Beazer Homes USA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beazer Homes USA Bundle

Beazer Homes USA navigates a competitive landscape shaped by powerful buyer bargaining, intense rivalry, and the ever-present threat of new entrants. Understanding these forces is crucial for any stakeholder in the homebuilding sector.

The complete report reveals the real forces shaping Beazer Homes USA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The homebuilding sector, including companies like Beazer Homes USA, depends heavily on suppliers for critical materials such as lumber, steel, and electrical components. Recent years have shown significant price fluctuations and upward trends for these inputs, driven by persistent supply chain disruptions, international trade tensions, and robust consumer demand. For instance, lumber prices, a key cost for homebuilders, experienced considerable volatility in 2023, with futures contracts showing significant swings throughout the year.

While Beazer Homes, as a substantial buyer, can leverage its volume to negotiate better terms, the broader market dynamics often empower suppliers. When demand for essential building materials outstrips supply, or when geopolitical events impact production and transportation, suppliers can exert considerable bargaining power, directly influencing Beazer Homes' cost of goods sold and overall profitability.

The construction industry, including homebuilding, is grappling with a significant and ongoing labor shortage. As of early 2024, the sector consistently reports hundreds of thousands of job openings each month, highlighting a substantial demand for workers.

This scarcity of skilled tradespeople and specialized construction professionals directly amplifies the bargaining power of the available workforce. Consequently, companies like Beazer Homes USA may experience upward pressure on wages and face potential project delays due to insufficient labor.

Beazer Homes' commitment to building 100% Zero Energy Ready homes means they often require specialized, high-performance components. This focus on energy efficiency and quality construction can lead to a reliance on a smaller pool of suppliers capable of providing these advanced technologies. For instance, in 2024, the demand for advanced HVAC systems and high-efficiency insulation materials saw significant growth, potentially concentrating supply for these niche products.

Transportation and Logistics Costs

The cost and availability of transportation and logistics services directly impact Beazer Homes' ability to get building materials to its construction sites efficiently. Fluctuations in fuel prices, driver availability, and shipping rates can significantly alter the overall cost of goods. For instance, in late 2023 and early 2024, the transportation sector experienced ongoing challenges, including higher diesel prices and a shortage of truck drivers, which collectively put upward pressure on logistics costs for many industries, including homebuilding.

These increased transportation expenses can empower logistics providers, giving them leverage over Beazer Homes. When shipping becomes more expensive and complex, suppliers of these services can command higher prices.

- Rising Fuel Prices: Diesel prices, a key component of transportation costs, saw volatility in 2023 and early 2024, impacting freight rates.

- Labor Shortages: A persistent shortage of qualified truck drivers continued to affect the capacity and cost of logistics services.

- Supply Chain Bottlenecks: Lingering effects of global supply chain disruptions can still lead to increased transit times and higher shipping expenses.

- Impact on Beazer Homes: Higher logistics costs translate directly to increased material costs for Beazer Homes, potentially squeezing profit margins.

Land Availability and Developers

The availability of desirable land is a critical input for homebuilders like Beazer Homes. In 2024, the company continued its strategy of increasing controlled lots to support future community development, aiming for a higher community count. However, the supply of suitable and affordable land in high-demand markets remains constrained. This scarcity can significantly enhance the bargaining power of land developers and sellers, potentially increasing acquisition costs for Beazer Homes.

Limited land availability directly impacts Beazer Homes' ability to secure prime locations for new communities. As of early 2025, reports indicate continued competition for developable land in many key metropolitan areas. This competitive landscape means that land sellers can often dictate terms, pushing up prices and reducing profit margins for homebuilders. Beazer Homes' success in managing this factor hinges on its land acquisition strategy and its ability to forecast market demand accurately to secure land at favorable terms.

- Land Scarcity: Limited supply of desirable and affordable land in attractive housing markets.

- Developer Leverage: Land sellers and developers gain significant bargaining power due to this scarcity.

- Cost Impact: Increased land acquisition costs can reduce Beazer Homes' profit margins.

- Strategic Importance: Effective land acquisition is crucial for Beazer Homes' community expansion plans.

Suppliers of essential building materials like lumber and steel hold significant sway over Beazer Homes USA, particularly when demand surges or supply chains falter. In 2023, lumber prices saw considerable swings, illustrating this power. The company's reliance on specialized components for its Zero Energy Ready homes further concentrates this power among a smaller group of providers, as seen with the growing demand for advanced HVAC systems in 2024.

The bargaining power of suppliers is amplified by factors such as rising fuel prices and a persistent shortage of truck drivers, which increased logistics costs for Beazer Homes in late 2023 and early 2024. This situation empowers transportation service providers to command higher rates, directly impacting Beazer Homes' material acquisition expenses and potentially squeezing profit margins.

Land scarcity in desirable markets in 2024 and early 2025 grants considerable leverage to land developers and sellers. This limited availability of suitable land means Beazer Homes faces increased acquisition costs and potentially less favorable terms, impacting its ability to expand communities profitably.

| Supplier Type | Key Factors Influencing Power | Impact on Beazer Homes | Relevant Data/Trend (2023-2024) |

|---|---|---|---|

| Building Materials (Lumber, Steel) | Supply chain disruptions, demand fluctuations | Increased cost of goods sold, potential project delays | Lumber futures showed significant volatility in 2023. |

| Specialized Components (HVAC, Insulation) | Niche product demand, limited supplier pool | Higher costs for advanced materials, reliance on specific vendors | Growing demand for high-efficiency insulation in 2024. |

| Logistics & Transportation | Fuel prices, driver shortages, supply chain bottlenecks | Elevated shipping costs, impacting material affordability | Diesel price volatility and truck driver shortages persisted. |

| Land Developers & Sellers | Limited availability of prime locations | Increased land acquisition costs, reduced profit margins | Continued competition for developable land in key markets as of early 2025. |

What is included in the product

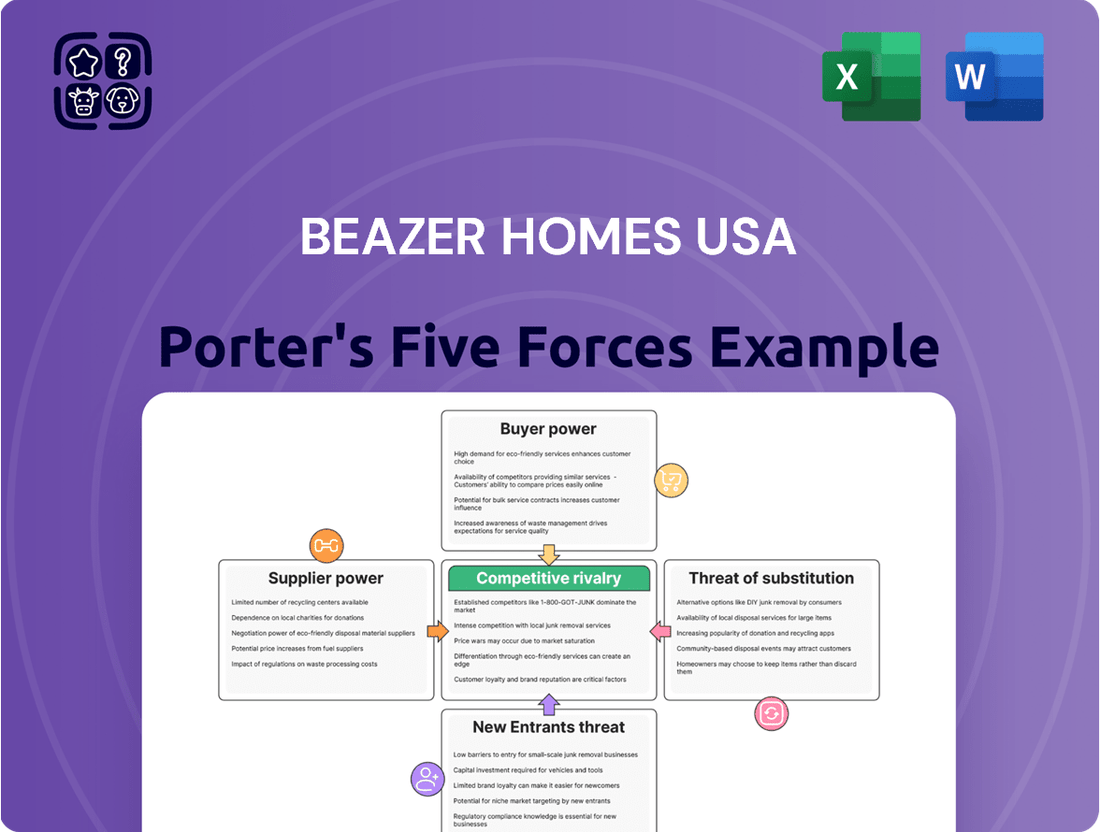

This Porter's Five Forces analysis for Beazer Homes USA examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on the company's profitability.

Instantly visualize competitive intensity and identify strategic opportunities with a dynamic, multi-scenario Porter's Five Forces analysis for Beazer Homes USA.

Effortlessly adapt to market shifts by easily updating key drivers and assumptions to proactively address Beazer Homes USA's competitive landscape.

Customers Bargaining Power

The substantial cost of a new home makes customers acutely aware of price and the impact of mortgage rates. This sensitivity gives them significant bargaining power, especially when rates rise.

For Beazer Homes, this is particularly true for first-time and move-up buyers. As of late 2023 and into 2024, mortgage rates have remained elevated, hovering around 6.5% to 7.5% for a 30-year fixed mortgage. This directly affects affordability, pushing buyers to seek concessions from builders like Beazer.

Customers' ability to secure favorable mortgage solutions directly impacts their purchasing power with homebuilders like Beazer Homes. In 2024, the landscape of mortgage financing continues to evolve, with various lenders offering competitive rates and terms. This availability of choice empowers potential buyers, allowing them to shop around for the best deals.

Beazer Homes USA's 'Mortgage Choice' program directly addresses this by helping buyers compare loan options from different lenders. This transparency can lead to better terms for the customer, effectively increasing their bargaining power. For instance, a buyer securing a lower interest rate through comparison could save tens of thousands of dollars over the life of the loan, a significant factor in their overall purchasing decision.

Beazer Homes USA's 'choice plans' allow buyers to personalize their homes, which can empower customers. This flexibility means buyers can often dictate specific features or design elements, giving them leverage in negotiations. For instance, a customer might be willing to pay a premium or choose a different builder if their desired customizations aren't met, directly impacting Beazer's sales volume and pricing power.

Information Availability and Comparison Shopping

Customers today have unprecedented access to information, making comparison shopping for homes incredibly easy. Online platforms and review sites provide detailed insights into pricing, home features, and builder reputations. This transparency significantly shifts bargaining power towards the buyer.

For Beazer Homes, this means customers can readily compare their offerings against those of competitors, scrutinizing price points, included features, and available incentives. This ease of comparison empowers customers to negotiate more effectively, demanding better terms or lower prices.

- Information Accessibility: Online portals and consumer review sites offer extensive data on home builders and their projects.

- Price Transparency: Buyers can easily compare pricing structures and financing options across different developers.

- Feature Comparison: Detailed specifications of homes, from square footage to included amenities, are readily available for side-by-side analysis.

- Negotiation Leverage: Armed with this knowledge, customers can negotiate more confidently on price, upgrades, and closing costs.

Limited Resale Inventory and New Home Demand

Even with elevated interest rates, demand for new homes remains robust in certain markets. This sustained interest is partially fueled by a scarcity of available existing homes for sale. In 2024, the U.S. median existing home price was around $417,700, reflecting this tight inventory. This limited resale supply can temper the bargaining power of customers, as they face fewer immediate alternatives and may be more inclined to opt for new construction, despite potential affordability concerns.

Customers' bargaining power is somewhat constrained by the limited resale inventory, especially in regions experiencing strong demand. For instance, data from early 2024 indicated that the number of existing homes for sale remained significantly below pre-pandemic levels. This scarcity means buyers might have fewer comparable options readily available, pushing them toward new builds even if they present a higher initial cost.

- Limited Resale Inventory: In early 2024, the U.S. housing market continued to grapple with a shortage of existing homes available for sale.

- Sustained New Home Demand: Despite higher mortgage rates, consumer interest in purchasing new construction homes remained a significant factor.

- Reduced Customer Bargaining Power: The lack of readily available resale homes gives builders like Beazer Homes a stronger position, as buyers have fewer immediate alternatives.

- Affordability Challenges: While demand is present, buyers still face affordability hurdles, which can influence their willingness to negotiate on new home prices.

Customers' bargaining power is significantly influenced by the availability of financing options and their ability to compare them. In 2024, Beazer Homes' Mortgage Choice program facilitates this by allowing buyers to explore various lenders, potentially securing more favorable terms. This access to competitive mortgage rates, which in early 2024 hovered around 6.5% to 7.5% for a 30-year fixed loan, directly enhances a buyer's purchasing power and negotiation leverage.

| Factor | Impact on Beazer Homes Customers | 2024 Data/Context |

|---|---|---|

| Mortgage Rate Sensitivity | High; buyers are sensitive to interest rate fluctuations impacting affordability. | 30-year fixed mortgage rates generally between 6.5% - 7.5% in early 2024. |

| Information Accessibility | Increased; online platforms allow easy comparison of prices, features, and builder reputations. | Websites and review platforms provide extensive data, empowering informed negotiation. |

| Financing Choice | Enhanced; programs like Beazer's Mortgage Choice offer access to multiple lenders. | Buyers can shop for competitive rates, increasing their leverage. |

| Customization Demands | Moderate; buyers may negotiate for specific features or design elements. | Flexibility in personalization can influence buyer choice and negotiation stance. |

What You See Is What You Get

Beazer Homes USA Porter's Five Forces Analysis

This preview showcases the comprehensive Beazer Homes USA Porter's Five Forces Analysis you will receive upon purchase, offering a detailed examination of the competitive landscape within the homebuilding industry. You're looking at the actual document, which delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

The U.S. homebuilding sector is a dynamic landscape, marked by a significant number of participants. However, a notable shift is underway, with larger, national builders, including Beazer Homes, steadily increasing their market share. This consolidation trend means that while Beazer operates within a fragmented market, its competitive environment is increasingly shaped by these larger entities.

Despite the consolidation, Beazer Homes continues to contend with a broad spectrum of competitors. This includes a multitude of regional and local builders who often possess deep understanding of their specific markets and can offer tailored products. This persistent presence of numerous smaller players fuels a high degree of competitive rivalry, impacting pricing and market strategies.

In 2024, the ongoing consolidation is evident in the market share gains of top builders. For instance, the top 100 U.S. homebuilders accounted for approximately 47% of all single-family housing starts in 2023, a figure that continues to inch upwards, indicating the growing influence of larger players like Beazer in a historically fragmented industry.

The housing market in 2024 and into early 2025 has been characterized by significant affordability hurdles for buyers, primarily driven by elevated mortgage rates and persistent high home prices. This environment forces homebuilders, including Beazer Homes, into intense price competition. To stimulate demand and move inventory, they frequently resort to offering attractive incentives. These can include direct price reductions, but more commonly, they involve concessions like mortgage rate buydowns, which can significantly lower a buyer's monthly payment.

These competitive pressures directly impact Beazer Homes' profitability. For instance, during their third quarter of fiscal year 2025, the company reported an increase in price concessions. This suggests that to secure sales in a challenging market, Beazer Homes had to absorb a portion of the cost through reduced selling prices or absorbed costs associated with buyer incentives, thereby putting downward pressure on their gross margins.

Beazer Homes USA is actively distinguishing itself in the housing market by focusing on superior energy efficiency and robust quality in its construction. The company has a stated goal of achieving 100% Zero Energy Ready homes, a significant commitment to sustainability and lower long-term operating costs for homeowners.

This strategic emphasis on energy efficiency and quality construction serves as a key differentiator for Beazer Homes. However, the homebuilding industry is inherently competitive, and other builders are also increasingly investing in similar features. This means Beazer must continually innovate and effectively communicate the tangible value of its energy-efficient and high-quality homes to maintain its competitive edge.

Community Count and Geographic Presence

Beazer Homes USA is actively working to increase its community count across various geographic regions. This expansion strategy aims to provide a broader selection of homes for potential buyers and deepen market penetration.

A significant community presence can translate into a competitive edge, but it necessitates substantial investment in land acquisition and development. For instance, as of the first quarter of 2024, Beazer Homes reported active selling communities totaling 59, a slight decrease from 62 in the prior year's comparable period, indicating a dynamic approach to managing its geographic footprint and community development pipeline.

- Community Expansion Strategy: Beazer Homes prioritizes growing its presence in new and existing markets through community development.

- Market Penetration: A larger number of communities offers more product variety and increases the company's reach within its target demographics.

- Investment Requirements: Expanding community counts demands significant capital for land acquisition, zoning, and infrastructure development.

- 2024 Community Data: In Q1 2024, Beazer Homes operated 59 active selling communities, reflecting ongoing strategic adjustments in its development portfolio.

Marketing and Sales Strategies

Competitive rivalry within the homebuilding sector, including Beazer Homes USA, is intensely focused on marketing and sales. Companies differentiate themselves through robust online presences, offering immersive virtual tours and leveraging dedicated direct sales forces to engage potential buyers. This heightened competition necessitates innovative approaches to capture market share.

Beazer Homes USA's strategic 'Mortgage Choice' program exemplifies this drive for innovation. This initiative aims to attract buyers by simplifying the mortgage process and potentially offering financial incentives, underscoring the critical role of creative sales tactics in a crowded marketplace. Such programs are vital for standing out and securing customer commitment.

- Marketing Differentiators: Companies like Beazer Homes USA invest heavily in digital marketing, virtual reality home tours, and personalized customer experiences to attract buyers.

- Sales Force Effectiveness: The strength and training of direct sales teams are crucial for converting leads into sales, with many builders offering incentives for their sales professionals.

- Innovative Programs: Initiatives such as Beazer Homes' 'Mortgage Choice' program are designed to reduce buyer friction and provide added value, a key strategy in a competitive environment.

- Market Share Focus: In 2024, the homebuilding industry saw continued emphasis on capturing market share through aggressive pricing, financing assistance, and enhanced marketing campaigns.

Competitive rivalry is a defining characteristic of the homebuilding industry, with Beazer Homes USA navigating a landscape populated by numerous national, regional, and local builders. This intense competition is further amplified by a market trend towards consolidation, where larger builders are steadily gaining market share. In 2024, this trend continued, with the top 100 U.S. homebuilders accounting for a significant portion of housing starts, underscoring the growing influence of major players.

The affordability crisis in 2024, driven by high mortgage rates and home prices, has intensified this rivalry, forcing builders like Beazer to offer substantial incentives, such as mortgage rate buydowns, to stimulate demand. This pressure directly impacts profit margins, as evidenced by Beazer's reported increase in price concessions in Q3 2025, demonstrating a direct trade-off between sales volume and profitability.

| Competitor Type | Key Characteristics | Impact on Beazer Homes |

|---|---|---|

| National Builders | Large scale, significant market share, strong brand recognition | Drive consolidation, increase competition for land and buyers |

| Regional/Local Builders | Deep market knowledge, tailored products, flexibility | Offer niche competition, can be agile in pricing and design |

| Industry Trend (2024) | Focus on incentives, digital marketing, energy efficiency | Requires Beazer to innovate in sales, marketing, and product features |

SSubstitutes Threaten

The most direct substitute for new homes is the market for existing homes. While a shortage of resale inventory in 2024 has benefited new home builders like Beazer Homes, a substantial rise in available pre-owned properties could redirect buyer interest away from new constructions.

For individuals and families unable or unwilling to purchase a home, renting an apartment or house presents a significant substitute to homeownership, impacting demand for new construction by companies like Beazer Homes USA. In 2024, persistent high mortgage rates, averaging around 6.5% to 7.5% for a 30-year fixed loan, continue to make home buying less accessible for many, pushing them towards the rental market.

The increasing cost of renting itself, however, can also become a factor. When rental prices escalate significantly, the affordability gap between renting and owning may narrow, potentially encouraging some to reconsider purchasing, even with higher interest rates. This dynamic creates a complex substitution effect for homebuilders.

The rise of modular and prefabricated homes poses a growing threat of substitutes for Beazer Homes. These alternative construction methods promise faster build times and potential cost savings, appealing to a segment of the market, especially those prioritizing speed or affordability.

The prefabricated housing market is experiencing significant growth. For instance, the global prefabricated construction market was valued at approximately $155 billion in 2023 and is projected to reach over $250 billion by 2030, indicating a substantial and expanding alternative for homebuyers.

Renovation and Expansion of Existing Properties

The renovation and expansion of existing properties present a significant threat of substitution for new home construction. Consumers might opt to upgrade their current residences rather than purchase a new one, particularly if they benefit from low existing mortgage rates. This can make renovations a more financially attractive alternative, diverting demand from new home builders like Beazer Homes USA.

In 2024, the home improvement market continued to show resilience. For instance, spending on home renovations and repairs was projected to remain robust, with many homeowners leveraging existing equity and favorable financing. This trend directly impacts the demand for new housing, as a substantial segment of potential buyers may choose to invest in their current homes instead.

- Consumer Preference Shift: A notable portion of the market may prioritize customization and cost savings offered by renovations over the expense and process of buying new.

- Economic Factors: Low interest rates on existing mortgages make refinancing or home equity loans for renovations more appealing than taking on a new, potentially higher-rate mortgage for a new build.

- Market Data: Reports from early 2024 indicated that while new home sales saw fluctuations, the demand for remodeling services remained strong, suggesting a continued substitution effect.

Alternative Living Arrangements

Beyond the traditional single-family homes Beazer Homes specializes in, alternative living arrangements are increasingly gaining traction. These include co-housing communities, compact tiny homes, and multi-generational living setups. These options can appeal to specific demographics or individuals prioritizing affordability and community over the typical suburban single-family dwelling.

The rise of these alternatives presents a competitive threat. For instance, the tiny home movement, while niche, offers a drastically lower entry cost, potentially drawing buyers who might otherwise consider a starter home from Beazer. Similarly, co-housing models cater to a growing desire for community and shared resources, which a standard single-family home doesn't inherently provide.

In 2024, the demand for more flexible and affordable housing solutions continued to grow. Data from the National Association of Realtors indicated a persistent interest in starter homes, but also a notable uptick in inquiries about smaller, more efficient living spaces. This trend suggests that Beazer Homes faces a growing substitute market that caters to evolving consumer preferences and economic realities.

- Co-housing: Offers shared amenities and community living, appealing to those seeking social connection.

- Tiny Homes: Provide a significantly lower cost of entry and reduced environmental footprint.

- Multi-generational Living: Addresses affordability and family care needs, becoming more prevalent.

- Market Shift: Consumer preference for affordability and community can divert potential buyers from traditional single-family homes.

The threat of substitutes for Beazer Homes USA remains significant, encompassing existing homes, rentals, and alternative housing models. While the resale market's inventory constraints in 2024 offered a temporary advantage, a rebound in pre-owned properties could shift buyer focus. High mortgage rates in 2024, hovering around 6.5% to 7.5%, continue to push potential buyers towards rentals, though escalating rental costs may eventually narrow the affordability gap with ownership.

Modular and prefabricated homes are also gaining traction, offering faster construction and potential cost savings. The global prefabricated construction market, valued around $155 billion in 2023, is a clear indicator of this growing segment. Furthermore, renovations and expansions of existing homes present a compelling alternative, especially when homeowners can leverage low existing mortgage rates, as seen in the robust home improvement market of 2024.

| Substitute Category | Key Appeal | 2024 Relevance |

|---|---|---|

| Existing Homes | Lower price point, established neighborhoods | Inventory shortages benefited new builds, but recovery poses a threat. |

| Rentals | Flexibility, lower upfront costs | High mortgage rates in 2024 drove rental demand. |

| Modular/Prefab Homes | Speed, cost efficiency | Market projected to exceed $250 billion by 2030. |

| Renovations | Leveraging existing equity, lower mortgage rates on current homes | Strong home improvement market in 2024 indicates continued diversion of demand. |

Entrants Threaten

Entering the homebuilding sector, like that of Beazer Homes USA, demands immense financial resources. Significant capital is needed for acquiring land, preparing it for construction, and then actually building the homes. This upfront investment acts as a substantial hurdle for anyone looking to start a new homebuilding company.

Beazer Homes, for instance, maintains a considerable land inventory and healthy liquidity, reflecting the scale of investment required. In 2023, Beazer Homes reported total assets of approximately $4.2 billion, a portion of which is tied up in land and work-in-progress. This financial muscle, common among established players, effectively deters many potential new entrants who lack the necessary funding.

The homebuilding sector faces a labyrinth of local, state, and federal regulations, encompassing zoning ordinances, environmental protections, and stringent building codes. For potential new entrants, successfully navigating these complex requirements and enduring protracted permitting procedures presents a substantial barrier, escalating both expenses and project timelines.

Established homebuilders, including Beazer Homes USA, benefit from robust, long-standing relationships with a diverse range of suppliers for crucial building materials and skilled labor. These existing networks are vital for securing consistent quality and competitive pricing, especially in a market often strained by demand.

New entrants attempting to penetrate the homebuilding market face a significant hurdle in replicating these established supply chains. They would likely need to invest considerable time and resources to cultivate similar supplier relationships, potentially encountering higher initial material costs and less favorable payment terms. For example, in 2024, the average cost of lumber, a key building material, experienced volatility, making it harder for new players without established purchasing power to secure favorable rates compared to incumbents like Beazer Homes.

Brand Recognition and Customer Trust

Beazer Homes USA benefits from significant brand recognition and customer trust built over years of operation. New entrants face a substantial hurdle in replicating this established reputation, as cultivating trust in the homebuilding sector requires consistent quality and extensive marketing efforts. For instance, in 2024, Beazer Homes continued its focus on customer satisfaction, a key driver in their brand loyalty.

The substantial investment in marketing and brand building necessary to compete with established players like Beazer Homes presents a significant barrier. New companies must not only offer competitive pricing but also convince potential buyers of their reliability and quality, a process that can take considerable time and financial resources. This makes it challenging for newcomers to quickly gain market share.

- Established Brand Reputation: Beazer Homes has cultivated a strong brand image associated with quality and customer satisfaction.

- High Marketing Investment: New entrants need substantial capital for marketing to build comparable brand awareness.

- Customer Trust Barrier: Building trust in home construction is a lengthy process, difficult for new companies to accelerate.

- Competitive Landscape: The homebuilding market is crowded, making it harder for new brands to stand out.

Access to Skilled Labor and Management

The construction industry, including homebuilders like Beazer Homes USA, faces a persistent challenge with a shortage of skilled labor. This makes it difficult for any company, especially new entrants, to find and keep qualified workers and experienced management. Established firms often have the advantage of offering more consistent work and better benefits, making them more attractive to top talent.

New companies entering the housing market must contend with the need to build a skilled workforce from scratch. This can involve significant investment in training and recruitment. For instance, the U.S. Bureau of Labor Statistics projected that employment in construction would grow by 8% from 2022 to 2032, adding over 590,000 jobs, highlighting the demand for workers that new entrants must compete for.

- Skilled Labor Scarcity: A general shortage of skilled tradespeople like carpenters, electricians, and plumbers impacts all construction firms.

- Management Competition: Experienced project managers and site supervisors are in high demand, often preferring established companies with proven track records.

- Recruitment Costs: New entrants face higher costs and longer timelines to build a competent and reliable workforce compared to established players.

- Retention Challenges: Attracting and retaining talent is crucial, as high turnover can significantly disrupt project schedules and increase costs for new companies.

The threat of new entrants for Beazer Homes USA is moderate, primarily due to the substantial capital requirements and regulatory hurdles inherent in the homebuilding industry. While the allure of the housing market exists, the sheer financial commitment for land acquisition, development, and construction, coupled with navigating complex zoning and building codes, acts as a significant deterrent for many aspiring builders.

Porter's Five Forces Analysis Data Sources

Our Beazer Homes USA Porter's Five Forces analysis leverages data from Beazer Homes' annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and housing market trend reports.