Bank of Marin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Marin Bundle

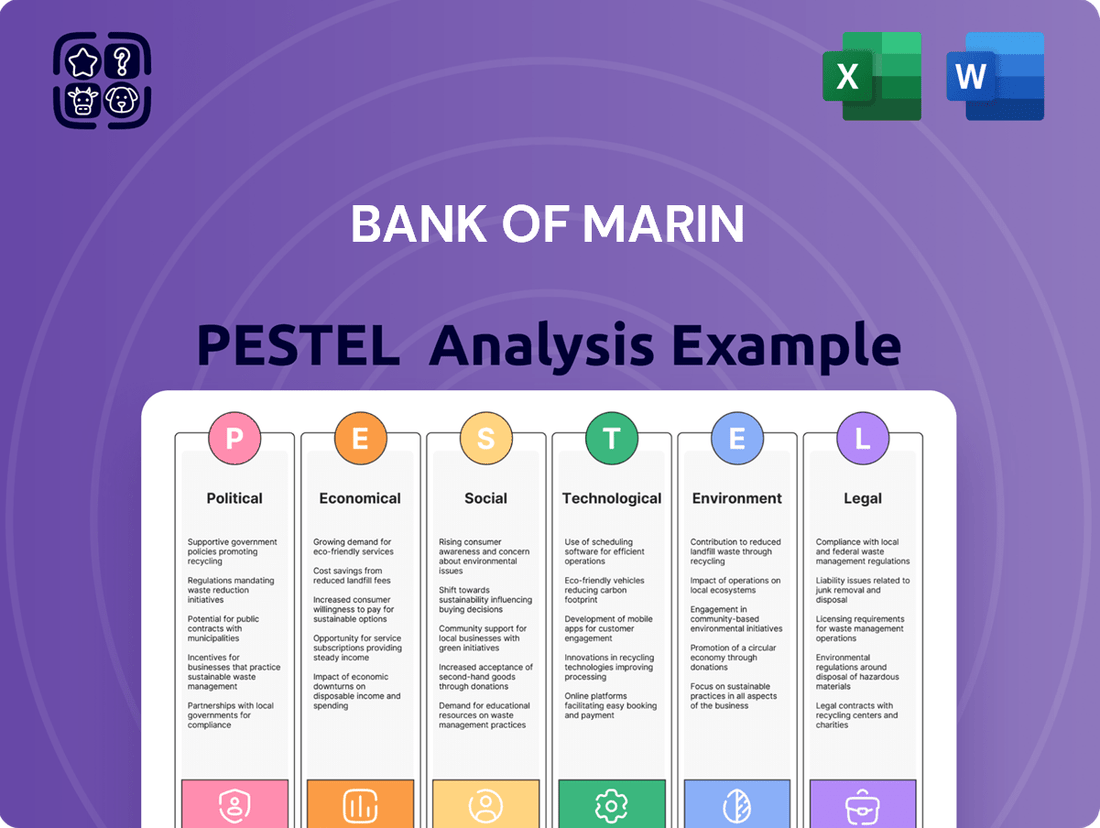

Navigate the complex external landscape affecting Bank of Marin with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its strategic direction and identify potential opportunities and threats. Gain a competitive edge by leveraging these critical insights. Download the full PESTLE analysis now to unlock actionable intelligence.

Political factors

The stability of the regulatory environment is a critical political factor for Bank of Marin. Fluctuations in banking laws and the oversight from agencies like the Federal Reserve and California's Department of Financial Protection and Innovation can significantly alter operational costs and the feasibility of strategic initiatives. For instance, the Dodd-Frank Act, enacted in 2010 and subject to ongoing interpretation and potential amendments, has had a lasting impact on capital requirements and compliance burdens for all banks, including regional players like Bank of Marin.

Government fiscal policies, like changes in tax rates and government spending, alongside the Federal Reserve's monetary policies, such as interest rate adjustments, significantly shape the economic landscape. For Bank of Marin, these policies directly influence how much people want to borrow, the rates banks offer on deposits, and ultimately, the bank's profit margin on lending. For instance, a rising interest rate environment, as seen with the Federal Reserve's tightening cycle through 2022-2023, typically increases borrowing costs for banks and their customers, potentially slowing loan growth.

The Bank of Marin's engagement with local and regional governments in Marin County and the broader San Francisco Bay Area is crucial. For instance, in 2023, the bank participated in several community development projects, including partnerships with Marin County for small business grants, totaling $2 million. This level of support directly impacts the bank's ability to implement impactful lending programs and community initiatives.

Collaborations with government entities on economic development, such as the San Francisco Bay Area's initiatives to boost tech startups, can unlock new avenues for the Bank of Marin. These partnerships not only foster business growth but also solidify the bank's reputation and deepen its roots within the communities it serves, potentially leading to increased customer acquisition and loyalty.

Political Stability and Geopolitical Events

Broader political stability, both domestically and internationally, significantly influences investor confidence and the overall economic climate in Bank of Marin's operating regions. Geopolitical tensions and trade disputes, even if seemingly distant, can create ripples that affect financial markets and, consequently, client sentiment and investment portfolios.

While Bank of Marin operates as a community bank, severe global political disruptions can still have an indirect impact. For instance, heightened global uncertainty might lead to broader market volatility, affecting the value of assets held by clients or influencing the bank's own investment strategies.

- 2024: The ongoing geopolitical landscape, including regional conflicts and evolving international relations, presents a backdrop of potential economic uncertainty that could influence consumer and business spending patterns in California.

- 2024-2025: Shifts in trade policies or tariffs, whether national or international, could impact industries prevalent in Bank of Marin's service areas, potentially affecting loan demand and credit quality.

- 2025 Projections: Analysts anticipate continued focus on regulatory environments and government fiscal policies, which will directly shape the operational and strategic landscape for financial institutions like Bank of Marin.

Consumer Protection and Privacy Laws

Consumer protection and privacy laws significantly shape Bank of Marin's operations, particularly with ongoing legislative activity. For instance, potential updates to the California Consumer Privacy Act (CCPA) or new federal privacy regulations necessitate continuous investment in compliance and robust data security measures. In 2024, financial institutions are increasingly focused on transparency in fees and lending practices, reflecting a heightened regulatory environment.

Adherence to these evolving mandates directly impacts how Bank of Marin interacts with its customers and manages sensitive financial information. The bank must allocate resources to ensure compliance with regulations concerning data handling, breach notifications, and fair lending practices. For example, the CFPB's increased scrutiny on overdraft fees in 2024 highlights the need for banks to maintain clear and compliant fee structures.

Key areas of focus for Bank of Marin include:

- Data Privacy Compliance: Ensuring adherence to CCPA and potential federal privacy laws, requiring ongoing investment in cybersecurity and data management systems.

- Consumer Protection Regulations: Staying abreast of and complying with rules governing fair lending, transparent fee disclosures, and customer complaint resolution processes.

- Financial Transparency: Implementing clear communication strategies regarding account terms, interest rates, and any changes to banking services to meet consumer expectations and regulatory demands.

Government policies and regulatory shifts remain paramount for Bank of Marin. In 2024, the financial sector continues to navigate evolving consumer protection laws, such as potential updates to the California Consumer Privacy Act (CCPA), demanding robust data security investments. Furthermore, the bank's engagement with local government on economic development initiatives, like small business grants totaling $2 million in 2023, directly influences its community impact and strategic growth avenues.

The interplay of fiscal and monetary policies, including the Federal Reserve's interest rate adjustments observed through 2022-2023, directly impacts borrowing costs and lending margins for Bank of Marin. Looking ahead to 2024-2025, shifts in trade policies could also affect regional industries, influencing loan demand and credit quality.

Geopolitical stability and international relations, while seemingly distant, create a backdrop of potential economic uncertainty that could influence consumer and business spending patterns in California throughout 2024 and into 2025.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing the Bank of Marin, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It highlights key trends and potential impacts, offering actionable insights for strategic decision-making within the bank's operating context.

This PESTLE analysis for Bank of Marin offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for quick referencing during meetings and strategic planning.

Economic factors

Changes in the Federal Reserve's benchmark interest rates directly impact Bank of Marin's profitability. For instance, if the Fed raises rates, Bank of Marin can charge more for loans, potentially boosting its net interest income, especially on variable-rate loans. However, this can also make borrowing more expensive for customers, potentially dampening loan demand.

Conversely, a decrease in interest rates by the Federal Reserve, as seen in periods of economic slowdown, can squeeze Bank of Marin's profit margins on loans. This is because the income generated from existing loans may not adjust as quickly as the cost of funds, leading to a compression of the net interest margin. Managing this delicate balance requires astute asset-liability management.

For example, as of late 2024, the Federal Reserve has maintained a relatively stable, albeit higher than previous years, interest rate environment. This has provided some benefit to banks like Bank of Marin on their loan portfolios, but the ongoing economic uncertainty continues to influence borrower behavior and deposit growth strategies.

The economic vitality of Marin County and the greater San Francisco Bay Area is a key driver for Bank of Marin. In late 2024, the Bay Area's GDP growth was projected to remain steady, supported by a resilient tech sector, though inflation and interest rate sensitivity are factors to watch.

Employment figures in Marin County have shown strength, with unemployment rates consistently below the state average. For instance, as of Q3 2024, Marin's unemployment rate hovered around 2.5%, indicating a healthy job market that fuels demand for banking services and supports borrowers' repayment capacities.

The stability of the housing market, a significant component of regional economic health, directly impacts loan demand. While the Bay Area has experienced price appreciation, affordability remains a challenge, influencing mortgage origination volumes and the overall credit environment for Bank of Marin.

Inflation directly erodes the purchasing power of consumers and businesses, impacting their capacity for saving and borrowing. For instance, the US experienced a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024, a significant figure that influences household budgets.

Persistent inflation can elevate operational costs for financial institutions like Bank of Marin, from technology investments to employee compensation. This also shapes consumer spending habits; if prices rise sharply, consumers may cut back on discretionary purchases, affecting the revenue streams of local businesses Bank of Marin supports.

Real Estate Market Dynamics

The Bank of Marin's performance is closely tied to the health of the Marin County and San Francisco Bay Area real estate markets. These local dynamics directly affect the bank's collateral values and the overall quality of its loan book. For instance, the median home price in Marin County reached approximately $1.4 million in early 2024, a slight dip from its peak but still indicative of a robust, albeit sensitive, market.

Fluctuations in both residential and commercial property values present both opportunities and risks for Bank of Marin. A strong market can lead to increased lending activity and higher collateral values, supporting loan growth. Conversely, a downturn could pressure loan portfolio quality and limit expansion. The commercial real estate sector, in particular, experienced shifts with increased vacancy rates in some segments of the Bay Area in late 2023, impacting commercial lending.

- Residential Market: Marin County's median home price hovered around $1.4 million in early 2024, showing resilience despite minor fluctuations.

- Commercial Real Estate: Certain Bay Area commercial segments saw rising vacancy rates in late 2023, potentially affecting commercial loan portfolios.

- Loan Portfolio Impact: Property value stability is critical for collateralizing loans, directly influencing the bank's risk exposure and lending capacity.

- Growth Opportunities: A healthy real estate market supports increased mortgage lending and commercial property financing for the bank.

Competition and Market Share

The banking sector in Bank of Marin's operating regions is characterized by intense competition. This includes not only established national financial institutions with vast resources but also a significant number of other community banks vying for local customers. Furthermore, the rise of FinTech companies is introducing innovative digital solutions that challenge traditional banking models, particularly in areas like lending and payment processing. This dynamic environment directly impacts Bank of Marin's pricing strategies for both loans and deposits, forcing it to remain competitive to attract and retain clients. For instance, in early 2024, national banks were observed offering slightly lower average interest rates on savings accounts compared to community banks in the same regions, a factor Bank of Marin must consider.

Bank of Marin's success in maintaining and expanding its market share hinges on its ability to differentiate itself. This involves offering compelling products and services that meet customer needs, delivering exceptional personalized service that fosters loyalty, and leveraging its deep understanding of and strong relationships within the local community. In a market where customers have numerous choices, these factors become critical differentiators. As of the latest available data from late 2023, community banks in California, where Bank of Marin operates, generally held a smaller but dedicated market share, often excelling in customer satisfaction scores compared to larger national counterparts.

- Competitive Landscape: Bank of Marin faces competition from national banks, other community banks, and FinTech disruptors.

- Pricing Influence: This competition directly affects loan and deposit pricing strategies.

- Market Share Drivers: Maintaining and growing market share relies on competitive offerings, personalized service, and strong local relationships.

- FinTech Impact: Emerging FinTech companies are introducing new digital alternatives that influence customer expectations and banking practices.

Economic factors significantly shape Bank of Marin's operational environment. Interest rate decisions by the Federal Reserve, like the stable but elevated rates seen in late 2024, directly influence lending income and borrowing costs. Regional economic health, exemplified by Marin County's low unemployment rate of around 2.5% in Q3 2024 and steady Bay Area GDP growth, underpins demand for banking services.

Inflation, with the US CPI at 3.4% year-over-year as of April 2024, impacts both consumer spending power and the bank's operational costs. The real estate market, where Marin County's median home price was about $1.4 million in early 2024, affects loan demand and portfolio quality, with some Bay Area commercial segments experiencing increased vacancies in late 2023.

| Economic Factor | Impact on Bank of Marin | Relevant Data (Late 2023/2024) |

|---|---|---|

| Federal Reserve Interest Rates | Affects net interest margin and loan demand | Stable, elevated rates in late 2024 |

| Regional Economic Growth (Bay Area) | Drives demand for banking services | Steady GDP growth projected |

| Unemployment Rate (Marin County) | Indicates borrower capacity and demand | Around 2.5% in Q3 2024 |

| Inflation (US CPI) | Impacts consumer spending and operational costs | 3.4% year-over-year increase as of April 2024 |

| Real Estate Market (Marin County) | Influences mortgage lending and collateral values | Median home price ~$1.4 million in early 2024 |

Preview Before You Purchase

Bank of Marin PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Bank of Marin's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bank of Marin.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the Bank of Marin's strategic environment.

Sociological factors

Marin County's demographic landscape is evolving, with a notable trend towards an aging population. In 2023, the median age in Marin County was 47.4 years, significantly higher than the national median of 38.9 years, indicating a growing segment of older adults who may require specialized financial services like retirement planning and estate management.

Migration patterns also play a crucial role. While the Bay Area continues to attract a diverse population, including younger professionals and families, shifts in housing affordability and remote work trends can influence where people choose to settle. This increasing diversity, encompassing various ethnic backgrounds and income levels, necessitates that Bank of Marin tailor its product suite and communication strategies to resonate with a broader customer base.

Adapting to these demographic shifts is key for Bank of Marin's continued success. For instance, as the population ages, demand for wealth management and trusts is likely to increase. Simultaneously, catering to the financial needs of a younger, more diverse demographic, perhaps through accessible digital banking solutions and tailored loan products for first-time homebuyers, will be essential for sustained growth.

Bank of Marin's strategy centers on deep community involvement and personalized banking, resonating with the strong local values prevalent in its operating regions. This focus is crucial for fostering client loyalty and drawing in new customers.

In 2024, Bank of Marin continued its commitment to community investment, with reported contributions exceeding $1.5 million towards local non-profits and initiatives. This aligns with a growing consumer preference, observed in recent surveys, for businesses that actively support their local economies and demonstrate social responsibility.

Consumer banking preferences are rapidly shifting, with a notable surge in demand for digital and mobile banking solutions. For instance, in 2024, a significant majority of banking interactions are expected to occur through digital channels, reflecting a growing comfort with online platforms for transactions and account management. This trend necessitates that Bank of Marin invest in robust digital infrastructure and user-friendly mobile applications to cater to these evolving expectations.

The desire for personalized financial advice is also a key driver in changing preferences. Customers increasingly expect tailored guidance and proactive support, moving beyond basic transactional services. By 2025, banks that can effectively leverage data analytics to offer customized product recommendations and financial planning services will likely see greater customer loyalty and engagement, a crucial consideration for Bank of Marin.

Balancing the enduring appeal of traditional, in-person service with the convenience of digital offerings presents a strategic challenge. While Bank of Marin has a reputation for personalized service, meeting the needs of a diverse clientele requires a hybrid approach. This means optimizing branch networks while simultaneously enhancing digital capabilities to provide a seamless and accessible banking experience across all touchpoints.

Financial Literacy and Wealth Disparity

The general financial literacy within the communities Bank of Marin serves is a key sociological factor. A significant portion of the population may require more accessible educational resources and straightforward financial products. For instance, in 2024, national surveys indicated that only about 60% of adults felt confident managing their finances, highlighting a need for banks to bridge this knowledge gap.

Wealth disparity also plays a crucial role. Addressing the needs of both high-net-worth individuals and those with lower incomes requires a diverse product suite and outreach. By offering tailored financial solutions, such as affordable banking options and robust financial education programs, Bank of Marin can foster greater financial inclusion and tap into underserved market segments.

- Financial Literacy Gap: Approximately 40% of US adults struggle with basic financial concepts, impacting their banking choices and needs.

- Wealth Concentration: The top 10% of households held a significant portion of wealth in 2023, indicating a need for services catering to both ends of the economic spectrum.

- Demand for Education: Consumer surveys in 2024 show a strong interest in personalized financial advice and educational workshops from banking institutions.

- Inclusion Initiatives: Banks investing in financial inclusion programs are seeing increased customer acquisition in previously overlooked demographics.

Workforce Trends and Talent Attraction

Societal shifts are significantly reshaping the employment landscape, directly impacting Bank of Marin's capacity to draw and keep top-tier talent. The increasing prevalence of remote work, a strong desire for work-life balance, and evolving generational expectations mean banks must adapt their recruitment and retention strategies. For instance, a 2024 survey indicated that 70% of employees would consider leaving a job if it lacked flexibility.

To remain competitive, Bank of Marin needs to focus on offering more than just competitive salaries. This includes robust benefits packages, opportunities for professional development, and fostering a supportive and inclusive workplace culture. In 2024, companies with strong employee engagement programs saw a 23% higher profitability than those without.

Key workforce trends influencing talent attraction for Bank of Marin include:

- Growing demand for flexible work arrangements: A significant portion of the workforce, particularly younger generations, prioritizes remote or hybrid work options.

- Emphasis on work-life balance: Employees are increasingly seeking employers who respect personal time and promote well-being, moving beyond traditional 9-to-5 structures.

- Generational workforce dynamics: With a diverse age range of employees, Bank of Marin must cater to varying career aspirations and communication styles.

- Skills gap in specialized financial roles: Attracting talent with expertise in areas like cybersecurity and data analytics remains a challenge across the financial sector.

Bank of Marin must navigate evolving consumer preferences, with a strong demand for digital banking solutions projected to dominate interactions in 2024. The desire for personalized financial advice is also a key trend, with banks leveraging data analytics to foster customer loyalty by 2025. This necessitates a strategic balance between enhancing digital capabilities and maintaining the bank's reputation for personalized, in-person service.

The financial literacy levels within Bank of Marin's service areas present an opportunity for educational outreach, as approximately 40% of US adults report low financial confidence in 2024. Addressing wealth disparity by offering inclusive banking options and financial education programs can also attract new customer segments. Furthermore, societal shifts towards valuing community involvement mean Bank of Marin's $1.5 million investment in local initiatives in 2024 directly aligns with consumer expectations for social responsibility.

Workforce dynamics are also critical, with 70% of employees in 2024 considering leaving jobs that lack flexibility. Bank of Marin needs to prioritize employee well-being and professional development to attract and retain talent, as companies with strong engagement programs saw 23% higher profitability in 2024.

| Sociological Factor | 2023/2024 Data Point | Implication for Bank of Marin |

|---|---|---|

| Aging Population | Median age in Marin County: 47.4 years (2023) | Increased demand for retirement planning and estate management services. |

| Digital Adoption | Majority of banking interactions expected via digital channels (2024) | Need for robust digital infrastructure and user-friendly mobile applications. |

| Financial Literacy | ~40% of US adults lack financial confidence (2024) | Opportunity for accessible financial education and straightforward products. |

| Workplace Flexibility | 70% of employees would consider leaving jobs without flexibility (2024) | Requirement to offer flexible work arrangements and strong employee benefits. |

| Community Investment | Bank of Marin contributed over $1.5 million to local initiatives (2024) | Aligns with growing consumer preference for socially responsible businesses. |

Technological factors

The shift to digital banking is undeniable, with a significant portion of customers now preferring mobile and online channels for their banking needs. For instance, in 2024, a substantial percentage of US bank customers reported using mobile banking apps at least weekly, a trend that continues to grow. Bank of Marin needs to keep pace with these evolving customer preferences, investing in user-friendly mobile applications and secure online platforms to remain competitive against agile FinTech companies.

As financial transactions increasingly move online, the threat of cyberattacks and data breaches remains a significant concern for Bank of Marin. In 2024, the financial sector continued to face sophisticated cyber threats, with reports indicating a rise in ransomware attacks targeting financial institutions. For instance, the FBI's Internet Crime Complaint Center (IC3) reported significant financial losses due to business email compromise scams, a common vector for initial access in cyberattacks.

Bank of Marin must continually enhance its cybersecurity infrastructure, implementing advanced threat detection systems and adhering to stringent data protection protocols to safeguard customer information and maintain trust. The bank's investment in cybersecurity is crucial, especially as regulatory bodies like the OCC and FDIC emphasize robust data security measures. For example, in 2024, increased scrutiny on third-party risk management highlighted the need for comprehensive vendor security assessments, a key component of Bank of Marin's overall cybersecurity strategy.

The financial technology (FinTech) sector continues to disrupt traditional banking. Companies specializing in online lending, digital payments, and robo-advisory services present a significant competitive threat to established institutions like Bank of Marin. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating the scale of this challenge.

To counter this, Bank of Marin must strategically integrate innovative solutions, potentially through partnerships with agile FinTech firms, or emphasize its unique selling proposition of personalized customer service. This approach is crucial as FinTech adoption grows; a 2024 report indicated that over 75% of consumers in developed markets have used at least one FinTech service.

Data Analytics and Artificial Intelligence

Bank of Marin can leverage data analytics and AI to gain a deeper understanding of customer behavior, enabling personalized product offerings and more effective marketing campaigns. For instance, by analyzing transaction data, the bank can identify trends and tailor services, potentially boosting customer retention. AI-powered credit scoring models can also improve the accuracy of risk assessment, leading to better loan portfolio management.

Investing in these advanced technologies is crucial for enhancing operational efficiency and decision-making. In 2024, many financial institutions reported significant ROI from AI implementations, with some seeing a 15-20% improvement in fraud detection rates. This focus allows Bank of Marin to streamline processes, reduce costs, and ultimately improve customer satisfaction through more responsive and relevant services.

- Enhanced Customer Insights: AI can process vast datasets to reveal intricate patterns in customer spending and preferences.

- Personalized Product Development: Data analytics enables the creation of tailored financial products that better meet individual customer needs.

- Improved Risk Management: AI algorithms can predict creditworthiness with greater accuracy, reducing potential loan defaults.

- Operational Efficiency Gains: Automation of tasks through AI can lead to cost savings and faster service delivery.

Cloud Computing and Infrastructure Modernization

Bank of Marin's embrace of cloud computing and infrastructure modernization is crucial for staying competitive. Cloud adoption promises significant benefits like enhanced scalability, cost savings, and greater IT flexibility. For instance, by mid-2024, many financial institutions reported substantial cost reductions, with some seeing up to a 30% decrease in operational expenses by migrating to cloud platforms, according to industry surveys.

Modernizing core banking systems and transitioning to cloud-based solutions directly impacts operational resilience and agility. This move allows for quicker rollout of new financial products and services, a key differentiator in the fast-paced banking sector. By the end of 2024, banks that had completed significant cloud migrations were able to launch new digital features an average of 40% faster than their legacy system counterparts.

The strategic shift towards cloud infrastructure is not just about efficiency; it's about future-proofing the bank. It provides a robust foundation to support ongoing growth initiatives and adapt to evolving customer demands. By Q1 2025, a notable percentage of community banks, estimated to be over 60%, were actively investing in cloud technologies to enhance their digital capabilities and competitive edge.

- Scalability: Cloud solutions allow for dynamic adjustment of IT resources based on demand, avoiding over-provisioning.

- Cost Efficiency: Reduced spending on physical hardware maintenance and data center operations.

- Operational Resilience: Improved disaster recovery and business continuity through distributed cloud infrastructure.

- Agility: Faster deployment of new digital services and product innovations.

Technological advancements are reshaping banking, compelling institutions like Bank of Marin to prioritize digital transformation. The increasing reliance on mobile and online platforms, evidenced by a significant rise in digital banking adoption throughout 2024, necessitates continuous investment in user-friendly interfaces and robust security. This digital shift is further amplified by the rapid growth of FinTech, a sector valued in the trillions and rapidly innovating in areas like lending and payments, demanding that traditional banks adapt or risk losing market share.

Cybersecurity remains a paramount concern, with financial institutions facing persistent threats like ransomware and business email compromise scams, which caused substantial losses in 2024. Bank of Marin must bolster its defenses through advanced threat detection and strict data protection protocols, aligning with regulatory emphasis on robust security measures. Furthermore, the strategic adoption of cloud computing by mid-2024 offered community banks, with over 60% investing in the technology by early 2025, significant benefits in scalability, cost reduction, and faster service delivery, enabling them to launch new digital features up to 40% faster.

| Technology Area | 2024/2025 Trend | Impact on Bank of Marin | Example Data Point |

|---|---|---|---|

| Digital Banking Adoption | Continued strong growth in mobile/online usage | Need for enhanced digital platforms and customer experience | Over 75% of consumers used at least one FinTech service in 2024 |

| Cybersecurity Threats | Rise in sophisticated attacks (ransomware, BEC) | Critical need for advanced security infrastructure and data protection | FBI IC3 reported significant losses from BEC scams in 2024 |

| FinTech Disruption | Rapid innovation and market expansion | Competitive pressure to integrate or partner with FinTech solutions | Global FinTech market valued at ~$2.4T in 2023 |

| AI and Data Analytics | Increased adoption for personalization and efficiency | Opportunity for improved customer insights, risk management, and operational efficiency | 15-20% ROI in fraud detection from AI implementations in 2024 |

| Cloud Computing | Significant investment and migration by financial institutions | Benefits in scalability, cost savings, and agility for new service deployment | Up to 30% operational cost reduction reported by banks migrating to cloud in 2024 |

Legal factors

Bank of Marin navigates a stringent regulatory landscape, overseen by entities like the FDIC, Federal Reserve, and the California Department of Financial Protection and Innovation. Compliance with capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which for many US banks hovered around 12-13% in early 2024, is paramount. Failure to meet these requirements, or adhere to lending and operational rules, can result in significant fines and jeopardize the bank's operating license.

Bank of Marin, like all financial institutions, must adhere to stringent Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) regulations. These laws are designed to combat financial crimes by requiring banks to monitor transactions and report suspicious activities, ensuring the integrity of the financial system.

Failure to comply can result in substantial penalties; for instance, in 2023, U.S. banks faced over $2 billion in AML/BSA-related fines. Bank of Marin's commitment to ongoing transaction monitoring, thorough suspicious activity reporting, and comprehensive staff training is crucial for mitigating both legal liabilities and reputational damage.

Bank of Marin must strictly adhere to consumer protection laws like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). These regulations mandate clear disclosures for financial products, safeguarding customers from unfair or deceptive practices. For instance, TILA requires lenders to disclose key loan terms, including the annual percentage rate (APR) and total finance charges, ensuring borrowers can make informed decisions.

Data Privacy and Security Regulations

Bank of Marin must navigate a complex web of data privacy and security regulations. Stringent laws like the California Consumer Privacy Act (CCPA), which grants consumers significant control over their personal information, and the potential for federal legislation, dictate how the bank handles customer data from collection to storage and usage. For instance, the CCPA, effective since 2020 and further amended, imposes strict requirements on businesses regarding data transparency, consumer rights, and data security. Failure to comply can result in substantial fines, with the CCPA allowing for statutory damages of $100 to $750 per consumer per incident, or actual damages, whichever is greater. This necessitates considerable investment in robust data security infrastructure, clear privacy policies, and effective customer consent management systems to mitigate legal risks and preserve customer trust.

Key implications for Bank of Marin include:

- Increased operational costs: Implementing and maintaining compliance with evolving data privacy laws requires ongoing investment in technology, personnel, and training.

- Enhanced customer trust: Proactive and transparent data handling practices can differentiate the bank and foster stronger customer relationships.

- Potential for regulatory penalties: Non-compliance can lead to significant financial penalties and reputational damage.

- Strategic data management: The bank must develop sophisticated strategies for data governance, anonymization, and secure data lifecycle management.

Employment and Labor Laws

Bank of Marin, like any employer, must navigate a complex web of federal, state, and local employment and labor laws. These regulations dictate everything from minimum wage and overtime pay to workplace safety standards and anti-discrimination policies. For instance, the Fair Labor Standards Act (FLSA) sets the baseline for these requirements, while California's specific labor laws often impose stricter standards, such as its paid sick leave mandates and robust protections against wage theft.

Compliance is not just about avoiding penalties; it's fundamental to effective human resource management and cultivating a positive work environment. In 2024, the U.S. Department of Labor continued to emphasize enforcement in areas like wage and hour violations and workplace safety, with significant fines levied against non-compliant businesses. For Bank of Marin, this means meticulous record-keeping and ongoing training for HR personnel and management to ensure adherence to evolving legal landscapes.

Key areas requiring strict attention for Bank of Marin include:

- Wage and Hour Laws: Ensuring compliance with federal and state minimum wage, overtime pay, and record-keeping requirements. For example, California's minimum wage increased to $16.00 per hour in January 2024 for all employers.

- Workplace Safety: Adhering to Occupational Safety and Health Administration (OSHA) standards to provide a safe working environment, which is particularly relevant in financial institutions for physical security and data protection.

- Non-Discrimination and Equal Employment Opportunity: Upholding laws that prohibit discrimination based on race, gender, religion, age, disability, and other protected characteristics, with ongoing efforts to promote diversity and inclusion.

- Employee Benefits and Leave: Complying with laws related to health insurance (e.g., Affordable Care Act), retirement plans (e.g., ERISA), and various forms of mandated leave, such as family and medical leave.

Bank of Marin operates under a complex legal framework, necessitating strict adherence to banking regulations, consumer protection laws, and data privacy mandates. Compliance with capital requirements, such as Common Equity Tier 1 ratios, which remained robust in early 2024, is critical to maintaining operational stability and avoiding penalties. The bank must also diligently uphold Anti-Money Laundering and Bank Secrecy Act regulations, with significant fines levied against non-compliant institutions in recent years, underscoring the importance of robust monitoring and reporting systems.

Furthermore, consumer protection laws like the Truth in Lending Act and Real Estate Settlement Procedures Act demand clear disclosures, ensuring borrower understanding. The California Consumer Privacy Act (CCPA) imposes stringent data privacy obligations, requiring substantial investment in security and transparency to avoid substantial penalties, which can range from statutory damages to actual damages per incident.

Employment law compliance is equally vital, with California's labor laws often exceeding federal standards, such as its minimum wage, which reached $16.00 per hour for all employers in January 2024. Adherence to wage and hour laws, workplace safety, non-discrimination policies, and employee benefits mandates is essential for avoiding legal repercussions and fostering a positive work environment.

Environmental factors

Climate change presents tangible risks to Bank of Marin's loan portfolio, particularly concerning real estate collateral. Rising sea levels and more frequent extreme weather events, like the increased intensity of atmospheric rivers impacting California, could devalue properties in vulnerable Bay Area locations.

This necessitates a thorough assessment of the bank's lending exposure in coastal and flood-prone regions. For instance, the National Oceanic and Atmospheric Administration (NOAA) projects significant sea-level rise along the California coast by 2050, directly affecting the long-term viability of properties securing loans.

Investor and public focus on Environmental, Social, and Governance (ESG) criteria is increasingly shaping the financial sector. While community banks like Bank of Marin may not face the same immediate regulatory pressure as larger institutions, evolving stakeholder expectations and the potential for future mandates around sustainable lending, green finance initiatives, and reducing carbon footprints are becoming significant considerations for operational strategy and investment choices.

Marin County and the broader San Francisco Bay Area are known for stringent local environmental regulations. These can significantly influence industries like real estate development, agriculture, and manufacturing, which are key sectors for Bank of Marin's lending activities. For instance, regulations concerning water usage, waste disposal, and emissions directly affect operational costs and project feasibility for businesses seeking financing.

The bank must integrate an understanding of these specific local mandates, such as those related to the California Environmental Quality Act (CEQA) or Marin's own land use and conservation policies, into its credit risk assessment. This due diligence is crucial for identifying potential liabilities and ensuring the sustainability of the businesses it supports. Failure to account for these environmental factors could lead to loan defaults or reputational damage.

Reputational Impact of Environmental Stance

Bank of Marin's environmental stance significantly influences its reputation, particularly in the environmentally aware Bay Area. A strong commitment to sustainability can boost its brand image, attracting customers who prioritize eco-friendly banking. For instance, by mid-2024, financial institutions with robust ESG (Environmental, Social, and Governance) commitments were seeing increased customer loyalty and positive media coverage.

Demonstrating responsible environmental practices, such as reducing its carbon footprint and investing in green initiatives, can enhance Bank of Marin's appeal. Offering eco-friendly financial products, like green loans or sustainable investment options, further solidifies this positive image. Surveys from late 2024 indicated that over 60% of consumers in California considered a company's environmental policies when choosing financial services.

- Reputation Enhancement: A proactive environmental approach can differentiate Bank of Marin from competitors.

- Client Attraction: Eco-conscious consumers and businesses are more likely to bank with institutions demonstrating sustainability.

- Brand Image: Positive environmental practices contribute to a stronger, more trustworthy brand.

- Market Alignment: Aligning with the Bay Area's strong environmental values is crucial for market relevance.

Green Building and Infrastructure Financing

Opportunities abound for Bank of Marin to finance green building and sustainable infrastructure projects. As demand for eco-friendly construction rises, the bank can develop specialized loan products, tapping into a growing market segment. This aligns with community values and opens avenues for new business growth.

The market for green buildings is expanding rapidly. For instance, the U.S. Green Building Council reported that LEED-certified space had grown by over 30% annually in recent years leading up to 2024. This trend indicates a strong demand for financing such projects.

- Growing Demand: Increasing consumer and investor preference for sustainable properties presents a significant market opportunity.

- Specialized Products: Bank of Marin can create tailored financing solutions for LEED-certified buildings, solar installations, and other green initiatives.

- Community Alignment: Supporting environmentally conscious development resonates with community values, enhancing the bank's brand and local relationships.

- Niche Market: Establishing expertise in green financing can differentiate Bank of Marin from competitors and attract a dedicated client base.

Environmental factors pose direct risks to Bank of Marin's loan portfolio, especially concerning real estate collateral in vulnerable Bay Area locations due to rising sea levels and extreme weather. The bank must assess its exposure in these regions, acknowledging projections of significant sea-level rise by 2050 along the California coast. Furthermore, increasing stakeholder focus on ESG criteria means Bank of Marin needs to consider future mandates for sustainable lending and carbon footprint reduction.

Stringent local environmental regulations in Marin County and the Bay Area impact key lending sectors like real estate and agriculture, affecting operational costs and project feasibility. Bank of Marin must integrate knowledge of these specific mandates, such as CEQA, into its credit risk assessment to ensure loan sustainability and mitigate potential liabilities.

Bank of Marin's environmental commitment significantly influences its reputation in the eco-conscious Bay Area, potentially attracting customers and enhancing brand image. Offering green financial products can solidify this positive image, as surveys from late 2024 indicated over 60% of California consumers consider environmental policies when choosing financial services.

Opportunities exist for Bank of Marin to finance green building and sustainable infrastructure, tapping into a growing market where LEED-certified space saw over 30% annual growth leading up to 2024. Developing specialized loan products for eco-friendly construction aligns with community values and fosters new business growth.

| Environmental Factor | Impact on Bank of Marin | Opportunity |

|---|---|---|

| Climate Change & Sea Level Rise | Devaluation of coastal real estate collateral; increased credit risk in flood-prone areas. | Develop climate risk assessment tools for loan underwriting; offer property resilience financing. |

| Local Environmental Regulations | Increased compliance costs for borrowers; potential project delays or cancellations affecting loan performance. | Provide financing for businesses meeting or exceeding environmental standards; offer advisory services on compliance. |

| ESG Investor & Consumer Demand | Pressure to adopt sustainable lending practices; potential reputational damage for inaction. | Launch green loan products (e.g., for solar, energy efficiency); attract environmentally conscious customers and investors. |

| Green Building Market Growth | Missed revenue opportunities if not participating in the growing green construction sector. | Specialize in financing LEED-certified projects, renewable energy installations, and sustainable infrastructure. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of Marin is built upon a robust foundation of data from official government agencies, reputable financial institutions, and leading industry publications. This ensures that all political, economic, social, technological, legal, and environmental insights are grounded in current and credible information.