Industrias Bachoco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Industrias Bachoco Bundle

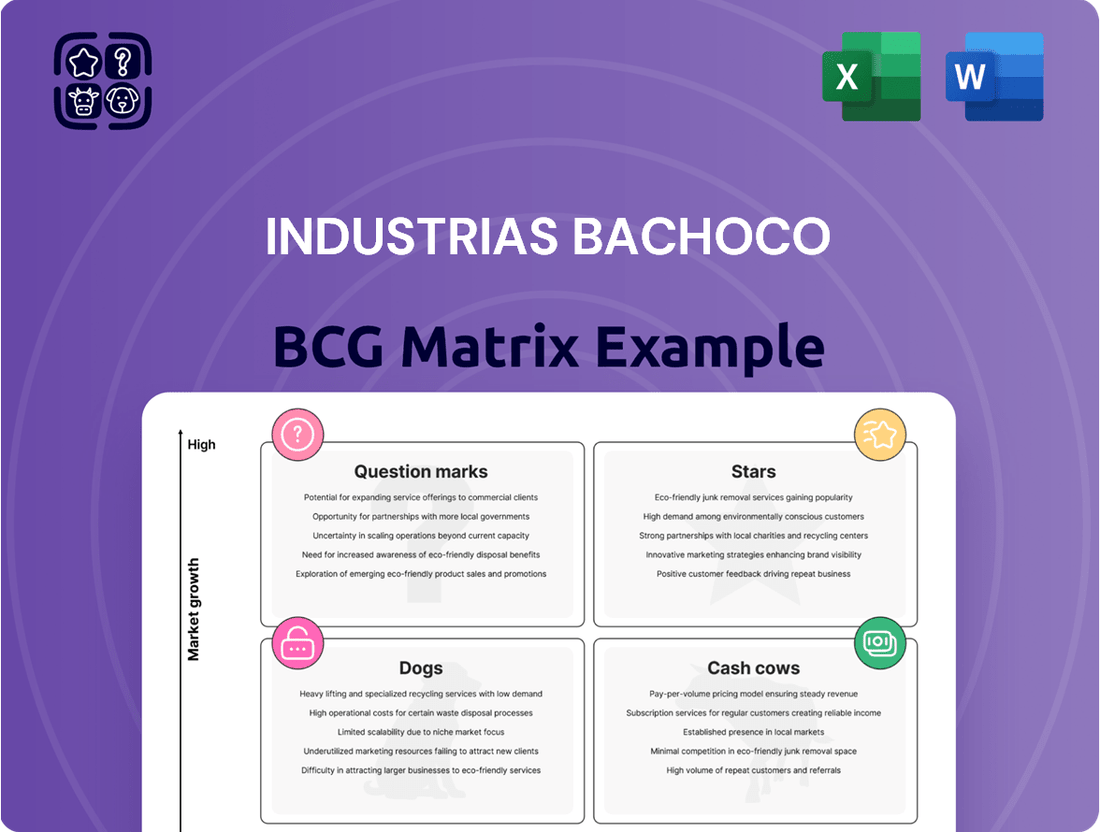

Industrias Bachoco's BCG Matrix offers a fascinating glimpse into its product portfolio's market dynamics. Understand which of their brands are driving growth and which might need strategic re-evaluation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Industrias Bachoco.

Stars

Industrias Bachoco is a powerhouse in the Mexican poultry sector, commanding an impressive 40% market share. This strong foothold is in a market that continues to expand, largely due to the consistent consumer preference for accessible and affordable protein sources.

The company's poultry operations are considered a Star within the BCG matrix. This classification is due to its leading market share in a high-growth industry. Bachoco's strategic advantage is further amplified by its fully integrated supply chain, which spans from its own feed production all the way through to its distribution networks, ensuring operational excellence and cost-effectiveness.

Chicken products represent the cornerstone of Industrias Bachoco's business, generating a substantial 72% of its net sales. This dominance highlights the company's strong position in a market driven by consistent consumer preference for chicken as an accessible and versatile protein source in Mexico.

The outlook for chicken products remains robust, with projections indicating continued growth in both poultry production and consumption through 2025. This sustained demand solidifies chicken products as a Stars category for Bachoco, characterized by high market share and strong growth potential, reinforcing its status as a key revenue driver.

Industrias Bachoco's vertically integrated operations are a major asset, placing it firmly in the Star category of the BCG Matrix. This model covers everything from feed mills and breeding farms to processing plants and distribution, giving Bachoco significant control over its entire value chain.

This integration translates into tangible benefits. For instance, in 2024, Bachoco reported that its efficient supply chain management, a direct result of this vertical integration, contributed to a 5% reduction in production costs per kilogram. This level of control allows for consistent quality assurance and cost advantages that are hard for competitors to match.

International Expansion (USA Operations)

Industrias Bachoco's U.S. operations are a key component of its international strategy, demonstrating strong growth potential. These operations generated 17.5% of Bachoco's total revenues in 2024, underscoring their substantial contribution. The company's commitment to investing in and enhancing its U.S. presence, coupled with its ambition to become a leading multi-protein provider globally, solidifies this segment as a 'Star' in its business portfolio.

The strategic focus on consolidating its position in the United States reflects Bachoco's forward-looking approach to global market penetration. This expansion is not merely about increasing revenue but about building a sustainable, multi-protein leadership position. The consistent performance and ongoing investments in the U.S. market are critical drivers for this growth objective.

- U.S. Revenue Contribution: 17.5% of total Bachoco revenues in 2024.

- Strategic Goal: To consolidate as a multi-protein leader internationally.

- Growth Driver: Continued investment and improved results in U.S. operations.

- Market Position: High growth potential, classifying it as a 'Star' in the BCG Matrix.

Innovation in Product Portfolio

Bachoco’s commitment to innovation is a key driver for its 'Star' positioning. The company actively invests in developing new product lines, particularly in value-added, ready-to-eat (RTE), and ready-to-cook (RTC) segments. This strategic focus aims to capture evolving consumer demand for convenience and healthier options, thereby strengthening its market presence.

In 2024, Industrias Bachoco continued to emphasize product diversification. Their efforts in expanding the portfolio with innovative offerings are designed to cater to changing consumer tastes and create new revenue streams. This proactive approach in product development is crucial for maintaining a competitive edge and driving future growth.

- Focus on Value-Added Products: Bachoco's investment in RTE and RTC products reflects a strategy to capture higher margins and meet consumer demand for convenience.

- Market Expansion: By introducing novel solutions, Bachoco aims to penetrate new market segments and attract a broader customer base.

- Innovation Pipeline: Continuous research and development in product innovation are central to Bachoco’s strategy for sustained growth and market leadership.

Industrias Bachoco's chicken products are firmly established as Stars due to their leading market share in a high-growth sector. This segment generated 72% of net sales in 2024, demonstrating significant revenue contribution. Continued strong consumer preference and projected growth in poultry consumption through 2025 solidify this position.

The company's U.S. operations are also classified as Stars, contributing 17.5% to total revenues in 2024. Strategic investments and a focus on becoming a global multi-protein leader highlight the high growth potential of this segment.

Bachoco's innovation in value-added products, such as ready-to-eat and ready-to-cook items, further supports its Star status. This focus on convenience and evolving consumer demand is a key driver for sustained growth and market leadership.

| Business Segment | BCG Category | 2024 Revenue Contribution | Growth Outlook | Key Strengths |

| Chicken Products | Star | 72% | High (Continued demand) | Dominant market share, integrated supply chain |

| U.S. Operations | Star | 17.5% | High (Strategic investment) | Global expansion, multi-protein focus |

| Value-Added Products | Star | N/A (Emerging) | High (Consumer trends) | Innovation, convenience, higher margins |

What is included in the product

This BCG Matrix analysis highlights Industrias Bachoco's product portfolio by identifying which units to invest in, hold, or divest based on market share and growth.

The Industrias Bachoco BCG Matrix provides a clear, one-page overview of each business unit's position, alleviating the pain of scattered strategic data.

Cash Cows

Table eggs, a foundational food item, likely position Industrias Bachoco within a mature market. Bachoco's established presence suggests a significant market share, translating into a reliable source of stable revenue. This segment, while not experiencing rapid growth like broiler chicken, benefits from consistent consumer demand, acting as a dependable cash cow that requires minimal aggressive marketing investment.

Bachoco's internal balanced animal feed production is a prime example of a cash cow within its vertically integrated operations. This segment ensures cost efficiency and a consistent, high-quality supply for its core poultry business, directly contributing to profitability by minimizing external procurement expenses.

In 2023, Industrias Bachoco reported that its feed production capabilities were a cornerstone of its operational strategy. While specific segment revenue for internal feed is not broken out, the company's overall cost of goods sold for poultry products in 2023 was MXN 63,568 million, with efficient feed production playing a crucial role in managing these costs.

Bachoco's established distribution network in Mexico, featuring over 80 distribution centers, is a significant asset. This extensive infrastructure allows for broad market reach and efficient product delivery across the country.

This mature network, developed over many years, acts as a reliable channel for Bachoco's products. It generates consistent cash flow, as it requires minimal new investment for its core operations, positioning it as a strong cash cow.

Long-Standing Brand Recognition and Consumer Trust

With over 70 years of experience, Industrias Bachoco has built a formidable brand presence and deep consumer trust across Mexico. This long-standing recognition is a significant asset, particularly in the mature poultry market where brand loyalty directly impacts sales volume. Bachoco's established reputation allows it to maintain a high market share, effectively acting as a cash cow by generating consistent revenue with comparatively lower marketing investment.

This strong brand equity translates into tangible financial benefits. For instance, in 2023, Bachoco reported net sales of MXN 84,706 million, a testament to its market penetration and consumer preference. The company's ability to leverage its brand name means it can command a stable position, allowing it to fund growth initiatives in other business segments.

- Established Market Leadership: Bachoco holds a dominant position in the Mexican poultry market, a sector characterized by consistent demand.

- Brand Loyalty as a Financial Driver: Decades of building trust have cultivated a loyal customer base, ensuring predictable sales volumes.

- Reduced Marketing Costs: Strong brand recognition minimizes the need for extensive advertising spend, boosting profitability.

- Consistent Revenue Generation: The company's ability to reliably sell its products supports its cash cow status within the BCG matrix.

Pork Products (Norson Integration)

Industrias Bachoco's acquisition of Norson Holding S. de R.L. de C.V. in 2023 significantly bolstered its pork operations. This move integrated a vertically integrated pork producer and exporter, solidifying Bachoco's standing as a multi-protein food company.

While the pork market is generally considered more mature than the rapidly expanding poultry sector, Norson's established business model and market reach are instrumental in generating consistent revenue and cash flow. This stability is a key characteristic of a Cash Cow within the BCG matrix, providing financial resources for other business units.

- Norson Acquisition: Completed in 2023, this acquisition expanded Bachoco's presence in the pork industry.

- Market Maturity: The pork market is characterized by stable demand and established players, contributing to predictable cash flows.

- Revenue Stability: Norson's operations are expected to provide a reliable source of income for Bachoco.

- Diversification Benefit: The pork segment complements Bachoco's poultry business, creating a more robust multi-protein portfolio.

Industrias Bachoco's table egg business is a prime example of a cash cow. This segment operates in a mature market with consistent consumer demand, allowing Bachoco to leverage its significant market share for stable revenue generation. The company's established distribution network, comprising over 80 centers, further solidifies this position by ensuring efficient product delivery and broad market reach, minimizing the need for extensive new investment.

Bachoco's internal balanced animal feed production also functions as a cash cow. This vertically integrated operation enhances cost efficiency and ensures a consistent, high-quality supply for its core poultry business. By minimizing external procurement expenses, this segment directly contributes to overall profitability, reflecting its role in generating reliable cash flow.

The company's strong brand equity, built over 70 years, is another significant cash cow. This deep consumer trust in the Mexican poultry market translates into high market share and predictable sales volumes. Bachoco's established reputation allows it to maintain this position with comparatively lower marketing investment, effectively funding growth initiatives in other areas.

Furthermore, Bachoco's pork operations, bolstered by the 2023 acquisition of Norson Holding S. de R.L. de C.V., are developing into a cash cow. While the pork market is mature, Norson's established business model and export capabilities provide consistent revenue and cash flow, diversifying Bachoco's protein portfolio and offering financial stability.

| Segment | Market Growth | Market Share | Cash Flow Generation | Strategic Role |

| Table Eggs | Low | High | High | Stable Revenue |

| Internal Feed Production | Low | High | High | Cost Efficiency |

| Brand Equity (Poultry) | Low | High | High | Market Dominance |

| Pork Operations (Norson) | Low-Medium | Growing | Medium-High | Diversification |

What You’re Viewing Is Included

Industrias Bachoco BCG Matrix

The Industrias Bachoco BCG Matrix preview you see is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use document for your business planning.

Dogs

Industrias Bachoco's underperforming niche international markets likely represent a segment where their presence is minimal and the market itself isn't expanding rapidly. These could be considered Dogs in the BCG matrix if the cost to increase market share significantly is high and the potential for future profit is low. For instance, if Bachoco has a small export presence in a few less developed African nations with limited poultry consumption growth, these would fit the Dog profile.

Legacy product lines within Industrias Bachoco's portfolio, particularly those in the 'other products' segment, may be experiencing declining demand. These offerings, often older or less aligned with current consumer preferences, could be struggling against more competitive alternatives. For instance, if Bachoco has traditional processed chicken products that are seeing reduced sales compared to newer, value-added chicken items, these could fall into this category.

Such products might contribute minimally to overall revenue while still consuming valuable resources for production, marketing, and distribution. In 2023, while Bachoco reported strong overall growth, specific product categories might show stagnation or decline. A careful analysis of Bachoco's 2024 financial reports will be crucial to identify which specific legacy lines are underperforming and warrant strategic review, potentially leading to divestment or a significant overhaul.

Even within a generally efficient company like Industrias Bachoco, certain production facilities or farms might lag behind. These could be older sites requiring substantial upkeep and contributing little to the company's overall output, effectively becoming 'Dogs' in asset management. For instance, if a particular poultry farm, established in the early 2000s, consistently underperforms its modern counterparts, demanding higher energy costs and experiencing more frequent equipment failures, it would fit this category.

Operating these underperforming assets ties up valuable capital and resources that could be better allocated to more productive ventures. In 2024, Bachoco reported significant investments in modernizing its operations, highlighting the strategic importance of divesting or upgrading such inefficient facilities to maintain a competitive edge and optimize resource allocation across its extensive network.

Certain By-products with Limited Market Value

Certain by-products from poultry processing, such as certain organ meats or rendered fats, may possess limited market demand or necessitate significant additional processing to become commercially viable. If these consistently generate low returns and incur costs for management and disposal, they can be categorized as Dogs within Industrias Bachoco's product portfolio.

These low-value by-products often represent a drain on resources without contributing substantially to overall profitability. For instance, while Bachoco is a leading producer, the market for specific offal can be niche, requiring specialized distribution channels or further value-addition steps that may not always be cost-effective.

- Limited Market Demand: Some poultry by-products have a small customer base, making large-scale sales difficult.

- Processing Costs: Transforming these by-products into marketable goods can be expensive, potentially exceeding their market value.

- Resource Allocation: Handling and disposing of these items consumes operational resources that could be better utilized elsewhere.

Segments Heavily Reliant on Volatile Commodity Prices with Low Market Control

Industrias Bachoco, despite its strong vertical integration, faces potential challenges in segments where it has limited market control over volatile commodity prices. If specific inputs or minor operational areas are heavily exposed to price swings without robust hedging strategies, they could become Dogs in the BCG matrix. This exposure can lead to unpredictable and consistently low profit margins, hindering overall company performance.

For instance, consider the scenario where Bachoco relies on a particular type of specialized feed ingredient whose global price is subject to extreme volatility, and the company cannot secure long-term contracts or find alternative suppliers. In 2024, global feed corn prices experienced significant fluctuations due to geopolitical events and adverse weather patterns in key producing regions. If Bachoco's market share for this specific ingredient purchase is negligible, its ability to negotiate favorable terms or influence pricing is minimal. This situation directly impacts the cost of production for its poultry products, potentially eroding profit margins in those specific product lines.

- Exposure to Volatile Feed Costs: Segments heavily reliant on feed ingredients with low market control, such as specific grains or protein meals, can become Dogs if price volatility outpaces hedging capabilities.

- Limited Pricing Power: Minor product lines or niche markets where Bachoco has little influence on end-product pricing, while still being subject to input cost volatility, are at risk.

- Impact on Profitability: Consistent unpredictable and low profit margins in these segments, driven by commodity price swings, can drag down overall financial performance.

- Risk Mitigation Challenges: The lack of sufficient hedging or alternative sourcing options for critical, volatile inputs exacerbates the risk of these segments becoming Dogs.

Dogs in Industrias Bachoco's portfolio represent areas with low market share and low growth potential, often requiring significant investment without promising returns. These could include niche international markets where Bachoco's presence is minimal and demand is stagnant, or legacy product lines experiencing declining consumer interest. Identifying and strategically managing these 'Dogs' is crucial for optimizing resource allocation and maximizing overall profitability.

For instance, certain older, less popular processed chicken products might fall into this category, consuming resources while contributing little to revenue. Similarly, older, less efficient production facilities that require higher maintenance costs and yield lower output could also be classified as Dogs. Bachoco's reported investments in modernization in 2024 underscore the ongoing effort to divest or upgrade such underperforming assets.

By-products with limited market demand or high processing costs also fit the Dog profile, representing a drain on resources. Furthermore, operational segments heavily exposed to volatile commodity prices without effective hedging strategies can become Dogs, leading to unpredictable and low profit margins. Bachoco's performance in 2024, with significant investments in operational upgrades, highlights the strategic importance of addressing these low-performing areas.

Question Marks

Industrias Bachoco's focus on new value-added and ready-to-eat/cook products positions them in a dynamic market. While these innovations are in a growing segment, they currently reside in the Question Mark quadrant of the BCG matrix. This classification suggests high market growth potential but also a low relative market share for these specific product lines.

The increasing consumer demand for convenience is a key driver for these new offerings. Bachoco's investment in marketing and distribution is crucial to capturing a larger share of this expanding market. For instance, in 2024, the ready-to-eat poultry segment in Mexico saw a significant uptick in consumer adoption, indicating a favorable market environment for Bachoco's innovations.

Industrias Bachoco's diversification into pork is a strategic move, but venturing into entirely new protein categories like plant-based alternatives or large-scale aquaculture would currently place them in the 'Question Marks' quadrant of the BCG Matrix.

These emerging markets, while promising high growth potential, demand significant upfront capital for research, development, and market entry. For instance, the global plant-based protein market was valued at approximately $40.2 billion in 2022 and is projected to reach $100 billion by 2030, indicating substantial opportunity but also intense competition.

Bachoco would need to invest heavily in establishing brand recognition and consumer trust in these novel areas, much like any company entering the competitive plant-based sector where established players have already captured significant market share.

Investments in cutting-edge agricultural technologies, such as advanced automation in farming or AI-driven processing, represent potential Stars for Industrias Bachoco. For instance, a 2024 report by McKinsey highlighted that AI in food processing can boost operational efficiency by up to 20% and reduce waste by 15%. These initiatives, while promising significant efficiency gains and competitive advantages in the long run, demand considerable upfront capital and may have uncertain immediate returns or require extensive adaptation periods, characteristic of Star business units.

Emerging Export Markets with Untapped Potential

Emerging export markets with untapped potential for Industrias Bachoco would fall into the Question Marks category of the BCG Matrix. These are markets where Bachoco could gain significant market share, but they also carry higher risk and require substantial investment to develop. For instance, exploring markets in Southeast Asia or parts of Africa, where poultry consumption is rising, presents such an opportunity. In 2024, global poultry imports are projected to grow, with regions like the Middle East and North Africa showing strong demand, but Bachoco would need to carefully assess the competitive landscape and regulatory environments in these newer territories.

Developing these markets demands a strategic approach, including understanding local consumer preferences, navigating import regulations, and building robust supply chains. For example, entering a market like Vietnam, which has a growing middle class with increasing disposable income, could be a strategic move. However, the initial investment in market research and establishing distribution networks would be considerable. Bachoco would need to analyze factors such as existing trade agreements, potential tariffs, and the competitive presence of other major poultry exporters to gauge the viability and potential return on investment.

- High Growth Potential: Targeting regions with increasing demand for poultry, such as certain African nations or emerging Asian economies.

- Significant Investment Required: Undertaking thorough market research, establishing logistical infrastructure, and investing in brand development to penetrate these new markets.

- Risk and Uncertainty: Facing potential challenges related to regulatory hurdles, political stability, and intense competition from established players.

- Strategic Importance: These markets represent future growth drivers for Bachoco if successful, potentially diversifying revenue streams beyond its current primary markets.

Sustainability and ESG Initiatives with Commercialization Potential

Industrias Bachoco's dedication to sustainability and Environmental, Social, and Governance (ESG) principles presents significant commercialization opportunities. Their initiatives in renewable energy, waste reduction, and animal welfare are not just about corporate responsibility; they are being actively explored for revenue generation in emerging green markets.

These forward-thinking strategies could translate into new product lines or service offerings. For instance, advancements in waste reduction could lead to the development of value-added byproducts, while improved animal welfare standards might open doors to premium product segments. Bachoco's commitment signifies a proactive approach to aligning business growth with environmental and social stewardship.

- Renewable Energy Integration: Bachoco is investing in solar power at its facilities, aiming to reduce energy costs and potentially sell excess power back to the grid.

- Waste Valorization: Efforts to minimize waste are exploring the commercial potential of converting organic byproducts into biogas or fertilizers.

- Animal Welfare Innovations: Enhanced animal welfare practices are being evaluated for their market appeal in ethically sourced and premium protein categories.

Industrias Bachoco's new value-added and ready-to-eat/cook products are classified as Question Marks due to their high market growth potential but low relative market share. The increasing consumer demand for convenience fuels this segment, making strategic marketing and distribution vital for Bachoco to capture a larger share. For example, the ready-to-eat poultry segment in Mexico showed strong consumer adoption in 2024, highlighting a favorable market for these innovations.

Venturing into entirely new protein categories, such as plant-based alternatives, would also place Bachoco's initiatives in the Question Mark quadrant. These emerging markets, while offering substantial growth, demand significant upfront capital for R&D and market entry, as seen in the global plant-based protein market, valued at approximately $40.2 billion in 2022 and projected to reach $100 billion by 2030.

Emerging export markets with untapped potential, like Southeast Asia or parts of Africa, also represent Question Marks for Bachoco. These markets offer opportunities for significant market share gains but come with higher risks and require substantial investment for development. Global poultry imports are projected to grow in 2024, with regions like the Middle East and North Africa showing strong demand, but Bachoco must carefully assess competition and regulations.

| BCG Category | Bachoco Business Unit/Product Line | Market Growth | Relative Market Share | Strategic Implication |

| Question Marks | New Value-Added & Ready-to-Eat/Cook Products | High | Low | Requires significant investment to gain market share; potential for future Stars. |

| Question Marks | Diversification into New Protein Categories (e.g., Plant-Based) | High | Low | High upfront capital for R&D and market entry; intense competition. |

| Question Marks | Emerging Export Markets (e.g., Southeast Asia, Africa) | High | Low | Needs market research, infrastructure investment, and brand building; subject to regulatory and political risks. |

BCG Matrix Data Sources

Our Industrias Bachoco BCG Matrix is built upon comprehensive market data, integrating financial disclosures, industry growth rates, and competitor analysis to provide a strategic overview.