Bank of Xi'an PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Xi'an Bundle

Uncover the intricate web of political stability, economic growth, and technological advancements impacting Bank of Xi'an. Our PESTLE analysis provides a critical overview of these external forces, offering you a strategic advantage. Download the full version now to gain actionable intelligence and navigate the evolving landscape with confidence.

Political factors

The Chinese government's unwavering commitment to financial stability significantly shapes the operational landscape for regional banks, including Bank of Xi'an. Policies targeting deleveraging and curbing excessive credit expansion directly affect the bank's ability to lend and the overall health of its loan portfolio. For instance, in 2024, the People's Bank of China (PBOC) continued its prudent monetary policy, aiming to balance growth with risk mitigation, which translates to stricter oversight on credit disbursement for institutions like Bank of Xi'an.

Directives from regulatory bodies such as the PBOC and the China Banking and Insurance Regulatory Commission (CBIRC) are pivotal. These often mandate specific capital adequacy ratios and robust risk management frameworks. In 2024, the CBIRC emphasized enhanced supervision of asset quality and liquidity management for city commercial banks, directly influencing Bank of Xi'an's strategic planning and operational compliance.

The Bank of Xi'an operates within a landscape shaped by China's commitment to regional economic development, notably the Western Development Strategy. This initiative, aimed at boosting economic growth in less developed western regions including Shaanxi province, presents significant opportunities. For instance, the strategy has fueled substantial infrastructure investments; by the end of 2023, cumulative investment in key national projects within western regions had reached trillions of yuan, creating a robust demand for banking services like project financing and corporate loans.

These government-backed development plans directly translate into increased business for banks like Bank of Xi'an, which are well-positioned to serve the growing financial needs of local enterprises and infrastructure projects. The bank can capitalize on this by offering tailored financial products and services that support regional growth, potentially leading to higher loan volumes and fee income. For example, Shaanxi province's GDP grew by approximately 4.3% in 2023, indicating a healthy economic environment conducive to banking expansion.

However, these regional strategies can also introduce complexities. Government directives might encourage or mandate lending to specific sectors or projects deemed critical for regional development, potentially influencing the bank's risk appetite and asset allocation. While this can align with national policy goals, it might also necessitate careful management to ensure compliance and maintain a healthy loan portfolio, especially if directed lending deviates from purely commercial viability.

Political influence on State-Owned Enterprises (SOEs) is a critical factor for Bank of Xi'an, given China's economic framework. Many SOEs are significant clients for regional banks, meaning government directives on their financial health or investment strategies directly affect the bank's corporate loan portfolio. For instance, in 2023, the Chinese government continued to prioritize support for strategic SOEs in sectors like advanced manufacturing and green energy, potentially boosting their creditworthiness and thus their borrowing capacity from banks like Bank of Xi'an.

This close political linkage can also manifest as preferential lending treatment or, conversely, political pressure on lending decisions. In 2024, the emphasis on financial stability and risk management within the banking sector might lead to increased scrutiny of loans to SOEs, balancing political imperatives with prudent financial practices. The performance of SOEs in 2025 will be closely watched, as their financial stability is intrinsically tied to the health of regional banking systems.

Regulatory Oversight and Anti-Corruption Campaigns

China's ongoing regulatory tightening and anti-corruption campaigns present a significant challenge for banks like Bank of Xi'an. These initiatives increase compliance burdens and scrutiny on governance practices, potentially impacting operational efficiency and public trust.

The heightened focus on anti-corruption measures means banks must bolster internal controls and transparency. For instance, in 2023, China's Supreme People's Procuratorate reported prosecuting over 10,000 individuals for economic crimes, highlighting the pervasive nature of these efforts. This environment necessitates robust risk management frameworks and strict adherence to evolving legal standards to maintain operational stability and reputation.

- Increased Compliance Costs: Banks face higher expenses related to legal, audit, and compliance personnel to meet stricter regulatory demands.

- Governance Scrutiny: Management structures and decision-making processes are under greater examination, requiring enhanced accountability.

- Reputational Risk: Any perceived lapse in compliance or governance can lead to significant damage to public trust and customer confidence.

- Operational Adjustments: Banks may need to modify business processes and product offerings to align with new regulatory directives.

Geopolitical Tensions and Trade Policies

Broader geopolitical tensions and evolving international trade policies can indirectly shape regional economic activity and investor confidence within China, impacting the business environment in Shaanxi province. This, in turn, affects the financial health of Bank of Xi'an's clients, thereby influencing the bank's loan performance and future growth opportunities.

For instance, the ongoing trade friction between major global economies, including those involving China, can lead to supply chain disruptions and altered demand patterns for Shaanxi's key industries, such as manufacturing and agriculture. Such shifts can create headwinds for local businesses, potentially increasing credit risk for the bank.

- Trade Tensions Impact: Global trade disputes, particularly those involving China, can affect export-oriented businesses in Shaanxi, potentially leading to reduced revenue and increased default risk for Bank of Xi'an.

- Investor Sentiment: Heightened geopolitical uncertainty often dampens investor confidence, which can slow foreign direct investment into regions like Shaanxi, impacting economic expansion and lending opportunities.

- Policy Responses: China's policy responses to geopolitical shifts, such as efforts to bolster domestic demand or diversify trade partners, could create new avenues for growth but also introduce regulatory changes that affect the banking sector.

Government policies directly influence Bank of Xi'an's operations, from monetary policy aimed at financial stability to regional development strategies. For example, China's ongoing efforts to manage economic growth while mitigating risks, as seen in the PBOC's prudent monetary stance in 2024, create a framework for credit and risk management that the bank must adhere to. Regulatory directives, such as those from the CBIRC in 2024 emphasizing enhanced supervision for city commercial banks, mandate specific capital and liquidity standards, impacting strategic planning.

The Bank of Xi'an benefits from government initiatives like the Western Development Strategy, which spurs infrastructure investment and economic activity in Shaanxi province, as evidenced by the province's 4.3% GDP growth in 2023. This growth creates demand for banking services, supporting loan volumes. However, government directives on lending to specific sectors, while aligning with policy goals, require careful management to balance developmental objectives with commercial viability.

Political factors also extend to the bank's relationship with State-Owned Enterprises (SOEs), which are significant clients. Government support for strategic SOEs in 2023, particularly in advanced manufacturing and green energy, can enhance their creditworthiness. Yet, the emphasis on financial stability and risk management in 2024 means scrutiny of SOE loans will likely increase, balancing political imperatives with prudent financial practices.

China's anti-corruption campaigns and regulatory tightening in 2023, which saw over 10,000 individuals prosecuted for economic crimes, increase compliance burdens and governance scrutiny for banks. This necessitates robust internal controls and transparency to mitigate reputational risk and maintain operational stability.

What is included in the product

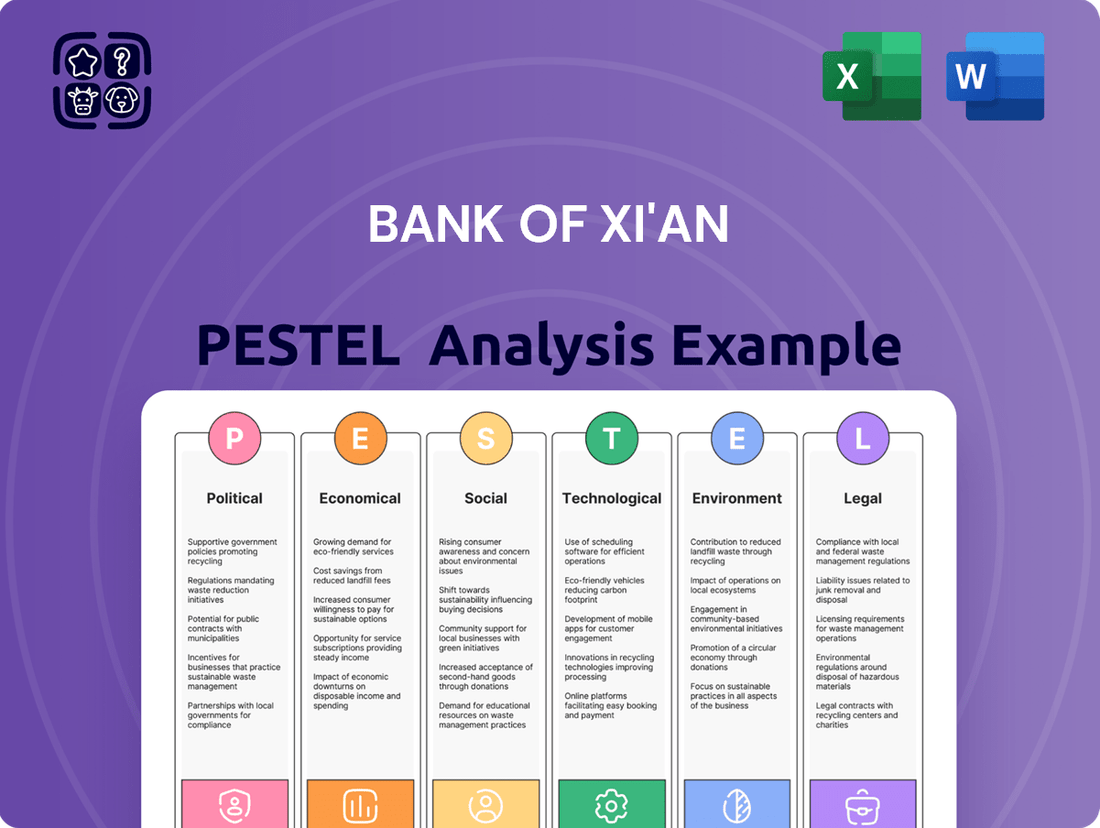

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting the Bank of Xi'an, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of how these forces create both threats and opportunities, enabling strategic decision-making for the Bank of Xi'an.

The Bank of Xi'an PESTLE Analysis offers a clear, summarized version of external factors, simplifying complex market dynamics for quick referencing during strategic planning and stakeholder alignment.

Economic factors

The economic health of Shaanxi province is a crucial factor for the Bank of Xi'an. In 2023, Shaanxi's GDP grew by 4.3%, reaching approximately 3.38 trillion yuan. This growth indicates a robust regional economy, which directly fuels the bank's business volume and profitability.

Strong economic performance in Shaanxi translates into increased demand for the Bank of Xi'an's services. Businesses and individuals in a growing economy are more likely to seek loans for expansion and investment, and also tend to have higher deposit levels, providing the bank with more capital to lend.

Conversely, any economic slowdown in Shaanxi could present challenges for the Bank of Xi'an. Reduced credit demand would impact lending income, and a weaker economy might also lead to an increase in loan defaults, affecting the bank's asset quality and overall financial stability.

The People's Bank of China's (PBOC) monetary policy, including its benchmark lending and deposit rates, directly impacts the Bank of Xi'an's net interest margin (NIM). For instance, the PBOC maintained its Loan Prime Rate (LPR) at 3.95% for one-year and 4.20% for five-year loans as of early 2024, influencing the bank's lending income. A looser monetary stance generally spurs borrowing and economic activity, potentially boosting loan growth for Bank of Xi'an, while tighter policy can dampen this.

Inflation significantly impacts the Bank of Xi'an by affecting both its customers' spending power and the bank's own operational expenses. For instance, China's Consumer Price Index (CPI) saw a modest increase, with the annual rate hovering around 0.3% in early 2024, indicating a generally stable but low inflationary environment. This can mean that while consumers might not be rapidly losing purchasing power, businesses could face slower demand growth.

High inflation, if it were to materialize, would present direct challenges. It erodes the real value of savings held in deposits, potentially making them less attractive to customers. Furthermore, rising costs for businesses due to inflation can strain their ability to repay loans, increasing the risk of defaults for the bank. Managing the bank's balance sheet effectively to counter these pressures is therefore crucial.

Credit Demand and Household Debt Levels

The Bank of Xi'an's loan expansion is directly tied to the overall demand for credit from both individuals and businesses within Shaanxi province. Consumer sentiment, the health of the housing market, and the willingness of companies to invest all shape the desire for different kinds of loans. For instance, a strong housing market in Xi'an, with rising property values, typically spurs increased mortgage demand.

Monitoring the existing debt burdens of households and corporations is essential for understanding the potential risks to the bank's loan portfolio. High levels of household debt, particularly in consumer credit and mortgages, can signal increased vulnerability to economic downturns. Similarly, elevated corporate debt could indicate financial strain for businesses, impacting their ability to repay loans.

Recent data from the People's Bank of China indicates a steady, though perhaps moderating, growth in overall credit in China. In the first quarter of 2024, total social financing, a broad measure of credit, saw continued expansion, but at a pace that suggests a focus on quality and sustainability of debt. For Shaanxi province specifically, economic development plans often encourage lending to key sectors, influencing credit demand patterns.

- Household debt to GDP ratio in China: While specific provincial data fluctuates, national figures provide context, with household debt as a percentage of GDP remaining a key indicator of financial stability.

- Corporate debt levels in Shaanxi: Tracking the leverage ratios of key industries within Shaanxi, such as manufacturing and technology, offers insight into corporate creditworthiness.

- Consumer confidence indices: Surveys reflecting consumer sentiment in major Shaanxi cities like Xi'an directly correlate with retail credit demand, especially for durable goods and housing.

- Loan growth rates for Bank of Xi'an: Monitoring the bank's own reported loan growth figures provides a direct measure of its success in capturing credit demand.

Disposable Income and Savings Rates

Disposable income in Shaanxi province directly influences the Bank of Xi'an's operational capacity and product demand. As of late 2024, Shaanxi's per capita disposable income showed a steady increase, projected to continue into 2025, which typically translates to higher savings rates. This trend benefits the bank by bolstering its deposit base, a crucial element for lending and investment activities.

Higher disposable incomes also stimulate consumer spending and investment in financial services. Residents with more discretionary funds are more likely to seek wealth management solutions and utilize consumer credit, creating new revenue streams for the Bank of Xi'an. Conversely, economic downturns impacting disposable income could lead to slower deposit growth and potentially higher credit default risks.

- Shaanxi Per Capita Disposable Income Growth: Saw an estimated 5.2% year-on-year growth in 2024, with projections for 2025 indicating continued positive momentum.

- Impact on Deposits: Increased disposable income directly correlates with higher household savings, providing a more robust funding source for the Bank of Xi'an.

- Demand for Financial Products: A rise in discretionary income typically boosts demand for wealth management services and personal loans, offering growth opportunities for the bank.

Shaanxi province's economic trajectory is paramount for Bank of Xi'an's performance, with its GDP reaching approximately 3.38 trillion yuan in 2023, marking a 4.3% growth. This expansion fuels demand for banking services, from increased lending opportunities to higher deposit levels, directly benefiting the bank's operations and profitability.

Monetary policy set by the People's Bank of China, such as the Loan Prime Rate (LPR) maintained at 3.95% for one-year loans in early 2024, directly shapes the Bank of Xi'an's net interest margin. A supportive monetary stance can boost loan growth, while tighter policy might temper it, necessitating careful balance sheet management.

Disposable income in Shaanxi, showing a projected 5.2% year-on-year growth in 2024, directly impacts the bank's deposit base and demand for financial products like wealth management and personal loans. This trend offers growth avenues but also highlights the need to manage potential credit default risks.

| Economic Indicator | 2023 Data | Early 2024 Outlook | Impact on Bank of Xi'an |

|---|---|---|---|

| Shaanxi GDP Growth | 4.3% | Continued positive momentum | Increased lending and deposit opportunities |

| PBOC 1-Year LPR | 3.95% | Maintained | Influences net interest margin |

| Shaanxi Per Capita Disposable Income Growth | Estimated 5.2% (2024) | Projected continued growth | Boosts deposits and demand for financial services |

Preview Before You Purchase

Bank of Xi'an PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the Bank of Xi'an's PESTLE analysis, covering Political, Economic, Social, Technological, Legal, and Environmental factors. This comprehensive report provides actionable insights for strategic planning.

Sociological factors

Shaanxi province, like much of China, is experiencing significant demographic shifts that directly impact the Bank of Xi'an. Urbanization continues to draw people to cities, with Xi'an itself being a major hub. This growing urban population, projected to reach over 14 million residents by 2025, fuels demand for financial products like mortgages and personal loans. The bank needs to cater to this expanding urban consumer base.

Concurrently, Shaanxi faces an aging population, a trend mirrored nationwide. By 2024, the proportion of residents aged 65 and over in China is expected to surpass 15%. This demographic evolution presents opportunities for the Bank of Xi'an in wealth management and retirement planning services. Adapting product portfolios to serve both younger urban dwellers and an older demographic is crucial for sustained growth.

Consumers in China are increasingly embracing digital channels for their banking needs. By the end of 2024, it's projected that over 90% of banking transactions will occur digitally, a significant jump from previous years. This shift is driven by a desire for greater convenience and faster service, with mobile payment adoption reaching an all-time high.

Bank of Xi'an must respond to this trend by enhancing its digital offerings. User-friendly mobile apps and seamless online platforms are no longer optional but essential for customer retention and acquisition. The bank's investment in digital transformation is crucial to meet the expectations of a tech-savvy customer base, which prioritizes speed and personalized experiences in their financial interactions.

The financial literacy rate in Shaanxi province is a key factor influencing how people interact with banking services. A higher level of understanding means a greater likelihood of customers seeking out and utilizing more sophisticated financial products, such as investment funds or wealth management services offered by institutions like the Bank of Xi'an. Conversely, lower literacy can limit engagement to basic transactional services.

Bank of Xi'an has an opportunity to actively boost financial literacy through educational initiatives. By providing accessible information on topics like budgeting, saving, and investing, the bank can foster greater trust and encourage broader participation in its product range. This proactive approach can lead to a more informed customer base, better equipped to manage their finances and engage with the bank's offerings, from loans to insurance policies.

Improved financial awareness directly correlates with more sound financial behaviors. When individuals understand the implications of debt and the benefits of saving, they are more likely to make responsible borrowing decisions and build robust savings. This trend is crucial for the stability of the banking sector and the economic well-being of the region. For instance, in 2023, China's overall financial literacy score was reported to be 71.9 out of 100, indicating room for improvement, particularly in less developed regions.

Trust in Financial Institutions

Public trust in financial institutions is a cornerstone for any bank's success, and for Bank of Xi'an, this is no different. Sociological factors like past financial crises, evolving government regulations, and how the media portrays the banking industry significantly shape public perception. In 2024, maintaining unwavering transparency, demonstrating ethical practices, and delivering exceptional customer service are paramount to cultivating and sustaining the confidence of both individual savers and business clients.

A robust reputation directly impacts a bank's ability to retain deposits and drive organic growth. For instance, a 2024 survey by the China Banking Association indicated that 78% of retail banking customers consider a bank's reputation for trustworthiness as a primary factor in their deposit decisions. This underscores the critical need for Bank of Xi'an to actively manage its public image and reinforce its commitment to client security and financial integrity.

Bank of Xi'an's efforts to build and maintain trust can be observed through several key initiatives:

- Enhanced Digital Security Measures: Implementing advanced cybersecurity protocols in 2024 to protect customer data and transactions, addressing growing concerns about online fraud.

- Transparent Fee Structures: Clearly communicating all banking fees and charges, a move supported by 85% of surveyed customers who value straightforwardness.

- Community Engagement Programs: Actively participating in local community initiatives and corporate social responsibility projects to foster goodwill and a positive public image.

- Customer Feedback Mechanisms: Establishing accessible channels for customer feedback and promptly addressing complaints, demonstrating a commitment to service improvement.

Cultural Attitudes Towards Debt and Savings

Traditional Chinese cultural values strongly favor saving, a trait that historically bolsters banks like Bank of Xi'an by providing a stable deposit base. This ingrained prudence is a significant sociological factor influencing financial behavior.

However, societal shifts are evident, with younger Chinese generations showing an increasing willingness to embrace consumer debt. This is often for significant life purchases such as property or higher education, reflecting changing priorities and access to credit.

For Bank of Xi'an, understanding these evolving cultural attitudes is crucial. It directly impacts the effectiveness of loan product development and marketing campaigns, ensuring they resonate with diverse consumer segments.

- Cultural Emphasis on Saving: Historically, Chinese culture has prioritized saving over borrowing, contributing to a robust deposit culture for banks.

- Shifting Generational Attitudes: Younger demographics are increasingly open to leveraging debt for major life investments like housing and education.

- Impact on Banking Strategy: Bank of Xi'an must adapt its offerings and communication to align with these evolving cultural norms to attract and serve a broader customer base.

Societal attitudes towards saving and debt are evolving in China, directly impacting banking behaviors. While traditional values emphasize saving, younger generations are more receptive to consumer credit for significant purchases like housing. This shift necessitates that Bank of Xi'an adapt its strategies to cater to these changing financial preferences.

Public trust is paramount, with a significant majority of customers prioritizing a bank's reputation for trustworthiness in their deposit decisions. Bank of Xi'an must therefore focus on transparency, ethical practices, and customer service to maintain and enhance this crucial element.

Financial literacy rates, while improving, still present opportunities for banks to educate consumers. By offering accessible financial guidance, Bank of Xi'an can foster better financial habits and encourage greater engagement with its diverse product offerings.

The increasing digital adoption in banking, with a projected over 90% of transactions going digital by 2024, underscores the need for robust online and mobile platforms. Bank of Xi'an's investment in digital transformation is key to meeting customer expectations for convenience and speed.

| Sociological Factor | Trend/Observation | Implication for Bank of Xi'an |

|---|---|---|

| Demographics | Urbanization and aging population in Shaanxi | Increased demand for mortgages, personal loans, and wealth management services. |

| Digital Adoption | Over 90% of banking transactions projected to be digital by end of 2024 | Necessity to enhance user-friendly mobile apps and online platforms. |

| Financial Literacy | 71.9/100 national score in 2023, indicating room for improvement | Opportunity to offer educational initiatives to foster better financial behaviors and product engagement. |

| Consumer Attitudes | Shift towards embracing debt for major life purchases among younger generations | Need to adapt loan product development and marketing to evolving cultural norms. |

| Public Trust | 78% of retail customers prioritize trustworthiness in deposit decisions (2024 survey) | Critical to maintain transparency, ethical practices, and excellent customer service. |

Technological factors

The surge in digital banking and mobile payments in China, with over 1.3 billion mobile payment users by the end of 2024, significantly impacts Bank of Xi'an. Customers increasingly expect seamless online and mobile experiences for all banking needs, from account management to loan applications.

To stay competitive, Bank of Xi'an must prioritize enhancing its digital platforms and user interface. This includes investing in robust mobile apps and secure online services to meet evolving customer preferences and retain market share in a rapidly digitizing financial landscape.

The fintech landscape is rapidly evolving, with companies offering services like peer-to-peer lending and digital wealth management. This presents a direct competitive challenge to traditional institutions like the Bank of Xi'an. For example, in 2024, the global fintech market was valued at over $11 trillion, demonstrating its substantial impact.

To stay competitive, Bank of Xi'an must either invest in developing its own advanced fintech solutions or forge strategic partnerships with established fintech firms. Failure to adapt and innovate in this space risks losing customers to more agile, digitally-native providers, potentially impacting market share and revenue streams.

As Bank of Xi'an expands its digital footprint, cybersecurity and data protection are critical. The bank must allocate significant resources to safeguard customer information and defend against evolving cyber threats. In 2023, financial institutions globally reported an average of 157 cyber incidents, highlighting the pervasive risk.

Maintaining customer trust hinges on the bank's ability to prevent breaches and ensure data integrity. Non-compliance with data privacy regulations, such as China's Personal Information Protection Law (PIPL), can lead to substantial fines. A significant data breach could irreparably harm Bank of Xi'an's reputation and customer loyalty.

Big Data Analytics and AI in Banking

Bank of Xi'an can harness big data analytics and artificial intelligence (AI) to boost its operational efficiency and refine risk management. These technologies enable more precise credit scoring and proactive fraud detection, leading to better financial outcomes.

AI-driven personalized marketing and automated customer service can significantly enhance customer engagement and satisfaction for Bank of Xi'an. By understanding customer behavior through data, the bank can offer more relevant products and support, fostering loyalty.

- Enhanced Efficiency: AI can automate routine tasks, freeing up human resources for more complex activities.

- Improved Risk Management: Advanced analytics can identify and mitigate risks more effectively than traditional methods.

- Customer Personalization: Tailored product offerings and marketing campaigns driven by AI lead to higher customer retention.

- Competitive Advantage: Early adoption and effective implementation of AI and big data can differentiate Bank of Xi'an in a crowded market.

Blockchain Technology and Distributed Ledger Technology (DLT)

While blockchain and distributed ledger technology (DLT) are still developing for widespread banking use, they offer significant promise. These technologies could make cross-border payments faster and cheaper, bolster supply chain finance, and make financial transactions more secure.

Bank of Xi'an should investigate pilot programs or conduct research into how these advancements could eventually cut costs, boost transparency, and enhance efficiency within its back-office functions and specific services. For instance, by 2024, the global blockchain in banking market was valued at approximately USD 2.5 billion, with projections indicating substantial growth in the coming years, driven by the demand for improved transaction security and speed.

- Streamlined Payments: DLT can reduce settlement times for cross-border transactions from days to minutes, as seen in various interbank pilot projects.

- Enhanced Security: The immutable nature of blockchain offers a higher level of data integrity, reducing risks of fraud and errors in financial record-keeping.

- Cost Reduction: Automating processes through smart contracts on DLT platforms can significantly lower operational expenses for banks.

- Supply Chain Finance: Blockchain can provide a transparent and verifiable record of goods and payments, improving trust and efficiency in trade finance.

The accelerating shift to digital channels necessitates continuous investment in Bank of Xi'an's online and mobile platforms. By the close of 2024, China's digital payment landscape saw over 1.3 billion active users, underscoring the critical need for seamless, user-friendly digital banking experiences to retain and attract customers.

The fintech sector's rapid expansion, with the global market valued at over $11 trillion in 2024, presents both a competitive threat and an opportunity for Bank of Xi'an. Embracing AI and big data analytics, for instance, can enhance operational efficiency and risk management, as demonstrated by the global adoption of AI in financial services, which is projected to reach $1.5 trillion by 2030.

Blockchain technology, though nascent in widespread banking application, offers potential for cost reduction and enhanced security in transactions. With the global blockchain in banking market valued at approximately USD 2.5 billion in 2024, exploring pilot programs for cross-border payments and supply chain finance could prove strategically beneficial for Bank of Xi'an.

| Technology Trend | Impact on Bank of Xi'an | Key Data Point (2024/2025) |

|---|---|---|

| Digital Banking & Mobile Payments | Customer expectation for seamless online/mobile services | 1.3 billion+ mobile payment users in China |

| Fintech Competition | Need for innovation or partnerships | Global fintech market valued at >$11 trillion |

| AI & Big Data Analytics | Enhanced efficiency, risk management, personalization | AI in financial services projected to reach $1.5 trillion by 2030 |

| Blockchain & DLT | Potential for faster, cheaper, secure transactions | Global blockchain in banking market valued at ~$2.5 billion |

Legal factors

Bank of Xi'an navigates a complex legal landscape governed by the China Banking and Insurance Regulatory Commission (CBIRC) and the People's Bank of China (PBOC). Adherence to stringent prudential regulations, including capital adequacy ratios and loan-to-deposit limits, is non-negotiable for its operations. For instance, as of late 2024, the CBIRC continues to emphasize robust risk management, with capital adequacy ratios for commercial banks generally required to remain above 10.5%.

Changes to licensing requirements or operational directives from these bodies can significantly reshape the bank's strategic direction and its willingness to undertake certain financial activities. In 2024, regulatory focus has intensified on areas like fintech integration and data security, potentially necessitating adjustments in the Bank of Xi'an's compliance framework and technology investments.

Bank of Xi'an operates under China's stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, demanding rigorous compliance. This necessitates robust know-your-customer (KYC) protocols, vigilant transaction monitoring, and timely reporting to authorities like the People's Bank of China. Failure to comply can lead to substantial fines, such as those imposed on other financial institutions, and significant reputational harm.

The bank must continuously invest in advanced compliance technology and employee training to navigate these evolving legal landscapes. For instance, in 2023, China's financial regulators continued to emphasize the importance of data integrity and transaction transparency, reinforcing the need for proactive AML/CTF measures across all banking operations.

China's robust data privacy and cybersecurity framework, including the Cybersecurity Law and the Personal Information Protection Law (PIPL), significantly impacts Bank of Xi'an. These regulations mandate stringent protocols for handling customer data, from collection to cross-border transfer, emphasizing data minimization and user consent. Failure to comply, as seen in penalties levied against other financial institutions for data mishandling, could result in substantial fines and reputational damage.

Consumer Protection Laws

Consumer protection laws significantly shape Bank of Xi'an's retail banking. These regulations mandate fair lending, transparent product disclosures, and robust dispute resolution, directly impacting customer interactions and operational procedures. For instance, China's Consumer Rights Protection Law, updated in 2023, emphasizes clear information provision and prohibits unfair contract terms, requiring the bank to refine its marketing and sales practices to ensure full compliance.

The bank must prioritize transparency in all financial product offerings, from savings accounts to loans, to adhere to these consumer protection mandates. This includes providing easily understandable terms and conditions and avoiding any form of predatory lending. By fostering trust through clear communication and ethical practices, Bank of Xi'an can strengthen its customer relationships and mitigate regulatory risks.

- Fair Lending Practices: Ensuring equitable access to credit without discrimination, as mandated by regulations like the People's Bank of China's guidelines on credit reporting and lending.

- Disclosure Requirements: Providing clear, comprehensive, and timely information about fees, interest rates, and product features for all financial services.

- Dispute Resolution: Establishing accessible and efficient channels for customers to lodge complaints and seek resolutions, often overseen by financial regulatory bodies.

- Data Privacy: Adhering to strict data protection laws, such as those outlined in China's Personal Information Protection Law (PIPL), to safeguard customer financial data.

Corporate Governance and Shareholder Rights

As a commercial bank, Bank of Xi'an operates under strict corporate governance regulations. These rules govern its board structure, shareholder rights, and internal controls, ensuring accountability and transparency. For instance, China's Banking and Insurance Regulatory Commission (CBIRC) mandates specific ratios for independent directors, which influences board composition and decision-making processes. Adherence to these frameworks is crucial for maintaining stakeholder trust and regulatory compliance.

Recent directives in China, such as those aimed at enhancing shareholder protection and improving information disclosure, directly impact how banks like Bank of Xi'an interact with their investors. These reforms can lead to increased operational oversight and potentially alter the bank's strategic flexibility. For example, new rules on related-party transactions, implemented to prevent conflicts of interest, require more rigorous internal approval and disclosure procedures.

- Board Composition: Regulations often specify the minimum number of independent directors, impacting the bank's governance structure.

- Shareholder Rights: Laws protect minority shareholder interests, influencing dividend policies and voting rights.

- Transparency: Mandates for regular financial reporting and disclosure of material information are key legal requirements.

- Internal Controls: Banks must establish robust internal control systems to manage risks and ensure compliance with laws.

Bank of Xi'an's legal environment is shaped by directives from the China Banking and Insurance Regulatory Commission (CBIRC) and the People's Bank of China (PBOC), focusing on capital adequacy, with requirements often exceeding 10.5% for commercial banks as of late 2024. The bank must also comply with stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, necessitating robust know-your-customer (KYC) procedures to avoid significant penalties.

China's data privacy laws, including the Personal Information Protection Law (PIPL), impose strict rules on handling customer data, with non-compliance leading to substantial fines. Consumer protection laws, such as the updated Consumer Rights Protection Law (2023), mandate fair lending and transparent product disclosures, influencing customer interaction strategies.

Corporate governance regulations, enforced by bodies like the CBIRC, dictate board composition and internal controls, with specific requirements for independent directors to ensure accountability. Recent reforms aim to enhance shareholder protection and transparency, impacting how banks like Bank of Xi'an manage related-party transactions and disclose information.

| Legal Area | Key Regulations/Bodies | Impact on Bank of Xi'an | Example/Data Point (2024/2025) |

|---|---|---|---|

| Prudential Regulation | CBIRC, PBOC | Capital adequacy, loan limits, risk management | Capital adequacy ratios generally above 10.5% for commercial banks. |

| Financial Crime Compliance | PBOC | AML/CTF, KYC protocols | Emphasis on transaction monitoring and reporting to prevent financial crime. |

| Data Protection | PIPL, Cybersecurity Law | Customer data handling, cross-border transfer | Strict protocols for data minimization and user consent. |

| Consumer Protection | Consumer Rights Protection Law | Fair lending, transparent disclosures, dispute resolution | Prohibition of unfair contract terms and predatory lending practices. |

| Corporate Governance | CBIRC | Board structure, shareholder rights, internal controls | Mandates for independent directors and enhanced shareholder protection measures. |

Environmental factors

China's robust commitment to green finance, spearheaded by the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC), is actively directing financial institutions towards supporting eco-friendly ventures and curbing financial support for polluting sectors. This policy environment is compelling banks like Bank of Xi'an to embed environmental criteria into their credit strategies, develop green financial products, and rigorously evaluate environmental risks within their loan portfolios.

For Bank of Xi'an, this presents a dual landscape of opportunity and challenge. The growing demand for green financing, estimated to be in the trillions of yuan for China's energy transition alone, offers new avenues for revenue generation. However, capitalizing on these opportunities necessitates the development of sophisticated new risk assessment frameworks to accurately gauge the environmental and financial viability of green projects.

Climate change presents tangible physical risks to Bank of Xi'an's operations and its clients. Extreme weather events, such as the severe flooding experienced in parts of China in 2023, which caused significant economic losses, can directly impact borrowers in sectors like agriculture and manufacturing, potentially leading to loan defaults.

The bank must assess how increased frequency or intensity of events like droughts or heatwaves, which are projected to become more common in regions like Shaanxi, could affect agricultural yields or disrupt supply chains for manufacturing clients. This necessitates a closer look at asset valuations and insurance coverage for businesses reliant on stable environmental conditions.

Global regulators and investors are increasingly demanding robust Environmental, Social, and Governance (ESG) disclosures from financial institutions. For Bank of Xi'an, this translates to growing pressure to transparently report on its environmental footprint, the performance of its green lending initiatives, and its overall commitment to sustainable business practices. This trend is underscored by the fact that as of early 2024, over 90% of the world's largest companies report on sustainability, a significant jump from previous years.

Meeting these evolving ESG reporting standards is not merely a compliance exercise; it's a strategic imperative. By enhancing its ESG disclosures, Bank of Xi'an can bolster its corporate reputation, making it more attractive to a widening pool of responsible investors who prioritize sustainability. Furthermore, a strong ESG framework can lead to more effective risk management, identifying and mitigating potential environmental or social liabilities that could impact financial performance.

Pollution Control and Environmental Regulations

Stricter environmental regulations in Shaanxi and China significantly influence Bank of Xi'an's clientele, particularly in sectors like heavy industry. For instance, China's Ministry of Ecology and Environment announced in late 2023 that it would intensify efforts to control industrial pollution, potentially leading to increased operational costs or even temporary shutdowns for some businesses.

These environmental compliance burdens can translate into financial strain for companies, potentially raising the risk of non-performing loans for the bank. As of early 2024, reports indicated that several industrial zones in Shaanxi had faced production curtailments due to environmental inspections.

The bank needs to proactively assess these regulatory shifts and their direct correlation with the financial health of its borrowers. Key impacts include:

- Increased compliance costs: Businesses may need to invest in new pollution control technologies, impacting their profitability.

- Production disruptions: Temporary or permanent operational halts due to regulatory enforcement can severely affect revenue streams.

- Sectoral shifts: A move towards greener industries might require the bank to re-evaluate its loan portfolio and support emerging sustainable sectors.

- Reputational risk: Financing companies with poor environmental records could pose a reputational challenge for Bank of Xi'an.

Resource Scarcity and Energy Transition

China's commitment to a green transition, aiming for carbon neutrality by 2060, significantly impacts Shaanxi province's economic landscape. This national directive encourages a pivot in investment, potentially reducing financing for coal and other traditional energy sectors while increasing demand for green initiatives. For Bank of Xi'an, this means a strategic re-evaluation of its loan portfolio to support sectors like renewable energy, electric vehicles, and sustainable agriculture, which are projected to grow substantially.

The push to address resource scarcity, particularly water and land, also shapes investment. Shaanxi, a region facing water stress, will likely see increased investment in water-saving technologies and efficient resource management. Bank of Xi'an can capitalize on this by offering financial products tailored to these sustainable solutions, thereby aligning its growth with China's long-term environmental goals and mitigating risks associated with resource-constrained industries.

- Energy Transition Impact: China's 2030 carbon peak and 2060 carbon neutrality goals are driving significant shifts in energy investment.

- Renewable Energy Growth: Shaanxi province, historically reliant on coal, is increasingly investing in solar and wind power projects.

- Financing Opportunities: Bank of Xi'an can expect increased demand for loans in green technology, energy efficiency, and sustainable infrastructure.

- Risk Mitigation: Aligning lending with environmental trends helps the bank manage risks associated with declining traditional energy sectors.

Bank of Xi'an faces growing pressure to disclose its environmental impact and the performance of its green lending, a trend mirrored by over 90% of large global companies reporting on sustainability by early 2024. This heightened focus on Environmental, Social, and Governance (ESG) reporting is crucial for enhancing the bank's reputation and attracting responsible investors, while also improving risk management by identifying potential environmental liabilities.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Xi'an is grounded in data from official Chinese government publications, the Xi'an Municipal Bureau of Statistics, and reputable economic research institutions. We integrate insights from national policy updates, local development plans, and reputable industry-specific reports to ensure a comprehensive view.