Bank of Marin Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Marin Bundle

Bank of Marin operates within a dynamic banking landscape, where understanding the interplay of competitive forces is crucial for success. Our analysis reveals the significant influence of buyer power and the constant threat of new entrants in the regional banking sector.

The complete report reveals the real forces shaping Bank of Marin’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers, including core banking system vendors and cybersecurity firms, exert moderate bargaining power over banks like Bank of Marin. The increasing reliance on sophisticated technology for digital banking, AI integration, and robust security measures means banks need these specialized services. This dependence, however, is tempered by a competitive market landscape where numerous vendors offer comparable solutions, thereby capping the leverage of any single provider.

Suppliers of financial data and analytics services are gaining influence as banks like Bank of Marin increasingly rely on data for customer insights, fraud prevention, and risk assessment. The demand for specialized datasets and advanced analytical tools, particularly those supporting AI and machine learning initiatives, grants these providers significant bargaining power.

The availability of skilled professionals, especially in high-demand fields like cybersecurity, AI development, and digital banking, is a critical supplier to the banking sector. A scarcity of this specialized human capital can drive up labor expenses and hinder a bank's capacity for innovation and market competitiveness. For community banks like Bank of Marin, strategic investment in employee training and robust retention programs are essential to effectively manage this supplier power.

Regulatory Compliance Services

The bargaining power of suppliers for regulatory compliance services is considerable for Bank of Marin. The financial sector faces an increasingly intricate web of regulations, from data privacy mandates to anti-money laundering (AML) protocols and capital adequacy requirements. Providers of specialized software, consulting, and auditing are therefore in a strong position, as banks cannot afford to fall out of compliance.

The demand for these essential services is amplified by the constant evolution of the regulatory environment. For instance, anticipated regulatory shifts in 2025 are expected to drive even greater reliance on these expert providers. This creates a situation where banks are often dependent on a limited number of highly specialized firms.

- High switching costs: Banks often invest heavily in specific compliance software and training, making it costly and time-consuming to switch providers.

- Concentration of providers: The market for certain niche compliance services may be dominated by a few key players, giving them pricing power.

- Essential nature of services: Non-compliance carries severe penalties, including fines and reputational damage, making these services non-negotiable for banks.

- Increasing complexity: As regulations become more complex, the need for specialized expertise from external suppliers grows, enhancing their leverage.

Payment Network Providers

Payment network providers like Visa and Mastercard hold significant bargaining power over banks, including Bank of Marin. Their extensive, established infrastructure for processing transactions and facilitating digital payments is essential for any bank’s operations. This reliance means banks have limited alternatives for providing these core services to their customers.

The increasing adoption of instant payment systems, such as the Federal Reserve's FedNow service launched in July 2023, further strengthens the position of these network providers. FedNow, designed to enable real-time payments, requires banks to integrate with its network, reinforcing the indispensable role of these payment facilitators. For instance, as of early 2024, a growing number of financial institutions are joining the FedNow network, underscoring its expanding influence.

- Essential Infrastructure: Banks depend on payment networks for fundamental transaction processing and digital payment capabilities.

- Widespread Acceptance: The broad adoption of networks like Visa and Mastercard limits banks' ability to switch providers without significant disruption.

- Rise of Instant Payments: New systems like FedNow, operational since mid-2023, are becoming critical infrastructure, further concentrating power with network operators.

Suppliers of essential banking infrastructure, such as core processing systems and payment networks, wield considerable bargaining power over institutions like Bank of Marin. The critical nature of these services, coupled with high switching costs and the concentration of providers in certain areas, means banks have limited leverage. For example, the widespread adoption of payment networks like Visa and Mastercard, and the increasing integration with new instant payment systems like FedNow, solidify their essential role and bargaining strength.

| Supplier Category | Bargaining Power Level | Key Factors |

|---|---|---|

| Technology Providers (Core Banking, Cybersecurity) | Moderate | Dependence on specialized services, but tempered by competitive market. |

| Financial Data & Analytics Services | Increasingly High | Growing reliance on data for insights, AI, and risk assessment. |

| Skilled Professionals (Cybersecurity, AI) | High | Scarcity of specialized talent drives up costs and impacts innovation. |

| Regulatory Compliance Services | Considerable | Complex and evolving regulations necessitate specialized expertise; high penalties for non-compliance. |

| Payment Network Providers (Visa, Mastercard, FedNow) | Significant | Essential infrastructure, widespread acceptance, and rise of instant payments. |

What is included in the product

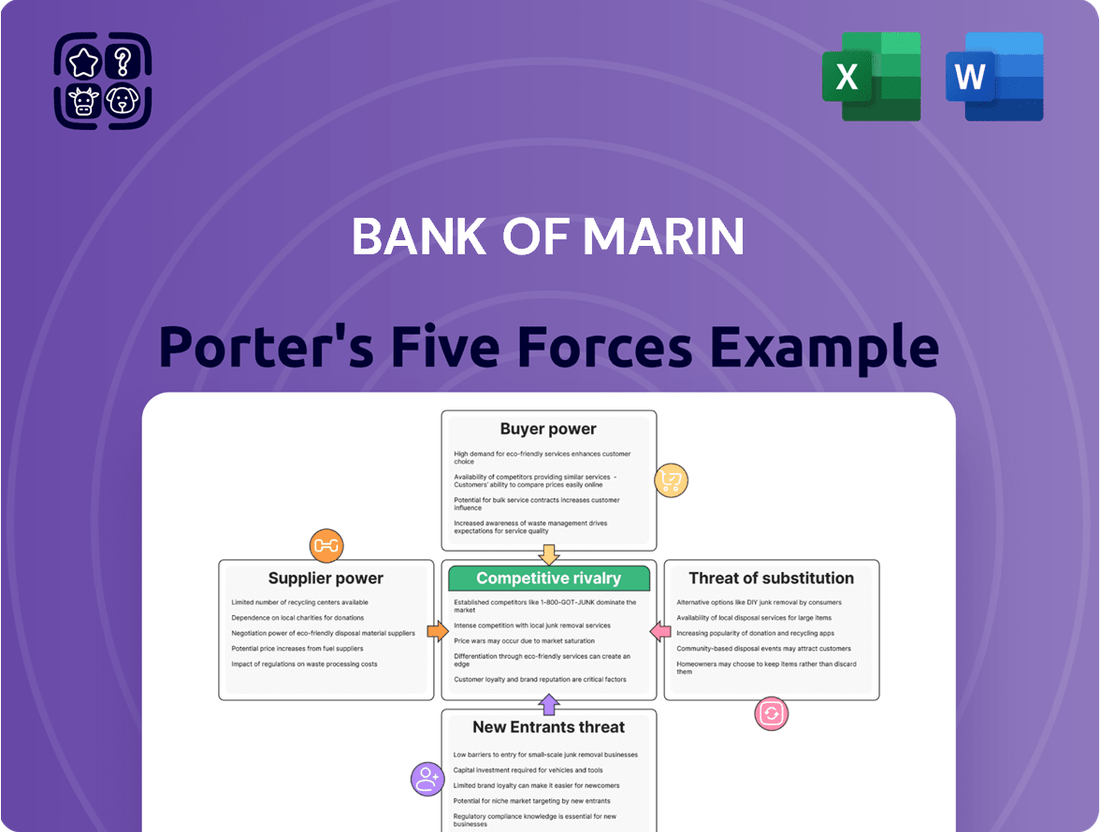

Tailored exclusively for Bank of Marin, analyzing its position within its competitive landscape by examining industry rivalry, buyer and supplier power, threat of new entrants, and substitutes.

Visualize competitive intensity with a dynamic Porter's Five Forces chart, allowing Bank of Marin to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

The bargaining power of individual deposit holders at banks like Bank of Marin is typically quite low. This is largely because basic checking and savings accounts are seen as commodities, meaning there's not much differentiation between them from one bank to another. In 2024, the average interest rate on savings accounts remained relatively low, often below 1%, further emphasizing the commoditized nature of these products.

While customers do look for competitive interest rates, the ease of switching banks, especially with advancements in digital banking, means they can move their money if they find a better deal. However, community banks such as Bank of Marin often counter this by building strong relationships with their customers, offering personalized service that can foster loyalty beyond just the interest rate offered.

Business clients, especially larger ones, wield significant bargaining power with banks like Bank of Marin. Their ability to place substantial loan volumes and deposit balances allows them to negotiate for more favorable interest rates, reduced fees, and tailored banking services. For instance, a large business client seeking a multi-million dollar loan could easily take their business elsewhere if Bank of Marin doesn't offer competitive terms.

Bank of Marin actively works to manage this customer power by fostering deep relationships with local businesses. This strategy involves offering personalized service, understanding specific business needs, and engaging in community initiatives, which can create loyalty and reduce the likelihood of clients switching for minor rate differences. As of the first quarter of 2024, Bank of Marin reported total deposits of approximately $3.6 billion, indicating a substantial base of business clients whose collective deposit activity influences their bargaining position.

Wealth management clients at Bank of Marin likely wield considerable bargaining power. These individuals often manage substantial assets, giving them leverage to seek out the best terms and services. For instance, in 2024, the average assets under management for high-net-worth individuals globally continued to climb, meaning clients have significant resources to move if unsatisfied.

The availability of numerous alternative wealth management providers means clients can easily switch banks if their demands for personalized service, competitive returns, or specialized financial advice aren't met. This competitive landscape compels Bank of Marin to offer compelling value propositions to retain its high-value clientele.

Digital-First Customers

Digital-first customers, a rapidly expanding demographic particularly among millennials, wield significant bargaining power. Their expectation of seamless, intuitive digital experiences means they are quick to switch financial institutions if these needs aren't met. For instance, a 2024 survey indicated that over 70% of Gen Z and millennial consumers consider a bank's digital capabilities a primary factor in their choice of institution. This trend compels banks like Bank of Marin to prioritize substantial investments in digital transformation, including advanced mobile banking features and AI-driven personalization, to retain and attract this crucial customer segment.

The increasing ease of switching financial providers, facilitated by digital platforms, further amplifies customer bargaining power. Customers can now compare offerings, initiate account transfers, and manage their finances across different institutions with unprecedented speed and convenience. This environment necessitates that banks continuously innovate their digital offerings to maintain customer loyalty and competitive advantage. For example, banks that successfully integrated features like instant mobile check deposit and real-time transaction alerts in 2023 saw higher customer retention rates compared to those with lagging digital capabilities.

- Digital Adoption: By the end of 2024, it's projected that over 85% of banking interactions for younger demographics will occur through digital channels.

- Switching Propensity: Studies from early 2024 reveal that nearly 60% of consumers under 35 would consider switching banks for a superior digital experience.

- Investment in Digital: Major banks are allocating upwards of 30% of their technology budgets to digital transformation initiatives in 2024 to meet these demands.

- AI and Personalization: The adoption of AI for personalized financial advice and customer service is becoming a key differentiator, with early adopters reporting a 15% increase in customer satisfaction.

Customers Seeking Specialized Loans

Customers seeking specialized loans, like niche commercial real estate financing or intricate business funding, possess a moderate level of bargaining power. This power is influenced by how unique their requirements are and how many other banks can meet them. For instance, a business needing a very specific type of equipment financing might have more sway than one seeking a standard business line of credit.

Bank of Marin's strategy of offering a wide array of loan products is designed to cater to these varied and often specialized demands. By providing comprehensive solutions under one roof, the bank aims to minimize the necessity for clients to shop around with multiple financial institutions, thereby potentially lessening individual customer bargaining power.

In 2024, community banks like Bank of Marin have seen continued demand for specialized lending. For example, the U.S. Small Business Administration (SBA) loan programs, which often involve complex structures, remained a key area for many regional banks. The success of these specialized offerings directly impacts a bank's ability to retain clients and manage customer bargaining power.

- Specialized Loan Demand: Continued strong demand for niche financing, such as commercial real estate and complex business loans, in 2024.

- Lender Availability: Customer bargaining power is directly tied to the number of financial institutions capable of meeting unique loan requirements.

- Bank of Marin's Strategy: Offering a diverse product suite to capture specialized lending needs and reduce customer reliance on external providers.

- Impact on Bargaining Power: A broad product offering can consolidate client relationships, potentially dampening individual customer bargaining leverage.

The bargaining power of customers for Bank of Marin is multifaceted, influenced by customer segment and the nature of the banking product. While individual deposit holders have low power due to the commoditized nature of basic accounts, large business clients and wealth management clients wield significant influence, capable of negotiating better terms. Digital-first customers, expecting seamless online experiences, also hold considerable sway, driving banks to invest heavily in technology.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Bank of Marin's Response |

|---|---|---|---|

| Individual Deposit Holders | Low | Commoditized products, low switching costs (digital) | Relationship building, personalized service |

| Large Business Clients | High | Large deposit/loan volumes, ability to negotiate rates/fees | Tailored services, community engagement |

| Wealth Management Clients | High | Substantial assets, numerous alternative providers | Compelling value propositions, specialized advice |

| Digital-First Customers | High | Expectations of seamless digital experience, high switching propensity | Investment in digital transformation, AI personalization |

| Specialized Loan Seekers | Moderate | Uniqueness of needs, availability of specialized lenders | Diverse loan product offerings |

Preview the Actual Deliverable

Bank of Marin Porter's Five Forces Analysis

This preview showcases the complete Bank of Marin Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the banking industry. You are viewing the exact document you will receive immediately after purchase, ensuring full transparency and no hidden content. This professionally formatted analysis is ready for immediate use, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitute products.

Rivalry Among Competitors

Bank of Marin contends with significant rivalry from other community banks concentrated in Marin County and the broader San Francisco Bay Area. These institutions frequently mirror Bank of Marin's approach, emphasizing personalized customer service and deep local community ties. This shared strategy intensifies competition for local customers and their deposits.

Larger regional and national banks present a substantial competitive challenge for Bank of Marin. These behemoths offer a broader spectrum of financial products and services, boast extensive branch networks across wider geographies, and often feature more sophisticated digital banking platforms. For instance, in 2024, major national banks continued to invest heavily in technology, with many reporting double-digit percentage increases in their digital transaction volumes.

While Bank of Marin prides itself on delivering personalized customer experiences and community-focused banking, these larger competitors can harness economies of scale. This allows them to operate at lower per-unit costs and deploy more significant marketing budgets, enabling them to reach and attract a wider customer base. In the first half of 2024, the top 10 U.S. banks collectively spent billions on advertising and customer acquisition initiatives.

Credit unions present a significant competitive force for banks like Bank of Marin. Their member-owned, non-profit structure often allows them to offer more competitive interest rates on loans and higher yields on deposits. For instance, as of late 2024, the average interest rate on a new car loan from a credit union was approximately 5.5%, compared to an average of 6.2% at traditional banks. This cost advantage, coupled with a focus on community and member service, can attract a substantial customer base, particularly those prioritizing value and a more personal banking experience.

Fintech Companies and Digital-Only Banks

Fintech companies and digital-only banks present a significant competitive challenge. These innovative firms often lead in digital capabilities, offering niche products, intuitive interfaces, and attractive pricing, drawing in digitally inclined customers.

For instance, by the end of 2023, neobanks globally had amassed over 300 million customers, demonstrating their rapid growth and appeal. Their agility allows them to quickly adapt to market demands and introduce new features, putting pressure on traditional institutions to keep pace.

- Digital Innovation: Fintechs often prioritize user experience and specialized digital services.

- Customer Acquisition: Neobanks are attracting customers with lower fees and streamlined processes.

- Market Share Growth: The global digital banking market is projected to reach over $30 trillion by 2026, indicating a substantial shift in customer preference.

- Competitive Pricing: Fintechs frequently offer more competitive rates on loans and savings accounts.

Non-Bank Lenders and Alternative Financial Service Providers

Non-bank lenders and alternative financial service providers present a significant competitive force for traditional banks like Bank of Marin. These players, including online mortgage lenders and peer-to-peer lending platforms, often focus on specific loan products or customer segments. For instance, by mid-2024, the alternative lending market continued its robust growth, with platforms like LendingClub and Prosper facilitating billions in loans annually, often offering quicker approval processes and more flexible terms than many traditional institutions.

These competitors can carve out market share by offering specialized services or a more streamlined customer experience. For example, fintech companies are increasingly offering digital-first solutions for small business loans or personal credit, bypassing some of the overhead and legacy systems of established banks. This agility allows them to respond rapidly to market demands and attract customers seeking convenience and speed.

The challenge for banks like Bank of Marin lies in matching the innovative offerings and operational efficiency of these newer entrants.

- Niche Specialization: Alternative lenders often excel in specific areas, such as small business financing or consumer credit, offering tailored products.

- Faster Processing: Many non-bank lenders leverage technology to provide quicker loan approvals and funding compared to traditional banks.

- Digital-First Approach: Fintech providers often prioritize user-friendly online platforms and mobile accessibility, appealing to a tech-savvy customer base.

- Lower Overhead: Without the extensive branch networks of traditional banks, alternative providers can sometimes operate with lower costs, potentially translating to competitive pricing.

Bank of Marin faces intense competition from numerous community banks within its core geographic areas, all vying for local deposits and customers through similar relationship-based strategies. Larger regional and national banks also pose a significant threat, leveraging their extensive product offerings, wider branch networks, and advanced digital platforms to attract customers. For instance, in 2024, major banks continued to boost digital investments, with many reporting double-digit growth in digital transaction volumes.

Credit unions, operating as non-profits, often provide more attractive interest rates on loans and deposits, as seen in late 2024 where average credit union car loan rates were around 5.5% compared to 6.2% at traditional banks. Fintech companies and digital-only banks are rapidly gaining traction by offering superior digital experiences, niche products, and competitive pricing, evidenced by neobanks globally reaching over 300 million customers by the end of 2023.

Non-bank lenders and alternative financial providers are also capturing market share by specializing in specific loan types and offering faster, more flexible processes, with platforms like LendingClub facilitating billions in loans annually by mid-2024.

| Competitor Type | Key Strengths | Impact on Bank of Marin |

|---|---|---|

| Community Banks | Local focus, personalized service | Direct competition for local deposits and relationships |

| Regional/National Banks | Broader product range, larger networks, advanced digital | Attracts customers seeking convenience and wider services |

| Credit Unions | Better rates, member-focused | Offers cost advantage, appealing to value-conscious customers |

| Fintech/Digital Banks | Digital innovation, niche products, competitive pricing | Draws digitally-savvy customers, pressures traditional offerings |

| Non-Bank Lenders | Specialization, speed, flexibility | Captures specific loan segments with streamlined processes |

SSubstitutes Threaten

Digital payment platforms like PayPal, Apple Pay, and Venmo present a significant threat of substitution to traditional banking services. These platforms offer users faster and more convenient ways to transfer money, directly competing with services like wire transfers and check processing. For instance, the total value of mobile payments in the US was projected to reach over $2.5 trillion by the end of 2024, indicating a strong shift away from legacy payment methods.

Online lending platforms present a significant threat of substitution for Bank of Marin's traditional loan products. These platforms, offering everything from personal loans to mortgages, often boast faster application processes and quicker approvals. For instance, by mid-2024, many fintech lenders were reporting approval times measured in hours rather than days, a stark contrast to traditional bank timelines.

Borrowers are increasingly drawn to the convenience and speed offered by these digital alternatives. Some platforms even provide more flexible repayment terms or cater to niche markets that traditional banks might overlook. This competitive edge means Bank of Marin must continually innovate its own loan offerings to retain customers seeking a more streamlined and responsive borrowing experience.

Independent investment management firms and automated robo-advisors present a considerable threat of substitution for wealth management services. These entities often provide specialized investment strategies or cost-efficient digital platforms, attracting clients who might otherwise utilize a bank's offerings. For instance, the robo-advisor market saw substantial growth, with assets under management reaching an estimated $1.7 trillion globally by the end of 2023, according to industry reports.

The appeal of these substitutes lies in their potential for lower management fees and access to a wider array of investment products, sometimes tailored to niche market segments. Many investors, particularly younger demographics or those with simpler portfolios, find these alternatives more accessible and aligned with their financial goals. The competitive fee structures, often ranging from 0.25% to 0.50% annually, stand in contrast to the potentially higher fees associated with traditional bank-managed wealth services.

Cryptocurrencies and Decentralized Finance (DeFi)

Cryptocurrencies and decentralized finance (DeFi) pose a growing, albeit still developing, threat to traditional banking. These platforms offer alternative methods for value storage, fund transfers, and access to financial products, bypassing traditional intermediaries. As of early 2024, the total market capitalization of cryptocurrencies remained significant, demonstrating continued investor interest and technological development in this space.

While mainstream adoption is still in its early stages, the potential for DeFi to disrupt banking services is substantial. Consider these points:

- Alternative Financial Services: DeFi platforms are increasingly offering services like lending, borrowing, and trading, directly competing with core banking functions.

- Lower Transaction Costs: Many blockchain-based transactions can be executed at a lower cost compared to traditional wire transfers or payment processing fees.

- Growing User Base: The number of active DeFi users has seen a steady increase over recent years, indicating growing comfort and engagement with these technologies.

- Regulatory Uncertainty: While regulatory frameworks are still evolving, clarity could accelerate the integration and acceptance of DeFi services, thereby increasing their substitutive power.

Peer-to-Peer (P2P) Lending and Crowdfunding

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat of substitutes for traditional banking services. These platforms enable direct lending and borrowing, bypassing financial intermediaries like Bank of Marin. For instance, the global P2P lending market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong alternative for both borrowers seeking capital and investors looking for returns.

These digital platforms offer borrowers more accessible and often faster loan origination compared to traditional banks. For investors, they provide opportunities for diversification and potentially higher yields than traditional savings accounts or CDs. This direct access to capital and investment channels directly competes with Bank of Marin's core lending and deposit-taking functions.

- Alternative Financing: P2P lending and crowdfunding platforms offer direct pathways for individuals and businesses to secure loans and raise funds, bypassing traditional banking channels.

- Market Growth: The P2P lending market, valued around $50 billion in 2023, demonstrates a robust and growing alternative to conventional bank loans.

- Investor Appeal: These platforms attract investors seeking potentially higher returns and diversification, directly competing with bank deposit products.

- Competitive Pressure: The increasing adoption of these digital alternatives puts pressure on traditional banks like Bank of Marin to innovate and offer competitive services.

The threat of substitutes for Bank of Marin is substantial, with digital payment platforms like PayPal and Venmo offering faster, more convenient money transfers, directly challenging traditional banking services. The projected over $2.5 trillion value of US mobile payments by the end of 2024 underscores this shift. Similarly, online lenders provide quicker loan approvals, with some fintech lenders achieving approvals in hours by mid-2024, a stark contrast to traditional bank timelines.

Independent investment firms and robo-advisors also present a significant substitution threat to wealth management. With global assets under management in robo-advisors reaching an estimated $1.7 trillion by the end of 2023, these alternatives often offer lower fees, typically 0.25% to 0.50% annually, and wider investment access, particularly appealing to younger demographics.

Cryptocurrencies and DeFi platforms are emerging as disruptive forces, offering alternative financial services like lending and borrowing with potentially lower transaction costs. The growing user base and ongoing technological development in this space, evidenced by significant cryptocurrency market capitalization in early 2024, signal a developing but potent competitive pressure.

Peer-to-peer lending and crowdfunding platforms directly compete with Bank of Marin's core lending and deposit functions by enabling direct borrower-lender connections. The global P2P lending market, valued at approximately $50 billion in 2023, illustrates a robust alternative for capital seekers and investors, offering both accessibility and potentially higher yields compared to traditional bank products.

Entrants Threaten

Fintech startups are a considerable threat to traditional banks like Bank of Marin. These newcomers, often powered by advanced technologies such as AI, machine learning, and blockchain, are introducing novel financial services. Their agility and digital-first strategies allow them to target specific market segments or address particular customer needs with greater efficiency.

For instance, in 2024, the global fintech market was valued at an estimated $1.17 trillion, showcasing rapid growth and innovation. These startups frequently operate with lower overhead costs compared to established institutions, enabling them to offer competitive pricing and user-friendly experiences that can attract customers away from incumbent banks.

Neobanks, or digital-only banks, pose a significant threat due to their asset-light models and focus on customer experience. Operating without the overhead of physical branches, they can offer more competitive pricing and streamlined digital services, appealing to a tech-savvy customer base. For instance, by the end of 2023, neobanks globally had amassed over 200 million users, a figure expected to climb substantially in the coming years.

Large technology companies, often referred to as Big Tech, represent a significant potential threat to incumbent banks like Bank of Marin. Companies such as Apple, Google, and Amazon possess enormous customer bases and substantial financial resources, enabling them to invest heavily in new ventures. For instance, Apple Pay has seen widespread adoption, and Google Pay is also a major player in digital payments. These tech giants have already established significant trust with consumers and possess advanced technological capabilities, making a further expansion into traditional banking services a plausible and disruptive move.

Non-Financial Companies Offering Embedded Finance

The rise of embedded finance presents a significant threat of new entrants for banks like Bank of Marin. Non-financial companies are increasingly integrating financial services, such as payments and lending, directly into their customer experiences. This trend allows businesses with strong customer bases and data to offer financial products without needing a traditional banking license, effectively becoming new competitors.

Consider the retail sector, where companies can now offer branded credit cards or point-of-sale financing. For instance, a large e-commerce platform might partner with a payment processor to offer instant loans at checkout, bypassing traditional bank involvement. This strategy leverages existing customer relationships and transaction data to provide a seamless financial offering.

- Embedded Finance Growth: The global embedded finance market is projected to reach $7.2 trillion by 2030, indicating a substantial shift in financial service delivery.

- Customer Convenience: Companies offering embedded finance benefit from enhanced customer loyalty and convenience by providing financial solutions within their primary purchase journey.

- Data Utilization: Non-financial firms can leverage their vast customer data to assess risk and tailor financial products more effectively than traditional banks might in certain contexts.

- Blurring Industry Lines: This trend challenges the traditional banking model by allowing technology companies and retailers to offer financial services, creating a more competitive landscape.

Relaxation of Regulatory Barriers

The banking sector, while traditionally a heavily regulated environment, faces potential shifts that could impact the threat of new entrants. If regulatory barriers are relaxed or licensing becomes more streamlined, the cost of entry could significantly decrease, potentially inviting a wave of new competitors. For instance, in 2024, discussions around digital banking licenses and reduced capital requirements for certain fintech-focused institutions highlighted this evolving landscape.

Conversely, increased regulatory oversight on collaborations between established banks and fintech firms might inadvertently create openings for new, fully compliant entities. These new entrants could leverage a clean slate and a strong adherence to evolving regulations to gain market share. The ongoing scrutiny of data privacy and cybersecurity in banking, exemplified by the increased fines levied in 2024 for compliance breaches, underscores the importance of robust regulatory frameworks for all players.

- Relaxation of Regulatory Barriers: Future easing of licensing and capital requirements could lower entry costs.

- Simplification of Processes: Streamlined approval pathways might encourage new banks, especially in digital banking.

- Regulatory Scrutiny on Partnerships: Stricter rules on bank-fintech collaborations could favor new, compliant entrants.

- Impact on Competition: Changes in regulation directly influence the ease with which new institutions can enter the market.

New entrants, particularly agile fintech startups and Big Tech firms, pose a significant threat to Bank of Marin. These entities leverage technology, lower overheads, and strong customer relationships to offer competitive financial services. The rise of embedded finance further blurs industry lines, allowing non-financial companies to integrate financial offerings seamlessly.

| Competitor Type | Key Advantage | 2024 Market Data/Trend |

|---|---|---|

| Fintech Startups | Technological innovation, agility, lower costs | Global Fintech Market valued at ~$1.17 trillion |

| Neobanks | Digital-first, asset-light models, customer experience | Over 200 million global users by end of 2023 |

| Big Tech Companies | Large customer bases, financial resources, established trust | Widespread adoption of Apple Pay and Google Pay |

| Embedded Finance Providers | Integration into non-financial platforms, data utilization | Projected market growth to $7.2 trillion by 2030 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of Marin is built upon a foundation of publicly available financial statements, SEC filings, and industry-specific reports from reputable financial data providers. We also incorporate insights from news articles and press releases detailing competitive actions and market trends within the regional banking sector.