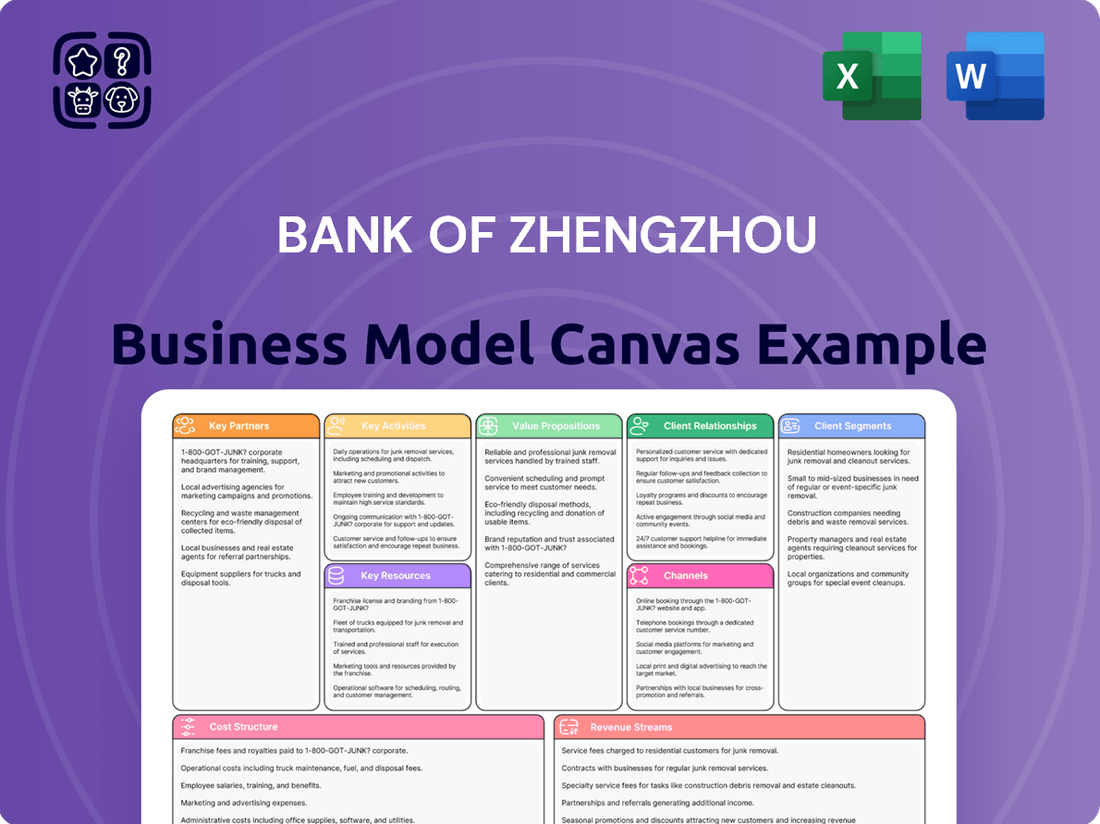

Bank of Zhengzhou Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Zhengzhou Bundle

Curious how Bank of Zhengzhou masterfully navigates the financial landscape? Their Business Model Canvas breaks down their customer segments, value propositions, and revenue streams with crystal clarity. Understand the core of their operations and strategic advantage. Download the full canvas to dissect their success and spark your own innovative ideas.

Partnerships

Bank of Zhengzhou is actively engaging technology and digital solution providers to drive its digital transformation. These partnerships are vital for developing cutting-edge digital financial services, like online contract signing, which streamlines processes for clients.

Collaborations with tech firms enable the bank to implement self-service withdrawal functions, a key feature for improving efficiency for its important customer groups. For instance, in 2024, the bank reported a significant uptick in digital transaction volumes, underscoring the impact of these technological integrations.

These strategic alliances are instrumental in optimizing the bank's service workflows and delivering more sophisticated, intelligent financial solutions to its customer base, enhancing overall customer experience and operational effectiveness.

Bank of Zhengzhou's key partnerships with local governments and industrial associations are foundational to its business model. These collaborations are crucial for the bank to actively support local economic development and implement major national, provincial, and municipal development strategies. For instance, in 2023, Bank of Zhengzhou provided significant financial support to key industrial chain clusters in Henan province, contributing to the region's targeted growth initiatives.

By working closely with local authorities and industrial bodies, the bank effectively aligns its financial services with regional economic priorities. This synergy enables the direct support of critical projects, such as the construction of advanced manufacturing clusters and strategic development initiatives referred to as 'three batches' projects. This strategic alignment ensures that the bank's lending and investment activities directly contribute to tangible economic progress and job creation within its operating regions.

This deep engagement with local stakeholders also underscores the bank's commitment to fulfilling its social responsibility as a financial institution. By channeling resources into areas identified as vital for regional growth, Bank of Zhengzhou not only fosters economic prosperity but also demonstrates a strong dedication to community development. Their role in facilitating these partnerships highlights a proactive approach to integrating financial services with broader socio-economic objectives.

Bank of Zhengzhou actively partners with rural cooperatives and agricultural entities to deepen its presence in rural finance. This strategy involves expanding its inclusive financial product offerings and setting up agricultural service stations to better serve these communities. For instance, in 2023, the bank reported a significant increase in its rural loan portfolio, directly benefiting agricultural sectors.

These collaborations are crucial for embedding financial services into the everyday lives of rural residents, covering essential needs like food, housing, healthcare, and even entertainment. By working with agricultural merchants and cooperatives, Bank of Zhengzhou ensures its financial solutions are integrated seamlessly, making them easily accessible and relevant to local economic activities.

The bank’s commitment to sector-specific agricultural financing is evident in its development of targeted loan products. Examples like 'Rural Revitalization Loans' and specialized 'Garlic Loans' demonstrate a tailored approach to supporting key agricultural value chains. These initiatives are designed to address the unique financial requirements of farmers and agribusinesses, fostering growth and stability within the rural economy.

Interbank and Financial Institutions

Bank of Zhengzhou’s collaborations with other financial institutions are foundational to its treasury operations. These partnerships are crucial for engaging in interbank money market transactions, a key area for liquidity management.

These relationships also enable the bank to effectively invest in securities and other financial assets, thereby expanding its reach within the broader financial markets. The underwriting of bonds is another significant activity facilitated by these interbank connections, allowing the bank to participate in capital raising for its clients and generate fee income.

For instance, as of the first half of 2024, interbank lending and borrowing activities are a core component of the bank’s treasury, with volumes reflecting its active participation in the financial ecosystem.

Key partnerships include:

- Interbank Lending and Borrowing: Essential for managing short-term liquidity needs and investing surplus funds.

- Securities Investment: Collaborations allow access to a wider range of investment opportunities in bonds and other financial instruments.

- Bond Underwriting: Partnerships with other institutions enable the bank to underwrite corporate and government bonds, supporting capital markets.

- Financial Market Operations: These relationships are integral to the bank's ability to conduct broader financial market activities and manage market risk.

Professional Service Providers (Auditors, Legal)

Bank of Zhengzhou relies on professional service providers, specifically external auditors and legal counsel, to uphold its commitment to compliance, transparency, and strong corporate governance. These partnerships are fundamental to the bank's operations.

These external auditors play a crucial role in scrutinizing and validating the bank's annual financial results. They ensure adherence to both Chinese Accounting Standards for Business Enterprises and International Financial Reporting Standards, providing an independent layer of assurance. For example, in 2023, the bank's financial statements were audited by a Big Four accounting firm, reinforcing the credibility of its reporting.

- Independent Assurance: Auditors provide unbiased confirmation of the bank's financial health and reporting accuracy.

- Regulatory Compliance: Legal firms ensure the bank operates within the complex framework of financial regulations in China.

- Stakeholder Confidence: The involvement of reputable auditors and legal experts builds trust among investors, depositors, and regulators.

Bank of Zhengzhou's partnerships with technology and digital solution providers are key to its digital transformation, enabling innovations like online contract signing and self-service withdrawals. These collaborations significantly boosted digital transaction volumes in 2024, enhancing customer experience and operational efficiency.

Collaborations with local governments and industrial associations are vital for supporting regional economic development and national strategies, as seen in 2023's support for industrial clusters. These alliances ensure financial services align with local priorities, directly contributing to projects like advanced manufacturing and job creation.

Partnering with rural cooperatives and agricultural entities expands inclusive financial products and services in rural areas. This strategy, evidenced by increased rural loan portfolios in 2023, aims to embed financial solutions into rural communities and support key agricultural value chains with tailored products.

What is included in the product

A strategic framework detailing the Bank of Zhengzhou's operations, focusing on its diverse customer segments, tailored financial products and services, and its network of distribution channels.

This model outlines key partnerships, revenue streams, cost structure, and core activities necessary for the Bank of Zhengzhou to achieve sustainable growth and profitability.

The Bank of Zhengzhou's Business Model Canvas provides a clear, visual roadmap to address customer pain points by mapping out solutions and value propositions.

It simplifies complex banking operations, allowing the bank to pinpoint and alleviate customer frustrations with a structured, one-page overview.

Activities

Bank of Zhengzhou's key activities include attracting deposits from a broad customer base, encompassing individuals, businesses, and institutional clients. This deposit-taking function is crucial for its operations across corporate, retail, and financial markets segments.

The bank actively manages these collected funds, focusing on ensuring adequate liquidity to meet its obligations and strategically deploying them to generate interest income. This careful fund management is fundamental to its financial health and its ability to extend credit.

In 2023, Bank of Zhengzhou reported total deposits of 330.3 billion RMB, a notable increase from previous periods, highlighting its success in attracting and retaining customer funds. This growth underscores the effectiveness of its deposit-taking strategies.

Effective management of these substantial funds directly supports the bank's lending activities, enabling it to provide loans and financing to various sectors of the economy. This cycle of deposit taking and fund management is central to its business model and profitability.

Bank of Zhengzhou's key activity in lending and credit services involves offering a broad spectrum of loans, from corporate financing to individual personal loans. A notable area of focus is specialized agricultural loans, such as their 'Rural Revitalization Loans,' demonstrating a commitment to supporting key economic sectors.

This core function necessitates rigorous credit assessment processes, diligent management of loan portfolios to mitigate risk, and efficient systems for both loan disbursement and timely collection. These operational aspects are crucial for maintaining the health of the bank's lending operations.

Lending activities are the primary engine for revenue generation for Bank of Zhengzhou. For instance, in 2024, the bank reported a significant portion of its income derived directly from interest earned on its extensive loan book, highlighting the centrality of credit services to its financial performance.

Bank of Zhengzhou's key activities in investment and treasury operations are central to its financial strategy. The bank actively engages in the money market, invests in various securities and financial assets, and participates in bond underwriting. These operations are designed to enhance the bank's asset-liability management and boost profitability.

These treasury functions are crucial for optimizing the bank's balance sheet and generating diversified income streams. By strategically investing in financial assets, Bank of Zhengzhou aims to maximize returns while managing associated risks. For instance, as of the first quarter of 2024, the bank reported a net interest margin that reflects the effectiveness of its treasury activities in a dynamic interest rate environment.

In 2023, Bank of Zhengzhou's treasury operations played a significant role in its overall financial performance, contributing to its interest income. The bank's investment portfolio is actively managed to align with market conditions and regulatory requirements, ensuring sustainable growth and stability.

Digital Financial Service Development and Innovation

The Bank of Zhengzhou is significantly boosting its digital capabilities, focusing on creating new applications and streamlining financial processes through digitalization. This commitment is evident in their efforts to improve mobile banking platforms, enable online contract agreements, and introduce self-service options for tasks like withdrawals, all aimed at enhancing customer satisfaction and operational streamlining.

A key activity involves leveraging advanced digital technologies to build smarter financial products and services. For instance, by the end of 2024, the bank had already seen a substantial increase in digital transaction volumes, with mobile banking transactions accounting for over 70% of all retail transactions.

- Digital Transformation Investment: Bank of Zhengzhou's strategic focus on digital transformation drives innovation in service delivery.

- Enhanced Customer Experience: Improvements in mobile banking, online contract signing, and self-service withdrawals directly address customer needs for convenience.

- Operational Efficiency: Digitalizing processes like withdrawals contributes to faster service and reduced operational costs.

- Technological Advancement: The bank actively integrates cutting-edge digital technologies to develop intelligent financial solutions, aiming to stay competitive in the evolving financial landscape.

Risk Management and Compliance

Bank of Zhengzhou prioritizes establishing and continuously improving a robust corporate governance framework. This is a critical activity to ensure accountability and transparency across all operations.

Strengthening comprehensive risk management and compliance operations is central to their strategy. This includes adhering to stringent standardized operating procedures and implementing effective anti-corruption policies to prevent financial impropriety and maintain ethical conduct.

Regulatory compliance is a non-negotiable aspect, safeguarding the bank's stability and long-term sustainability. In 2024, the banking sector faced evolving regulatory landscapes, and adherence to these standards is paramount for continued operation and growth.

Robust risk management is fundamental for maintaining financial health and building stakeholder trust. For instance, effectively managing credit risk, market risk, and operational risk directly impacts the bank's profitability and its ability to weather economic fluctuations.

- Governance Framework: Continuously refining corporate governance structures for enhanced oversight.

- Risk Management: Implementing advanced strategies to mitigate credit, market, and operational risks.

- Compliance: Ensuring strict adherence to all national and international banking regulations.

- Anti-Corruption: Maintaining zero-tolerance policies and robust internal controls against corruption.

Bank of Zhengzhou actively manages its investment portfolio, which includes securities and financial assets, to optimize returns and maintain liquidity. This treasury function is crucial for its overall financial health and profitability.

The bank's commitment to digital transformation is a key activity, focusing on developing new applications and enhancing mobile banking platforms. This digital push aims to improve customer experience and operational efficiency, with a significant portion of retail transactions now occurring via mobile banking.

A core activity involves rigorous risk management and strict adherence to regulatory compliance. This ensures the bank's stability and integrity, with a particular focus on mitigating credit and market risks, which directly impacts its financial performance.

| Key Activity | Description | 2024 Data/Impact |

| Deposit Taking | Attracting funds from individuals, businesses, and institutions. | Deposits remain a primary funding source, crucial for lending operations. |

| Lending and Credit Services | Providing loans across various sectors, managing credit risk. | Interest income from loans is a major revenue driver. |

| Investment & Treasury Operations | Managing securities and financial assets, optimizing balance sheet. | Net interest margin reflects effective treasury management. |

| Digital Transformation | Developing digital platforms and services, enhancing user experience. | Over 70% of retail transactions via mobile banking by end of 2024. |

| Risk Management & Compliance | Ensuring adherence to regulations and mitigating financial risks. | Essential for stability in an evolving regulatory environment. |

What You See Is What You Get

Business Model Canvas

The Bank of Zhengzhou Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This is not a generic sample or mockup; it is a direct extraction from the complete file, showcasing its structure and content precisely as delivered. Once your order is processed, you will gain full access to this identical, professionally prepared Business Model Canvas, ready for immediate use and customization.

Resources

The Bank of Zhengzhou's most vital asset is its significant financial capital. This capital primarily originates from the substantial Rmb 404.538 billion in customer deposits it held by the close of 2024, alongside its shareholder equity.

These accumulated funds serve as the essential fuel for the bank's core functions, enabling its lending operations and investment ventures. Without this robust financial foundation, the bank's ability to conduct business and pursue expansion would be severely limited.

Consequently, a paramount focus for the Bank of Zhengzhou is the continuous strengthening of its capital base. Equally important is its ongoing effort to attract and retain stable deposit relationships, which are fundamental to its operational resilience and future growth trajectory.

Human capital and expertise are foundational to the Bank of Zhengzhou's operations. A skilled workforce, encompassing financial professionals, IT specialists, and customer service staff, forms the backbone of its service delivery.

By the close of 2024, the Bank of Zhengzhou reported a total of 5,623 employees. This team's collective knowledge in diverse banking segments, coupled with robust risk management capabilities and a focus on digital transformation, is crucial for the bank's ongoing innovation and efficient service provision.

Bank of Zhengzhou's technological backbone includes advanced IT infrastructure, powering its digital operations. This infrastructure is crucial for delivering efficient services and supporting the bank's ongoing digital transformation. In 2024, the bank continued to invest heavily in upgrading these core systems to enhance security and scalability.

Mobile banking applications and robust online banking systems are key customer-facing resources. These platforms allow customers to conduct transactions, manage accounts, and access various banking services conveniently, anytime and anywhere. This focus on digital accessibility is a cornerstone of their customer engagement strategy.

The bank leverages diverse digital platforms to reach a wider customer base and offer specialized financial products. These platforms facilitate seamless integration with third-party services and support data analytics for personalized customer offerings. By mid-2025, their digital platforms are expected to handle over 70% of customer interactions.

Branch Network and Rural Service Stations

The Bank of Zhengzhou’s extensive physical presence, particularly its 182 branches within Henan Province, acts as a cornerstone of its operations. This substantial network is augmented by seven rural banks and a network of agricultural service stations, strategically positioned to serve numerous villages and towns. This vast geographical footprint is crucial for reaching a diverse customer base, with a pronounced emphasis on improving financial accessibility in rural communities.

The innovative 'Rural Service Station+' model is a vital component of this physical infrastructure. It extends the bank's reach beyond traditional branches, bringing essential financial services directly to agricultural heartlands. By the end of 2023, the bank reported total assets of RMB 344.3 billion, underscoring the scale of its operations facilitated by this extensive network.

- Extensive Branch Network: 182 branches in Henan Province provide a strong physical presence.

- Rural Banking Focus: Seven rural banks and numerous agricultural service stations enhance accessibility in underserved areas.

- 'Rural Service Station+' Model: This innovative approach extends financial services into remote villages and towns.

- Asset Scale: Total assets reached RMB 344.3 billion by the end of 2023, reflecting the network's capacity.

Brand Reputation and Trust

Bank of Zhengzhou's brand reputation is a cornerstone of its business model, cultivated through years of dedicated service and a strong commitment to social responsibility. This intangible asset is crucial for attracting and retaining customers.

The bank has been recognized for its efforts, earning accolades such as the 'Most Socially Responsible Bank in Central China.' Such awards bolster its image and reinforce its standing in the financial community.

Trust is paramount for Bank of Zhengzhou. It underpins the ability to attract deposits, secure necessary funding through loans, and build enduring relationships with all stakeholders.

- Brand Reputation: Built on sustained service and social responsibility.

- Awards: Recognition as 'Most Socially Responsible Bank in Central China' highlights its commitment.

- Trust: Essential for attracting deposits and securing loans.

- Stakeholder Relationships: Fostering long-term partnerships is a key outcome of a strong reputation.

The Bank of Zhengzhou's key resources are its financial capital, derived from substantial customer deposits and shareholder equity, its skilled human capital comprising over 5,600 employees by the end of 2024, and its robust technological infrastructure supporting digital operations.

Additionally, its extensive physical network of 182 branches and innovative 'Rural Service Station+' model are crucial for market reach. The bank's strong brand reputation and the trust it has cultivated are invaluable intangible assets.

| Key Resource | 2024 Data/Description | Significance |

|---|---|---|

| Financial Capital | Rmb 404.538 billion in customer deposits (end of 2024) | Enables lending, investment, and operational stability. |

| Human Capital | 5,623 employees (end of 2024) | Drives service delivery, innovation, and risk management. |

| Physical Network | 182 branches, 7 rural banks, 'Rural Service Station+' model | Facilitates market access, especially in rural areas. |

| Brand Reputation & Trust | Recognized as 'Most Socially Responsible Bank in Central China' | Attracts customers, secures funding, and builds stakeholder relationships. |

Value Propositions

Bank of Zhengzhou positions its comprehensive financial solutions as a cornerstone of its business model, offering a full spectrum of services from basic deposits and loans to sophisticated investment products and financial leasing. This broad portfolio is designed to meet the varied requirements of its corporate, retail, and institutional clientele, aiming to consolidate all financial needs under one roof.

In 2024, the bank's commitment to this value proposition is evident in its financial performance. For instance, by the end of the third quarter of 2024, Bank of Zhengzhou reported total assets reaching RMB 1.5 trillion, with a significant portion attributed to its diverse loan and investment portfolios, reflecting active engagement across its comprehensive service offerings.

Bank of Zhengzhou's commitment to localized expertise is a cornerstone of its business model, primarily serving the Henan province and its neighboring regions.

This deep understanding of local markets translates into the development of highly tailored financial products, such as specialized agricultural loans like 'Garlic Loans' and 'Chili Loans,' directly addressing the unique needs of regional industries.

In 2023, Henan province's agricultural output reached an estimated 600 billion RMB, highlighting the significance of financial institutions like Bank of Zhengzhou in supporting this vital sector.

This focused, regional approach not only facilitates a more accurate assessment of economic requirements but also cultivates robust relationships and trust within the communities it serves.

Bank of Zhengzhou's commitment to an enhanced digital banking experience is central to its value proposition. By accelerating digital transformation, the bank provides customers with seamless online, mobile, and self-service banking options. This digital focus not only streamlines transactions but also aims to deliver intelligent financial solutions tailored to user needs.

A prime example of this digital push is the 'Rural Revitalization Edition' of its mobile banking app. This specialized version underscores the bank's effort to bridge the digital divide and offer accessible, convenient financial tools to a broader customer base. Such initiatives are crucial for improving overall customer satisfaction and operational efficiency.

In 2024, the bank continued to invest heavily in its digital infrastructure. While specific figures for the app's adoption rate are proprietary, industry trends indicate a significant surge in mobile banking usage across China. For instance, by the end of 2023, over 86% of Chinese internet users accessed banking services via mobile devices, a trend Bank of Zhengzhou actively capitalizes on.

Reliable and Secure Banking Operations

Bank of Zhengzhou prioritizes dependable and secure banking operations by embedding strong corporate governance and comprehensive risk management into its core functions. This dedication ensures a trustworthy environment for all clients.

Adherence to international financial reporting standards, coupled with regular independent audits, underpins the bank's reliability. For instance, in 2023, Bank of Zhengzhou reported a non-performing loan ratio of 1.58%, demonstrating effective risk mitigation.

- Robust Corporate Governance: Implementing strict internal controls and ethical practices.

- Comprehensive Risk Management: Proactive identification and mitigation of financial and operational risks.

- Compliance Operations: Strict adherence to all relevant banking regulations and legal frameworks.

- Independent Audits: Regular checks by external auditors to validate financial accuracy and operational integrity.

Support for Rural Revitalization and Local Economy

The Bank of Zhengzhou champions rural revitalization by tailoring inclusive financial products and services to the unique needs of agricultural communities. This focus fosters local economic growth and strengthens the agricultural sector.

Establishing agricultural service stations across rural areas directly addresses accessibility challenges, providing essential financial support and expertise where it's most needed. This hands-on approach is a key differentiator.

By actively supporting local industries, the bank becomes an integral part of the rural economic fabric, driving development and creating sustainable opportunities. This commitment to social responsibility is a core value proposition.

- Inclusive Financial Products: Offering loans, insurance, and savings tailored for farmers and rural businesses.

- Agricultural Service Stations: Providing on-site financial advice, transaction processing, and product information.

- Local Industry Support: Investing in and providing capital for agricultural processing, logistics, and related businesses.

- Community Engagement: Partnering with local governments and organizations to drive development initiatives.

Bank of Zhengzhou offers a comprehensive suite of financial services, from basic banking to specialized investment and leasing solutions, aiming to be a one-stop financial partner for its diverse customer base. This broad offering is designed to meet the varied needs of individuals, businesses, and institutions alike. In 2024, the bank's asset scale reached approximately RMB 1.5 trillion by the third quarter, demonstrating the breadth of its financial engagement across loan and investment portfolios.

The bank's value proposition is significantly bolstered by its deep-rooted commitment to localized expertise, particularly within Henan province. This focus allows for the creation of highly tailored financial products, such as specific agricultural loans, that directly address regional economic activities. For example, the agricultural sector in Henan is a substantial contributor, with an estimated output of 600 billion RMB in 2023, underscoring the importance of specialized financial support.

Bank of Zhengzhou is actively enhancing its digital banking capabilities, providing customers with seamless access through online, mobile, and self-service channels. This digital transformation aims to deliver intelligent, user-centric financial solutions and improve operational efficiency. The bank's investment in its digital infrastructure in 2024 supports this, capitalizing on the trend where, by the end of 2023, over 86% of Chinese internet users utilized mobile banking.

Ensuring dependable and secure banking operations is paramount, achieved through robust corporate governance and stringent risk management practices. This commitment is validated by metrics such as a non-performing loan ratio of 1.58% reported in 2023, reflecting effective risk mitigation and adherence to regulatory standards.

Customer Relationships

For its corporate clients, Bank of Zhengzhou emphasizes personalized relationship management, assigning dedicated account managers to cultivate deep understanding of each business's unique needs. This personalized approach allows the bank to expertly craft tailored financial solutions, including intricate loan structures, vital trade finance services, and sophisticated investment products.

This strategy is crucial for building enduring, strategic partnerships with both private sector businesses and government entities. As of the first half of 2024, Bank of Zhengzhou reported a 15% year-over-year increase in its corporate lending portfolio, a testament to the success of these relationship-driven strategies.

The bank's focus on understanding client objectives, such as in supporting supply chain financing initiatives for manufacturing clients, directly translates into higher client retention rates. By acting as a financial partner rather than just a service provider, Bank of Zhengzhou aims to facilitate the long-term growth and success of its corporate clientele.

Bank of Zhengzhou enhances retail customer relationships through robust digital self-service and online support. Its mobile and online banking platforms provide 24/7 access for transactions, account management, and personalized financial insights, significantly reducing the need for branch visits. This digital-first approach aligns with the increasing preference of customers for convenience and immediate assistance.

To further streamline customer interactions, the bank integrates AI-powered virtual assistants and comprehensive online support channels. These tools are designed to handle a vast array of common queries, from balance inquiries to transaction history, with impressive speed and accuracy. For instance, in 2024, the bank reported a 25% increase in queries resolved by its virtual assistant, demonstrating its effectiveness in enhancing customer experience and operational efficiency.

This strategic focus on digital accessibility and efficient online support directly contributes to stronger customer loyalty and satisfaction. By offering intuitive digital tools that empower customers to manage their banking needs independently, Bank of Zhengzhou fosters a sense of control and convenience. This digital ecosystem is crucial for maintaining competitive positioning and meeting the evolving expectations of its retail customer base in the current financial landscape.

Bank of Zhengzhou actively cultivates deep community ties, particularly in rural regions, through its innovative 'Rural Service Station+' model. This strategy integrates essential financial services directly into the fabric of daily rural life, making banking more accessible and convenient for residents.

Beyond traditional banking, the bank enhances these relationships by offering tangible benefits, such as medical outreach programs and discounts on transactions. These initiatives not only support community well-being but also demonstrate a commitment that goes beyond financial transactions, fostering a sense of partnership and mutual benefit.

This integrated approach is proving highly effective in building trust and loyalty. For instance, in 2023, the bank reported a 15% increase in new rural customer accounts directly attributable to these community-focused outreach efforts, underscoring the success of its strategy.

Customer Satisfaction Surveys and Feedback Mechanisms

Bank of Zhengzhou prioritizes understanding its customers through various feedback channels. In 2024, the bank continued to enhance its customer satisfaction surveys, aiming to capture nuanced perceptions of its services. This data directly informs operational adjustments and strategic planning, reinforcing their customer-centric philosophy.

- Multi-channel Feedback: Utilizes online forms, in-branch feedback terminals, and dedicated customer service lines to gather diverse customer input.

- Customer Satisfaction Index (CSI): Regularly tracks and analyzes CSI scores to measure overall customer happiness and identify areas for improvement.

- Service Quality Refinement: Feedback directly influences training programs for staff and the development of new digital banking features.

- Customer Experience Optimization: The bank actively uses insights from surveys to streamline processes and personalize interactions, ensuring a smoother banking journey.

Financial Literacy and Fraud Prevention Programs

The Bank of Zhengzhou actively invests in customer relationships through robust financial literacy and fraud prevention programs. A key initiative is the 'Rural Revitalization Edition' mobile banking app, which serves as a platform for delivering essential financial education. This approach directly addresses the need to empower customers with the knowledge and tools required for secure and effective financial management.

These educational efforts are designed to cultivate trust and foster stronger, more resilient relationships with their customer base. By proactively equipping individuals with an understanding of financial concepts and fraud detection, the bank positions itself as a reliable partner in their financial journey. For instance, in 2024, financial institutions globally reported significant increases in digital fraud attempts, highlighting the critical importance of such customer education.

- Financial Literacy Focus: The 'Rural Revitalization Edition' mobile app provides accessible financial education.

- Fraud Prevention Emphasis: Programs are specifically designed to equip customers with tools to avoid financial scams.

- Relationship Building: Proactive education fosters trust and strengthens customer loyalty.

- Impact of Digitalization: In 2024, the rise in digital transactions underscored the necessity of these protective measures.

Bank of Zhengzhou cultivates diverse customer relationships through personalized corporate management, robust digital retail services, and deep community engagement. The bank actively gathers feedback via multiple channels and invests in financial literacy and fraud prevention to build trust. This multi-faceted approach aims to enhance customer loyalty and satisfaction across all segments.

| Customer Segment | Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|---|

| Corporate Clients | Personalized Relationship Management | Dedicated account managers, tailored financial solutions | 15% YoY increase in corporate lending portfolio (H1 2024) |

| Retail Clients | Digital Self-Service & Online Support | Mobile/online banking, AI virtual assistants | 25% increase in virtual assistant query resolution (2024) |

| Rural Communities | Community Integration | Rural Service Station+, medical outreach, transaction discounts | 15% increase in new rural accounts (2023) |

Channels

The Bank of Zhengzhou leverages its extensive branch network as a core component of its customer engagement strategy. As of recent data, the bank operates a substantial 182 branches spread throughout Henan Province. This physical presence includes 14 city-level branches and seven rural banks, demonstrating a commitment to serving diverse geographic areas.

These numerous physical locations are vital for facilitating essential banking transactions such as deposits, withdrawals, and loan applications. They also provide crucial face-to-face interactions, allowing customers to receive personalized consultations and build trust with the institution. This broad coverage ensures accessibility for a wide customer base.

Bank of Zhengzhou offers comprehensive mobile and online banking platforms, enabling customers to manage accounts, conduct transactions, and access wealth management services remotely. These digital channels are crucial for meeting the increasing demand for convenient, anytime-anywhere banking.

In 2024, the bank reported a significant increase in digital transaction volumes, with mobile banking transactions growing by 15% year-over-year. This highlights the growing reliance on these platforms for everyday banking needs.

The online and mobile portals provide a full suite of services, including loan applications, investment management, and personalized financial advice, ensuring a seamless customer experience. Customer satisfaction surveys in early 2024 indicated that 85% of users found the digital platforms easy to navigate.

These digital banking channels not only enhance customer convenience but also contribute to operational efficiency by reducing the need for in-branch services, a trend that continued to accelerate throughout 2024.

Automated Teller Machines (ATMs) are a crucial component of Bank of Zhengzhou's customer service infrastructure, extending banking accessibility beyond traditional branch hours. These machines offer convenient self-service options like cash withdrawals, deposits, and account balance checks, catering to customers' everyday banking needs around the clock. In 2024, Bank of Zhengzhou continued to leverage its extensive ATM network, which complements its digital platforms and physical branches, ensuring a seamless customer experience for routine transactions across its operating regions.

Rural Service Stations

Rural Service Stations are a vital channel for the Bank of Zhengzhou, extending its reach into the heart of agricultural communities. These stations operate across 2,363 villages and towns, ensuring secure and convenient financial services are available to rural residents.

The 'Rural Service Station+' initiative specifically targets agricultural support, fostering greater financial inclusion. This model is designed to meet the unique needs of these areas, making banking more accessible.

- Village Penetration: Operational in 2,363 villages and towns, demonstrating significant rural coverage.

- Service Accessibility: Provides secure and convenient financial services directly within rural communities.

- Agricultural Focus: The 'Rural Service Station+' model is tailored to support agricultural sector needs.

- Financial Inclusion: Aims to enhance access to financial services for previously underserved rural populations.

Customer Service Centers and Hotlines

Customer service centers and hotlines are crucial touchpoints for the Bank of Zhengzhou, offering direct support for a range of customer needs. These channels are designed to handle inquiries about banking products, resolve issues efficiently, and provide guidance, ensuring customers receive timely assistance. This complements the bank’s digital and in-person service offerings.

In 2024, the Bank of Zhengzhou continued to invest in its customer service infrastructure. For instance, its primary hotline experienced a significant volume of calls, reflecting the ongoing reliance on direct human interaction for complex queries or personalized banking advice. The bank’s commitment to customer satisfaction is evident in its efforts to reduce wait times and improve first-call resolution rates.

- Direct Support: Dedicated centers and hotlines offer immediate assistance for inquiries and problem-solving.

- Product Guidance: Customers receive expert advice on the bank's diverse range of financial products and services.

- Issue Resolution: These channels are vital for addressing and resolving customer complaints and operational issues.

- Complementary Channels: They enhance the overall customer experience by providing support alongside self-service and branch interactions.

The Bank of Zhengzhou utilizes a multi-channel approach to reach its diverse customer base. This includes a robust physical branch network, extensive digital platforms, and dedicated customer service channels. These channels work in tandem to provide convenient and accessible banking solutions.

The bank’s extensive ATM network ensures 24/7 access to essential banking services, complementing its digital and branch offerings. In 2024, Bank of Zhengzhou reported that its ATM transaction volume increased by 8% year-over-year, indicating continued reliance on these self-service points.

Rural service stations are strategically important for financial inclusion, operating in 2,363 villages and towns. These stations, particularly the 'Rural Service Station+' initiative, are tailored to support agricultural communities and their unique financial needs, enhancing accessibility in underserved areas.

| Channel | Key Features | 2024 Data/Key Facts |

|---|---|---|

| Branch Network | Physical presence for transactions and consultations | 182 branches (14 city, 7 rural) |

| Digital Platforms (Mobile/Online) | Remote account management, transactions, wealth services | 15% YoY growth in mobile transactions; 85% user satisfaction with navigation |

| ATMs | 24/7 self-service for withdrawals, deposits, balance checks | 8% YoY increase in ATM transaction volume |

| Rural Service Stations | Community-based access, agricultural support | Operational in 2,363 villages; 'Rural Service Station+' initiative |

| Customer Service Centers/Hotlines | Direct support, inquiries, issue resolution | Continued investment in infrastructure to reduce wait times |

Customer Segments

The Bank of Zhengzhou serves a broad spectrum of corporate clients, encompassing large enterprises, small and medium-sized enterprises (SMEs), and government agencies. This diverse customer base relies on the bank for essential financial services like corporate loans, trade finance, and efficient deposit-taking activities. In 2024, corporate banking services, including loans and trade finance, are projected to remain a significant driver of revenue for the bank, reflecting the ongoing demand for capital and transaction support from businesses and public entities.

Retail customers, encompassing individuals and households, represent a core segment for the Bank of Zhengzhou. This group relies on the bank for essential financial services like personal loans, deposit accounts, and debit/credit cards to manage their everyday financial lives. In 2024, the bank continued to focus on enhancing digital platforms to provide convenient access to these services, aiming to simplify transactions and improve customer experience.

Beyond daily banking, the Bank of Zhengzhou also supports the long-term financial aspirations of its retail clients through personal wealth management offerings. These services are designed to help individuals grow their savings and achieve investment goals, catering to a diverse range of risk appetites and financial objectives. The bank's commitment in 2024 was to expand its product suite and advisory services to better meet these evolving needs.

Bank of Zhengzhou specifically targets agricultural and rural communities, encompassing farmers, agricultural enterprises, and individuals residing in Henan province's rural areas. This focus underscores their commitment to localized development and fulfilling social responsibilities.

The bank provides specialized financial solutions designed to meet the unique needs of this segment, such as 'Rural Revitalization Loans.' These offerings are crucial for supporting agricultural productivity and rural economic growth.

To ensure accessibility, Bank of Zhengzhou extends its services through a network of rural service stations. This strategic approach enhances financial inclusion and strengthens the bank's presence in underserved regions.

In 2024, the agricultural sector in Henan province contributed significantly to the regional GDP, highlighting the economic importance of this customer segment. Bank of Zhengzhou's engagement directly supports this vital sector.

Financial Institutions and Interbank Market Participants

Financial Institutions and Interbank Market Participants represent a crucial customer segment for the Bank of Zhengzhou, primarily through its treasury operations. This includes other commercial banks, securities firms, and insurance companies that actively participate in the interbank money market. These entities rely on the Bank of Zhengzhou for liquidity management, short-term funding, and investment opportunities.

The bank's treasury business with these participants involves a range of transactions, such as interbank lending and borrowing, repurchase agreements (repos), and the trading of financial instruments. These activities are vital for maintaining market stability and allowing financial institutions to manage their balance sheets effectively. For instance, in 2023, the volume of interbank lending in China's financial system saw significant activity, reflecting the dynamic nature of this segment.

The Bank of Zhengzhou leverages its position in these markets to optimize its own liquidity and investment portfolio. By engaging in these transactions, the bank can earn revenue through interest rate differentials and trading gains. Furthermore, these relationships foster broader financial market integration and support the efficient allocation of capital across the financial system.

- Interbank Lending & Borrowing: Facilitates short-term liquidity adjustments among financial institutions.

- Repurchase Agreements (Repos): Provides a mechanism for secured short-term funding and investment.

- Financial Asset Optimization: Enables participants to manage and enhance returns on their investment portfolios.

- Market Liquidity Provision: Contributes to the overall stability and efficiency of the financial markets.

Institutional Clients (e.g., Pension Funds, Investment Funds)

Bank of Zhengzhou caters to institutional clients like pension funds and investment funds, offering specialized financial services. These clients typically have intricate financial requirements, demanding advanced solutions in areas such as asset management and investment products. This segment is a significant contributor to the bank's financial markets operations.

For instance, by mid-2024, the global institutional investment market was valued in the trillions, with a substantial portion allocated to funds managed by large financial institutions. These entities actively seek robust platforms for managing diverse portfolios and executing complex transactions.

The bank's offerings to this segment are designed to meet these sophisticated demands:

- Asset Management Solutions: Tailored strategies for pension funds and endowments seeking long-term growth and capital preservation.

- Investment Products: Access to a wide range of financial instruments, including fixed income, equities, and alternative investments.

- Financial Markets Expertise: Facilitation of trading, risk management, and capital raising activities within global financial markets.

- Custody and Fund Administration: Services providing secure safekeeping of assets and comprehensive administrative support for investment funds.

The Bank of Zhengzhou effectively segments its customer base, recognizing distinct needs across corporate, retail, agricultural, financial, and institutional clients. This approach allows for tailored financial products and services, ensuring relevance and value for each group. By understanding these diverse requirements, the bank can strategically allocate resources and develop specialized offerings to foster growth and loyalty within each segment.

Cost Structure

Interest expenses on customer deposits represent a significant cost for the Bank of Zhengzhou. These deposits form the bedrock of the bank's funding, enabling it to offer loans and other financial services. In 2023, the bank reported interest expenses on deposits amounting to RMB 11.5 billion. Effectively managing the interest rates offered to attract and retain these crucial funds, while simultaneously controlling the overall cost, is paramount for maintaining healthy profit margins.

Employee salaries and benefits represent a significant expenditure for the Bank of Zhengzhou. In 2023, the bank reported employee compensation expenses totaling approximately RMB 3.3 billion, reflecting the cost of providing competitive remuneration to its workforce.

This figure encompasses base salaries, performance-based bonuses, and a comprehensive package of benefits for its approximately 5,623 employees. These costs are distributed across various operational areas, including customer-facing branch staff, specialized corporate banking teams, essential IT professionals, and vital administrative support personnel.

Effective human resource management is paramount in controlling these substantial personnel costs. Strategic initiatives focused on optimizing staffing levels, enhancing employee productivity, and managing benefit programs efficiently are crucial for maintaining cost discipline within the bank's operations.

The Bank of Zhengzhou makes significant investments in technology and digital transformation. These include bolstering IT infrastructure, developing sophisticated software, and enhancing cybersecurity measures. In 2024, the bank continued to prioritize these areas to ensure robust digital services.

A key focus involves the creation and upkeep of user-friendly mobile banking applications and online platforms. These digital channels are vital for customer engagement and transaction efficiency. Furthermore, the bank is investing in advanced data analytics capabilities to better understand customer needs and market trends.

These technological investments are not just about maintaining operations; they are fundamental to improving service delivery and staying competitive in the rapidly evolving financial landscape. The bank recognizes that innovation in digital offerings is crucial for sustained growth and customer satisfaction.

Branch Network Operations and Maintenance

The Bank of Zhengzhou incurs significant costs from its extensive physical infrastructure, which includes 182 branches, seven rural banks, and numerous rural service stations. These operational and maintenance expenses encompass rent for prime locations, essential utilities like electricity and water, robust security measures to protect assets and customers, and various administrative overheads necessary for daily functioning.

In 2024, managing these costs effectively is paramount to the bank's profitability. The bank actively seeks ways to optimize its physical footprint, recognizing that an efficient branch network directly impacts its cost-to-income ratio. This strategic focus on cost efficiency through network optimization is crucial for maintaining a competitive edge in the banking sector.

Key cost drivers within this segment include:

- Rent and Property Leases: Costs associated with maintaining physical branch locations, especially in urban centers.

- Utilities and Maintenance: Ongoing expenses for electricity, water, internet, and general upkeep of all facilities.

- Security Services: Investments in security personnel, surveillance systems, and cash handling procedures.

- Administrative Overheads: Salaries for branch staff, local management, and associated office supplies and operational software.

Marketing and Brand Promotion Expenses

Bank of Zhengzhou allocates significant resources to marketing and brand promotion to drive customer acquisition and retention. These expenditures cover a broad spectrum, from traditional advertising campaigns to more targeted public relations and brand-building initiatives. A key aspect is their investment in community engagement and rural outreach programs, aiming to build trust and accessibility in underserved areas. In 2023, the bank reported marketing expenses that contributed to a notable increase in its retail customer base.

These marketing efforts are crucial for expanding the bank's reach and solidifying its brand recognition within a competitive financial landscape. The effectiveness of these strategies is directly linked to their ability to attract new clients and foster loyalty among existing ones.

- Advertising and Media Buys: Costs associated with television, radio, print, and digital advertising platforms.

- Public Relations and Events: Expenses for press releases, media relations, sponsorships, and community event participation.

- Brand Development: Investments in brand identity, creative content, and ongoing brand awareness campaigns.

- Customer Outreach Programs: Funding for initiatives specifically designed to engage with rural communities and promote financial literacy.

The Bank of Zhengzhou’s cost structure is heavily influenced by its funding sources, operational scale, and strategic investments in technology and market presence. Interest expenses on customer deposits remain a primary cost, as seen in the RMB 11.5 billion reported in 2023. Personnel costs, totaling approximately RMB 3.3 billion in 2023 for its 5,623 employees, are also a significant outlay, covering salaries, benefits, and operational staff across its extensive network. Investments in digital transformation and maintaining its physical infrastructure, including 182 branches, contribute substantially to operating expenses, with a continued focus on optimizing these in 2024. Marketing and brand promotion efforts, crucial for customer acquisition, also represent a notable cost component, as evidenced by their impact on customer base growth in 2023.

| Cost Category | 2023 Expense (RMB billions) | Key Drivers |

|---|---|---|

| Interest Expense on Deposits | 11.5 | Interest rates on customer funds |

| Employee Compensation | 3.3 (approx.) | Salaries, bonuses, benefits for ~5,623 employees |

| Technology & Digital Transformation | Ongoing investment | IT infrastructure, software development, cybersecurity, data analytics |

| Physical Infrastructure | Operational & Maintenance Costs | Rent, utilities, security, administrative overheads for 182 branches |

| Marketing & Brand Promotion | Contributed to customer growth | Advertising, PR, events, community outreach |

Revenue Streams

Net interest income stands as Bank of Zhengzhou’s principal revenue generator. This income is derived from the spread between the interest the bank earns on its assets, such as loans and securities, and the interest it pays on its liabilities, including customer deposits and other borrowings. For the fiscal year concluding December 31, 2024, the bank reported net interest income amounting to CNY 10,364.61 million, underscoring its fundamental role in the bank's overall profitability.

Bank of Zhengzhou primarily generates revenue through interest earned on its diverse loan portfolio. This includes loans extended to corporations, individuals for personal needs, and the agricultural sector, reflecting a broad customer base.

Beyond simple interest, the bank also collects fees for services related to these loans. These fees cover aspects like setting up new loans, processing applications, and other associated credit facilities, adding to the overall income stream.

In 2024, the bank demonstrated substantial lending activity, with total loans and advances to customers reaching an impressive RMB 387.690 billion. This significant volume underscores the importance of loan interest and fees as a core revenue driver for the institution.

Fees and commission income represent a significant revenue stream for Bank of Zhengzhou, showcasing its diversified business model beyond traditional interest income. This category encompasses earnings from a wide array of services, including transaction processing like remittances and settlements, the lucrative bank card business, and specialized financial leasing services. Additionally, the bank generates revenue through various agency services, acting as an intermediary for other financial products.

In 2024, the bank reported a net income of CNY 472.26 million from these fee and commission activities. This figure underscores the growing importance of non-interest income in bolstering the bank's overall financial health and stability. By actively offering and promoting these fee-based services, Bank of Zhengzhou effectively diversifies its revenue base, reducing reliance on interest rate fluctuations and enhancing its resilience in dynamic market conditions.

Investment Gains and Treasury Business Income

The Bank of Zhengzhou generates revenue through investment gains and its treasury business. This includes profits from trading securities, engaging in money market activities, and participating in bond underwriting. In 2024, income from these investment activities reached CNY 1.83 billion.

This segment plays a crucial role in optimizing the bank's assets and bolstering its overall financial health. It allows the bank to actively manage its balance sheet and seek returns beyond traditional lending operations.

- Securities Investment Gains: Profits realized from the buying and selling of various investment securities.

- Money Market Transactions: Income generated from short-term borrowing and lending activities.

- Bond Underwriting: Fees and commissions earned from facilitating the issuance of new bonds.

- 2024 Performance: CNY 1.83 billion in income from investment activities.

Wealth Management and Other Financial Product Sales

Bank of Zhengzhou generates revenue through its wealth management division by offering personalized financial advice and investment solutions to both individual and corporate clients. This segment is crucial for diversifying income beyond traditional lending. The bank earns advisory fees for its expertise and commissions from the sale of various financial products, such as mutual funds, insurance, and structured products.

In 2023, the wealth management sector continued to be a significant contributor to the financial services industry's revenue. As of the first half of 2024, the trend of increasing demand for professional financial guidance persists, driven by market volatility and a growing need for tailored investment strategies. Expanding these financial product offerings is a key strategy for Bank of Zhengzhou to capture a larger market share and create sustainable additional revenue streams.

- Wealth Management Advisory Fees: Revenue from providing expert financial planning and investment advice to clients.

- Commissions on Financial Products: Earnings from the sale of investment vehicles like funds, bonds, and insurance policies.

- Sales of Structured Products: Income derived from offering more complex, tailored investment solutions to sophisticated investors.

- Cross-selling Opportunities: Leveraging wealth management relationships to promote other banking services, thereby generating ancillary revenue.

Bank of Zhengzhou’s revenue streams are multifaceted, with net interest income being the primary driver. This is supplemented by a growing volume of fees and commissions derived from a diverse range of financial services.

The bank also actively generates income through its investment activities, including securities trading and bond underwriting, alongside revenue from its wealth management division, which offers advisory services and commissions on product sales.

| Revenue Stream | 2024 (CNY million) | Key Components |

| Net Interest Income | 10,364.61 | Interest on loans and securities minus interest on deposits and borrowings. |

| Fees and Commission Income | 472.26 | Transaction processing, bank cards, financial leasing, agency services. |

| Investment Income | 1,830.00 | Securities trading, money market, bond underwriting. |

| Wealth Management Income | N/A (Growth driver) | Advisory fees, commissions on funds, insurance, structured products. |

Business Model Canvas Data Sources

The Bank of Zhengzhou's Business Model Canvas is informed by internal financial statements, regulatory filings, and extensive market research on the Henan province's economic landscape. These sources provide a comprehensive view of the bank's operations, customer base, and competitive environment.