b1BANK PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

b1BANK Bundle

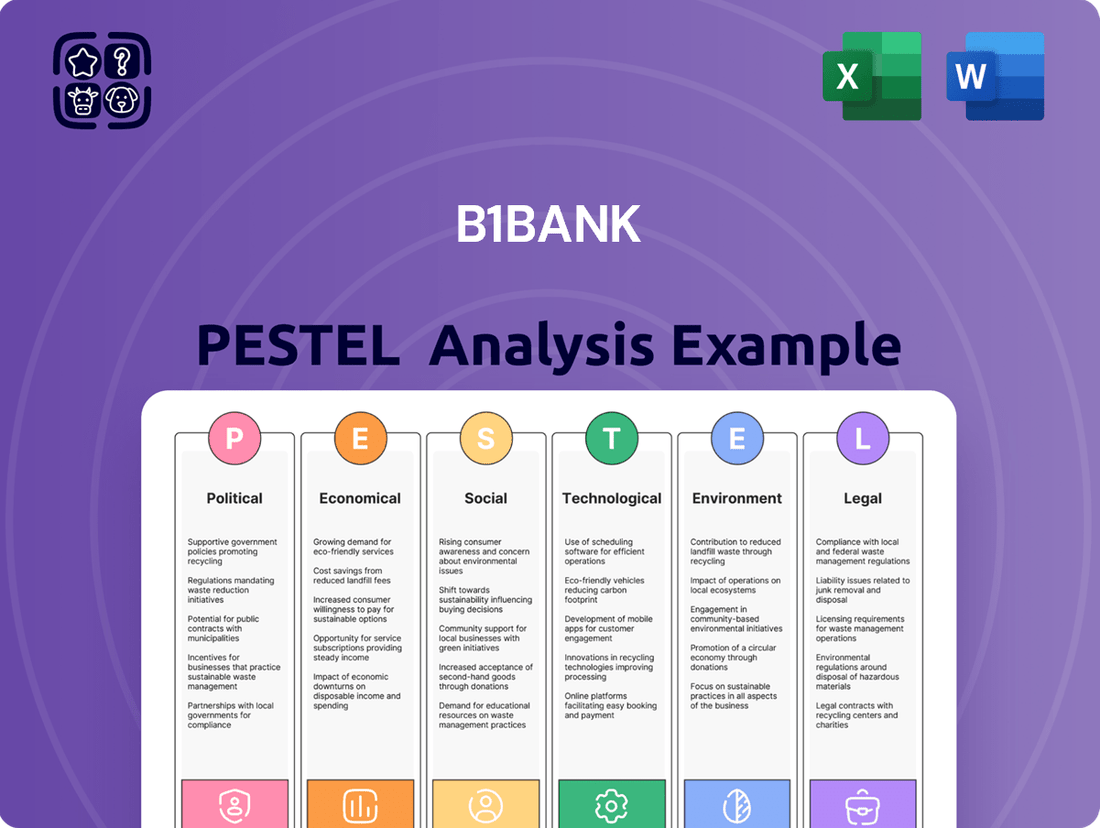

Unlock the secrets to b1BANK's future by understanding the external forces at play. Our PESTLE analysis dives deep into political, economic, social, technological, legal, and environmental factors impacting the bank. Gain a competitive edge by leveraging these critical insights for your strategic planning. Download the full PESTLE analysis now and make informed decisions.

Political factors

The federal regulatory environment for banks, particularly actions by the Consumer Financial Protection Bureau (CFPB), remains in flux. Proposed rules concerning consumer financial products, data brokers, and nonbank oversight have seen both introductions and withdrawals, demanding constant vigilance and strategic adjustments from financial institutions to ensure compliance.

The American Bankers Association (ABA) is actively advocating for a singular national data privacy standard. This initiative aims to simplify compliance burdens and recognize the already strong data protections inherent in financial institutions, seeking to move away from the current complex and varied state-by-state regulations.

The year 2025 is a critical juncture for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. New Financial Action Task Force (FATF) guidelines are pushing for more robust National Risk Assessments and increased transparency regarding who truly owns and controls companies. This means institutions like b1BANK must adapt to avoid hefty penalties, which can reach millions, and protect their reputation.

The upcoming FinCEN Modernization Rule in 2025 will further underscore the importance of risk-based AML/CFT programs. Banks will be compelled to enhance their compliance frameworks, investing in technology and processes to identify and mitigate financial crime risks effectively. Failure to comply could lead to significant financial repercussions and operational disruptions.

Government initiatives and policies aimed at bolstering small and medium-sized enterprises (SMEs) are crucial for b1BANK, as these businesses form a significant portion of its customer base. Community banks like b1BANK are inherently positioned to support local economic development by nurturing small business expansion, often offering more adaptable credit solutions than larger financial institutions.

b1BANK's role in facilitating government aid was evident during the COVID-19 pandemic, where its participation in programs like the Paycheck Protection Program (PPP) helped disburse billions in vital funding to struggling businesses. For instance, in 2021, the PPP alone provided over $742 billion in loans to millions of small businesses across the United States, with community banks playing a pivotal role in reaching underserved markets.

Federal Reserve Monetary Policy

The Federal Reserve's monetary policy, especially its stance on interest rates, significantly impacts b1BANK's operational costs and revenue streams. For instance, the Federal Funds Rate, a key benchmark, influences borrowing costs across the economy. As of early 2024, the Federal Reserve maintained a target range for the Federal Funds Rate, impacting how much banks like b1BANK can earn on loans versus how much they pay for deposits.

Changes in the Federal Reserve's policy directly affect b1BANK's net interest margin, which is the difference between the interest income generated by the bank and the interest it pays out to its depositors. Higher interest rates generally boost this margin, but can also dampen loan demand. Conversely, lower rates can compress margins but potentially stimulate borrowing. For example, if the Federal Reserve were to increase rates by 25 basis points in late 2024, it would likely lead to higher yields on b1BANK's variable-rate loans and new fixed-rate loans, while also increasing the cost of its funding.

- Federal Funds Rate Impact: The Federal Reserve's adjustments to the Federal Funds Rate directly influence b1BANK's cost of funds and the interest income from its loan portfolio.

- Net Interest Margin Sensitivity: b1BANK's profitability is closely tied to its net interest margin, which fluctuates with changes in interest rates set by the Federal Reserve.

- Loan Demand and Profitability: Monetary policy shifts affect commercial clients' borrowing appetite, thereby influencing b1BANK's overall lending volume and profitability.

- Balance Sheet Management: Banks must adapt their balance sheet strategies, including asset-liability management, in anticipation of or response to Federal Reserve policy changes.

State-Level Political Stability and Policies

The political landscape in Louisiana and Texas, b1BANK's core markets, directly influences its operational success. For instance, Texas's consistent focus on business-friendly regulations, including a lack of state income tax, has fostered a robust economic environment, attracting significant business investment. Louisiana, while facing its own set of political dynamics, has seen initiatives aimed at revitalizing its economy through targeted development programs.

State-level policies regarding commercial development and infrastructure are crucial. Texas, in 2024, continued its substantial investment in transportation infrastructure, a move that benefits businesses by improving logistics and supply chains. Louisiana, in its 2025 budget proposals, emphasized funding for workforce development and grants for small businesses, aiming to stimulate regional growth.

- Texas's 2024 economic outlook was bolstered by its commitment to low corporate tax rates and a favorable regulatory environment.

- Louisiana's 2025 budget prioritizes investments in infrastructure and small business support programs to enhance economic stability.

- State-specific legislation impacting the financial services sector, such as lending regulations and consumer protection laws, directly affects b1BANK's risk management and compliance efforts.

Government policies, especially those from the Consumer Financial Protection Bureau (CFPB), continue to shape the banking landscape, with proposed rules on data brokers and nonbank oversight demanding constant adaptation. The American Bankers Association is pushing for a unified national data privacy standard to streamline compliance for institutions like b1BANK. Furthermore, 2025 marks a critical period for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, with new Financial Action Task Force (FATF) guidelines requiring enhanced transparency and risk assessments, potentially leading to significant penalties for non-compliance.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting b1BANK, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and data-driven perspectives to help b1BANK navigate its operating landscape and capitalize on emerging opportunities.

The b1BANK PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby alleviating the pain point of sifting through extensive data.

Economic factors

The prevailing interest rate environment significantly shapes b1BANK's operations. For instance, the Federal Reserve's benchmark interest rate, which stood at 5.25%-5.50% as of early 2024, directly impacts the bank's cost of funds and the pricing of its loans. Higher rates can make borrowing more expensive for b1BANK's business clients, potentially leading to reduced loan origination volumes.

Conversely, elevated interest rates can boost the attractiveness of b1BANK's deposit products, drawing in more customer funds. However, this also necessitates careful management of the bank's net interest margin to ensure sustained profitability. The bank must navigate the delicate balance of managing interest rate risk, particularly as economic forecasts for 2025 suggest potential shifts in monetary policy.

Inflationary pressures remain a significant concern for community banks like b1BANK, as highlighted in Q1 2025 data. These pressures directly impact operational expenses and the financial stability of their customer base.

High inflation erodes consumer and business purchasing power, potentially hindering loan repayment capabilities and devaluing deposit real worth. For instance, the US CPI rose 3.4% year-over-year in April 2024, impacting household budgets.

b1BANK must implement robust strategies to shield its balance sheet and client financial well-being from these inflationary effects.

The economic performance of Louisiana and Texas is critical for b1BANK, as its commercial banking operations are concentrated in these regions. A strong regional economy, evidenced by job growth and business expansion, fuels demand for b1BANK's lending and treasury services. For instance, Texas's GDP grew by an estimated 4.7% in 2023, significantly outpacing the national average, while Louisiana's GDP saw a more modest increase of 1.5% during the same period, highlighting differing growth dynamics within b1BANK's core markets.

Small Business Lending Trends

The economic environment for small business lending significantly impacts b1BANK. Community banks, which are key players, hold over 60% of small business loans across the U.S., often reporting higher customer satisfaction. This suggests a robust market where b1BANK can leverage its focus on this sector.

Recent data from the Federal Reserve's 2024 Small Business Credit Survey indicated that while overall loan demand remained steady, access to credit continued to be a challenge for some small businesses, particularly those in underserved communities. This presents both a risk and an opportunity for institutions like b1BANK that specialize in this lending segment.

- Community banks hold over 60% of all small business loans in the U.S.

- Higher borrower satisfaction is often reported by community banks.

- Small businesses continue to face varying degrees of access to credit, as highlighted in recent surveys.

Consumer Spending and Household Debt

Consumer spending and household debt in Louisiana and Texas indirectly impact b1BANK's business clients. Robust consumer spending, such as the projected 3.1% growth in Texas retail sales for 2024, translates to increased revenue for local businesses, enhancing their ability to repay loans and utilize commercial services. Conversely, rising household debt, which stood at an average of $164,000 per household in Texas as of Q4 2023, could lead to reduced discretionary spending, potentially straining business performance.

These economic conditions directly shape the demand for b1BANK's commercial lending and financial services. Strong consumer confidence, a key driver of spending, bolsters the financial health of small and medium-sized enterprises, making them more attractive borrowers and increasing their capacity to invest. For instance, Louisiana's unemployment rate holding steady at 3.9% in early 2024 supports consistent consumer income, benefiting businesses.

- Consumer Spending Impact: Increased consumer spending in Texas and Louisiana directly boosts sales for b1BANK's business clients, improving their financial stability.

- Household Debt Influence: High levels of household debt can curb consumer spending, negatively affecting business revenue and loan repayment capacity.

- Economic Indicators: Texas retail sales growth projections for 2024 and Louisiana's stable unemployment rate are key indicators of consumer financial health affecting businesses.

- Creditworthiness: Healthy consumer spending and manageable household debt enhance the creditworthiness of b1BANK's business clients, influencing their access to capital.

The prevailing interest rate environment significantly shapes b1BANK's operations, with the Federal Reserve's benchmark rate at 5.25%-5.50% in early 2024 impacting borrowing costs and loan pricing. Inflationary pressures, evidenced by a 3.4% year-over-year CPI increase in April 2024, directly affect operational expenses and customer financial stability. Regional economic performance, such as Texas's 4.7% GDP growth in 2023, fuels demand for b1BANK's services, while consumer spending and household debt levels, like the average $164,000 debt per household in Texas in Q4 2023, indirectly influence business clients' repayment capacity.

| Economic Factor | Key Data Point (2024/2025) | Impact on b1BANK |

|---|---|---|

| Interest Rates | Federal Reserve Benchmark: 5.25%-5.50% (Early 2024) | Affects cost of funds, loan pricing, and net interest margin. |

| Inflation | US CPI: 3.4% YoY (April 2024) | Increases operational costs, impacts customer purchasing power and loan repayment. |

| Regional GDP Growth | Texas: 4.7% (2023), Louisiana: 1.5% (2023) | Strong growth fuels demand for lending and treasury services in core markets. |

| Consumer Spending | Texas Retail Sales Growth: Projected 3.1% (2024) | Boosts revenue for business clients, enhancing their creditworthiness. |

| Household Debt | Texas Average Household Debt: $164,000 (Q4 2023) | High debt can reduce discretionary spending, potentially straining business performance. |

Preview the Actual Deliverable

b1BANK PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive b1BANK PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. It provides actionable insights to inform strategic decision-making.

Sociological factors

Customer expectations are rapidly evolving, with younger demographics like Millennials and Gen Z demanding intuitive, personalized digital banking. A significant 75% of Gen Z and 62% of Millennials prefer mobile banking for most transactions, according to a 2024 survey, pushing b1BANK to prioritize its digital infrastructure.

This digital-first preference translates into a need for streamlined online account opening processes and mobile-centric features. Banks that fail to adapt risk losing a substantial customer base, as convenience and accessibility are paramount for these digitally native consumers.

The persistent gap in financial literacy across the U.S., with average scores hovering around 50% for several years, presents both a challenge and an opportunity for b1BANK. This means many potential clients may not fully grasp complex financial products or strategies.

A lower understanding of financial concepts among potential clients necessitates b1BANK to invest more in financial education. This could involve workshops, online resources, and personalized guidance to ensure clients make informed decisions.

However, this also creates a significant avenue for b1BANK to build trust and cultivate strong client relationships. By proactively offering accessible educational resources and clear, jargon-free guidance, b1BANK can position itself as a reliable partner in their clients' financial journeys.

The deep-seated value placed on community banking, with its personalized service and support for local economies, directly benefits b1BANK's strategy. This sociological element highlights how the bank's integration within Louisiana and Texas communities is crucial for its success.

By actively participating in local initiatives and maintaining a visible presence, b1BANK can cultivate client loyalty. For instance, community banks often see higher retention rates, with data from the Independent Community Bankers of America showing that community banks are more likely to lend to small businesses in their local areas, fostering economic growth and client trust.

Generational Banking Behaviors

Generational differences significantly shape banking behaviors, presenting a key sociological factor for b1BANK. Millennials, for instance, are deeply embedded in digital channels, frequently leveraging online platforms and social media for financial advice and transactions. A 2024 report indicated that over 70% of Millennials prefer mobile banking for everyday tasks.

Gen Z, the newest cohort entering the financial landscape, demonstrates an even stronger preference for mobile-first experiences and often gravitates towards digital-only banks and neobanks. Research from late 2024 shows that 60% of Gen Z consumers have never even visited a physical bank branch.

Conversely, Baby Boomers often maintain a preference for traditional banking methods, valuing face-to-face interactions with bank staff and financial advisors. This demographic still represents a substantial portion of the banking customer base, with many preferring in-branch services or phone banking. b1BANK must therefore adapt its strategies to cater to these varied preferences.

- Millennial Digital Adoption: Over 70% of Millennials prefer mobile banking (2024 data).

- Gen Z Digital-Only Preference: 60% of Gen Z have never visited a physical bank branch (late 2024 data).

- Boomer Traditionalism: Baby Boomers often favor in-branch services and financial advisors.

- Strategic Imperative: b1BANK must tailor service delivery and marketing to engage all generations effectively.

Demographic Shifts and Wealth Transfer

Significant demographic shifts are fundamentally altering the banking landscape. A monumental intergenerational wealth transfer, estimated to be around $80 trillion, is actively moving from older generations to younger ones. This massive influx of capital will reshape the client base for institutions like b1BANK.

Understanding the evolving financial needs and behaviors of Millennials and Gen Z is paramount as they inherit and accumulate wealth. These generations, often digitally native and with different investment priorities, require tailored approaches.

- Wealth Transfer: An estimated $80 trillion in wealth is projected to transfer to younger generations in the coming years.

- Client Base Reshaping: This demographic shift will significantly alter the composition of a bank's client base.

- Emerging Affluent Segments: Millennials and Gen Z represent key emerging affluent segments whose financial needs must be understood.

- Adaptation Required: Banks must adapt product offerings and advisory services to effectively capture and retain these growing wealth segments.

Sociological factors significantly influence banking preferences, with younger generations like Gen Z and Millennials prioritizing digital channels. A 2024 survey found that 75% of Gen Z and 62% of Millennials prefer mobile banking, pushing b1BANK to enhance its digital offerings. Conversely, older demographics often prefer traditional, in-person interactions, necessitating a multi-channel approach.

Financial literacy levels also present a key consideration; with average U.S. scores around 50%, b1BANK has an opportunity to build trust by providing accessible educational resources. The strong value placed on community banking, where personalized service and local economic support are key, directly benefits b1BANK's strategy in its operating regions.

| Sociological Factor | Impact on b1BANK | Supporting Data (2024/2025) |

|---|---|---|

| Digital Preference (Gen Z/Millennials) | Need for robust mobile and online banking platforms | 75% of Gen Z, 62% of Millennials prefer mobile banking. |

| Traditional Preference (Boomers) | Continued need for in-branch services and personal advisors | Boomers often favor face-to-face interactions. |

| Financial Literacy Gap | Opportunity for educational outreach and trust-building | Average U.S. financial literacy scores ~50%. |

| Community Focus | Leveraging local presence for client loyalty and growth | Community banks often have higher retention rates. |

Technological factors

The financial services sector is rapidly digitizing, with cloud computing at its core. Globally, over 90% of financial institutions are now utilizing cloud services, drawn to their scalability, cost efficiencies, and improved disaster recovery. This trend is fundamentally reshaping how banks operate and serve their customers.

For b1BANK, leveraging cloud technology is crucial for modernizing its infrastructure. This adoption promises to streamline internal processes, increase operational flexibility, and accelerate the creation of innovative digital offerings specifically tailored for its commercial clientele, keeping pace with market demands.

Financial institutions like b1BANK are increasingly targeted by advanced cyber threats, such as ransomware and AI-powered attacks. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the escalating risk. b1BANK must prioritize continuous investment in cutting-edge security technologies and comprehensive employee training to safeguard sensitive client information and uphold its reputation.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the banking sector, with a significant majority of banks, over 90% by 2024, actively investing in these advanced technologies. These tools are now integral to core banking operations, from bolstering fraud detection systems and refining credit scoring models to enhancing risk management strategies and delivering hyper-personalized customer experiences.

For b1BANK, the strategic integration of AI and ML presents a substantial opportunity to streamline its commercial lending operations, leading to more efficient processing and quicker decision-making. Furthermore, these technologies can significantly sharpen the bank's ability to assess credit risk accurately, thereby mitigating potential losses and improving the overall health of its loan portfolio. This advanced analytical capability also allows b1BANK to develop and offer highly customized financial solutions tailored to the specific needs and growth trajectories of its business clients, fostering stronger relationships and driving mutual success.

Fintech Competition and Collaboration

The fintech sector is a dynamic force, constantly introducing novel services that intensify competition for established banks. For instance, by the end of 2024, fintech funding globally reached an estimated $30 billion, indicating robust innovation and market penetration. This environment necessitates that b1BANK actively considers how to leverage these advancements.

Fintechs, while competitive, also offer significant avenues for strategic alliances. b1BANK can forge partnerships to integrate cutting-edge technologies, thereby enriching its product suite and ensuring its offerings remain relevant. For example, collaborations could focus on areas like AI-driven customer service or blockchain-based payment solutions, which are gaining traction in the 2025 market outlook.

- Increased Competition: Fintech startups are challenging traditional banking models with agile, digital-first solutions.

- Opportunities for Collaboration: Partnerships can allow b1BANK to adopt new technologies and expand service capabilities.

- Integration of Innovation: Exploring fintech collaborations can help b1BANK offer modern banking solutions, such as enhanced digital onboarding or personalized financial advice, to its SMB clients.

- Market Adaptability: Proactive engagement with fintech trends is crucial for b1BANK to maintain its competitive edge in the evolving financial services landscape.

Mobile and Online Banking Adoption

The increasing reliance on digital platforms for financial management presents a significant technological shift. By Q1 2024, over 85% of retail banking transactions in the US were conducted through digital channels, a figure projected to climb higher. This widespread adoption of mobile and online banking means b1BANK must prioritize the user experience and security of its digital offerings to retain and attract customers.

Business clients are also increasingly demanding seamless digital access for treasury management and commercial lending. A recent industry survey indicated that 70% of small and medium-sized businesses prefer digital onboarding and transaction processing. Therefore, b1BANK's investment in robust, intuitive, and secure digital infrastructure is paramount to meeting these evolving client expectations and remaining competitive in the financial sector.

- Digital Transaction Dominance: Over 85% of US retail banking transactions occurred digitally in early 2024.

- Business Client Expectations: 70% of SMEs favor digital processes for banking services.

- b1BANK's Imperative: Enhance digital channels for user-friendliness, security, and efficient remote banking.

The technological landscape for banking is defined by rapid digitization, with cloud adoption at over 90% among financial institutions by 2024, driven by scalability and cost efficiencies. For b1BANK, this means modernizing infrastructure to streamline operations and accelerate digital product development for its commercial clients.

Cybersecurity threats are escalating, with global cybercrime costs projected to hit $10.5 trillion annually by 2025, necessitating continuous investment in advanced security and employee training for b1BANK to protect sensitive data.

AI and ML adoption is widespread, with over 90% of banks investing by 2024 to enhance fraud detection, credit scoring, and customer personalization, opportunities b1BANK can leverage for efficient commercial lending and risk assessment.

Fintech funding reached an estimated $30 billion globally by the end of 2024, highlighting innovation that b1BANK can integrate through strategic partnerships to expand its service offerings, such as AI-driven customer service or blockchain payments.

| Technology Trend | Adoption/Impact (2024-2025) | b1BANK Implication |

|---|---|---|

| Cloud Computing | >90% financial institutions utilize | Infrastructure modernization, operational efficiency |

| Cybersecurity Threats | $10.5T annual cost projected by 2025 | Prioritize investment in security tech & training |

| AI/ML | >90% banks investing | Streamline lending, improve risk assessment, personalize services |

| Fintech Innovation | ~$30B global funding (end 2024) | Strategic partnerships for enhanced service offerings |

Legal factors

b1BANK navigates a stringent federal banking regulatory landscape, with the Consumer Financial Protection Bureau (CFPB) playing a pivotal role. The CFPB's continuous efforts in rulemaking and enforcement, particularly concerning consumer financial products and services, directly shape the compliance obligations for financial institutions. For instance, in 2023, the CFPB continued to focus on areas like fair lending and data privacy, issuing guidance and taking enforcement actions that financial institutions must meticulously follow.

Adherence to these federal mandates is not merely a matter of compliance but is fundamental to maintaining operational integrity and avoiding significant financial penalties. In 2024, regulatory scrutiny is expected to remain high, with potential new rules impacting areas like digital banking and cybersecurity. Banks like b1BANK must invest in robust compliance programs to ensure they meet these evolving federal requirements, safeguarding both their reputation and financial stability.

Global and domestic regulations for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) are becoming more stringent. For instance, the Financial Crimes Enforcement Network (FinCEN) is expected to finalize its Modernization Rule in 2025, which will necessitate more sophisticated, risk-based AML programs. This includes enhanced customer due diligence and more granular transaction monitoring to effectively combat illicit financial flows.

The U.S. lacks a unified federal data privacy law, presenting a fragmented landscape for b1BANK. This means navigating a mix of sector-specific federal rules like the Gramm-Leach-Bliley Act (GLBA) and a growing number of state privacy laws, such as California's CCPA/CPRA. For instance, as of early 2024, over a dozen states had enacted comprehensive privacy legislation, each with unique compliance demands.

b1BANK must diligently manage these diverse regulations to safeguard customer data, especially sensitive financial details. Failure to comply with these varying requirements can lead to significant legal penalties and reputational damage, underscoring the critical need for robust data protection strategies.

Consumer Protection Laws

Consumer protection laws, largely overseen by the Consumer Financial Protection Bureau (CFPB), are crucial for fostering fair, transparent, and competitive financial markets. These regulations govern how banks engage with their customers, including product marketing and complaint resolution processes. For instance, the CFPB reported in 2023 that consumer complaints related to credit reporting and debt collection saw significant increases, underscoring the importance of strict adherence for institutions like b1BANK.

b1BANK must meticulously follow these rules, especially regarding clear disclosures for both commercial lending and standard deposit accounts. Failure to do so can erode customer trust and invite substantial regulatory penalties. In 2024, the CFPB continued its focus on ensuring clear and accurate fee disclosures, a critical area for banks to manage carefully to maintain compliance and customer confidence.

- CFPB Oversight: The Consumer Financial Protection Bureau actively enforces regulations to ensure fairness and transparency in banking.

- Disclosure Requirements: Strict adherence to disclosure rules for commercial lending and deposit accounts is vital for maintaining consumer trust.

- Regulatory Focus: In 2024, the CFPB emphasized clear fee disclosures, a key area of compliance for financial institutions.

- Complaint Trends: Monitoring consumer complaint data, such as the rise in credit reporting issues noted in 2023, helps banks proactively address potential violations.

State-Specific Banking and Business Laws

Operating primarily in Louisiana and Texas, b1BANK must navigate a complex web of state-specific banking and business laws. These regulations, distinct from federal mandates, govern crucial aspects like licensing, branch expansion, and lending procedures. For instance, Texas has specific capital requirements for state-chartered banks, while Louisiana's consumer protection laws may influence loan origination and servicing.

These state-level legal frameworks directly impact b1BANK's operational strategies and risk management. Compliance with varying statutes concerning deposit insurance, usury limits, and fair lending practices is paramount. Staying abreast of legislative changes and judicial interpretations at both the state and local levels is therefore critical for maintaining operational integrity and avoiding penalties.

The financial sector in 2024 and 2025 continues to see evolving state-level regulatory landscapes. For b1BANK:

- Texas enacted new cybersecurity requirements for financial institutions in late 2023, impacting data protection protocols.

- Louisiana's legislature may consider changes to its corporate governance statutes in its 2025 session, potentially affecting bank board responsibilities.

- Both states maintain distinct rules on branch banking and interstate acquisitions, influencing b1BANK's growth strategies.

b1BANK must navigate a complex legal environment, with the Consumer Financial Protection Bureau (CFPB) setting stringent federal standards for consumer protection and fair lending practices. In 2023, the CFPB intensified its focus on areas like digital banking and cybersecurity, issuing guidance that requires significant compliance investments. Anticipated rule finalizations in 2025, such as FinCEN's AML modernization, will demand more sophisticated risk-based programs for combating illicit financial activities.

The patchwork of state-specific laws, particularly in Louisiana and Texas, adds another layer of complexity, impacting everything from branch expansion to data privacy. For instance, Texas introduced new cybersecurity mandates for financial institutions in late 2023, requiring updated data protection measures. Staying agile and informed about these evolving state and federal regulations is crucial for b1BANK's continued operational integrity and market standing.

| Regulatory Body | Key Focus Areas (2023-2025) | Impact on b1BANK |

| CFPB | Consumer protection, fair lending, fee disclosures, digital banking, cybersecurity | Mandatory compliance investments, risk mitigation, potential penalties for non-adherence |

| FinCEN | AML/CTF modernization (rule expected 2025) | Enhanced due diligence, improved transaction monitoring systems |

| State Regulators (LA/TX) | Cybersecurity (TX late 2023), corporate governance (LA potential 2025), branch banking, lending procedures | State-specific compliance programs, strategic planning for expansion, operational adjustments |

Environmental factors

Financial institutions like b1BANK face growing pressure to manage climate-related risks, a category encompassing physical threats such as extreme weather events and transition risks tied to the shift to a low-carbon economy.

For b1BANK, particularly in vulnerable regions like Louisiana and Texas, integrating assessments of physical climate risks into lending practices and overall portfolio management is paramount, especially given the increasing frequency of severe weather events impacting collateral values.

In 2024, the U.S. experienced numerous billion-dollar weather and climate disasters, with coastal areas like those b1BANK serves being particularly exposed, underscoring the need for robust risk mitigation strategies in financial operations.

The increasing focus on Environmental, Social, and Governance (ESG) factors significantly shapes how investors and the public view financial institutions like b1BANK. While specific ESG reporting mandates for regional banks can differ, embedding ESG principles into lending and daily operations can bolster b1BANK's image and draw in clients who value sustainability. This means carefully assessing the environmental footprint of projects b1BANK finances.

Louisiana and Texas, regions where b1BANK has significant operations, face substantial environmental risks due to their high susceptibility to natural disasters like hurricanes and floods. For instance, the Gulf Coast experienced an active hurricane season in 2023, with several storms making landfall, causing billions in damages and disrupting economic activity. These events directly threaten b1BANK's physical infrastructure, disrupt client businesses, and can lead to increased loan defaults as borrowers struggle with property damage and business interruptions.

The economic fallout from these disasters can be severe, impacting collateral values and increasing the risk profile of b1BANK's loan portfolio. Following Hurricane Ida in 2021, Louisiana saw widespread power outages and significant property damage, impacting businesses and individuals across the state. This underscores the critical need for b1BANK to maintain robust disaster preparedness and recovery plans, alongside a thorough assessment of the resilience of its loan collateral against such environmental threats.

Green Financing and Sustainability Trends

The financial sector is increasingly embracing sustainability, with a notable rise in green financing. By 2024, global sustainable debt issuance was projected to reach over $1 trillion, reflecting strong investor appetite for environmentally conscious investments. b1BANK can capitalize on this by integrating sustainable practices into its operations and product offerings, such as developing 'green loans' for businesses focused on environmental impact reduction.

Financial institutions are actively working to minimize their environmental impact, with many committing to net-zero emissions targets. For instance, a significant portion of major global banks have pledged to achieve net-zero operational emissions by 2030 or 2040. b1BANK's exploration of green cloud computing and other eco-friendly operational strategies aligns with this broader industry commitment and can enhance its corporate image.

- Sustainable Debt Issuance: Global sustainable debt issuance is expected to surpass $1 trillion in 2024.

- Net-Zero Commitments: A majority of large banks aim for net-zero operational emissions by 2030-2040.

- Green Product Development: Opportunities exist for b1BANK to offer green loans and other eco-focused financial products.

- Market Alignment: Adopting sustainability trends helps b1BANK meet evolving customer and investor expectations.

Regulatory Scrutiny on Environmental Risks

Regulators are stepping up their examination of how financial institutions handle climate-related financial risks. This includes how banks identify, measure, monitor, and manage these environmental exposures. While current regulations aren't as detailed as those for other banking areas, the direction is clear: banks will soon need to prove they can effectively manage environmental risks.

For b1BANK, this means a proactive approach is essential. Developing robust frameworks for assessing and reporting on its exposure to environmental factors is crucial for future compliance and risk management. This foresight will position b1BANK to navigate evolving regulatory landscapes and demonstrate its commitment to sustainable finance.

- Increased Focus: Global regulators, including the European Central Bank (ECB) and the Bank of England, have intensified their focus on climate risk in banking supervision. For instance, the ECB's 2022 Supervisory Banking Review highlighted climate-related and environmental risks as a key priority.

- Future Requirements: While specific mandates are still developing, the trend suggests a move towards more prescriptive requirements for climate risk management, similar to existing capital adequacy or liquidity regulations.

- Proactive Strategy: b1BANK should consider integrating climate risk assessments into its existing Enterprise Risk Management (ERM) framework, potentially leveraging scenario analysis to understand potential impacts on its loan portfolio and operations.

Environmental factors present significant challenges and opportunities for b1BANK, particularly concerning climate-related risks and the growing demand for sustainable finance. The increasing frequency of extreme weather events in regions like Louisiana and Texas directly impacts collateral values and operational stability, necessitating robust risk mitigation strategies.

The global push towards Environmental, Social, and Governance (ESG) principles is reshaping the financial landscape, encouraging institutions like b1BANK to embed sustainability into their core operations and product offerings. This includes developing green financing options and aligning with net-zero emission targets, reflecting evolving customer and investor expectations.

Regulatory scrutiny on climate-related financial risks is intensifying, prompting b1BANK to proactively integrate these considerations into its enterprise risk management framework to ensure future compliance and operational resilience.

| Environmental Factor | Impact on b1BANK | Data/Trend (2024/2025 Projection) |

|---|---|---|

| Climate Change & Extreme Weather | Increased physical risk to assets, potential loan defaults, collateral devaluation. | U.S. experienced numerous billion-dollar weather disasters in 2024; Gulf Coast remains highly vulnerable to hurricanes. |

| ESG Focus & Sustainable Finance | Enhanced reputation, access to green capital, demand for eco-friendly products. | Global sustainable debt issuance projected to exceed $1 trillion in 2024; growing investor preference for ESG-compliant investments. |

| Regulatory Scrutiny on Climate Risk | Need for enhanced risk management frameworks, reporting, and compliance. | Increased focus from regulators like the ECB on climate risk supervision; trend towards more prescriptive requirements anticipated. |

PESTLE Analysis Data Sources

Our b1BANK PESTLE Analysis is built on a comprehensive blend of public and proprietary data, drawing from official financial reports, regulatory filings, and market intelligence platforms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, real-world business conditions.