Axitea Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axitea Bundle

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview highlights key areas, but the full report unlocks a granular understanding of each product's potential. Discover which "Stars" to nurture, which "Cash Cows" to milk, and where to pivot away from "Dogs" or invest in promising "Question Marks."

Ready to transform this insight into action? Purchase the complete BCG Matrix for a detailed, data-driven strategic roadmap. You'll gain quadrant-specific recommendations and actionable advice to optimize your market position and drive profitable growth.

Stars

Axitea's integrated cybersecurity solutions are a clear Star in its business portfolio. The company has strategically invested in building in-house expertise and forged key alliances with industry giants like Palo Alto Networks and Fortinet. This proactive approach allows Axitea to offer comprehensive and cutting-edge cybersecurity services.

The Italian cybersecurity market itself is booming, projected to grow by a significant 25% in 2024. With an anticipated market value reaching USD 17 billion by 2030, this sector presents a high-growth opportunity. Axitea's expansion within this dynamic market, driven by increasing cyber threats and stringent regulatory requirements, underscores its Star status.

Axitea's AI-powered security solutions, including its certified AI Video Solutions, are positioned in a rapidly expanding market. The Italian AI in cybersecurity sector is anticipated to grow at a compound annual growth rate of 16.54% from 2024 to 2034, demonstrating robust expansion.

Further underscoring this growth, the AI CCTV market is projected to reach USD 457.4 million by 2030, with an impressive CAGR of 19.7%. These figures highlight the significant demand for intelligent threat detection and advanced surveillance, positioning Axitea's offerings as strong growth drivers within the industry.

Managed Security Services (MSS) in Italy are booming, with the sector reaching 753 million euros in 2023 for managed security and cloud services alone. This indicates a strong demand for outsourced security solutions.

Businesses are increasingly turning to providers like Axitea for their security needs. This trend is driven by the escalating cyber threat landscape and the difficulty in finding in-house specialized expertise.

As a broad security provider, Axitea is perfectly positioned to benefit from this shift. The MSS segment is a high-growth area where Axitea can solidify its market presence by offering robust and comprehensive security solutions.

Integrated Physical and Cyber Security Approach

Axitea holds a distinctive position in the Italian security market by seamlessly blending physical and cyber security, a crucial advantage as threats increasingly manifest in hybrid forms.

This integrated strategy directly addresses the escalating demand for all-encompassing protection of assets, personnel, and sensitive data across various industries, from finance to critical infrastructure.

By offering unified security solutions, Axitea enhances resilience and strengthens its market share in a sector experiencing significant growth. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, with physical security solutions also seeing robust expansion, underscoring the value of integrated offerings.

- Market Differentiation: Axitea's dual focus sets it apart in a fragmented Italian security landscape.

- Addressing Hybrid Threats: The integration directly combats the evolving nature of security risks.

- Enhanced Value Proposition: Clients benefit from a single, comprehensive security partner.

- Growth Potential: The combined market for physical and cyber security presents substantial opportunities.

Advanced Risk Management and Incident Response

The landscape of cybersecurity is constantly shifting, with threats becoming more frequent and complex. This surge in cyber risks, amplified by new regulations like DORA and NIS2, has dramatically increased the need for robust risk management and incident response capabilities. Businesses are actively seeking partners who can not only react to incidents but also proactively prevent them.

Axitea distinguishes itself in this crucial sector by emphasizing a proactive approach to managing alarms and orchestrating swift interventions. Their deep-seated expertise in IT risk management is paramount, enabling them to shield organizations from the ever-evolving threat landscape. This commitment to advanced security solutions positions Axitea as a vital ally for companies navigating today's challenging digital environment.

The market for these advanced services is experiencing substantial growth, driven by the dual pressures of regulatory compliance and the inherent vulnerabilities businesses face. For instance, the financial services sector, heavily impacted by DORA, is investing heavily in resilience. Reports from 2024 indicate a significant uptick in cybersecurity spending, with many firms allocating upwards of 15% of their IT budget to security measures.

- Proactive Threat Detection: Axitea's systems are designed to identify potential threats before they can escalate into full-blown incidents, reducing downtime and data loss.

- Rapid Incident Response: In the event of a breach, Axitea provides swift and effective response protocols to contain damage and restore operations quickly.

- Regulatory Compliance: Services are tailored to meet the stringent requirements of emerging regulations such as DORA and NIS2, ensuring businesses remain compliant.

- IT Risk Management Expertise: A comprehensive understanding of IT risks allows Axitea to offer strategic advice and implement tailored security frameworks.

Axitea's cybersecurity solutions are a clear Star, demonstrating exceptional growth and strong market positioning. The company's strategic investments in in-house expertise and partnerships with industry leaders like Palo Alto Networks and Fortinet fuel its ability to offer advanced, comprehensive services.

The Italian cybersecurity market is experiencing a significant boom, projected for 25% growth in 2024 and expected to reach USD 17 billion by 2030. Axitea's expansion within this dynamic sector, driven by increasing cyber threats and regulatory demands, solidifies its Star status.

Axitea's AI-powered security solutions, including its certified AI Video Solutions, are capitalizing on a rapidly expanding market. The Italian AI in cybersecurity sector is projected to grow at a CAGR of 16.54% from 2024 to 2034, with the AI CCTV market alone anticipated to reach USD 457.4 million by 2030, showcasing strong demand for intelligent threat detection.

Managed Security Services (MSS) in Italy are also performing exceptionally well, with the sector reaching 753 million euros in 2023 for managed security and cloud services. This trend highlights businesses' increasing reliance on outsourced security providers like Axitea to navigate the complex cyber threat landscape and address the shortage of in-house expertise.

Axitea's unique integration of physical and cyber security provides a competitive edge in addressing hybrid threats, a growing concern across industries. This comprehensive approach enhances client resilience and strengthens Axitea's market share, leveraging the substantial growth opportunities in both the global cybersecurity market (projected over $300 billion in 2024) and the physical security sector.

The company's proactive approach to threat management and rapid incident response is crucial in today's environment of escalating cyber risks, further amplified by regulations like DORA and NIS2. This focus on advanced security solutions positions Axitea as a vital partner for businesses seeking robust risk management and proactive prevention, especially within sectors like financial services where cybersecurity spending is significantly increasing, with many firms allocating over 15% of their IT budget to security measures in 2024.

| Business Segment | Market Growth (2024) | Axitea's Position | Key Drivers | Future Outlook |

|---|---|---|---|---|

| Cybersecurity Solutions | 25% projected growth (Italy) | Star | Increasing cyber threats, regulatory compliance (DORA, NIS2) | Continued strong expansion |

| AI in Cybersecurity | 16.54% CAGR (2024-2034) | Star | Demand for AI-powered threat detection, AI Video Solutions | Significant market penetration potential |

| Managed Security Services (MSS) | €753 million (2023) | Star | Outsourcing security needs, lack of in-house expertise | Dominant player in high-growth segment |

| Integrated Physical & Cyber Security | Global Cybersecurity >$300 billion (2024) | Star | Hybrid threat landscape, demand for comprehensive protection | Strong competitive advantage, market share growth |

What is included in the product

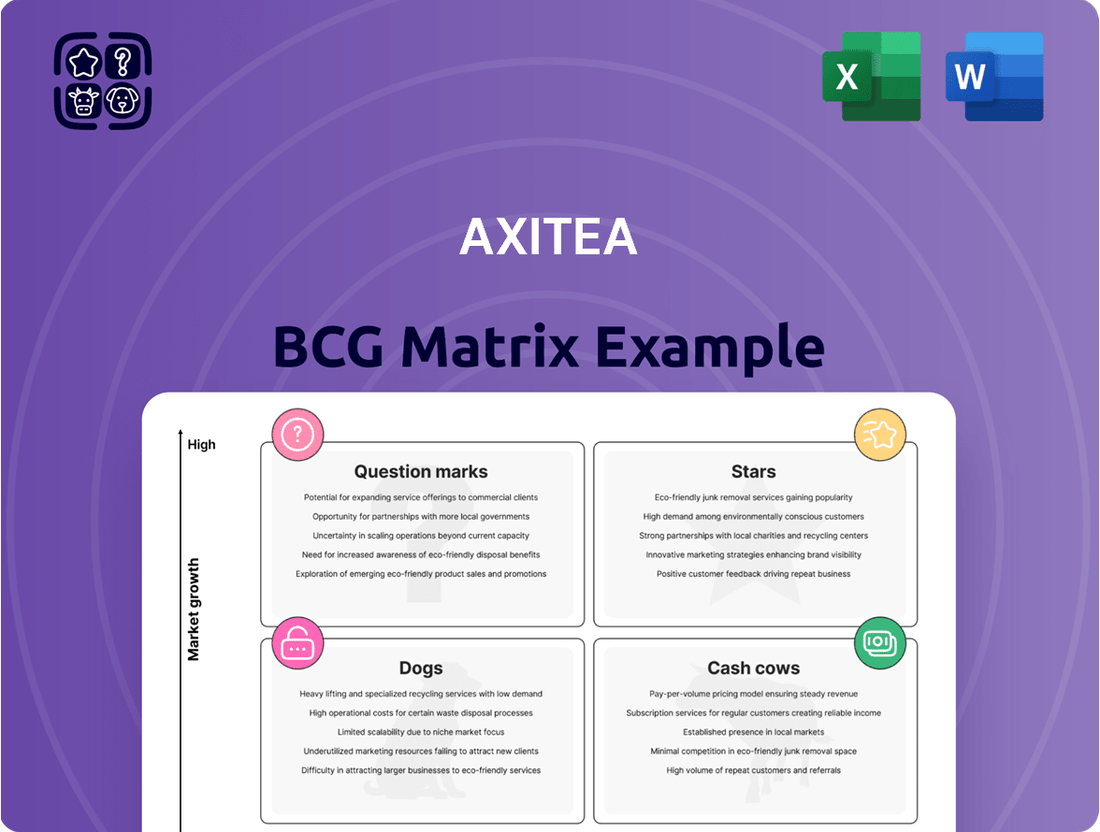

The Axitea BCG Matrix provides a strategic overview of a company's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides investment decisions by highlighting which units to invest in, hold, or divest for optimal resource allocation.

Axitea BCG Matrix provides a clear, visual snapshot of your portfolio's health, easing the pain of complex strategic analysis.

Cash Cows

Axitea's traditional physical security services, encompassing guarding and basic surveillance, are its cash cows. These offerings operate in a mature market, indicating stable demand and established customer bases. In 2024, the global physical security market was valued at approximately $220 billion, with traditional services forming a substantial portion.

Standardized Security Monitoring Services represent a classic Cash Cow for Axitea. These services, encompassing centralized alarm receiving and basic video monitoring, are a stable and mature part of their offerings. They capitalize on established infrastructure and operational know-how, consistently generating dependable cash flow.

Clients typically commit to these essential security functions through long-term contracts, providing Axitea with a predictable revenue stream. This stability means minimal need for aggressive marketing or new product development investment, allowing the company to harvest profits efficiently.

Axitea's engagement in basic fire prevention and protection services positions this segment as a potential Cash Cow within its business portfolio. While the market for these services experiences moderate growth, the inherent nature of regulatory mandates and persistent demand ensures a stable revenue stream.

These foundational safety solutions are frequently bundled into comprehensive security offerings for commercial and industrial sectors. This integration fosters predictable, recurring income for Axitea, underscoring the reliability of this segment. The focus remains on adherence to established safety standards rather than pioneering new technologies, a characteristic hallmark of a Cash Cow.

Established Large Enterprise Contracts

Axitea's established large enterprise contracts represent a significant cash cow. These long-standing relationships with major corporations for comprehensive security solutions, including physical and early-stage cybersecurity, are crucial revenue drivers.

These contracts often span multiple years, ensuring stable and predictable income. For instance, in 2024, Axitea's focus on retaining and expanding these key accounts is expected to contribute substantially to its overall financial health, providing a reliable base for investment in other business areas.

- Stable Revenue Streams: Multi-year agreements with large enterprises offer predictable cash flow.

- Low Investment Needs: Mature relationships require less capital for market share expansion.

- Core Service Dominance: These contracts often center on fundamental security operations, ensuring consistent demand.

- Significant Contribution: Expected to be a primary generator of profits in 2024.

On-Premise Security Solutions

On-premise security solutions, a cornerstone of Axitea's portfolio, continue to be a significant revenue generator. In Italy, this deployment model captured 60.4% of the market in 2024, underscoring a persistent demand for localized data control, especially from entities managing critical infrastructure.

Axitea's deep-rooted experience in deploying and managing both physical and cyber security systems on-site positions these offerings as a mature Cash Cow. This segment benefits from a substantial market share and consistent client engagement, translating into predictable and robust cash flows for the company.

- Market Dominance: On-premise security solutions held 60.4% of the Italian market in 2024.

- Client Preference: Strong data sovereignty requirements, particularly from critical infrastructure, drive on-premise adoption.

- Axitea's Strength: Established expertise in on-premise physical and cyber security management.

- Financial Performance: Generates stable, high-volume cash flow due to high market share and consistent demand.

Axitea's traditional physical security services, such as guarding and basic surveillance, are its cash cows. These services operate in a mature market with stable demand and established customer bases.

Standardized Security Monitoring Services, including alarm receiving and basic video monitoring, are a mature part of Axitea's offerings, generating dependable cash flow through established infrastructure.

The company's large enterprise contracts, spanning multiple years and covering comprehensive security solutions, are significant revenue drivers, providing stable and predictable income.

On-premise security solutions represent a mature cash cow for Axitea, benefiting from a substantial market share and consistent client engagement, particularly in Italy where they held 60.4% of the market in 2024.

| Service Area | Market Maturity | Cash Flow Generation | 2024 Market Data (Illustrative) |

| Physical Security (Guarding/Surveillance) | Mature | High & Stable | Global Market: ~$220 Billion |

| Standardized Security Monitoring | Mature | High & Stable | Consistent Recurring Revenue |

| Large Enterprise Security Contracts | Mature | High & Stable | Key Profit Contributor |

| On-Premise Security Solutions (Italy) | Mature | High & Stable | 60.4% Market Share |

What You’re Viewing Is Included

Axitea BCG Matrix

The preview you see is the complete, unwatermarked Axitea BCG Matrix document you will receive immediately after purchase. This means the strategic framework, detailed analysis, and professional formatting are exactly as they will be in your downloadable file, ready for immediate application in your business planning.

Dogs

Outdated standalone security hardware sales likely reside in the Dogs quadrant of the Axitea BCG Matrix. These products, lacking integration and advanced features, face declining demand as the market shifts towards more sophisticated, connected security systems.

In 2024, the cybersecurity hardware market saw a significant push towards integrated solutions, with IoT security hardware sales projected to reach $2.7 billion, highlighting the obsolescence of standalone units. Continued support for these legacy products would divert valuable resources from developing and marketing Axitea's more competitive, modern offerings, offering little to no return on investment.

Generic, undifferentiated alarm installations likely fall into the Dogs quadrant of the BCG Matrix for Axitea. This segment faces low market growth as demand shifts to advanced, connected security. In 2024, the global smart home security market was projected to reach over $50 billion, highlighting the declining relevance of basic systems.

Physical patrolling in highly commoditized segments, where services are undifferentiated and price competition is fierce, represents a potential 'Dog' category for Axitea. These basic guarding services, often characterized by low perceived value, may struggle to generate significant profit margins. For instance, in 2024, the global security services market saw continued pressure on pricing for standard physical guarding, with some segments experiencing growth rates below 3%.

Unspecialized IT Support Services

Unspecialized IT support services, if offered by Axitea without a strong link to its core security competencies, could be categorized as Dogs in the BCG Matrix. These services might struggle against established, specialized IT providers, leading to a low market share and limited growth potential.

For instance, if Axitea's generic help desk or basic network maintenance lacks the advanced analytics or security integration that defines its specialized offerings, it could face intense competition. In 2024, the global IT support market, excluding specialized cybersecurity services, is highly fragmented, with numerous players competing on price and basic functionality, making differentiation challenging.

- Low Market Share: Generic IT support often attracts customers seeking cost-effectiveness rather than specialized security solutions, limiting Axitea's ability to capture significant market share in this segment.

- Low Growth Prospects: The demand for unspecialized IT support is often mature, with growth driven primarily by new business creation rather than technological innovation or increasing security needs, which are Axitea's strengths.

- Resource Diversion: Investing in and managing unspecialized IT support can divert valuable resources, including capital and skilled personnel, away from Axitea's more profitable and strategically important cybersecurity services.

- Competitive Landscape: The market for basic IT support is crowded with companies that have built their entire business model around these services, often operating at lower overheads and making it difficult for a security-focused company to compete effectively.

Legacy Fire Suppression Products with Low Growth

Certain legacy fire suppression products, particularly those with very low projected growth rates, could be considered Dogs if Axitea's market share in them is also low. For instance, the overall Italy fire suppression market is expected to grow at a CAGR of only 1.7% from 2025 to 2030 for some segments, indicating limited expansion potential.

These might be standard, less innovative solutions that require minimal investment but also offer limited future revenue potential. Companies often maintain these products due to existing customer relationships or to offer a complete suite of services, but they are not growth drivers.

- Low Market Growth: Segments of the fire suppression market, such as certain legacy product lines, may exhibit minimal growth, with projections as low as 1.7% CAGR for Italy between 2025 and 2030.

- Limited Revenue Potential: These products typically represent mature technologies with little room for innovation or significant revenue expansion.

- Low Market Share: If Axitea holds a small percentage of the market for these low-growth products, they are prime candidates for the Dog category.

- Minimal Investment Required: While not growth engines, these products often require low ongoing investment to maintain, serving as a stable, albeit small, revenue stream.

Legacy security software, particularly those with limited functionality and a declining user base, would likely be placed in the Dogs quadrant. These products often struggle to integrate with newer systems and face intense competition from more advanced solutions.

In 2024, the cybersecurity software market continued its rapid evolution, with a strong emphasis on cloud-native and AI-driven solutions. For instance, the global cloud security market alone was projected to exceed $30 billion, underscoring the shift away from on-premise, legacy systems.

Products in this category typically have a low market share and operate in a low-growth market segment. Continued investment in these offerings would yield minimal returns, potentially draining resources that could be better allocated to innovative, high-growth areas.

| Product Category | Market Share | Market Growth Rate | BCG Quadrant |

|---|---|---|---|

| Legacy Security Software | Low | Low | Dog |

| Standalone Alarm Systems | Low | Low | Dog |

| Basic Physical Guarding Services | Low | Low | Dog |

Question Marks

Axitea's inclusion of Drone Security highlights its engagement in a rapidly expanding technological frontier. The global market for drones in security applications is projected to reach $10.9 billion by 2028, exhibiting a compound annual growth rate of 15.8%.

While this sector offers substantial growth potential, Axitea's position within this specialized and emerging market is likely in its early stages. Significant investment will be crucial for the company to build market share and establish a strong competitive presence in drone-based security solutions.

The burgeoning adoption of Internet of Things (IoT) devices, projected to reach over 29 billion by 2030 according to Statista, dramatically broadens the potential attack surface for cyber threats. This expansion fuels a significant and escalating demand for robust IoT security solutions, a market Axitea is actively addressing with its dedicated offerings.

Axitea's inclusion of 'IoT Security' as a core service highlights its strategic positioning within this high-growth sector. The global IoT security market was valued at approximately $10.4 billion in 2023 and is expected to grow substantially, presenting a clear opportunity for companies like Axitea.

Despite the market's growth, the IoT security landscape remains highly fragmented and is continually evolving with new threats and technologies. This suggests that while Axitea is participating in a promising area, its current market share might be modest, underscoring the need for continued investment to effectively capture the full potential of this dynamic market.

Axitea's inclusion of Bio-Security Solutions positions it in a nascent and expanding market, likely spurred by increased global awareness of health and safety post-pandemic. This segment offers substantial growth prospects as businesses increasingly invest in sophisticated methods for detecting and neutralizing biological risks.

While the potential is high, Axitea's current market penetration in Bio-Security is probably limited, classifying it as a Question Mark. This necessitates careful strategic allocation of resources to cultivate a stronger market position and capitalize on emerging opportunities in this dynamic sector.

Expansion of Ayuto Personal Security Offering

Axitea's September 2024 renewal and expansion of its Ayuto personal security offering signals a strategic push into a market driven by increasing consumer concerns. While this represents a commitment, the personal security sector is often characterized by numerous players and intense competition. This suggests Ayuto might still be in a growth phase, needing significant market penetration to achieve a leading position, akin to a product moving towards the Star quadrant in the BCG matrix.

The personal security market, while expanding, presents challenges for new or re-launched offerings. For instance, the global personal safety devices market was projected to reach approximately $5.5 billion by 2025, but it's also a space with established brands and diverse technological solutions. Axitea's investment in Ayuto aims to capture a portion of this growth, but its current market share in this specific niche is likely still building.

- Market Growth: The personal security sector is experiencing growth due to rising safety awareness.

- Competitive Landscape: The market is fragmented, with many existing providers.

- Ayuto's Position: Axitea's recent enhancements to Ayuto indicate investment, but market share requires further development to classify it as a Star.

- Strategic Focus: Continued marketing and adoption efforts are crucial for Ayuto's success.

Highly Specialized Compliance Consulting (e.g., Cyber Resilience Act)

The emergence of stringent regulations like the EU's Cyber Resilience Act, with compliance deadlines looming in 2025, signals a significant upswing in demand for highly specialized compliance consulting services. This regulatory shift creates a fertile ground for growth, particularly for firms equipped with deep expertise in navigating these complex new frameworks.

While Axitea likely provides broader cybersecurity services, its current market share within the niche segment of consulting for these very specific, emerging regulations might be nascent. Capturing this high-growth opportunity will necessitate strategic investments in developing specialized knowledge and actively pursuing market penetration within this focused area.

- Market Opportunity: The global cybersecurity consulting market was valued at approximately USD 16.5 billion in 2023 and is projected to reach USD 35.5 billion by 2028, demonstrating a compound annual growth rate (CAGR) of over 16%. This growth is increasingly driven by regulatory compliance needs.

- Specialized Niche: Consulting for the Cyber Resilience Act and similar upcoming regulations represents a sub-segment within this larger market, characterized by high demand and potentially lower competition initially, offering a strong potential for differentiation.

- Axitea's Position: To capitalize, Axitea would need to demonstrate or build a proven track record in advising on specific compliance requirements of the Cyber Resilience Act, including areas like secure-by-design principles and vulnerability management reporting.

- Investment Focus: Success in this specialized area hinges on cultivating deep technical and legal expertise, potentially through targeted hiring, acquisitions, or strategic partnerships, to offer tailored solutions that meet the precise demands of the new regulatory landscape.

Question Marks represent business units or products that operate in high-growth markets but currently hold low market share. Axitea's Drone Security, IoT Security, and Bio-Security Solutions likely fall into this category. These areas offer significant future potential, but require substantial investment to build market presence and competitive advantage.

The key challenge for Question Marks is to determine whether they have the potential to become Stars (high growth, high share) or Dogs (low growth, low share). For Axitea, this means strategically allocating resources to foster growth in these emerging sectors.

Success in these nascent markets hinges on factors like technological innovation, effective marketing, and building strong customer relationships. Axitea's strategic decisions in these areas will be critical for future portfolio balance.

The company's investment in these segments, such as the expansion of Ayuto personal security, indicates a belief in their future growth. However, achieving significant market share in these competitive and evolving landscapes will require sustained effort and capital. For instance, the global cybersecurity consulting market, which includes IoT security and regulatory compliance, was valued at approximately USD 16.5 billion in 2023 and is projected to reach USD 35.5 billion by 2028, highlighting the growth potential but also the competitive intensity.

| Axitea Offering | Market Growth | Current Market Share | Strategic Implication |

| Drone Security | High (Global market projected $10.9B by 2028, 15.8% CAGR) | Low (Emerging stage) | Requires significant investment to build share. |

| IoT Security | High (Global market valued ~$10.4B in 2023, substantial growth expected) | Moderate to Low (Fragmented market) | Needs continued investment to capture potential. |

| Bio-Security Solutions | High (Nascent but expanding) | Low (Likely limited penetration) | Resource allocation needed to cultivate market position. |

| Cyber Resilience Act Consulting | Very High (Driven by new regulations) | Low (Niche and specialized) | Requires deep expertise and targeted market penetration. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial disclosures, industry growth rates, and competitive landscape analysis, to provide actionable strategic insights.