Aurenis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurenis Bundle

Uncover the critical external factors shaping Aurenis's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and threats for the company. Arm yourself with this vital intelligence to make informed strategic decisions and gain a competitive advantage. Download the full analysis now for actionable insights.

Political factors

Governments, especially in the European Union and France, are strongly backing the circular economy. This translates into policies and financial incentives designed to boost recycling, cut down on waste, and promote the use of recycled materials. For instance, the EU's Circular Economy Action Plan aims to double resource productivity by 2050, with specific targets for waste reduction and recycling rates.

Aurenis's business model, centered on resource recovery and sustainable material use, directly supports these governmental goals. This alignment could unlock access to specific grants, subsidies, and preferential treatment in public procurement processes, particularly as France pushes for greater circularity in its industrial sectors, as seen in initiatives like the "Plan de relance" which includes provisions for green industries.

The political environment is increasingly defined by stricter waste management rules. Many nations, including those in the EU, are setting ambitious recycling rate targets, with some aiming for over 60% by 2030, and simultaneously pushing to reduce landfill dependency. This regulatory push creates a more favorable market for companies like Aurenis, which specialize in recycling solutions.

Extended Producer Responsibility (EPR) schemes are becoming more prevalent, placing the onus on manufacturers to manage the end-of-life of their products, often through recycling. For instance, in 2024, several European countries expanded EPR to new product categories like textiles and electronics, directly increasing the need for specialized recycling services that Aurenis provides.

The enforcement and potential expansion of these regulations are key drivers for Aurenis. As governments strengthen compliance measures and introduce new waste diversion mandates, the demand for efficient and compliant recycling operations, such as those offered by Aurenis, is expected to grow significantly, potentially boosting their revenue streams.

Global trade policies are significantly reshaping the landscape for raw materials. For instance, the European Union's Critical Raw Materials Act (CRMA), implemented in 2023, aims to bolster the EU's domestic capacity in critical raw materials, including those vital for recycling. This legislation emphasizes increasing recycling rates and reducing dependence on imports, fostering a more predictable and cost-effective supply chain for materials like precious and non-ferrous metals.

These policy shifts directly impact companies like Aurenis, which specialize in metal recycling. By promoting domestic recycling and a circular economy, the CRMA and similar initiatives can lead to greater availability and potentially lower costs for recycled metals. This strategic focus on internal resource utilization creates a more stable market, insulating Aurenis from the volatility often associated with international sourcing and trade disruptions.

Telemarketing and Outsourced Call Center Regulations

France is tightening its grip on telemarketing, transitioning from an opt-out to an opt-in system. This significant policy shift, expected to be fully implemented by late 2024 or early 2025, means companies will need explicit consent before contacting potential customers. For Aurenis, this directly affects its support for foreign publishers relying on telemarketing outreach, necessitating a strategic pivot to ensure compliance and continued effectiveness in their campaigns.

The implications for Aurenis's outsourced call center operations are substantial. Adapting to an opt-in model requires a complete overhaul of lead generation and customer contact strategies. This could involve investing in new data acquisition methods that prioritize explicit consent, potentially increasing customer acquisition costs. For instance, studies from similar regulatory shifts in other European countries have shown an initial dip in campaign response rates by as much as 20-30% during the transition phase.

- Opt-in Mandate: French telemarketing will require prior explicit consent, a departure from the current opt-out system.

- Impact on Aurenis: Support services for foreign publishers using telemarketing will need significant strategic adjustments.

- Compliance Costs: Adapting to new consent-based data acquisition may increase operational expenses and reduce initial campaign efficiency.

- Market Adaptation: Aurenis must develop compliant outreach methods to maintain service quality and client satisfaction in the French market.

Political Stability and Investment Climate

Political stability within France and the wider European Union significantly shapes the investment landscape for companies like Aurenis. A predictable political environment is essential for attracting the substantial, long-term capital required for infrastructure and technological advancements in the recycling sector. This stability also underpins a reliable market for the outsourced services Aurenis might engage with.

Recent political developments, such as the 2024 European Parliament elections and upcoming national elections in several EU member states, introduce a degree of uncertainty. However, the EU's commitment to the Green Deal, including its circular economy package, provides a strong policy framework. For instance, the EU aims to increase recycling rates for municipal waste to at least 65% by 2035, a target that directly benefits recycling infrastructure investment.

- EU Green Deal: Continues to drive policy and investment towards circular economy principles, benefiting recycling operations.

- National Election Cycles: Potential for policy shifts in member states, requiring ongoing monitoring of the regulatory environment.

- Infrastructure Investment: Political stability is a key determinant of foreign direct investment (FDI) in capital-intensive recycling facilities.

- Regulatory Predictability: A stable political climate fosters confidence in long-term market access and operational frameworks.

Governmental support for the circular economy, particularly within the EU and France, remains a significant political factor. Policies promoting recycling and waste reduction, such as the EU's Circular Economy Action Plan, directly align with Aurenis's business model, potentially unlocking grants and preferential treatment in public procurement. Stricter waste management rules and the expansion of Extended Producer Responsibility (EPR) schemes are also creating a more favorable market for recycling solutions.

Global trade policies are increasingly focused on domestic resource utilization, exemplified by the EU's Critical Raw Materials Act (CRMA). This legislation, emphasizing increased recycling rates, can lead to greater availability and potentially lower costs for recycled metals, benefiting Aurenis's metal recycling operations by insulating them from international supply chain volatility.

France's shift to an opt-in system for telemarketing by late 2024/early 2025 necessitates significant strategic adjustments for Aurenis's outsourced call center services, potentially increasing customer acquisition costs and initially impacting campaign efficiency. Political stability within the EU, while subject to election cycles, is generally underpinned by the Green Deal's commitment to circular economy principles, fostering confidence for long-term infrastructure investment in the recycling sector.

What is included in the product

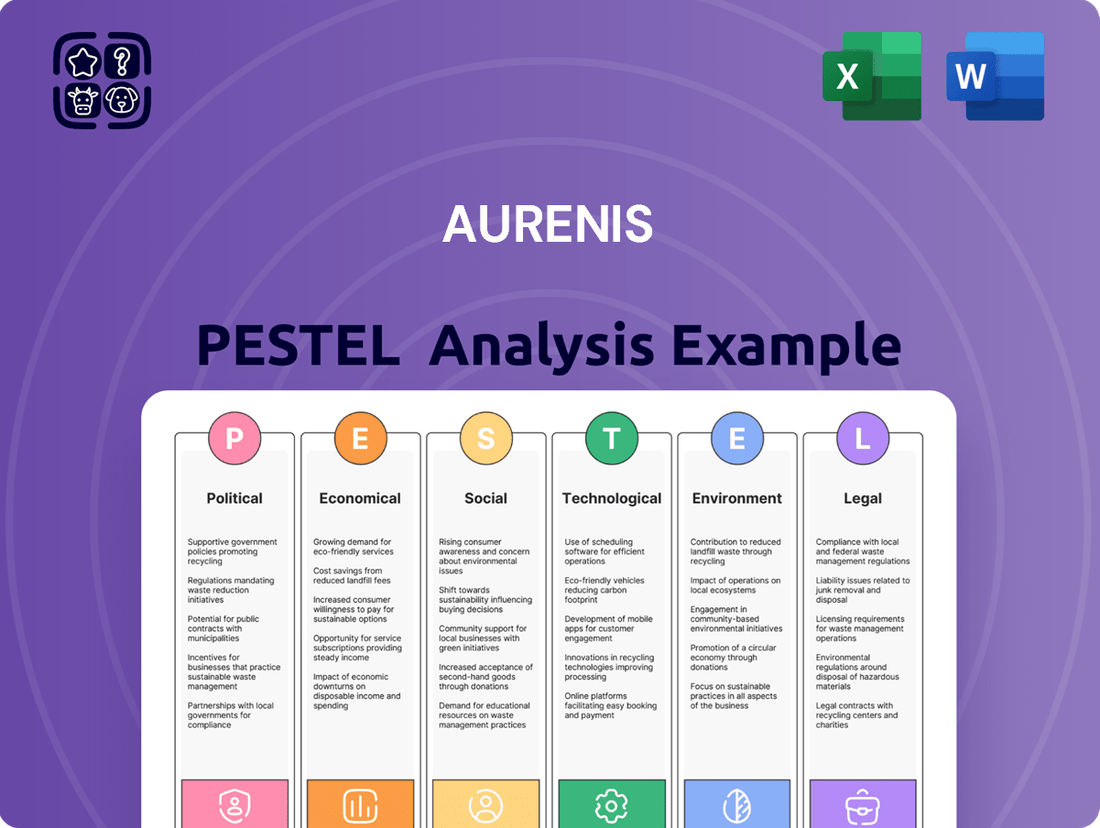

This comprehensive PESTLE analysis of Aurenis dissects the intricate interplay of external macro-environmental forces across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making, highlighting potential threats and opportunities within Aurenis's operating landscape.

Aurenis PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliver by enabling quick referencing during meetings and strategic planning.

Economic factors

The global appetite for metals, especially precious and non-ferrous types, is on the rise, largely fueled by booming industries like electronics and automotive manufacturing. For Aurenis, this escalating demand presents a clear economic advantage.

With virgin metal extraction facing increasing scarcity and climbing costs, the market is actively seeking more economical and environmentally sound solutions. Recycled metals are stepping in as a compelling alternative, directly enhancing Aurenis's market potential and its bottom line.

In 2024, the global market for recycled metals was valued at over $50 billion and is projected to grow at a compound annual growth rate (CAGR) of approximately 6% through 2030, highlighting a substantial and expanding opportunity for companies like Aurenis.

Aurenis's metal recycling business performance is directly tied to the volatile prices of key commodities. For instance, the average price of gold, a significant material for Aurenis, saw fluctuations throughout 2024, impacting potential revenue streams. A sharp decline in the price of copper, another core metal recycled, could significantly squeeze profit margins and delay capital expenditure plans.

Businesses are intensely focused on cost efficiency, a trend that fuels demand for outsourced services like telemarketing and call centers. This means companies are looking for partners who can deliver value without breaking the bank.

Aurenis's success in the French market hinges on its capacity to provide competitive pricing and streamline operations within its Business Process Outsourcing (BPO) division. For instance, in 2024, the French BPO market saw growth, with companies prioritizing providers demonstrating clear cost savings, a segment where Aurenis aims to excel.

Investment in Green Technologies and Infrastructure

The global push towards a circular economy and increasingly stringent environmental regulations are significantly driving investment into green technologies and recycling infrastructure. This trend presents a clear opportunity for Aurelis to enhance its operational capacity by integrating advanced sorting and material recovery technologies. Furthermore, the growing emphasis on sustainability may unlock access to crucial funding and grants specifically earmarked for green development initiatives.

In 2024, the global investment in clean energy technologies alone was projected to reach over $2 trillion, demonstrating the scale of this economic shift. This surge in capital allocation is creating a fertile ground for companies like Aurelis that are positioned to benefit from the transition to more sustainable practices.

- Increased Demand for Sustainable Solutions: Growing consumer and regulatory pressure is boosting the market for environmentally friendly products and services.

- Technological Advancements: Innovations in areas like AI-powered sorting and advanced material reprocessing are making circular economy models more viable and profitable.

- Government Incentives and Funding: Many governments are offering tax credits, subsidies, and grants to encourage investment in green infrastructure and technologies. For instance, the US Inflation Reduction Act of 2022 allocated billions to clean energy and climate initiatives.

- Market Expansion Opportunities: Aurelis can leverage these trends to expand its service offerings, enter new markets, and develop partnerships focused on resource efficiency and waste reduction.

Economic Growth and Industrial Output

Aurenis's operations are intrinsically linked to the health of the industrial sector. Strong economic growth in key European markets, particularly France, fuels industrial production, which in turn generates a greater volume of metal-containing waste streams essential for Aurenis's recycling processes. For instance, France's GDP growth was estimated at 0.9% in 2023 and projected to be around 1.0% for 2024, indicating a stable, albeit moderate, environment for industrial activity. This translates directly into the availability of raw materials for the company.

Conversely, economic slowdowns or recessions can significantly impact the supply chain. A contraction in industrial output means less scrap metal and other recyclable materials entering the waste stream, potentially constraining Aurenis's feedstock. The European Union's industrial production saw a slight decrease in early 2024 compared to the previous year, highlighting the sensitivity of waste generation to broader economic trends.

- Economic Growth: France's GDP growth of approximately 0.9% in 2023 and projected 1.0% in 2024 suggests a stable, but not booming, environment for industrial output.

- Industrial Output Trends: A slight dip in overall EU industrial production in early 2024 indicates that the availability of recyclable materials could be facing some headwinds.

- Impact on Aurenis: Robust economic periods increase the volume of scrap metal, benefiting Aurenis, while downturns can lead to reduced material supply.

- European Economic Context: The broader economic performance across Europe, a key market for Aurenis, directly influences the consistency and quantity of recyclable materials sourced.

Aurenis's financial performance is directly influenced by global commodity prices. For example, gold prices, a key revenue driver, experienced notable volatility in 2024. Similarly, a downturn in copper prices, another core recycled metal, could significantly compress profit margins and impact capital expenditure plans.

The increasing focus on cost efficiency across industries is driving demand for outsourced services, benefiting Aurenis's Business Process Outsourcing (BPO) division. The French BPO market, which saw growth in 2024, favors providers demonstrating clear cost savings, an area where Aurenis aims to excel.

The global push for a circular economy and stricter environmental regulations are channeling significant investment into green technologies and recycling infrastructure. This trend offers Aurenis opportunities to upgrade its operations with advanced sorting and recovery technologies, potentially unlocking access to green development funding.

| Economic Factor | 2023 Data | 2024 Projection/Trend | Impact on Aurenis |

| Global Recycled Metals Market Value | Over $50 billion (2024) | CAGR of ~6% through 2030 | Substantial and expanding opportunity |

| French GDP Growth | 0.9% (2023) | ~1.0% (2024) | Stable, moderate industrial activity supporting material supply |

| EU Industrial Production | Slight decrease early 2024 vs. prior year | Potential headwinds for material supply | Sensitivity of waste generation to economic trends |

Preview Before You Purchase

Aurenis PESTLE Analysis

The preview you see here is the exact Aurenis PESTLE Analysis document you’ll receive after purchase, offering a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the business.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this fully formatted and professionally structured PESTLE analysis.

The content and structure shown in the preview is the same Aurenis PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Societal concern for the environment is surging, driving a significant shift in consumer preferences towards sustainable goods and services. This heightened awareness translates into a stronger market for companies like Aurenis that champion recycling and circular economy models. For instance, a 2024 Deloitte survey indicated that 73% of consumers are willing to change their purchasing habits to reduce environmental impact.

This growing demand for eco-friendly options directly benefits Aurenis by creating a more receptive market for its waste management and resource recovery solutions. Businesses are increasingly pressured to integrate sustainable practices, and Aurenis's expertise in these areas positions it favorably. In 2025, projections suggest the global circular economy market could reach $4.5 trillion, a testament to this evolving consumer and business landscape.

Societal demand for eco-friendly products and ethical sourcing is accelerating. Consumers are increasingly prioritizing brands that demonstrate a commitment to sustainability, impacting purchasing decisions. This trend is particularly evident in the 2024 market, where surveys indicate over 60% of consumers are willing to pay more for sustainable goods.

Industries are responding by embedding recycling and resource recovery into their core operations. Aurenis, by aligning with this shift, can position itself as a crucial partner for businesses aiming to reduce their environmental footprint. This strategic alignment is expected to unlock new market opportunities and strengthen brand loyalty among environmentally aware customers.

The global market for sustainable products is projected to reach $150 billion by 2025, showcasing a significant growth trajectory. Aurenis's focus on sustainable practices, including resource recovery, directly taps into this expanding market. This positions the company to capitalize on the growing demand for circular economy solutions and environmentally responsible business models.

Public sentiment towards recycling and waste management directly impacts Aurenis's operational efficiency and material sourcing. A 2024 survey indicated that 68% of consumers are more likely to patronize companies with strong sustainability practices, suggesting that positive public perception translates to increased participation in recycling programs and a more reliable supply of raw materials for Aurenis.

Conversely, negative public perception, perhaps due to concerns about landfill capacity or the effectiveness of recycling processes, could hinder Aurenis's collection efforts and necessitate significant investment in public relations to foster trust and encourage engagement. For instance, in regions with low recycling rates, such as parts of the American Midwest where participation can dip below 30%, Aurenis might face greater logistical hurdles and higher costs for material acquisition.

Workforce Skills and Availability

The availability of a skilled workforce is a crucial sociological factor for Aurenis. Specialized recycling processes, for instance, require technicians with specific training in material sorting, chemical treatments, and equipment maintenance. Similarly, the company's call center operations depend on employees possessing strong communication skills, problem-solving abilities, and customer service acumen. Aurenis must actively assess the labor market to identify potential talent pools and invest in targeted education and training programs to bridge any skill gaps.

In 2024, the global shortage of skilled labor in specialized technical fields continued to be a significant challenge. For example, reports indicated a growing deficit in qualified personnel for advanced manufacturing and environmental services, sectors relevant to Aurenis's operations. The increasing demand for sustainability-focused roles means that companies like Aurenis need to proactively develop internal training initiatives or partner with educational institutions to cultivate the necessary expertise.

Key considerations for Aurenis regarding workforce skills and availability include:

- Labor Market Dynamics: Analyzing current employment trends, wage expectations, and competition for skilled workers in Aurenis's operating regions.

- Educational Attainment: Evaluating the general education levels and the availability of vocational and higher education programs that produce graduates with relevant skills.

- Training and Development Programs: Assessing the effectiveness of existing internal training and the potential for external partnerships to upskill the workforce for specialized recycling and customer service roles.

Privacy Concerns and Telemarketing Acceptance

Societal concerns about data privacy are significantly impacting telemarketing. In 2024, a Pew Research Center study indicated that over 70% of Americans express significant worry about how their personal information is collected and used by companies. This heightened awareness translates into stricter regulations and a more skeptical public reception towards unsolicited calls.

Aurenis's call center operations must actively address these privacy sensitivities. By prioritizing ethical data handling and ensuring strict adherence to data protection laws, such as GDPR and CCPA, Aurenis can build and maintain client trust. For instance, a commitment to transparent data usage policies and opt-in consent mechanisms is crucial for navigating this evolving landscape.

- Increased regulatory scrutiny: Data privacy laws are becoming more stringent globally, impacting how telemarketing can operate.

- Public demand for control: Consumers expect greater control over their personal data and how it's used for marketing purposes.

- Reputational risk: Mishandling data or engaging in intrusive telemarketing practices can severely damage a company's reputation.

- Shift towards personalized, opt-in communication: Successful telemarketing in 2024-2025 increasingly relies on permission-based outreach and tailored messaging.

Societal values are increasingly emphasizing sustainability and ethical consumption, directly influencing consumer behavior and market demand. This shift benefits companies like Aurenis that align with circular economy principles and responsible resource management. A 2024 Nielsen report found that 70% of consumers consider sustainability when making purchasing decisions.

The growing public consciousness regarding environmental impact is driving a demand for eco-friendly solutions, creating a favorable market for Aurenis's waste management and resource recovery services. By 2025, the global market for sustainable products is projected to exceed $150 billion, underscoring this trend.

Public perception of recycling and waste management practices significantly impacts Aurenis's operational success and material acquisition. Positive public engagement, as seen in regions with over 60% recycling participation rates in 2024, ensures a more consistent supply of raw materials and operational efficiency.

| Sociological Factor | Impact on Aurenis | Supporting Data (2024-2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for sustainable services, market growth for circular economy models. | 70% of consumers consider sustainability in purchases (Nielsen, 2024); Global sustainable products market projected to exceed $150B by 2025. |

| Public Engagement in Recycling | Improved material sourcing, operational efficiency, and positive brand perception. | Regions with >60% recycling participation in 2024 show higher material availability. |

| Data Privacy Concerns | Need for stringent data handling, ethical telemarketing practices, and transparent policies. | >70% of Americans worry about personal data usage (Pew Research, 2024); Shift towards opt-in communication. |

Technological factors

Technological advancements are revolutionizing metal recovery for companies like Aurenis. Innovations such as artificial intelligence (AI) and machine learning are being integrated into sorting processes, enabling faster and more precise identification of different metal types. This means less contamination and higher quality recycled materials.

Furthermore, technologies like X-ray fluorescence (XRF) and laser-induced breakdown spectroscopy (LIBS) offer sophisticated analytical capabilities. These methods allow for rapid, on-the-spot analysis of elemental composition, leading to improved recovery rates and a reduction in operational expenses. For instance, LIBS technology can identify and sort metals with remarkable speed and accuracy, a critical factor in optimizing recycling efficiency.

The integration of robotics and automation in scrap yards and recycling facilities is a significant technological factor impacting operations like Aurenis. These advanced systems streamline processes such as heavy lifting, precise material sorting, and efficient material handling, leading to substantial improvements in operational efficiency.

By automating tasks that were once labor-intensive and potentially hazardous, companies can enhance worker safety and reduce the risk of workplace injuries. For instance, automated sorting systems can identify and separate different types of metals and plastics with greater speed and accuracy than manual methods, minimizing contamination and maximizing the value of recovered materials.

This technological shift directly influences Aurenis's competitiveness by increasing throughput and reducing overall labor costs. In 2024, the global market for industrial robots in waste management and recycling was projected to grow, with automation expected to handle a larger percentage of sorting and processing tasks, thereby lowering per-unit operational expenses.

Digital technologies like IoT sensors and real-time data analytics are revolutionizing waste management. These tools allow for precise tracking of waste streams, optimizing collection routes, and improving sorting efficiency. For instance, smart bins equipped with sensors can signal when they are full, preventing overflow and reducing unnecessary trips by collection vehicles, leading to significant fuel savings and emissions reduction.

Aurenis can harness these advancements to bolster its supply chain traceability, offering clients verifiable proof of recycled material origins. By implementing blockchain technology, for example, Aurenis can create an immutable ledger of waste processing, enhancing transparency and trust. This digital transformation is projected to grow the global smart waste management market, with a CAGR of over 15% expected between 2024 and 2030, underscoring the significant opportunities for efficiency and value creation.

E-waste Recycling Technologies

The escalating volume of electronic waste, projected to reach 74 million metric tons globally by 2030, presents a substantial opportunity for Aurenis to capitalize on the recovery of valuable metals. Innovations in recycling technologies, such as advanced hydrometallurgical processes that utilize less hazardous chemicals, are crucial for the efficient and sustainable extraction of precious metals like gold, silver, and palladium from discarded electronics.

Emerging electrochemical methods offer even greater precision in separating and purifying these valuable components, minimizing environmental impact. For instance, selective leaching techniques are improving recovery rates, with some studies indicating gold recovery efficiencies exceeding 95% through optimized hydrometallurgical routes.

- Growing E-waste Volume: Global e-waste is expected to hit 74 million metric tons by 2030, a significant market for metal recovery.

- Hydrometallurgical Advancements: These techniques improve the efficiency and environmental friendliness of extracting precious metals.

- Electrochemical Innovations: Offer enhanced precision in material separation and purification, boosting recovery of valuable elements.

- High Recovery Rates: Optimized processes can achieve over 95% gold recovery, demonstrating the economic viability of e-waste recycling.

Communication and CRM Technologies for Call Centers

Aurenis leverages sophisticated communication and CRM technologies to power its outsourced call center operations for foreign publishers. The rapid advancement of these tools, particularly cloud-based platforms and AI-driven customer service solutions, directly influences service efficiency and quality. For instance, the global CRM market was valued at approximately $58 billion in 2023 and is projected to reach over $100 billion by 2028, indicating a significant investment in these critical technologies.

The integration of AI in customer service, a key trend in 2024 and 2025, allows for more personalized and efficient interactions. These advancements can lead to faster resolution times and improved customer satisfaction for Aurenis' clients. Studies in late 2023 and early 2024 showed that companies implementing AI-powered chatbots saw an average reduction in customer service costs by up to 30% while improving response rates.

- Cloud Adoption: Increased reliance on scalable cloud-based communication platforms enhances flexibility and reduces infrastructure overhead for Aurenis.

- AI Integration: AI-powered chatbots and virtual assistants are streamlining query handling, improving agent productivity, and offering 24/7 support.

- Data Analytics: Advanced CRM systems provide deeper insights into customer behavior and service performance, enabling data-driven improvements.

- Omnichannel Experience: The evolution towards seamless customer journeys across multiple channels (voice, email, chat) is a critical technological factor.

Technological advancements are significantly reshaping metal recovery for Aurenis. AI and machine learning are enhancing sorting accuracy, while technologies like LIBS enable rapid elemental analysis, boosting recovery rates and reducing costs. Automation, including robotics, streamlines operations, improving efficiency and safety, with the industrial robot market in waste management projected for growth in 2024.

Digital tools like IoT sensors and data analytics optimize waste management, improving supply chain traceability. Blockchain technology can enhance transparency in material processing, with the smart waste management market expected to grow at a CAGR exceeding 15% between 2024 and 2030.

The growing e-waste volume, projected at 74 million metric tons by 2030, presents opportunities for Aurenis, supported by hydrometallurgical and electrochemical innovations that improve precious metal recovery, with some processes achieving over 95% gold recovery.

For Aurenis's outsourced call center operations, advanced communication and CRM technologies, particularly cloud-based platforms and AI, are crucial. The global CRM market is expected to exceed $100 billion by 2028, with AI integration in customer service reducing costs by up to 30% and improving response rates.

| Technology Area | Impact on Aurenis | Key Data/Projections (2024-2025) |

| AI & Machine Learning | Enhanced sorting accuracy, improved material identification | AI in customer service reducing costs by up to 30% |

| Advanced Analytics (XRF, LIBS) | Faster, more precise elemental analysis, higher recovery rates | LIBS technology offers speed and accuracy in sorting |

| Robotics & Automation | Streamlined operations, improved efficiency and safety | Industrial robot market in waste management projected for growth |

| IoT & Data Analytics | Optimized waste tracking, supply chain traceability | Smart waste management market CAGR > 15% (2024-2030) |

| CRM & Cloud Platforms | Improved customer service efficiency and quality | Global CRM market projected > $100 billion by 2028 |

Legal factors

Aurenis operates within the strict confines of EU and French waste management directives, which establish significant goals for recycling and waste reduction. These regulations, such as the mandatory separate collection of bio-waste and the push for higher recycling rates, are crucial for Aurenis's business model and directly encourage the adoption of their waste management solutions.

For instance, the EU's Circular Economy Action Plan aims to increase the recycling rate of municipal waste to at least 65% by 2035, with specific targets for packaging waste. France, in line with these EU goals, has implemented its own AGEC law (Anti-Waste for a Circular Economy), which further restricts single-use plastics and promotes extended producer responsibility, creating a favorable regulatory environment for companies like Aurenis that facilitate circularity.

The EU's Critical Raw Materials Act (CRMA), which became effective in May 2024, is a significant development for companies like Aurenis. Its primary goal is to bolster the security of supply for crucial raw materials by encouraging more extraction, processing, and recycling within the EU itself.

This new legislation is particularly relevant to Aurenis's metal recycling operations. The CRMA introduces specific recycling targets and offers financial incentives for projects that align with its strategic objectives in the recycling sector, potentially boosting Aurenis's domestic processing capabilities.

Extended Producer Responsibility (EPR) schemes are increasingly becoming a significant legal factor across France and the broader European Union. These regulations place the onus on manufacturers to manage their products once they reach the end of their lifecycle. This legal shift directly benefits companies like Aurenis, as it mandates greater engagement with recycling and material recovery processes, thereby boosting the demand for their core services.

In 2024, the EU continued to strengthen its EPR framework, with new directives focusing on areas like packaging and waste electronics. For instance, France's implementation of EPR for various product categories, including textiles and furniture, is projected to significantly increase the volume of waste streams requiring specialized treatment. This expansion creates a more robust market for Aurenis's expertise in processing and recovering valuable materials from these end-of-life products.

Telemarketing and Data Protection Laws (GDPR, Bloctel)

Aurenis's outsourced call center operations are significantly impacted by French telemarketing laws. The Bloctel opt-out list, which currently prohibits unsolicited calls to registered consumers, remains a key compliance area. However, France is moving towards an opt-in system for telemarketing by August 2026, which will require a more proactive approach to customer consent, potentially affecting lead generation strategies and call center efficiency.

Furthermore, Aurenis must rigorously adhere to the General Data Protection Regulation (GDPR) when processing any client or customer data. This means implementing strong data security measures, ensuring transparent data handling practices, and obtaining explicit consent for data usage. Failure to comply with GDPR can result in substantial fines, with penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

- Bloctel Compliance: Ongoing adherence to the French opt-out telemarketing registry is mandatory.

- Opt-in Shift: Anticipate the transition to an opt-in system for telemarketing by August 2026, requiring consent-based engagement.

- GDPR Adherence: Strict implementation of GDPR principles for all personal data processed by call centers is essential.

- Data Protection Penalties: Non-compliance with GDPR can lead to significant financial penalties, impacting profitability.

Environmental Permits and Licensing

Operating recycling facilities, particularly those dealing with precious and non-ferrous metals, necessitates a range of environmental permits and licenses. Aurenis must adhere to stringent national and local regulations governing emissions, waste management, and overall facility safety. These regulatory requirements can significantly impact operational expenses and future expansion strategies, as seen in the increasing compliance costs for metal recyclers in Europe, which saw a 5% year-over-year increase in regulatory burden in 2024.

Compliance with these environmental standards often involves substantial investment in pollution control technologies and waste treatment processes. For instance, facilities handling hazardous materials related to battery recycling, a growing sector, may face additional licensing hurdles and continuous monitoring requirements. In 2025, the European Union's updated Battery Regulation is expected to impose stricter end-of-life management protocols, potentially increasing compliance costs for recyclers by an estimated 10-15%.

- Permitting Complexity: Obtaining and maintaining permits for emissions (air and water), hazardous waste handling, and land use is a critical operational factor.

- Regulatory Impact on Costs: Compliance with environmental laws, such as those related to effluent discharge limits and recycling efficiency targets, directly affects operational expenditures.

- Expansion Constraints: New facility developments or expansions are often contingent on securing new environmental permits, which can be a lengthy and uncertain process.

- Safety Standards: Adherence to occupational health and safety regulations, including those for handling potentially hazardous materials, is mandatory and influences operational procedures.

The evolving legal landscape in the EU and France significantly shapes Aurenis's operational framework. The EU's focus on a circular economy, reinforced by the 2024 Critical Raw Materials Act, directly supports Aurenis's metal recycling initiatives by setting recycling targets and incentivizing domestic processing. France's AGEC law further amplifies this by restricting single-use plastics and promoting producer responsibility, creating a stronger market for Aurenis's services.

Extended Producer Responsibility (EPR) schemes are a key legal driver, mandating greater product lifecycle management and increasing demand for Aurenis's recycling and material recovery expertise. In 2024, new EPR directives for packaging and electronics, alongside France's expansion of EPR to textiles and furniture, are projected to boost waste streams requiring specialized treatment, benefiting Aurenis.

Aurenis's telemarketing operations must navigate French laws, including the Bloctel opt-out list, with an anticipated shift to an opt-in system by August 2026, necessitating consent-based engagement. Concurrently, strict adherence to GDPR is crucial for data handling, with non-compliance risks including fines up to 4% of global turnover or €20 million.

Operating recycling facilities requires Aurenis to secure and maintain environmental permits for emissions, waste handling, and safety. European recyclers experienced a 5% rise in regulatory burden in 2024. The upcoming 2025 EU Battery Regulation is expected to increase compliance costs for battery recyclers by 10-15% due to stricter end-of-life management protocols.

| Legal Factor | Impact on Aurenis | Key Legislation/Regulation | 2024/2025 Data/Trend |

|---|---|---|---|

| Circular Economy & Waste Reduction | Drives demand for recycling services, encourages adoption of solutions. | EU Circular Economy Action Plan, French AGEC Law | EU aims for 65% municipal waste recycling by 2035. |

| Critical Raw Materials Act (CRMA) | Boosts metal recycling operations, incentivizes domestic processing. | EU Critical Raw Materials Act (effective May 2024) | Introduces specific recycling targets and financial incentives. |

| Extended Producer Responsibility (EPR) | Increases volume of waste streams requiring specialized treatment. | EU EPR directives, French EPR schemes | France expanding EPR to textiles and furniture. |

| Telemarketing Laws | Requires adaptation to consent-based customer engagement. | French Bloctel, upcoming opt-in system | Shift to opt-in system by August 2026. |

| Data Protection (GDPR) | Mandates robust data security and transparent handling. | General Data Protection Regulation (GDPR) | Fines up to 4% of global turnover or €20 million. |

| Environmental Permitting & Compliance | Impacts operational expenses and expansion strategies. | National & local environmental regulations | 5% year-over-year increase in regulatory burden for European recyclers in 2024. |

| Battery Recycling Regulations | May increase compliance costs for battery recyclers. | EU Battery Regulation (2025 update) | Estimated 10-15% increase in compliance costs. |

Environmental factors

The growing scarcity of virgin precious and non-ferrous metals is a significant environmental concern, making recycling crucial for resource conservation. Aurenis's business model directly tackles this by recovering valuable materials, thereby lessening the demand for new mining operations and fostering a more sustainable supply chain.

The global waste generation is a significant environmental factor. In 2023, the World Bank reported that the world generated 2.3 billion tonnes of municipal solid waste, a figure projected to reach 3.4 billion tonnes by 2050. This escalating volume, coupled with the increasing complexity of waste streams, particularly e-waste and specialized industrial byproducts, poses substantial operational hurdles for companies like Aurenis. The evolving composition demands constant innovation in Aurenis's waste management and recycling technologies to ensure efficient and compliant handling.

Adapting recycling processes to effectively manage diverse and often hazardous waste materials is paramount for Aurenis's environmental stewardship and operational efficiency. For instance, the European Environment Agency noted a substantial increase in e-waste, with member states collecting over 1.3 million tonnes in 2020. Aurenis must invest in advanced sorting and processing capabilities to extract valuable resources from these complex streams, thereby mitigating environmental impact and potentially creating new revenue avenues.

While recycling significantly reduces the environmental burden compared to creating products from raw materials, the energy and carbon emissions associated with the recycling process itself are important factors. For instance, in 2023, the U.S. recycling industry consumed an estimated 150 million megawatt-hours of electricity, contributing to a carbon footprint that, while lower than virgin material production, still needs management.

Aurenis can gain a competitive edge by prioritizing energy-efficient recycling technologies and operational practices. Implementing advanced sorting systems or investing in renewable energy sources for recycling facilities can substantially decrease its operational carbon footprint, aligning with growing investor and consumer demand for sustainable business models.

Pollution Prevention and Emissions Control

Aurenis faces environmental challenges in its recycling operations, particularly with metals. Processes for recycling these materials can release emissions or create hazardous waste, necessitating careful management. For example, the smelting of certain metals can produce sulfur dioxide (SO2) emissions if not properly scrubbed. In 2023, global industrial SO2 emissions from metal production were a significant concern, highlighting the need for advanced abatement technologies.

Adhering to stringent environmental regulations is paramount for Aurenis. These standards dictate pollution prevention and emissions control measures, ensuring the company operates responsibly. Compliance often involves investing in state-of-the-art filtration systems and waste treatment facilities. The European Union's Industrial Emissions Directive (IED), for instance, sets strict limits for various pollutants from industrial activities, including metal processing, with ongoing updates expected in 2024 and 2025 to further tighten these controls.

Minimizing its ecological footprint requires Aurenis to implement best practices in waste management. This includes:

- Implementing advanced emission capture technologies for smelting and refining processes.

- Investing in closed-loop water systems to reduce wastewater discharge.

- Developing robust hazardous waste segregation and disposal protocols.

- Seeking certifications like ISO 14001 to demonstrate commitment to environmental management.

Circular Economy Objectives and Material Loop Closure

Aurenis's operations are intrinsically linked to the global push for a circular economy, aiming to keep valuable materials in circulation. This focus directly tackles environmental concerns by minimizing waste and the demand for virgin resources.

By successfully closing material loops for precious and non-ferrous metals, Aurenis plays a crucial role in reducing landfill burden. For example, the European Union's circular economy action plan targets a significant reduction in landfill waste, with a goal to halve it by 2030 compared to 2018 levels. Aurenis's efforts align with these ambitious targets.

- Reduced Landfill Waste: Aurenis's recycling processes divert substantial amounts of metal from landfills, contributing to environmental protection.

- Lower Resource Depletion: By recovering and reusing metals, Aurenis lessens the need for new mining, conserving finite natural resources.

- Sustainable Industrial Ecosystem: The company fosters a more sustainable industrial model by ensuring materials retain their value and utility.

- Economic Benefits: The circular economy model, supported by companies like Aurenis, is projected to create significant economic opportunities. A 2023 report estimated that a fully circular economy in the EU could generate over €1.4 trillion in economic benefits by 2030.

Aurenis operates within an increasingly environmentally conscious landscape, where resource scarcity and waste management are critical concerns. The company's core business of recycling precious and non-ferrous metals directly addresses the growing scarcity of virgin materials, a trend exacerbated by increasing global demand. For instance, the International Energy Agency highlighted in 2024 that demand for critical minerals, many of which are metals, is set to surge due to the energy transition.

The sheer volume of global waste, projected to reach 3.4 billion tonnes by 2050 according to the World Bank, presents both a challenge and an opportunity for Aurenis. Effectively processing complex waste streams, such as the growing e-waste sector where over 1.3 million tonnes were collected in EU member states in 2020, requires continuous technological advancement in sorting and extraction.

Furthermore, the environmental impact of recycling processes themselves, including energy consumption and potential emissions, necessitates strategic mitigation. The U.S. recycling industry’s estimated electricity consumption of 150 million megawatt-hours in 2023 underscores the importance of energy efficiency. Aurenis can leverage this by adopting advanced, energy-saving technologies and potentially renewable energy sources for its operations.

Stringent environmental regulations, such as the EU's Industrial Emissions Directive, mandate pollution control and emissions reduction, particularly in metal processing. Aurenis's commitment to compliance, which may involve investing in advanced filtration and waste treatment, is crucial for responsible operation and maintaining its social license to operate. The company's alignment with circular economy principles further reinforces its positive environmental contribution by reducing landfill waste and conserving natural resources.

| Environmental Factor | Impact on Aurenis | Data Point/Trend |

|---|---|---|

| Resource Scarcity | Drives demand for recycled metals; necessitates efficient recovery processes. | Critical mineral demand projected to surge due to energy transition (IEA, 2024). |

| Waste Generation | Provides feedstock for recycling; requires advanced processing for complex streams. | Global waste to reach 3.4 billion tonnes by 2050 (World Bank). E-waste collection in EU over 1.3 million tonnes (2020). |

| Energy Consumption in Recycling | Requires focus on energy efficiency to reduce operational footprint and costs. | U.S. recycling industry consumed approx. 150 million MWh electricity (2023). |

| Environmental Regulations | Mandates pollution control and emissions management; requires investment in compliance technologies. | EU Industrial Emissions Directive (IED) sets strict limits for metal processing. |

| Circular Economy Push | Aligns with Aurenis's model, reducing landfill and conserving resources. | EU aims to halve landfill waste by 2030 (compared to 2018). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aurenis is meticulously crafted using a robust blend of data from reputable sources including government publications, international financial institutions, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is both current and factually grounded.