Bank of Zhengzhou PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Zhengzhou Bundle

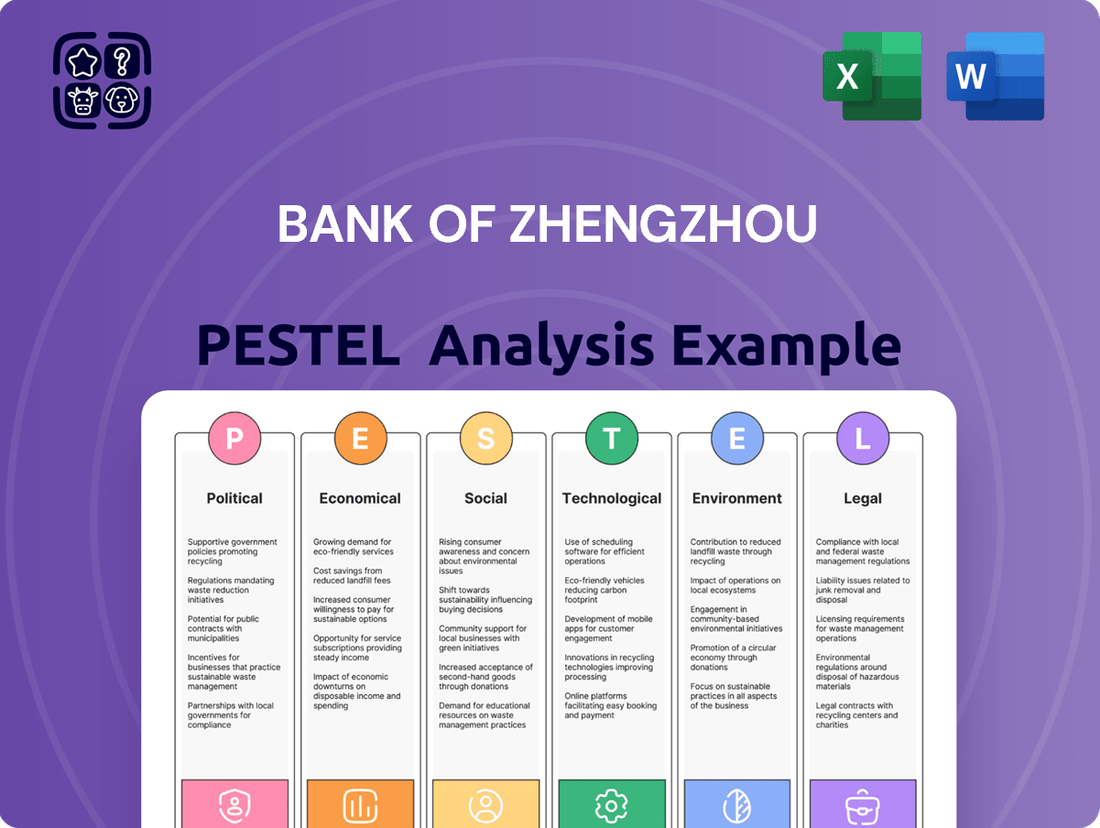

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Bank of Zhengzhou. From evolving government regulations to shifting consumer behavior and technological advancements, understanding these external forces is paramount for strategic success. Our comprehensive PESTLE analysis provides the in-depth insights you need to anticipate challenges and capitalize on opportunities. Don't get left behind; gain a competitive edge by downloading the full report now and making informed decisions for the Bank of Zhengzhou's future.

Political factors

Government policy is a major influence on the Bank of Zhengzhou. Both the central Chinese government and provincial authorities, like Henan's, actively shape the banking landscape. These policies can directly impact the bank's lending activities and access to funding.

Policies aimed at boosting regional economic development in Henan province are particularly beneficial for the Bank of Zhengzhou. This can translate into more opportunities for the bank to finance local projects and businesses, potentially increasing its loan portfolio. For example, initiatives supporting agriculture or manufacturing within Henan would be positive catalysts.

However, the Bank of Zhengzhou must also navigate potential challenges arising from government oversight. Stricter regulations or policy shifts focused on enhancing financial stability across the region could introduce new compliance requirements or limit certain types of lending activities.

The People's Bank of China (PBOC) plays a crucial role in shaping the financial landscape for institutions like the Bank of Zhengzhou through its monetary policy decisions. These directives, encompassing interest rates and reserve requirements, directly influence a bank's profitability and its ability to lend.

Looking ahead to 2025, the PBOC is anticipated to continue its stance of moderately loose monetary policy. This approach is likely to involve further adjustments, such as potential cuts to benchmark interest rates and the reserve requirement ratio (RRR). For instance, if the PBOC were to lower the RRR by 50 basis points, it could free up significant liquidity for banks.

China's financial sector is experiencing substantial regulatory shifts, notably with the creation of the National Financial Regulatory Administration (NFRA) in March 2023, which now oversees most financial institutions, excluding securities. This consolidation is designed to streamline oversight and enhance the effectiveness of regulation. Bank of Zhengzhou must navigate these changes, which include stricter capital requirements and enhanced risk management frameworks intended to bolster financial stability.

These reforms are a direct response to previous instances of regulatory fragmentation and aim to foster a more cohesive and robust financial system. The NFRA’s mandate includes tighter supervision over areas like shadow banking and fintech, potentially impacting Bank of Zhengzhou's business lines and requiring greater adherence to compliance protocols. For instance, the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) functions have been largely absorbed by the NFRA, signaling a more centralized approach.

Local Government Debt and Real Estate Stability

The financial health of local governments and the real estate sector in Henan province presents a significant political consideration for the Bank of Zhengzhou. The stability of Local Government Financing Vehicles (LGFVs) directly impacts the bank's asset quality and credit risk exposure. For instance, in late 2023 and early 2024, concerns persisted regarding the debt servicing capabilities of many Chinese LGFVs, which are heavily reliant on land sales and infrastructure project revenues.

Government policies aimed at managing local government debt and injecting stability into the property market are critical. Initiatives such as the 'whitelist' system for real estate projects, designed to ensure the completion of pre-sold housing, are intended to mitigate risks within the bank's loan portfolio. The effectiveness of these top-down directives in resolving underlying economic fragilities will be a key determinant of the Bank of Zhengzhou's operational environment.

- Local Debt Management: Chinese authorities have been actively addressing local government debt, with measures to restructure and refinance existing obligations throughout 2024.

- Real Estate Support: The 'whitelist' program, implemented in various provinces including Henan, aims to provide financial support to eligible property developments, impacting developer creditworthiness and project viability.

- Economic Interdependence: The health of the real estate sector is intrinsically linked to local government revenues, creating a complex interplay that influences the banking sector.

Anti-Corruption and Governance Initiatives

China's ongoing commitment to anti-corruption campaigns, particularly within its financial sector, directly impacts institutions like the Bank of Zhengzhou. These efforts, intensified in recent years, mandate higher standards of transparency and ethical conduct, pushing banks to strengthen internal oversight and compliance mechanisms. For instance, the crackdown on financial misconduct in 2023 saw numerous officials and executives investigated, reinforcing the need for robust governance structures.

The push for enhanced corporate governance means the Bank of Zhengzhou must adapt to stricter regulations. This includes improved risk management frameworks, greater accountability for decision-making, and more rigorous disclosure requirements. Such measures are designed to build trust and mitigate systemic financial risks across the nation.

These initiatives translate into tangible operational changes for the bank:

- Increased Compliance Costs: Implementing and maintaining enhanced governance and anti-corruption protocols often requires significant investment in technology and personnel.

- Reputational Benefits: Adherence to strong governance can bolster the bank's image, attracting investors and customers who prioritize ethical business practices.

- Reduced Operational Risk: Stricter controls and transparency measures can help prevent fraud and mismanagement, thereby lowering the bank's exposure to operational risks.

- Focus on ESG: The emphasis on good governance aligns with broader Environmental, Social, and Governance (ESG) principles, which are increasingly important for financial institutions globally.

Government policy continues to be a primary driver for the Bank of Zhengzhou, with directives from the People's Bank of China (PBOC) and the newly established National Financial Regulatory Administration (NFRA) setting the operational parameters. Anticipated moderately loose monetary policy in 2025, potentially including RRR cuts, aims to inject liquidity into the banking system. The NFRA's consolidated oversight, absorbing functions from previous bodies like the CBIRC, signals a more centralized and stringent regulatory environment, demanding enhanced risk management and compliance from institutions like Bank of Zhengzhou.

Navigating local government debt and real estate sector stability remains a critical political factor. Policies designed to manage Local Government Financing Vehicle (LGFV) debt and support struggling property developments, such as the 'whitelist' system, directly influence the bank's asset quality and credit risk. The effectiveness of these measures in stabilizing the economic foundation of Henan province is paramount for the Bank of Zhengzhou's loan portfolio health.

China's aggressive anti-corruption drive has a direct bearing on the Bank of Zhengzhou, necessitating robust governance and transparency. Increased compliance costs and stricter oversight are expected as the bank fortifies its internal controls and adheres to higher ethical standards, aiming to mitigate operational risks and enhance its reputation.

What is included in the product

This PESTLE analysis of the Bank of Zhengzhou examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic direction.

A concise PESTLE analysis for the Bank of Zhengzhou acts as a pain point reliever by offering a clear, summarized overview of external factors, simplifying complex market dynamics for efficient decision-making.

Economic factors

Bank of Zhengzhou's fortunes are closely tied to the economic pulse of Henan Province, its primary operational base. The bank's growth and profitability are therefore directly influenced by the region's economic dynamism and development trajectory.

Henan Province is actively pursuing ambitious economic development goals, with strategic investments concentrated in key sectors. These include the expansion of advanced manufacturing capabilities, the burgeoning new energy vehicle (NEV) industry, and significant infrastructure development initiatives across the province.

These targeted growth areas are expected to generate increased demand for a wide range of banking services. For instance, the expansion of manufacturing and the NEV sector will likely spur demand for corporate lending, trade finance, and investment banking services, while infrastructure projects will necessitate substantial financing and project management support.

In 2023, Henan Province's GDP reached approximately 6.13 trillion yuan, representing a 5.0% year-on-year increase, underscoring a steady pace of economic expansion that supports the Bank of Zhengzhou's operational environment.

The Bank of Zhengzhou, like its peers in China, faces headwinds from declining interest margins and lending rates. In 2023, China's benchmark loan prime rate (LPR) saw reductions, impacting banks' ability to earn on loans. This trend continued into early 2024, with further cuts aimed at boosting economic activity.

These rate cuts, while intended to stimulate broader economic growth, directly squeeze the Bank of Zhengzhou's net interest margin (NIM). A narrower NIM means less profit generated from the spread between interest income and interest expenses, a critical component of bank profitability.

For instance, the average NIM for Chinese commercial banks has been on a downward trajectory, falling below 2% in recent periods, a level that challenges profitability. This environment necessitates strategic adjustments by banks like Zhengzhou to manage costs and diversify revenue streams.

The People's Bank of China's accommodative monetary policy, while supportive of economic expansion, presents a persistent challenge for the Bank of Zhengzhou in maintaining robust NIM levels. Navigating this landscape requires a keen focus on operational efficiency and fee-based income generation.

Overall credit expansion in China has been subdued, impacting regional banks like the Bank of Zhengzhou. In 2023, China's total social financing, a broad measure of credit to the real economy, saw slower growth compared to previous years, reflecting weaker corporate and consumer demand for loans. This trend has continued into early 2024, with loan growth moderating.

This tepid credit demand presents a significant challenge for the Bank of Zhengzhou. Expanding its loan portfolio and achieving robust asset growth becomes more difficult when businesses and individuals are hesitant to borrow. The bank needs to navigate this environment by focusing on specific sectors or customer segments that still exhibit borrowing needs.

Real Estate Market Conditions

The Chinese real estate market's ongoing struggles present a substantial headwind for the broader economy, directly impacting financial institutions like the Bank of Zhengzhou. This sector's downturn translates into increased risks of non-performing loans and a general erosion of asset quality for banks.

The stability of the property market, both within Henan province and across China, is therefore a critical determinant of the Bank of Zhengzhou's financial well-being. Recent data highlights the severity of this challenge; for instance, in early 2024, property investment in China saw a significant year-on-year decline, contributing to broader economic concerns.

The Bank of Zhengzhou's exposure to the real estate sector is a key area of focus for its risk management strategies.

- Property Sector Drag: The real estate downturn continues to weigh heavily on China's economic growth.

- NPL Risk: A struggling property market directly increases the risk of non-performing loans for banks.

- Asset Quality Impact: Declining property values can significantly reduce the value of assets held by banks.

- Henan's Role: The health of Henan's real estate market is particularly important for the Bank of Zhengzhou.

Inflation and Consumer Spending

Persistently low inflation, hovering around 0.7% in China for much of 2023, coupled with subdued domestic demand, presents a significant headwind for consumer spending and overall business confidence. This economic climate directly impacts entities like the Bank of Zhengzhou, whose retail banking operations are especially vulnerable. A lack of robust consumer spending can translate into slower deposit growth and reduced demand for personal loans.

The Bank of Zhengzhou's retail segment is intricately linked to consumer sentiment, which is often dampened by prolonged periods of low inflation and economic uncertainty. For instance, if consumers perceive that their purchasing power isn't increasing or is even stagnant, they are less likely to borrow for major purchases or increase their savings. This can affect the bank's net interest margin and overall profitability.

- Consumer Spending Trends: China's retail sales growth, while recovering, has shown volatility. For example, retail sales saw a 3.1% year-on-year increase in the first four months of 2024, indicating a gradual but uneven recovery in consumer demand.

- Inflation Data: The Consumer Price Index (CPI) in China remained at a low level, with year-on-year increases generally below 1% throughout much of 2023 and early 2024, signalling weak inflationary pressures.

- Impact on Deposits: Lower consumer confidence can lead to a preference for saving over spending, potentially boosting deposit levels but at lower interest rates if demand for loans remains weak.

- Loan Demand: A cautious consumer outlook, influenced by inflation and economic sentiment, typically results in reduced demand for discretionary loans, impacting the bank's lending business.

Henan Province's economy is a key driver for the Bank of Zhengzhou. In 2023, the province's GDP grew by 5.0% to approximately 6.13 trillion yuan, indicating a stable economic environment that supports the bank's operations. Strategic investments in advanced manufacturing, new energy vehicles, and infrastructure are poised to further boost demand for banking services.

However, the bank faces challenges from declining interest margins. China's benchmark loan prime rate (LPR) cuts in 2023 and early 2024 have compressed net interest margins (NIMs) for Chinese commercial banks, with average NIMs falling below 2%. This trend directly impacts the Bank of Zhengzhou's profitability, necessitating a focus on operational efficiency and diversified revenue.

Subdued credit expansion in China, with slower growth in total social financing in 2023 compared to previous years, also presents a hurdle. This weaker demand for loans makes it more challenging for the Bank of Zhengzhou to expand its loan portfolio and achieve robust asset growth, requiring a targeted approach to lending.

The downturn in China's real estate sector, including in Henan, poses a significant risk. Property investment saw a notable year-on-year decline in early 2024, increasing the potential for non-performing loans and impacting asset quality for the Bank of Zhengzhou. The bank's exposure to this sector is a critical consideration for its risk management.

Preview the Actual Deliverable

Bank of Zhengzhou PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of Zhengzhou provides actionable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the market landscape and strategic considerations for this key financial institution.

Sociological factors

Chinese consumers, particularly in regions like Henan, are rapidly shifting towards digital banking. By the end of 2024, it's projected that over 85% of daily transactions in major Chinese cities will be conducted digitally, a significant jump from 70% in 2022. This trend is fueled by the widespread adoption of smartphones and the convenience of mobile payment systems like Alipay and WeChat Pay.

Bank of Zhengzhou must actively adapt to these changing consumer preferences. To stay competitive, the bank needs to invest in and continuously improve its digital banking platforms, offering user-friendly mobile apps and secure online services. This includes features such as seamless account management, quick money transfers, and integrated bill payments.

Meeting these evolving demands is crucial for customer retention and acquisition. For instance, surveys from early 2025 indicate that over 60% of younger banking customers in China prioritize a bank's digital capabilities when choosing a financial institution. Therefore, Bank of Zhengzhou's ability to provide a robust and intuitive digital experience will be a key differentiator.

Bank of Zhengzhou's success hinges on addressing varying levels of financial literacy across its customer base, from novice individuals to established businesses. In 2023, Henan province’s rural population, a key demographic for the bank, saw a per capita disposable income of approximately ¥16,000, indicating a need for accessible financial education.

To foster financial inclusion, especially in less-developed regions of Henan, Bank of Zhengzhou is focusing on developing user-friendly digital platforms and offering targeted workshops. For instance, a recent initiative saw over 5,000 individuals in rural counties participate in financial planning seminars by mid-2024.

Zhengzhou, as the capital of Henan province, is experiencing significant urbanization, drawing over 12.6 million permanent residents as of the end of 2023. This influx fuels demand for banking services, presenting Bank of Zhengzhou with opportunities to grow its retail and corporate offerings in a dynamic urban environment.

The aging demographic, with over 15% of China’s population aged 65 and above in 2024, also requires specific financial products and services, including wealth management and retirement planning. Bank of Zhengzhou must adapt its strategies to cater to this evolving customer base.

Trust and Reputation in the Banking System

Public trust is a bedrock for any financial institution, and for regional banks like the Bank of Zhengzhou, this is especially true. In China, depositor confidence can be influenced by broader systemic issues. For instance, concerns about the financial health of specific regional banks, as highlighted by past events, can create ripple effects, making customers more cautious about where they place their money. This underscores the critical importance of maintaining a strong reputation for stability and ethical conduct.

The Bank of Zhengzhou's reputation is intrinsically linked to the overall health and perception of the Chinese banking sector. Any negative news or perceived instability within the larger system can erode depositor confidence, potentially leading to capital flight or a general reluctance to engage with regional players. For example, while specific data for the Bank of Zhengzhou's trust metrics isn't publicly granular, broader surveys of consumer confidence in Chinese banks provide a general barometer. A 2024 report indicated that while overall confidence remained relatively stable, specific concerns about smaller, regional institutions persisted among a segment of the population.

Maintaining a positive reputation requires a proactive approach to transparency and communication. In 2024 and leading into 2025, banks are facing increased scrutiny regarding their risk management practices and customer service. The Bank of Zhengzhou, like its peers, must demonstrate robust financial health and adhere to strict regulatory standards to reassure both individual and corporate depositors.

Key factors influencing trust include:

- Regulatory Compliance: Adherence to all banking regulations and capital requirements builds confidence.

- Financial Performance: Consistent profitability and strong asset quality are vital indicators.

- Customer Service: Responsive and ethical customer interactions foster loyalty.

- Risk Management: Effective identification and mitigation of financial risks are paramount.

Wealth Distribution and Income Levels

Wealth distribution and income levels in Henan province directly shape the demand for Bank of Zhengzhou's offerings. As of 2023, Henan's per capita disposable income reached RMB 27,334, indicating a growing consumer base with varying financial needs. This disparity means the bank must cater to both those seeking basic savings solutions and a rising segment interested in sophisticated wealth management and investment products.

The uneven distribution of wealth means the Bank of Zhengzhou needs to segment its market carefully. For instance, while urban areas might see higher demand for premium banking services, rural areas may still focus on essential deposit and loan products. By understanding these local economic realities, the bank can more effectively tailor its product development and marketing strategies.

- Henan's Per Capita Disposable Income: RMB 27,334 in 2023, showing an upward trend.

- Urban vs. Rural Disparities: Significant differences in income and wealth accumulation require tailored banking approaches.

- Demand for Financial Products: Growing middle class fuels demand for wealth management, but basic banking services remain crucial.

- Targeted Service Development: Understanding income levels is key to designing relevant and accessible banking solutions for all segments of the Henan population.

Societal attitudes towards digital finance are rapidly evolving in China, with a strong preference for convenience and speed. By the end of 2024, it is anticipated that over 85% of daily financial transactions in major Chinese cities will be conducted digitally, a significant increase from 70% in 2022. This shift necessitates that Bank of Zhengzhou enhance its digital platforms to meet customer expectations for seamless mobile banking experiences.

Financial literacy levels present a varied landscape, particularly in Henan province. With a per capita disposable income of approximately ¥16,000 in rural areas in 2023, the bank must balance offering sophisticated products with accessible financial education. Initiatives like financial planning seminars, which saw over 5,000 rural participants by mid-2024, are crucial for broader customer engagement.

Demographic shifts, including an aging population where over 15% of China’s citizens are projected to be 65+ by 2024, demand tailored financial services. Bank of Zhengzhou needs to develop specialized products for retirement planning and wealth management to serve this growing segment effectively.

Public trust is paramount, and regional banks like Bank of Zhengzhou are sensitive to broader market perceptions. While specific trust metrics for the bank are not granularly public, a 2024 report indicated that some consumers remain cautious about smaller regional institutions, highlighting the need for transparent communication and robust risk management to maintain confidence.

Technological factors

The digital finance landscape in China is booming, with an impressive nearly 90% of citizens actively using digital finance apps and mobile payment solutions. This widespread adoption means Bank of Zhengzhou must prioritize significant investments in its digital banking infrastructure to keep pace. This includes continually improving its online platforms and mobile applications.

To effectively serve its growing customer base, the bank needs to ensure its mobile applications and payment systems are not only user-friendly but also highly secure and efficient. Meeting customer expectations for seamless digital transactions is paramount in this rapidly evolving market.

The financial technology (FinTech) landscape is rapidly evolving, presenting significant competition and driving innovation within the banking sector. FinTech firms are increasingly offering specialized, user-friendly solutions that can challenge traditional banking models. For instance, by mid-2024, digital payment platforms in China, many with FinTech roots, processed trillions of yuan in transactions, a figure expected to continue its upward trajectory.

Bank of Zhengzhou needs to proactively embrace technological advancements to remain competitive. This includes integrating artificial intelligence (AI) for personalized customer service and utilizing big data analytics to understand market trends and customer behavior more effectively. By Q1 2025, major Chinese banks are projected to increase their investment in AI and cloud computing by over 15% year-over-year to enhance operational efficiency and product development.

Furthermore, collaboration with FinTech companies presents a strategic opportunity for Bank of Zhengzhou. Such partnerships can accelerate the development of new digital products, improve existing services, and expand market reach. In 2024, over 60% of established financial institutions globally reported engaging in some form of FinTech partnership or acquisition to bolster their digital capabilities.

The increasing reliance on digital platforms for banking operations elevates cybersecurity and data security to paramount concerns for the Bank of Zhengzhou. As the financial sector experiences rapid digitalization, the potential for sophisticated cyber threats and data breaches grows significantly. Protecting sensitive customer information and maintaining the integrity of financial transactions are critical for preserving trust and operational stability. In 2023, the global cost of cybercrime was estimated to reach $10.5 trillion annually, a stark reminder of the financial and reputational damage that can result from security lapses. Consequently, the Bank of Zhengzhou must allocate substantial resources towards implementing cutting-edge cybersecurity defenses and ensuring strict adherence to evolving data protection regulations, such as China's Personal Information Protection Law (PIPL).

Artificial Intelligence (AI) and Big Data Integration

Artificial Intelligence (AI) and Big Data are fundamentally reshaping the banking sector, allowing for sharper risk evaluations, customized client experiences, and more effective fraud prevention. The Bank of Zhengzhou can leverage these advancements to streamline its operations, bolster its risk management framework, and develop more specialized financial offerings for its customers. For instance, in 2024, banks globally are investing heavily in AI, with some reports suggesting that AI adoption in financial services could reach $25 billion by 2025, up from an estimated $10 billion in 2023. This investment fuels the development of sophisticated algorithms for credit scoring and market trend analysis.

The integration of AI and Big Data analytics allows institutions like the Bank of Zhengzhou to gain deeper insights into customer behavior, leading to more targeted marketing campaigns and product development. This also translates to improved efficiency in back-office processes, such as compliance checks and transaction monitoring. The potential for enhanced customer retention through personalized services is significant, as studies indicate that personalized banking experiences can increase customer loyalty by up to 20%.

Key applications for the Bank of Zhengzhou include:

- Enhanced Risk Management: Utilizing AI algorithms to predict loan defaults and identify potential market risks with greater accuracy.

- Personalized Customer Experiences: Deploying AI-powered chatbots for 24/7 customer support and offering tailored financial advice based on individual spending patterns.

- Fraud Detection and Prevention: Implementing machine learning models to identify and flag suspicious transactions in real-time, reducing financial losses.

- Operational Efficiency: Automating routine tasks and optimizing internal workflows, leading to cost savings and increased productivity.

Blockchain Technology and Digital Currency

Blockchain technology and the evolving landscape of digital currencies, particularly the central bank's digital currency (CBDC) initiatives, present a significant technological factor for Bank of Zhengzhou. These advancements have the potential to fundamentally alter traditional payment systems and the very nature of financial transactions, offering increased efficiency and new avenues for service delivery. As of early 2024, China's pilot programs for the digital yuan (e-CNY) have expanded, with transactions reaching trillions of yuan in value across various use cases, indicating a tangible shift in the financial ecosystem.

Bank of Zhengzhou must actively monitor these technological shifts. The increasing adoption and sophistication of blockchain could lead to new competitive pressures from fintech firms leveraging these platforms. Furthermore, the integration of CBDCs might necessitate significant adjustments to the bank's existing infrastructure and service offerings to remain competitive and relevant in a digitally transformed financial environment. For instance, understanding how CBDCs will interact with existing interbank settlement systems is crucial for strategic planning.

- Evolving Payment Systems: Blockchain's ability to facilitate secure, transparent, and faster transactions could disrupt traditional banking models.

- Digital Currency Impact: The widespread adoption of a CBDC like the e-CNY could alter deposit structures and the demand for traditional banking services.

- Operational Adaptation: Banks will need to invest in technology and talent to integrate blockchain and CBDC capabilities into their operations.

- Regulatory Landscape: Staying abreast of regulatory changes surrounding digital assets and blockchain is paramount for compliance and strategic positioning.

The rapid digitalization of China's financial sector, with nearly 90% of citizens using digital finance, necessitates significant investment in Bank of Zhengzhou's digital infrastructure, including mobile apps and online platforms. FinTech's rise presents both competition and opportunities, as digital payment platforms processed trillions of yuan in 2024. To stay competitive, the bank must embrace AI and big data for enhanced customer service and market analysis, with projected investments in these areas by major Chinese banks increasing by over 15% year-over-year by Q1 2025.

Cybersecurity is a paramount concern, with global cybercrime costs reaching an estimated $10.5 trillion annually in 2023, highlighting the need for robust defenses. AI and Big Data are transforming risk management, customer experience, and fraud prevention, with global AI investment in financial services projected to reach $25 billion by 2025. Blockchain and the digital yuan (e-CNY) are also reshaping payment systems, as e-CNY pilot programs saw transactions reaching trillions of yuan in value by early 2024, demanding operational adaptation from banks.

Legal factors

The Bank of Zhengzhou, like all financial institutions in China, operates under the stringent purview of the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC). These bodies enforce a robust legal framework covering everything from capital adequacy ratios to consumer protection. For instance, the Banking Law of the People's Republic of China dictates the operational standards and licensing requirements. In 2023, the PBOC continued its focus on financial stability, with regulatory actions aimed at curbing systemic risks in the banking sector, impacting how institutions like the Bank of Zhengzhou manage their portfolios and risk exposure.

China's authorities maintain rigorous anti-money laundering (AML) and counter-terrorist financing (CTF) regulations to curb illicit financial activities. The Bank of Zhengzhou, like other financial institutions, is obligated to establish strong internal controls, detailed reporting systems, and thorough customer due diligence procedures to adhere to these demanding mandates.

Failure to comply can result in significant penalties. For instance, in 2023, the People's Bank of China (PBOC) issued fines totaling hundreds of millions of yuan to various financial institutions for AML/CTF violations, underscoring the gravity of these regulations.

As digital banking services expand, data privacy and consumer protection regulations are increasingly vital for the Bank of Zhengzhou. Compliance requires meticulous attention to the secure storage and processing of sensitive customer information. For instance, in 2024, China's Personal Information Protection Law (PIPL) continued to shape how financial institutions manage data, with potential fines for non-compliance reaching significant levels. The bank must prioritize transparent communication regarding data usage and ensure robust cybersecurity measures to safeguard consumer rights and maintain trust.

Capital Adequacy and Risk Management Regulations

Chinese banking regulators, such as the China Banking and Insurance Regulatory Commission (CBIRC), mandate strict capital adequacy ratios to ensure financial stability. For instance, the Basel III framework, implemented in China, requires banks to maintain a Common Equity Tier 1 (CET1) ratio, typically around 7.5%, and an overall capital adequacy ratio (CAR) of 10.5%.

Bank of Zhengzhou, like its peers, must adhere to these regulations by maintaining robust capital buffers. This includes managing various risks, such as credit risk, market risk, and operational risk, through comprehensive frameworks. Failure to meet these requirements can lead to supervisory actions, impacting the bank's operations and reputation.

The bank's risk management strategies are crucial for compliance and operational resilience. This involves detailed policies and procedures for identifying, assessing, and mitigating potential threats to its financial health. For example, effective management of market risk, which involves potential losses from changes in market prices like interest rates or foreign exchange rates, is a key regulatory focus.

- Capital Adequacy: Banks must maintain a minimum Capital Adequacy Ratio (CAR) to absorb unexpected losses.

- Risk Management Frameworks: Robust systems for managing credit, market, operational, and liquidity risks are mandatory.

- Regulatory Compliance: Adherence to guidelines set by authorities like the CBIRC is essential for operational continuity.

- Market Risk Mitigation: Strategies to counter potential losses from adverse market movements are a critical component of compliance.

ESG Reporting and Sustainability Disclosure Requirements

China's regulatory landscape is increasingly emphasizing Environmental, Social, and Governance (ESG) reporting for listed companies. This push means banks like the Bank of Zhengzhou must bolster their sustainability disclosures to comply with evolving national requirements.

As a dual-listed bank, Bank of Zhengzhou faces the dual challenge of meeting both Chinese domestic regulations and international expectations for ESG transparency. This necessitates a comprehensive approach to sustainability reporting, aiming to align with evolving global standards and investor demands.

Key regulatory developments in China, such as guidelines from the Shanghai Stock Exchange and Shenzhen Stock Exchange, are driving this trend. For instance, by the end of 2024, many listed firms were expected to have enhanced their ESG reporting frameworks.

The Bank of Zhengzhou's strategy must therefore incorporate robust data collection and reporting mechanisms for ESG factors. This includes detailing environmental impact, social responsibility initiatives, and corporate governance practices.

- Mandatory ESG Disclosures: China's regulatory bodies are moving towards making ESG reporting a more formal requirement for listed firms.

- International Alignment: The Bank of Zhengzhou needs to ensure its disclosures are comparable to international standards like those from the Global Reporting Initiative (GRI).

- Investor Demand: There's a growing global investor preference for companies with strong ESG performance, influencing disclosure strategies.

- Risk Management: Enhanced ESG reporting helps identify and mitigate environmental and social risks, which is crucial for financial institutions.

The Bank of Zhengzhou operates within a dynamic legal framework shaped by the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC). These bodies enforce strict capital adequacy requirements, with Basel III standards typically requiring a Common Equity Tier 1 ratio around 7.5% and an overall Capital Adequacy Ratio of 10.5%. The bank must also navigate increasingly stringent anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, facing substantial penalties for non-compliance, as evidenced by significant fines levied in 2023.

Environmental factors

China's commitment to green finance is a significant driver, with the People's Bank of China (PBOC) actively encouraging financial institutions to boost lending for eco-friendly initiatives. By the end of 2023, outstanding green loans in China reached RMB 33.45 trillion, marking a substantial 35.3% year-on-year increase, demonstrating the government's push and market adoption.

Bank of Zhengzhou is well-positioned to capitalize on this trend by expanding its green loan offerings. This includes supporting key sectors within Henan province such as renewable energy projects, water resource management, and the development of low-carbon transportation and manufacturing technologies, aligning with national environmental goals.

The bank can leverage this environmental focus to attract environmentally conscious investors and customers, while also mitigating risks associated with traditional, carbon-intensive industries. This strategic alignment with China's green development agenda presents a clear opportunity for growth and enhanced corporate social responsibility.

Banks like the Bank of Zhengzhou are increasingly expected to go beyond mere regulatory compliance and weave Environmental, Social, and Governance (ESG) principles into their fundamental business strategies. This shift reflects a growing global demand for sustainable and ethical financial practices.

Integrating ESG can significantly bolster the Bank of Zhengzhou's public image, making it more attractive to investors who prioritize corporate responsibility. For instance, the bank's 2023 sustainability report highlighted a 15% increase in green bond issuances, demonstrating tangible commitment.

Furthermore, a strong stance on ESG and corporate social responsibility can lead to improved risk management and operational efficiency. By focusing on environmental impact and social equity, the bank can mitigate potential future liabilities and foster stronger community relationships, which are crucial for long-term stability.

Climate change presents tangible risks to the Bank of Zhengzhou's loan portfolio. Extreme weather events, like the severe flooding experienced in parts of China in 2023, can directly impact the collateral value of loans and the ability of borrowers in affected regions to repay. For instance, agricultural loans could be jeopardized by prolonged droughts or unseasonal storms, while real estate loans in coastal areas face increased risk from rising sea levels and storm surges.

Furthermore, evolving global and national policies aimed at decarbonization create significant transition risks. Industries heavily reliant on fossil fuels may see their creditworthiness decline as regulations tighten and consumer preferences shift. The Bank of Zhengzhou must proactively assess how these policy shifts, potentially impacting sectors like coal mining or traditional manufacturing, could affect the financial health of its corporate borrowers and the overall stability of its loan book.

In 2024, China continued its commitment to carbon neutrality goals, with renewable energy investment surging. While this presents opportunities, it also means that banks like the Bank of Zhengzhou need to understand the credit risk associated with companies still heavily invested in high-carbon industries. Failing to account for these shifts could lead to a rise in non-performing loans as these sectors face increased operational and regulatory pressures.

Sustainable Development Goals (SDGs) Alignment

Aligning its business strategies with national and global Sustainable Development Goals (SDGs) can significantly guide the Bank of Zhengzhou's investments and operational activities toward more sustainable practices. This strategic alignment is crucial for fostering long-term value creation and mitigating risks. For instance, the bank can prioritize financing green infrastructure projects and renewable energy initiatives that directly contribute to SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). By actively supporting businesses focused on resource efficiency and circular economy models, the Bank of Zhengzhou can also bolster its contributions to SDG 12 (Responsible Consumption and Production).

In 2024, China's commitment to green finance continued to strengthen, with the People's Bank of China (PBOC) actively promoting the development of the green bond market and related financial instruments. As of Q1 2024, outstanding green bonds in China reached approximately RMB 2.5 trillion, showcasing a robust market for sustainable investments. The Bank of Zhengzhou can leverage this momentum by increasing its portfolio of green loans and investments, thereby supporting China's dual carbon goals and contributing to a more sustainable economic future. This focus not only enhances the bank's corporate social responsibility but also opens up new avenues for profitable growth in the burgeoning green economy.

- Environmental Protection: Financing projects that reduce pollution, conserve water, and protect biodiversity aligns with SDG 14 (Life Below Water) and SDG 15 (Life on Land).

- Resource Efficiency: Supporting businesses that implement water-saving technologies and waste reduction programs contributes to SDG 6 (Clean Water and Sanitation) and SDG 12.

- Climate Action: Investing in renewable energy, energy-efficient buildings, and climate-resilient infrastructure supports SDG 7 and SDG 13.

- Sustainable Cities: Funding urban development projects that prioritize public transportation, green spaces, and efficient waste management aligns with SDG 11 (Sustainable Cities and Communities).

Resource Consumption and Operational Footprint

The Bank of Zhengzhou's environmental impact is directly tied to its operational footprint. This includes managing energy consumption in its branches and offices, which is a significant factor in its resource use. Reducing waste generation and optimizing water usage are also key elements of its environmental responsibility.

The bank is actively pursuing eco-friendly practices to enhance its sustainability. Initiatives like digital transformation to reduce paper usage and exploring renewable energy sources for its facilities are central to these efforts. By improving its environmental performance, the Bank of Zhengzhou aims to align with broader sustainability goals.

- Energy Consumption: In 2023, the Bank of Zhengzhou reported that its primary energy consumption was derived from electricity used in its extensive network of branches and data centers. Specific figures for total kilowatt-hours consumed were not publicly disclosed in their latest annual reports, but industry benchmarks suggest significant usage for lighting, HVAC, and IT infrastructure.

- Waste Management: The bank has implemented a phased approach to reducing paper waste, with digital banking solutions being a key driver. While precise waste tonnage figures are not readily available, the focus on digitizing customer interactions and internal processes aims to significantly decrease paper output.

- Water Usage: Water consumption is primarily associated with restroom facilities and cooling systems in larger office buildings. The bank's environmental reports indicate efforts to monitor and conserve water, though specific volumetric data for 2023 is not detailed.

China's robust green finance policies, including substantial growth in green loans which reached RMB 33.45 trillion by end-2023, offer significant opportunities for the Bank of Zhengzhou to expand its eco-friendly lending. The bank's alignment with national environmental goals, such as supporting renewable energy and low-carbon technologies in Henan province, is crucial for capitalizing on these trends and attracting environmentally conscious stakeholders.

The Bank of Zhengzhou faces transition risks from evolving decarbonization policies, impacting high-carbon industries within its loan portfolio. Proactive assessment of these shifts is vital to mitigate potential non-performing loans, especially as China reinforces its commitment to carbon neutrality in 2024, with renewable energy investments continuing to surge.

Integrating Environmental, Social, and Governance (ESG) principles is becoming standard practice, with the Bank of Zhengzhou's 2023 sustainability report noting a 15% increase in green bond issuances. This strategic focus not only enhances the bank's reputation but also improves risk management and operational efficiency, fostering long-term stability.

Climate change poses direct risks to the Bank of Zhengzhou's loan book, with extreme weather events in 2023 impacting borrower repayment capabilities and collateral values, particularly in agriculture and coastal real estate. The bank must diligently manage these physical risks to safeguard its financial health.

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Bank of Zhengzhou is meticulously constructed using data from official Chinese government publications, the People's Bank of China, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the bank.