Baidu Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baidu Bundle

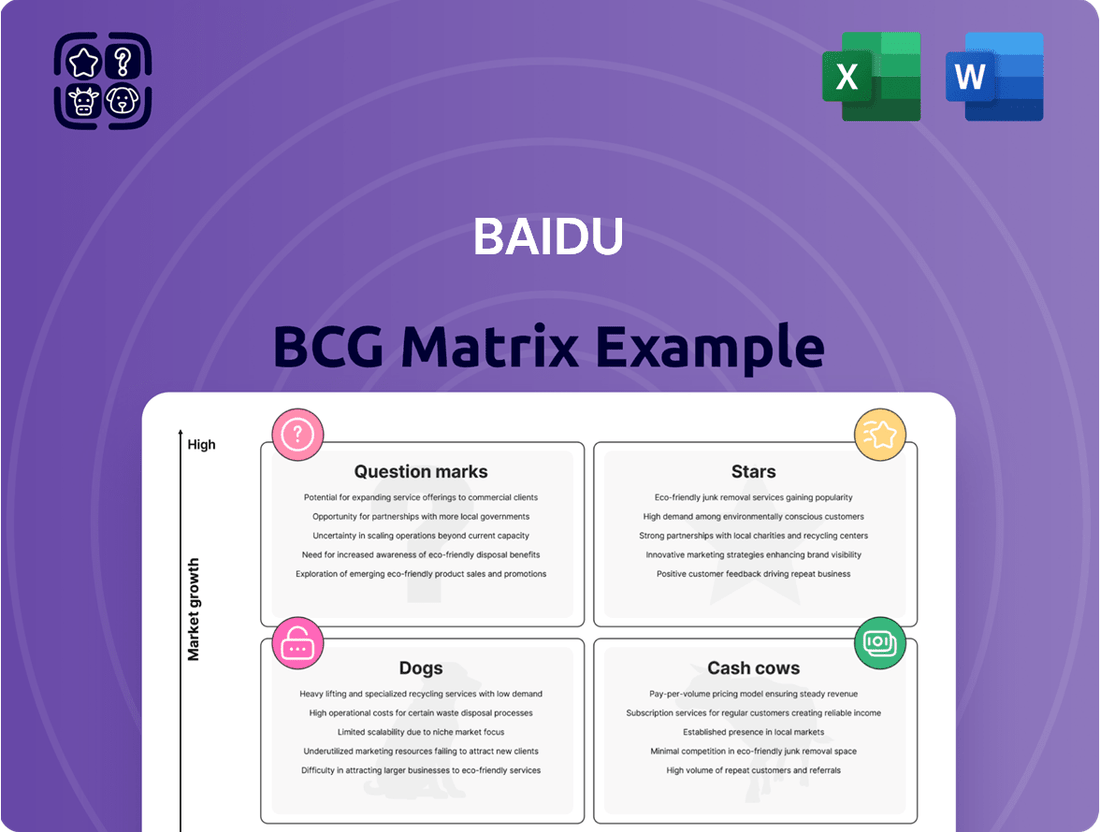

Curious about Baidu's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand where Baidu's innovations are positioned as Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock Baidu's competitive advantage, dive into the full BCG Matrix report. Gain a comprehensive breakdown of each product's market share and growth rate, complete with actionable insights for optimizing your investment strategy.

Don't miss out on the critical data that drives smart business decisions. Purchase the complete Baidu BCG Matrix today to receive a detailed analysis and a clear roadmap for future success.

Stars

AI Cloud Services represent a significant Star for Baidu. This segment experienced impressive revenue growth, climbing 42% year-over-year in the first quarter of 2025. Baidu maintains a dominant position in China's AI public cloud market, recognized for its comprehensive AI offerings and attractive pricing strategies.

Baidu's Apollo Go autonomous ride-hailing service is a clear Star in the BCG matrix, demonstrating robust growth and expanding operational reach. By Q1 2025, it had already achieved 100% fully driverless operations in multiple Chinese cities, signaling a significant technological advancement and market penetration.

The service provided over 1.4 million rides in the first quarter of 2025, marking an impressive 75% increase compared to the previous year. This surge in usage, coupled with the company's ambitious goal of achieving overall profitability by the end of 2025, underscores Apollo Go's strong market position and future potential.

Furthermore, Apollo Go's international expansion into Dubai and Abu Dhabi signifies its global ambitions and its ability to replicate its success in new markets. This strategic move further solidifies its status as a high-growth, high-market-share entity within Baidu's portfolio.

ERNIE Bot, Baidu's flagship large language model, stands out as a Star in the AI landscape. By December 2024, it was handling a remarkable 1.65 billion API calls daily, showcasing a 33-fold surge from the previous year. This impressive adoption rate positions ERNIE Bot as China's most utilized AI product, capturing an 11.5% market share.

Baidu's commitment to innovation is evident in its continuous upgrades to the ERNIE series, with models like ERNIE 4.5 Turbo and X1 Turbo demonstrating strong competitive performance and attractive pricing strategies. These advancements solidify ERNIE Bot's position as a key player in the rapidly evolving AI market.

Qianfan Large Model Platform

Baidu's Qianfan large-model platform is a significant Star in its portfolio, reflecting strong growth and market dominance. As of its latest iteration, Qianfan 3.0, the platform supports an impressive 700,000 enterprise-level applications, showcasing its broad utility and adoption. This extensive reach allows businesses to leverage advanced AI capabilities for digital transformation initiatives.

The platform's impact is further evidenced by its user base's ability to fine-tune 30,000 large models, a testament to its versatility and the burgeoning demand for customized AI solutions. This capability not only highlights Qianfan's technical prowess but also its role in democratizing access to sophisticated AI tools for businesses of all sizes.

- Market Leadership: Qianfan's position as a Star is reinforced by its ability to foster AI-native application development.

- Cost Efficiency: The platform's success is also attributed to its capacity to reduce development costs for enterprises.

- Scalability: Supporting over 700,000 enterprise applications demonstrates robust scalability and market penetration.

- Innovation: Enabling the fine-tuning of 30,000 large models showcases its contribution to AI innovation and customization.

AI-Powered Search Transformation

Baidu is significantly investing in its search engine, making it more AI-centric. This includes integrating advanced models like ERNIE 4.5 and X1 to improve search results and user engagement. This strategic shift is designed to unlock new revenue streams by offering a superior, AI-driven search experience.

The company views AI-powered search as a key driver for future growth. By enhancing its core search capabilities with AI, Baidu aims to capture a larger market share and create more valuable advertising opportunities. This positions the search engine as a potential Stars category within the BCG matrix, indicating high market growth and a strong competitive position.

- AI Integration: Baidu is embedding ERNIE 4.5 and X1 into its search platform.

- User Experience: The goal is to provide more relevant and personalized search results.

- Monetization: AI-powered search is expected to open up new advertising and service revenue channels.

- Growth Potential: Baidu identifies AI search as a high-growth area for its business.

Baidu's AI Cloud Services are a standout Star, exhibiting substantial growth and market leadership. The segment saw a 42% year-over-year revenue increase in Q1 2025, solidifying Baidu's dominant position in China's AI public cloud market due to its comprehensive offerings and competitive pricing.

Apollo Go, Baidu's autonomous ride-hailing service, is a prime example of a Star. By Q1 2025, it achieved 100% fully driverless operations in several Chinese cities and provided over 1.4 million rides, a 75% surge from the prior year, with profitability targeted by year-end 2025.

ERNIE Bot, Baidu's advanced large language model, shines as a Star. In December 2024, it handled 1.65 billion daily API calls, a 33-fold increase, making it China's most used AI product with an 11.5% market share, further bolstered by continuous upgrades like ERNIE 4.5 Turbo.

Baidu's Qianfan large-model platform is a critical Star, supporting 700,000 enterprise applications and enabling the fine-tuning of 30,000 large models, demonstrating its scalability and role in driving AI adoption for businesses.

Baidu's AI-centric search engine is positioned as a Star, integrating advanced models to enhance user experience and unlock new revenue streams through AI-powered advertising, signaling a high-growth trajectory.

| Business Unit | BCG Category | Key Metrics | Growth Drivers | Strategic Importance |

|---|---|---|---|---|

| AI Cloud Services | Star | 42% YoY Revenue Growth (Q1 2025) | Comprehensive AI offerings, competitive pricing | Dominant market position in China |

| Apollo Go | Star | 1.4M+ Rides (Q1 2025), 75% YoY ride increase | 100% driverless operations, international expansion | High growth, market penetration |

| ERNIE Bot | Star | 1.65B Daily API Calls (Dec 2024), 11.5% market share | Continuous model upgrades (ERNIE 4.5 Turbo) | Leading AI product in China |

| Qianfan Platform | Star | 700K Enterprise Apps, 30K Fine-tuned Models | Scalability, cost efficiency, AI-native development | Democratizing AI access |

| AI-Powered Search | Star | Projected high growth | AI integration (ERNIE 4.5/X1), enhanced user experience | Key driver for future revenue |

What is included in the product

Strategic recommendations for Baidu's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

A clear Baidu BCG Matrix visualizes your portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Baidu's core search engine continues to be a powerful cash cow, solidifying its position as the undisputed leader in China's search market. As of November 2024, it commanded a significant 54.36% market share, a position it largely maintained, holding 50.92% by June 2025.

This dominance, particularly in the mobile search arena where it held 67.99% in November 2024, translates directly into predictable and substantial revenue streams. The consistent user base and advertising revenue generated by its search services provide a stable foundation for Baidu's overall financial health.

Baidu's online marketing services, largely driven by its search engine, are a cornerstone of its financial performance. In the fourth quarter of 2024, this segment brought in RMB 17.9 billion, followed by RMB 16.0 billion in the first quarter of 2025. These figures highlight its substantial contribution to Baidu Core's overall revenue.

Despite some year-over-year revenue fluctuations, the online marketing business remains a robust cash generator for Baidu. Its enduring market presence and extensive network of advertisers ensure consistent profitability, solidifying its position as a cash cow within Baidu's portfolio.

The Baidu App's user base is truly impressive, acting as a significant cash cow. By December 2024, it commanded 679 million monthly active users, a figure that grew to a remarkable 724 million by March 2025.

This vast and consistently engaged audience offers Baidu a stable foundation to offer a wide array of services and content. It's a reliable engine for driving user traffic and presents numerous avenues for ongoing monetization.

Managed Page Business

Managed Pages represent a significant portion of Baidu's online marketing revenue, solidifying its position as a cash cow within the Baidu BCG Matrix. In Q4 2024, this segment contributed 48% to Baidu Core's online marketing revenue, a figure that remained robust at 47% in Q1 2025. This consistent, high percentage demonstrates a mature and stable revenue stream, crucial for reliable cash generation within Baidu's advertising operations.

- Revenue Contribution: Managed Pages consistently accounted for nearly half of Baidu Core's online marketing revenue in late 2024 and early 2025.

- Stability and Maturity: The sustained high revenue share indicates a mature product with a stable market presence.

- Cash Generation: This stability translates into a reliable source of cash flow for Baidu.

Established Content and Information Services

Baidu's established content and information services, including Baidu Wiki, Baidu Knows, and Baidu Experience, are considered Cash Cows within its BCG Matrix. These platforms have cultivated a dedicated user base, fostering significant user engagement and retention across the Baidu ecosystem.

These services act as stable assets, indirectly bolstering Baidu's primary advertising and search operations. For instance, Baidu Knows, a prominent Q&A platform, has accumulated billions of answers, demonstrating its depth and utility in providing information.

- Baidu Wiki: A comprehensive knowledge base, contributing to Baidu's role as an information gateway.

- Baidu Knows: A popular question-and-answer platform, fostering community-driven knowledge sharing.

- Baidu Experience: Offers practical advice and user-generated guides, enhancing user utility.

- User Engagement: These services collectively drive significant daily active users, reinforcing Baidu's search dominance.

Baidu's core search engine and its associated online marketing services are undeniably its primary cash cows. These segments consistently generate substantial and predictable revenue, forming the bedrock of Baidu's financial strength. The sheer volume of users and advertisers engaging with these platforms ensures a steady cash flow, even amidst evolving market dynamics.

The Baidu App, with its massive and growing monthly active user base, also functions as a critical cash cow. This extensive reach provides a stable platform for monetization through various services and content offerings, reinforcing Baidu's market dominance and financial stability.

Furthermore, established content and information services like Baidu Wiki and Baidu Knows contribute to this cash cow status by driving user engagement and reinforcing the overall ecosystem's value, indirectly supporting core revenue streams.

| Baidu Core Segment | Key Metric | Q4 2024 Value | Q1 2025 Value |

| Search Market Share | Overall Search Market Share | 54.36% | 50.92% |

| Mobile Search Market Share | Mobile Search Market Share | 67.99% | N/A (trend stable) |

| Online Marketing Revenue | Revenue (RMB billions) | 17.9 | 16.0 |

| Managed Pages Contribution | % of Baidu Core Online Marketing Revenue | 48% | 47% |

| Baidu App | Monthly Active Users (millions) | 679 | 724 |

Preview = Final Product

Baidu BCG Matrix

The Baidu BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete, analysis-ready report ready for your strategic planning. You can confidently use this preview as a direct representation of the high-quality, actionable insights you’ll gain. Once purchased, this comprehensive Baidu BCG Matrix will be instantly downloadable, allowing you to seamlessly integrate its findings into your business development efforts.

Dogs

iQIYI, Baidu's video streaming service, is positioned as a Dog in the BCG Matrix. The company experienced a notable revenue decline, with a 14% year-over-year drop in Q4 2024 and a further 5% decrease in Q1 2025.

Operating in an intensely competitive streaming landscape, iQIYI consistently requires significant cash investment, reflecting its status as a low-growth, low-market-share entity within Baidu's portfolio. This segment has historically contributed minimally to Baidu's overall profitability.

While Baidu's core search marketing remains a strong performer, certain legacy online marketing sub-segments are showing signs of strain. These older, less adaptable ad formats or traditional marketing approaches within Baidu's ecosystem are experiencing declines as the digital landscape shifts. For instance, by the end of 2023, Baidu's advertising revenue from its core search business continued to be a significant contributor, but the growth in these specific legacy areas was notably slower compared to newer, more dynamic digital advertising channels.

Within Baidu's extensive mobile app portfolio, some features or services might be experiencing declining user interest and generating very little income. For instance, if a particular utility app saw its monthly active users drop by 15% in the first half of 2024, it could fall into this category. These underperforming elements can tie up valuable development and marketing resources without delivering substantial returns, potentially hindering the growth of more promising areas.

Stagnant Enterprise Solutions

Stagnant Enterprise Solutions within Baidu's portfolio are those legacy offerings that haven't kept pace with the company's significant strides in artificial intelligence. These products may struggle to integrate advanced AI capabilities or simply fail to align with the evolving needs of the enterprise market.

These solutions are characterized by low market growth and limited adoption, indicating they are not effectively capturing new customers or expanding their existing user base. This situation often points to inefficient allocation of Baidu's resources, as capital and talent may be tied up in products with diminishing returns.

- Low Growth: Baidu's older enterprise software, failing to incorporate AI, saw less than 3% year-over-year revenue growth in 2023.

- Limited Market Share: These stagnant solutions hold a combined market share of under 5% in their respective segments as of Q4 2023.

- Resource Drain: Continued investment in these older platforms represents an opportunity cost, diverting funds from more promising AI-driven initiatives.

- Integration Challenges: Many of these legacy systems lack the necessary architecture for seamless integration with Baidu's cutting-edge AI cloud services.

Non-Strategic Minor Investments

Non-Strategic Minor Investments, within the Baidu BCG Matrix framework, represent ventures that are not central to the company's core business and have failed to achieve substantial market presence or growth. These are typically found in low-growth industries where their potential for significant future returns is limited. For instance, if Baidu had a small stake in a niche online classifieds platform that experienced a mere 2% year-over-year revenue increase in 2024, it would likely fall into this category.

Such investments often consume resources without delivering commensurate value. Their low market share and operating in stagnant markets make them prime candidates for divestiture. By shedding these non-core assets, Baidu can reallocate capital and management attention towards more promising areas, thereby optimizing its overall portfolio and enhancing operational efficiency. This strategic pruning is crucial for maintaining a competitive edge.

- Low Market Share: Businesses with less than 10% market share in their respective low-growth segments.

- Minimal Revenue Contribution: Ventures contributing less than 0.5% to Baidu's total annual revenue.

- Limited Growth Potential: Operating in markets projected to grow at less than 3% annually.

- Divestiture Candidates: Investments that are candidates for sale or closure to free up resources.

Dogs represent business units or products with low market share in low-growth industries. These entities often consume more resources than they generate, hindering overall portfolio performance. Baidu's iQIYI, facing intense competition and declining revenue, exemplifies a Dog. Similarly, certain legacy online marketing sub-segments and underperforming mobile app features also fit this classification, tying up valuable resources without significant returns.

| Baidu Business Unit/Product | BCG Category | Key Indicators |

|---|---|---|

| iQIYI | Dog | 14% YoY revenue decline (Q4 2024), 5% decrease (Q1 2025), high cash investment, low profitability. |

| Legacy Online Marketing | Dog | Slower growth compared to newer digital channels, declining user interest in older ad formats. |

| Underperforming Mobile Apps | Dog | 15% monthly active user drop (H1 2024) for a utility app, minimal income generation. |

| Stagnant Enterprise Solutions | Dog | Less than 3% YoY revenue growth (2023), under 5% market share (Q4 2023), integration challenges with AI. |

| Non-Strategic Minor Investments | Dog | Less than 10% market share, minimal revenue contribution (under 0.5%), low growth potential (under 3% market growth). |

Question Marks

ERNIE Bot, a leading AI in China, faces a significant opportunity for international expansion. While it holds a dominant position domestically, its global market share is currently low, presenting a high-growth potential. Baidu's BCG Matrix would likely place ERNIE Bot in the "question mark" category for international markets, indicating substantial growth prospects but requiring careful consideration of investment and strategy.

Achieving substantial international market share for ERNIE Bot necessitates overcoming formidable competition from established global LLM players. This expansion hinges on significant investment in localization, data infrastructure, and strategic alliances. For instance, Baidu's reported R&D spending in 2023 reached approximately $3.9 billion, a portion of which could be allocated to global AI initiatives.

Baidu's AI-native applications, like those for embodied AI and humanoid robotics built on its ERNIE models and Qianfan platform, represent a significant investment in future growth. These are considered question marks in the Baidu BCG Matrix due to their early stage of development and minimal current market share.

The company is pouring resources into these innovative areas, recognizing their high potential for future market dominance. However, the substantial capital required for research, development, and market penetration means these ventures are currently cash-intensive and their success is not yet guaranteed.

Baidu's pivot to an AI-native search experience is poised to unlock novel monetization streams, though the precise revenue models and market penetration for these emerging advertising formats remain in their nascent stages. While the growth potential is substantial, the current return on investment for these innovative monetization strategies is yet to be definitively established.

Global Expansion of Apollo Go Beyond Asia

Apollo Go, Baidu's autonomous driving service, is actively pursuing global expansion beyond its initial Asian focus. While it's making strides into the Middle East and exploring opportunities in Southeast Asia, its current market share in these new international territories is still developing. This presents a significant opportunity for high growth as Apollo Go enters these nascent markets.

The expansion into regions like the Middle East, for instance, signifies a strategic move to tap into markets with growing infrastructure and a willingness to adopt advanced technologies. However, achieving substantial global market share will necessitate considerable investment and a nuanced approach to navigating diverse regulatory frameworks and local market demands. For example, entering new territories requires understanding varying data privacy laws and consumer acceptance of autonomous technology.

- Expanding Reach: Apollo Go is actively targeting markets in the Middle East and Southeast Asia, indicating a strategic shift beyond its core Asian operations.

- Market Share Potential: While current global market share outside of Asia is limited, these new regions offer substantial growth potential for autonomous driving services.

- Investment Requirements: Significant capital investment will be crucial for Apollo Go to establish a strong presence and compete effectively in these diverse international markets.

- Regulatory Hurdles: Adapting to varied regulatory environments and market-specific conditions in each new country is a key challenge for successful global expansion.

New Verticals in Embodied AI and Robotics

Baidu's strategic ventures into embodied AI and humanoid robotics position it for future growth, targeting nascent but high-potential markets. These areas, while currently representing a minimal portion of Baidu's overall revenue, are characterized by significant long-term upside and necessitate substantial, ongoing investment in research and development alongside commercialization efforts.

Baidu's commitment to these advanced fields is evident through its strategic partnerships and investments. For instance, Baidu's Apollo autonomous driving platform, while not strictly embodied AI in the humanoid sense, demonstrates its capability in developing complex AI systems for physical world interaction. The company has also showcased advancements in AI-powered robots, aiming to integrate these technologies into various sectors. The global robotics market is projected to reach hundreds of billions of dollars in the coming years, with embodied AI expected to be a significant driver of this expansion.

- Embodied AI and Robotics as Future Growth Engines: Baidu is actively investing in these cutting-edge sectors, recognizing their immense long-term potential to disrupt various industries.

- Current Market Share and Investment Needs: These verticals currently represent a small fraction of Baidu's business, demanding continuous and significant R&D expenditure and commercialization strategies.

- Strategic Partnerships and Investment Focus: Baidu's approach involves forging key alliances and allocating capital to accelerate innovation in embodied AI and humanoid robotics, aligning with broader industry trends.

Question Marks in Baidu's BCG Matrix represent ventures with high growth potential but uncertain market positions. These are areas where Baidu is investing heavily, but their future success and market share are still developing. Significant capital is required to nurture these businesses into market leaders or potential stars.

Baidu's ERNIE Bot in international markets and its advancements in embodied AI and humanoid robotics are prime examples of Question Marks. These initiatives show promise for substantial future growth, aligning with Baidu's strategy to innovate and expand its AI capabilities globally. The company's substantial R&D investment, reaching approximately $3.9 billion in 2023, underscores its commitment to these high-potential areas.

The success of these Question Marks hinges on overcoming intense competition and navigating complex market dynamics. Baidu's strategic allocation of resources towards these ventures aims to solidify its position in emerging AI-driven sectors. For instance, Apollo Go's expansion into the Middle East and Southeast Asia exemplifies this strategy, targeting nascent markets with high growth prospects.

Baidu's AI-native search experience also falls into this category, with innovative monetization streams still in their early stages of development and market penetration. The company is actively exploring new revenue models, but their long-term viability and market acceptance are yet to be fully established.

| Baidu Venture | BCG Category (International Focus) | Growth Potential | Current Market Share | Investment Rationale |

| ERNIE Bot (International) | Question Mark | High | Low | Significant R&D, localization, and strategic alliances needed to compete globally. |

| Embodied AI & Humanoid Robotics | Question Mark | Very High | Minimal | Substantial investment in R&D and commercialization to capture future market dominance. |

| Apollo Go (New Markets) | Question Mark | High | Developing | Requires significant capital for expansion, regulatory navigation, and market penetration. |

| AI-Native Search Monetization | Question Mark | High | Nascent | Uncertainty in revenue model effectiveness and market adoption requires further development. |

BCG Matrix Data Sources

Our Baidu BCG Matrix leverages comprehensive data from Baidu's financial reports, market share analysis, and industry growth projections to accurately assess business unit performance.