Bausch Health Companies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bausch Health Companies Bundle

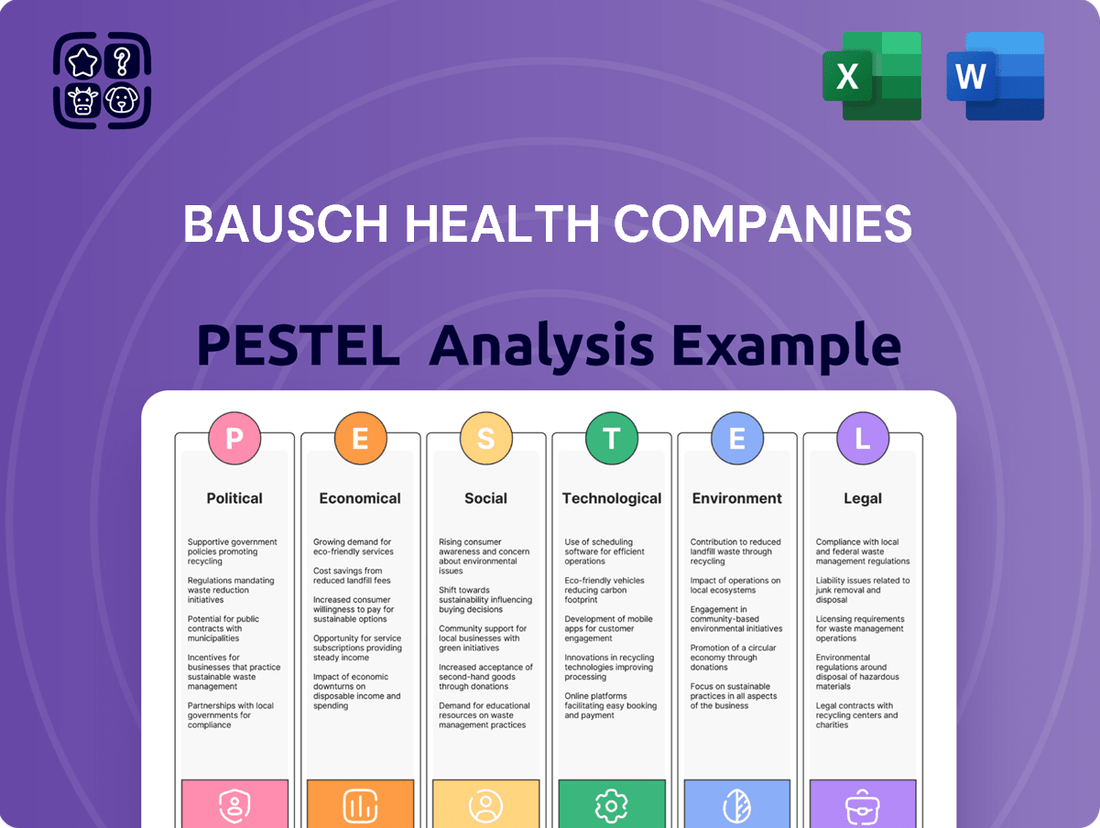

Navigate the complex external landscape affecting Bausch Health Companies with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its strategic direction and market opportunities. Gain a competitive advantage by leveraging these critical insights.

Ready to make informed decisions about Bausch Health Companies? Our PESTLE analysis offers a deep dive into the political, economic, social, technological, legal, and environmental factors influencing its performance. Download the full version now to unlock actionable intelligence and fortify your strategy.

Political factors

Government policies, particularly those concerning drug pricing and reimbursement, significantly influence Bausch Health's financial performance and ability to reach patients. For example, the Inflation Reduction Act (IRA) enacted in the U.S. is designed to curb prescription drug expenses, potentially impacting revenue streams for pharmaceutical firms like Bausch Health.

Changes in international trade agreements and the imposition of tariffs directly impact Bausch Health's global supply chain and the cost of its products. As a multinational corporation, fluctuations in trade policy can significantly alter operational expenses and pricing strategies.

The U.S. Department of Commerce's ongoing investigation into the national security implications of pharmaceutical imports, initiated in 2023 and continuing through 2024, could result in new trade measures. Such measures might include import restrictions or increased duties, directly affecting the cost and availability of raw materials and finished goods for Bausch Health.

Bausch Health Companies operates across numerous global markets, each with its own unique political landscape. Political stability, or lack thereof, in these key regions directly influences the company's ability to conduct business smoothly. For instance, geopolitical tensions in Eastern Europe, which saw some escalation in 2024, could potentially affect supply chain logistics or market access for Bausch Health's products in those areas.

Regulatory Approval Processes

The stringency and speed of regulatory approval processes, particularly from bodies like the FDA in the United States and the EMA in Europe, directly impact Bausch Health's ability to launch new pharmaceuticals and medical devices. For instance, the FDA's review timelines can vary significantly, affecting market entry dates and the competitive landscape.

Delays or increased complexity in securing these crucial approvals can lead to substantial financial consequences. This includes impacting projected revenue streams, delaying the realization of R&D investments, and potentially requiring costly resubmissions or additional clinical trials.

Bausch Health's product pipeline is subject to these evolving regulatory standards. In 2024, the company continued to navigate these processes, with the success of new product launches heavily dependent on efficient regulatory clearance.

- FDA approval timelines: Average review times for new drug applications (NDAs) and medical device submissions can range from months to several years, directly impacting Bausch Health's go-to-market strategy.

- Impact on R&D: Extended regulatory review periods can increase the cost of capital for R&D projects and reduce the overall return on investment for new product development.

- Global variations: Differences in regulatory requirements across key international markets necessitate tailored approval strategies, adding complexity and potential delays for Bausch Health's global product launches.

Intellectual Property Protection

Government enforcement of intellectual property (IP) rights, particularly patents, is a critical political factor for pharmaceutical firms like Bausch Health. Strong IP protection is vital for these companies to recoup their significant research and development investments and maintain market exclusivity for their innovative drugs. For instance, the United States, a key market for Bausch Health, has robust patent laws, but the landscape of patent litigation can shift, impacting how long exclusivity is preserved.

Changes in patent litigation trends and the strength of enforcement directly influence Bausch Health's ability to fend off generic competition. In 2024, the pharmaceutical industry continues to navigate a complex legal environment where patent challenges are common. A report from LexisNexis in late 2023 indicated a sustained high volume of patent litigation in the life sciences sector, underscoring the importance of strong legal defenses for companies like Bausch Health to protect their market share.

- Patent Enforcement: The effectiveness of government bodies in upholding patent rights directly impacts Bausch Health's revenue streams by preventing early generic entry.

- Litigation Trends: Evolving patent litigation strategies and outcomes in key markets like the US and Europe can significantly alter market exclusivity periods for Bausch Health's products.

- Regulatory Alignment: International agreements and national policies on IP, such as those discussed in trade negotiations in 2024, shape the global IP protection framework relevant to Bausch Health's operations.

Government policies on drug pricing, such as the Inflation Reduction Act in the U.S., directly impact Bausch Health's revenue potential. Trade agreements and tariffs influence supply chain costs and product pricing globally. The ongoing U.S. Department of Commerce investigation into pharmaceutical imports could lead to new trade measures affecting Bausch Health's operations.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Bausch Health Companies, covering political, economic, social, technological, environmental, and legal influences.

It provides a strategic overview to identify opportunities and threats for Bausch Health, informing proactive business planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting key external factors influencing Bausch Health's strategies.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear overview of political, economic, social, technological, legal, and environmental impacts.

Economic factors

Global healthcare spending is a significant driver for Bausch Health Companies. In 2023, worldwide health spending reached an estimated $9.8 trillion, a figure projected to climb steadily. This growth is fueled by an aging global population and the continuous introduction of innovative medical technologies and pharmaceuticals, directly impacting the market for Bausch Health's diverse product portfolio.

Looking ahead to 2024 and beyond, projections suggest this upward trend in healthcare expenditure will persist. For instance, the Organisation for Economic Co-operation and Development (OECD) anticipates healthcare spending in member countries to grow by an average of 2.5% annually through 2025. This sustained increase in investment within the healthcare sector bodes well for companies like Bausch Health, as it indicates a robust and expanding market for their offerings.

Bausch Health Companies faces significant drug pricing pressures from governments, payers, and consumers globally. For instance, in the United States, the Inflation Reduction Act of 2022 empowers Medicare to negotiate prices for certain high-cost drugs, a move that could impact Bausch Health's product revenues if any of its offerings fall under these provisions. This trend towards greater price transparency and negotiation is a key economic factor affecting the pharmaceutical industry.

Inflationary pressures continue to be a significant consideration for Bausch Health Companies. Increased costs for raw materials, manufacturing, and logistics, driven by a persistent inflationary environment throughout 2024 and into early 2025, directly impact the company's operating expenses. For instance, the cost of certain pharmaceutical ingredients saw notable increases, affecting gross margins.

The prevailing interest rate environment also poses a challenge. As interest rates remained elevated or even increased through the first half of 2025, Bausch Health's debt servicing costs were negatively affected. This was evident in their Q1 2025 financial reporting, which highlighted a rise in interest expenses, impacting overall profitability and cash flow available for reinvestment or debt reduction.

Economic Growth and Consumer Purchasing Power

Economic growth is a crucial driver for Bausch Health Companies, directly impacting consumer purchasing power and the overall demand for healthcare products. When economies are expanding, individuals typically see an increase in their disposable income, making them more likely to spend on both prescription and over-the-counter health solutions. This trend is particularly relevant for Bausch Health's diverse product portfolio, which spans pharmaceuticals, medical devices, and consumer health brands.

For instance, in 2024, global GDP growth was projected to be around 3.1%, according to the International Monetary Fund (IMF), indicating a generally supportive economic environment that could translate to increased healthcare expenditure. Stronger economic conditions often lead to higher affordability for healthcare services and products, benefiting companies like Bausch Health. Conversely, economic downturns can dampen consumer spending, potentially affecting sales volumes and pricing power.

- Economic Growth Impact: A robust economy generally boosts consumer disposable income, enhancing affordability for Bausch Health's products.

- Healthcare Spending Correlation: Strong economic performance typically correlates with increased overall healthcare spending, benefiting the sector.

- Market Demand Influence: Economic conditions directly influence demand for both branded pharmaceuticals and over-the-counter consumer health products.

- Affordability Factor: Higher consumer purchasing power allows for greater spending on healthcare needs, supporting Bausch Health's revenue streams.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Bausch Health Companies, a global player. As a multinational corporation, converting revenues and expenses earned in foreign currencies back to its primary reporting currency, the US dollar, can lead to gains or losses. These shifts directly affect reported financial results.

For instance, Bausch Health noted in its Q1 2025 earnings call that unfavorable currency movements played a role in the reported revenue changes for the quarter. This highlights the sensitivity of their international operations to foreign exchange volatility.

- Impact on International Revenue: A stronger US dollar can reduce the reported value of foreign earnings, while a weaker dollar can boost them.

- Cost of Goods Sold: Fluctuations can also affect the cost of imported raw materials or manufactured goods, influencing profit margins.

- Competitive Landscape: Exchange rates can alter the price competitiveness of Bausch Health's products in different international markets relative to local competitors.

- Q1 2025 Revenue Influence: Specific currency headwinds were cited as a contributing factor to the revenue performance observed in the first quarter of 2025.

Persistent inflation in 2024 and early 2025 has increased Bausch Health's operating costs, particularly for raw materials and logistics, impacting gross margins. Elevated interest rates through mid-2025 also increased the company's debt servicing expenses, as seen in Q1 2025 results, affecting profitability and cash flow. While global economic growth, projected around 3.1% for 2024, generally supports demand, currency fluctuations, as noted in Q1 2025, can impact reported international revenues and costs.

| Economic Factor | 2024/2025 Trend | Impact on Bausch Health |

|---|---|---|

| Inflation | Persistent increases in costs | Higher operating expenses, reduced gross margins |

| Interest Rates | Elevated or increasing | Increased debt servicing costs, reduced profitability |

| Global Economic Growth | Projected ~3.1% in 2024 | Supports demand and affordability, but vulnerable to downturns |

| Currency Exchange Rates | Volatile fluctuations | Impacts reported international revenues and costs, affecting financial results |

Full Version Awaits

Bausch Health Companies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Bausch Health Companies delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. It provides a detailed overview of the external forces shaping the company's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a deep dive into Bausch Health's PESTLE factors.

Sociological factors

The world's population is getting older, and this trend is a major tailwind for companies like Bausch Health. As people age, they tend to need more medications, particularly for conditions common in later life. This is precisely where Bausch Health has a strong presence, with its focus on eye health and gastroenterology products.

By 2050, the United Nations projects that nearly 1 in 6 people globally will be over 65, up from 1 in 11 in 2015. This demographic shift directly translates to increased demand for pharmaceuticals addressing chronic and age-related diseases, a core segment for Bausch Health's product portfolio.

The increasing prevalence of chronic diseases, such as cardiovascular conditions and diabetes, is a significant sociological trend. This rise, driven by factors like aging demographics and evolving lifestyle choices, fuels a sustained demand for ongoing pharmaceutical treatments. For instance, by 2023, an estimated 6 in 10 adults in the US had a chronic disease, and 4 in 10 had two or more, highlighting the substantial market for long-term care solutions.

This growing burden of chronic illness directly benefits companies like Bausch Health, whose product portfolio often addresses these long-term health needs. As more individuals require continuous management of conditions like gastrointestinal disorders or dermatological issues, the market for Bausch Health's therapeutic offerings expands, creating a stable revenue stream.

Growing health consciousness is a significant driver for Bausch Health Companies. As individuals become more proactive about their well-being, there's a rising demand for products that support preventive care and manage chronic conditions. This trend directly impacts Bausch Health's portfolio, particularly in areas like eye care and gastroenterology. For instance, the global dry eye market, a key segment for Bausch Health, was valued at approximately $3.5 billion in 2023 and is projected to grow significantly, fueled by increased awareness and diagnosis of the condition.

Furthermore, the shift towards healthier lifestyles, including better nutrition and increased physical activity, can influence the demand for certain pharmaceutical and medical device offerings. The adoption of digital health solutions, such as telehealth and remote patient monitoring, is also on the rise. Bausch Health is positioned to benefit from these shifts by integrating digital components into its product offerings and patient support programs, aligning with evolving consumer preferences for convenient and accessible healthcare solutions.

Patient Access and Affordability Concerns

Societal expectations are increasingly focused on healthcare access and affordability. This trend puts pressure on pharmaceutical companies like Bausch Health to ensure their products are within reach for a broader population, potentially influencing public perception and regulatory scrutiny regarding drug pricing. For instance, in 2023, out-of-pocket prescription drug costs remained a significant concern for many Americans, with surveys indicating a substantial percentage struggling to afford their medications.

Bausch Health's market acceptance and reputation are directly tied to its ability to offer accessible and affordable solutions. If the company is perceived as prioritizing profit over patient affordability, it could lead to negative publicity and reduced market share. In the competitive landscape of 2024, demonstrating value and affordability is crucial for sustained growth and positive brand image.

- Public Demand for Lower Drug Prices: Growing societal pressure for more affordable healthcare continues to shape the pharmaceutical industry.

- Impact on Brand Reputation: Bausch Health's pricing strategies and product accessibility directly influence public perception and market acceptance.

- Affordability as a Competitive Differentiator: In 2024, companies that can effectively address affordability concerns may gain a significant market advantage.

Diversity and Inclusion in Clinical Trials

Societal pressure for greater diversity and inclusion is increasingly impacting clinical trials, with specific goals set for minority participation. This focus directly shapes how Bausch Health Companies approaches its research and development, influencing trial design and the overall product development lifecycle.

For instance, the U.S. Food and Drug Administration (FDA) has been actively encouraging broader participation. By 2024, the FDA's guidance aimed to increase the representation of underrepresented racial and ethnic groups in clinical trials, pushing companies like Bausch Health to actively recruit from diverse populations to ensure their products are safe and effective for everyone.

- Increased Scrutiny: Regulatory bodies and patient advocacy groups are closely monitoring diversity metrics in clinical trials.

- R&D Strategy: Bausch Health must integrate diverse patient recruitment into its early-stage R&D planning.

- Market Access: Products developed with diverse trial data may face fewer hurdles in gaining market approval and acceptance.

- Reputational Impact: A commitment to inclusive trials can enhance Bausch Health's corporate image and public trust.

The aging global population is a significant tailwind for Bausch Health, as older individuals generally require more medications, particularly for age-related conditions. By 2050, the UN projects nearly 1 in 6 people globally will be over 65, up from 1 in 11 in 2015, directly increasing demand for Bausch Health's therapeutic areas like eye health and gastroenterology.

Growing health consciousness and the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, are driving sustained demand for pharmaceutical treatments. In the US, by 2023, an estimated 60% of adults had at least one chronic disease, underscoring the market for long-term health management solutions that Bausch Health provides.

Societal pressure for healthcare affordability and accessibility is a key factor, influencing public perception and regulatory scrutiny of drug pricing. In 2024, companies like Bausch Health must demonstrate value to maintain market acceptance, as out-of-pocket costs remain a concern for many consumers.

Furthermore, a push for greater diversity and inclusion in clinical trials, encouraged by bodies like the FDA, impacts Bausch Health's R&D. By 2024, the FDA aimed to increase underrepresented group participation, requiring companies to actively recruit diverse populations to ensure product safety and efficacy across all demographics.

| Sociological Factor | Description | Impact on Bausch Health | Relevant Data Point (2023-2025) |

| Aging Population | Increasing proportion of individuals aged 65+ globally. | Drives demand for chronic disease and age-related condition treatments. | UN projects 1 in 6 people globally over 65 by 2050 (up from 1 in 11 in 2015). |

| Health Consciousness & Chronic Disease | Greater public focus on well-being and rising rates of chronic illnesses. | Boosts demand for ongoing pharmaceutical treatments and preventive care products. | 60% of US adults had a chronic disease in 2023; Bausch Health's dry eye market valued at ~$3.5 billion in 2023. |

| Healthcare Affordability & Access | Societal demand for lower drug prices and accessible healthcare. | Influences pricing strategies, brand reputation, and market acceptance. | Out-of-pocket prescription costs remain a significant concern for consumers in 2023-2024. |

| Diversity & Inclusion in Trials | Emphasis on diverse representation in clinical research. | Requires Bausch Health to adapt R&D strategies for broader patient recruitment. | FDA guidance by 2024 encourages increased representation of underrepresented racial/ethnic groups in trials. |

Technological factors

Technological innovations, particularly in artificial intelligence and machine learning, are dramatically speeding up drug discovery. These tools are improving the accuracy of identifying promising chemical compounds, which in turn shortens the overall development timeline. For Bausch Health, harnessing these advancements offers a significant opportunity to bolster its research and development pipeline.

The surge in digital health and telemedicine adoption is fundamentally reshaping how healthcare is delivered. For Bausch Health, this presents a clear opportunity to embed these technologies into its patient engagement strategies and streamline product distribution, potentially enhancing accessibility and adherence.

By 2024, the global telemedicine market was projected to reach over $200 billion, indicating a substantial shift towards virtual care solutions. This trend allows Bausch Health to explore innovative patient support programs and direct-to-consumer models for its pharmaceutical and medical device offerings.

Bausch Health Companies is increasingly leveraging automation and robotics within its pharmaceutical manufacturing operations. This technological shift is aimed at boosting production efficiency, driving down operational costs, and significantly enhancing quality control throughout the manufacturing lifecycle. By integrating advanced automated systems, Bausch Health can streamline its processes, from raw material handling to final product packaging.

Investments in these cutting-edge technologies are crucial for optimizing Bausch Health's production capabilities and fortifying its supply chain resilience. For instance, the pharmaceutical industry saw a notable increase in automation adoption between 2023 and 2024, with many companies reporting efficiency gains of up to 15%. This trend is expected to continue, allowing Bausch Health to maintain competitiveness and meet growing market demands with greater precision and speed.

Data Analytics and AI in Commercial Operations

Bausch Health is increasingly relying on big data analytics and artificial intelligence to sharpen its market insights and personalize its marketing efforts. These technologies are vital for understanding patient needs and physician prescribing patterns, ultimately optimizing sales strategies in the competitive pharmaceutical landscape. For instance, in 2024, companies across the healthcare sector saw significant ROI from AI-driven customer segmentation, with some reporting up to a 15% increase in campaign effectiveness.

By harnessing these advanced analytical tools, Bausch Health can enhance its commercial operations and foster deeper customer engagement. AI algorithms can predict market trends and identify key opinion leaders, allowing for more targeted outreach. This data-driven approach is essential for navigating the complexities of the pharmaceutical market and improving patient access to treatments.

- Data-Driven Market Insights: AI and big data analytics enable Bausch Health to gain deeper understanding of market dynamics, competitor activities, and patient demographics, leading to more informed strategic decisions.

- Personalized Marketing Campaigns: Leveraging AI for customer segmentation allows for tailored marketing messages, increasing relevance and engagement with healthcare professionals and patients.

- Sales Strategy Optimization: Predictive analytics can help optimize sales force deployment and resource allocation, focusing efforts on high-potential areas and improving overall commercial effectiveness.

- Enhanced Customer Engagement: By understanding customer behavior and preferences through data, Bausch Health can develop more impactful and personalized interactions, strengthening relationships within the healthcare ecosystem.

New Medical Device Technologies

Innovations in medical device technology, especially within eye health and aesthetic treatments, are crucial for Bausch Health. These advancements directly influence the performance of their Bausch + Lomb division and the Solta Medical segment. Staying ahead through continuous innovation is key to maintaining market leadership.

For instance, the medical aesthetics market, where Solta Medical operates, saw significant growth. In 2023, the global medical aesthetics market was valued at approximately $15.9 billion, with projections indicating continued expansion. Bausch Health's investment in R&D for devices like Thermage and Fraxel directly addresses this trend, aiming to capture a larger share of this lucrative market.

Bausch + Lomb also benefits from technological leaps in areas like contact lens materials and ophthalmic surgical equipment. The global ophthalmic devices market was estimated to be worth around $46.5 billion in 2023, underscoring the importance of cutting-edge products for Bausch Health's core business.

- Advancements in laser and energy-based devices for skin rejuvenation and body contouring are critical for Solta Medical's growth.

- Development of new contact lens technologies, including advanced materials for enhanced comfort and vision correction, supports Bausch + Lomb's market position.

- Innovation in surgical instrumentation and diagnostic tools for ophthalmology is essential for maintaining Bausch + Lomb's leadership in eye care.

Technological advancements in AI and data analytics are revolutionizing drug discovery and market insights for Bausch Health. The company is also capitalizing on the digital health boom, with the global telemedicine market projected to exceed $200 billion by 2024, enhancing patient engagement and product accessibility.

Bausch Health's manufacturing operations are increasingly automated, aiming for efficiency gains of up to 15% reported by industry peers between 2023-2024. This technological adoption is crucial for cost reduction and quality control.

Innovations in medical devices, particularly in eye care and aesthetics, are vital. The medical aesthetics market reached approximately $15.9 billion in 2023, and the ophthalmic devices market was valued around $46.5 billion in the same year, areas where Bausch Health actively invests.

Legal factors

Bausch Health Companies navigates a complex legal environment shaped by pharmaceutical patent law. Key to their strategy are mechanisms like patent term extensions, which can add years to exclusivity for innovative drugs, and the patentability of new uses for existing compounds. These legal protections are vital for recouping research and development costs and maintaining market share.

The company faces ongoing challenges from generic and biosimilar manufacturers seeking to enter the market once patents expire. Patent litigation, particularly concerning disputes over generic drug approvals, remains a significant and costly trend in the industry. For instance, in 2023, the U.S. Food and Drug Administration (FDA) approved over 1,200 generic drug applications, highlighting the constant pressure on originator products.

New legislation, like the U.S. Inflation Reduction Act (IRA), directly affects Bausch Health's revenue streams and how it gets its products to market. The IRA, enacted in August 2022, allows Medicare to negotiate prices for certain high-cost drugs, potentially impacting Bausch Health's profitability on those specific products. This legislative shift also drives efforts for greater price transparency across the pharmaceutical industry.

Bausch Health Companies must navigate a complex web of healthcare regulations, with agencies like the U.S. Food and Drug Administration (FDA) setting stringent standards. In 2024, the FDA continued its focus on drug safety and manufacturing quality, impacting product approvals and market access for pharmaceutical companies. Failure to comply can result in substantial fines, product recalls, and severe reputational harm, as seen in past enforcement actions across the industry.

International regulatory bodies also play a critical role, requiring Bausch Health to maintain compliance with varying standards in markets worldwide. The company's commitment to ethical marketing practices and supply chain transparency is under increasing scrutiny, with regulators in 2025 expected to further emphasize these areas. For instance, the European Medicines Agency (EMA) has been proactive in its oversight of marketing claims and product distribution.

Anti-Trust and Competition Laws

Bausch Health Companies operates under stringent anti-trust and competition laws, critical for preventing monopolistic practices and fostering a fair marketplace. These regulations significantly shape the company's strategic decisions, particularly concerning mergers, acquisitions, and overall market positioning. For instance, in 2023, regulatory bodies globally continued to scrutinize pharmaceutical industry consolidation, impacting potential M&A activities for companies like Bausch Health.

Navigating these legal frameworks is essential to avoid penalties and maintain operational flexibility. Failure to comply can result in substantial fines and operational restrictions, directly affecting market access and growth potential. The ongoing enforcement of these laws means Bausch Health must continually assess its market share and competitive strategies to ensure adherence.

- Regulatory Scrutiny: Antitrust authorities worldwide actively monitor the pharmaceutical sector for anti-competitive behavior.

- Merger & Acquisition Impact: Competition laws directly influence Bausch Health's ability to pursue strategic deals, potentially requiring divestitures or blocking transactions altogether.

- Market Strategy Constraints: Pricing strategies and product launches must be carefully considered to avoid allegations of predatory pricing or market dominance.

- Compliance Costs: Significant resources are allocated to legal counsel and compliance programs to ensure adherence to evolving antitrust regulations.

Data Privacy and Security Regulations

Bausch Health Companies, like all healthcare entities, faces stringent legal requirements regarding data privacy and security. The increasing digitalization of patient records and healthcare services means that compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe is non-negotiable. These laws are designed to safeguard sensitive patient information, and any breaches can lead to significant fines and reputational damage. For instance, in 2023, healthcare organizations faced an average cost of $10.10 million per data breach, a figure that underscores the financial implications of non-compliance.

The evolving landscape of artificial intelligence (AI) in healthcare also presents new data privacy challenges. As Bausch Health explores AI for drug discovery, diagnostics, or personalized medicine, ensuring that patient data used for training and deployment is anonymized and handled ethically is paramount. The legal framework surrounding AI and data usage is still developing, creating a complex environment for companies to navigate. For example, the European Union's AI Act, expected to be fully implemented by 2025, will introduce specific obligations for AI systems handling personal data, impacting how companies like Bausch Health can leverage AI technologies.

Key legal considerations for Bausch Health include:

- HIPAA Compliance: Ensuring all patient data handled within the US meets HIPAA's strict privacy and security standards, including business associate agreements with third-party vendors.

- GDPR Adherence: For operations or data processing involving EU residents, complying with GDPR's comprehensive rules on consent, data subject rights, and cross-border data transfers.

- Cybersecurity Laws: Staying abreast of and adhering to national and international cybersecurity laws that mandate specific security measures to prevent data breaches.

- AI Governance Frameworks: Developing internal policies and procedures that align with emerging AI regulations and ethical guidelines to ensure responsible data use in AI applications.

Bausch Health Companies operates within a dynamic legal and regulatory framework that significantly influences its operations and market strategies. The company must adhere to evolving patent laws, healthcare regulations, antitrust statutes, and data privacy mandates. Compliance is crucial to avoid penalties, maintain market access, and foster sustainable growth.

The U.S. Inflation Reduction Act (IRA), enacted in 2022, directly impacts pricing strategies for certain high-cost drugs by allowing Medicare negotiation, potentially affecting Bausch Health's revenue. Furthermore, ongoing FDA scrutiny in 2024 on drug safety and manufacturing quality necessitates rigorous adherence to standards. International regulations also demand compliance, with a growing emphasis in 2025 on ethical marketing and supply chain transparency.

Antitrust laws shape Bausch Health's M&A activities and market positioning, with global regulators scrutinizing industry consolidation in 2023. Data privacy laws like HIPAA and GDPR are paramount, especially with the increasing use of AI in healthcare, where emerging regulations like the EU's AI Act (expected by 2025) will govern data handling.

| Legal Area | Key Regulations/Trends | Impact on Bausch Health | Relevant Data/Examples |

|---|---|---|---|

| Patent Law | Patent Term Extension, Generic/Biosimilar Entry | Protects R&D investment, market exclusivity | Over 1,200 generic drug applications approved by FDA in 2023 |

| Healthcare Regulation | IRA, FDA Safety/Quality Standards | Affects drug pricing, market access | IRA allows Medicare negotiation for select drugs |

| Antitrust Law | Market Competition, M&A Scrutiny | Influences strategic deals and market strategy | Global scrutiny of pharma consolidation in 2023 |

| Data Privacy | HIPAA, GDPR, AI Regulations | Mandates patient data protection, impacts AI use | Average cost of data breach in healthcare: $10.10 million (2023) |

Environmental factors

Bausch Health, like many in the pharmaceutical sector, faces growing demands to implement sustainable manufacturing. This includes significant efforts to lower carbon emissions, reduce energy usage, and minimize waste generation. For instance, in 2023, the pharmaceutical industry continued to see a surge in companies publicly committing to net-zero targets, with many setting interim goals for emissions reductions by 2030.

These sustainability initiatives directly influence Bausch Health's operational expenses, as investing in greener technologies and processes can incur upfront costs. However, failing to adapt can negatively impact public perception and brand reputation, which are crucial in the healthcare industry. The increasing focus on Environmental, Social, and Governance (ESG) factors by investors and consumers alike means that proactive environmental stewardship is becoming a competitive necessity.

Stricter regulations around pharmaceutical waste and packaging are compelling companies like Bausch Health to enhance their waste management and pollution control. This includes a growing emphasis on reducing hazardous materials and adopting more sustainable packaging solutions.

Public and governmental pressure for environmental responsibility is driving investments in biodegradable packaging and circular economy models. For instance, the pharmaceutical industry is increasingly exploring ways to minimize its environmental footprint, with many companies setting targets for waste reduction by 2025.

Water scarcity and evolving regulations on water usage present a critical environmental factor for Bausch Health Companies. Pharmaceutical manufacturing, often reliant on significant water volumes for processes like cleaning, cooling, and formulation, can be directly impacted by these constraints. For instance, regions facing increased water stress may impose stricter limits on industrial water withdrawal, potentially affecting production capacity or increasing operational costs through water acquisition and treatment.

In response, Bausch Health is compelled to integrate robust water conservation techniques across its operations. This includes implementing water-efficient technologies in its manufacturing plants, such as closed-loop cooling systems and advanced filtration methods that allow for water reuse. Furthermore, effective wastewater treatment is paramount to ensure compliance with environmental discharge standards and to minimize the company's overall water footprint.

While specific 2024/2025 data on Bausch Health's water usage and conservation initiatives is not publicly detailed, the broader industry trend highlights a growing emphasis on sustainable water management. Reports from organizations like the World Health Organization in 2024 continue to underscore the increasing global pressure on freshwater resources, making proactive water stewardship a key element of operational resilience and corporate responsibility for pharmaceutical manufacturers like Bausch Health.

Supply Chain Environmental Footprint

Bausch Health Companies, like many in the pharmaceutical sector, faces increasing pressure regarding its supply chain's environmental footprint. This includes the impact of sourcing raw materials, manufacturing processes, and the transportation of finished goods. The company is therefore focused on initiatives to reduce emissions across its entire value chain.

Decarbonizing these complex networks is a significant undertaking. For instance, in 2023, the transportation sector globally accounted for approximately 25% of direct CO2 emissions, highlighting the critical role of logistics optimization for companies like Bausch Health. This necessitates exploring more sustainable shipping methods and efficient route planning.

- Supply Chain Emissions: Bausch Health is actively assessing and working to mitigate greenhouse gas emissions generated from its global supply chain operations.

- Logistics Optimization: Efforts are underway to enhance the efficiency of product distribution, aiming to reduce fuel consumption and associated environmental impacts.

- Sustainable Sourcing: The company is increasingly scrutinizing the environmental practices of its raw material suppliers to ensure alignment with its sustainability goals.

- Regulatory Scrutiny: Evolving environmental regulations worldwide place greater emphasis on corporate responsibility for supply chain sustainability.

Climate Change and Resource Availability

Long-term climate change presents significant challenges for Bausch Health Companies. Extreme weather events, such as intensified hurricanes or prolonged droughts, could disrupt the supply chain for crucial raw materials used in pharmaceutical and medical device manufacturing. For instance, a 2024 report highlighted that climate-related disruptions cost the global economy an estimated $100 billion in 2023 alone, impacting various industries including healthcare supply chains.

Manufacturing facilities and distribution networks are also vulnerable. Increased frequency of severe weather could lead to operational downtime, damage to infrastructure, and higher insurance premiums. Bausch Health’s reliance on global manufacturing sites means that regional climate impacts can have a cascading effect on product availability. Adapting to these evolving environmental conditions requires proactive risk management and investment in resilient infrastructure.

- Supply Chain Vulnerability: Climate change can impact the availability and cost of raw materials essential for Bausch Health's product portfolio.

- Operational Disruptions: Extreme weather events pose a risk to manufacturing sites and logistics, potentially leading to production delays and increased operational costs.

- Resource Depletion: Long-term scarcity of water or other key resources due to climate change could affect manufacturing processes and increase input costs.

- Adaptation Strategies: Bausch Health must implement robust risk management and adaptation strategies to mitigate the financial and operational impacts of climate change.

Bausch Health, like many in the pharmaceutical sector, faces growing demands to implement sustainable manufacturing, focusing on reducing carbon emissions and waste. In 2023, a significant number of pharmaceutical companies committed to net-zero targets, with interim goals for emissions reductions by 2030, influencing operational costs and brand reputation.

Stricter regulations on pharmaceutical waste and packaging are compelling companies like Bausch Health to enhance waste management and pollution control, including reducing hazardous materials and adopting sustainable packaging. Public and governmental pressure for environmental responsibility is driving investments in biodegradable packaging and circular economy models, with industry-wide targets for waste reduction by 2025.

Water scarcity and evolving regulations on water usage are critical environmental factors for Bausch Health. Pharmaceutical manufacturing's reliance on significant water volumes makes it vulnerable to stricter limits on industrial water withdrawal in water-stressed regions, potentially affecting production and increasing costs. The company is integrating water conservation techniques, such as closed-loop cooling systems, and effective wastewater treatment to comply with environmental discharge standards.

Long-term climate change poses significant challenges, with extreme weather events potentially disrupting raw material supply chains. A 2024 report indicated that climate-related disruptions cost the global economy approximately $100 billion in 2023. These events can lead to operational downtime, infrastructure damage, and increased insurance premiums for manufacturing facilities and distribution networks.

PESTLE Analysis Data Sources

Our PESTLE analysis for Bausch Health Companies draws from a comprehensive blend of official government reports, leading financial news outlets, and reputable industry-specific publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical and healthcare sectors.