Banca IFIS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca IFIS Bundle

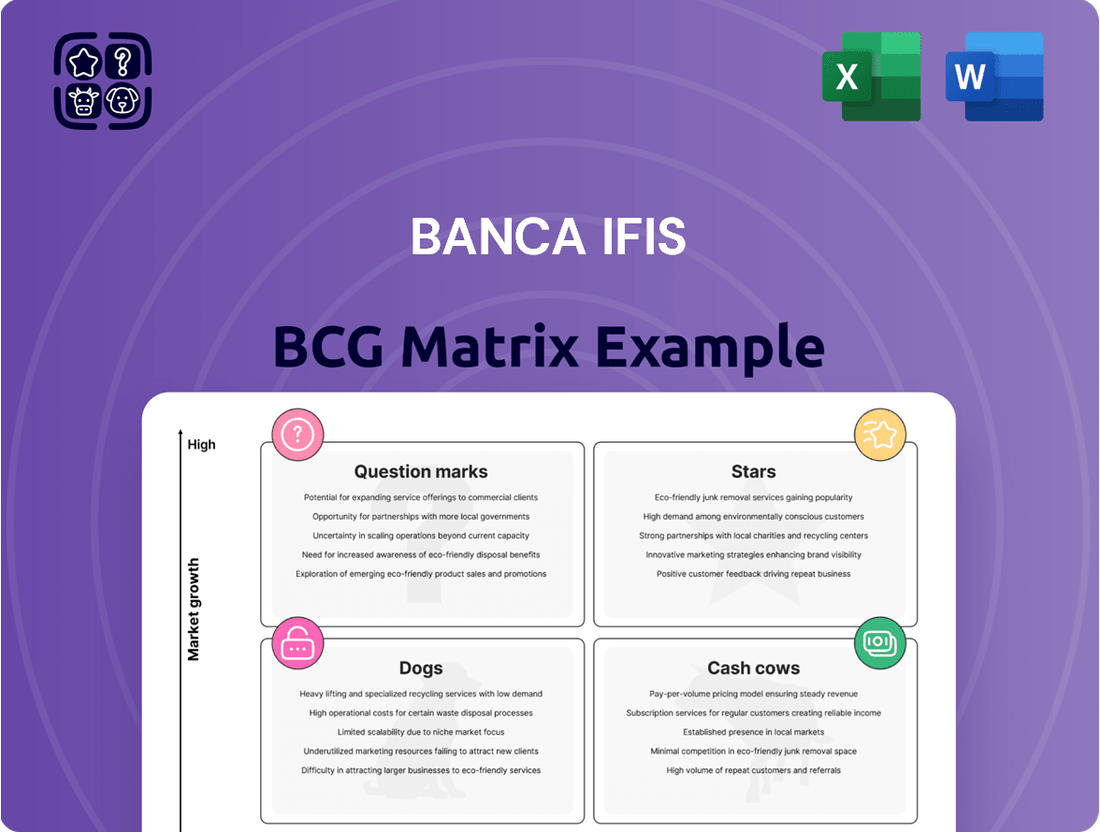

Unlock the strategic potential of Banca IFIS with our comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders (Stars), reliable profit generators (Cash Cows), underperformers (Dogs), or require further investment (Question Marks).

This glimpse into Banca IFIS's product portfolio is just the beginning. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing their business strategy and resource allocation.

Stars

Banca IFIS commands a substantial portion of the Italian factoring market, especially among its active clients, solidifying its position as a key provider of liquidity for small and medium-sized enterprises. This strong market presence, coupled with the overall expansion of the factoring sector, highlights the strategic importance of these services for the bank.

The Italian factoring market is on an upward trajectory, with projections for 2024 and 2025 anticipating continued growth. This expansion is fueled by a rising need among businesses for robust working capital financing solutions. For instance, the Italian factoring market saw a significant increase in turnover, reaching €39.7 billion in the first quarter of 2024, a 9.4% rise compared to the same period in 2023, as reported by Assifact.

Given this robust market share within a growing industry, Banca IFIS’s factoring services are clearly positioned as a Star within the BCG Matrix. This classification indicates a high-growth, high-market-share segment, demanding continued investment to maintain and capitalize on its leading position.

Banca IFIS stands out as a significant force in the Italian Non-Performing Loans (NPLs) market. Despite evolving market conditions, this segment remains a fertile ground for specialized servicers like Banca IFIS.

The bank's NPL operations are a consistent and substantial contributor to its overall revenue, underscoring its robust market position and adept management within this niche. This strong performance highlights Banca IFIS's ability to navigate and capitalize on the complexities of the NPL sector.

The NPL market is currently experiencing a notable shift towards increased secondary market activity. This trend creates fresh opportunities for growth, further solidifying Banca IFIS's expertise in NPL management as a key strategic asset, akin to a Star in the BCG matrix.

Banca IFIS has strategically poured resources into digital transformation, targeting a doubling of customer acquisition via digital avenues for its Corporate and Commercial Banking by the close of 2024. This ambitious goal is supported by investments in streamlined operations and user-friendly digital tools like online onboarding and contract signing. The bank’s commitment to digitalization is a clear play to secure a more substantial slice of the growing digitally-savvy SME market, enhancing both reach and operational efficiency.

Strategic Partnerships (High Growth, High Potential Market Share)

Banca IFIS actively pursues strategic partnerships to bolster its presence in high-growth markets, particularly in credit product distribution and non-performing loan (NPL) acquisition and management. These alliances are designed to unlock new customer segments and amplify existing market penetration by tapping into external capabilities and extensive networks.

Such collaborations are positioned as key drivers for accelerated growth, offering a pathway to significantly expand market share within promising sectors. For instance, in 2024, Banca IFIS continued to explore and solidify partnerships aimed at enhancing its digital offerings and expanding its reach in specialized lending areas.

- Strategic alliances are crucial for Banca IFIS's expansion in credit distribution.

- Partnerships in NPL acquisition and management offer significant growth potential.

- Leveraging external expertise and networks accelerates market penetration.

- These collaborations are vital for increasing Banca IFIS's overall market share.

ESG-linked Financial Solutions (Emerging High Growth, Developing Market Share)

Banca IFIS is strategically positioned within the ESG-linked Financial Solutions category, reflecting its emerging high growth potential and developing market share. The bank's commitment to sustainability is underscored by its MSCI ESG rating upgrade to AAA in March 2025, demonstrating a robust framework for responsible finance.

This strong ESG performance is a significant differentiator in a market experiencing rapid expansion. While precise market share figures for ESG-linked solutions are still solidifying, the global imperative for sustainable investments creates a fertile ground for Banca IFIS to leverage its leadership and capture a larger portion of this burgeoning sector.

- MSCI ESG Rating: Upgraded to AAA in March 2025, signaling top-tier sustainability performance.

- Market Growth: The global demand for ESG-linked financial products is rapidly increasing, driven by investor and regulatory focus.

- Competitive Advantage: Banca IFIS's established ESG leadership provides a strong foundation for market share gains in this high-growth segment.

- Future Outlook: The bank is well-equipped to capitalize on evolving ESG trends and expand its offerings in sustainable finance.

Banca IFIS's factoring services are a clear Star in the BCG Matrix. With a significant market share in a growing Italian factoring sector, the bank is well-positioned to capitalize on the increasing demand for working capital solutions. The sector's growth, evidenced by a 9.4% turnover increase in Q1 2024 to €39.7 billion, underscores the strategic importance and high-potential nature of this business line for Banca IFIS.

What is included in the product

This BCG Matrix analysis categorizes Banca IFIS's business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Banca IFIS BCG Matrix offers a clear, quadrant-based visualization of business units, alleviating the pain of strategic uncertainty.

Cash Cows

Banca IFIS's traditional factoring operations, especially within the Italian SME market, are a prime example of a Cash Cow. Despite the overall factoring market experiencing growth, this core segment for Banca IFIS is mature, characterized by a high market share among active clients.

This established position allows the bank to generate consistent and substantial revenue and cash flow. The need for significant promotional investment is relatively low, as the business benefits from its strong market presence and long-standing relationships.

For instance, in 2024, Banca IFIS reported significant contributions from its factoring division, underscoring its role as a reliable source of earnings. The bank's focus on traditional domestic factoring for SMEs highlights its strategic advantage in a well-understood and profitable niche.

Banca IFIS's corporate banking for established Small and Medium-sized Enterprises (SMEs), excluding factoring, likely operates as a Cash Cow. This segment benefits from a high market share within a mature, low-growth sector.

These services, encompassing a broad spectrum of financial solutions, consistently generate robust income streams and healthy profit margins. For instance, in 2023, Banca IFIS reported a net profit of €277.7 million, with its diversified lending activities contributing significantly to this performance.

Strategic investment in this area would focus on optimizing operational efficiency and nurturing existing client relationships. This approach ensures the continued stability and profitability of the business line, rather than pursuing aggressive expansion.

Banca IFIS's extensive experience in recovering non-performing loans (NPLs) through judicial and extrajudicial means positions this segment as a cash cow. This business line benefits from a mature market presence and well-honed recovery processes, generating consistent cash flow from existing portfolios.

The NPL recovery sector, while subject to market shifts, offers Banca IFIS a stable income stream. In 2024, the Italian NPL market continued to see significant activity, with gross NPLs in the Italian banking system decreasing. Banca IFIS, with its deep expertise, is well-placed to capitalize on these ongoing recovery efforts, leveraging its established infrastructure.

Proprietary Finance / Securities Portfolio (Low Growth, High Market Share)

Banca IFIS's proprietary finance and securities portfolio fits the cash cow profile, characterized by its high market share within its niche and low growth expectations. This segment is crucial for generating consistent net banking income through the efficient management of existing assets, rather than pursuing rapid expansion.

This strategic focus on asset management allows Banca IFIS to derive stable returns, contributing significantly to the bank's overall profitability. The investments required to maintain this segment are relatively low, reinforcing its cash cow status.

- Net Banking Income Contribution: The portfolio consistently generates substantial net banking income for Banca IFIS.

- Asset Management Focus: Prioritizes managing existing assets for stable returns over aggressive growth.

- Low Investment Requirement: Requires minimal additional investment to maintain its profitability.

- Profitability Driver: Acts as a stable source of funds, supporting other business areas.

Mature Digitalized Processes (Low Growth, High Efficiency)

Banca IFIS's 2022-2024 business plan saw substantial digital transformation, significantly boosting operational efficiency and lowering costs. These mature digital processes, including streamlined customer onboarding and accelerated loan disbursements, now act as cash cows by optimizing internal operations, thereby generating high profit margins without the need for aggressive market expansion.

The focus on these highly efficient, digitalized processes allows Banca IFIS to maximize profitability through cost optimization. For instance, by automating key functions, the bank reduces manual intervention and associated expenses, directly contributing to a healthier bottom line.

- Digitalization Investments: Banca IFIS completed its 2022-2024 plan with significant investments in digital technologies.

- Efficiency Gains: These investments have led to enhanced operational efficiency and reduced operating costs.

- Profit Margin Optimization: Mature digitalized processes, like faster onboarding, contribute to high profit margins by optimizing operations.

- Cash Cow Status: These efficient processes generate strong profits through operational excellence rather than market share growth.

Banca IFIS's traditional factoring operations for Italian SMEs represent a mature business with a strong market position, generating consistent cash flow. This segment requires minimal new investment, allowing profits to be channeled elsewhere. In 2024, the factoring division continued to be a significant contributor to the bank's earnings, highlighting its reliable revenue generation.

| Business Segment | Market Position | Cash Flow Generation | Investment Needs |

|---|---|---|---|

| Traditional Factoring (SMEs) | High Market Share | Consistent & Substantial | Low |

| Corporate Banking (Established SMEs) | High Market Share | Robust Income Streams | Low (Focus on Optimization) |

| NPL Recovery | Mature Presence | Stable Income Stream | Low (Leveraging Infrastructure) |

| Proprietary Finance & Securities | High Niche Share | Stable Returns | Minimal |

Preview = Final Product

Banca IFIS BCG Matrix

The Banca IFIS BCG Matrix preview you are viewing is the identical, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, meticulously prepared by industry experts, offers a clear framework for evaluating Banca IFIS's business portfolio. You can confidently expect the same high-quality, professionally formatted report that will empower your decision-making processes. This is not a sample, but the complete, analysis-ready BCG Matrix for your business planning needs.

Dogs

The Non-Core and Governance & Services segment of Banca IFIS, as represented in its BCG Matrix, signifies an area of low growth and low market share. This segment's contribution to the bank's overall revenue has been on a downward trend, suggesting it's not a growth engine for the institution.

This segment likely encompasses a mix of legacy assets or administrative functions that, while necessary for operations, do not represent strategic growth opportunities. For instance, in 2024, the bank continued its efforts to divest or manage non-performing loans and other non-core assets, which are typically categorized within such segments.

Underperforming legacy loan portfolios, characterized by low growth and minimal market share, would be classified as Dogs in Banca IFIS's BCG Matrix. These portfolios often represent a drag on capital, offering little in terms of future returns. For instance, a legacy portfolio with a projected annual growth rate of only 1% and a market share of less than 2% would exemplify this category.

These assets, while not necessarily Non-Performing Loans (NPLs), tie up valuable capital that could be deployed in more promising ventures. Banca IFIS, like many financial institutions, must carefully manage these portfolios to mitigate their negative impact. In 2023, the European banking sector continued to grapple with optimizing legacy portfolios, with some institutions reporting that such assets comprised over 15% of their total loan book, despite contributing less than 5% to net interest income.

Highly niche or specialized services with limited scalability, often termed 'Dogs' in the BCG Matrix, represent offerings that cater to very specific, small market segments. These services, while potentially profitable in their limited scope, struggle to achieve significant growth or capture a substantial market share. For instance, if Banca IFIS were to offer highly bespoke wealth management for a select group of ultra-high-net-worth individuals with extremely unique investment needs, this could fall into the Dog category. Such a service might generate steady, albeit small, revenue but would have minimal impact on the bank's overall expansion trajectory or market dominance.

Outdated Technology Systems (Low Growth, High Cost)

Outdated Technology Systems (Low Growth, High Cost) represent a significant drag on Banca IFIS's potential. Despite substantial investments in digitalization, any lingering legacy systems that are expensive to maintain and hinder current or future strategic goals fall into this category. These systems divert valuable resources without generating growth or offering a competitive edge.

These legacy systems are characterized by their inefficiency and inability to support modern banking operations. Their high maintenance costs, coupled with a lack of scalability, directly impact profitability and operational agility. For instance, if a core banking system from the early 2000s is still in use, it likely incurs substantial costs for specialized IT support and lacks the APIs necessary for seamless integration with newer digital platforms. This directly contrasts with the bank's stated commitment to digital transformation, creating a disconnect between strategic vision and operational reality.

- High Maintenance Costs: Legacy systems often require specialized, expensive support personnel and software licenses that are no longer widely available or cost-effective.

- Operational Inefficiencies: These systems are typically slow, prone to errors, and lack the automation capabilities of modern platforms, leading to increased manual work and longer processing times.

- Hindrance to Innovation: Outdated technology restricts the bank's ability to launch new digital products, services, or integrate with third-party fintech solutions, thereby limiting growth opportunities.

- Security Vulnerabilities: Older systems may have unpatched security flaws, making them more susceptible to cyber threats, which is a critical concern in the financial sector.

Specific Client Segments with High Servicing Costs and Low Profitability (Low Growth, Low Market Share)

Certain client segments, perhaps those requiring extensive manual processing or having high default rates without corresponding higher interest income, could represent the Dogs in Banca IFIS's BCG Matrix. These segments might consume disproportionate resources relative to the revenue they generate, hindering overall profitability and growth.

For instance, in 2024, a hypothetical segment of small, infrequent business clients with a high volume of cash transactions might have incurred servicing costs that exceeded the net interest margin and fees collected. This scenario is common when operational inefficiencies are high and the client's contribution to overall loan volume or fee-based services is minimal.

- High Operational Costs: Segments demanding significant manual intervention, such as processing paper-based applications or frequent customer support interactions, drive up operational expenses.

- Low Revenue Generation: These clients typically have low balances, generate minimal fee income, and may have a higher propensity for non-performing loans, offsetting any potential interest income.

- Limited Growth Potential: Their market share is often small, and the underlying economic or demographic trends for these segments may indicate stagnant or declining future growth prospects.

- Resource Drain: The resources allocated to managing these low-profitability segments could be better utilized in higher-growth, higher-return areas of the bank's portfolio.

Dogs within Banca IFIS's BCG Matrix represent business units or assets with low market share in low-growth industries. These offerings consume resources without contributing significantly to profits or market expansion. For instance, a legacy portfolio of small business loans with a projected annual growth rate of 1% and a market share of less than 2% would exemplify this category.

These "Dogs" often include outdated technology systems or niche services that are costly to maintain and offer limited scalability. In 2024, Banca IFIS continued its strategy of optimizing its portfolio, which involves identifying and managing these low-performing assets. The European banking sector, as of 2023, saw legacy assets sometimes comprising over 15% of loan books while contributing less than 5% to net interest income, highlighting the challenge these assets present.

The bank's focus remains on divesting or streamlining these less productive areas to free up capital for more strategic investments. This approach is crucial for enhancing overall financial health and operational efficiency. For example, a hypothetical segment of small, infrequent business clients with high transaction costs might have been a "Dog" in 2024, generating minimal revenue relative to the servicing expenses incurred.

Managing these "Dogs" requires careful consideration to minimize their negative impact on profitability and resource allocation. Banca IFIS's ongoing efforts in digital transformation and portfolio management aim to mitigate the drag from such assets.

Question Marks

Banca IFIS is actively pursuing innovation in new digital financial products and platforms, a strategic move to capitalize on evolving consumer behaviors and market opportunities. These initiatives, while promising, are in their nascent stages, reflecting a commitment to exploring high-growth segments. For instance, the bank might be investing in early-stage fintech partnerships or developing proprietary solutions for areas like embedded finance or specialized digital lending.

The focus here is on future potential rather than current market dominance. While specific market share figures for these emerging digital offerings might be minimal as of early 2024, the underlying trend they tap into, such as the increasing demand for personalized financial services or streamlined digital onboarding, shows significant upward trajectory. This positions Banca IFIS to potentially capture substantial market share as these digital ecosystems mature and gain wider adoption.

Banca IFIS's ventures into new geographical markets, moving beyond its established Italian base for services like factoring and non-performing loans (NPLs), would be classified as Stars. These markets offer substantial growth prospects but, by definition of being new, begin with a low market share. This requires considerable investment to establish a foothold, build brand recognition, and capture market share.

For instance, if Banca IFIS were to expand its factoring services into a burgeoning Eastern European market in 2024, it would likely find a sector experiencing double-digit annual growth. However, its initial market share might be a mere fraction of a percent, necessitating aggressive marketing and sales efforts, alongside tailored product offerings to meet local business needs.

Banca IFIS's acquisition of illimity Bank in the first half of 2025 places it squarely in the Question Mark category of the BCG Matrix. This move is characterized by high growth potential, particularly in the digital banking space, but with an uncertain future market share and profitability as integration is still underway.

The strategic rationale behind acquiring illimity Bank is to tap into its innovative digital platform and customer base, aiming for significant synergies. However, the success of this integration, and thus its transition from a Question Mark to a Star or even a Dog, hinges on Banca IFIS's ability to effectively merge operations and realize the projected value, a process that typically requires substantial investment and careful management.

Specialized Lending Beyond Core SME Factoring (High Growth, Low Market Share)

Banca IFIS is exploring specialized lending beyond its core SME factoring and corporate banking. These initiatives target niche, high-growth sectors requiring substantial investment to establish market presence and expertise.

Examples of such specialized lending could include:

- Financing for renewable energy projects: Focusing on solar, wind, and other green energy infrastructure, a sector projected to see significant growth in Italy.

- Technology and innovation financing: Supporting startups and scale-ups in sectors like fintech, AI, and biotech, which are experiencing rapid expansion.

- Supply chain finance for specific industries: Developing tailored solutions for sectors with complex or evolving supply chains, such as automotive or advanced manufacturing.

Development of AI-driven Financial Solutions (High Growth, Nascent Market)

Banca IFIS is actively exploring and developing AI-driven financial solutions, recognizing the burgeoning potential in this high-growth, yet nascent market. These initiatives align with the broader trend of artificial intelligence adoption within corporate banking, aiming to offer more sophisticated advisory services and tools to clients.

The bank's focus is on creating intelligent platforms that can analyze vast datasets to provide personalized financial insights, optimize investment strategies, and automate complex financial processes. This strategic direction positions Banca IFIS to capture a significant share of a market that, while currently small, is projected for substantial expansion in the coming years.

- AI-Powered Credit Risk Assessment: Banca IFIS is investing in AI algorithms to enhance credit risk evaluation, moving beyond traditional scoring models to incorporate a wider array of data points for more accurate and timely assessments.

- Personalized Investment Advisory: Development of robo-advisory services powered by AI to offer tailored investment recommendations based on individual client risk profiles and market conditions.

- Fraud Detection and Prevention: Implementing machine learning models to identify and mitigate fraudulent transactions in real-time, safeguarding both the bank and its customers.

- Market Trend Analysis: Utilizing AI for sophisticated analysis of market trends and economic indicators to provide clients with predictive insights and strategic financial planning support.

Banca IFIS's acquisition of illimity Bank in early 2025 places it in the Question Mark category. This strategic move targets the high-growth digital banking sector, but the bank's future market share and profitability remain uncertain as integration efforts are still in their early stages.

The success of merging illimity's innovative digital platform and customer base hinges on Banca IFIS's execution. Significant investment and careful management are crucial for this integration to potentially transform the acquired entity from a Question Mark into a Star or even a Dog.

The bank's exploration of specialized lending, such as financing for renewable energy projects or technology startups, also falls into the Question Mark quadrant. These niche areas offer high growth potential but require substantial investment to build market presence and expertise, with initial market share being minimal.

Similarly, Banca IFIS's development of AI-driven financial solutions represents a Question Mark. While the market for AI in banking is expanding rapidly, the bank's current share is small, and the long-term success of these sophisticated tools is yet to be fully realized.

BCG Matrix Data Sources

Our BCG Matrix leverages robust financial statements, comprehensive market research, and strategic industry analysis to provide actionable insights.