Avianca Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avianca Holdings Bundle

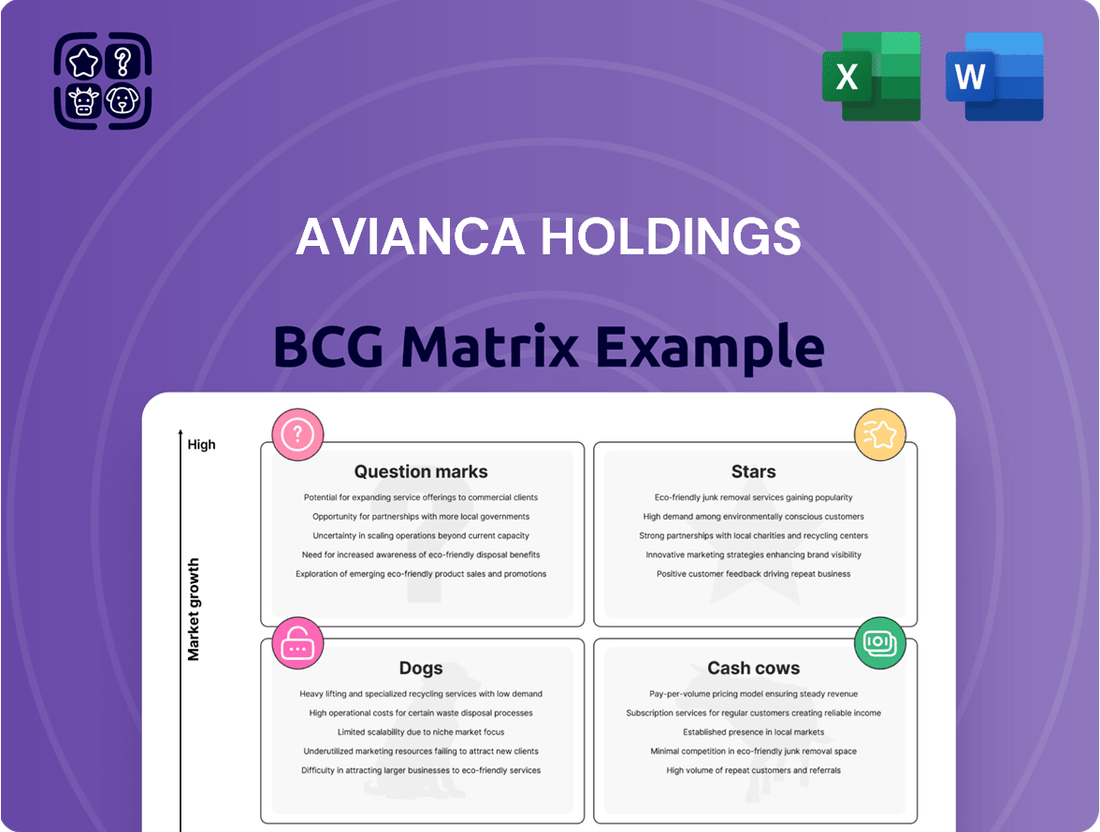

Avianca Holdings' BCG Matrix reveals a dynamic portfolio, with some segments showing strong growth potential while others are mature cash generators. Understanding these positions is crucial for strategic resource allocation and future investment decisions.

This preview offers a glimpse into Avianca's market standing, but the full BCG Matrix report provides a comprehensive breakdown of each business unit's quadrant placement. Unlock detailed insights and actionable strategies to navigate the competitive aviation landscape effectively.

Don't miss out on the complete picture – purchase the full BCG Matrix to gain a clear roadmap for optimizing Avianca's product portfolio and driving sustainable growth.

Stars

Avianca has significantly boosted its international reach, launching new routes to Europe and North America throughout 2024. This strategic move includes planned additions in 2025 like Paris, Chicago, and several Florida cities, directly addressing rising international travel demand.

This aggressive expansion positions Avianca as a crucial link between Latin America and global markets. By leveraging its strong hub infrastructure, the airline aims to capitalize on the increasing desire for cross-continental travel, a trend that saw international passenger numbers for Latin American carriers rebound strongly in late 2023 and early 2024.

Avianca Holdings is demonstrating impressive momentum, having flown a record 38 million passengers in 2024. This figure represents a significant 27% jump from 2019 levels and a solid 19% increase year-on-year, highlighting robust demand and operational success.

This substantial passenger growth, combined with Avianca's established leadership in key markets like Colombia, Ecuador, and Central America, strongly positions it as a dominant player. Its strong market share within these growing regions suggests a healthy and expanding customer base.

Avianca Cargo stands as a dominant force, especially in the lucrative flower transport sector from Colombia and Ecuador. In 2024, the company bolstered its operations with increased capacity and more frequent flights to key markets like the U.S. and Europe, a trend expected to continue into 2025. This strategic focus on high-value, time-sensitive perishables underpins its strong market position.

Hybrid Business Model Success

Avianca Holdings has demonstrated remarkable success with its hybrid business model, a strategic blend of low-cost operational efficiencies and the provision of premium services. This approach allows them to cater to a broad spectrum of travelers, from budget-conscious individuals to those seeking enhanced comfort and amenities, thereby broadening their market reach.

This adaptability is crucial for navigating the competitive aviation landscape. By optimizing operations for cost-effectiveness while simultaneously offering differentiated, higher-value services, Avianca can effectively compete in various market segments and maintain a healthy profit margin. For instance, in 2024, Avianca reported a significant increase in passenger traffic, driven partly by its ability to attract different customer types through its tiered service offerings.

- Hybrid Model Appeal: Attracts both price-sensitive and service-seeking passengers.

- Operational Optimization: Achieves cost efficiencies characteristic of low-cost carriers.

- Revenue Diversification: Generates income from both base fares and ancillary premium services.

- Market Competitiveness: Enables effective competition across various passenger segments.

Enhanced Customer Experience and Loyalty Program

Avianca Holdings has significantly enhanced its customer experience, particularly in premium cabins. Investments in lie-flat seats and gourmet dining on long-haul routes aim to capture a higher-spending demographic. This strategic move is designed to differentiate Avianca in a competitive market.

The airline's LifeMiles loyalty program has seen substantial growth, becoming a key driver of customer retention and engagement. By offering valuable rewards and personalized experiences, Avianca fosters strong customer loyalty. This focus on loyalty is crucial for maintaining a competitive edge and attracting repeat business.

- Enhanced Premium Offerings: Upgraded business and first-class amenities, including lie-flat seats and gourmet menus, cater to discerning travelers.

- LifeMiles Growth: The loyalty program has experienced considerable expansion, boosting customer retention and attracting new members.

- Competitive Advantage: These initiatives strengthen Avianca's market position by appealing to high-value customers and fostering loyalty.

Avianca's cargo operations, particularly its focus on transporting flowers from Colombia and Ecuador, represent a significant Star in its BCG Matrix. In 2024, this segment saw increased capacity and flight frequency to key markets like the U.S. and Europe, capitalizing on high demand for time-sensitive perishables. This strong performance is expected to continue into 2025, solidifying its position as a market leader.

| Business Unit | Market Share | Market Growth | BCG Classification |

|---|---|---|---|

| Avianca Cargo (Perishables) | High | High | Star |

| International Routes (Europe/North America) | Growing | High | Potential Star |

| Domestic Operations (Colombia, Ecuador, Central America) | High | Moderate | Cash Cow |

| LifeMiles Loyalty Program | High | High | Star |

What is included in the product

Avianca Holdings' BCG Matrix analysis categorizes its business units, guiding strategic decisions on investment, divestment, or maintenance based on market share and growth.

The Avianca Holdings BCG Matrix provides a clear, one-page overview, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Avianca's established Latin American network is a significant asset, connecting over 80 destinations across 28 countries. This extensive reach, built over years, provides a solid foundation for consistent revenue generation.

The maturity of this network translates into predictable cash flow. Avianca benefits from its strong presence in key regional markets, allowing it to leverage economies of scale and brand loyalty.

In 2024, Avianca continued to solidify its position, with reports indicating a robust passenger load factor across its Latin American routes, a testament to the enduring demand for its extensive network.

Avianca Holdings exhibits strong cost discipline, evident in its reduced Passenger Costs per Available Seat Kilometer (CASK) excluding fuel. For instance, in the first quarter of 2024, Avianca reported a CASK ex-fuel of 3.6 cents, a notable improvement. This operational efficiency, coupled with a robust on-time performance rate consistently above 85% throughout 2023 and into early 2024, fuels high profit margins.

These efficiencies translate directly into stable, predictable cash flow from Avianca's core flight operations. The airline's commitment to streamlining processes and managing expenses effectively positions its established routes as reliable cash cows within the BCG matrix, generating consistent revenue to support other business ventures.

Avianca is strategically shifting its focus, moving aircraft from the saturated Colombian domestic market to international routes that offer more promising profit margins. This strategic redeployment is a key move to boost revenue by leveraging existing assets in high-demand international travel corridors.

In 2024, Avianca reported a significant increase in its international passenger traffic, with a notable uptick in load factors on routes connecting Colombia to the United States and Europe. This strategic pivot is designed to capitalize on these more lucrative markets, aiming to improve overall profitability.

LifeMiles Loyalty Program Contribution

The LifeMiles loyalty program is a cornerstone of Avianca's financial strength, acting as a significant cash cow. Its ability to generate consistent revenue streams and attract a growing member base, coupled with increasing redemption activity, highlights its robust performance.

This program effectively monetizes Avianca's existing customer relationships, providing a predictable and cost-efficient income source. In 2024, LifeMiles continued to demonstrate its value:

- Revenue Generation: LifeMiles consistently contributes a substantial portion to Avianca's overall revenue, with its financial performance remaining strong.

- Member Growth: The program has seen sustained growth in its active member base, indicating increasing engagement and loyalty.

- Redemption Activity: Higher redemption rates in 2024 suggest a healthy and active program, driving customer satisfaction and repeat business.

- Profitability: LifeMiles operates with a favorable cost structure, making it a highly profitable segment for Avianca Holdings.

Post-Restructuring Financial Strength

Avianca Holdings, post-restructuring, demonstrates considerable financial resilience, a key characteristic of a Cash Cow. The company successfully navigated Chapter 11, emerging with a significantly healthier balance sheet. This strategic maneuver substantially reduced its debt burden, a critical step in solidifying its financial foundation.

This improved financial standing translates directly into robust liquidity. For instance, as of the first quarter of 2024, Avianca reported a strong cash position, enabling it to comfortably cover its operational expenses and debt obligations. This stability is crucial for its Cash Cow status, as it ensures consistent cash generation without the need for external financing for day-to-day activities.

The ability to retain more cash provides Avianca with the necessary capital for reinvestment and strategic initiatives. This internal funding capacity allows the company to maintain its operations efficiently and explore opportunities for growth or optimization within its established market segments. The financial strength achieved allows for sustained profitability and a reliable return on investment.

- Reduced Debt: Avianca significantly lowered its debt levels post-Chapter 11, enhancing its financial flexibility.

- Robust Liquidity: The airline maintains strong cash reserves, ensuring operational continuity and financial stability.

- Cash Generation: The company's stable operations and market position allow for consistent and reliable cash flow generation.

- Investment Capacity: Retained earnings provide capital for necessary investments in fleet modernization and operational improvements.

Avianca's established Latin American network and the LifeMiles loyalty program are key cash cows. These segments generate consistent, predictable revenue streams, allowing Avianca to fund other business areas. The airline's operational efficiency, demonstrated by improved CASK ex-fuel and high on-time performance, further solidifies their cash cow status.

| Segment | Market Position | Revenue Contribution | Growth Potential |

| Latin American Network | Dominant, established | High, consistent | Moderate |

| LifeMiles Loyalty Program | Strong, growing member base | High, recurring | Moderate to High |

Preview = Final Product

Avianca Holdings BCG Matrix

The Avianca Holdings BCG Matrix preview you see is the complete, unwatermarked document you will receive upon purchase, offering a direct insight into the strategic positioning of their business units. This comprehensive analysis, meticulously crafted, will be delivered instantly for your immediate use in strategic planning and decision-making. Rest assured, the preview accurately represents the final, professionally formatted report, ready for integration into your business intelligence tools or presentations. No further editing or revisions will be necessary, as this is the final, analysis-ready BCG Matrix of Avianca Holdings.

Dogs

Avianca's domestic Colombian routes are currently facing headwinds, characterized by an oversupply of seats and a general contraction in market capacity. This situation has been exacerbated by the departure of several low-cost carriers from the market, intensifying competition for the remaining players.

Despite Avianca's significant market share within Colombia, specific domestic routes are demonstrating weaker profitability and more subdued growth potential when contrasted with the airline's more robust international operations. For instance, in 2024, while overall passenger traffic in Colombia showed signs of recovery, certain less-trafficked domestic corridors experienced yield pressures, impacting overall route profitability for carriers like Avianca.

Seasonal or less frequented routes, particularly those with limited direct passenger traffic, can be categorized as Dogs within Avianca Holdings' BCG Matrix. These routes often struggle to generate substantial revenue and may demand a significant operational investment relative to their financial returns.

Such routes are frequently maintained primarily to bolster network connectivity, ensuring a comprehensive route map, rather than for their direct profitability. For instance, in 2024, Avianca continued to operate certain routes in less densely populated regions of South America, which, while crucial for regional access, exhibited lower load factors compared to major international corridors.

Older, less fuel-efficient aircraft within Avianca Holdings' fleet, particularly those not yet upgraded or retired, can be categorized as Dogs. These planes, while still operational, incur higher operating expenses due to increased fuel consumption and potentially more frequent maintenance. For instance, a Boeing 787-8, a common aircraft type, can consume around 5,000 gallons of fuel per hour, whereas older models might be significantly less efficient.

These assets represent a drain on cash flow. The higher costs associated with their operation, when compared to the revenue they generate, can negatively impact profitability. This situation is exacerbated as newer, more efficient aircraft become the industry standard, making older models less competitive and more costly to maintain in the long run.

Segments with Intense Low-Cost Competition

In routes where ultra-low-cost carriers (ULCCs) aggressively compete on price, Avianca's traditional or hybrid service model faces significant challenges. These segments can become cash traps if Avianca cannot effectively differentiate its offering or manage costs to remain competitive.

For instance, in many Latin American domestic markets, ULCCs like Volaris and Viva Aerobus have captured substantial market share by offering rock-bottom fares. Avianca's efforts to compete directly in these price-sensitive segments might dilute its brand and profitability, especially if it cannot achieve the same operational efficiencies as ULCCs.

- Intense Price Pressure: Routes dominated by ULCCs often see fares significantly lower than full-service carriers, making it difficult for Avianca to maintain market share without sacrificing margins.

- Potential Cash Traps: Investing heavily in these segments without a clear path to profitability or differentiation can drain resources.

- Market Share Challenges: In 2024, the continued expansion of ULCCs across key Latin American markets means Avianca must carefully select which price-sensitive routes to engage in, and how.

- Hybrid Model Strain: Avianca's strategy to offer both full-service and more basic options can be strained when competing against carriers solely focused on the lowest possible price point.

Cargo Revenue Decline in Soft Markets

Avianca Cargo, despite its strong market position, faced revenue headwinds in soft market conditions. This decline was partly attributed to an oversupply of freighter capacity that emerged following the COVID-19 pandemic, intensifying competition.

Specific routes or product segments within Avianca Cargo's operations likely experienced greater pressure. These areas would have been characterized by either reduced demand from key industries or a significant influx of new competitors, impacting pricing power and volume.

- Revenue Decline: Avianca Cargo saw revenue dips in periods marked by market softening.

- Post-COVID Capacity: Increased freighter availability post-pandemic contributed to competitive pressures.

- Route/Product Sensitivity: Certain cargo lanes or specialized services were more susceptible to demand shifts and competition.

Routes with consistently low passenger numbers or those serving less populated regions can be classified as Dogs in Avianca's portfolio. These routes often require significant operational support to maintain network connectivity, yet yield minimal financial returns. For example, in 2024, certain domestic routes within Colombia continued to exhibit lower load factors compared to major international corridors, necessitating careful cost management to avoid becoming a drain on resources.

Question Marks

Avianca's expansion into new international routes, such as to Tampa and specific Central American locations, positions these as potential Stars or Question Marks within its BCG Matrix. While these routes offer promising growth avenues, they likely start with a smaller market share as Avianca builds customer recognition and demand.

Significant investment in marketing and route development is crucial for these new services to gain traction and achieve profitability. For instance, in 2024, Avianca continued to strategically expand its network, aiming to capture emerging market demand.

Avianca's proposed expansion into new U.S. markets, specifically targeting routes from Florida like Tampa, positions these ventures as potential Stars or Question Marks within the BCG Matrix. While the U.S. market offers significant growth potential, these new direct services represent uncharted territory, demanding considerable investment to build brand recognition and secure market share. For instance, in 2024, the U.S. airline industry saw passenger traffic rebound strongly, with domestic enplanements exceeding pre-pandemic levels, indicating a favorable overall environment.

Avianca is enhancing its narrowbody aircraft with premium offerings, specifically a relaunched and expanded business class service on key routes. This strategic pivot aims to tap into a lucrative segment of the market, potentially boosting revenue per passenger.

The success of this initiative hinges on Avianca's ability to attract and retain premium travelers. In 2024, the airline industry saw a continued demand for premium cabin experiences, with many carriers reporting strong yields in business and first class. Avianca's challenge will be to differentiate its offering and gain significant market share against well-established competitors in this competitive space.

Future Fleet Modernization and Expansion

Avianca's strategic fleet modernization, including the planned lease of new Airbus A320neo aircraft for 2027 deliveries, positions these investments as 'Question Marks' within the BCG Matrix. While the long-term goal is enhanced fuel efficiency and operational cost reduction, the immediate market share and profitability impact during the integration phase remains uncertain. This uncertainty stems from the significant capital outlay and the need to optimize route networks and passenger demand to fully leverage the new assets.

The integration of these new A320neo aircraft is a critical step for Avianca's future competitiveness. By 2024, Avianca had already been focusing on optimizing its existing fleet, and this expansion continues that trend. The success of these new leases will depend on factors such as the airline's ability to secure favorable financing, the actual fuel savings realized compared to older models, and the market's response to potentially expanded routes or increased capacity.

- Fleet Modernization: Lease of new Airbus A320neo aircraft scheduled for delivery starting in 2027.

- Strategic Goal: Improve fuel efficiency and reduce operational costs for long-term sustainability.

- BCG Matrix Classification: Positioned as 'Question Marks' due to uncertain immediate market share and profitability impact.

- Key Dependencies: Success hinges on financing, actual fuel savings, and market acceptance of route/capacity changes.

Digital Transformation and Customer Self-Service

Avianca Holdings is actively enhancing its digital infrastructure, focusing on customer self-service portals and online support channels. This strategic move aims to streamline operations and improve customer experience, mirroring industry trends where digital engagement is paramount.

The airline is investing in revamping its digital platforms to offer more intuitive self-service options for booking, managing flights, and accessing information. This aligns with a broader industry push to reduce reliance on call centers and empower customers directly.

- Digital Investment: Avianca is channeling resources into its digital transformation, a critical component for modern airline competitiveness.

- Self-Service Focus: The airline is prioritizing the enhancement of customer self-service capabilities through its online channels.

- Market Impact Uncertainty: The direct, immediate impact of these digital investments on Avianca's market share and profitability is currently categorized as a 'Question Mark'.

- Adoption and Efficiency: Realizing the full benefits hinges on customer adoption rates and the efficiency gains achieved through these new digital tools.

Avianca's new international routes, like Tampa and certain Central American destinations, are classified as Question Marks. These routes are in nascent stages, requiring substantial investment to build market share and brand recognition against established competitors.

The success of these new ventures depends on effective marketing, route development, and capturing emerging demand. In 2024, Avianca actively pursued network expansion, aiming to capitalize on growing passenger traffic, particularly in the U.S. market where domestic enplanements showed a strong rebound.

These new routes represent potential growth areas, but their future performance and market share are not yet solidified, making them classic Question Marks in the BCG framework. Continued strategic investment is essential to transform them into Stars.

BCG Matrix Data Sources

Our Avianca Holdings BCG Matrix is informed by comprehensive industry data, including airline financial reports, passenger traffic statistics, and market growth projections.