Industrias Bachoco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Industrias Bachoco Bundle

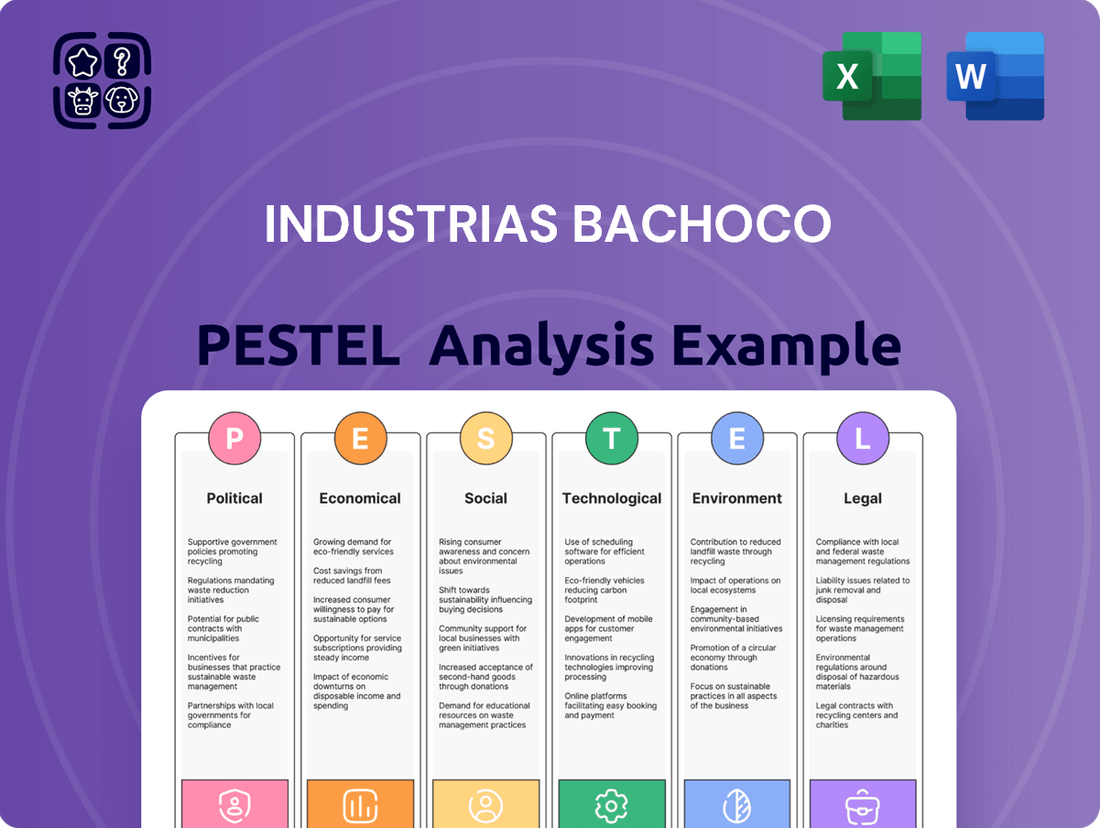

Navigate the complex external forces shaping Industrias Bachoco's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are impacting the poultry giant. Gain a critical edge in your market strategy by leveraging these in-depth insights.

Unlock actionable intelligence for your business decisions. Our PESTLE analysis of Industrias Bachoco provides a deep dive into the external factors that matter most, from evolving consumer preferences to emerging trade policies. Download the full version now to equip yourself with the knowledge needed to anticipate challenges and seize opportunities.

Political factors

Government policies significantly shape Industrias Bachoco's operational landscape. Changes in agricultural subsidies, particularly for feed grains like corn and soy, directly influence Bachoco's primary input costs. For instance, in 2024, fluctuations in global grain prices, often influenced by national agricultural support programs, can lead to considerable shifts in Bachoco's cost of goods sold and, consequently, its ability to maintain competitive pricing in the poultry market.

Furthermore, evolving trade agreements and tariffs present both opportunities and challenges. Shifts in import/export regulations for poultry products or key feed ingredients can impact Bachoco's international market access and the cost-effectiveness of its supply chain. For example, any new tariffs on imported corn in 2025 could necessitate adjustments in sourcing strategies, potentially increasing operational expenses if domestic supply cannot fully compensate.

Industrias Bachoco operates under a complex web of food safety and health regulations that significantly shape its operations. Evolving standards, both domestically in Mexico and internationally for export markets, necessitate continuous investment in production processes and product development to ensure compliance. For instance, stricter residue limits for veterinary drugs or enhanced traceability requirements can directly impact manufacturing costs and supply chain management.

The financial implications of these regulations are substantial. In 2023, the global food industry saw increased spending on compliance, with companies allocating significant portions of their budgets to meet new safety protocols and certifications. Bachoco, like its peers, must navigate these costs, which can include upgrades to facilities, advanced testing equipment, and specialized training for personnel. Failure to adapt can lead to market access restrictions or costly product recalls.

Furthermore, the specter of disease outbreaks, such as avian influenza, presents a constant regulatory challenge. Governments often implement swift and stringent measures, including quarantines and trade restrictions, which can disrupt Bachoco's supply chain and impact its ability to bring products to market. The economic impact of such events, as seen in past outbreaks affecting poultry producers globally, underscores the critical need for robust biosecurity measures and proactive regulatory engagement.

Mexico's trade relations, especially with the United States under the USMCA, are crucial for Industrias Bachoco. Any shifts towards protectionism or trade disputes could impact Bachoco's ability to export its products, particularly poultry and eggs, to its significant North American market. In 2024, the US remains Mexico's largest trading partner, underscoring the importance of stable trade policies.

Political Stability and Security

Political stability in Mexico is a critical factor for Industrias Bachoco, directly influencing its operational continuity and investment attractiveness. Instability, including issues like corruption and organized crime, can disrupt supply chains and deter foreign investment, impacting the company's ability to secure resources and distribute products efficiently.

For instance, reports from 2023 indicated persistent challenges with organized crime affecting various sectors in Mexico, potentially increasing security costs for businesses like Bachoco. Social unrest, though not always widespread, can also lead to temporary disruptions in transportation and labor availability, affecting production schedules.

- Impact on Supply Chains: Political instability can lead to unpredictable disruptions in logistics and transportation networks, increasing costs and delivery times for Industrias Bachoco.

- Investment Climate: A stable political environment is crucial for attracting and retaining foreign direct investment, which is vital for expansion and technological upgrades within the poultry and egg industry.

- Operational Risks: Factors such as corruption can increase the cost of doing business through illicit payments or bureaucratic hurdles, while social unrest can directly halt operations.

Labor Policies and Union Influence

Government labor policies in Mexico, including minimum wage adjustments and regulations on worker benefits, directly influence Industrias Bachoco's operational costs. For instance, the national minimum wage saw an increase for 2024, impacting payroll expenses. The strength and activity of labor unions within the poultry sector can also lead to negotiations affecting wages, working conditions, and the potential for labor disputes, which could disrupt production.

New legislation concerning workers' rights or mandatory benefits, should it be enacted, would require Bachoco to adapt its human resources strategies and potentially increase its labor expenditure. For example, any proposed changes to overtime pay structures or social security contributions would need careful financial modeling. The company's ability to manage these labor-related factors is crucial for maintaining competitive operational costs and ensuring a stable workforce.

- Minimum Wage Impact: Mexico's minimum wage for 2024 was set at MXN 248.93 per day in most of the country, a figure that directly affects Bachoco's lowest-paid employees.

- Union Negotiations: The presence and influence of unions in the agricultural and food processing sectors can lead to collective bargaining agreements that stipulate wage increases or improved benefits beyond the statutory minimum.

- Worker Rights Legislation: Potential government initiatives to enhance worker protections, such as stricter regulations on temporary contracts or mandated profit-sharing schemes, could add to Bachoco's labor overhead.

- Labor Dispute Risk: The historical propensity for labor actions in Mexico's industrial sectors underscores the need for proactive employee relations management by companies like Bachoco to mitigate risks of strikes or work stoppages.

Government policies directly impact Industrias Bachoco's cost structure and market access. For instance, agricultural subsidies for feed grains in 2024 and potential tariffs on corn imports in 2025 could significantly alter input expenses. Trade agreements, like the USMCA, are vital for Bachoco's exports, with Mexico's trade relations remaining a key focus in 2024.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Industrias Bachoco across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and detailed sub-points with specific examples to aid in strategic planning and identify market opportunities and threats.

This PESTLE analysis for Industrias Bachoco acts as a pain point reliver by providing a clear, summarized version of external factors, enabling swift identification of opportunities and threats during strategic planning.

Economic factors

Inflation, particularly in crucial inputs like animal feed and energy, directly impacts Industrias Bachoco's profitability and necessitates adjustments to its pricing strategies. For instance, the average price of corn, a primary feed component, saw significant volatility in late 2023 and early 2024, influencing production costs.

Fluctuations in interest rates also play a critical role, affecting Bachoco's borrowing costs for essential capital expenditures and ongoing operations. As of mid-2024, benchmark interest rates in Mexico, like the one set by Banxico, have remained elevated, increasing the expense of financing expansion projects or managing working capital.

Consumer purchasing power in Mexico is a critical driver for Industrias Bachoco. Factors like employment rates and disposable income directly shape demand for their poultry and other food products. For instance, a strong job market and rising wages in 2024 would likely translate to increased consumer spending on protein, benefiting Bachoco.

Economic downturns, however, can significantly impact spending habits. During periods of reduced household income or job insecurity, consumers often shift towards more affordable protein sources, potentially impacting Bachoco's sales volume for premium products.

Exchange rate fluctuations significantly impact Industrias Bachoco. The Mexican Peso's value against the US Dollar directly affects the cost of imported feed ingredients, a major expense for the company. For instance, a weaker Peso in 2024 would increase Bachoco's input costs, potentially squeezing profit margins.

Conversely, currency volatility influences Bachoco's international sales revenue. A stronger Peso can make its products more expensive for foreign buyers, potentially dampening export demand. In 2023, the average exchange rate hovered around 17.5 MXN/USD, a level that Bachoco likely monitored closely for its export competitiveness.

Commodity Prices (Feed Inputs)

Industrias Bachoco's profitability is significantly influenced by the fluctuating global prices of essential feed inputs like corn, soy, and sorghum. These commodity markets are inherently volatile, directly impacting Bachoco's cost of goods sold. For instance, in late 2024 and early 2025, global corn prices saw upward pressure due to weather patterns in major producing regions, while soybean futures experienced fluctuations based on South American harvest expectations.

Bachoco actively employs strategies to mitigate these price risks. These often include forward contracts and hedging instruments to lock in prices for a portion of their feed ingredient needs, providing a degree of cost stability. The company's ability to manage these volatile input costs is crucial for maintaining competitive pricing and healthy profit margins in the highly competitive poultry and pork sectors.

- Feed Input Cost Volatility: Global corn prices averaged around $4.50-$5.00 per bushel in late 2024, while soybean prices ranged from $11.00-$12.50 per bushel, impacting Bachoco's raw material expenses.

- Hedging Strategies: Bachoco utilizes financial derivatives, such as futures and options contracts, to secure a percentage of its anticipated feed ingredient purchases at predetermined prices, aiming to reduce exposure to market swings.

- Impact on Margins: A sharp increase in feed costs, if not fully offset by hedging or price adjustments, can compress Bachoco's operating margins, as seen in periods of unexpected supply chain disruptions.

Economic Growth and Market Expansion

Mexico's economic growth is a key driver for Industrias Bachoco. In 2024, the Mexican economy was projected to grow around 2.4%, with similar forecasts for 2025, creating a more robust consumer base for food products. This expansion directly translates into opportunities for Bachoco to increase sales volume and potentially enter new market segments within Mexico and its export markets.

Economic diversification also plays a role. As Mexico's economy broadens beyond traditional sectors, the food industry benefits from increased disposable income and evolving consumer preferences. This trend supports market expansion for companies like Bachoco.

- Projected GDP Growth (Mexico 2024-2025: ~2.4% annually This indicates a stable environment for consumer spending on essential goods like poultry and other protein sources.

- Increased Disposable Income: Economic growth generally leads to higher household incomes, enabling consumers to purchase more and potentially higher-value food products.

- Market Penetration: Opportunities exist for Bachoco to deepen its penetration in existing markets and explore expansion into regions experiencing significant economic uplift.

The economic landscape for Industrias Bachoco in 2024-2025 is shaped by a mix of growth prospects and persistent cost pressures. While Mexico's projected GDP growth of around 2.4% annually offers a supportive environment for consumer spending, the company must navigate the impact of inflation on key inputs and fluctuating interest rates.

| Economic Factor | 2024-2025 Outlook | Impact on Bachoco | Key Data/Considerations |

| GDP Growth (Mexico) | Projected ~2.4% annually | Supports increased consumer demand for protein products. | Stable economic expansion fosters a favorable market for food producers. |

| Inflation (Feed & Energy) | Persistent pressure on inputs | Increases production costs, potentially squeezing margins. | Corn prices volatile; energy costs remain a concern. |

| Interest Rates (Mexico) | Elevated levels (Banxico benchmark) | Increases borrowing costs for capital expenditures and operations. | Higher financing expenses impact profitability and investment capacity. |

| Consumer Purchasing Power | Influenced by employment and disposable income | Directly impacts sales volume and demand for Bachoco's products. | Strong job market and rising wages are beneficial. |

| Exchange Rates (MXN/USD) | Fluctuating, with potential for Peso weakness | Affects cost of imported feed and competitiveness of exports. | Weaker Peso increases input costs; stronger Peso can hurt export revenue. |

Same Document Delivered

Industrias Bachoco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Industrias Bachoco delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers an in-depth examination of how these external forces shape Industrias Bachoco's competitive landscape and future growth opportunities, providing valuable insights for stakeholders.

Sociological factors

Consumer demand for healthier options continues to shape the food industry. In 2024, a significant portion of consumers, particularly in developed markets, are actively seeking products with lower fat, sodium, and sugar content. This trend directly impacts poultry producers like Bachoco, as consumers increasingly favor white meat as a leaner protein source compared to red meat.

The growing emphasis on health consciousness is also driving the market for organic and sustainably sourced foods. By 2025, it's projected that the global organic food market will reach over $300 billion. Bachoco's ability to adapt its product lines to meet these evolving preferences, perhaps through increased offerings of organic chicken or improved animal welfare practices, will be crucial for maintaining market share and driving innovation.

Mexico's population is projected to reach approximately 131 million by the end of 2024, a continued upward trend that directly fuels demand for food products like those supplied by Industrias Bachoco. This demographic expansion, coupled with a steady migration towards urban centers, means more mouths to feed in concentrated areas, placing a premium on efficient distribution networks and product availability. Urbanization also tends to shift consumption patterns, often favoring convenience and processed foods, areas where Bachoco has a significant presence.

Chicken holds a central place in Mexican culinary traditions, featuring prominently in everyday meals and special occasions, which directly translates to a consistent and robust demand for poultry products. This cultural integration ensures a stable market for companies like Bachoco.

The deep-rooted preference for chicken across diverse regions of Mexico, from the hearty stews of the north to the vibrant moles of the south, underpins its status as a staple protein. This widespread acceptance means Bachoco benefits from a broad consumer base, with consumption per capita in Mexico reaching approximately 23.3 kilograms in 2023, according to industry estimates.

Labor Availability and Workforce Demographics

Industrias Bachoco's operations are significantly influenced by the availability of both skilled and unskilled labor in its key agricultural and processing regions. In Mexico, where Bachoco is a major player, the agricultural sector often faces challenges in attracting and retaining a consistent workforce, particularly with ongoing rural-to-urban migration trends. This demographic shift can lead to increased labor costs and potential disruptions to operational efficiency if not managed proactively.

The company's reliance on a stable workforce is critical for maintaining production quality and output. As of 2024, Mexico's workforce participation rate for those aged 15 and over was around 60%, with a significant portion employed in agriculture and manufacturing. An aging workforce in certain rural areas, coupled with younger generations seeking opportunities elsewhere, presents a challenge for industries like poultry farming that require a steady supply of manual labor.

- Labor Availability: Bachoco's operational efficiency is directly tied to securing sufficient skilled and unskilled labor for its farms and processing facilities across Mexico.

- Demographic Shifts: Rural-to-urban migration in Mexico potentially reduces the available labor pool in agricultural areas, impacting labor costs and availability.

- Workforce Stability: Retaining a consistent and experienced workforce is crucial for maintaining production standards and operational continuity.

- Aging Workforce: An aging demographic in some rural operating regions could exacerbate labor shortages and increase the need for training and recruitment initiatives.

Consumer Awareness and Ethical Concerns

Consumer awareness regarding animal welfare and sustainable sourcing is a significant sociological factor impacting Industrias Bachoco. Growing demand for ethically produced food means companies like Bachoco must increasingly demonstrate responsible practices to maintain brand reputation. This trend is amplified by social media, where consumer concerns can quickly gain traction, influencing purchasing decisions and corporate social responsibility (CSR) initiatives. For instance, in 2024, surveys indicated that over 60% of consumers in key markets considered ethical sourcing a crucial factor when buying poultry products.

The influence of social media on consumer perception cannot be overstated. Negative publicity regarding animal welfare or environmental impact can spread rapidly, damaging brand image. Bachoco's proactive engagement in CSR, such as investments in improved animal housing and waste reduction programs, is vital to address these evolving consumer expectations. By 2025, it is projected that 75% of consumers will actively seek information about a company's ethical standing before making a purchase.

Key considerations for Bachoco include:

- Enhanced Transparency: Consumers expect clear communication about sourcing and production methods.

- Animal Welfare Standards: Adherence to and promotion of higher animal welfare practices are becoming a competitive differentiator.

- Sustainability Initiatives: Demonstrating commitment to environmental stewardship resonates with a growing segment of the market.

- Social Media Engagement: Actively managing online reputation and responding to consumer feedback is crucial for brand health.

Consumer preferences are increasingly leaning towards healthier and ethically sourced food options. By 2025, the global organic food market is anticipated to exceed $300 billion, reflecting a significant shift. Bachoco must align its product offerings with these evolving demands, potentially by expanding its organic chicken lines or showcasing enhanced animal welfare practices to maintain its market position and foster innovation.

Technological factors

Industrias Bachoco is increasingly integrating advanced automation in its processing and packaging operations. For instance, by 2024, the company has invested significantly in robotic systems for tasks like deboning and packaging, aiming to boost efficiency by an estimated 15%.

This technological shift is designed to lower labor expenses, which represented approximately 18% of Bachoco's operating costs in 2023. Enhanced product consistency and stricter adherence to food safety protocols are also key benefits, contributing to a more reliable supply chain.

The capital expenditure for these automation upgrades is substantial, but Bachoco anticipates a return on investment through increased throughput, potentially raising processing capacity by 10% in key facilities by the end of 2025.

Industrias Bachoco benefits significantly from advancements in genetics and breeding, which are crucial for enhancing poultry health and growth rates. These techniques directly improve feed conversion ratios, meaning less feed is needed for more meat, boosting cost efficiency. For instance, by 2024, the poultry industry globally has seen continued improvements in genetic lines leading to faster growth cycles, potentially reducing production times by several days compared to a decade ago.

Industrias Bachoco is increasingly leveraging digital technologies to streamline its operations. The company is implementing solutions like the Internet of Things (IoT) for real-time monitoring of its vertically integrated supply chain, from feed production to final distribution. This focus on digitalization aims to boost traceability, minimize waste, and significantly enhance logistics efficiency across its extensive network.

Biotechnology in Animal Nutrition and Health

Biotechnology is revolutionizing animal nutrition and health, offering advanced feed formulations, probiotics, and vaccines. These innovations aim to boost animal well-being, decrease reliance on antibiotics, and improve the nutritional quality of poultry. For instance, the global animal feed additives market, which includes many biotechnological products, was valued at approximately $25.4 billion in 2023 and is projected to grow significantly. This growth is driven by increasing demand for animal protein and a greater focus on animal welfare and sustainable farming practices.

The integration of biotechnology in animal feed can lead to more efficient nutrient utilization and disease prevention, ultimately impacting the profitability and sustainability of companies like Industrias Bachoco. For example, the development of novel enzymes and prebiotics can enhance gut health in poultry, leading to better feed conversion ratios and reduced mortality rates. The market for probiotics in animal feed alone is expected to reach over $7.5 billion by 2028, highlighting the substantial impact of these biotechnological advancements.

Key technological factors include:

- Development of novel feed additives: Innovations in enzymes, amino acids, and vitamins through biotechnology enhance nutrient absorption and overall animal performance.

- Probiotic and prebiotic applications: These live microorganisms and non-digestible fibers improve gut microflora balance, boosting immunity and reducing the need for antibiotics.

- Advancements in vaccine technology: Biotechnology enables the creation of more effective and targeted vaccines against poultry diseases, improving flock health and reducing economic losses.

- Regulatory considerations: Navigating the approval processes for new biotechnological products in animal feed and health is crucial for market entry and adoption.

Data Analytics and Predictive Modeling

Industrias Bachoco is increasingly leveraging data analytics and predictive modeling to sharpen its operational efficiency. By analyzing vast datasets from its farms, the company can optimize feeding schedules, monitor animal health proactively, and improve resource allocation, leading to better yield. For instance, in 2024, the company continued to invest in systems that allow for real-time performance tracking across its poultry and swine operations.

These data-driven insights are crucial for forecasting demand more accurately, which in turn helps manage inventory levels and reduce waste. This predictive capability allows Bachoco to align production more closely with market needs, minimizing overstocking and ensuring product availability. This strategic use of analytics directly contributes to cost savings and enhanced profitability.

The benefits of data analytics extend to more informed business decisions across the board. From supply chain management to marketing strategies, Bachoco utilizes predictive models to anticipate market trends and consumer preferences. This analytical approach supports agility in responding to market shifts, a key advantage in the competitive agribusiness sector.

Key applications of data analytics at Bachoco include:

- Optimized Farm Management: Real-time data analysis for feed conversion ratios, growth rates, and health monitoring.

- Demand Forecasting: Utilizing historical sales data and market indicators to predict consumer demand for poultry and pork products.

- Inventory Control: Predictive models to manage raw material and finished goods inventory, reducing holding costs and spoilage.

- Operational Efficiency: Identifying bottlenecks and areas for improvement in processing, logistics, and distribution through data analysis.

Technological advancements are pivotal for Industrias Bachoco's efficiency and product quality. The company's investment in automation, particularly robotic systems for deboning and packaging, aims to boost efficiency by an estimated 15% by 2024, directly addressing labor costs which were around 18% of operating expenses in 2023. Furthermore, breakthroughs in genetics and breeding continue to enhance poultry health and growth rates, improving feed conversion ratios and potentially reducing production cycles by several days compared to previous years.

Digitalization, including the use of IoT for supply chain monitoring, is a key focus for Bachoco, enhancing traceability and logistics. Biotechnology is also transforming animal nutrition and health, with the global animal feed additives market valued at approximately $25.4 billion in 2023, supporting improved animal well-being and reduced antibiotic reliance. Data analytics and predictive modeling are further optimizing farm management and demand forecasting, contributing to cost savings and better resource allocation.

| Technology Area | Impact on Bachoco | Key Data/Trends (2023-2025) |

|---|---|---|

| Automation & Robotics | Increased processing efficiency (est. 15% by 2024), reduced labor costs (18% of op. costs in 2023), improved product consistency. | Investment in robotic systems for deboning and packaging. Potential 10% increase in processing capacity by end of 2025. |

| Genetics & Breeding | Enhanced poultry health, faster growth rates, improved feed conversion ratios. | Global industry trend towards faster growth cycles, reducing production times. |

| Digitalization (IoT) | Streamlined supply chain monitoring, improved traceability, reduced waste, enhanced logistics. | Real-time monitoring across vertically integrated operations. |

| Biotechnology | Advanced feed formulations, improved animal health, reduced antibiotic use, better nutritional quality. | Global animal feed additives market ~$25.4 billion (2023). Probiotics market for animal feed projected to exceed $7.5 billion by 2028. |

| Data Analytics & AI | Optimized farm management, accurate demand forecasting, improved inventory control, enhanced operational efficiency. | Real-time performance tracking in poultry and swine operations (2024). Predictive models for market trends. |

Legal factors

Industrias Bachoco operates under strict food safety and labeling regulations in Mexico and its export markets. Compliance with these laws, covering processing, hygiene, and ingredient transparency, is paramount. For instance, Mexican regulations, such as those from COFEPRIS (Federal Commission for the Protection from Sanitary Risks), mandate rigorous standards for poultry production and handling. Failure to adhere can lead to significant penalties and legal liabilities, particularly concerning product recalls, which can severely damage brand reputation and incur substantial financial costs.

Industrias Bachoco must navigate a complex web of environmental protection laws governing waste management, water usage, air emissions, and land use, all critical to its farming and processing activities. Non-compliance can lead to substantial fines; for instance, in 2023, Mexico's environmental prosecutor PROFEPA reported issuing millions of pesos in sanctions for various environmental violations across industries.

The company faces ongoing costs associated with implementing sustainable practices to meet these legal requirements, impacting operational expenses. For example, investments in advanced wastewater treatment facilities or renewable energy sources are becoming increasingly necessary to align with stricter environmental standards and avoid potential penalties.

Mexican labor laws significantly influence Industrias Bachoco's operational costs and human resources strategies. The minimum wage in Mexico saw an increase, with the general minimum wage rising to MXN 248.93 per day in 2024, impacting payroll expenses. Regulations concerning working conditions, mandatory employee benefits like profit-sharing (PTU), and vacation entitlements directly affect Bachoco's cost structure and employee management practices.

The right to unionization and collective bargaining in Mexico presents another key legal consideration for Bachoco. The company must navigate collective bargaining agreements, which can dictate wage scales, benefits, and work rules, potentially leading to increased labor costs. Failure to comply with these labor regulations or instances of unfair labor practices could result in legal disputes, fines, and reputational damage, as seen in various labor court cases across the Mexican industrial sector.

Antitrust and Competition Laws

Antitrust and competition laws in Mexico, where Industrias Bachoco primarily operates, directly influence its ability to maintain market share and pursue mergers or acquisitions. These regulations aim to prevent monopolistic practices and ensure fair competition within the poultry sector. Bachoco's pricing strategies are also scrutinized to avoid any perception of anti-competitive behavior, which could lead to investigations or penalties.

Recent enforcement actions highlight the importance of compliance. For instance, the Mexican Federal Economic Competition Commission (COFECE) has actively investigated and sanctioned companies for practices that distort competition. While specific Bachoco-related penalties for 2024 or early 2025 are not publicly detailed, the general regulatory environment suggests a continued focus on market fairness.

- Market Share Scrutiny: Regulatory bodies monitor Bachoco's market share to ensure it doesn't dominate unfairly.

- Merger & Acquisition Oversight: Any significant acquisitions by Bachoco are subject to antitrust review to prevent market concentration.

- Pricing Strategy Compliance: Bachoco must ensure its pricing models adhere to competition laws, avoiding predatory or collusive practices.

- Potential Penalties: Non-compliance can result in substantial fines and operational restrictions.

International Trade and Customs Laws

International trade and customs laws significantly impact Industrias Bachoco's operations. Regulations concerning import and export, such as tariffs and quotas, directly affect the cost and accessibility of raw materials and finished goods. For instance, Mexico, Bachoco's primary market, is a signatory to numerous free trade agreements, including the United States-Mexico-Canada Agreement (USMCA), which aims to facilitate trade. However, changes in these agreements or the imposition of new duties could alter Bachoco's competitive landscape.

Sanitary and phytosanitary certifications are also critical, especially for a poultry producer like Bachoco, as they dictate market access for its products. Compliance with international standards ensures that Bachoco's products can be exported to various countries. The company must navigate complex customs procedures and potential trade disputes or sanctions that could disrupt supply chains or market access, as seen with past trade tensions impacting agricultural exports globally.

- Trade Agreements: Mexico's participation in over 12 free trade agreements, including the USMCA, influences Bachoco's import/export costs and market access.

- Customs Duties: Fluctuations in tariffs on feed ingredients like corn and soybean meal can impact Bachoco's production costs.

- Sanitary Certifications: Obtaining and maintaining certifications like HACCP (Hazard Analysis and Critical Control Points) is vital for exporting poultry products to markets like the United States and Japan.

- Trade Disputes: Potential trade disputes or retaliatory tariffs could affect Bachoco's profitability and supply chain stability.

Industrias Bachoco's operations are heavily influenced by Mexican and international legal frameworks. Food safety regulations, environmental protection laws, and labor standards are critical compliance areas, with non-adherence leading to significant financial penalties and reputational damage. For instance, Mexico's minimum wage increased to MXN 248.93 per day in 2024, impacting payroll. Additionally, antitrust laws scrutinize market share and pricing strategies, while international trade agreements like the USMCA shape import/export costs and market access.

| Legal Area | Key Regulations/Considerations | Impact on Bachoco | Example/Data Point (2024/2025) |

|---|---|---|---|

| Food Safety & Labeling | COFEPRIS standards, export market requirements | Compliance costs, risk of recalls, brand reputation | Strict adherence to hygiene and processing standards is mandatory. |

| Environmental Protection | Waste management, water usage, emissions laws | Operational costs for sustainable practices, risk of fines | PROFEPA sanctions for environmental violations can be substantial. |

| Labor Laws | Minimum wage, working conditions, benefits, unionization | Payroll expenses, HR strategy, potential labor disputes | General minimum wage in Mexico: MXN 248.93/day (2024). |

| Antitrust & Competition | COFECE oversight, market share monitoring | Pricing strategy, M&A activities, potential penalties | COFECE actively investigates anti-competitive practices. |

| International Trade | Tariffs, quotas, sanitary certifications, trade agreements | Import/export costs, market access, supply chain stability | USMCA facilitates trade but tariff changes can impact costs. |

Environmental factors

Industrias Bachoco faces significant risks from climate change and extreme weather. Increased droughts or floods can directly impact the availability and cost of feed crops like corn and soy, which are crucial for poultry production. For instance, prolonged droughts in key agricultural regions in 2024 led to a noticeable increase in feed ingredient prices globally.

The intensity and frequency of heatwaves also pose a direct threat to poultry farming by affecting bird health, growth rates, and increasing mortality. This can lead to reduced production yields and higher operational costs due to increased cooling requirements. Bachoco's reliance on stable weather patterns for efficient farming operations makes it vulnerable to these climate-induced disruptions.

Furthermore, long-term climate change projections suggest potential shifts in water availability, impacting irrigation for feed crops and water resources for poultry operations. This could necessitate investments in water management technologies and potentially alter geographical operational strategies for Bachoco to mitigate future risks.

Water scarcity is a significant environmental concern in Mexico, directly impacting Industrias Bachoco's operations. The company's extensive use of water, from growing feed crops to processing poultry, means efficient management is crucial. For instance, in 2023, Mexico faced severe drought conditions in several regions, potentially increasing water costs and limiting availability for agricultural inputs.

Regulatory pressures are also mounting, with stricter water usage policies and potential penalties for non-compliance. Public perception regarding corporate water consumption is increasingly negative, making responsible water stewardship a key factor for Bachoco's reputation and social license to operate. This necessitates investment in water-saving technologies and water recycling initiatives across its facilities.

Disease outbreaks, particularly avian influenza, represent a significant environmental risk for Industrias Bachoco. Such events can necessitate mass culling of poultry, leading to substantial financial losses and disruptions in production. Trade restrictions imposed by governments to contain outbreaks further compound these challenges, impacting both domestic and international sales channels.

Bachoco actively invests in robust biosecurity measures across its operations to mitigate the impact of disease outbreaks. These measures include strict hygiene protocols, controlled access to farms, and regular health monitoring of flocks. The company also maintains contingency plans to address potential outbreaks, aiming to minimize losses and ensure business continuity.

The economic impact of avian influenza on the poultry industry can be severe. For instance, outbreaks in 2022 and early 2023 led to significant losses globally, with some countries reporting millions of birds culled. While specific Bachoco financial data related to disease impact isn't publicly detailed for 2024/2025, the general industry trend indicates ongoing vigilance and preparedness are crucial.

Waste Management and Pollution Control

Industrias Bachoco faces environmental scrutiny regarding waste management, particularly from animal by-products and wastewater generated across its poultry operations. Compliance with increasingly stringent environmental regulations in Mexico and the United States is crucial for maintaining operational licenses and public trust.

The company is investing in technologies to minimize its environmental footprint. For instance, in 2023, Bachoco reported efforts to optimize water usage and explore energy recovery from waste streams, aligning with circular economy principles. Specific data on waste reduction targets and achievements for 2024 and early 2025 will be key indicators of their progress.

- Regulatory Compliance: Bachoco must adhere to Mexican environmental standards (e.g., NOM-141-SEMARNAT-2003 for wastewater discharge) and similar regulations in its operating regions.

- Waste Reduction Initiatives: Efforts focus on processing by-products into valuable materials, such as animal feed or organic fertilizers, thereby reducing landfill dependency.

- Pollution Control Investments: Capital expenditures in 2024 are likely directed towards upgrading wastewater treatment facilities and implementing advanced waste processing technologies.

- Circular Economy Adoption: Exploring partnerships for biogas production from manure or utilizing processing waste for renewable energy sources represents a forward-looking strategy.

Biodiversity Loss and Habitat Protection

Industrias Bachoco faces environmental scrutiny regarding its agricultural footprint and its impact on biodiversity. The company's operations, like much of the poultry industry, can contribute to habitat degradation through land conversion for feed production and waste management. Bachoco's commitment to environmental stewardship involves initiatives aimed at mitigating these effects, focusing on sustainable land use and responsible sourcing of raw materials.

Addressing biodiversity loss is crucial for long-term sustainability in the agricultural sector. Bachoco's approach includes efforts to minimize its environmental impact, though specific details on habitat protection programs are often part of broader corporate sustainability reports. For instance, in 2023, the company continued to assess its supply chain for environmental risks, which implicitly includes biodiversity considerations.

The company's environmental strategy is increasingly aligned with global calls for conservation. While direct financial figures for biodiversity-specific projects are not always granularly reported, Bachoco's overall investment in environmental management systems and compliance with regulations underscores its recognition of these challenges. Their focus on responsible sourcing aims to ensure that the agricultural inputs used do not exacerbate habitat destruction.

Key considerations for Bachoco in this area include:

- Sustainable Land Use: Implementing practices that reduce the pressure on natural habitats from agricultural expansion.

- Responsible Sourcing: Ensuring that feed ingredients, such as soy and corn, are sourced from suppliers who adhere to environmental standards that do not promote deforestation.

- Environmental Stewardship: Proactively managing waste, water usage, and emissions to minimize ecological disruption.

- Regulatory Compliance: Adhering to national and international environmental regulations pertaining to habitat protection and biodiversity.

Environmental factors significantly shape Industrias Bachoco's operational landscape. Climate change, particularly extreme weather events like droughts and heatwaves, directly impacts feed crop yields and poultry health, leading to increased costs. For example, global feed ingredient prices saw a noticeable increase in 2024 due to droughts in key agricultural regions.

Water scarcity is another critical concern, with Mexico facing severe drought conditions in 2023, potentially raising water costs for Bachoco's extensive operations. Stricter water usage regulations and public perception demand responsible water stewardship, pushing for investments in water-saving technologies.

Disease outbreaks, such as avian influenza, pose substantial financial risks through potential mass culling and trade restrictions, as seen in industry-wide impacts in 2022-2023. Bachoco mitigates this through robust biosecurity measures and contingency planning.

Waste management and pollution control are also under environmental scrutiny, with increasing regulatory pressure in Mexico and the US. Bachoco's 2023 efforts included optimizing water usage and exploring energy recovery from waste, aligning with circular economy principles.

| Environmental Factor | Impact on Bachoco | 2024/2025 Relevance/Data |

|---|---|---|

| Climate Change & Extreme Weather | Impacts feed crop availability/cost, poultry health, and mortality. | Global feed ingredient prices increased in 2024 due to droughts. Heatwaves increase cooling costs. |

| Water Scarcity | Affects water availability for feed crops and poultry operations; increases operational costs. | Mexico faced severe drought in 2023, potentially increasing water costs and limiting agricultural inputs. |

| Disease Outbreaks (e.g., Avian Influenza) | Causes significant financial losses via culling, production disruptions, and trade restrictions. | Industry-wide losses reported in 2022-2023; ongoing vigilance and preparedness are crucial. |

| Waste Management & Pollution | Requires compliance with stringent environmental regulations; impacts public trust. | Focus on water optimization and energy recovery from waste streams in 2023. Compliance with NOM-141-SEMARNAT-2003 for wastewater. |

| Biodiversity Loss & Land Use | Potential habitat degradation from land conversion for feed production. | Commitment to sustainable land use and responsible sourcing of feed ingredients to mitigate impact. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Industrias Bachoco is built upon a robust foundation of data from official Mexican government agencies, international financial institutions like the IMF and World Bank, and leading industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are current and credible.