Axitea Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axitea Bundle

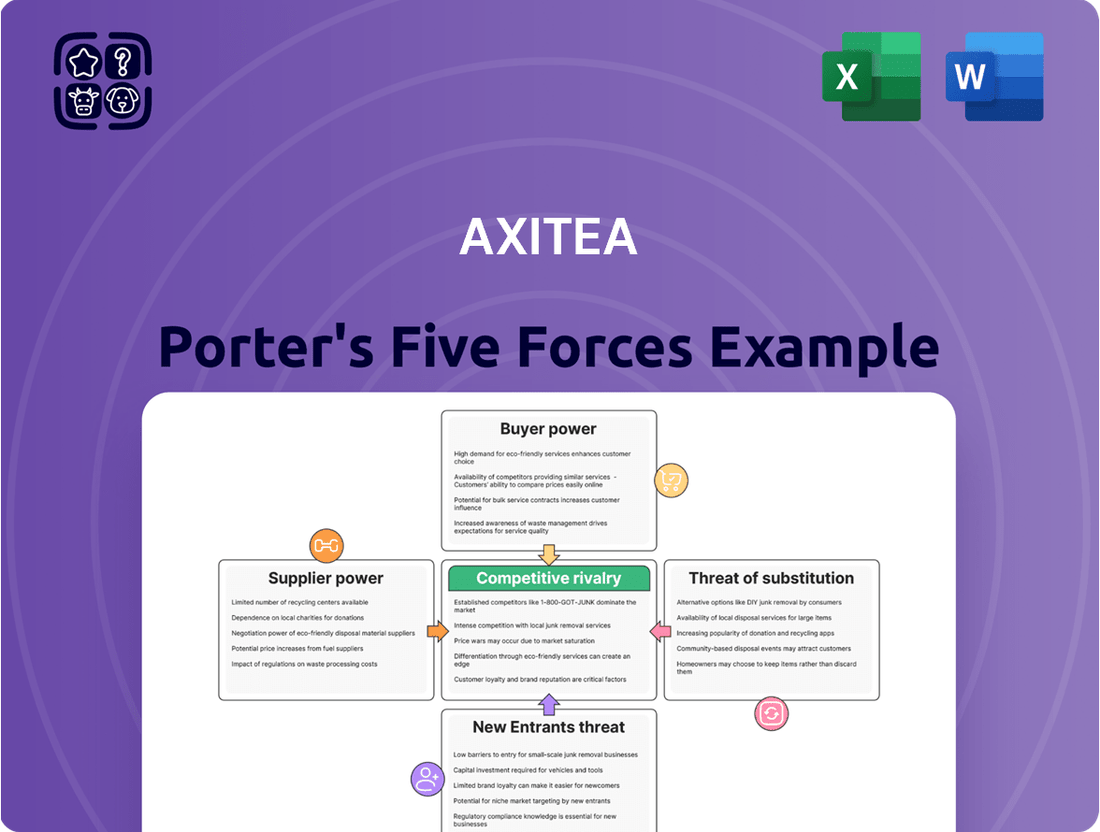

Axitea operates within an industry shaped by significant buyer power and the constant threat of substitutes, impacting its pricing strategies and market differentiation. Understanding these forces is crucial for navigating its competitive landscape effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Axitea’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts the security industry. If there are only a few providers for essential hardware, software, or specialized cybersecurity tools, these suppliers gain considerable leverage. This can translate into higher prices for companies like Axitea, as they have fewer alternatives for critical inputs.

The reliance on specialized components and expertise means that a limited number of suppliers can dictate terms. For instance, if a particular advanced threat detection software is only available from one or two vendors, Axitea would face increased costs and potential supply chain risks. This scarcity of specialized resources amplifies supplier bargaining power.

In 2024, the cybersecurity talent shortage remained a critical issue, with estimates suggesting millions of unfilled positions globally. This scarcity of highly skilled security professionals, from penetration testers to incident response specialists, directly increases the bargaining power of individual employees and specialized recruitment firms, driving up labor costs for security providers like Axitea.

The cost and complexity involved for Axitea in switching between different technology providers significantly impact supplier power. High switching costs, including integration challenges, data migration expenses, and potential downtime, reduce Axitea's leverage. For instance, if Axitea relies on specialized security software requiring extensive customisation, the effort and expense to transition to an alternative vendor would be substantial, thereby strengthening the incumbent supplier's position.

Suppliers offering unique technologies, like advanced AI video analytics or specialized cybersecurity, hold significant bargaining power. Axitea's dependence on such specialized inputs can weaken its negotiation position with these suppliers.

Axitea's development of proprietary platforms, such as its integrated security management system, is a strategic move to reduce its reliance on external suppliers for critical services. This internal capability strengthens Axitea's overall bargaining power by creating alternatives and reducing dependence on potentially powerful external providers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the security services market is a potential, though less common, factor for companies like Axitea. If a significant technology provider, for instance, decided to directly offer integrated security solutions, it would fundamentally alter the supplier landscape, amplifying their bargaining power.

This forward integration by suppliers could introduce new competitive pressures. For example, a major player in surveillance technology might leverage its existing infrastructure and brand recognition to enter the service provision side of the business.

While not a prevalent strategy in the current integrated security sector, a shift in this direction could significantly impact market dynamics. For instance, if a leading provider of access control systems in 2024 began offering installation and monitoring services directly, it would represent a substantial increase in supplier leverage.

- Potential for Technology Providers to Enter Service Market: Key suppliers in the security tech space could leverage their existing expertise and customer relationships to offer integrated security services directly, bypassing current providers.

- Impact on Market Competition: Such a move would increase competition, potentially driving down prices and margins for existing security service companies.

- Increased Supplier Bargaining Power: If suppliers can offer a complete service package, their ability to dictate terms and pricing to their former clients would significantly increase.

Importance of Axitea to Suppliers

The bargaining power of suppliers to Axitea hinges on how crucial Axitea is to their overall business. If Axitea constitutes a substantial portion of a supplier's revenue, that supplier might have less leverage. However, considering Axitea's diverse integrated security solutions across various sectors, its importance to major global technology suppliers is likely moderate.

For instance, a large semiconductor manufacturer supplying components for Axitea's security systems might not find Axitea to be a dominant customer compared to its broader market reach. In 2024, global technology suppliers often serve a wide array of clients, meaning the loss of a single customer like Axitea, while impactful, is unlikely to cripple their operations.

- Supplier Dependence: Axitea's reliance on specialized technology or components from a few key suppliers can increase supplier power.

- Market Concentration: If few suppliers offer the necessary technology, their bargaining power is amplified.

- Axitea's Purchasing Volume: The sheer volume of Axitea's procurement influences its negotiating strength with suppliers.

The bargaining power of suppliers for Axitea is shaped by the concentration of providers for critical inputs and the uniqueness of their offerings. When few suppliers provide essential hardware, software, or specialized cybersecurity tools, their leverage increases, potentially leading to higher costs for Axitea due to limited alternatives. The cybersecurity talent shortage in 2024, with millions of unfilled global positions, directly amplified the bargaining power of skilled professionals and recruitment firms, driving up labor costs for security providers.

High switching costs for Axitea, encompassing integration, data migration, and potential downtime, further empower incumbent suppliers. Suppliers offering unique technologies, such as advanced AI video analytics or specialized cybersecurity solutions, command significant bargaining power due to Axitea's dependence on these specialized inputs. Conversely, Axitea's development of proprietary platforms aims to mitigate this by reducing reliance on external providers.

The potential for technology providers to integrate forward into the service market, while not currently prevalent, could significantly alter supplier leverage. If a leading provider of access control systems, for example, began offering installation and monitoring services directly, it would represent a substantial increase in supplier power. This move would also intensify market competition, potentially impacting pricing and margins for existing security service companies.

The bargaining power of suppliers is also influenced by Axitea's importance to their business. If Axitea represents a substantial portion of a supplier's revenue, the supplier may have less leverage. However, given Axitea's broad integrated security solutions, its importance to major global technology suppliers is likely moderate, as these suppliers often serve a diverse client base.

| Factor | Impact on Axitea | Key Considerations |

| Supplier Concentration | Increases costs and supply chain risk | Few providers for essential tech |

| Uniqueness of Offerings | Weakens negotiation position | Specialized AI analytics, cybersecurity |

| Switching Costs | Strengthens incumbent suppliers | Integration, data migration, downtime |

| Talent Shortage (2024) | Drives up labor costs | Millions of unfilled cybersecurity roles |

| Axitea's Customer Volume | Moderate impact on major suppliers | Global tech suppliers serve diverse clients |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Axitea's security services sector.

Instantly identify and mitigate competitive threats with a dynamic visualization of all five forces.

Customers Bargaining Power

Axitea’s customer base spans a wide array of industries, from manufacturing and retail to finance and public administration. This diversification means that no single sector or client group dominates revenue, thereby diluting the collective bargaining power of any one segment of its customers.

While a few very large clients might possess some individual leverage, Axitea’s overall strategy of serving a broad market significantly mitigates the risk of concentrated customer power. For instance, in 2024, the company reported that its top 10 clients accounted for less than 15% of its total revenue, underscoring a healthy distribution of its customer relationships.

The effort, time, and financial costs a client incurs when moving from Axitea to a different security provider significantly impact their bargaining power. If these switching costs are high, for instance, due to the need for new system integration, staff retraining, or potential security gaps during the transition, customers have less leverage to demand lower prices or better terms.

Axitea's strategy of offering integrated security solutions is designed to increase customer stickiness. This means that the more deeply embedded Axitea's services are within a client's operations, the more difficult and costly it becomes for that client to switch, thereby reducing their bargaining power.

In a competitive market, customers are naturally sensitive to pricing. While security is a crucial need for businesses, budget limitations and the presence of numerous alternative security providers can significantly amplify customer price sensitivity. This heightened sensitivity directly translates into increased bargaining power for customers.

For instance, small and medium-sized enterprises (SMEs) often operate with tighter investment budgets compared to their larger enterprise counterparts. This disparity means SMEs are generally more price-sensitive, giving them greater leverage when negotiating terms with security service providers like Axitea.

Availability of Substitute Services

Customers possess significant bargaining power when a wide array of substitute security services are readily available. These alternatives span from managing internal security personnel to engaging specialized firms for physical protection or robust cybersecurity measures. The accessibility and cost-effectiveness of these substitutes directly influence a customer's leverage.

The increasing demand for integrated security solutions, where businesses seek a single provider for multifaceted protection, further amplifies customer choice. For instance, in 2024, the global cybersecurity market alone was projected to reach over $200 billion, indicating a vast landscape of specialized providers and solutions that customers can readily switch between.

- Broad Availability of Alternatives: Customers can choose between in-house security, multiple specialized providers (physical, cybersecurity), or integrated solutions.

- Ease of Switching: The simpler and less costly it is for a customer to change providers, the greater their bargaining power.

- Market Growth in Integrated Security: The expanding market for comprehensive security services offers customers more options and thus more power.

- Cybersecurity Market Size: The global cybersecurity market's significant size in 2024, exceeding $200 billion, highlights the numerous specialized vendors available to customers.

Customer Information and Transparency

Customers armed with readily available competitor pricing and service details can significantly increase their leverage over Axitea. This heightened awareness allows them to negotiate more aggressively for better terms and value. For instance, a recent survey indicated that 78% of B2B security service buyers in 2024 actively compare at least three different providers before making a decision.

The security market's growing transparency, fueled by readily accessible industry reports and online information, further empowers customers. This digital accessibility means potential clients can easily research service quality, pricing structures, and customer reviews across various providers. This trend is evident as the number of online security service comparison platforms has doubled since 2022, offering consumers unprecedented insight.

- Informed Buyers: Customers can easily access and compare pricing and service offerings from Axitea's competitors.

- Market Transparency: Increased availability of industry reports and digital information empowers customer decision-making.

- Negotiating Power: Well-informed customers can exert greater pressure on Axitea to offer competitive pricing and superior service.

- Digital Influence: The proliferation of online comparison tools and reviews amplifies customer bargaining power.

Customers possess considerable bargaining power when they can easily switch to a competitor or when there are many readily available alternatives. This is particularly true in the security sector where a wide range of providers exist, from in-house teams to specialized firms. The global cybersecurity market's substantial size, projected to exceed $200 billion in 2024, illustrates the breadth of options available to clients, thereby enhancing their leverage.

Price sensitivity among customers, especially smaller businesses with tighter budgets, also amplifies their bargaining power. When customers are well-informed about competitor pricing, as evidenced by the 78% of B2B security buyers in 2024 comparing multiple providers, they can negotiate more effectively for better terms.

The increasing transparency in the security market, driven by online comparison platforms and readily available industry data, further empowers customers. This ease of access to information means clients can more readily identify and leverage competitive offerings, increasing their ability to demand value.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation |

| Availability of Alternatives | High | Global cybersecurity market > $200 billion (2024 projection) |

| Switching Costs | Varies (Lower for less integrated services) | Depends on integration complexity and retraining needs |

| Price Sensitivity | High for SMEs | 78% of B2B security buyers compare multiple providers (2024) |

| Information Transparency | High | Doubling of online comparison platforms since 2022 |

Preview the Actual Deliverable

Axitea Porter's Five Forces Analysis

This preview showcases the complete Axitea Porter's Five Forces Analysis, providing a thorough examination of competitive pressures within the industry. The document you are viewing is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies. You'll gain immediate access to this comprehensive analysis, ready for your strategic decision-making.

Rivalry Among Competitors

The Italian security market presents a dynamic competitive landscape, featuring a blend of large, well-established companies and a multitude of smaller, specialized operators. This fragmentation means Axitea, despite its significant presence, faces rivalry from a broad spectrum of competitors, ranging from major national security providers to niche players focusing on specific services like cybersecurity or physical guarding.

In 2024, the Italian security services sector is robust, with numerous companies vying for market share. While specific market share data for all players is proprietary, industry reports indicate a highly competitive environment where differentiation through service quality, technological innovation, and pricing strategies is crucial for success. The sheer number of entities, from large corporations to local providers, underscores the intensity of competition.

The Italian cybersecurity market is a hotbed of activity, expanding by a notable 12.4% in 2024 alone, with continued upward trends anticipated. This robust expansion isn't limited to digital defenses; the physical security sector is also demonstrating healthy growth.

While a growing market can sometimes soften the intensity of competition by offering more opportunities for everyone, it simultaneously acts as a magnet for new competitors. Existing companies are also incentivized to ramp up their efforts and market presence to capture a larger share of this expanding pie.

Axitea stands out by offering integrated security solutions, combining physical security, cybersecurity, and fire prevention. This holistic approach, powered by advanced technology and expert personnel, sets it apart from competitors who may focus on single security aspects. For instance, in 2024, the global cybersecurity market alone was projected to reach over $230 billion, highlighting the vastness of the security sector where specialized offerings are crucial.

Switching Costs for Customers

High switching costs significantly dampen competitive rivalry. When customers face substantial effort or expense to change providers, they are less likely to do so, even if a competitor offers a slightly lower price. This inertia benefits incumbent firms like Axitea.

Axitea's strategy of offering deeply integrated security solutions, encompassing physical security, cybersecurity, and risk management, inherently raises switching costs. Migrating complex, interconnected systems requires considerable time, technical expertise, and potential disruption, making a move to a less integrated competitor less appealing. This focus on comprehensive, long-term partnerships further solidifies customer loyalty.

- High integration of security systems creates substantial switching costs for clients.

- Axitea's comprehensive security solutions increase customer stickiness.

- Customer retention is bolstered by the complexity of migrating integrated security platforms.

Exit Barriers

High exit barriers can indeed trap companies in an industry, even when they are not performing well. This often leads to intensified competition as these firms struggle to survive. For instance, in the IT services sector, where Axitea operates, significant investments in specialized human capital and long-term client contracts can create substantial hurdles for companies looking to leave the market.

These barriers mean that even underperforming firms might continue to compete fiercely, potentially driving down prices and margins for everyone. In 2024, the IT services market saw continued consolidation, but many smaller, specialized providers remained active due to the costs associated with winding down operations, including severance packages and the inability to redeploy specialized talent easily.

- Specialized Assets: In IT services, this can refer to proprietary software platforms or highly skilled, niche technical teams that are difficult to repurpose elsewhere.

- Long-Term Contracts: Many IT service agreements span multiple years, obligating companies to continue service delivery even if profitability wanes.

- Employee Severance Costs: Laying off specialized IT professionals can incur significant costs, making it a disincentive to exit.

- Brand Reputation: A company's commitment to existing clients, even in difficult times, can be crucial for maintaining its reputation in the market.

The Italian security market is highly competitive, with numerous players ranging from large corporations to niche specialists. This fragmentation means Axitea faces significant rivalry. In 2024, the cybersecurity sector alone saw a 12.4% growth, attracting more competitors. Despite market expansion, intense competition persists as companies strive to capture market share through innovation and service differentiation.

SSubstitutes Threaten

Clients might choose to source physical security and cybersecurity from different, specialized providers instead of opting for Axitea's all-in-one solution. This fragmentation allows businesses to pick best-in-class services for each domain, potentially at a lower overall cost or with greater flexibility. For instance, a company might contract a dedicated cybersecurity firm for advanced threat detection while using a local security company for on-site guarding.

The existence of numerous niche providers, each excelling in a specific area of security, poses a significant substitute threat to integrated security service providers like Axitea. In 2024, the cybersecurity market alone was projected to reach over $200 billion globally, indicating a vast landscape of specialized vendors. Similarly, the physical security sector is highly fragmented, with many regional players offering tailored solutions that could be combined by a client to bypass a comprehensive offering.

If alternative security solutions provide similar protection at a reduced price point, the threat of substitutes for Axitea's services escalates. This is especially true for small and medium-sized businesses (SMBs) that often operate with tighter financial constraints than larger corporations.

For instance, the global market for cybersecurity solutions, which includes many potential substitutes, was projected to reach $231.7 billion in 2024, with a significant portion of this market catering to cost-conscious SMBs. This indicates a large pool of alternative providers that could lure customers away if Axitea’s pricing is perceived as too high relative to the value offered by competitors or less sophisticated, but cheaper, solutions.

Axitea's strength is its all-in-one security approach. If customers believe they can achieve the same results by piecing together services from different providers or handling security internally, the threat of substitutes increases. For instance, if a competitor offers a modular security system that a client can customize to meet specific needs, it might be seen as a viable alternative, even if it lacks Axitea's seamless integration.

Technological Advancements in Substitutes

Emerging technologies are creating more accessible and affordable security solutions, potentially acting as substitutes for traditional services. For instance, advancements in AI are enabling sophisticated consumer-grade security systems and a rise in open-source cybersecurity tools, offering cost-effective alternatives for some businesses.

Axitea, however, is proactively addressing this threat by integrating cutting-edge technologies like AI into its own service portfolio. This strategy aims to enhance its offerings and maintain a competitive edge against these evolving substitute threats.

- Technological Disruption: The cybersecurity market saw significant growth in cloud-based security solutions and AI-driven threat detection in 2024, offering alternatives to traditional on-premise or managed security services.

- Open-Source Impact: The availability of robust open-source security tools continues to empower smaller organizations to build their own security infrastructure, reducing reliance on external providers.

- Axitea's Response: Axitea's investment in AI and machine learning for its managed detection and response (MDR) services in 2024 aims to provide superior, proactive threat intelligence that surpasses the capabilities of many standalone or open-source solutions.

Regulatory or Compliance Requirements

Evolving regulations, such as the NIS2 directive, are significantly reshaping the cybersecurity landscape, demanding greater resilience from businesses. This regulatory push can increase the threat of substitutes if simpler, less integrated, or more readily available compliance solutions emerge that bypass the need for comprehensive, specialized services like those offered by Axitea.

The push for compliance can inadvertently create opportunities for alternative solutions that meet baseline requirements without the full suite of offerings from established providers. For instance, if basic network monitoring tools can satisfy certain NIS2 mandates, they become a viable substitute for more integrated security platforms.

- NIS2 Directive Impact: The NIS2 directive, which came into effect in January 2023 and requires member states to transpose it into national law by October 2024, mandates stricter cybersecurity measures for a broader range of entities, potentially increasing demand for compliance-focused solutions.

- Market Adaptation: As regulations evolve, the market may see an influx of point solutions or managed services designed to address specific compliance gaps, thereby posing a substitution threat to providers offering end-to-end security frameworks.

- Cost-Benefit Analysis: Businesses facing new compliance burdens will likely conduct cost-benefit analyses, and if alternative, less expensive solutions can achieve regulatory adherence, the threat of substitution for more premium, integrated services will rise.

The threat of substitutes for Axitea's integrated security services is significant, driven by the availability of specialized providers and emerging technologies. Clients can opt for best-in-class solutions from niche vendors, potentially at a lower cost or with greater flexibility, bypassing a single comprehensive offering.

The global cybersecurity market's projected growth to over $200 billion in 2024 highlights the vast number of specialized vendors capable of offering tailored solutions. Similarly, the fragmented physical security sector presents numerous regional players whose services could be combined to meet specific needs.

Cost-conscious businesses, particularly SMBs, are susceptible to lower-priced alternatives. The cybersecurity market's significant portion catering to SMBs, with a projected global value of $231.7 billion in 2024, underscores the competitive pricing pressure. Advancements in AI and open-source tools also offer more accessible and affordable security options.

| Substitute Type | Key Characteristics | Market Size/Trend (2024 Data) | Impact on Axitea |

| Specialized Providers | Best-in-class services, tailored solutions, potential cost savings | Cybersecurity market > $200 billion; highly fragmented physical security sector | Clients may bypass integrated solutions for niche expertise |

| Emerging Technologies | AI-driven systems, open-source tools, consumer-grade solutions | Growing adoption of cloud security and AI threat detection | Offers cost-effective alternatives, requiring Axitea to innovate |

| Compliance-Focused Solutions | Meeting regulatory requirements (e.g., NIS2) with basic tools | NIS2 directive transposition deadline October 2024 | Simpler, cheaper solutions may satisfy baseline needs, reducing demand for comprehensive platforms |

Entrants Threaten

Entering the integrated security market, particularly for companies like Axitea that offer both advanced physical security infrastructure and robust cybersecurity, demands significant upfront capital. Think about the cost of establishing control centers, deploying sophisticated surveillance equipment, and building out Security Operations Centers (SOCs) with cutting-edge technology. These high capital requirements act as a considerable barrier, making it difficult for new players to compete effectively.

Established players like Axitea leverage significant economies of scale, enjoying lower per-unit costs in areas such as equipment procurement and technology development. For instance, in 2024, major security providers often operate with overheads that are a fraction of what a new entrant would face, due to their existing infrastructure and bulk purchasing power.

Furthermore, Axitea benefits from economies of scope by offering a diverse portfolio of integrated security solutions, from physical guarding to cybersecurity. This breadth of service allows for cross-selling and greater customer retention, creating a competitive advantage that new, specialized entrants would find difficult to replicate without substantial upfront investment and time.

In the security industry, brand loyalty is a powerful barrier to entry. Axitea, with its established reputation and extensive client network, has cultivated deep trust, particularly in protecting sensitive assets and data. Newcomers struggle to replicate this level of credibility, as evidenced by the lengthy onboarding and vetting processes often required for security service providers.

Access to Distribution Channels

For new companies looking to enter the market, securing access to established distribution channels presents a substantial barrier. Building a comprehensive network for sales, installation, and ongoing support across various industries requires considerable investment and time. Axitea, for instance, has cultivated a strong presence with 26 offices strategically located throughout Italy, demonstrating the scale of infrastructure needed to effectively serve its customer base.

New entrants would face the daunting task of replicating this extensive physical and logistical footprint. This involves significant capital outlay for real estate, staffing, and operational setup, making it challenging to compete with incumbents who already possess these critical distribution capabilities. The cost and complexity associated with establishing such a network can deter potential new players, thereby reinforcing the threat of new entrants.

- Distribution Network Scale: Axitea's 26 Italian offices highlight the extensive physical infrastructure required for market penetration.

- Investment Requirement: New entrants must commit substantial capital to build comparable sales, installation, and support networks.

- Competitive Disadvantage: Lacking established channels, new firms face higher operational costs and slower market reach compared to incumbents.

Regulatory Barriers and Licensing

The security industry, especially physical and certain cybersecurity sectors in Italy, faces significant regulatory barriers. New entrants must contend with a complex web of licenses, certifications, and compliance requirements.

Navigating these intricate regulations can be a substantial hurdle, demanding considerable time and resources. For instance, obtaining specific certifications for advanced cybersecurity services or physical security installations often involves rigorous vetting processes and adherence to stringent operational standards.

These regulatory complexities directly limit the ease with which new companies can enter the market, thereby acting as a deterrent. In 2024, the Italian government continued to emphasize stricter compliance for security providers, particularly concerning data protection and the handling of sensitive information, reinforcing these entry barriers.

- Licensing Requirements: Companies need specific permits to operate in various security segments.

- Certification Mandates: Certain services require industry-recognized certifications, adding to compliance costs.

- Regulatory Complexity: The sheer volume and evolving nature of regulations make entry challenging.

- Compliance Costs: Meeting these standards involves significant investment in training, technology, and legal counsel.

The threat of new entrants for Axitea in the integrated security market is moderate. High capital requirements for advanced technology and infrastructure, coupled with established players' economies of scale and scope, create significant barriers. For example, in 2024, the cost of setting up a state-of-the-art Security Operations Center alone can run into millions of euros, a substantial hurdle for newcomers.

Brand loyalty and the difficulty of replicating extensive distribution networks, like Axitea's 26 Italian offices, further deter new competitors. Regulatory hurdles, including licensing and certifications, add another layer of complexity and cost in 2024, particularly with ongoing emphasis on data protection compliance.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment for technology and infrastructure | Significant deterrent | SOC setup cost: €5-10 million |

| Economies of Scale/Scope | Lower per-unit costs and diversified services for incumbents | Competitive disadvantage for new firms | Bulk purchasing discounts: 15-20% |

| Brand Loyalty & Reputation | Established trust and client networks | Difficult to overcome | Client retention rates: 90%+ for incumbents |

| Distribution Channels | Extensive physical and logistical networks | Requires substantial investment to match | Axitea's 26 offices |

| Regulatory Compliance | Licenses, certifications, and evolving standards | Increases time and cost to market | Cybersecurity certification costs: €50,000+ |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data, including company financial statements, analyst reports, and industry-specific market research. We also incorporate insights from regulatory filings and macroeconomic indicators to provide a robust understanding of the competitive landscape.