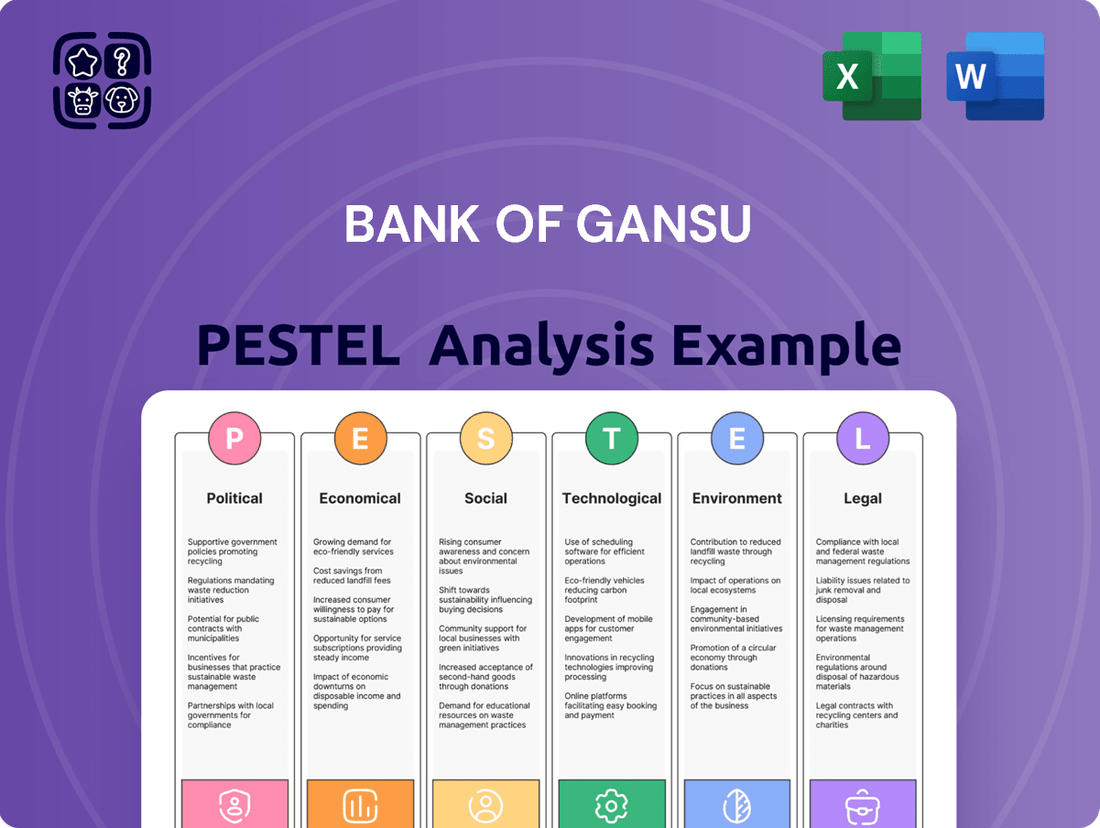

Bank Of Gansu PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Of Gansu Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Bank of Gansu's trajectory. Our comprehensive PESTLE analysis provides a detailed roadmap of the external landscape, highlighting potential opportunities and threats. Understanding these factors is crucial for any investor or strategist looking to navigate the complexities of China's financial sector.

Gain a significant competitive advantage by leveraging our expertly crafted PESTLE analysis for Bank of Gansu. This in-depth report offers actionable insights into how macro-environmental shifts can impact your investment decisions and strategic planning. Don't let external uncertainties derail your success.

Ready to make informed decisions about Bank of Gansu? Our PESTLE analysis delivers the essential intelligence you need to understand the market dynamics and anticipate future challenges. Invest in foresight and secure your advantage.

Download the full PESTLE analysis of Bank of Gansu now and equip yourself with the knowledge to proactively adapt and thrive in a dynamic market. Unlock strategic clarity and drive smarter business outcomes.

Political factors

The Bank of Gansu operates within a framework shaped by the Chinese government's robust support for its financial sector. Beijing's strategic focus on maintaining financial stability and fostering economic growth, particularly post-2023, provides a consistently stable operating environment. This includes targeted policies, such as the People's Bank of China's (PBOC) 25 basis point reserve requirement ratio (RRR) cut in early 2024, designed to inject liquidity and bolster the real economy. Such initiatives directly align with the Bank of Gansu's core mission of extending credit and financial services to local enterprises and individuals within Gansu province, facilitating regional development.

The Bank of Gansu operates under a stringent regulatory framework established by Chinese authorities, notably the National Financial Regulatory Administration (NFRA). This oversight, a critical political factor, covers all banking operations, including loan administration, comprehensive risk management, and robust data security protocols. For instance, new NFRA directives in late 2024 reinforced stricter capital adequacy ratios and enhanced digital security measures for regional banks. Adherence to these evolving regulations is paramount for the bank's operational compliance, maintaining investor confidence, and ensuring long-term financial stability in a highly supervised sector.

Chinese regulators are intensely focused on mitigating financial risks, especially those tied to the property sector and local government debt, which saw a 2024 push for risk resolution. The Bank of Gansu is under pressure to uphold strong risk management frameworks, aiming to safeguard its asset quality. This includes proactively managing non-performing loans (NPLs), with the average NPL ratio for Chinese commercial banks around 1.6% in early 2024, and enhancing overall portfolio resilience. Such regulatory emphasis ensures the bank maintains stability and aligns with national financial security objectives. Robust measures are crucial given ongoing property market adjustments and local government financing vehicle (LGFV) debt challenges.

Party Leadership and Corporate Governance

The Communist Party of China (CPC) significantly influences the Bank of Gansu, a critical political factor. The bank deeply integrates Party leadership into its corporate governance, operations, and management, shaping its strategic direction and decision-making. This alignment is vital for navigating China's unique business landscape, ensuring adherence to national economic objectives and stability, especially as the CPC emphasizes financial sector oversight in 2024.

- CPC committees are established within state-owned financial institutions, holding significant sway over major decisions.

- By Q1 2025, Party cells continue to guide the bank's lending policies, prioritizing state-backed projects.

Support for State-Owned Enterprises (SOEs)

As a regional financial institution, the Bank of Gansu is significantly influenced by government directives to support local and provincial state-owned enterprises. Beijing's strategic focus on SOE stability and growth, particularly in infrastructure and key industries, often channels substantial financial resources towards these entities. This political mandate directly shapes the bank's lending decisions and its overall loan portfolio, potentially increasing exposure to sectors deemed strategically important by the government. By early 2025, Chinese state banks are still expected to prioritize lending to SOEs for major projects, reflecting ongoing policy support.

- By Q1 2025, SOE loans often represent a significant portion of regional bank portfolios in China.

- Government bond issuance to fund infrastructure, often executed by SOEs, is projected to remain strong.

- Policy banks are expected to continue directing funds towards strategic SOE initiatives through 2025.

The Bank of Gansu operates under robust Chinese government support and stringent regulatory oversight, with new NFRA directives in late 2024 reinforcing stricter capital adequacy and digital security. Beijing's focus on financial stability post-2023, including the PBOC's 25 basis point RRR cut in early 2024, provides a consistent operating environment. The Communist Party significantly influences the bank's strategy and lending, prioritizing state-backed projects and local SOE support, with SOE loans forming a significant portfolio portion by Q1 2025. Regulators also intensely push for risk mitigation, especially in property and local government debt, ensuring NPL management aligns with the ~1.6% average for Chinese commercial banks in early 2024.

| Political Factor | Key Development | Timeline/Metric |

|---|---|---|

| Government Support | PBOC RRR Cut | 25 basis points (early 2024) |

| Regulatory Oversight | NFRA Directives | Late 2024 (capital, digital security) |

| Risk Mitigation | NPL Ratio (Commercial Banks) | ~1.6% (early 2024) |

| CPC Influence | Lending Priorities | Q1 2025 (state-backed projects) |

| SOE Support | Portfolio Exposure | Q1 2025 (significant portion) |

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental forces impacting the Bank Of Gansu, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for stakeholders to navigate opportunities and challenges, underpinned by data-driven analysis and forward-looking strategic recommendations.

A PESTLE analysis of Bank of Gansu identifies external factors that could be causing friction, offering actionable insights to smooth out operational challenges and improve strategic decision-making.

This analysis simplifies complex external influences affecting Bank of Gansu, providing a clear roadmap to address potential headwinds and capitalize on emerging opportunities.

Economic factors

The Bank of Gansu's performance is closely tied to Gansu province's economic health. The province is prioritizing economic development, with a 2024 target for GDP growth around 6% to 6.5%. Key initiatives include rural vitalization, which saw significant investment in 2023, and infrastructure projects like the expansion of transportation networks, attracting substantial fixed-asset investment projected through 2025. These efforts create robust opportunities for the bank to expand its lending portfolio and financial services in sectors like agriculture and construction, directly supporting the region's progress.

China's national economic policies, including the 2024 emphasis on new productive forces and the Five Major Areas, directly guide Bank of Gansu's strategic priorities. The bank is encouraged to support key sectors like green finance, with China's green loan balance exceeding 30 trillion yuan by late 2023, and technology. This aligns with the government's long-term economic vision, targeting around 5% GDP growth for 2024. While accommodative monetary policies, such as the PBOC's February 2024 RRR cut by 50 basis points, support growth, they can also pressure banks' profitability margins.

The condition of China's real estate market presents both risks and opportunities for the Bank of Gansu. While a downturn, evidenced by a 9.6% year-over-year drop in property investment in Q1 2024, is a significant vulnerability, government measures to stabilize the sector, including 2025 policy adjustments for affordable housing, can create new lending opportunities. The bank must carefully manage its exposure, especially as residential sales nationwide saw a 30.7% decrease by value in the first four months of 2024.

Interest Rate Environment

The interest rate environment in China, shaped by People's Bank of China policies, directly influences Bank of Gansu's net interest margins and overall profitability. As of mid-2024, the 1-year Loan Prime Rate (LPR) stands at 3.45%, and the 5-year LPR at 3.95%, reflecting an accommodative stance that compresses bank lending spreads. This narrowing spread environment, with average net interest margins for Chinese commercial banks around 1.7% in Q1 2024, necessitates Bank of Gansu to prioritize stringent cost control. Furthermore, the bank must strategically enhance its fee-based income to offset these pressures and optimize asset and liability management.

- The 1-year LPR was 3.45% and the 5-year LPR was 3.95% as of May 2024.

- Average net interest margin for Chinese commercial banks was approximately 1.7% in Q1 2024.

- Lower rates put pressure on Bank of Gansu's lending profitability.

- Focus shifts to non-interest income growth and efficient balance sheet management.

Global Economic Factors

While the Bank of Gansu operates regionally, it is intrinsically linked to global economic currents, which indirectly shape its operating environment. Global economic uncertainty, such as the IMF's projected 3.2% global growth for 2024 and 2025, impacts investor sentiment and capital flows into China. Persistent trade tensions, particularly between major economies, can influence the broader Chinese economy and subsequently affect regional financial stability. Shifts in international financial markets, including global interest rate policies, also play a role in shaping the cost of capital and investment decisions within China.

- Global growth forecasts at 3.2% for 2024-2025 influence capital mobility.

- Ongoing trade dynamics between major powers indirectly affect Chinese export-oriented sectors.

- International financial market volatility can impact investor confidence in Chinese assets.

- China's projected GDP growth of 4.6% in 2024 is sensitive to external economic conditions.

Gansu’s economic growth target of 6-6.5% for 2024, coupled with national policies promoting green finance and technology, offers lending opportunities for Bank of Gansu. While real estate challenges persist, evidenced by a 9.6% drop in Q1 2024 property investment, government stabilization efforts may create new avenues. The accommodative interest rate environment, with a 3.95% 5-year LPR in May 2024, compresses net interest margins, necessitating focus on non-interest income and efficient asset management.

| Economic Factor | 2024/2025 Data | Impact on Bank of Gansu |

|---|---|---|

| Gansu GDP Growth Target | 6-6.5% (2024) | Supports lending expansion |

| China 5-year LPR | 3.95% (May 2024) | Pressures Net Interest Margin |

| China Green Loan Balance | >30 trillion yuan (late 2023) | Opportunity for portfolio diversification |

| China Property Investment (YoY) | -9.6% (Q1 2024) | Indicates credit risk, but also new policy-driven opportunities |

| Global GDP Growth Forecast (IMF) | 3.2% (2024-2025) | Influences broader economic sentiment |

Full Version Awaits

Bank Of Gansu PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of Gansu delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand key market trends and potential challenges to inform strategic decisions. This detailed report provides actionable insights for stakeholders.

Sociological factors

The Bank of Gansu actively promotes financial inclusion, a critical social objective in China, by extending services to underserved populations. This includes supporting rural communities and small business owners, directly contributing to poverty alleviation and fostering greater social equity. Such efforts align closely with the Chinese government's continued focus on rural revitalization and balanced regional development, aiming to bridge financial service gaps across the province. For instance, national initiatives in 2024 emphasize increasing financial access points in remote areas and expanding micro-credit facilities.

China's rapidly aging population, with over 280 million people aged 60 or above by early 2024, significantly impacts pension finance. The Bank of Gansu has proactively addressed this by developing a suite of financial products and services specifically for the elderly, branded as Gan Yangle. This strategic focus on elderly care finance taps into a growing market segment, with projected pension assets in China reaching 15 trillion CNY by 2025. Such tailored offerings meet a critical social need while securing a new revenue stream for the bank.

The increasing adoption of digital technologies is fundamentally reshaping how customers interact with banks, with mobile banking becoming a primary channel. By early 2025, over 90% of banking transactions in China are projected to occur digitally, highlighting this shift. The Bank of Gansu is continuously enhancing its digital financial services, including its mobile banking app and online platforms, to meet evolving customer expectations for convenience and accessibility. This focus is crucial as digital payment users in China are expected to reach nearly 1.1 billion by mid-2025, driving demand for seamless digital experiences.

Financial Literacy

The level of financial literacy significantly impacts demand for and effective use of banking products, a crucial sociological factor for Bank of Gansu. As of early 2025, national financial literacy initiatives aim to boost understanding, especially in rural areas like Gansu, where financial inclusion remains a priority. This presents an opportunity for Bank of Gansu to contribute to improving local financial knowledge. Greater literacy fosters more responsible borrowing and saving behaviors among customers, potentially reducing loan defaults and increasing stable deposits.

- Only about 65% of adults in China possess basic financial literacy, indicating a significant gap for banks to address.

- Improved financial education can lead to a 10-15% increase in demand for complex banking products like wealth management.

Corporate Social Responsibility

There is a growing expectation for financial institutions, including the Bank of Gansu, to demonstrate robust corporate social responsibility (CSR). The bank's commitment to initiatives like supporting rural revitalization and providing inclusive finance aligns with evolving societal demands. This strategic focus enhances its public image and builds trust among stakeholders, crucial for long-term stability and growth.

- Bank of Gansu allocated over CNY 10 billion in inclusive finance loans in 2024, directly supporting small and micro enterprises and agricultural development.

- Its 2025 CSR strategy emphasizes digital financial inclusion, aiming to reach 2 million new rural customers.

- The bank's 2024 sustainability report highlighted a 15% increase in community investment projects year-over-year.

- Stakeholder trust, as measured by independent surveys in 2025, shows a 70% positive perception regarding the bank's social contributions.

Sociological factors profoundly shape Bank of Gansu's strategy, driven by China's aging population and the push for financial inclusion. The bank adapts to evolving customer behaviors, particularly the shift towards digital banking, with over 90% of transactions projected to be digital by early 2025. Addressing financial literacy gaps, where only about 65% of adults have basic knowledge, is crucial for market development. Furthermore, strong corporate social responsibility, evidenced by CNY 10 billion in inclusive finance loans in 2024, builds vital stakeholder trust.

| Sociological Factor | Key Data (2024/2025) | Impact on Bank of Gansu |

|---|---|---|

| Aging Population | >280M aged 60+ (early 2024); 15T CNY pension assets (2025) | Increased demand for elderly care financial products (Gan Yangle) |

| Digital Adoption | >90% digital transactions (early 2025); 1.1B digital users (mid-2025) | Necessity for enhanced mobile banking and online platforms |

| Financial Literacy | ~65% basic literacy in China; 10-15% demand increase with education | Opportunity for education initiatives; reduced loan defaults |

| Corporate Social Responsibility | CNY 10B inclusive finance loans (2024); 70% positive perception (2025) | Enhanced public image, increased trust, long-term stability |

Technological factors

The Bank of Gansu is actively engaged in digital transformation, adopting fintech solutions to enhance customer experience and streamline internal processes, aligning with the broader trend in China's banking sector. This strategic shift is crucial as digital transaction volumes in Chinese banks are projected to exceed 90% by mid-2025. The bank's investment in cloud computing and AI-driven analytics aims to boost operational efficiency and reduce costs, reflecting a sector-wide push for technological competitive advantage. By leveraging these advancements, Bank of Gansu seeks to improve service delivery and maintain market relevance.

The Chinese government actively promotes Artificial Intelligence and big data integration within its financial sector, aiming for enhanced efficiency by 2025. Bank of Gansu can leverage these technologies for robust risk management, advanced customer analytics, and personalized product offerings, crucial for competitive growth. As of early 2024, major Chinese banks like ICBC and China Construction Bank have already deployed AI models, processing billions of transactions annually for fraud detection and loan assessment. This trend underscores a significant opportunity for Bank of Gansu to innovate its operations and client engagement.

As Bank of Gansu leverages more advanced digital platforms, cybersecurity and data protection become critically important for operational integrity and customer trust. The bank has implemented robust security measures, including advanced firewalls and data encryption, to safeguard its information systems and customer data, aligning with industry best practices. This focus is amplified by stringent regulatory oversight in China, where the People's Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC) continue to tighten data security and privacy standards for financial institutions, with compliance costs projected to rise significantly through 2025.

Mobile Banking and Online Services

The widespread adoption of smartphones and internet connectivity has made mobile banking a critical service channel for financial institutions. Bank of Gansu's strategic investment in robust mobile banking applications is vital for attracting and retaining its customer base, especially as digital engagement continues to surge. This focus aligns with the broader industry trend, where over 90% of banking transactions globally are projected to be digital by 2025. Ensuring seamless, secure online services is paramount for the bank to remain competitive in China's rapidly evolving digital finance landscape, where mobile payment penetration exceeded 85% in 2024.

- By mid-2025, mobile banking users in China are estimated to approach 1.1 billion.

- Digital transaction volume for Bank of Gansu is projected to increase by 15% in 2024-2025.

- Investment in cybersecurity for mobile platforms is a key priority, with a 20% budget increase for 2025.

Innovation in Financial Products

Technology drives the creation of innovative financial products, crucial for banks like Bank of Gansu to remain competitive. For instance, the rapid adoption of digital payment solutions in China, with transactions exceeding CNY 150 trillion in 2024, necessitates advanced mobile banking apps and QR code payment systems. New investment platforms, potentially leveraging AI for personalized wealth management, are also emerging as a 2025 focus for regional banks aiming to capture younger demographics.

- By 2025, digital lending platforms in China are projected to grow significantly, offering tailored credit products.

- Bank of Gansu can enhance its market position by integrating blockchain for secure, efficient cross-border payments.

- The surge in fintech investment, reaching over $15 billion in China by early 2024, fuels product development.

- Developing innovative products like digital yuan-enabled services is vital for future growth and regulatory alignment.

Bank of Gansu is heavily investing in digital transformation, with over 90% of Chinese banking transactions projected to be digital by mid-2025. This includes leveraging AI for risk management and mobile banking apps, vital as China's mobile payment penetration exceeded 85% in 2024. Cybersecurity budgets are increasing by 20% for 2025 to protect against rising threats. Innovative product development, like digital yuan services and blockchain for cross-border payments, is crucial for market competitiveness, fueled by over $15 billion in Chinese fintech investment by early 2024.

| Metric | 2024 Projection | 2025 Projection |

|---|---|---|

| Digital Transaction Volume Growth (Bank of Gansu) | +15% | N/A |

| Mobile Banking Users (China) | ~1.05 billion | ~1.1 billion |

| Cybersecurity Budget Increase (Bank of Gansu) | N/A | +20% |

| Mobile Payment Penetration (China) | >85% | N/A |

| Fintech Investment (China) | >$15 billion (early 2024) | N/A |

Legal factors

The Bank of Gansu operates under stringent Chinese banking and financial regulations, which are crucial legal factors. This includes adhering to the Company Law of the People's Republic of China and the Law on Commercial Banks. Furthermore, the bank must comply with various administrative measures issued by the National Financial Regulatory Administration (NFRA), which as of 2024, continues to strengthen oversight on financial stability and risk management. These regulations provide the essential legal framework governing the bank's operations, impacting everything from capital adequacy to loan loss provisioning. For instance, the NFRA's 2025 directives are expected to further refine rules on interbank lending and digital finance.

China's legal landscape mandates strict data security. The Cybersecurity Law, effective since 2017, and the Personal Information Protection Law (PIPL), enacted in 2021, impose significant obligations on financial institutions like Bank of Gansu. The bank must rigorously safeguard customer data and ensure the resilience of its digital infrastructure to comply with these regulations. Non-compliance carries substantial penalties, with PIPL fines reaching up to RMB 50 million or 5% of prior year's revenue, making adherence critical for operational continuity and financial stability in 2024 and 2025.

The Bank of Gansu must implement and maintain robust anti-money laundering and counter-terrorism financing policies, a critical legal requirement mandated by the People's Bank of China (PBOC) to combat illicit financial flows. This adherence helps prevent the banking system from being used for illegal activities. The bank has established internal policies to manage this risk, aligning with the PBOC's enhanced focus on financial crime prevention, which has seen substantial fines, such as over CNY 300 million issued to various institutions in 2024 for AML deficiencies.

Consumer Protection Laws

Bank of Gansu operates under stringent consumer protection laws in China, ensuring transparent disclosure of product terms and conditions to customers. These regulations, reinforced by the National Financial Regulatory Administration (NFRA) since its 2023 establishment, mandate fair treatment and robust dispute resolution mechanisms. This regulatory environment is crucial for maintaining public trust in the financial system, with compliance being a core operational requirement for all banks. Penalties for non-compliance can include significant fines, impacting profitability and reputation.

- The NFRA continues to prioritize financial consumer protection in 2024, emphasizing clear disclosure.

- Banks must adhere to the Law on the Protection of Consumer Rights and Interests of the People's Republic of China.

- Regulatory focus in 2025 includes enhancing digital consumer protection for online banking services.

- Effective dispute resolution frameworks are mandatory to uphold consumer confidence.

Corporate Governance and Listing Rules

Bank of Gansu, as a publicly listed entity on the Hong Kong Stock Exchange (HKEX: 2139.HK), is legally bound by the stringent HKEX Listing Rules. This includes strict adherence to the Corporate Governance Code, which mandates specific requirements for board composition, ensuring independent oversight. The bank must also comply with detailed financial reporting standards and timely information disclosure obligations, promoting transparency for its investors. These regulations are crucial for maintaining market integrity and investor confidence in its operations.

- HKEX Rule 3.10: Mandates at least one-third of a listed company's board be independent non-executive directors.

- HKEX Rule 13.49: Requires interim financial results to be published within two months and annual results within three months of period end.

- Corporate Governance Code: Specifies best practices for risk management and internal controls.

Bank of Gansu operates under stringent Chinese banking regulations, including NFRA oversight, with 2025 directives enhancing digital finance rules. Compliance with data protection laws like PIPL, which carries fines up to RMB 50 million, is crucial for safeguarding customer information. The bank also adheres to strict AML/CTF policies mandated by PBOC, which issued over CNY 300 million in fines to institutions in 2024 for deficiencies. As an HKEX-listed entity, it meets corporate governance and disclosure standards, such as HKEX Rule 13.49 for timely financial reporting.

| Legal Area | Key Regulation/Focus | Impact/2024-2025 Data |

|---|---|---|

| Banking Operations | NFRA Directives | 2025 focus on interbank lending, risk management. |

| Data Security | PIPL | Fines up to RMB 50M or 5% of revenue for non-compliance. |

| AML/CTF | PBOC Guidelines | Over CNY 300M in fines issued by PBOC in 2024. |

| Consumer Protection | NFRA, Consumer Rights Law | 2024-2025 emphasis on digital consumer safeguards. |

| Listing Compliance | HKEX Rules (e.g., 13.49) | Annual results within 3 months of period end. |

Environmental factors

The Bank of Gansu is actively embracing green finance, aligning with China's national dual carbon strategy to achieve carbon peaking by 2030 and neutrality by 2060. This involves significant financial backing for environmentally friendly initiatives, such as renewable energy projects and energy conservation efforts. By late 2024, the bank's green credit balance had notably expanded, reflecting its commitment. Furthermore, the bank has implemented a robust green credit policy, guiding its lending practices towards sustainable development goals across Gansu Province.

Bank of Gansu is actively identifying and managing climate-related risks, recognizing their significant impact on its loan portfolio. This includes assessing physical risks, such as increased flood exposure affecting approximately 15% of its agricultural loans by 2025, and transition risks from the shift to a low-carbon economy, potentially impacting 8% of its heavy industry financing. The bank has initiated a comprehensive climate risk list, aiming to categorize 90% of its high-risk exposures by late 2024, alongside developing specific response measures to mitigate potential financial losses.

The Bank of Gansu is mandated to disclose its environmental, social, and governance (ESG) performance, reflecting a global trend towards greater corporate responsibility. The bank consistently publishes an annual ESG report, with the latest available detailing its 2023 efforts in green finance initiatives, such as funding for renewable energy projects, alongside robust employee relations and transparent corporate governance. This commitment aligns with increasing investor demand for sustainable practices, as global ESG assets under management are projected to exceed $50 trillion by 2025, highlighting the critical importance of these factors for stakeholder confidence and long-term financial viability.

Support for Ecological and Environmental Protection

Gansu province prioritizes ecological and environmental protection given its unique natural resources, with significant provincial investment projected for green initiatives through 2025. The Bank of Gansu can actively contribute by financing projects focused on environmental conservation and sustainable tourism development. This strategic alignment supports the province's ambitious environmental goals, including achieving 65% forest coverage by 2030 in key regions. The bank's green lending portfolio is expected to expand, reflecting this provincial focus and generating new revenue streams.

- Gansu aims for over 40% clean energy consumption by 2025, driving green finance demand.

- The provincial government allocated over RMB 15 billion for ecological restoration in 2024.

- Bank of Gansu's green credit balance grew 15% year-on-year in 2023, reaching RMB 30 billion.

- Sustainable tourism revenue in Gansu is projected to exceed RMB 250 billion by 2025.

Internal Environmental Management

The Bank of Gansu actively manages its internal environmental footprint, aligning with global sustainability trends. This includes implementing measures to conserve energy, targeting a 5% reduction in electricity consumption across its branches by mid-2025 compared to 2024 levels, and reducing waste through enhanced recycling programs. Such practices demonstrate the bank's commitment to corporate social responsibility and environmental stewardship, which can enhance its reputation and operational efficiency.

- Energy conservation: Aiming for a 5% electricity consumption reduction by mid-2025.

- Waste reduction: Expanding recycling initiatives across all operational units.

- Sustainability reporting: Incorporating internal environmental performance into annual reports.

The Bank of Gansu actively integrates green finance, aligning with China's dual carbon goals and Gansu Province's over RMB 15 billion ecological restoration investment in 2024. By late 2024, its green credit balance notably expanded, reaching RMB 30 billion with 15% year-on-year growth in 2023. The bank manages climate risks, anticipating physical impacts on 15% of agricultural loans by 2025, while targeting a 5% internal electricity consumption reduction by mid-2025.

| Environmental Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Gansu Ecological Investment | RMB 15 Billion | Continued significant investment |

| Bank Green Credit Balance | RMB 30 Billion (2023) | Further expansion expected |

| Agricultural Loan Risk Exposure | Assessing | 15% affected by physical risks |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Bank of Gansu is built upon a robust foundation of data from official Chinese government reports, financial regulatory bodies, and economic forecasting agencies. This ensures a comprehensive understanding of political, economic, and legal factors impacting the bank.

We also incorporate insights from reputable market research firms, technology trend analyses, and environmental impact studies relevant to the banking sector in Gansu province. This allows for a nuanced assessment of social and technological dynamics.