Banca IFIS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca IFIS Bundle

Banca IFIS navigates a complex financial landscape, where the bargaining power of buyers and the threat of substitutes significantly shape its strategic options. Understanding these forces is crucial for any stakeholder looking to grasp the bank's competitive position.

The complete report reveals the real forces shaping Banca IFIS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Banca IFIS benefits from a robust and varied funding strategy, which inherently limits supplier bargaining power. As of December 31, 2024, a substantial 60.4% of its funding came from customer deposits, creating a broad and stable base.

This reliance on a wide array of individual and corporate depositors means that no single depositor can exert significant influence over the bank's terms. The bank further strengthens its position by accessing other funding avenues like bonds and securitization, ensuring a diversified financial structure.

Banca IFIS demonstrates a strong capital and liquidity position, crucial for navigating supplier negotiations. In 2024, its CET1 Ratio stood at a robust 16.10%, comfortably surpassing regulatory mandates.

This financial resilience, underscored by a stable Baa3 investment-grade rating from Moody's, makes the bank an attractive proposition for capital providers. Such strength grants Banca IFIS greater bargaining power when securing funding, signaling reduced risk to the market.

Banca IFIS's significant investment of 76 million Euro in digitalization from 2022 to 2024 highlights its reliance on technology providers. This substantial commitment means the bank is a key client for many tech firms, potentially giving it leverage to negotiate better terms and specialized services.

NPL Portfolio Origination

Banca IFIS, as a specialist in non-performing loans (NPLs), faces banks and financial institutions as its primary suppliers in this market segment. These are the entities looking to divest their NPL portfolios. The Italian NPL market experienced a notable shift in 2024, with transaction volumes on the primary market seeing a decline. Conversely, activity within the secondary NPL market showed an uptick.

While a reduced volume of primary NPL sales might suggest an increased bargaining power for sellers, Banca IFIS’s deep-rooted expertise and strong market standing in NPL management are crucial factors. These elements help to foster and maintain more balanced negotiation dynamics with its suppliers, ensuring fair terms for both parties.

- Supplier Concentration: The NPL market can involve numerous banks, but the largest portfolios may come from a few key institutions, potentially increasing their leverage.

- Market Conditions: A shrinking primary NPL market in 2024, as observed in Italy, can empower sellers as demand for these assets might outstrip supply, leading to more competitive bidding.

- Banca IFIS's Expertise: Banca IFIS's specialized knowledge in NPL servicing and recovery provides a competitive edge, allowing it to negotiate favorable terms even in tight supply situations.

- Alternative Buyers: The presence of other specialized NPL investors in the market can limit the bargaining power of any single supplier, as Banca IFIS has alternative sourcing options.

Access to Specialized Talent

The specialized nature of Banca IFIS's operations, particularly in factoring and Non-Performing Loan (NPL) management, necessitates a workforce with unique expertise. This demand for specialized talent inherently grants these individuals significant bargaining power, potentially leading to increased wage demands. For instance, as of early 2024, the demand for financial analysts with NPL experience in Italy remained robust, with salary expectations reflecting this scarcity.

However, Banca IFIS is actively mitigating this supplier power through strategic investments in efficiency and digital transformation. By optimizing its operational processes, the bank aims to reduce its reliance on extensive human capital for certain tasks, thereby controlling operating costs. This focus on technology can also streamline workflows, potentially reducing the overall need for highly specialized, and thus expensive, personnel in the long run.

Furthermore, Banca IFIS's consistent financial performance and its commitment to fostering an attractive work environment are crucial for retaining and attracting top-tier talent. A strong employer brand, coupled with competitive compensation and development opportunities, helps to secure the specialized skills the bank requires. This proactive approach ensures a steady supply of qualified professionals, lessening the suppliers' (talent) leverage.

- Specialized Demand: Banca IFIS operates in niche financial sectors like factoring and NPL management, requiring specific skill sets.

- Talent Leverage: Skilled professionals in these areas can command higher salaries due to their specialized knowledge.

- Digital Optimization: Strategic investments in technology aim to improve efficiency and potentially reduce dependence on extensive human resources.

- Retention Strategy: A strong company culture and competitive compensation are key to attracting and keeping specialized talent.

Banca IFIS's reliance on customer deposits, which constituted 60.4% of its funding as of December 31, 2024, significantly dilutes the bargaining power of individual depositors. This broad funding base, complemented by access to bond markets and securitization, ensures that no single supplier of capital holds substantial leverage over the bank.

What is included in the product

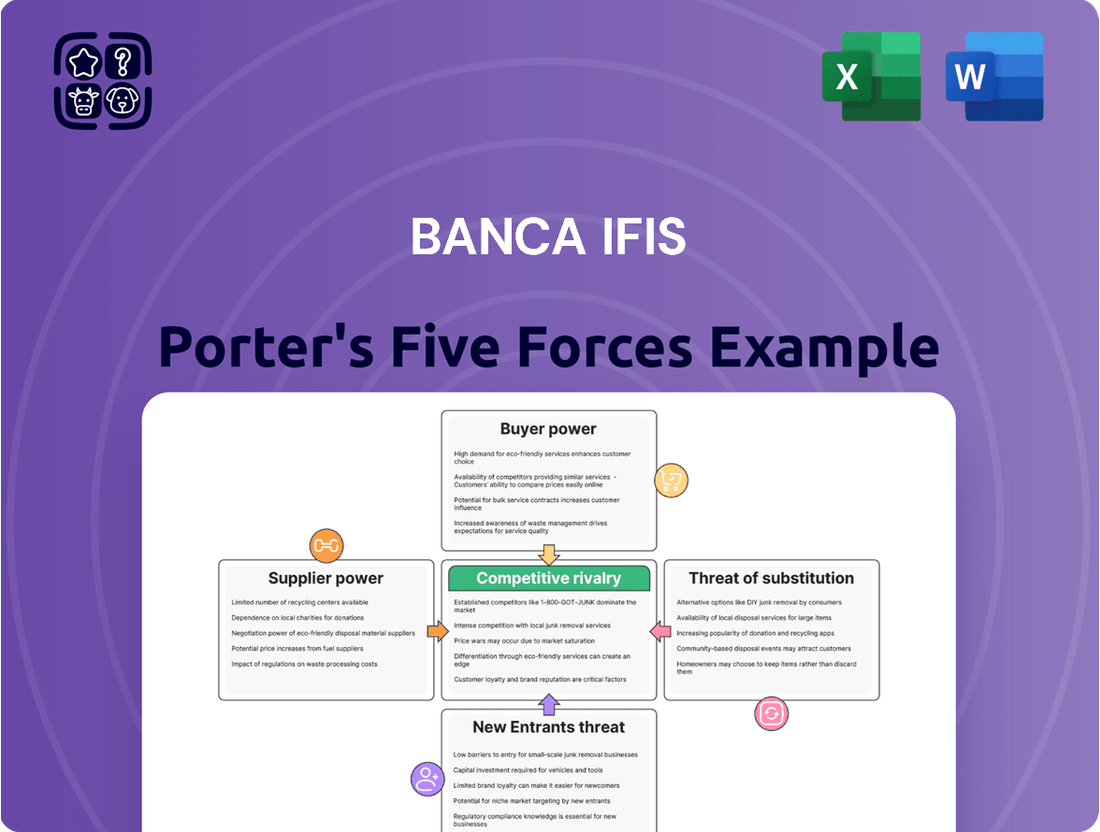

This Porter's Five Forces analysis for Banca IFIS dissects the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes within the Italian banking sector, providing strategic insights into its market position.

Banca IFIS's Porter's Five Forces Analysis provides a clear, visual representation of competitive pressures, enabling swift identification of threats and opportunities.

Easily adapt the analysis to changing market dynamics by updating key variables, offering a dynamic tool for strategic adjustments.

Customers Bargaining Power

Banca IFIS's customer base is largely comprised of small and medium-sized enterprises (SMEs) in Italy, a sector that represents a remarkable 99% of all businesses. This extensive fragmentation means that individual customers typically have limited bargaining power, as their transaction volumes are relatively small and their needs are quite varied.

Italian SMEs are increasingly finding financing beyond traditional banks. Options like crowdfunding, venture capital, and minibonds are becoming more common. For instance, the Italian crowdfunding market saw significant growth, with volumes reaching hundreds of millions of euros in recent years, offering SMEs more leverage.

Fintech innovation plays a crucial role by providing faster, more flexible working capital solutions. This rise in digital lending platforms means SMEs can shop around for the best terms, speed, and user experience, directly impacting their negotiation power with any single financial institution.

In the realm of Non-Performing Loans (NPLs), Banca IFIS's customers are primarily sophisticated institutional investors and financial institutions. These entities are actively participating in Italy's robust and expanding NPL secondary market, which offers them a variety of acquisition choices.

The Italian NPL market saw a modest rise in portfolio sale prices in 2023, reaching an average of 30-35% of gross book value for unsecured NPLs, up from 25-30% in 2022. This uplift is attributed to heightened competition among buyers and a slight contraction in available NPL volumes, signaling that while the market is dynamic, buyers still retain a degree of bargaining leverage due to the availability of alternative investment opportunities.

Digitalization Lowering Switching Costs

The increasing digitalization of financial services, particularly with the proliferation of fintech platforms, has significantly streamlined processes for small and medium-sized enterprises (SMEs). This digital shift inherently lowers the barriers and costs associated with switching financial providers, as customers can now more readily compare and move between institutions offering superior digital interfaces or faster service delivery.

Banca IFIS's own strategic investments in digital transformation are designed to elevate the customer experience, a crucial factor in today's competitive landscape. However, this enhanced digital accessibility also means that customers, armed with more readily available information and easier switching mechanisms, have greater power to move to competitors if their expectations for digital engagement and service efficiency are not met.

- Digitalization's Impact on Switching Costs: The ease of comparing digital banking and fintech solutions has reduced the effort and expense for SMEs to change financial partners.

- Banca IFIS's Digital Strategy: While aiming to improve customer retention through digital enhancements, Banca IFIS must also acknowledge the increased customer mobility this creates.

- Competitive Landscape: In 2024, the financial sector saw continued growth in digital-only banks and fintechs, intensifying the pressure on traditional institutions like Banca IFIS to maintain competitive digital offerings.

Price Sensitivity and Economic Conditions

Small and medium-sized enterprises (SMEs), a core focus for Banca IFIS, demonstrate significant price sensitivity, particularly when economic conditions tighten. The ongoing need for liquidity to fuel growth and maintain stability makes cost-effectiveness a paramount concern for these businesses. For instance, during periods of economic uncertainty, such as the lingering effects of global supply chain disruptions impacting 2024, SMEs are more inclined to compare loan and financing rates across various institutions.

While Banca IFIS differentiates itself with specialized financial products tailored for SMEs, the broader economic climate and the competitive landscape of financial services mean customers will naturally gravitate towards the most economical options available. This inherent price sensitivity necessitates that Banca IFIS consistently offers competitive pricing structures and value-added services to retain its customer base.

- SME Price Sensitivity: SMEs often prioritize cost when selecting financial partners, especially in uncertain economic environments.

- Economic Impact: Economic pressures in 2024, including inflation and interest rate adjustments, amplify customer focus on pricing.

- Competitive Landscape: The presence of numerous financial providers compels Banca IFIS to maintain competitive pricing to attract and retain SME clients.

- Liquidity Needs: SMEs require accessible and affordable capital for operational stability and growth, driving price-conscious decisions.

Banca IFIS's SME clients exhibit notable price sensitivity, a factor amplified by economic conditions. In 2024, ongoing inflationary pressures and fluctuating interest rates meant SMEs actively sought the most cost-effective financing solutions. This drive for affordability, coupled with increased access to digital comparison tools, empowers customers to negotiate better terms or switch providers if pricing is not competitive.

The Italian financial sector in 2024 continued to see a surge in digital-first banking and fintech solutions. These platforms often offer streamlined onboarding and more transparent fee structures, directly challenging traditional institutions. Consequently, Banca IFIS must ensure its pricing remains attractive relative to these agile competitors to mitigate the bargaining power of its SME clientele.

| Factor | Impact on Banca IFIS Customer Bargaining Power | Supporting Data/Context (2024 Focus) |

| Digitalization & Switching Costs | Reduced costs and effort for customers to switch providers. | Continued growth of fintechs offering easier comparison and account opening. |

| Price Sensitivity | Customers prioritize cost-effectiveness, especially during economic uncertainty. | Inflationary pressures in 2024 increased SME focus on loan and financing rates. |

| Alternative Financing Options | Availability of non-traditional funding sources provides leverage. | Crowdfunding and digital lending platforms continued to expand their reach to SMEs. |

Same Document Delivered

Banca IFIS Porter's Five Forces Analysis

This preview showcases the complete Banca IFIS Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. You're viewing the exact document you'll receive instantly after purchase, providing actionable insights into threats and opportunities. This professionally formatted analysis is ready for immediate use, ensuring you get the full, detailed report without any modifications.

Rivalry Among Competitors

The Italian banking landscape is fiercely competitive, with giants like Intesa Sanpaolo and UniCredit holding substantial sway, particularly in the corporate banking and factoring arenas. These behemoths are heavily investing in digital advancements and providing a broad spectrum of services tailored for small and medium-sized enterprises (SMEs). For instance, as of early 2024, Intesa Sanpaolo reported total assets exceeding €1 trillion, underscoring its immense market power and ability to offer competitive financing solutions.

Banca IFIS contends with an intensifying competitive rivalry not only from traditional banks but also from a growing array of specialized lenders and innovative fintech firms in Italy. The factoring market, a key area for IFIS, is anticipated to see continued expansion through 2024 and into 2025, naturally drawing in a diverse range of new participants.

Fintechs are making significant inroads, particularly in digital lending solutions and peer-to-peer financing platforms tailored for small and medium-sized enterprises (SMEs). These digital alternatives often provide more agile and expedited financing options compared to conventional banking services.

The competitive rivalry within the Non-Performing Loan (NPL) servicing market is intense, with numerous specialized servicers vying for market share. This is highlighted by significant merger and acquisition activity, as firms consolidate to gain scale and efficiency. For instance, in 2023, the European NPL market saw continued consolidation, with major players acquiring smaller entities to bolster their servicing capabilities and expand their geographic reach.

Banca IFIS operates in this dynamic landscape, facing competition not only from established servicers but also from new entrants attracted by the growing NPL market. The active secondary NPL market, where portfolios of distressed assets are frequently traded, further fuels this competition. Servicers must constantly innovate and demonstrate superior asset management skills to win mandates and maintain profitability.

Product Differentiation and Niche Specialization

Banca IFIS carves out its competitive edge through a deliberate focus on specialized financial services. Its core strengths lie in factoring, catering to small and medium-sized enterprises (SMEs) with tailored financing solutions, and in the management of non-performing loans (NPLs). This niche specialization allows the bank to develop deep expertise and offer distinct value propositions, setting it apart from more generalized financial institutions.

However, this very specialization presents a challenge as competitors can and do attempt to mirror these offerings. The banking sector, particularly in Italy, sees rivals striving to replicate Banca IFIS's success in factoring and NPL services. For instance, in 2024, several Italian banks announced expanded factoring divisions, directly targeting Banca IFIS's established client base.

To maintain its advantage, Banca IFIS heavily invests in digitalization and innovation. This strategy aims to enhance the efficiency and attractiveness of its specialized products, making them more appealing than those offered by competitors. For example, the bank's 2024 digital transformation initiatives focused on streamlining factoring processes, which saw a 15% increase in new client onboarding for that service segment.

- Specialized Services: Banca IFIS excels in factoring, SME corporate banking, and NPL management.

- Competitive Replication: Rivals are actively seeking to imitate these specialized financial products.

- Digitalization and Innovation: The bank leverages technology to differentiate its offerings and stay ahead.

- Market Impact: Digital enhancements in 2024 led to a significant rise in new clients for its factoring services.

Economic Pressures and Market Adaptability

The Italian economy's moderate GDP growth and shifting economic pressures directly influence demand for conventional banking services, creating a dynamic competitive landscape. This environment compels financial institutions like Banca IFIS to be highly adaptable and strategically agile.

Banca IFIS's demonstrated resilience, highlighted by its robust profitability figures in 2024 and projections for 2025, underscores its capacity to manage these evolving economic conditions effectively. This financial strength is a key determinant in its ability to maintain and enhance its competitive standing amidst these pressures.

- Italian GDP Growth: Projected to be around 0.7% for 2024, indicating a stable but not rapid expansion.

- Inflationary Environment: While moderating, inflation continues to influence consumer spending and business investment decisions.

- Banca IFIS 2024 Performance: The bank reported a net profit of €250 million for the first nine months of 2024, showcasing strong operational performance.

- Strategic Adaptation: Banca IFIS's focus on digital transformation and specialized lending segments positions it to capitalize on changing market demands.

Banca IFIS faces intense competition from large Italian banks like Intesa Sanpaolo and UniCredit, which possess significant market power and are actively investing in digital solutions for SMEs. Furthermore, specialized lenders and agile fintech companies are increasingly challenging traditional banking models, particularly in digital lending and peer-to-peer financing, offering faster alternatives.

The rivalry extends to the Non-Performing Loan (NPL) servicing sector, characterized by ongoing consolidation and new entrants attracted by market growth. Banca IFIS differentiates itself through specialization in factoring and NPL management, but competitors are actively seeking to replicate these successful offerings, with some Italian banks expanding their factoring divisions in 2024.

To counter this, Banca IFIS prioritizes digitalization and innovation, as evidenced by its 2024 digital transformation efforts that streamlined factoring processes, leading to a 15% increase in new client onboarding for this segment. This strategic focus on specialized services, enhanced by technology, is crucial for maintaining its competitive edge in a dynamic market.

| Competitor Type | Key Offerings | Banca IFIS's Response |

|---|---|---|

| Large Banks (e.g., Intesa Sanpaolo) | Broad SME services, digital advancements, significant asset base (€1T+ total assets for Intesa Sanpaolo as of early 2024) | Specialization in factoring and NPLs, digital process streamlining |

| Fintechs | Agile digital lending, P2P financing for SMEs | Investing in digitalization to enhance specialized product efficiency |

| NPL Servicers | NPL portfolio management, M&A activity for scale | Focus on superior asset management skills and innovation |

SSubstitutes Threaten

For small and medium-sized enterprises, traditional bank loans and Banca IFIS's factoring services face substitutes from a variety of alternative finance instruments. These include crowdfunding (equity and lending), private equity and venture capital, minibonds, and direct lending platforms. These options offer flexible and often faster liquidity solutions, appealing to SMEs seeking diverse funding sources.

In 2024, the alternative finance market continued its robust growth, with crowdfunding platforms alone facilitating billions in SME funding globally. For instance, European crowdfunding platforms saw a significant uptick in SME participation, with some reporting over a 20% increase in deployed capital year-over-year, demonstrating a clear preference for these accessible channels.

The rise of digital lending and fintech platforms presents a substantial threat of substitutes for traditional banking and factoring services. These platforms, offering streamlined digital lending, invoice trading, and peer-to-peer financing, provide agile alternatives that can bypass conventional banking processes.

Fintech solutions often boast enhanced user experience with real-time account management and competitive pricing, directly challenging established financial institutions. For instance, a significant portion of Italian small and medium-sized enterprises (SMEs) are actively exploring and investing in fintech and AI-driven financial services, underscoring their growing preference for these digital substitutes.

Large banking institutions may choose to handle their non-performing loan (NPL) portfolios internally through dedicated workout divisions. This strategy allows them to maintain direct control over the recovery process and potentially reduce costs associated with outsourcing to specialized servicers. For instance, in 2023, several major European banks announced plans to bolster their in-house NPL management capabilities, signaling a shift in how they address distressed assets.

Furthermore, the market sees a threat from generalist debt recovery agencies and other financial entities that can offer partial or alternative solutions to NPL management. These providers might focus on specific aspects of debt collection or offer restructuring services that, while not a complete substitute, can divert business from specialized NPL servicers. The competitive landscape for NPL servicing is evolving, with a growing number of players offering tailored solutions.

Capital Markets for Corporate Funding

For larger small and medium-sized enterprises (SMEs) and mid-cap companies, capital markets offer a significant alternative to traditional bank financing and factoring. Instruments such as corporate bonds, including minibonds, and even listings on stock exchanges provide avenues for raising capital. This directly substitutes the need for bank loans or factoring services.

Recent initiatives in Italy have focused on reforming capital markets to make them more accessible to corporations. These reforms are designed to streamline the process and reduce barriers, thereby increasing the attractiveness of these alternative funding channels. For instance, the Italian Stock Exchange’s AIM Italia market has seen increased activity in recent years, demonstrating a growing appetite for public listings among growing companies.

- Corporate Bonds (Minibonds): These offer companies a way to raise debt directly from investors, bypassing traditional bank lending. As of early 2024, the Italian minibond market continues to expand, providing a viable substitute for bank credit lines.

- Stock Market Listings: For established SMEs and mid-caps, listing on exchanges like AIM Italia provides access to equity capital, offering an alternative to debt financing or factoring. In 2023, AIM Italia welcomed a notable number of new issuers, indicating growing confidence in public markets for corporate funding.

- Increased Attractiveness of Capital Markets: Reforms aimed at simplifying listing requirements and improving market liquidity are making capital markets a more competitive substitute for bank financing, especially for companies seeking substantial growth capital.

Government Support and Guarantee Schemes

Government support and guarantee schemes can present a significant threat of substitutes for traditional financial services like factoring, especially for Small and Medium-sized Enterprises (SMEs). These programs often offer more favorable terms, such as lower interest rates or extended repayment periods, making them an attractive alternative. For instance, in 2024, various national governments continued to implement and expand SME support initiatives, aiming to bolster economic recovery and growth.

These government-backed funds can directly compete with Banca IFIS by providing businesses with access to capital that might otherwise be sought through commercial factoring or corporate loans. UniCredit's programs, which often leverage state guarantees for SME lending, exemplify how these schemes reduce the immediate need for private sector financial solutions. Such government interventions can significantly alter the competitive landscape by lowering the cost of capital for businesses.

- Government Guarantee Funds: These programs reduce the risk for lenders, allowing them to offer more competitive rates to SMEs.

- Favorable Financing Conditions: Government schemes often provide lower interest rates and longer repayment terms compared to commercial factoring.

- Reduced Demand for Commercial Factoring: SMEs may opt for government-backed loans or guarantees, diminishing their reliance on factoring services.

- UniCredit's State-Guaranteed Programs: Examples like UniCredit's initiatives highlight the direct competition posed by government-supported lending.

The threat of substitutes for Banca IFIS's factoring services is substantial, driven by a growing array of alternative finance options for SMEs. These range from digital lending platforms and crowdfunding to capital markets and government support schemes. These substitutes often offer greater flexibility, speed, and potentially lower costs, directly challenging traditional factoring.

In 2024, the fintech sector continued to innovate, with digital lending platforms providing streamlined invoice financing and peer-to-peer lending solutions. These platforms often boast superior user experience and faster approval times compared to traditional banks. For instance, a significant portion of Italian SMEs actively explore fintech solutions for their financing needs, indicating a clear preference for these agile alternatives.

Capital markets, particularly minibonds and stock exchange listings, also present a strong substitute for larger SMEs. Reforms in 2023 and 2024 aimed at making these markets more accessible are increasing their appeal. For example, the Italian AIM Italia market has seen a rise in new issuers, demonstrating growing confidence in public markets for corporate funding.

| Substitute Type | Key Features | 2024 Relevance/Trend |

|---|---|---|

| Fintech & Digital Lending | Streamlined processes, faster approvals, P2P financing | Continued growth, increased SME adoption, enhanced user experience |

| Crowdfunding | Equity and debt-based funding for SMEs | Billions facilitated globally, significant growth in European SME participation |

| Capital Markets (Minibonds, Listings) | Direct access to debt and equity capital | Market reforms increasing accessibility, AIM Italia growth |

| Government Support Schemes | Guarantees, favorable rates, extended repayment | Expansion of SME support initiatives, direct competition with commercial finance |

Entrants Threaten

Entering Italy's banking and specialized financial services, especially in factoring and NPL management, presents considerable regulatory challenges and demands significant capital. New capital market regulations in Italy, while intended to boost competitiveness, still require strict adherence to a complex legal and supervisory structure.

Banca IFIS benefits from a robust capital base and established regulatory compliance, which together create a substantial barrier for potential new entrants. For instance, as of the first quarter of 2024, Banca IFIS reported a Common Equity Tier 1 (CET1) ratio of 15.3%, well above the minimum regulatory requirements, demonstrating its strong financial footing.

The factoring and non-performing loan (NPL) management sectors demand significant specialized expertise and substantial investment in IT infrastructure. Developing the necessary skills for client acquisition and efficient debt recovery is a lengthy and expensive undertaking, creating a considerable barrier for newcomers. Banca IFIS leverages its existing operational efficiency in these critical areas, giving it a distinct advantage.

Established institutions like Banca IFIS possess significant brand recognition and deep-seated trust within their core SME market. This is a formidable barrier for newcomers. For instance, in 2024, Italian banks collectively reported a net profit of €30.6 billion, indicating a robust and competitive landscape where established brands command loyalty.

New entrants would face the daunting task of investing heavily in marketing and enduring a lengthy period to cultivate a similar level of reputation and client confidence. The Italian banking sector, characterized by a strong tradition of customer relationships, makes this challenge even more pronounced.

Fintech Innovation and Niche Entrants

While traditional banking faces significant capital and regulatory hurdles, the fintech landscape reveals a different story. Innovative companies are carving out specific niches, often bypassing established barriers through agile, digital-first approaches. For instance, Aidexa, a digital financial institution focusing on small and medium-sized enterprises (SMEs), demonstrates how specialized fintechs can gain traction by prioritizing customer experience and operational efficiency.

This trend suggests that the threat of new entrants, particularly in specialized lending or service areas, remains a pertinent concern for incumbent banks like Banca IFIS. These new players can leverage technology to offer more competitive pricing or tailored solutions, effectively lowering the perceived entry threshold for those targeting underserved segments. By mid-2024, the fintech sector continued to see substantial investment, with global fintech funding reaching over $20 billion in the first half of the year, indicating sustained innovation and potential for new market entrants.

- Niche Targeting: Fintechs like Aidexa focus on specific customer segments, such as SMEs, offering tailored digital solutions.

- Digital-First Models: These new entrants often operate with lower overheads by leveraging technology and avoiding physical branch networks.

- Agility and Innovation: Fintechs can adapt quickly to market changes and introduce novel products or services, challenging traditional banking models.

- Reduced Entry Barriers: While not eliminating them entirely, digital innovation can lower some of the traditional capital and operational barriers to entry in financial services.

Economies of Scale and Cost Advantages

Banca IFIS, as a well-established institution, leverages significant economies of scale across its operations. This translates into cost advantages in areas like customer acquisition, loan processing, and sophisticated risk management systems, which are difficult for new entrants to replicate quickly. For instance, in 2023, Banca IFIS reported a cost-to-income ratio of 40.5%, demonstrating its operational efficiency.

New competitors would face substantial hurdles in matching these cost efficiencies from the outset. To compete on pricing, they would likely need to absorb higher initial operating costs, potentially leading to unsustainable margins. This makes it challenging for them to gain market share without significant capital investment and a long-term strategy to achieve scale.

- Economies of Scale: Banca IFIS benefits from lower per-unit costs due to its large operational volume.

- Cost Advantages: Established infrastructure and processes reduce operating expenses for Banca IFIS compared to newcomers.

- Operational Efficiency: The bank's focus on streamlining operations further solidifies its cost leadership.

- Barrier to Entry: The cost disadvantage for new entrants makes it difficult to compete effectively on price.

While traditional banking faces significant capital and regulatory hurdles, the fintech landscape reveals a different story, with innovative companies carving out niches. These new players can leverage technology to offer competitive pricing or tailored solutions, effectively lowering the perceived entry threshold for specific segments.

Banca IFIS benefits from economies of scale, translating into cost advantages in areas like customer acquisition and risk management that are difficult for new entrants to replicate. New competitors face substantial hurdles in matching these cost efficiencies from the outset, making it challenging to gain market share without significant capital and a long-term strategy.

| Factor | Banca IFIS Advantage | New Entrant Challenge |

| Capital Requirements | High, due to regulatory and operational scale. | Significant investment needed for compliance and infrastructure. |

| Regulatory Hurdles | Established compliance framework. | Navigating complex Italian and EU financial regulations. |

| Specialized Expertise | Proven track record in factoring and NPL management. | Requires substantial investment in talent and IT for niche services. |

| Brand & Trust | Strong reputation, especially with SMEs. | Time-consuming and costly to build customer loyalty. |

| Economies of Scale | Lower per-unit costs, operational efficiency (e.g., 40.5% cost-to-income ratio in 2023). | Difficulty in matching cost leadership without achieving significant scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Banca IFIS is built upon a foundation of robust data, including the bank's official annual reports, investor relations materials, and filings with regulatory bodies like the Bank of Italy and CONSOB. We also incorporate insights from reputable financial news outlets, industry-specific publications, and market research reports focused on the Italian banking sector.