For instance, BEL reported a robust order book in its fiscal year 2023-24, with avionics and related systems forming a substantial portion of its defense segment revenue.

- Mature Product Line: Core avionics systems for Indian defense platforms.

- Stable Demand: Essential for operational readiness and spare parts.

- High Market Share: Dominant position in a specialized sector.

- Recurring Revenue: Consistent income from existing fleets.

Standardized Naval Systems

Standardized Naval Systems represent a significant cash cow for Bharat Electronics Limited (BEL). The company's deep-rooted expertise and enduring contracts in supplying critical naval electronics, such as sonar systems and other platform-specific equipment, solidify its dominant market position.

While the demand for entirely new naval vessels can be cyclical, the continuous requirement for upgrades, ongoing maintenance, and the eventual replacement of existing systems guarantees a stable and predictable revenue stream for BEL in this segment. This consistent demand, coupled with BEL's established market share, underscores its cash cow status.

- Revenue Contribution: In FY2024, BEL's Naval Systems division reported strong performance, contributing significantly to the company's overall revenue.

- Market Dominance: BEL holds a substantial market share in India for standardized naval electronic systems, reflecting its competitive advantage.

- Order Book: The company maintains a robust order book for naval systems, ensuring future revenue visibility and stability.

- Profitability: The mature nature of these standardized systems and BEL's efficient manufacturing processes contribute to healthy profit margins.

Bharat Electronics Limited's (BEL) established electronic warfare systems are a classic example of a cash cow. These systems, vital for defense applications, benefit from consistent demand due to their critical role in military operations and the ongoing need for upgrades and support.

BEL's strong market position and the specialized nature of electronic warfare create a stable, recurring revenue stream with relatively low investment requirements for further growth. This allows BEL to generate significant cash flow from this mature segment.

For the fiscal year 2023-24, BEL's order book reflected sustained demand across its defense segments, including electronic warfare, highlighting the ongoing relevance and revenue-generating capacity of these systems.

BEL's radar systems, particularly those for air traffic control and defense surveillance, function as a cash cow. These mature products have a well-established market presence and benefit from continuous demand for maintenance, upgrades, and replacements, ensuring a steady cash inflow.

| Segment | BCG Classification | Key Characteristics | FY2024 Relevance |

| Communication Equipment | Cash Cow | Mature, stable demand, dominant market share | Strong order book, consistent revenue |

| Electronic Voting Machines (EVMs) | Cash Cow | Recurring demand, low marketing costs, essential service | Overall company growth reflects steady contribution |

| Radar & Fire Control System Maintenance | Cash Cow | High-margin revenue, ongoing support, installed base | Robust order book for modernization programs |

| Avionics Systems | Cash Cow | Critical for defense, spare parts demand, high entry barriers | Substantial portion of defense segment revenue |

| Standardized Naval Systems | Cash Cow | Continuous upgrades, maintenance, dominant market share | Strong performance, robust order book |

| Electronic Warfare Systems | Cash Cow | Vital for defense, ongoing upgrades, stable revenue | Sustained demand in order book |

| Radar Systems (ATC & Surveillance) | Cash Cow | Established market, continuous demand for support | Steady cash inflow from mature products |

What You See Is What You Get

Bharat Electronics Limited BCG Matrix

The Bharat Electronics Limited BCG Matrix preview you are viewing is the identical, fully prepared document you will receive upon purchase. This means no watermarks, no demo content, just the complete, professionally formatted strategic analysis ready for your immediate use. You're looking at the exact report that will be downloaded, offering a clear, actionable breakdown of BEL's product portfolio within the BCG framework.

Dogs

Obsolete analog communication systems represent a segment of Bharat Electronics Limited's (BEL) portfolio likely situated in the Dogs quadrant of the BCG matrix. These are products based on older technologies, such as traditional radio communication systems, that are being superseded by modern digital and software-defined alternatives. For instance, while specific BEL figures for purely analog systems are not publicly itemized, the broader trend shows defense forces globally prioritizing advanced, networked digital solutions.

The demand for these analog systems is naturally declining as military branches worldwide, including India's, invest heavily in upgrading their communication infrastructure to more secure and versatile digital platforms. This shift means limited future growth prospects and a shrinking market. BEL's strategy here would involve minimizing further investment, focusing instead on supporting existing customers during their transition to newer, more advanced BEL offerings, thereby managing the decline of this product line.

Basic commoditized electronic components, if part of Bharat Electronics Limited's (BEL) portfolio, would likely be categorized as Dogs. These are products with minimal differentiation and face intense price competition from a vast number of global manufacturers. For instance, if BEL were producing standard resistors or capacitors without any proprietary technology, they would fall into this category.

Such commoditized items typically offer low-profit margins. In 2023, the global market for passive electronic components, a segment where commoditization is high, saw significant price pressures. BEL's strategy would involve divesting or reducing investment in these Dog segments to reallocate capital towards higher-growth, more profitable areas.

Non-strategic, low-volume niche civilian products within Bharat Electronics Limited (BEL) would be categorized as Dogs in the BCG Matrix. These are ventures where BEL has diversified but which haven't gained significant market traction. For instance, BEL's foray into certain civilian radar systems or specialized communication equipment for non-defense sectors might fall into this category if sales volumes remain low and profitability is minimal.

These products often demand considerable investment relative to the returns generated, and they may not leverage BEL's core competencies in defense electronics effectively. For example, if a particular civilian product line in 2024 had sales of less than ₹50 crore and a negative or negligible profit margin, it would likely be considered a Dog, requiring a strategic review.

Legacy E-governance Hardware Solutions

Legacy e-governance hardware solutions, while foundational in the past, are now likely positioned as Dogs in Bharat Electronics Limited's (BEL) BCG Matrix. These older systems, often hardware-intensive, face declining demand as governments and organizations increasingly adopt integrated, software-centric, and cloud-based platforms. BEL's 2023-24 annual report indicated a strategic focus on newer technologies, with significant investments in areas like AI and advanced communication systems, suggesting a de-emphasis on legacy hardware maintenance and upgrades.

The market for these older e-governance hardware components is shrinking, making them less competitive and potentially a drain on resources. BEL's competitive landscape in this segment is evolving, with newer players offering more agile and cost-effective solutions. The company's reported revenue from its defense segment, which often includes such hardware, showed steady growth, but the specific contribution of legacy e-governance hardware is likely diminishing relative to newer defense technologies.

- Declining Market Share: Older hardware solutions are being replaced by modern, integrated software and cloud platforms, leading to a reduced market presence for BEL's legacy offerings.

- Resource Drain: Maintaining and supporting outdated hardware can consume significant resources without generating substantial returns, impacting profitability.

- Technological Obsolescence: The rapid pace of technological advancement makes these legacy systems increasingly outdated, requiring substantial investment for modernization, which may not be cost-effective.

- Strategic Shift: BEL's stated focus on advanced technologies like AI and secure communication systems indicates a strategic move away from heavily hardware-dependent legacy solutions.

Products with Limited Export Potential

Products with limited export potential, categorized as Dogs in Bharat Electronics Limited's BCG Matrix, are those tailored for very specific Indian defense needs. These items often struggle to find international buyers due to unique specifications or stringent export regulations. For instance, certain radar systems or electronic warfare suites designed exclusively for the Indian Army's operational environment may not meet the requirements of other nations, thus capping their market reach.

While these products are vital for national security and fulfill critical domestic requirements, their inability to scale globally significantly hinders their growth prospects. Unlike products with strong international demand, these 'Dogs' offer limited avenues for expansion, making them less appealing for substantial, long-term investment. Bharat Electronics Limited's focus on these niche areas, while essential for defense, means these specific product lines are unlikely to become major revenue drivers on the international stage.

Consider the following examples of product categories that might fall into this classification:

- Specialized Communication Systems: Devices built for specific Indian military communication protocols that are not interoperable with international standards.

- Niche Electronic Warfare Equipment: Countermeasure systems designed against threats unique to the Indian subcontinent, limiting their appeal elsewhere.

- Customized Radar Components: Sub-systems for defense platforms that are highly integrated and not easily adaptable for foreign military hardware.

Products with declining market share and low growth potential, such as obsolete analog communication systems or commoditized electronic components, are classified as Dogs within Bharat Electronics Limited's (BEL) BCG Matrix. These segments often face intense competition and technological obsolescence, leading to minimal profitability and limited future prospects. For instance, BEL's strategic focus in 2023-24 shifted towards advanced technologies, indicating a de-emphasis on legacy hardware.

BEL's approach to these Dog products typically involves minimizing further investment and managing their decline, possibly through divestment or by focusing on supporting existing customers during their transition to newer BEL offerings. This strategy aims to reallocate capital towards more promising growth areas, ensuring efficient resource utilization.

The company's 2023-24 financial reports highlight significant investments in AI and advanced communication systems, underscoring the strategic move away from less profitable, legacy product lines. This indicates a deliberate effort to streamline the portfolio and concentrate on segments with higher potential for innovation and market leadership.

For example, niche civilian products with low sales volumes and minimal profitability, or specialized defense hardware with limited export potential, fall into this category. These segments, while potentially fulfilling specific domestic needs, do not represent significant avenues for expansion or substantial revenue generation on a global scale.

Question Marks

Bharat Electronics Limited (BEL) is actively contributing to the smart cities initiative, notably with its EQUINOX platform. This positions BEL in a rapidly expanding market, driven by government focus and technological advancements. For instance, BEL's involvement in projects like the Chandigarh Smart City showcases its commitment to this sector.

While BEL operates in a high-growth segment, its market share within the complex smart city ecosystem is still nascent. The presence of numerous private sector competitors means BEL faces significant competition. This necessitates strategic investments to bolster its position.

To transition its smart city solutions from question marks to stars in the BCG matrix, BEL needs to accelerate its market penetration and forge strategic partnerships. Continued investment in research and development for its EQUINOX platform and other smart city technologies will be paramount. For example, BEL announced a significant order worth INR 2,200 crore in November 2023, partly related to electronic voting machines, but also indicating broader defense and potentially smart city related investments.

Bharat Electronics Limited's cybersecurity solutions are positioned within the 'Question Marks' category of the BCG matrix. The global cybersecurity market is booming, projected to reach $372 billion by 2024, driven by escalating digital threats. BEL's recent establishment of Strategic Business Units (SBUs) focused on Network & Cyber Security reflects its entry into this high-growth sector.

Despite the market's strong growth trajectory, BEL's position within the broader commercial cybersecurity landscape is nascent. This means the company currently holds a relatively low market share, necessitating significant investment to enhance its competitive standing and achieve scalability. As such, these solutions represent a strategic area for potential future growth, but require careful management of resources.

Bharat Electronics Limited's (BEL) strategic push into unmanned systems, particularly anti-drone technology, places it in a burgeoning defense sector. This market is experiencing significant growth, fueled by the increasing need for sophisticated counter-unmanned aerial system (C-UAS) solutions. BEL's investment in this area, including the development of integrated anti-drone systems, signifies its intent to capture a share of this expanding market.

While the overall market for unmanned systems and anti-drone solutions is poised for substantial expansion, BEL's position is likely that of a developing player. The company is actively building its capabilities and establishing its product portfolio in this dynamic field. For instance, BEL has showcased its capabilities with systems like the 'Corvus' counter-drone system, indicating progress in product development and market entry.

Sustained heavy investment in research and development, coupled with strategic collaborations, will be crucial for BEL to ascend to a leadership position in the unmanned systems domain. The global market for C-UAS is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, presenting a substantial opportunity for BEL to leverage its technological advancements.

Artificial Intelligence (AI) based Surveillance

Bharat Electronics Limited (BEL) is strategically investing in Artificial Intelligence (AI) based surveillance, a sector poised for significant growth in defense and homeland security applications. This aligns with BEL's forward-looking approach to adopting advanced technologies.

While the broader AI market is experiencing rapid expansion, BEL's penetration in specialized AI-driven surveillance solutions is in its nascent phase. This segment requires substantial and ongoing research and development, coupled with proactive market cultivation, to transition into a market leader.

- Market Potential: The global AI in surveillance market was valued at approximately USD 10.5 billion in 2023 and is projected to reach over USD 35 billion by 2030, indicating a substantial growth trajectory.

- BEL's Current Position: BEL is actively developing AI capabilities for its existing surveillance platforms, aiming to enhance threat detection and situational awareness.

- Investment Focus: Continuous investment in R&D is crucial for BEL to stay ahead in AI algorithm development, sensor fusion, and data analytics for surveillance.

- Strategic Goal: The objective is to establish BEL as a key player in AI-powered surveillance, moving this segment from a question mark to a potential star within its portfolio.

E-Mobility & Solar Solutions

Bharat Electronics Limited's (BEL) foray into e-mobility and solar solutions positions it within rapidly expanding civilian markets fueled by global sustainability trends. This diversification taps into the growing demand for electric vehicle (EV) charging infrastructure and renewable energy. For instance, India's EV market is projected to reach significant volumes, with government incentives driving adoption. BEL's entry aims to leverage its manufacturing prowess in these emerging sectors.

However, the e-mobility and solar solutions landscape is intensely competitive. Numerous domestic and international companies are vying for market share, bringing established brands and advanced technologies. BEL's current penetration in these specific segments is likely modest, necessitating substantial strategic investments in research and development, marketing, and channel expansion to carve out a meaningful presence. The company needs to develop unique value propositions to stand out.

- Market Growth: India's electric vehicle market is anticipated to grow substantially, with estimates suggesting millions of EVs on the road by 2030, creating a robust demand for charging infrastructure.

- Competitive Landscape: BEL faces competition from established players in the solar sector, such as Tata Power Solar, and emerging companies in the EV charging space, requiring strong differentiation.

- Strategic Investment: Capturing significant market share will demand considerable capital outlay for technology upgrades, production scaling, and building a strong brand presence in these nascent but high-potential markets.

Bharat Electronics Limited's (BEL) efforts in areas like e-mobility and solar solutions represent significant opportunities within rapidly expanding civilian markets. These sectors are driven by global sustainability trends and increasing demand for electric vehicle (EV) charging infrastructure and renewable energy. For instance, India's EV market is projected for substantial growth, with government incentives actively promoting adoption. BEL's strategic entry aims to leverage its established manufacturing capabilities in these emerging, high-potential sectors.

However, the e-mobility and solar solutions markets are highly competitive, featuring numerous domestic and international players with established brands and advanced technologies. BEL's current penetration in these specific segments is likely modest, requiring substantial strategic investments in R&D, marketing, and channel expansion to establish a meaningful presence and differentiate its offerings.

| Segment | Market Potential | BEL's Current Position | Strategic Imperative |

| E-Mobility & Solar Solutions | India's EV market projected for significant growth, millions of EVs by 2030. Robust demand for charging infrastructure and renewable energy. | Nascent, modest penetration. Faces intense competition from established and emerging players. | Significant investment in technology, scaling production, brand building, and developing unique value propositions to capture market share. |

BCG Matrix Data Sources

Our BCG Matrix for Bharat Electronics Limited is built on a foundation of robust data, including BEL's annual reports, market research on defense electronics, and industry growth forecasts.