BDO Unibank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BDO Unibank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping BDO Unibank's trajectory. This comprehensive PESTLE analysis provides actionable intelligence, empowering you to anticipate market shifts and refine your strategic approach. Invest in clarity and gain a competitive edge—download the full report now.

Political factors

The stability of the Philippine government and its economic policies are crucial for BDO Unibank. A predictable regulatory landscape, exemplified by consistent banking laws and a stable macroeconomic outlook, directly influences the bank's operational efficiency and strategic planning. For instance, the Bangko Sentral ng Pilipinas's monetary policy decisions, such as the key policy rate, significantly affect lending margins and overall profitability.

The Bangko Sentral ng Pilipinas (BSP) is making significant strides in promoting financial inclusion, with a target to bring 70% of Filipino adults into the formal financial system by 2023, a goal that continues to shape the banking landscape into 2024 and 2025. This push is particularly focused on expanding access to digital banking services and promoting the use of transaction accounts, aiming to reduce the unbanked population. As of late 2023, the BSP reported that approximately 53% of adult Filipinos had transaction accounts, highlighting the ongoing need for initiatives to reach the remaining segment.

BDO Unibank, being a dominant force in the Philippine banking sector, is directly impacted by these government-driven financial inclusion efforts. These initiatives are expected to fuel increased demand for both BDO's digital platforms, like its mobile app, and its extensive branch network, especially in rural and previously underserved regions. The bank's ability to cater to these new customers, offering accessible and user-friendly products, will be crucial for its growth in the coming years, aligning with the BSP's vision of a more financially integrated nation.

The Bangko Sentral ng Pilipinas (BSP) sets the rules for banks like BDO Unibank, covering areas such as digital banking, cybersecurity, and sustainable finance. These regulations are vital for the bank's operations and strategic planning.

Compliance with BSP guidelines, including recent ones on payment systems and fintech, directly influences BDO Unibank's product development and market strategies. For instance, the BSP's push for digital payments aims to increase financial inclusion, a key area for banks to focus on.

In 2024, the BSP continued to emphasize robust cybersecurity measures, with banks expected to invest significantly in protecting customer data. Furthermore, the BSP's Sustainable Finance Framework, introduced in recent years, guides banks in integrating environmental, social, and governance (ESG) factors into their business models, impacting lending and investment decisions.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Efforts

The Philippine government's intensified focus on anti-money laundering (AML) and counter-terrorism financing (CTF) significantly shapes the operational landscape for financial institutions like BDO Unibank. This commitment translates into a higher compliance burden, necessitating robust internal controls and reporting systems to meet evolving regulatory standards and efforts to improve the country's standing on international watchlists.

These stricter measures directly impact operational costs and risk management strategies for banks. For instance, the Anti-Money Laundering Council (AMLC) continues to enhance its capabilities and data analytics to detect suspicious transactions. In 2023, the Philippines made significant strides in its AML/CTF framework, aiming to address concerns raised by international bodies, which in turn requires continuous investment in technology and personnel for BDO to maintain compliance.

- Increased Compliance Costs: Banks must invest in advanced transaction monitoring software and train staff on new AML/CTF regulations.

- Enhanced Reporting Obligations: More detailed and frequent reporting to regulatory bodies like the AMLC becomes mandatory.

- Reputational Risk Mitigation: Adherence to AML/CTF standards is crucial for maintaining international trust and avoiding penalties.

- Operational Adjustments: Streamlining Know Your Customer (KYC) and Customer Due Diligence (CDD) processes is essential for efficient onboarding and ongoing monitoring.

Geopolitical Risks and Regional Stability

Broader geopolitical risks and regional stability, particularly concerning the South China Sea, introduce significant uncertainties that can dampen business confidence and deter investment within the Philippines. These external factors directly impact BDO Unibank's operational environment and future growth trajectory by influencing economic activity and overall market sentiment.

For instance, heightened tensions in the region can lead to increased volatility in financial markets, potentially affecting BDO's asset valuations and lending portfolios. The Philippine economy, heavily reliant on international trade and foreign direct investment, is particularly susceptible to disruptions stemming from geopolitical flashpoints.

- Impact on Trade: Disruptions in shipping lanes due to regional instability could affect import and export volumes, impacting businesses that rely on international trade and consequently their ability to service loans.

- Foreign Investment Flows: Increased geopolitical risk often leads to a cautious approach from foreign investors, potentially slowing down capital inflows crucial for economic expansion and BDO's expansion plans.

- Consumer and Business Confidence: Uncertainty surrounding regional stability can erode confidence, leading to reduced consumer spending and corporate investment, which are key drivers for BDO's banking services.

- Regulatory Environment: Geopolitical shifts can sometimes trigger changes in national security policies or international agreements, potentially creating new regulatory landscapes for financial institutions like BDO.

Government stability and economic policies in the Philippines directly influence BDO Unibank's operations. A predictable regulatory environment, including consistent banking laws and a stable macroeconomic outlook, is vital for the bank's strategic planning and efficiency. The Bangko Sentral ng Pilipinas's (BSP) monetary policies, such as interest rate adjustments, significantly impact BDO's lending margins and overall profitability. For example, the BSP's continued efforts to boost financial inclusion, aiming to bring more Filipinos into the formal financial system, are expected to drive demand for BDO's digital banking services and branch network expansion, especially in underserved areas.

What is included in the product

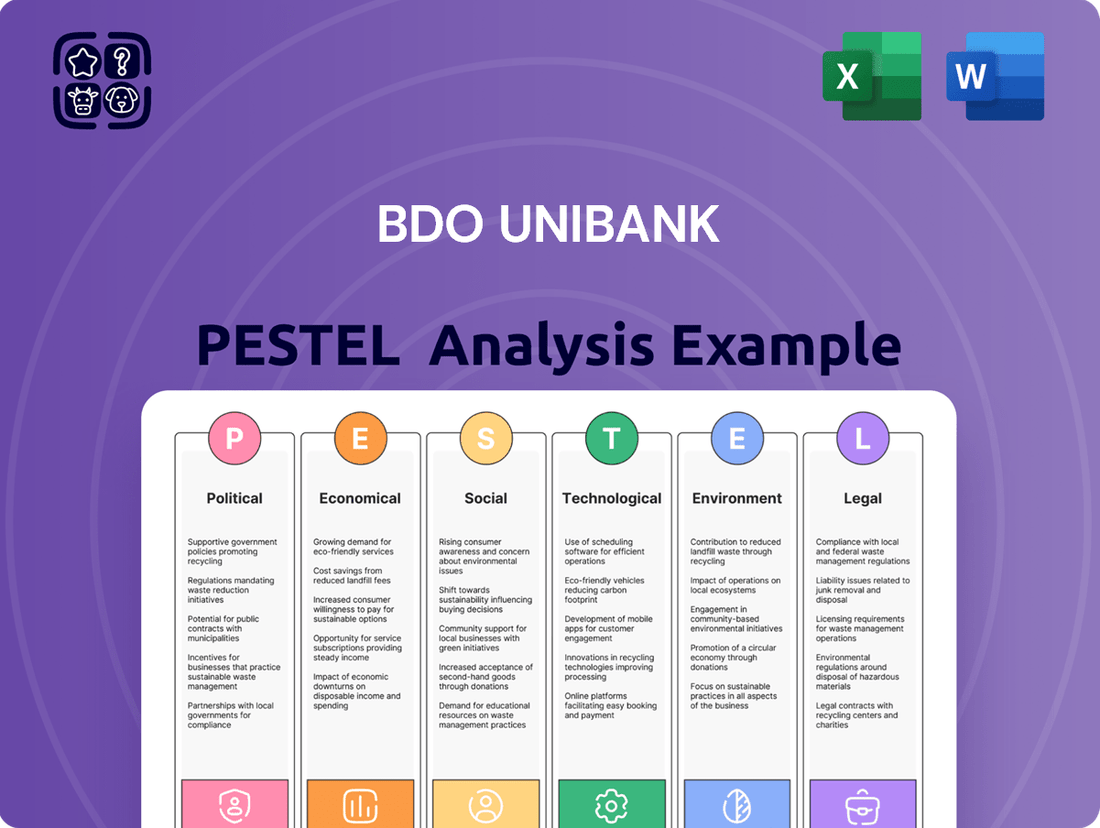

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting BDO Unibank, providing a comprehensive understanding of its operating landscape.

It offers actionable insights for strategic decision-making, helping BDO Unibank navigate external influences and capitalize on emerging opportunities within the Philippine banking sector.

A clear, actionable summary of BDO Unibank's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decision-making.

Economic factors

The Bangko Sentral ng Pilipinas' (BSP) monetary policy, especially its stance on interest rates, directly influences BDO Unibank's financial performance. Higher rates can boost net interest margins but may dampen loan demand, while lower rates can stimulate borrowing but compress profitability.

As of early 2025, the BSP has signaled a cautious approach, with expectations of potential rate cuts later in the year, influenced by inflation trends and global economic conditions. For BDO, this evolving environment means managing the cost of deposits against the yield on its loan portfolio.

In 2024, the BSP's policy rate remained at 6.50%, a key benchmark affecting BDO's lending and deposit rates. Navigating the anticipated shifts in 2025 will be crucial for BDO to maintain its profitability and strategic lending growth.

The Philippines' economic growth trajectory significantly impacts BDO Unibank's operational scale, affecting everything from loan origination to deposit accumulation. A robust economy typically translates to higher demand for financial services.

For 2024 and 2025, projections suggest the Philippine economy will continue to expand, though perhaps at a more measured pace than in prior years. This growth is anticipated to be fueled by strong domestic consumption and increased government spending on infrastructure projects.

This generally favorable economic climate bodes well for the banking sector. For instance, the Philippine GDP grew by 5.9% in the first quarter of 2024, and forecasts for the full year remain positive, indicating continued opportunities for banks like BDO Unibank to grow their business volumes.

Inflation significantly impacts purchasing power, directly affecting how much consumers have left to save or borrow. For BDO Unibank, this means that when inflation is high, consumers might spend more on immediate needs, potentially reducing deposits and increasing the risk of loan defaults. For instance, if inflation in the Philippines hovers around the upper end of the Bangko Sentral ng Pilipinas's (BSP) 2024 target range of 2-4%, or potentially higher if global supply chain issues persist, consumer spending habits will be closely watched.

Conversely, a projected lower inflation rate for 2025, perhaps settling closer to the BSP's 2% target, would be a boon for BDO's consumer lending. This scenario would allow consumers to stretch their budgets further, potentially leading to increased demand for loans like mortgages and car financing, and a healthier capacity to repay existing debts.

Loan and Deposit Growth Trends

BDO Unibank's fundamental success hinges on its ability to expand both its loan offerings and its deposit base. The economic outlook for 2024 and 2025 points towards a robust expansion within the Philippine banking sector.

Analysts are projecting double-digit growth across key banking metrics, including assets, loans, and deposits, for the 2024-2025 period. This positive trend creates a favorable landscape for BDO's ongoing development and market presence.

- Projected Asset Growth: Double-digit expansion expected for Philippine banks in 2024-2025.

- Loan Portfolio Expansion: Favorable conditions for BDO to increase its lending activities.

- Deposit Mobilization: Strong growth anticipated in deposit volumes, supporting BDO's funding needs.

- Overall Banking System Health: The projected growth indicates a healthy and expanding financial ecosystem.

Non-Performing Loans (NPLs) and Asset Quality

Non-performing loans (NPLs) are a crucial gauge of a bank's financial health. BDO Unibank has consistently demonstrated strong asset quality. For instance, as of the first quarter of 2024, BDO reported a gross NPL ratio of 1.78%, which is below the industry average and indicative of sound credit risk management.

The bank's robust NPL coverage ratio, standing at a healthy 108% as of the same period, further underscores its ability to absorb potential losses from bad loans. This strong coverage provides a buffer against economic downturns, ensuring stability for BDO Unibank's operations.

- BDO's Gross NPL Ratio (Q1 2024): 1.78%

- NPL Coverage Ratio (Q1 2024): 108%

- Impact: Demonstrates effective risk management and resilience against economic headwinds.

The Bangko Sentral ng Pilipinas' (BSP) monetary policy significantly shapes BDO Unibank's profitability and lending strategies. As of early 2025, the BSP's cautious stance, influenced by inflation and global trends, anticipates potential rate adjustments later in the year, impacting BDO's net interest margins and loan demand.

The Philippine economy's growth trajectory for 2024-2025, projected to expand due to domestic consumption and infrastructure spending, presents opportunities for BDO Unibank. The nation's GDP growth of 5.9% in Q1 2024 supports this positive outlook for increased banking business volumes.

Inflationary pressures, while monitored by the BSP, directly affect consumer spending and borrowing capacity. A sustained inflation rate within the BSP's target range for 2025 would likely boost demand for BDO's consumer lending products, such as mortgages and auto loans.

BDO Unibank's financial health is further supported by its strong asset quality, evidenced by a gross NPL ratio of 1.78% and an NPL coverage ratio of 108% as of Q1 2024, indicating robust risk management and resilience.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on BDO Unibank |

|---|---|---|---|

| BSP Policy Rate | 6.50% (2024) | Potential adjustments based on inflation/global trends | Influences net interest margins and loan demand |

| Philippine GDP Growth | 5.9% (Q1 2024) | Continued expansion, driven by consumption and infra spending | Increases opportunities for loan origination and deposit growth |

| Inflation Rate | Monitored within BSP's 2-4% target | Expected to stabilize closer to 2% target | Affects consumer spending, loan demand, and default risk |

| Non-Performing Loans (NPLs) | 1.78% (Q1 2024) | Expected to remain manageable with strong coverage | Indicates sound credit risk management and operational stability |

What You See Is What You Get

BDO Unibank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BDO Unibank covers all critical external factors impacting its operations. You'll gain insights into the political, economic, social, technological, legal, and environmental landscape affecting this leading Philippine bank.

Sociological factors

The financial literacy of Filipinos is crucial for BDO Unibank's success. A recent Bangko Sentral ng Pilipinas (BSP) survey in 2023 indicated that while financial literacy is improving, a significant portion of the population still struggles with basic financial concepts, impacting their engagement with formal banking services.

BDO Unibank actively addresses this through financial literacy programs. These initiatives, like their financial education webinars and community outreach, aim to boost financial inclusion. By empowering the unbanked and underserved with knowledge, BDO Unibank not only helps them manage their finances better but also expands its own customer base, tapping into a previously unreached market segment.

Filipinos are increasingly embracing digital tools, with a significant portion of the population now preferring online banking and digital payments. This trend directly impacts how BDO Unibank must deliver its services, pushing for more robust digital platforms. For instance, as of early 2024, the Bangko Sentral ng Pilipinas reported that e-wallets accounted for a substantial portion of digital transactions, highlighting a clear consumer shift away from traditional methods.

BDO's strategic emphasis on 'phygital' banking, a blend of physical branch accessibility and advanced digital services, is a direct response to these evolving consumer preferences. This approach acknowledges that while digital convenience is paramount, many customers still value the human touch and security offered by physical touchpoints, especially for more complex financial needs. This strategy positions BDO to effectively navigate the dynamic fintech environment and meet the diverse demands of its customer base.

The Philippines boasts a remarkably youthful demographic, with a median age of just 25.4 years as of 2024. This vibrant, growing population, projected to reach over 119 million by 2025, represents a substantial opportunity for BDO Unibank. A large segment of young individuals entering the workforce and forming households fuels a sustained demand for essential banking services, from savings accounts to loans and digital payment solutions.

This demographic advantage translates directly into a growing consumer base and a future workforce, both critical for long-term economic expansion and, consequently, for BDO Unibank's continued growth. As more Filipinos enter their prime earning years, their need for sophisticated financial products and services, including investments and insurance, will undoubtedly increase, creating a fertile ground for BDO Unibank to expand its market share.

Urbanization and Branch Network Expansion

The Philippines continues to experience significant urbanization, with a growing proportion of its population moving to cities. This trend directly impacts BDO Unibank's strategy for branch and ATM network expansion, as it allows the bank to tap into increasingly concentrated customer bases. By strategically placing new branches and ATMs in these expanding urban centers, BDO can effectively reach a wider segment of the population that may have previously lacked convenient access to banking services.

BDO's commitment to expanding its physical footprint, especially in underserved communities, is a key driver for enhancing market penetration. For instance, as of late 2024, BDO maintained a substantial network, aiming to further strengthen its presence in areas with lower banking accessibility. This proactive approach ensures that more Filipinos can benefit from BDO's financial products and services, fostering financial inclusion.

- Urban Shift: Over 50% of the Philippine population is projected to reside in urban areas by 2025, creating concentrated demand for financial services.

- Network Growth: BDO Unibank consistently invests in expanding its nationwide branch and ATM network, with specific targets for underserved regions.

- Accessibility Focus: The bank's strategy prioritizes placing new touchpoints in areas identified as having limited existing banking infrastructure.

- Market Penetration: This expansion directly supports BDO's goal of increasing its market share by making banking more convenient for a larger demographic.

Trust and Consumer Confidence in Banking

Public trust is the bedrock of BDO Unibank's success. In 2024, consumer confidence in financial institutions remains a critical element, especially with evolving digital landscapes. Cybersecurity threats are a constant concern, requiring robust measures from banks to protect customer data and transactions. This also places a responsibility on consumers to adopt secure practices when engaging with banking services.

Maintaining and enhancing consumer confidence is paramount for BDO Unibank in both its digital and traditional banking channels. Recent surveys indicate that while Filipinos are increasingly adopting digital banking, security concerns remain a significant factor influencing their choices. For instance, a 2024 report by Statista highlighted that over 60% of Filipino online banking users cited security as their primary concern.

- Cybersecurity Investments: BDO Unibank, like other major banks, is expected to continue significant investments in cybersecurity infrastructure to safeguard against data breaches and fraud.

- Digital Trust: Building trust in digital platforms is crucial, as more transactions move online, requiring transparent communication about security protocols.

- Consumer Education: Educating consumers on safe online banking practices is a shared responsibility that bolsters overall trust in the financial system.

- Regulatory Compliance: Adherence to stringent data protection and banking regulations by BDO Unibank reinforces consumer confidence in the security of their funds and personal information.

Filipino culture places a high value on family and community, influencing financial decisions and banking relationships. This collectivist orientation means that recommendations from family and peers often carry significant weight when choosing financial products. BDO Unibank can leverage this by fostering community engagement and encouraging word-of-mouth referrals.

Religious beliefs and traditions also shape financial behaviors in the Philippines, with a significant portion of the population adhering to Christian values that often emphasize prudence and ethical financial dealings. This cultural aspect can be integrated into BDO Unibank's marketing and customer service approach, aligning with deeply held societal values.

The increasing adoption of digital financial services is also a reflection of changing societal norms and aspirations. As more Filipinos embrace technology, their expectations for seamless and convenient banking experiences grow, pushing institutions like BDO Unibank to continuously innovate their digital offerings.

BDO Unibank's success is intertwined with the evolving social fabric of the Philippines, including its strong community ties and growing digital adoption. By understanding and adapting to these sociological factors, the bank can better serve its customers and strengthen its market position.

Technological factors

BDO Unibank is heavily invested in digital transformation, enhancing its mobile banking app and introducing AI for customer service. This focus on innovation aims to streamline operations and elevate the customer journey, reflecting a significant trend within the Philippine financial sector.

In 2024, BDO Unibank reported a 15% increase in digital transactions processed through its platforms, underscoring the growing reliance on digital channels. The bank's ongoing investment in self-service machines and advanced analytics is designed to further optimize efficiency and customer engagement.

Fintech's rapid expansion in the Philippines, particularly in digital payments and e-wallets, is reshaping the financial landscape, presenting both significant opportunities and intense competition for BDO Unibank.

By the end of 2024, digital payments in the Philippines were projected to exceed PHP 10 trillion, highlighting the massive shift towards cashless transactions and the critical need for BDO to enhance its digital offerings.

To stay ahead, BDO must aggressively adopt new technologies and explore strategic partnerships with fintech firms, aiming to integrate innovative solutions and broaden its digital service portfolio to meet evolving customer demands.

The Philippines has seen a concerning rise in cybercrimes, with the fintech sector being a prime target. For BDO Unibank, this translates to a substantial risk, especially with the growing volume of digital transactions. Protecting customer data is paramount in this environment.

In 2023 alone, the Department of Information and Communications Technology (DICT) reported a significant increase in cyberattack incidents nationwide, with phishing and malware being particularly prevalent. This trend directly impacts financial institutions like BDO Unibank, necessitating advanced cybersecurity defenses to prevent data breaches and maintain customer confidence.

To counter these threats, BDO Unibank must maintain and continuously enhance its robust cybersecurity measures and data protection protocols. This is not just about safeguarding sensitive customer information but also about ensuring compliance with stringent data privacy laws and regulations, which are becoming increasingly rigorous in the digital age.

Artificial Intelligence (AI) and Automation

Artificial intelligence and automation are rapidly transforming the banking sector. BDO Unibank is actively integrating AI into its operations, from enhancing customer service through chatbots to improving risk management by analyzing vast datasets for suspicious activities. This integration aims to boost efficiency and bolster regulatory compliance.

By leveraging AI, BDO Unibank is developing innovative features for its platforms. For instance, AI can personalize customer experiences and streamline internal processes. The bank's commitment to exploring these technologies underscores a strategic focus on future-proofing its services and maintaining a competitive edge in the evolving digital landscape.

The financial services industry saw significant AI investment in 2024, with global spending projected to reach over $100 billion by 2025. BDO Unibank's exploration of AI aligns with this broader industry trend, anticipating benefits such as:

- Enhanced customer engagement through AI-powered virtual assistants.

- Improved fraud detection and cybersecurity measures.

- Streamlined loan processing and credit scoring.

- Greater operational efficiency via automated back-office functions.

Cloud Computing and Infrastructure Modernization

BDO Unibank is actively pursuing a comprehensive digital transformation, heavily leaning on cloud computing and infrastructure modernization. This strategy involves the adoption of Software as a Service (SaaS) solutions and a significant migration to cloud environments. This move is crucial for enhancing their operational agility and customer service capabilities.

By leveraging a hybrid approach, utilizing both private and public cloud infrastructures, BDO Unibank is building a more robust and scalable IT backbone. This is further bolstered by real-time data replication across its data centers, a critical component for ensuring business continuity and operational resilience, especially in the face of potential disruptions.

The bank's investment in modernizing its IT infrastructure through cloud adoption directly supports its growth objectives. For instance, in 2024, BDO Unibank continued to invest heavily in technology, with digital initiatives forming a core part of its capital expenditure. This focus allows for greater flexibility in scaling operations up or down as market demands shift, a key advantage in the dynamic banking sector.

- Cloud Adoption: BDO Unibank's digital strategy centers on migrating core banking functions and customer-facing applications to cloud platforms.

- Infrastructure Modernization: Investments are directed towards updating legacy systems and adopting new technologies that improve efficiency and security.

- Hybrid Cloud Strategy: The bank utilizes a mix of private and public cloud services to optimize performance, cost, and data governance.

- Resilience and Continuity: Real-time data replication between data centers is a cornerstone of their strategy to ensure uninterrupted service delivery.

BDO Unibank is actively embracing technological advancements, including AI and cloud computing, to enhance its digital offerings and operational efficiency. This strategic direction is crucial for navigating the rapidly evolving financial landscape and meeting customer expectations for seamless digital experiences.

The bank's commitment to digital transformation is evident in its increased investment in AI for customer service and its ongoing migration to cloud infrastructure. These initiatives are designed to bolster agility, improve data analytics capabilities, and strengthen cybersecurity defenses against growing threats.

By prioritizing technology, BDO Unibank aims to stay competitive amid the surge of fintech innovations and the increasing demand for digital financial services in the Philippines. This proactive approach ensures the bank remains at the forefront of digital banking solutions.

Legal factors

BDO Unibank navigates a robust legal landscape primarily shaped by the Bangko Sentral ng Pilipinas (BSP). This includes strict adherence to the Manual of Regulations for Banks (MORB), which dictates operational standards and risk management practices. For instance, BSP Circular 1177, issued in 2023, mandates enhanced cybersecurity measures, directly impacting BDO's technological investments and compliance protocols.

The bank's commitment to legal compliance extends to evolving regulatory areas like sustainable finance and digital payment systems. BSP Circular 1105, effective from 2021, emphasizes environmental and social risk management in lending activities, influencing BDO's credit policies and product development. This focus ensures BDO's operations align with national and international legal expectations for responsible banking.

New legislation, such as the Anti-Financial Account Scamming Act, directly impacts BDO Unibank by mandating more robust fraud prevention and consumer protection measures. For instance, the Bangko Sentral ng Pilipinas (BSP) has been actively promoting digital banking safety, with initiatives aimed at reducing phishing and SIM swap fraud, which BDO must integrate into its operational framework.

BDO Unibank faces ongoing requirements to adapt its systems and processes to comply with evolving consumer protection laws. This includes ensuring transparency in fees, clear dispute resolution mechanisms, and secure data handling practices, all critical for maintaining customer trust and regulatory adherence in the digital age.

BDO Unibank's operations are significantly shaped by data privacy and security laws, particularly the Philippine Data Privacy Act of 2012. As digital banking expands, adherence to these regulations is paramount to protect sensitive customer information. Failure to comply can result in substantial penalties, impacting both financial standing and reputation.

The bank must maintain stringent data protection measures, including encryption and secure storage, to prevent breaches. In 2023, the National Privacy Commission reported a notable increase in data privacy complaints, highlighting the ongoing challenges and the critical need for robust compliance frameworks within the financial sector.

Regulations on Digital Banks and Fintech Licenses

The Bangko Sentral ng Pilipinas' (BSP) approach to digital bank licenses and its regulatory sandbox for fintech significantly shapes the market for BDO. The BSP's decision to lift the moratorium on new digital bank licenses in 2025 is a key indicator of this evolving landscape.

This regulatory shift means BDO Unibank must anticipate increased competition from newly licensed digital players. The BSP's framework aims to foster innovation while ensuring financial stability, a balance BDO must navigate.

Key considerations for BDO include:

- Anticipating New Competitors: The lifting of the moratorium in 2025 will likely lead to the entry of several new digital banks, intensifying competition for customer acquisition and market share.

- Adapting to Regulatory Sandbox Outcomes: Innovations tested within the BSP's fintech regulatory sandbox may soon become mainstream, requiring BDO to either adopt similar technologies or differentiate its offerings.

- Navigating Evolving Compliance: As the regulatory environment matures, BDO must remain agile in its compliance strategies to meet new requirements for digital banking operations and consumer protection.

Corporate Governance Standards

BDO Unibank's commitment to robust corporate governance is a cornerstone of its operations, underscored by accolades such as the Five Golden Arrow recognition from the Institute of Corporate Directors. This dedication is crucial for fostering investor trust and meeting stringent regulatory requirements within the financial sector.

The bank's governance framework is increasingly influenced by Environmental, Social, and Governance (ESG) principles and evolving sustainability reporting guidelines. These factors shape how BDO Unibank manages its business, ensuring transparency and accountability.

- Investor Confidence: Strong governance practices, like those recognized by the Five Golden Arrow award, directly bolster investor confidence, making BDO Unibank a more attractive proposition.

- Regulatory Compliance: Adherence to corporate governance standards ensures BDO Unibank operates within legal frameworks and meets the expectations of financial regulators.

- ESG Integration: The growing emphasis on ESG reporting means BDO Unibank must integrate sustainability considerations into its governance, impacting long-term strategy and risk management.

- Stakeholder Alignment: Effective governance ensures BDO Unibank's strategies align with the interests of all stakeholders, from shareholders to the wider community.

Legal factors significantly shape BDO Unibank's operations, driven by the Bangko Sentral ng Pilipinas (BSP) regulations like the Manual of Regulations for Banks. The BSP's proactive stance on digital banking, including the anticipated lifting of the moratorium on new digital bank licenses in 2025, signals increased competition and the need for BDO to innovate. Furthermore, laws such as the Anti-Financial Account Scamming Act and the Data Privacy Act of 2012 necessitate robust security and consumer protection measures, impacting BDO's technological investments and compliance protocols to safeguard customer data and prevent fraud.

Environmental factors

Climate change presents a substantial threat to the Philippine economy, directly affecting industries that BDO Unibank supports, such as agriculture and infrastructure. The Bangko Sentral ng Pilipinas (BSP) has recognized these climate-related financial risks, including the heightened frequency of extreme weather events like typhoons and floods, which can degrade loan portfolios and overall financial system stability.

BDO Unibank is a major player in the Philippines' sustainable development financing, having amassed a green investment portfolio worth over P1 trillion by the close of 2024.

This significant commitment, focused on areas like renewable energy and green infrastructure, directly supports the Philippines' national climate objectives and caters to the increasing investor preference for Environmental, Social, and Governance (ESG) compliant investments.

BDO Unibank is actively embedding Environmental, Social, and Governance (ESG) principles into its core operations and risk management. This commitment is evident in their adoption of sustainable finance frameworks and the issuance of sustainability bonds, demonstrating a strategic shift towards environmentally conscious banking practices.

The bank is prioritizing a reduction in its carbon footprint by investing in energy-efficient technologies across its branches and operations. This focus on operational sustainability aligns with growing investor and regulatory expectations for financial institutions to demonstrate tangible environmental stewardship.

Resource Efficiency and Pollution Control

BDO Unibank actively champions resource efficiency and pollution control through its sustainable finance programs. These initiatives are crucial for businesses aiming to cut down on emissions and reduce operational expenses. For instance, in 2024, BDO continued its support for green building certifications, which have been shown to lower energy consumption by as much as 30% compared to conventional structures.

The bank's portfolio includes significant investments in renewable energy, such as rooftop solar installations. These projects not only contribute to cleaner energy generation but also offer businesses a tangible way to manage and decrease their electricity costs. By financing these green technologies, BDO directly aids in the Philippines' broader environmental goals.

- Support for Green Buildings: BDO finances projects adhering to stringent environmental standards, leading to reduced energy and water usage.

- Renewable Energy Investments: The bank provides capital for solar power and other clean energy solutions, promoting a shift away from fossil fuels.

- Water Management Projects: Funding is directed towards sustainable water and wastewater management systems, crucial for environmental protection and resource conservation.

- Emission Reduction Focus: BDO's sustainable finance targets projects that demonstrably lower greenhouse gas emissions and other pollutants.

Regulatory Emphasis on Green Finance

Philippine regulators, notably the Bangko Sentral ng Pilipinas (BSP) and the Securities and Exchange Commission (SEC), are intensifying their focus on green finance. This regulatory drive aims to steer capital towards sustainable projects and investments, with a particular emphasis on preventing greenwashing. For instance, the BSP's Sustainable Finance Framework, introduced in 2019 and continually updated, guides banks in integrating environmental and social risk management into their operations.

This heightened regulatory scrutiny compels financial institutions like BDO Unibank to not only increase their funding for eco-friendly initiatives but also to meticulously adhere to evolving taxonomy guidelines. These guidelines help standardize what constitutes a green investment, ensuring transparency and accountability. By 2024, the Philippine sustainable finance market is projected to see significant growth, driven by these policy shifts and increasing investor demand for ESG-compliant products.

- BSP's Sustainable Finance Framework: Encourages banks to integrate ESG factors into risk management and lending practices.

- SEC's Green Bond Standards: Provides guidelines for issuers of green bonds, promoting market integrity.

- Anti-Greenwashing Initiatives: Aim to ensure that sustainability claims made by financial products are accurate and verifiable.

- Growing ESG Investment in the Philippines: Expected to see continued expansion, supported by regulatory mandates and investor preference for sustainable options.

Environmental factors significantly shape BDO Unibank's operational landscape, particularly concerning climate change impacts and the growing demand for sustainable finance. The bank's proactive stance, evidenced by its over P1 trillion green investment portfolio by the end of 2024, highlights its commitment to financing eco-friendly projects and aligning with national climate objectives. This strategic focus not only addresses environmental risks but also capitalizes on the increasing investor appetite for ESG-compliant investments.

PESTLE Analysis Data Sources

Our PESTLE Analysis for BDO Unibank draws on a comprehensive array of data, including official Philippine government reports, economic forecasts from institutions like the Bangko Sentral ng Pilipinas and the IMF, and industry-specific analyses from financial regulators and market research firms.