Beazer Homes USA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beazer Homes USA Bundle

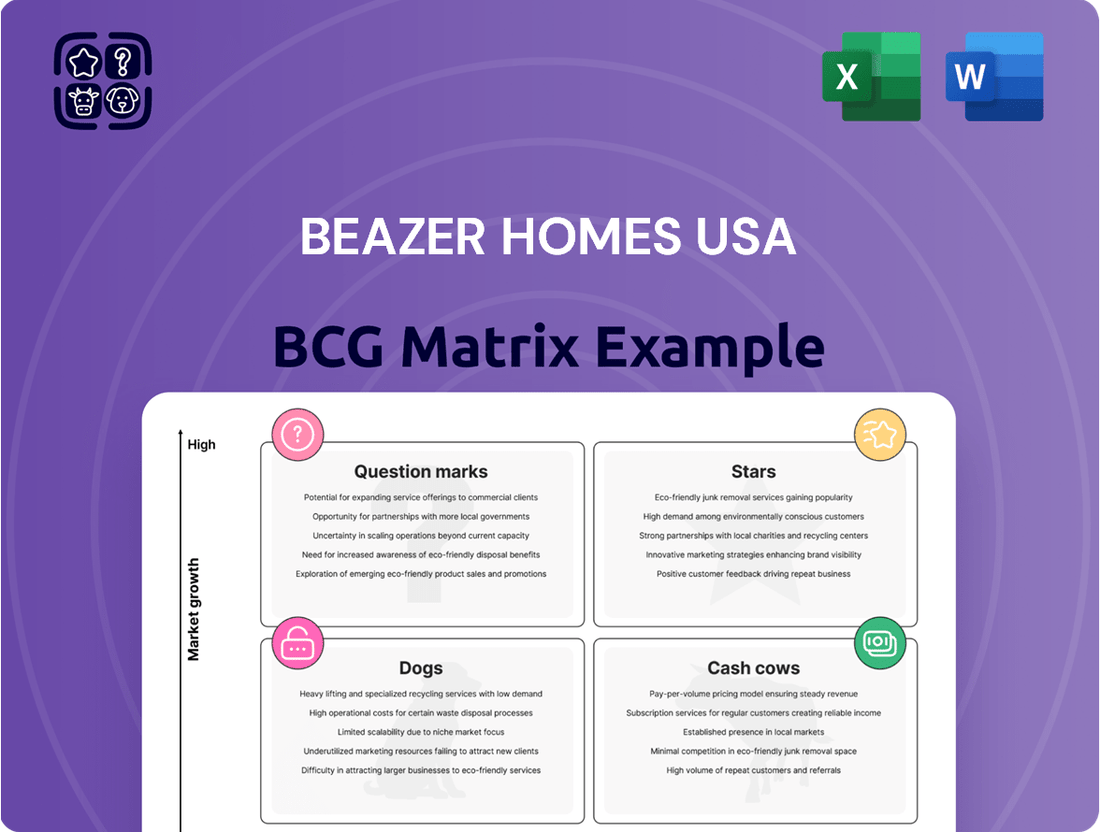

Curious about Beazer Homes USA's strategic positioning? Our BCG Matrix analysis reveals which segments are driving growth and which might need a closer look. Understand their market share and growth rate to make informed decisions.

This preview offers a glimpse into Beazer Homes USA's product portfolio. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Beazer Homes is strategically positioning its Zero Energy Ready (ZER) homes as a Stars category in the BCG Matrix. This initiative, aiming for 100% of new home starts to be ZER by the end of 2025, taps into a rapidly expanding market fueled by consumer desire for reduced utility expenses and eco-friendly living.

The company's dedication to energy efficiency is evidenced by its 2024 average Home Energy Rating System (HERS) score of 42, the lowest among major national homebuilders. This achievement underscores Beazer's strong competitive standing and significant market penetration within the high-demand ZER home segment.

Beazer Homes USA's Customizable 'Choice Plans' are a key element in their BCG Matrix positioning, likely falling into the Stars or Question Marks category due to their innovative approach to customer personalization. These plans allow buyers to select and customize primary living areas at no extra cost, a significant differentiator in the housing market. This feature directly addresses the growing consumer demand for tailored living spaces, even amidst economic uncertainties. For instance, in 2024, the demand for customizable homes remained a strong segment, allowing Beazer to potentially capture a larger market share of buyers prioritizing personalized environments.

Beazer Homes USA is strategically aiming to significantly increase its active community count, targeting over 200 by the end of fiscal 2027. This ambitious growth plan, up from 167 communities as of June 30, 2025, signifies a strong push for market expansion.

This expansion focuses on entering new geographic areas and sub-markets, particularly those with strong demographic appeal from first-time and move-up buyers. The company's growing portfolio of controlled lots provides the necessary foundation to support this aggressive community development strategy.

First-Time and Move-Up Buyer Focus

Beazer Homes USA is strategically positioned to capitalize on the first-time and move-up buyer markets. These segments are known for their resilience, often seeking energy-efficient and reasonably priced homes, which Beazer actively provides.

By concentrating on these substantial demographic groups, Beazer aims to secure a significant market share. This targeted approach fosters steady growth as these buyers consistently enter or progress in the housing market.

In 2024, the housing market saw continued interest from first-time buyers, with data indicating they represented a notable portion of overall home sales. Move-up buyers also remained active, seeking upgrades and larger spaces.

- First-Time Buyer Demand: Data from the National Association of Realtors in early 2024 showed first-time buyers accounting for approximately 30% of all homebuyers.

- Affordability Focus: Beazer's emphasis on affordability is crucial, as rising interest rates and home prices in 2024 continued to challenge affordability for many prospective buyers.

- Energy Efficiency Appeal: Homes with lower utility costs are particularly attractive to first-time buyers, a trend that persisted through 2024.

- Move-Up Market Trends: The move-up segment in 2024 was driven by a desire for more space and updated features, areas where Beazer's product development plays a key role.

Mortgage Choice Program

The Mortgage Choice program by Beazer Homes USA is designed to tackle affordability head-on. It lets buyers shop around for the best mortgage rates from various lenders, directly addressing a major hurdle for many in today's housing market.

This digital solution not only streamlines the home-buying process but also boosts sales by making homeownership more attainable. For instance, in early 2024, average 30-year fixed mortgage rates hovered around 6.6%, making mortgage cost a significant factor for buyers.

By helping customers potentially secure lower interest rates, the Mortgage Choice program offers a clear advantage. This can lead to substantial savings over the life of a loan, making Beazer Homes a more attractive option for a wider pool of buyers, especially in a climate where interest rate sensitivity is high.

- Addresses affordability: Helps buyers find competitive mortgage rates.

- Enhances customer experience: Simplifies the mortgage shopping process.

- Drives sales: Makes homeownership more accessible and cost-effective.

- Growth potential: Appeals to buyers sensitive to mortgage interest rates.

Beazer Homes' Zero Energy Ready (ZER) homes are positioned as Stars in the BCG matrix due to their high growth and market share potential. The company's goal is for 100% of new home starts to be ZER by the end of 2025, aligning with strong consumer demand for energy efficiency. Beazer's 2024 average HERS score of 42, the lowest among major national builders, highlights their competitive edge in this expanding segment.

What is included in the product

This BCG Matrix overview highlights Beazer Homes USA's portfolio, identifying Stars for growth, Cash Cows for stability, Question Marks needing evaluation, and Dogs for divestment.

A Beazer Homes USA BCG Matrix overview can relieve the pain of strategic uncertainty by clearly identifying which business units are Stars, Cash Cows, Question Marks, or Dogs, enabling focused resource allocation.

Cash Cows

Beazer Homes' established single-family home operations are the bedrock of its business, generating consistent revenue through construction and sales in numerous U.S. markets. Despite a slower housing market in 2024, the company's extensive reach and existing inventory ensure a steady income flow. These mature segments, while not explosive growth drivers, hold significant market share thanks to Beazer's established brand and operational scale.

Beazer Homes' mature geographic markets, like Florida, Georgia, North Carolina, and Arizona, are prime examples of cash cows. These regions benefit from Beazer's long-standing presence and strong brand recognition, translating into consistent sales and profitability.

In these established areas, Beazer leverages existing infrastructure, experienced local teams, and a deep understanding of buyer preferences. This operational efficiency contributes to healthy profit margins and a reliable stream of cash flow, often requiring minimal additional investment to maintain market share.

For instance, in 2024, Beazer Homes reported continued strength in its Southeast divisions, which encompass many of these mature markets. Their commitment to these areas allows them to capitalize on established demand, generating significant returns that can be reinvested in growth opportunities elsewhere.

Beazer Homes USA's existing inventory of spec homes functions as a Cash Cow within its BCG Matrix. While a higher proportion of spec homes can sometimes squeeze profit margins on individual sales, the advantage lies in their swift sale and closure. This translates directly into immediate cash flow, a crucial benefit in today's market where many buyers are eager for quicker move-in dates.

In the first quarter of fiscal year 2025, Beazer Homes reported that spec home closings accounted for a substantial nearly 70% of their total closings. This high percentage underscores Beazer's strong market presence in providing homes that are ready for immediate occupancy. This approach, even if it means slightly lower per-unit profits, reliably produces significant and predictable cash generation for the company.

Operational Efficiency and Cost Management

Beazer Homes USA's focus on operational efficiency is a key driver for its Cash Cows. The company has been actively working to boost the profitability of its spec homes. For instance, since October 2024, they've managed to reduce build costs by approximately $3,000 per home. This kind of cost management is crucial for maintaining robust cash flow, even when the market isn't expanding rapidly.

These cost-saving measures, combined with streamlined construction processes that shorten build cycle times, directly contribute to healthier profit margins. This allows Beazer Homes to generate consistent cash even in a low-growth economic climate. Their disciplined approach to capital allocation, which includes a more measured pace in land acquisition, further bolsters their ability to generate and retain cash.

- Cost Reduction: Approximately $3,000 cut per home since October 2024.

- Profitability Enhancement: Improved margins through efficient construction cycles.

- Cash Flow Generation: Supported by disciplined capital allocation and slowed land spend.

- Market Resilience: Maintaining healthy cash flow in a low-growth environment.

Brand Reputation and Customer Recommendation

Beazer Homes USA, with over three decades of experience in homebuilding, has cultivated a robust brand reputation. This is underscored by a remarkable 95% customer recommendation rating, a testament to their commitment to quality and customer satisfaction.

This strong brand equity translates directly into tangible business advantages. It significantly lowers customer acquisition costs, as positive word-of-mouth acts as a powerful, organic marketing channel. Furthermore, this trust fosters loyalty and encourages repeat business, solidifying Beazer Homes’ market share.

- Brand Strength: Over 30 years of homebuilding experience.

- Customer Loyalty: A 95% customer recommendation rating.

- Cost Efficiency: Reduced customer acquisition costs due to positive reputation.

- Market Stability: Consistent sales generation and maintained market share.

Beazer Homes' established operations in mature markets, like Florida and Georgia, are prime examples of its Cash Cows. These segments benefit from the company's long-standing presence and strong brand, ensuring consistent revenue streams. The focus on operational efficiency, including cost reductions of around $3,000 per home since October 2024, further bolsters profitability and cash generation in these reliable business areas.

The company's substantial inventory of spec homes also acts as a Cash Cow. In Q1 FY2025, nearly 70% of Beazer's closings were spec homes, highlighting their ability to generate immediate cash flow through quick sales. This strategy, coupled with disciplined capital allocation and a measured pace in land acquisition, solidifies these operations as consistent cash generators for Beazer Homes.

| Business Segment | BCG Category | Key Characteristics | Financial Impact |

|---|---|---|---|

| Established Single-Family Homes (Mature Markets) | Cash Cow | Strong brand recognition, consistent demand, operational efficiency | Steady revenue, healthy profit margins, minimal reinvestment needed |

| Spec Home Inventory | Cash Cow | High closing rates, immediate cash flow generation, reduced inventory holding | Reliable and significant cash generation, supports liquidity |

What You See Is What You Get

Beazer Homes USA BCG Matrix

The Beazer Homes USA BCG Matrix preview you see is the definitive, final document you will receive upon purchase. This comprehensive analysis, meticulously crafted to provide strategic insights, will be delivered in its entirety, ready for immediate application in your business planning. You can be confident that this preview accurately represents the fully formatted, watermark-free report that will be yours to use for any professional or analytical purpose.

Dogs

Beazer Homes USA's Texas markets in Q3 FY2025 are clearly struggling, fitting the profile of a Dog in the BCG Matrix. The company experienced a notably slower sales pace and weaker-than-expected performance in these regions. This underperformance is attributed to intense competition, with rivals employing aggressive pricing and incentives that pressured Beazer's market position.

The situation in Texas suggests Beazer Homes holds a low market share within a sub-market that is either experiencing slow growth or is exceptionally competitive. This dynamic directly impacts the company's ability to generate new orders, as evidenced by a decline in net new orders reported for the period. The challenges are compounded by operational hurdles, specifically labor availability issues in Texas, which further hampered the company's ability to execute its sales and construction strategies effectively.

Beazer Homes USA's Q3 FY2025 report highlighted $10.3 million in inventory impairment and abandonment charges. This figure points to specific communities or land parcels within their portfolio that are underperforming, indicating a potential decline in market value for these assets.

These underperforming assets are categorized as 'dogs' in the BCG Matrix framework. They consume valuable capital without yielding sufficient returns, signaling both a low market share and limited growth potential for these particular development projects.

The recognition of these charges underscores Beazer Homes' strategic necessity to either divest these underperforming assets or formally write down their value. This action is crucial for optimizing capital allocation and improving overall portfolio performance.

Legacy, less energy-efficient home models within Beazer Homes' portfolio can be categorized as Dogs in a BCG Matrix analysis. These are typically older designs that don't align with today's buyer demand for sustainability and reduced utility expenses. For instance, a home built before 2015 might lack the advanced insulation and HVAC systems found in newer constructions, making it less attractive.

These less efficient homes often require significant price reductions or incentives to attract buyers, impacting Beazer's profit margins. In 2024, the market trend clearly favors energy-efficient features, with studies showing a growing preference for homes with lower monthly operating costs. This segment of Beazer's offerings likely has a low market share and minimal growth prospects as the company pivots towards its Zero Energy Ready initiatives.

Areas with High Cancellation Rates

Beazer Homes USA's areas with high cancellation rates are a significant concern, particularly with the Q3 FY2025 cancellation rate reaching 19.8%, an increase from 18.6% in the same quarter of the previous year.

This upward trend suggests that certain communities or specific home designs are struggling to retain buyers, indicating potential issues with market fit or buyer confidence in those particular segments.

High cancellation rates directly translate to a lower effective market share and poor sales conversion, meaning resources are being invested in projects that do not reliably generate revenue.

- Increased Cancellations: Q3 FY2025 cancellation rate at 19.8%, up from 18.6% in Q3 FY2024.

- Market Resonance: High rates signal offerings are not resonating with buyers or are in volatile markets.

- Resource Drain: These areas consume resources without consistent sales, impacting overall profitability.

- Effective Market Share: Low conversion rates due to cancellations reduce the company's actual market penetration.

Divisions with Thin Operating Margins

Beazer Homes USA's divisions with thin operating margins are a significant concern, as highlighted by the company's own commentary. These segments are essentially operating at the break-even point or worse, making them vulnerable to potential write-downs or even complete closure. This situation points to divisions that are either struggling to gain traction or are caught in a cycle of low profitability and minimal growth potential.

These underperforming divisions often exhibit characteristics of a "Dog" in the BCG matrix. This means they likely possess a low market share within their respective communities and face intense competition, making it difficult to improve their financial standing. For example, if a division is in a market with declining demand or faces aggressive pricing from competitors, its operating margin can easily shrink to unsustainable levels.

- Low Profitability: Divisions with thin operating margins are barely generating profit, if at all.

- Cash Traps: These segments can consume resources without yielding substantial returns, acting as cash traps.

- Abandonment Risk: The company has expressed concerns about potential impairment or abandonment of these communities due to their poor financial performance.

- Competitive Weakness: Often, these divisions struggle to compete effectively in their markets, leading to their marginal performance.

Beazer Homes USA's Texas markets in Q3 FY2025 are clearly struggling, fitting the profile of a Dog in the BCG Matrix. The company experienced a notably slower sales pace and weaker-than-expected performance in these regions, with a 19.8% cancellation rate in Q3 FY2025, up from 18.6% in Q3 FY2024.

These underperforming assets, including legacy less energy-efficient homes and divisions with thin operating margins, consume valuable capital without yielding sufficient returns. The company recognized $10.3 million in inventory impairment and abandonment charges in Q3 FY2025, underscoring the need to divest or write down these underperforming assets.

The situation in Texas, characterized by intense competition and labor availability issues, directly impacts Beazer's ability to generate new orders, as evidenced by a decline in net new orders. These segments likely possess a low market share and minimal growth prospects as the company pivots towards its Zero Energy Ready initiatives.

Beazer Homes USA's divisions with thin operating margins are barely generating profit, if at all, and can consume resources without yielding substantial returns. The company has expressed concerns about potential impairment or abandonment of these communities due to their poor financial performance.

Question Marks

Beazer Homes is strategically expanding its footprint with new community openings like The Summit in Apex, NC, and Marshfield in Myrtle Beach, both targeting late 2025. These developments are situated in promising, high-growth areas, but as new ventures, they represent early-stage investments with unproven market penetration for Beazer.

These new communities, such as The Summit and Marshfield, require substantial capital outlay to establish brand presence and build market share from the ground up. While they hold significant future growth potential, their initial market position places them in the question mark category of the BCG matrix, demanding careful resource allocation and monitoring.

Beazer Homes USA's strategy to expand into untapped micro-markets positions it to capture high-growth opportunities where its brand recognition is currently limited. These new ventures represent potential "question marks" in the BCG matrix, requiring significant investment to build market share.

In 2024, Beazer Homes continued its focus on expanding its community count, a key driver for entering these less saturated areas. While specific micro-market entry data isn't publicly detailed, the company's overall growth trajectory suggests an active pursuit of these opportunities. Success hinges on Beazer's ability to implement targeted marketing, competitive pricing, and adapt quickly to local buyer preferences.

Beyond the established Mortgage Choice offering, Beazer Homes USA is pursuing broader digital transformation. Initiatives like digital tools for home design customization and immersive virtual tours are key areas for future growth. These innovations, if new to the market or their customer base, represent low current market share but hold significant potential to elevate the home buying journey and capture future market share.

Targeting Active Adult (55+) Buyer Segment with 'Gatherings'

Beazer Homes' 'Gatherings' brand specifically targets the active adult (55+) buyer segment, a market showing considerable growth. This demographic shift is driven by factors like the aging Baby Boomer generation, with millions reaching retirement age annually. For instance, in 2024, an estimated 10,000 Americans turn 65 every day, highlighting the sheer volume of potential buyers in this age bracket.

While Beazer's strategic focus on this niche is clear, its relative market share within the specialized 55+ community sector may still be in its formative stages. This means that despite the market's potential, Beazer's current penetration might not yet be as dominant as in other segments. For example, national data from 2024 indicates that while the 55+ housing market is expanding, it's also becoming more competitive with various builders offering specialized products.

To solidify its position and capitalize on this demographic trend, Beazer will likely need to invest significantly in both marketing and the development of these 'Gatherings' communities. This includes creating amenities and home designs that specifically appeal to active adults, such as single-story living, low-maintenance yards, and community spaces that foster social interaction. The success of these efforts will be crucial for converting initial interest into a substantial market share, especially as the demand for age-restricted housing continues to rise through 2025.

- Market Focus: 'Gatherings' brand aims to capture the expanding 55+ demographic.

- Growth Potential: Millions of Americans turn 65 daily in 2024, creating a large buyer pool.

- Market Share: Beazer's position in the specialized 55+ niche is likely still developing.

- Strategic Imperative: Significant investment in marketing and community features is needed to scale.

Leveraging New Construction Technologies and Materials

Beazer Homes USA's focus on 'Surprising Performance' likely translates into strategic investments in pioneering construction technologies and materials. This commitment suggests a deliberate effort to gain a competitive edge through innovation, potentially positioning these advancements as future growth drivers with high potential but currently limited market penetration.

These emerging technologies could represent Beazer's "question marks" in a BCG matrix analysis. While they might not yet command a significant market share, their innovative nature and alignment with performance goals indicate a strong potential for future growth and market disruption.

- Innovation Focus: Beazer's emphasis on quality and advanced building methods points to significant R&D in areas like smart home integration, energy-efficient systems, and sustainable materials.

- Market Potential: Early adoption of novel construction techniques can lead to differentiation, potentially capturing a larger market share as these technologies become more mainstream.

- Investment Strategy: Identifying these areas as question marks signifies a strategic allocation of resources towards developing and integrating these technologies, anticipating future market demand and competitive advantages.

Beazer Homes USA's new community developments, such as The Summit in Apex, NC, and Marshfield in Myrtle Beach, represent significant investments in high-growth markets. These ventures, while promising, are in their early stages, meaning Beazer is working to establish brand recognition and market share from the ground up.

These new communities are categorized as question marks in the BCG matrix due to their low current market share but high growth potential. Beazer's expansion strategy involves entering less saturated micro-markets, requiring substantial capital and careful resource allocation to build brand presence and capture market share.

The company's focus on digital transformation, including virtual tours and customization tools, also positions these initiatives as question marks. While they may have limited current adoption, these innovations hold the potential to significantly enhance the home buying experience and capture future market share.

Beazer's 'Gatherings' brand targets the growing 55+ demographic, a segment experiencing strong demand, with millions of Americans turning 65 daily in 2024. While the market potential is high, Beazer's market share within this specialized niche is likely still developing, necessitating investment in targeted marketing and community features.

BCG Matrix Data Sources

Our Beazer Homes USA BCG Matrix leverages official financial filings, robust market share data, and industry growth forecasts to accurately position each business unit.