Bausch Health Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bausch Health Companies Bundle

Curious about Bausch Health Companies' strategic positioning? Our BCG Matrix analysis reveals their portfolio's potential, highlighting which products are poised for growth and which require a closer look. Don't miss out on the full picture; purchase the complete report for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

Solta Medical, a key player in aesthetic medical devices, is a shining Star within Bausch Health's portfolio. Its impressive 33% organic revenue growth in the first quarter of 2025, fueled by robust sales in South Korea and China, highlights its position in a rapidly expanding market. Bausch Health's strategic focus and increasing market share in this segment underscore Solta's strong potential for continued success and global leadership.

Xifaxan, a flagship product within Bausch Health's gastroenterology portfolio, demonstrated robust performance with an 8% revenue increase in the first quarter of 2025. This sustained growth highlights its position as a strong contributor to the company's overall financial health.

A significant development for Xifaxan was the favorable ruling from the D.C. District Court in the Norwich case. This legal victory against the FDA concerning Xifaxan's market exclusivity and patent protection is crucial for securing its future revenue streams and reinforcing its market dominance within the expanding gastroenterology sector.

Daily SiHy lenses and Bausch + Lomb ULTRA contact lenses are performing strongly within Bausch Health Companies' eye health segment. In 2023, Bausch + Lomb saw net sales of $1.1 billion for its Vision Care segment, with contact lenses being a significant driver. These products are well-positioned in the expanding eye care market, a sector projected to grow steadily.

Bausch + Lomb's strategic focus on long-term, profitable growth and a revitalized product pipeline indicates continued investment in these successful product lines. This commitment aims to solidify or enhance their market share, suggesting these products are considered Stars in the BCG matrix, poised for significant future returns.

LUMIFY and Over-the-Counter Dry Eye Products

LUMIFY and other over-the-counter dry eye products from Bausch + Lomb are driving significant growth for Bausch Health Companies. This segment is benefiting from a heightened public awareness around eye health and a booming market for eye health supplements. These factors are positioning Bausch + Lomb's dry eye offerings for continued market share gains.

- Market Growth: The global dry eye market was valued at approximately $4.7 billion in 2023 and is projected to reach over $7.5 billion by 2030, indicating a compound annual growth rate of around 7%.

- LUMIFY's Performance: While specific sales figures for LUMIFY are not always broken out, the overall consumer eye health franchise, which includes LUMIFY, has demonstrated double-digit growth in recent reporting periods.

- Consumer Focus: Increased consumer spending on wellness and preventative health measures, including eye care, is a key driver for these over-the-counter products.

New Product Launches in Dermatology/Aesthetics

Bausch Health Companies is actively investing in the high-growth dermatology and aesthetics sector with recent product launches. The introduction of Thermage FLX, a non-invasive skin tightening device, and Fraxel FTX™, a new skin resurfacing laser, signals a strategic focus on innovative treatments. These products are positioned to capture market share in a rapidly expanding industry.

While these new offerings are still in the process of establishing their market presence, they represent significant future potential for Bausch Health. The aesthetics market, in particular, has shown robust growth. For instance, the global medical aesthetics market was valued at approximately $15.1 billion in 2023 and is projected to reach $31.7 billion by 2030, growing at a compound annual growth rate of 11.2% during this period. Successful adoption of Thermage FLX and Fraxel FTX™ could drive substantial revenue growth for the company.

- Thermage FLX: A non-invasive skin tightening device targeting the growing demand for anti-aging solutions.

- Fraxel FTX™: A new skin resurfacing laser designed to improve skin texture and tone, addressing a key aesthetic concern.

- Market Potential: Both products are entering a dynamic and expanding global medical aesthetics market, projected for significant growth through 2030.

- Strategic Importance: These launches underscore Bausch Health's commitment to innovation and capturing opportunities in high-margin aesthetic segments.

Solta Medical, with its 33% organic revenue growth in Q1 2025, is a prime example of a Star within Bausch Health's portfolio, capitalizing on the expanding aesthetic medical device market, particularly in Asia. Xifaxan, a key gastroenterology product, also demonstrates Star-like qualities, achieving an 8% revenue increase in Q1 2025, further bolstered by favorable court rulings protecting its market exclusivity. Bausch + Lomb's contact lenses and LUMIFY, representing the eye health segment, are performing strongly, supported by increased consumer spending on eye care and a growing market. The recent launches of Thermage FLX and Fraxel FTX™ in the high-growth dermatology sector also position these as potential Stars, targeting a market projected to reach $31.7 billion by 2030.

| Product/Segment | Category | Key Growth Driver | Market Growth (Approx.) | Bausch Health Performance |

|---|---|---|---|---|

| Solta Medical | Aesthetic Medical Devices | Demand for anti-aging, expansion in Asia | Global Medical Aesthetics: $15.1B (2023) to $31.7B (2030) | 33% organic revenue growth (Q1 2025) |

| Xifaxan | Gastroenterology | Market exclusivity, patent protection | Expanding gastroenterology sector | 8% revenue increase (Q1 2025) |

| Bausch + Lomb Contact Lenses | Eye Health | Consumer preference for vision correction | Contact Lens Market: Steady growth | $1.1B net sales for Vision Care (2023) |

| LUMIFY & Dry Eye Products | Eye Health (OTC) | Increased consumer awareness, wellness focus | Dry Eye Market: $4.7B (2023) to $7.5B (2030) | Double-digit growth in consumer eye health franchise |

| Thermage FLX & Fraxel FTX™ | Dermatology/Aesthetics | Innovation in skin tightening & resurfacing | Global Medical Aesthetics: 11.2% CAGR (2023-2030) | New launches in a high-growth, high-margin segment |

What is included in the product

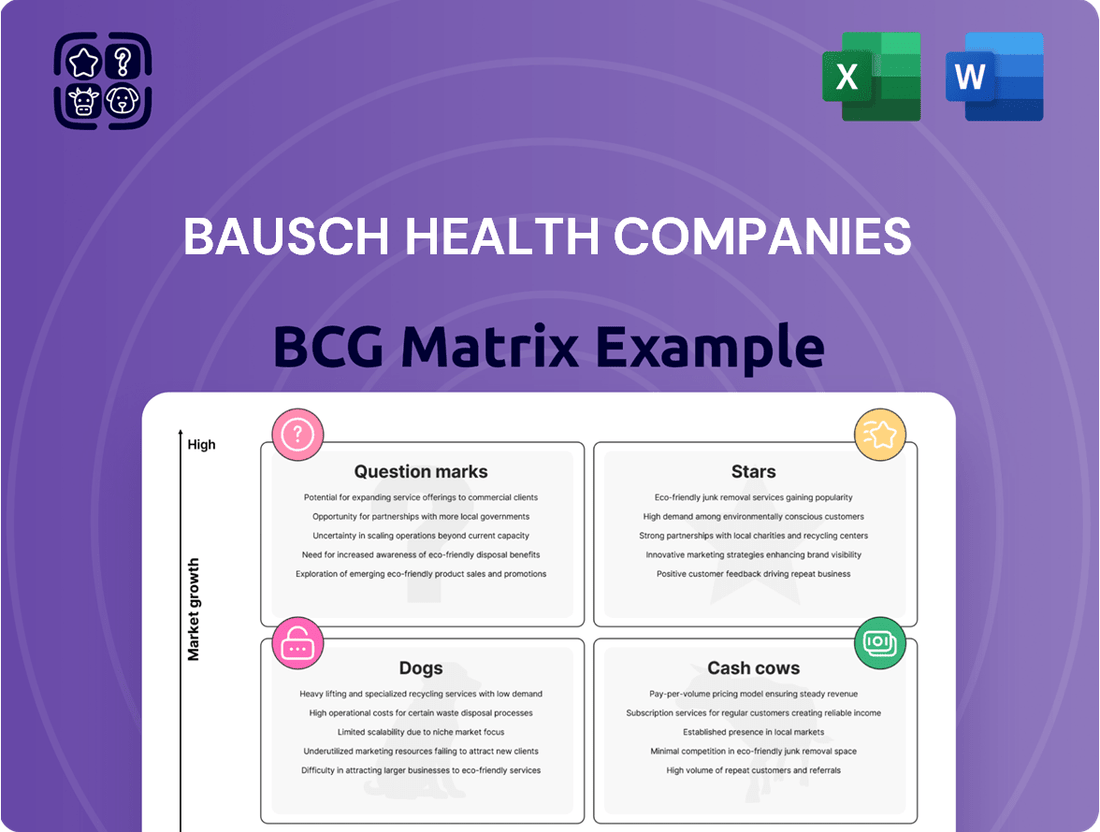

Bausch Health's BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This strategic framework highlights which business units to invest in, hold, or divest based on their market growth and share.

A clear BCG Matrix for Bausch Health, showing Stars, Cash Cows, Question Marks, and Dogs, acts as a strategic pain point reliever.

This visual tool helps Bausch Health prioritize investments and resource allocation, easing the pain of uncertain future growth.

Cash Cows

Bausch Health's established international pharmaceutical portfolio, a key segment, generally represents mature products in well-developed markets. This characteristic allows for consistent cash flow generation with relatively lower promotional spending, aligning perfectly with the definition of a Cash Cow in the BCG matrix.

While Q1 2025 saw a slight reported decrease, the segment demonstrated resilience with 5% organic growth, notably driven by strong performance in Canada. This ongoing stability and cash generation capability are crucial for funding other business ventures.

Bausch Health's mature gastroenterology portfolio, excluding Xifaxan, likely represents a significant source of stable cash flow. These products, benefiting from established market presence and brand loyalty, are positioned as Cash Cows within the BCG matrix. In 2023, Bausch Health reported total revenue of approximately $8.3 billion, with its Salix Pharmaceuticals division, which houses many of its gastroenterology products, being a key contributor.

Bausch Health's dermatology portfolio, featuring established treatments, likely represents strong cash cows within its business. These products, benefiting from high market share in mature segments, generate substantial and reliable cash flow. For instance, in 2023, Bausch Health's Salix Pharmaceuticals division, which includes many dermatology products, reported net sales of approximately $2.3 billion. This segment's consistent performance indicates its role as a significant contributor to the company's overall financial health, requiring minimal reinvestment to maintain its position.

Generic Pharmaceuticals Portfolio

Bausch Health Companies' generic pharmaceuticals portfolio represents a classic Cash Cow within its BCG Matrix. This segment benefits from established products that, while operating in a highly competitive market, often command significant market share. The mature nature of these generics translates to lower growth potential but robust profit margins and consistent cash flow generation, making them reliable contributors to the company's overall financial health.

The stability of these established generics is a key characteristic. Despite the intense competition inherent in the generic pharmaceutical market, these products have carved out their niches. This allows them to generate steady income streams, which are crucial for funding other strategic initiatives within Bausch Health.

- Market Position: Established generics in key therapeutic areas often hold substantial market share.

- Profitability: Mature generics typically exhibit high-profit margins due to lower R&D and marketing costs compared to branded drugs.

- Cash Flow: These products are consistent generators of free cash flow, supporting overall company operations and investments.

- Competitive Landscape: While competitive, the generic market offers stable demand for proven, cost-effective treatments.

Legacy Over-the-Counter Products

Bausch Health's legacy over-the-counter (OTC) products, distinct from their newer, high-growth segments like dry eye treatments, represent established brands that have a firm footing in mature consumer health markets. These products, often household names, continue to deliver reliable revenue streams with relatively low demands for significant new investment in marketing or product development.

These established OTC offerings are characterized by their stable cash generation, contributing significantly to the company's overall financial health. Their maturity means they require less capital expenditure to maintain their market position, allowing Bausch Health to allocate resources to more promising growth areas.

- Consistent Cash Flow: These products are reliable generators of cash, supporting the company's operations and investments.

- Mature Market Position: They hold established market share in consumer health categories that are not experiencing rapid expansion.

- Low Investment Needs: Unlike growth products, these legacy items require minimal new capital for marketing or R&D to sustain their performance.

- Brand Recognition: Many of these OTC products benefit from long-standing consumer trust and brand awareness.

Bausch Health's established international pharmaceutical portfolio, particularly its mature products in well-developed markets, functions as a Cash Cow. This segment generates consistent cash flow with relatively lower promotional spending, exemplified by Q1 2025's 5% organic growth, notably from Canada, demonstrating resilience and stable cash generation.

The gastroenterology portfolio, excluding Xifaxan, and the dermatology portfolio, featuring established treatments, are significant contributors. For instance, Salix Pharmaceuticals, housing many of these products, reported net sales of approximately $2.3 billion in 2023, highlighting their role as reliable cash generators requiring minimal reinvestment.

Bausch Health's generic pharmaceuticals and legacy over-the-counter (OTC) products also act as Cash Cows. These mature offerings, despite competitive markets, command significant market share and high-profit margins, generating steady income streams crucial for funding other strategic initiatives and overall company operations.

| Segment | BCG Category | Key Characteristics | 2023 Contribution (Illustrative) |

|---|---|---|---|

| International Pharma | Cash Cow | Mature products, stable markets, low promotional spend | Consistent cash flow generation |

| Gastroenterology (ex-Xifaxan) | Cash Cow | Established market presence, brand loyalty, stable revenue | Part of Salix's ~$2.3B revenue |

| Dermatology | Cash Cow | High market share in mature segments, reliable cash flow | Part of Salix's ~$2.3B revenue |

| Generics | Cash Cow | Established products, significant market share, high margins | Steady income streams |

| Legacy OTC | Cash Cow | Strong brand recognition, mature markets, low investment needs | Reliable revenue streams |

Full Transparency, Always

Bausch Health Companies BCG Matrix

The Bausch Health Companies BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This analysis-ready file has been professionally designed to provide strategic clarity on Bausch Health's product portfolio, mirroring the exact content and formatting of the final downloadable report.

Dogs

Bausch Health Companies' portfolio includes products that have experienced the expiration of their patent exclusivity, leading to significant generic competition. These products, once strong performers, now face market share erosion as lower-cost generic alternatives enter the landscape. For example, in 2024, the pharmaceutical sector continues to see this trend across various therapeutic areas, impacting companies like Bausch Health that rely on a diverse product pipeline.

Bausch Health Companies has been actively reviewing its business segments, with a focus on divesting underperforming or non-core assets. This strategic pruning is essential for optimizing resource allocation and sharpening the company's competitive edge. For instance, in 2023, Bausch Health completed the sale of its Bausch + Lomb Surgical business, a move that allowed them to concentrate on their core pharmaceutical and medical device offerings.

Assets that fall into the Dogs quadrant of the BCG matrix are typically characterized by low market share in slow-growing industries. These units often require significant investment to maintain their position without generating substantial returns, making them prime candidates for divestiture or restructuring. The company’s ongoing portfolio optimization efforts aim to identify and address such underperforming segments.

Products with declining market demand within Bausch Health's portfolio would be classified as Dogs in the BCG Matrix. These are offerings that have both a low market share and operate in a low-growth market.

For instance, if Bausch Health had a legacy ophthalmic drug whose market share has been eroded by newer, more effective treatments, and the overall market for that specific condition is shrinking, it would fit this category. Such products require careful management to minimize cash outflow and potentially phase out.

Certain International Pharmaceuticals with Stagnant Growth

Within Bausch Health Companies' international operations, certain established pharmaceutical products, particularly those with older formulations or facing increased competition in specific geographic markets, may exhibit stagnant growth. These products, while potentially contributing to revenue, could be characterized by low market share and declining profitability, placing them in the Dogs quadrant of the BCG Matrix.

For instance, if a legacy dermatological treatment in a European market has seen its market share erode from 15% to 5% over the past five years due to new entrants, it would represent a classic example of a Dog. Such products often require ongoing investment in marketing and distribution, diverting capital from more promising growth areas.

In 2024, this situation might be reflected in the company's reporting where specific international product lines show minimal or negative organic growth, contributing less than 1% to the overall international segment's revenue increase. This stagnation indicates a need for strategic evaluation, potentially leading to divestiture or a significant restructuring of marketing efforts.

- Stagnant International Products: Older pharmaceuticals in specific regions with declining market share.

- Resource Drain: These products may consume resources without generating substantial returns.

- Low Market Share: Indicative of reduced competitiveness or market saturation.

- Strategic Re-evaluation: Potential for divestment or repositioning due to poor performance.

Products with High Manufacturing Costs and Low Profitability

Products with high manufacturing costs and low profitability, often found in mature or declining markets, represent Bausch Health's Dogs in the BCG Matrix. These products consume resources without generating significant returns, potentially draining cash flow rather than contributing to it. Such items might include older pharmaceutical formulations or medical devices facing intense competition or obsolescence.

For instance, if a particular legacy drug requires expensive raw materials and complex manufacturing processes, yet its market share has dwindled due to newer, more effective treatments, it would likely fall into this category. In 2024, Bausch Health's focus on optimizing its product portfolio means identifying and potentially divesting or restructuring such underperforming assets to reallocate capital towards growth areas.

- High Cost, Low Return: Products with elevated production expenses and minimal profit margins.

- Cash Drainers: Items that consume more cash than they generate, negatively impacting overall cash flow.

- Market Position: Typically found in low-growth or declining market segments with limited competitive advantage.

- Strategic Consideration: Bausch Health likely evaluates these products for divestiture, restructuring, or discontinuation to improve efficiency.

Products classified as Dogs within Bausch Health Companies' BCG Matrix are those with low market share in industries experiencing minimal growth. These offerings often require substantial investment to maintain their position, yielding little in return, making them candidates for divestment or significant restructuring. For example, in 2024, the company continues its strategic review of its portfolio, which includes identifying and addressing such underperforming segments to optimize resource allocation.

These products are characterized by declining demand and a reduced competitive edge. They may represent older pharmaceutical formulations or medical devices that have been surpassed by newer innovations or face intense generic competition. The company's proactive approach involves evaluating these assets to potentially phase them out or reallocate capital to more promising areas of the business.

For instance, a legacy ophthalmic drug whose market share has significantly diminished due to the emergence of more effective treatments, coupled with a shrinking market for that specific condition, would exemplify a Dog. Such products necessitate careful management to minimize cash outflows and often require strategic decisions regarding their future within the company's portfolio.

In 2024, Bausch Health's focus on portfolio optimization means that products with high manufacturing costs and low profitability, especially those in mature or declining markets, are being scrutinized. These items, which consume resources without generating significant returns, could include older pharmaceutical formulations or medical devices facing obsolescence or fierce competition.

| Product Category | Market Growth | Market Share | BCG Classification | Strategic Implication |

| Legacy Pharmaceuticals | Low | Low | Dog | Divestment or Restructuring |

| Older Medical Devices | Declining | Low | Dog | Phase-out or Repositioning |

| Mature OTC Products | Stagnant | Low | Dog | Minimize Investment, Evaluate Divestment |

Question Marks

Amiselimod, a gastrointestinal pipeline product for Bausch Health Companies, fits squarely into the Question Mark quadrant of the BCG Matrix. Its status as a developmental compound signifies substantial growth potential within the GI market, a sector that continues to see innovation and patient demand. However, as it's not yet commercialized, its current market share is effectively zero, a defining characteristic of a Question Mark.

Bringing Amiselimod to market will necessitate significant capital investment for research, development, clinical trials, and eventual marketing. Bausch Health's commitment to this product reflects a strategic bet on future market penetration and revenue generation. The success of Amiselimod will hinge on its ability to gain regulatory approval and capture market share in a competitive therapeutic area.

Bausch Health’s Solta Medical is a recognized Star in the aesthetic market, but newly launched or niche devices, especially those targeting emerging sub-markets, would initially be classified as Question Marks within the BCG Matrix. These innovations, while positioned in potentially high-growth areas, are still building brand recognition and market penetration. For instance, if Bausch Health were to introduce a novel, non-invasive skin rejuvenation therapy in 2024 that targets a specific, underserved demographic, it would represent a significant investment in a developing segment.

Bausch Health Companies' early-stage R&D programs are crucial investments in future growth, spanning areas like dermatology, gastroenterology, and ophthalmology. These initiatives represent potential breakthroughs but currently hold no market share, making their future success a significant uncertainty. For instance, in 2023, Bausch Health reported $483 million in R&D expenses, a substantial commitment to nurturing these nascent projects.

Strategic Acquisitions in Emerging Therapeutic Areas

Strategic acquisitions in emerging therapeutic areas, where Bausch Health currently has a low market presence, would initially be classified as Stars within the BCG Matrix.

These ventures would be situated in high-growth markets, demanding substantial capital infusion to expand operations and capture market share. For instance, Bausch Health's recent strategic focus on dermatology and gastroenterology, areas with significant unmet needs and projected market growth, exemplifies this approach.

- Emerging Therapeutic Areas: High-growth potential markets with low current penetration for Bausch Health.

- Initial BCG Classification: Stars, requiring significant investment for market leadership.

- Investment Needs: Capital for R&D, marketing, and scaling operations to compete effectively.

- Example: Focus on dermatology and gastroenterology, reflecting a commitment to high-potential, underserved medical fields.

Products in International Markets with Nascent Presence

Products in nascent international markets for Bausch Health Companies would be classified as Question Marks in the BCG Matrix. These are offerings where the company is in the early stages of market entry or operating in developing regions with significant growth prospects but currently holding a minimal market share. For instance, consider Bausch Health's recent expansion into certain Southeast Asian markets with its ophthalmic solutions. While the overall market for eye care in these regions is projected to grow, Bausch Health's penetration is still nascent.

These ventures necessitate considerable investment to build brand awareness, establish distribution networks, and compete effectively. Such strategic moves are crucial for future growth but carry higher risk due to the unproven market position. For example, Bausch Health's investment in establishing local manufacturing capabilities in India for certain dermatological products, aiming to capture a growing middle-class consumer base, exemplifies this strategy.

- Nascent Market Entry: Bausch Health's foray into specific African countries with its gastroenterology products, where regulatory hurdles and distribution challenges are significant, places these offerings in the Question Mark category.

- Low Market Share in High-Growth Areas: In markets like Brazil, where the demand for pain management solutions is rising, Bausch Health's current market share for certain legacy pain relief products is still relatively small, requiring investment to gain traction.

- Investment for Penetration: The company's strategy to invest in marketing and sales force expansion for its orthopedic implants in emerging European markets, such as Poland, reflects the need for substantial capital to achieve significant market penetration.

Question Marks in Bausch Health Companies' BCG Matrix represent products or ventures with low market share in high-growth industries. These are typically new products, early-stage R&D projects, or expansions into nascent international markets. Significant investment is required to develop these into potential Stars or Cash Cows, as their future success is uncertain.

For instance, Bausch Health's investment in its Amiselimod gastrointestinal product exemplifies a Question Mark. While the GI market offers growth, Amiselimod's lack of commercialization means zero current market share, necessitating substantial capital for R&D and market entry. In 2023, Bausch Health allocated $483 million to R&D, a clear indicator of its commitment to nurturing such high-potential, uncertain ventures.

Newly launched aesthetic devices targeting niche demographics also fall into this category. These innovations, while in high-growth segments, need time and capital to build brand recognition and market share. Bausch Health's strategic focus on expanding its presence in dermatology and gastroenterology in emerging markets, where its current penetration is low, further highlights its investment in potential Question Marks.

These ventures require substantial capital for market penetration, including R&D, marketing, and sales force expansion, as seen in their efforts to gain traction in markets like Poland for orthopedic implants. The success of these Question Marks is crucial for Bausch Health's future growth pipeline.

| Bausch Health Companies BCG Matrix: Question Marks | Description | Example | Investment Needs | 2024 Outlook/Data |

|---|---|---|---|---|

| Product/Venture | Low Market Share in High-Growth Market | Amiselimod (GI Pipeline) | R&D, Clinical Trials, Marketing | Continued R&D investment; market potential in growing GI sector. |

| Product/Venture | Nascent Market Entry | Ophthalmic Solutions in Southeast Asia | Brand Building, Distribution Networks | Focus on expanding presence in developing regions. |

| Product/Venture | Emerging Technology/Niche Market | New Aesthetic Devices | Market Penetration, Sales & Marketing | Investment in innovation for underserved demographics. |

| Product/Venture | Early-Stage R&D Programs | Dermatology, Ophthalmology Initiatives | Research Funding, Development Capital | $483 million R&D spend in 2023 highlights commitment to future growth areas. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.