Bandwidth Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bandwidth Bundle

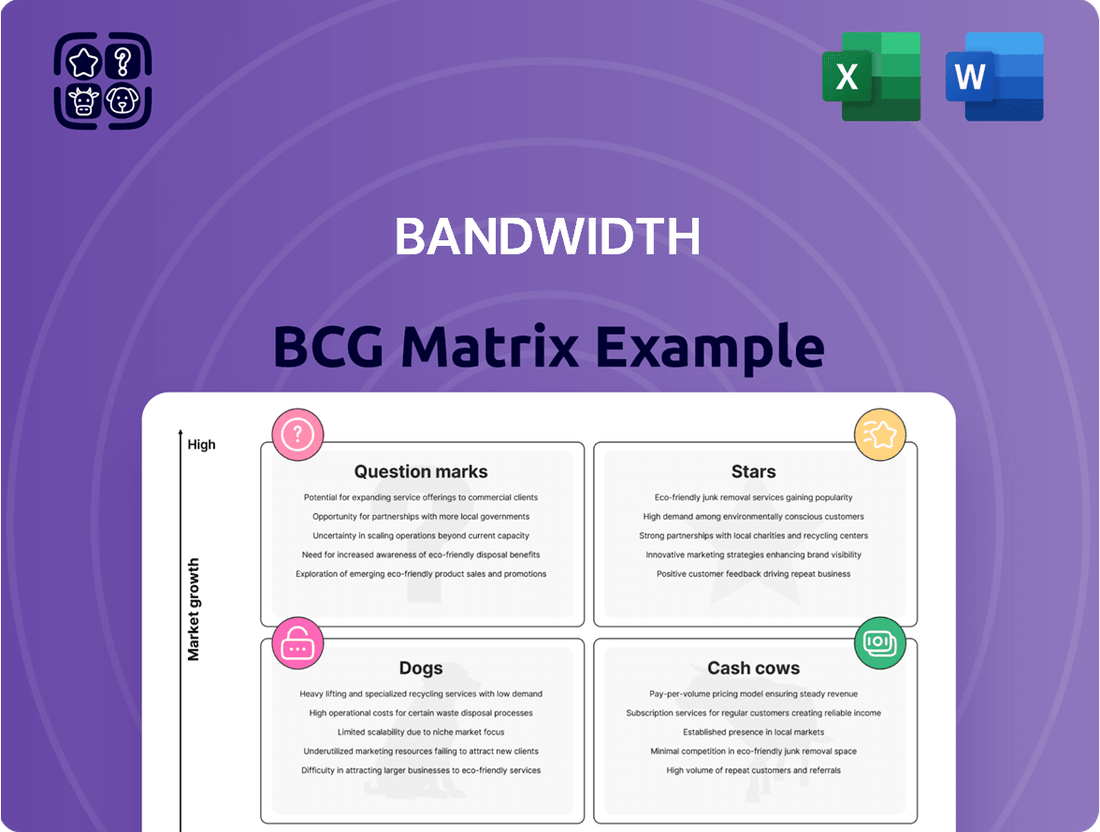

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See where its Stars shine, its Cash Cows generate revenue, its Dogs lag, and its Question Marks hold potential.

This glimpse is just the beginning of understanding your competitive landscape. Purchase the full BCG Matrix to receive a detailed breakdown of each quadrant, actionable insights, and a clear roadmap for optimizing your investments and product development strategies.

Stars

Bandwidth's Enterprise Voice solutions are a powerhouse within their portfolio, demonstrating robust expansion. In the second quarter of 2025, these offerings saw a substantial 29% surge in year-over-year revenue.

This impressive growth is largely attributed to businesses actively transitioning their contact centers and internal communication systems to cloud-based platforms. This trend highlights Bandwidth's strong position in a rapidly expanding segment of the Communications Platform as a Service (CPaaS) market.

The persistent and strong demand for essential enterprise communication tools further solidifies the leadership status of Bandwidth's voice solutions. Their ability to meet these critical needs positions them favorably in the competitive landscape.

Bandwidth's strategic investments in AI-powered communications, notably through its Maestro and AIBridge platforms, are demonstrating strong market traction. These innovative solutions are facilitating the seamless integration of AI voice capabilities into enterprise customer experiences.

As of the first quarter of 2025, over half of Bandwidth's enterprise customers are actively utilizing these AI voice platforms, a clear indicator of their value proposition and widespread adoption. This significant uptake highlights the growing demand for advanced communication solutions.

The company projects that these AI-driven offerings could generate three to four times the revenue of traditional voice calls. This substantial revenue uplift potential underscores the high-growth trajectory and expanding market share Bandwidth is achieving in the dynamic AI communications sector.

Bandwidth's Global Communications Cloud, spanning over 65 countries and touching 90% of global GDP, forms the bedrock of its operations. This expansive reach, coupled with its owner-operated network, offers unparalleled reliability and reach for communication services.

This robust infrastructure is a key differentiator, attracting major technology firms like AWS, Cisco, Google, and Microsoft. Their reliance on Bandwidth underscores the platform's capability to support mission-critical communications, highlighting a significant competitive edge in the Communications Platform as a Service (CPaaS) market.

In 2024, Bandwidth continued to solidify its position as a critical provider of underlying network infrastructure for CPaaS. The company's ability to deliver high-quality, reliable global connectivity is a primary driver of its market share and trust among leading technology companies.

Strategic Partnerships and Ecosystem Integrations

Bandwidth's strategic partnerships are a significant driver of its growth, particularly within the UCaaS and CCaaS sectors. These collaborations have resulted in a substantial increase in deal volume, demonstrating the company's expanding market penetration.

The expansion of Bandwidth's Bring-Your-Own-Carrier (BYOC) ecosystem further amplifies its partnership strategy. This allows for greater flexibility and integration, attracting a wider range of enterprise clients and solidifying Bandwidth's role as a key platform provider.

- Record Deal Volume: Bandwidth reported a record number of new deals in the first quarter of 2024, a direct result of its strong channel partnerships.

- UCaaS/CCaaS Dominance: The company continues to deepen relationships with leading UCaaS and CCaaS providers, securing significant contract wins across diverse industries.

- BYOC Expansion: Bandwidth's BYOC network grew by 25% in 2023, enabling more enterprises to leverage their existing carrier relationships with Bandwidth's platform.

- Industry Vertical Penetration: Partnerships have enabled Bandwidth to successfully enter and gain traction in key verticals such as healthcare and financial services, with significant revenue contributions from these sectors in the last fiscal year.

911 Emergency Services and Regulatory Expertise

Bandwidth excels in the highly regulated 911 emergency services sector, embedding this critical functionality into applications. This niche requires deep understanding of compliance and safety standards, a domain where Bandwidth demonstrates significant strength.

With a Tier 1 carrier status in 38 countries, Bandwidth possesses extensive regulatory expertise across diverse global markets. This broad reach and compliance capability are crucial for its leadership in cloud communications, especially for essential services like 911.

- Regulatory Dominance: Bandwidth's position as a Tier 1 carrier in 38 countries highlights its ability to navigate complex international telecommunications regulations.

- Essential Service Provision: The company's focus on 911 access within cloud communications underscores its role in providing vital, life-saving services.

- Market Advantage: Deep regulatory knowledge and global operational experience provide Bandwidth with a significant competitive edge in the emergency services communications market.

Stars in the Bandwidth BCG Matrix represent Bandwidth's rapidly growing and market-leading offerings, particularly in AI-powered communications and enterprise voice solutions. These segments exhibit high growth potential and strong market share, driven by significant customer adoption and strategic investments.

Bandwidth's AI voice platforms, like Maestro and AIBridge, are seeing substantial uptake, with over half of enterprise customers using them as of Q1 2025. The company projects these AI offerings could generate three to four times the revenue of traditional voice calls, underscoring their Star status.

The Enterprise Voice solutions also qualify as Stars, experiencing a 29% year-over-year revenue surge in Q2 2025 due to the ongoing shift to cloud-based communication systems. This strong performance, coupled with persistent demand, solidifies their position as a high-growth, market-leading product.

Stars are characterized by significant market share in high-growth industries, demanding continuous investment to maintain their leading position and capitalize on future opportunities.

What is included in the product

The Bandwidth BCG Matrix analyzes product portfolio performance based on market growth and relative market share.

Visualize your portfolio's health and identify areas needing strategic attention, alleviating the pain of unclear business unit performance.

Cash Cows

Bandwidth's core voice API services, the bedrock of its offerings, operate within a mature market segment. These services are crucial for numerous businesses integrating voice capabilities into their applications, indicating a strong market presence. In 2023, Bandwidth reported that its Communications Platform as a Service (CPaaS) segment, which includes these core voice APIs, generated $475.8 million in revenue, demonstrating the significant cash-generating power of these mature offerings.

Programmable messaging services, a cornerstone of cloud communications, accounted for 19% of Bandwidth's revenue in Q1 2025. This segment operates within a mature market, yet it continues to show steady growth, solidifying its position as a cash cow. The strategy here involves optimizing current offerings and ensuring unwavering reliability and strict compliance, particularly for high-volume senders.

The emphasis for programmable messaging is on maintaining and maximizing existing revenue streams rather than aggressive expansion. This translates to lower promotional investments, as the service already commands a significant market share. The consistent cash flow generated from these reliable services allows Bandwidth to allocate resources to other areas of its business, demonstrating its role as a stable financial contributor.

Bandwidth's established Global 2000 enterprise customer base, including major tech players, signifies a dominant market share within large-scale, established clients. This robust segment, with a median customer tenure of 11 years as of early 2024, generates predictable, recurring revenue streams.

These long-standing relationships allow Bandwidth to effectively leverage its existing infrastructure and customer loyalty, translating into consistent cash flow generation. This stable revenue base is crucial for funding new ventures and supporting the company's overall financial health, positioning these customers as true cash cows.

Existing Customer Expansions and Upselling

Existing customer expansions and upselling represent a significant Cash Cow for Bandwidth. The company's impressive net retention rate of 112% in Q2 2025 demonstrates their ability to not only retain but also grow revenue from their existing customer base. This focus on deepening relationships with current clients is a highly efficient strategy for generating consistent cash flow.

This approach leverages established trust and understanding of customer needs, reducing the marketing and sales expenses typically associated with acquiring new customers. Bandwidth's customer name retention, consistently above 99%, further solidifies this segment as a reliable revenue stream.

- High Net Retention: 112% in Q2 2025 highlights successful expansion within the existing customer base.

- Strong Customer Loyalty: Over 99% customer name retention indicates deep client satisfaction and reduced churn.

- Efficient Revenue Generation: Upselling and cross-selling to existing clients minimize new customer acquisition costs.

- Stable Cash Flow: This strategy provides a predictable and robust source of income for the company.

Owner-Operated Network's Operational Efficiency

Bandwidth's owner-operated network is a significant differentiator, directly contributing to improved gross margins. This control over infrastructure translates into more efficient cost management, allowing the company to achieve higher profitability from its core business activities. In 2023, Bandwidth reported a gross margin of 50.1%, underscoring the financial benefits of this operational model.

This robust infrastructure is crucial for sustained cash generation, particularly within a mature market landscape. The ability to manage costs effectively and optimize operations means Bandwidth can consistently generate strong free cash flow. For instance, in the first quarter of 2024, the company generated $31.5 million in free cash flow, a testament to its operational efficiency.

- Owner-operated network enhances gross margins.

- Efficient cost management drives profitability.

- Infrastructure supports sustained cash generation.

- 2023 gross margin reached 50.1%.

Cash Cows within Bandwidth's portfolio represent mature, high-market-share offerings that generate consistent, predictable revenue with minimal investment. These segments have established customer bases and benefit from economies of scale, providing stable financial resources for the company. Their primary function is to fund growth initiatives and support other business units.

Bandwidth's core voice API services and programmable messaging are prime examples of Cash Cows. These mature offerings benefit from strong market presence and customer loyalty, as evidenced by a 112% net retention rate in Q2 2025 and over 99% customer name retention. The company's owner-operated network further bolsters profitability, contributing to a 50.1% gross margin in 2023.

| Segment | Market Position | Key Financial Indicator | 2024 Data Point |

|---|---|---|---|

| Core Voice APIs | Mature, Strong Presence | High Revenue Contribution | $475.8M CPaaS Revenue (2023) |

| Programmable Messaging | Mature, Steady Growth | Predictable Revenue Stream | 19% of Q1 2025 Revenue |

| Existing Customer Expansions | High Loyalty, Upsell Potential | Strong Net Retention | 112% Net Retention (Q2 2025) |

What You’re Viewing Is Included

Bandwidth BCG Matrix

The preview you are currently viewing represents the complete and final Bandwidth BCG Matrix document you will receive immediately after purchase. This means you're seeing the exact, unwatermarked, and fully formatted report, ready for immediate strategic application without any additional editing or revisions needed. You can confidently assess its value knowing that the purchased version will be identical, providing you with a professional and actionable tool for your business planning.

Dogs

Legacy on-premises system integrations, while supported by Bandwidth for hybrid environments, represent a segment with likely low growth. As businesses increasingly shift towards cloud solutions, the demand for integrating older, on-site systems is expected to decline.

Investments in these legacy integrations are becoming less impactful compared to the returns seen in cloud-native solutions. Consequently, these areas are candidates for reduced resource allocation, focusing efforts where growth potential is higher.

For instance, while specific 2024 figures for Bandwidth's legacy integration revenue aren't publicly detailed, the broader trend shows a continued enterprise migration to the cloud. Gartner predicted in 2023 that by 2025, over 70% of IT spending would be on cloud technologies, underscoring the diminishing focus on on-premises infrastructure.

Revenue from cyclical political campaign messaging, while present during election cycles, is inherently inconsistent. This segment doesn't align with Bandwidth's long-term, sustainable growth objectives, making it a less strategic area for investment.

In non-election years, this revenue stream experiences low growth and minimal market share, characteristic of a 'dog' in the Bandwidth BCG Matrix. The focus should be on minimizing its impact or managing it passively to free up resources for more promising ventures.

In the Communications Platform as a Service (CPaaS) market, certain segments are highly commoditized, leading to intense price competition. Bandwidth may find itself in these areas where it doesn't possess a distinct market advantage. These services, often characterized by low margins, could be categorized as 'dogs' within the BCG matrix.

These commoditized CPaaS offerings might operate at a break-even point or even consume cash without demonstrating substantial growth potential. For instance, basic SMS and voice API services, while foundational, often face aggressive pricing from numerous providers. In 2024, the global CPaaS market, while growing, saw increased pressure on these core functionalities as more players entered the space, diluting pricing power for those without differentiated offerings.

Underperforming Regional Markets

Within Bandwidth's global operations, certain regional markets might be classified as 'dogs' in the BCG matrix if they exhibit low market share and low growth potential. These are areas where Bandwidth has invested resources but has not seen the expected traction or significant market penetration. For instance, if a particular European or Asian market shows stagnant demand for Bandwidth's core services and the company’s market share remains minimal, it would fit this category.

The company's strategic emphasis on expanding in high-growth international markets indirectly highlights that some existing regions may be underperforming. For example, if Bandwidth reported a 5% revenue growth in its key North American market but only 1% in a specific South American region, that latter region could be considered a 'dog'. This is especially true if the overall market in that region is also growing slowly.

Identifying these underperforming markets is crucial for resource allocation. Bandwidth’s 2024 financial reports might detail regional revenue breakdowns, showing where investments have yielded less than anticipated returns.

- Low Market Share: Regions where Bandwidth holds less than 5% of the total addressable market.

- Stagnant Growth: Markets experiencing annual growth rates below 2%, failing to meet Bandwidth's expansion targets.

- Resource Drain: Areas requiring significant marketing and operational investment without proportional revenue generation.

- Competitive Saturation: Markets dominated by entrenched local competitors, making it difficult for Bandwidth to gain a foothold.

Unsuccessful New Product Initiatives with Low Adoption

New product initiatives that miss the mark, failing to resonate with enterprise customers, fall squarely into the 'dogs' category of the Bandwidth BCG Matrix. These ventures, characterized by low adoption rates, translate directly into minimal market share and negligible revenue. For instance, a 2024 report indicated that nearly 60% of new software features launched by enterprise SaaS companies failed to achieve even a 5% adoption rate within the first six months, highlighting a significant challenge.

Such underperforming products represent a drain on resources without delivering expected returns. Companies often find themselves investing heavily in marketing and development for offerings that simply do not gain traction. In 2024, the average cost for an enterprise software company to bring a new product to market exceeded $3 million, making the failure to achieve adoption particularly costly.

The strategic implication for these 'dogs' is clear: they are prime candidates for divestiture or a fundamental re-evaluation. If costly turnaround strategies do not yield positive results, cutting losses becomes the more prudent financial decision. Consider the case of a major tech firm in late 2024 that announced the discontinuation of three key product lines after they collectively failed to capture more than 2% of their target market, freeing up substantial capital for more promising ventures.

- Low Adoption Metrics: Products failing to achieve significant user engagement or sales targets post-launch.

- Minimal Market Share: Inability to capture a meaningful portion of the intended market segment.

- Negative ROI: Revenue generated does not cover the investment in development, marketing, and sales.

- Strategic Re-evaluation: Products are candidates for divestment or significant strategic pivots if turnaround efforts are unsuccessful.

Dogs in Bandwidth's BCG Matrix represent offerings with low market share and low growth potential. These are typically mature, commoditized products or services where competition is fierce and margins are thin. For instance, basic SMS and voice APIs in the CPaaS market often fall into this category due to intense price competition and a crowded vendor landscape. In 2024, the global CPaaS market continued to see pressure on these core functionalities as more providers entered, impacting pricing power for undifferentiated offerings.

Investments in these areas yield minimal returns, and resources are better allocated to high-growth segments. Companies often manage dogs passively or consider divestiture to free up capital. For example, a new software product failing to gain traction, with less than 5% adoption within six months, is a prime candidate for divestiture, especially if turnaround efforts prove costly. In 2024, the average cost to bring an enterprise software product to market exceeded $3 million, highlighting the financial risk of such failures.

Regional markets with stagnant demand and minimal market penetration also fit the dog category. If Bandwidth's revenue growth in a specific South American market was only 1% in 2024, compared to 5% in North America, and the overall market there was also growing slowly, that region would be considered a dog. Such underperforming markets require strategic evaluation to determine if continued investment is warranted.

These segments often operate at break-even or consume cash without significant upside. The strategic implication is to minimize their impact or divest them to focus on more promising ventures. For Bandwidth, this means carefully assessing which product lines or geographic regions are no longer contributing meaningfully to growth and profitability.

Question Marks

Bandwidth is strategically positioning itself to capture a larger slice of the burgeoning Rich Business Messaging (RBM) and conversational messaging market. This expansion aims to elevate customer interaction through more dynamic and engaging communication channels. The global RBM market, for instance, was projected to reach approximately $10.5 billion by 2024, highlighting significant growth potential.

While the overall messaging market is robust, Bandwidth's current footprint in these advanced RBM and conversational features may be nascent. This positions these offerings as 'question marks' within a growth portfolio, necessitating substantial investment to build brand recognition and secure a competitive market share against established players. For example, adoption rates for RBM services among enterprises are still climbing, with many businesses actively exploring these capabilities in 2024.

Bandwidth is strategically positioning itself in the AI-powered fraud detection and compliance market, a critical and rapidly expanding sector within communications. Their Trust Services strategy, featuring a multilayered Trust Solutions framework, aims to address the increasing complexities of fraud and regulatory adherence in the AI era.

This focus on AI-driven trust solutions represents a significant growth opportunity. The global fraud detection and prevention market, for instance, was projected to reach over $100 billion by 2027, highlighting the immense potential for companies like Bandwidth investing in this space.

Bandwidth's strategic push into new international territories, while promising high growth, places them squarely in the question mark category of the BCG Matrix. These ventures, though potentially lucrative, demand substantial upfront capital for market penetration and navigating diverse regulatory landscapes.

For instance, in 2024, Bandwidth continued its global expansion efforts, targeting key markets in Europe and Asia. While specific investment figures for these individual expansions aren't publicly disclosed, the company has historically allocated significant resources to international market entry, reflecting the inherent costs associated with establishing a foothold in unfamiliar and competitive environments.

Emerging AI Voice Use Cases Beyond Current Offerings

Beyond established platforms like Maestro and AIBridge, emerging AI voice applications present a significant growth frontier for Bandwidth. These include sophisticated, integrated transcription services and more complex AI voice agent deployments that can handle intricate customer interactions.

These advanced use cases, while currently representing a smaller market share for Bandwidth, are poised for substantial expansion. Capturing leadership in this nascent space will demand considerable investment in research and development, alongside a focused strategy to innovate and scale these capabilities.

- Advanced Integrated Transcription: Offering real-time, highly accurate transcription with contextual understanding, moving beyond simple speech-to-text to include sentiment analysis and speaker identification.

- Complex AI Voice Agents: Developing agents capable of multi-turn conversations, proactive problem-solving, and personalized customer engagement across various industries.

- Market Potential: The global AI in voice recognition market was valued at approximately $10.7 billion in 2023 and is projected to reach over $32 billion by 2030, indicating a strong growth trajectory for these emerging use cases.

- Strategic Investment: Bandwidth's commitment to investing in these areas, potentially through R&D or strategic partnerships, will be crucial for establishing a dominant position in these high-potential segments.

Synergies from Future BYOC Ecosystem Additions (e.g., Kore.AI, Omilia)

Bandwidth’s BYOC (Bring Your Own Carrier) ecosystem is expanding with strategic additions like Kore.AI and Omilia, focusing on high-growth generative AI and AI-powered customer service. These partnerships are designed to enhance Bandwidth’s offerings in dynamic market segments.

While these integrations target significant growth potential, their current market share contribution to Bandwidth remains modest. Realizing their full value necessitates focused investment and strategic adoption initiatives.

- Kore.AI Integration: Enhances Bandwidth’s platform with advanced conversational AI capabilities, targeting enterprise automation and customer engagement solutions.

- Omilia Integration: Brings AI-driven self-service and contact center solutions, aiming to improve customer experience and operational efficiency.

- Synergistic Growth: These additions are expected to drive revenue growth by tapping into the expanding AI and customer service markets, which saw significant investment in 2024.

- Strategic Investment: Bandwidth’s ongoing commitment to integrating and promoting these BYOC partners is crucial for capturing market share in these competitive, AI-centric sectors.

Bandwidth's investments in Rich Business Messaging (RBM) and conversational AI represent clear question marks. While the RBM market is projected to reach approximately $10.5 billion by 2024, Bandwidth's current share in these advanced features is still developing. Significant investment is needed to build brand awareness and compete effectively in this evolving space.

The company's expansion into AI-powered fraud detection and compliance, and new international markets also fall into the question mark category. The global fraud detection market is expected to exceed $100 billion by 2027, indicating substantial growth potential. Similarly, international ventures, while promising, require considerable capital for market entry and navigating diverse regulatory environments, as seen in their 2024 European and Asian market focus.

Emerging AI voice applications, including advanced transcription and complex AI voice agents, are also question marks for Bandwidth. The global AI in voice recognition market was valued at about $10.7 billion in 2023 and is anticipated to grow significantly. Strategic investment in R&D and scaling these capabilities will be key to capturing leadership in these nascent, high-potential segments.

Bandwidth's BYOC ecosystem expansion with Kore.AI and Omilia targets high-growth generative AI and AI-powered customer service. Although these integrations tap into significant market potential, their current contribution to Bandwidth's market share is modest. Focused investment and strategic adoption are crucial for realizing their full value and capturing market share in these competitive, AI-centric sectors.

| Area | BCG Category | Key Considerations | Market Data Point |

|---|---|---|---|

| Rich Business Messaging (RBM) & Conversational AI | Question Mark | Nascent market share, requires significant investment for brand building and competitive positioning. | Global RBM market projected at $10.5 billion by 2024. |

| AI-Powered Fraud Detection & Compliance | Question Mark | High growth potential, requires investment to establish leadership in a critical sector. | Global fraud detection market projected over $100 billion by 2027. |

| International Market Expansion | Question Mark | High upfront capital needed for market penetration and navigating diverse regulatory landscapes. | Continued focus on European and Asian markets in 2024. |

| Emerging AI Voice Applications | Question Mark | Demands substantial R&D investment to innovate and scale for future market leadership. | Global AI in voice recognition market valued at $10.7 billion in 2023. |

| BYOC Ecosystem Expansion (Kore.AI, Omilia) | Question Mark | Modest current market share contribution, requires strategic investment for full value realization. | Targeting expanding AI and customer service markets with significant 2024 investment. |

BCG Matrix Data Sources

Our Bandwidth BCG Matrix is built on comprehensive market data, including subscriber growth rates, revenue figures, and network investment reports to provide strategic direction.