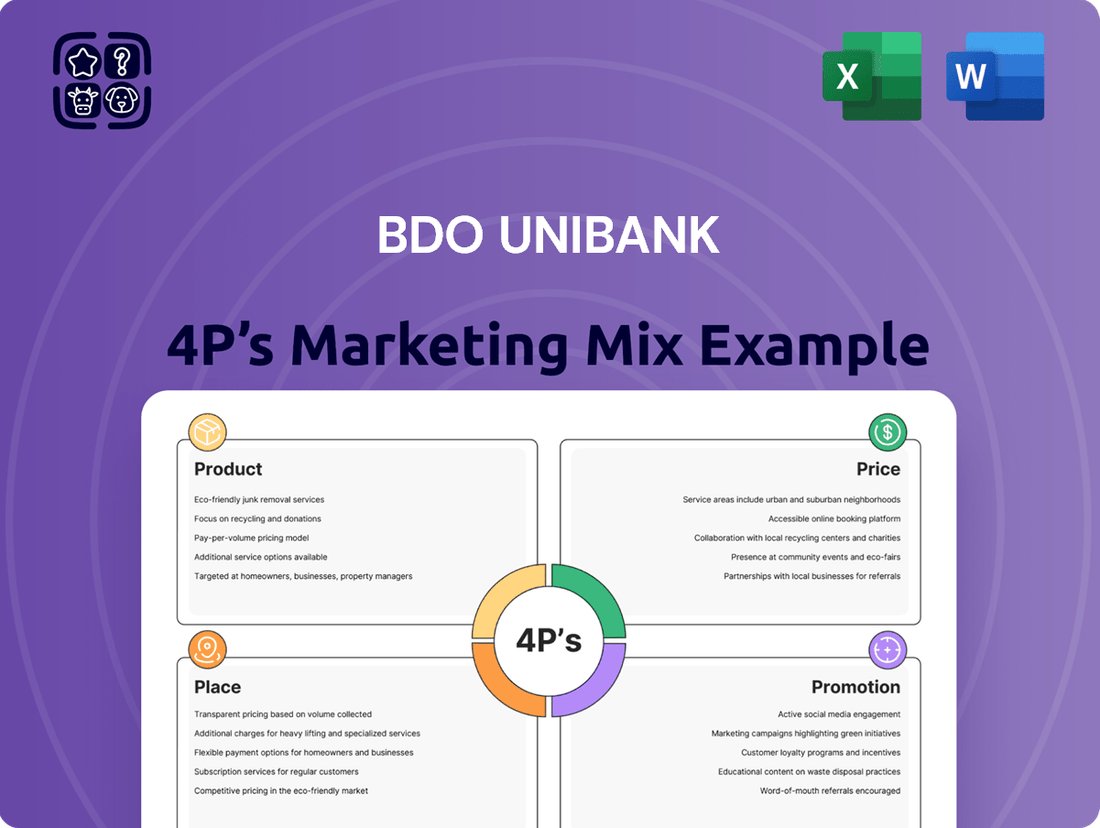

BDO Unibank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BDO Unibank Bundle

Discover how BDO Unibank masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate the Philippine banking landscape. This analysis reveals the intricate interplay of their offerings, competitive pricing, extensive branch network, and impactful advertising campaigns.

Unlock the full potential of this deep dive into BDO's marketing success. Get instant access to a professionally written, editable 4Ps Marketing Mix Analysis, perfect for students, professionals, and anyone seeking to understand market leadership.

Product

BDO Unibank's diverse financial services portfolio positions it as a comprehensive, full-service universal bank in the Philippines. This breadth covers essential deposit products and a wide array of lending solutions tailored for corporate, commercial, and individual clients.

As of the first quarter of 2024, BDO reported total assets of PHP 4.1 trillion, underscoring its significant market presence and capacity to serve a broad customer base. The bank actively refines its offerings, introducing innovative digital solutions and expanding access to credit to align with dynamic market needs and customer expectations.

BDO Unibank extends its offerings beyond conventional banking through specialized wealth and investment management. This includes treasury, trust, and wealth management services designed for a variety of investor needs.

In 2024, BDO Private Bank introduced a new client portal, a significant step in improving client interaction and offering immediate updates on investment portfolios. This initiative reflects a commitment to leveraging technology for enhanced client experience.

Further demonstrating its comprehensive approach, BDO also provides investment banking and insurance brokerage services. These integrated offerings aim to deliver a full spectrum of financial solutions to its clientele.

BDO Unibank is heavily invested in digital transformation, aiming to enhance customer experience through integrated technology. This commitment is evident in their digital cash management solutions, such as the Humanising Cash Management initiative, which focuses on providing secure and efficient transactions.

The bank actively promotes its digital tools via the BDO Online and BDO Pay applications, offering a comprehensive suite of services. For instance, BDO reported a significant increase in digital transactions, with BDO Online transactions growing by 35% year-on-year as of Q3 2024, reflecting strong customer adoption.

Consumer and SME Loan s

BDO Unibank offers a robust lending portfolio designed to meet the diverse financial needs of individuals and businesses alike. This extensive range includes corporate, commercial, and consumer loans, demonstrating the bank's commitment to supporting various economic sectors.

The bank actively caters to the small and medium enterprise (SME) market, a crucial engine for economic growth. In October 2024, BDO strategically rebranded its SME Loan as the BDO Multipurpose Loan. This move ensures the product continues to offer flexible financing solutions, addressing the varied and evolving requirements of SMEs.

The effectiveness of BDO's lending strategies is evident in its recent performance figures. Gross customer loans experienced a significant increase of 14% in the first half of 2025. This growth reflects a broad-based expansion across all lending segments, highlighting the bank's strong market penetration and the increasing demand for its loan products among consumers and businesses.

- Extensive Lending Portfolio: Covers corporate, commercial, and consumer loans.

- SME Market Focus: BDO Multipurpose Loan (formerly BDO SME Loan) launched in October 2024 to meet diverse SME financing needs.

- Strong Loan Growth: Gross customer loans grew by 14% in H1 2025, indicating widespread demand.

Sustainability-Linked Financial Instruments

BDO Unibank's Sustainability-Linked Financial Instruments, such as their ASEAN Sustainability Bonds, are a key part of their product strategy, directly funding green and sustainable projects. This initiative reflects a strong commitment to Environmental, Social, and Governance (ESG) principles, aligning with the growing global demand for responsible investing. By issuing these bonds, BDO not only supports the development of its sustainable finance portfolio but also positions itself as a leader in forward-thinking financial solutions.

The bank's active participation in sustainable finance is underscored by its issuance of these instruments, which are designed to finance projects with clear environmental and social benefits. For instance, BDO Unibank has actively participated in the issuance of sustainability bonds, channeling funds into areas like renewable energy and climate change mitigation. This strategic move is crucial for building a robust sustainable portfolio and demonstrating tangible progress towards ESG goals.

This commitment to sustainability-linked finance is not just about compliance; it's a strategic advantage. By offering these products, BDO caters to a growing segment of investors who prioritize ESG factors in their investment decisions. This approach not only strengthens the bank's market position but also contributes to a more sustainable economic future, aligning with broader national and international sustainability targets.

Key aspects of BDO's sustainability-linked financial instruments include:

- Direct funding for green and social projects

- Alignment with global ESG trends and investor preferences

- Growth of the bank's sustainable finance portfolio

- Demonstration of a forward-thinking product development strategy

BDO Unibank's product strategy encompasses a broad spectrum of financial solutions, from core deposit and lending products to specialized wealth management and investment banking services. The bank actively innovates, evident in its digital transformation efforts like the Humanising Cash Management initiative and the BDO Online and BDO Pay applications, which saw a 35% year-on-year increase in transactions by Q3 2024. Furthermore, BDO's commitment to sustainability is showcased through its Sustainability-Linked Financial Instruments, such as ASEAN Sustainability Bonds, which directly fund green projects and cater to the growing demand for ESG-aligned investments.

| Product Category | Key Offerings/Initiatives | Performance/Data Point |

|---|---|---|

| Deposit & Lending | Comprehensive loan portfolio (corporate, commercial, consumer) | Gross customer loans grew 14% in H1 2025 |

| Digital Services | BDO Online, BDO Pay, Humanising Cash Management | BDO Online transactions up 35% YoY (Q3 2024) |

| Wealth & Investment | Wealth management, trust, investment banking | New client portal for BDO Private Bank (2024) |

| Sustainable Finance | Sustainability-Linked Financial Instruments, ASEAN Sustainability Bonds | Direct funding for green and social projects |

What is included in the product

This analysis provides a comprehensive examination of BDO Unibank's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning and competitive advantages.

Simplifies complex marketing strategies by clearly articulating BDO Unibank's 4Ps, addressing the pain point of understanding how each element contributes to customer value and competitive advantage.

Place

BDO Unibank's extensive physical branch network is a cornerstone of its marketing strategy. As of December 2024, the bank operates over 1,700 branches and more than 5,800 ATMs and self-service machines across the Philippines, solidifying its position as having the largest distribution network in the country.

This vast physical footprint guarantees widespread accessibility, allowing customers convenient access to banking services regardless of their location. The bank's commitment to growth is evident in its plans to open an additional 100 to 120 new branches in the near future, further strengthening its market presence.

BDO Unibank's strategic expansion into rural areas, primarily through BDO Network Bank, is a key component of its place strategy. This initiative targets underserved and unbanked communities, aiming to boost financial inclusion. By year-end 2024, BDO Network Bank was projected to operate between 560 and 570 branches, having opened over 70 new locations in that year alone.

The bank plans to further increase its reach in 2025, extending essential banking services to regions with limited existing financial infrastructure. This expansion directly addresses the need for accessible financial services in rural Philippines, a critical step in bringing more of the population into the formal financial system.

BDO Unibank significantly bolsters its physical branch network with robust digital channels, offering customers unparalleled convenience and efficiency. This strategic move caters to the growing demand for accessible banking services, allowing for transactions anytime, anywhere.

Key to this digital push are the enhanced BDO Online Banking website and the user-friendly BDO Online and BDO Pay mobile applications. These platforms are central to BDO's strategy to provide seamless banking experiences, reflecting a strong commitment to digital innovation.

Through these digital avenues, BDO Unibank ensures 24/7 access to a comprehensive suite of services, including account management, fund transfers, and bill payments. The platforms also feature advanced card security measures, giving customers peace of mind. In 2024, BDO reported a substantial increase in digital transactions, with BDO Online and BDO Pay seeing a 25% year-on-year growth in active users, underscoring the success of their digital channel investments.

International Presence

BDO Unibank's international presence is a significant element of its marketing mix, extending its services to a global clientele. The bank operates 16 international offices, strategically located to serve overseas Filipinos and facilitate international business. This expansive network includes full-service branches in key financial hubs like Hong Kong and Singapore, alongside 14 other offices spread across Asia, Europe, North America, and the Middle East.

This global footprint is crucial for supporting remittances and cross-border financial activities, directly impacting BDO's competitive advantage. By offering accessible banking services to Filipinos abroad and enabling seamless international transactions, BDO solidifies its role as a vital financial partner in the global marketplace. This international reach is a testament to BDO's commitment to providing comprehensive financial solutions beyond Philippine borders.

- Global Reach: 16 international offices supporting overseas Filipinos and international business.

- Key Hubs: Full-service branches in Hong Kong and Singapore.

- Diverse Locations: Offices across Asia, Europe, North America, and the Middle East.

- Strategic Importance: Reinforces BDO's position in cross-border financial activities.

Innovative Access Points

BDO Unibank prioritizes customer convenience through innovative access points. Weekend banking and extended hours have proven popular, with BDO reporting a significant increase in customer transactions during these periods in 2024. This strategy directly addresses the needs of those with traditional weekday work schedules.

The Cash Agad service is another key differentiator, extending BDO's reach into underserved areas. By leveraging over 10,000 partner retail outlets nationwide, Cash Agad facilitated millions of cash withdrawals in 2024, particularly in provinces where traditional branch access is limited. This initiative significantly enhances financial inclusion.

- Extended Hours: BDO branches offer extended banking hours on weekdays and operate on weekends, catering to busy schedules.

- Weekend Banking: Select BDO branches are open on Saturdays and Sundays, providing crucial access during non-traditional banking days.

- Cash Agad Network: Over 10,000 retail partners nationwide allow BDO customers to withdraw cash conveniently.

- Financial Inclusion: Cash Agad specifically targets remote and rural areas, improving access to cash services where bank branches are scarce.

BDO Unibank's "Place" strategy emphasizes broad accessibility through an extensive physical and digital network. The bank's over 1,700 branches and 5,800 ATMs as of December 2024 ensure widespread reach, complemented by plans for 100-120 new branches. Its digital platforms, BDO Online and BDO Pay, saw a 25% year-on-year growth in active users in 2024, demonstrating a strong omnichannel approach.

The expansion via BDO Network Bank, projected to have 560-570 branches by year-end 2024, specifically targets financial inclusion in underserved rural areas. Furthermore, BDO's 16 international offices cater to overseas Filipinos and facilitate global transactions, reinforcing its comprehensive market coverage.

| Channel | Key Metrics (as of late 2024/early 2025) | Strategic Impact |

|---|---|---|

| Physical Branches | 1,700+ branches, 5,800+ ATMs | Dominant market presence, accessibility |

| BDO Network Bank | 560-570 projected branches (end 2024) | Financial inclusion in rural areas |

| Digital Platforms | 25% YoY growth in active users (2024) | 24/7 convenience, enhanced customer experience |

| International Offices | 16 offices globally | Support for OFWs, cross-border transactions |

What You See Is What You Get

BDO Unibank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of BDO Unibank's 4P's marketing mix is fully complete and ready for your immediate use.

Promotion

BDO Unibank utilizes integrated marketing campaigns to bolster brand visibility and connect with its diverse customer base. A prime example is the 'Sa Bangko, Sigurado' initiative, which actively promotes financial literacy and secure banking practices through engaging workshops and community events.

These campaigns are strategically designed to resonate with Filipinos, often incorporating well-known personalities to amplify their message and broaden reach. For instance, in 2023, BDO reported a significant increase in digital engagement, with their social media campaigns reaching over 15 million unique users, underscoring the effectiveness of their integrated approach.

BDO Unibank's marketing strategy heavily leans into digital engagement and brand positioning. This focus is evident in their efforts to segment customers and cultivate a strong brand identity.

The bank actively promotes its enhanced BDO Online and BDO Pay applications. These platforms are designed to provide a secure, smooth, and tailored banking experience, underscoring BDO's dedication to customer happiness.

These digital advancements have significantly boosted BDO's brand value. In 2025, this value jumped by an impressive 48%, reaching $3.7 billion, solidifying its status as the Philippines' most valuable brand for the second year running.

BDO Unibank actively champions financial literacy and inclusion, a key component of its marketing strategy. Their programs, like those tailored for armed forces personnel, aim to equip Filipinos with essential financial knowledge and skills, fostering greater economic participation. This commitment extends beyond mere banking services, reflecting a dedication to societal well-being and building long-term trust.

Strategic Public Relations and Awards

BDO Unibank leverages strategic public relations by consistently showcasing its industry accolades, such as those received at the Asian Banking & Finance Awards 2024. These awards, including 'Retirement Solutions of the Year' and 'Philippines Domestic Cash Management Bank of the Year,' serve as powerful endorsements of the bank's innovative offerings and market leadership.

These recognitions are not just trophies; they are tangible proof points that build trust and credibility with customers and stakeholders. For instance, BDO's repeated success in cash management highlights its operational efficiency and reliability, crucial factors for businesses managing their finances. The bank's commitment to excellence across diverse banking segments, from retail to corporate, is further solidified by these prestigious awards.

- Industry Validation: Awards like the Asian Banking & Finance Awards 2024 underscore BDO's consistent performance and innovation.

- Enhanced Credibility: Accolades such as 'Retirement Solutions of the Year' build customer confidence and reinforce the bank's expertise.

- Market Leadership: Being named 'Philippines Domestic Cash Management Bank of the Year' demonstrates BDO's strong position in a critical financial service area.

- Brand Reputation: Publicizing these achievements actively shapes a positive brand image, attracting new clients and retaining existing ones.

Investor Relations and Transparency

BDO Unibank prioritizes investor relations and transparency by consistently sharing performance data and strategic updates. This includes detailed annual reports and investor presentations, ensuring stakeholders have a clear view of the bank's financial health and future plans. For instance, BDO's 2023 financial results showcased a net income of PHP 60.4 billion, up 41% from the previous year, highlighting strong operational performance and strategic execution.

The bank actively participates in key financial events to broaden its reach. Its presence at forums like the Deutsche Bank ADR Virtual Investor Conference in 2024 allows BDO to connect with a global audience, presenting its growth initiatives and financial strategies. This engagement is crucial for attracting international investment and reinforcing its standing in the global market.

This commitment to open communication fosters trust and builds confidence among investors. By providing timely and accurate information, BDO strengthens its market position and demonstrates its dedication to shareholder value.

- Investor Presentations: Regular updates on financial performance and strategic outlook.

- Global Reach: Participation in virtual conferences to engage international investors.

- Transparency: Open communication builds trust and reinforces market position.

BDO Unibank's promotion strategy is multifaceted, focusing on integrated campaigns, digital engagement, and financial literacy. Their 'Sa Bangko, Sigurado' initiative, for example, actively promotes secure banking through workshops and events, reaching millions. The bank also highlights its digital platforms like BDO Online and BDO Pay, aiming for a seamless customer experience.

BDO effectively leverages public relations and investor relations to build credibility and attract investment. Showcasing industry awards, such as those from the Asian Banking & Finance Awards 2024, reinforces their market leadership. Furthermore, transparent communication with investors, including detailed financial reports like the 2023 net income of PHP 60.4 billion, builds confidence.

The bank's digital presence is a key promotional pillar, with social media campaigns reaching over 15 million unique users in 2023. This digital focus contributed to a significant 48% jump in BDO's brand value in 2025, reaching $3.7 billion. Their participation in global events like the Deutsche Bank ADR Virtual Investor Conference in 2024 also broadens their international reach.

| Promotional Focus | Key Initiatives/Examples | Impact/Data Point |

|---|---|---|

| Integrated Campaigns | Sa Bangko, Sigurado initiative | Promotes financial literacy and secure banking |

| Digital Engagement | BDO Online & BDO Pay promotion | Social media reached 15M+ unique users (2023) |

| Brand Value | Digital advancements | Brand value increased 48% to $3.7B (2025) |

| Public Relations | Asian Banking & Finance Awards 2024 | Awards include 'Retirement Solutions of the Year' |

| Investor Relations | 2023 Financial Results | Net income of PHP 60.4 billion (up 41%) |

Price

BDO Unibank strategically prices its loan products to remain competitive, covering corporate, commercial, and consumer segments. This approach ensures attractive rates for a broad customer base.

The bank's success in this area is evident in its 14% growth in gross customer loans during the first half of 2025. This significant increase demonstrates that BDO's pricing strategy is effectively driving demand and market share.

BDO Unibank's pricing strategy for deposits is designed to be attractive, offering competitive interest rates that encourage customers to maintain and grow their funds with the bank. This approach has proven effective, as evidenced by a significant 8% increase in deposits, reaching over P4 trillion in the first half of 2025.

For investment products, BDO provides a diverse portfolio, including unit investment trust funds (UITFs) and Personal Equity and Retirement Account (PERA) options. Each of these investment vehicles comes with its own distinct fee structure and potential return profile, catering to different investor needs and risk appetites.

BDO Unibank strategically prices its sustainability bonds to attract investors keen on supporting environmental and social projects. For instance, its July 2025 issuance of the fourth ASEAN Sustainability Bonds came with a 5.875% annual interest rate. This follows a July 2024 issuance that offered a 6.325% coupon rate.

Transparent Fee Structures and Reduced Transaction Costs

BDO Unibank prioritizes a clear and straightforward approach to its fee structures, ensuring clients fully comprehend the charges for their banking activities. This commitment to transparency builds trust and reduces confusion around transactional costs.

A significant move by BDO is the reduction of InstaPay transfer fees to just P10. This makes digital payments considerably more affordable, encouraging wider adoption among users looking for cost-effective ways to send money.

The bank's strategy of lowering costs for digital services directly addresses customer needs for economical transactions. This initiative is designed to boost customer satisfaction and accelerate the shift towards digital banking platforms.

- Transparent Fee Structures: BDO aims for clarity, so customers know exactly what they are paying for.

- Reduced InstaPay Fee: The transfer fee for InstaPay is now P10, making digital transfers cheaper.

- Affordability and Accessibility: Lower digital transaction costs enhance the appeal and usability of BDO's online services.

- Encouraging Digital Adoption: By making digital banking more cost-effective, BDO incentivizes customers to use these channels more frequently.

Value-Based Pricing and Market Positioning

BDO Unibank's pricing strategies are deeply rooted in the perceived value of its extensive suite of banking services, a deliberate approach that reinforces its standing as the Philippines' largest bank by total resources, loans, deposits, and capital. This market positioning allows BDO to command premium pricing where appropriate, reflecting the breadth and depth of its offerings.

The bank's financial performance, highlighted by a robust net income of P40.6 billion in the first half of 2025, serves as a testament to the success of its value-based pricing. This profitability indicates that BDO's pricing is well-calibrated to market demand and its own operational efficiencies, ensuring competitive yet profitable service costs for its diverse customer base.

- Value Proposition: BDO prices its services to reflect the comprehensive benefits offered, leveraging its scale and market leadership.

- Market Dominance: As the largest bank, BDO's pricing power is supported by its extensive reach and established customer trust.

- Profitability Metric: A P40.6 billion net income in H1 2025 validates the effectiveness of its pricing in capturing market value.

- Customer Perception: Pricing aligns with the expectation of quality and reliability associated with the BDO brand.

BDO Unibank's pricing strategy for its diverse loan portfolio, encompassing corporate, commercial, and consumer segments, aims for competitive attractiveness. This is validated by a 14% growth in gross customer loans in the first half of 2025, indicating successful market penetration and demand generation through strategic pricing.

| Product Segment | H1 2025 Growth | Pricing Strategy Focus |

|---|---|---|

| Gross Customer Loans | 14% | Competitive Rates |

| Deposits | 8% | Attractive Interest Rates |

| Sustainability Bonds (July 2025) | N/A | Competitive Coupon Rate (5.875%) |

4P's Marketing Mix Analysis Data Sources

Our BDO Unibank 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company disclosures, banking product details, and customer-facing promotional materials. We also incorporate insights from market research reports and competitive analyses to ensure accuracy.