Auction Technology Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auction Technology Group Bundle

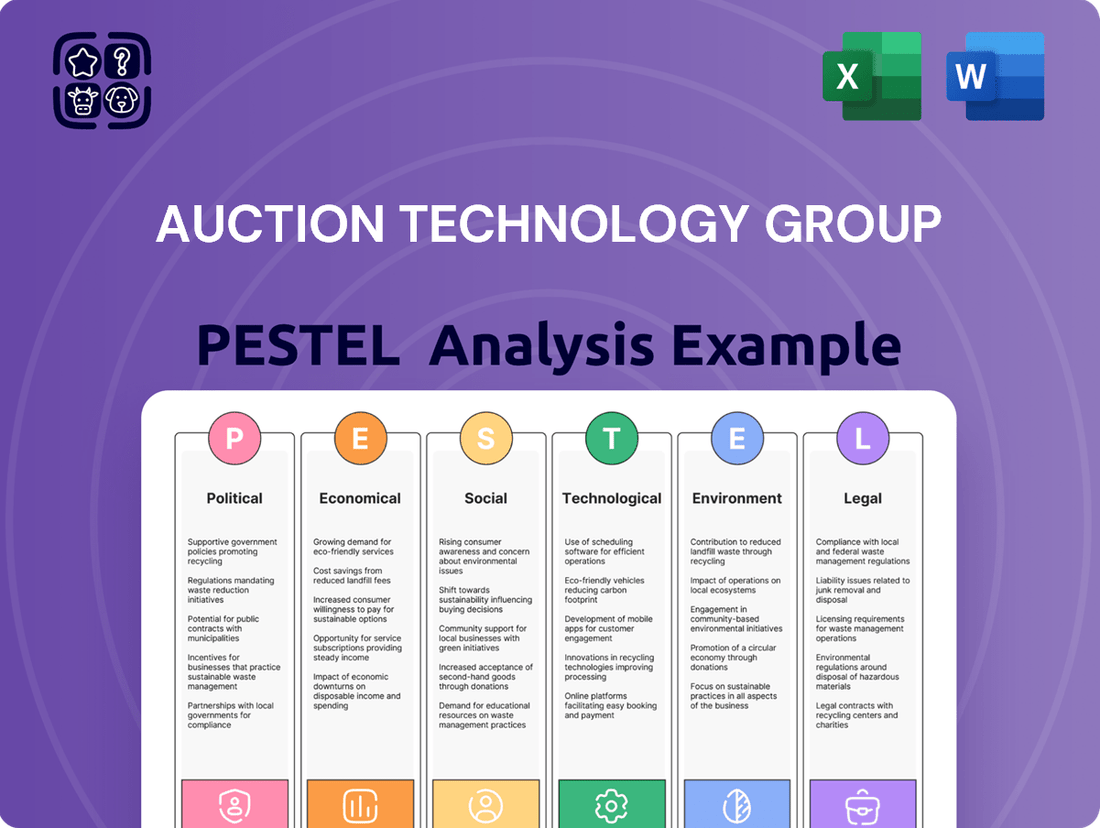

Navigate the complex external forces shaping Auction Technology Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact its operations and growth. Gain a strategic advantage by downloading the full report, packed with actionable intelligence for informed decision-making.

Political factors

Governments globally are intensifying their focus on online marketplaces, driven by concerns over consumer safety, fair competition, and tax collection. For Auction Technology Group (ATG), this translates into a dynamic regulatory landscape. For example, the European Union's Digital Services Act (DSA), fully applicable from February 17, 2024, imposes stricter rules on online platforms regarding illegal content and disinformation, potentially affecting how ATG moderates listings and user interactions.

Changes in international trade policies and tariffs directly impact Auction Technology Group (ATG) as it facilitates global transactions. For instance, increased tariffs on goods traded between the UK and the EU, following Brexit, could raise costs for buyers and sellers using ATG's platforms, potentially dampening cross-border activity. In 2024, the global trade landscape remains dynamic, with ongoing discussions around protectionist measures in various economies.

The political stability of Auction Technology Group's (ATG) key operating markets and user bases is a critical factor. For instance, ongoing geopolitical tensions in Eastern Europe, which saw a 2.5% contraction in global GDP in 2023 according to IMF estimates, can directly dampen economic activity and consumer confidence. This instability can disrupt supply chains for goods sold through ATG's platforms and reduce discretionary spending, thereby impacting transaction volumes.

Regulatory Stance on Data Sovereignty

Many countries are increasingly implementing data sovereignty laws, mandating that data be stored and processed within their national borders. This trend presents a significant challenge for global technology providers like Auction Technology Group (ATG).

Navigating these varied and often stringent data localization requirements adds considerable complexity and cost to ATG's data management and IT infrastructure. It can hinder the seamless provision of international services, potentially impacting operational efficiency and market reach.

- Increased Compliance Costs: Adhering to diverse data residency rules can necessitate building or leasing data centers in multiple jurisdictions, escalating infrastructure expenses.

- Operational Complexity: Managing data across different regulatory frameworks requires robust, adaptable systems and specialized legal and IT expertise.

- Service Delivery Impact: Restrictions on cross-border data flows could affect the speed and accessibility of ATG's platform for international users.

- Market Access Barriers: Failure to comply with data sovereignty laws can lead to fines or even exclusion from key markets.

Government Support for Digital Economy

Governments worldwide are increasingly recognizing the economic importance of a robust digital economy. For Auction Technology Group (ATG), this translates into a significant opportunity. For instance, the UK government's Digital Strategy, updated in 2024, emphasizes investment in digital infrastructure and skills, aiming to boost e-commerce and digital services. This proactive stance creates a more fertile ground for ATG's auction platforms and related technologies.

Support can manifest in various forms, including direct grants for technology adoption, tax incentives for digital businesses, and the development of national broadband networks. In 2024, the European Union continued its push for digital single market initiatives, potentially benefiting ATG by harmonizing regulations and fostering cross-border online trade. These initiatives directly reduce barriers and encourage greater participation in online marketplaces.

- Government investment in digital infrastructure: Initiatives like the US's Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, directly improve internet access, crucial for online auction participation.

- Supportive e-commerce policies: The growth of online retail, bolstered by government efforts to streamline digital transactions and consumer protection, benefits platforms like ATG.

- Digital skills development programs: Governments investing in training for digital literacy and online business management indirectly expand the pool of potential users and sellers on auction platforms.

Governments are increasingly scrutinizing online marketplaces, leading to new regulations like the EU's Digital Services Act, fully applicable from February 2024, which impacts how platforms like Auction Technology Group (ATG) manage content. Changes in international trade policies, such as post-Brexit tariffs between the UK and EU, can affect cross-border transaction costs on ATG's platforms, with global trade dynamics remaining fluid throughout 2024.

Political instability in key operating regions, exemplified by geopolitical tensions affecting global GDP, can dampen economic activity and consumer spending, thereby reducing transaction volumes on ATG. Data sovereignty laws are also a growing concern, requiring companies like ATG to manage data within national borders, adding complexity and cost to IT infrastructure and potentially impacting service delivery.

Governments are actively promoting digital economies, with initiatives like the UK's updated Digital Strategy in 2024 focusing on e-commerce growth, creating a more favorable environment for ATG. Support also comes through digital infrastructure investments, such as the US BEAD program's $42.45 billion allocation, which enhances internet access crucial for online auctions.

What is included in the product

This PESTLE analysis scrutinizes the external macro-environmental forces impacting Auction Technology Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by detailing how these global trends and regional specifics create both challenges and avenues for growth.

Provides a concise version of the ATG PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external factors impacting auction technology.

Economic factors

Global economic growth significantly influences Auction Technology Group's (ATG) performance, as consumer spending directly impacts auction volumes across diverse asset classes. Strong economic expansion generally fuels increased demand for goods, leading to higher transaction values and greater participation in auctions. For instance, the IMF projected global growth to be 3.2% in 2024, a slight moderation from 2023, indicating a generally supportive, albeit cautious, economic environment for ATG.

Conversely, economic downturns and reduced consumer confidence can dampen discretionary spending, negatively affecting asset valuations and auction activity. A slowdown in major economies could lead to lower disposable incomes, making consumers less inclined to purchase items through auction channels. The World Bank noted that global growth is expected to remain subdued in 2025, at 2.4%, highlighting the ongoing need for ATG to navigate a potentially challenging spending landscape.

Persistent inflationary pressures in 2024 could significantly impact Auction Technology Group's (ATG) operational costs, potentially increasing expenses for everything from technology infrastructure to marketing campaigns. This could squeeze profit margins for both ATG and its partner auctioneers.

The Bank of England's base rate, which stood at 5.25% in early 2024, is expected to remain elevated, affecting the cost of capital. Higher interest rates make financing more expensive for buyers of high-value assets, potentially leading to reduced bidding activity and demand in ATG's more premium auction segments.

The global e-commerce market is experiencing robust expansion, with projections indicating continued strong growth. For instance, in 2024, global e-commerce sales were anticipated to reach approximately $6.3 trillion, a significant increase from previous years. This upward trend is fueled by increasing digital adoption and evolving consumer preferences for online shopping convenience.

This sustained growth in online transactions directly benefits Auction Technology Group (ATG). As more consumers and businesses embrace digital platforms for their purchasing needs, ATG's auction marketplaces and related services see a larger pool of potential users and a greater volume of transactions. The ongoing shift towards online commerce across diverse demographics broadens ATG's addressable market, enhancing opportunities for revenue generation and platform development.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant risk for Auction Technology Group (ATG) given its international operations. Volatility in exchange rates can directly impact the reported value of revenue generated from sales in different countries, potentially leading to unexpected gains or losses. For instance, a strengthening GBP against currencies where ATG generates substantial revenue, like the Euro or US Dollar, could reduce the sterling equivalent of those earnings.

These shifts also affect the cost of goods and services procured internationally. If ATG sources technology or services from regions with appreciating currencies relative to the pound, its operating expenses could rise, squeezing profit margins. The company’s financial statements for the fiscal year ending September 2023, for example, would have reflected the impact of average exchange rates throughout that period, and ongoing volatility in 2024 and into 2025 will continue to shape these results.

- Impact on Revenue: A stronger pound can decrease the sterling value of international sales, affecting reported top-line growth.

- Cost of Operations: Fluctuations can increase the cost of imported technology or services, impacting profitability.

- Transaction Value: Cross-border transactions, including acquisitions or investments, become more expensive or cheaper depending on the prevailing exchange rates.

- Competitive Landscape: Exchange rate movements can alter the relative pricing of ATG's services compared to international competitors.

Asset Valuation Trends

The value of assets transacted on Auction Technology Group's (ATG) platforms, encompassing industrial equipment, art, and real estate, is intrinsically linked to prevailing market valuation trends. Economic cycles, shifts in industry-specific demand, and overall investment sentiment significantly influence asset prices. These fluctuations directly impact the average transaction value on ATG's sites and, consequently, its commission revenue.

For instance, during periods of economic expansion and strong investor confidence, asset values tend to rise, potentially leading to higher transaction volumes and values for ATG. Conversely, economic downturns or decreased investment appetite can suppress asset prices. The global economy in 2024 and projected into 2025 is navigating a complex landscape, with inflation concerns and interest rate policies continuing to shape investment decisions across various asset classes. This economic backdrop directly influences the purchasing power and willingness of buyers participating in auctions.

- Industrial Equipment: Global manufacturing output, a key driver for industrial equipment auctions, saw varied performance in 2024. For example, the OECD's industrial production index showed a modest uptick in early 2024, suggesting a stable, albeit not booming, demand for machinery.

- Art Market: The global art market experienced a slight contraction in sales in 2023, with reports indicating a 4% decrease to $65 billion, according to the Art Basel and UBS Global Art Market Report. Projections for 2024 suggest a stabilization, with a focus on high-value segments.

- Real Estate: Residential real estate markets in many developed economies in 2024 continued to be influenced by higher interest rates, leading to more cautious buyer behavior and moderating price growth compared to previous years. Commercial real estate, particularly office spaces, faced headwinds due to remote work trends.

- Investment Sentiment: Investor sentiment, often measured by indices like the VIX (Volatility Index), can signal risk appetite. While the VIX remained relatively contained for much of 2024, geopolitical uncertainties and economic policy shifts could introduce volatility, impacting the willingness to invest in auctioned assets.

The economic landscape for Auction Technology Group (ATG) in 2024 and 2025 is characterized by moderating global growth, with the IMF projecting 3.2% in 2024 and the World Bank forecasting 2.4% for 2025, indicating a generally supportive but cautious environment. Persistent inflation and elevated interest rates, such as the Bank of England's 5.25% base rate in early 2024, continue to influence operational costs and the cost of capital for buyers, potentially impacting demand in premium auction segments.

The robust expansion of the global e-commerce market, with sales expected to reach approximately $6.3 trillion in 2024, directly benefits ATG by increasing the pool of potential users and transaction volumes. However, currency fluctuations pose a risk, as a stronger pound can reduce the sterling value of international earnings and increase the cost of imported services. Asset values transacted on ATG's platforms are also subject to economic cycles and investment sentiment, with recent data showing a slight contraction in the art market in 2023 and moderating price growth in residential real estate due to higher interest rates.

| Economic Factor | 2024/2025 Projection/Status | Impact on ATG |

|---|---|---|

| Global Growth | IMF: 3.2% (2024), World Bank: 2.4% (2025) | Supportive but cautious demand |

| Interest Rates | Bank of England: 5.25% (early 2024) | Higher cost of capital, potential impact on premium asset demand |

| E-commerce Growth | Sales ~$6.3 trillion (2024) | Increased user pool and transaction volumes |

| Inflation | Persistent pressures in 2024 | Increased operational costs, potential margin squeeze |

| Currency Exchange Rates | Ongoing volatility | Risk to reported international revenue and operating costs |

Preview the Actual Deliverable

Auction Technology Group PESTLE Analysis

The preview shown here is the exact PESTLE Analysis document for Auction Technology Group you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

Consumer comfort with online transactions is a significant driver for Auction Technology Group (ATG). Data from Statista indicates that global e-commerce sales are projected to reach $7.4 trillion by 2025, a testament to this shift. This growing preference isn't limited to lower-value goods; consumers are increasingly willing to purchase specialized and even high-value items online, directly benefiting ATG's digital auction platforms.

The demographic makeup of developed nations, with an aging population in many, contrasts with the increasing digital fluency of younger generations. This dynamic directly impacts how online auction platforms like those facilitated by Auction Technology Group (ATG) are adopted. For instance, while older demographics might require more intuitive interfaces, younger, digitally native users expect seamless mobile experiences and advanced features.

Ensuring accessibility for all age groups is paramount for ATG to broaden its bidder pool. As of 2024, over 60% of global internet users are between 16 and 44 years old, a segment that is highly comfortable with digital transactions. Conversely, catering to the needs of older users, who may represent a significant portion of wealth and potential bidders in certain sectors, requires a focus on user-friendly design and clear navigation, potentially boosting bidder numbers by an estimated 10-15% in key markets.

There's a growing global consciousness around environmental issues, with a significant emphasis on sustainability. This awareness is driving a stronger adoption of the circular economy, which prioritizes reusing, repairing, and reselling products rather than discarding them. For instance, the global circular economy market is projected to reach $7.7 trillion by 2030, up from $4.5 trillion in 2022, according to Grand View Research.

This societal trend directly benefits auction platforms like Auction Technology Group (ATG). By facilitating the secondary market for a wide range of assets, from art and antiques to industrial equipment, ATG platforms align perfectly with the values of eco-conscious consumers and businesses looking for sustainable consumption options.

Trust and Transparency in Online Transactions

Consumer trust is the bedrock of online transactions, especially when dealing with high-value or unique items. A 2024 survey indicated that 65% of online shoppers cite trust as a primary factor in their purchasing decisions, a figure that rises for auction platforms. This societal expectation for openness and security directly influences bidder confidence in online marketplaces.

Societal demands for transparency in pricing, clear item descriptions, and secure payment gateways are non-negotiable for platforms like those supported by Auction Technology Group (ATG). Furthermore, the availability of robust dispute resolution processes is crucial for building and maintaining bidder confidence, directly impacting the perceived legitimacy and success of online auctions.

- Consumer Trust: 65% of online shoppers prioritize trust in 2024, a key metric for auction platforms.

- Transparency Expectations: Buyers demand clear pricing, accurate descriptions, and secure payment systems.

- Dispute Resolution: Effective mechanisms are vital for bidder confidence and platform legitimacy.

- High-Value Transactions: Trust is even more critical for the successful sale of unique or expensive items online.

Influence of Social Media and Digital Communities

Social media and online communities are increasingly shaping how people discover and decide on purchases, including unique items found through auction platforms. Auction Technology Group (ATG) can strategically utilize these digital spaces to boost marketing efforts and foster a sense of community. By engaging with societal trends that emphasize shared interests and digital interaction, ATG can attract a wider pool of bidders.

For instance, platforms like Instagram and TikTok have become powerful tools for showcasing unique auction lots, driving awareness and interest. In 2024, social media marketing spend is projected to reach over $200 billion globally, underscoring its significant reach. ATG can leverage user-generated content and influencer collaborations within these communities to highlight the excitement and potential value of auction items.

- Leveraging Digital Communities: ATG can foster online communities around specific auction categories, encouraging discussion and shared experiences among enthusiasts.

- Social Proof and Trust: Positive engagement and testimonials within digital communities can build trust and encourage participation from new bidders.

- Targeted Marketing: Social media analytics allow for precise targeting of individuals with specific interests, ensuring marketing messages reach the most relevant audience.

Societal shifts towards sustainability and the circular economy significantly benefit Auction Technology Group (ATG). As the global circular economy market is projected to reach $7.7 trillion by 2030, ATG's role in facilitating the secondary market for various assets aligns with eco-conscious consumer values.

Consumer trust remains a critical factor, with 65% of online shoppers in 2024 citing it as paramount. ATG must ensure transparency in pricing, item descriptions, and secure payment systems to foster bidder confidence, particularly for high-value items.

The increasing digital fluency of younger generations, coupled with the need to cater to older demographics, presents an opportunity for ATG to design accessible and engaging platforms. With over 60% of global internet users aged 16-44 in 2024, a focus on mobile-first experiences is essential.

Social media and online communities are powerful tools for ATG to market auction items and build engagement. Leveraging platforms where marketing spend is projected to exceed $200 billion globally in 2024 can amplify reach and attract new bidders.

Technological factors

Advancements in AI and machine learning are poised to revolutionize Auction Technology Group's (ATG) platform by enabling highly personalized bidder recommendations and bolstering fraud detection capabilities. These intelligent systems can also refine auction pricing strategies, leading to more efficient market outcomes. For instance, by analyzing vast datasets of past auction performance and bidder behavior, AI algorithms can predict optimal starting bids and increment amounts, potentially increasing revenue for sellers and providing a more engaging experience for buyers.

Auction Technology Group (ATG), as an online platform managing substantial sensitive user data and financial transactions, is perpetually exposed to evolving cybersecurity threats. Maintaining user trust and the integrity of its auction processes hinges on robust data protection and ongoing investment in security infrastructure.

In 2024, the global cost of data breaches was projected to reach $10 trillion, highlighting the significant financial and reputational risks. ATG's commitment to advanced encryption, regular security audits, and employee training is therefore paramount to mitigating these risks and safeguarding its operations.

The widespread adoption of smartphones means Auction Technology Group (ATG) must ensure its platforms are perfectly suited for mobile use. This allows users to easily bid and manage auctions from anywhere. In 2024, it's estimated that over 7 billion people worldwide use mobile phones, highlighting the critical need for a robust mobile strategy.

Ongoing advancements in mobile app capabilities, like faster loading times and intuitive interfaces, are vital for keeping a wide range of users actively involved. For instance, mobile commerce is projected to reach $8.1 trillion globally by 2025, demonstrating the significant revenue potential tied to mobile accessibility.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) are poised to revolutionize auction processes by offering unparalleled transparency and security. For Auction Technology Group (ATG), this means the potential for immutable records, ensuring the provenance of high-value items is verifiable and tamper-proof.

While still in its developmental stages for widespread auction adoption, blockchain's inherent immutability could significantly boost buyer confidence. Imagine a digital certificate of authenticity for a rare artwork or antique, securely recorded on a blockchain, accessible to all parties involved. This level of trust is crucial in the high-stakes world of auctions.

The market for blockchain in supply chain and asset tracking, a closely related field, is projected to grow substantially. For instance, Grand View Research estimated the global blockchain in supply chain market size to be valued at USD 1.23 billion in 2023, with expectations of reaching USD 11.16 billion by 2030, showcasing the increasing adoption of DLT for record-keeping and verification. This growth trajectory suggests that ATG could leverage similar advancements for its platforms.

- Enhanced Transparency: Blockchain provides a shared, immutable ledger, allowing all participants to view transaction history and ownership, fostering trust.

- Immutable Records: Once data is recorded on a blockchain, it cannot be altered or deleted, ensuring the integrity of auction records and item provenance.

- Secure Provenance: DLT can create a secure and verifiable chain of custody for high-value assets, reducing the risk of fraud and counterfeiting.

- Future Opportunities: As DLT matures, it presents significant opportunities for ATG to enhance its platforms' security, authenticity verification, and overall user trust.

Platform Scalability and Cloud Infrastructure

Platform scalability is paramount for Auction Technology Group (ATG), especially during high-demand periods. The company's investment in robust cloud infrastructure, like its use of Amazon Web Services (AWS), allows it to manage significant traffic spikes during major auctions. This ensures a smooth user experience for both auctioneers and bidders, a critical factor in maintaining market share and facilitating growth.

ATG's reliance on advanced cloud solutions directly supports its ability to rapidly expand its global network. By leveraging scalable cloud architecture, ATG can efficiently onboard new auction houses and accommodate a growing international user base. This technological agility is key to its strategy of extending its reach and increasing transaction volumes across diverse markets.

- Cloud Infrastructure Investment: ATG has consistently invested in its cloud capabilities, recognizing it as a core enabler of its business model.

- Peak Traffic Management: The platform's architecture is designed to handle surges in activity, ensuring uptime and performance during critical auction events.

- Global Network Expansion: Scalable cloud solutions facilitate ATG's ongoing efforts to grow its presence and service offerings in new geographical regions.

- Reliability and Performance: Advanced cloud services are fundamental to delivering the consistent reliability and high performance demanded by the online auction industry.

The integration of artificial intelligence and machine learning is set to significantly enhance Auction Technology Group's (ATG) platform. These technologies can personalize bidder experiences and improve fraud detection. AI's analytical power allows for optimized pricing strategies, potentially boosting revenue and engagement.

Legal factors

Global data privacy laws like GDPR in Europe and CCPA in California place stringent demands on how Auction Technology Group (ATG) handles user data, from collection to storage. Failure to comply with these ever-changing regulations can result in substantial financial penalties and erode customer confidence, a significant concern for ATG's international operations.

The increasing focus on data protection means ATG must invest in robust compliance measures, potentially impacting operational costs. For instance, in 2023, companies faced an average of $1.7 million in fines for GDPR violations, underscoring the financial imperative for strict adherence.

Consumer protection laws are crucial for Auction Technology Group (ATG), ensuring fair practices for bidders. These regulations prevent misrepresentation and unfair trading, a key concern in online marketplaces. For instance, in the UK, the Consumer Rights Act 2015 provides strong protections, requiring goods and services to be of satisfactory quality and as described.

These laws often mandate clear refund policies and robust dispute resolution processes, vital for maintaining trust in ATG's platforms. The clarity of terms and conditions for auction participation is also legally dictated, ensuring bidders understand their rights and obligations. Failure to comply can lead to significant penalties and reputational damage.

Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are critical for online auction platforms like those operated by Auction Technology Group (ATG). These legal frameworks are designed to prevent illicit financial activities, particularly important for platforms facilitating high-value transactions. For instance, the UK's Financial Conduct Authority (FCA) continues to emphasize robust AML/KYC compliance, with fines for non-compliance reaching substantial figures for financial institutions, setting a precedent for other regulated sectors.

ATG must therefore implement and maintain stringent verification processes for both users and their transactions to ensure adherence to these evolving legal obligations. Failure to comply can result in significant penalties and reputational damage, underscoring the necessity of proactive and thorough compliance measures in the current regulatory landscape.

Intellectual Property Rights and Counterfeiting

Auction Technology Group (ATG) faces a crucial legal hurdle in ensuring its platforms are free from intellectual property (IP) infringements and the sale of counterfeit goods. This is a constant battle, especially with the sheer volume of items listed across its various marketplaces. For instance, in 2024, global e-commerce platforms reported significant losses due to counterfeit sales, highlighting the scale of this issue.

To combat this, ATG must maintain and continuously improve its IP protection mechanisms and takedown procedures. These systems are vital for minimizing legal exposure and preserving the trust and credibility of its marketplaces. Failure to do so can result in substantial fines and reputational damage.

- IP Infringement: Ensuring sellers on ATG platforms do not list items that violate existing patents, trademarks, or copyrights.

- Counterfeit Prevention: Implementing proactive measures to identify and remove fake or imitation goods before they are sold.

- Takedown Procedures: Establishing clear and efficient processes for IP holders to report infringements and for ATG to act swiftly.

- Legal Compliance: Adhering to international and national laws regarding intellectual property and consumer protection in all operating regions.

Competition and Antitrust Laws

As a significant entity in the online auction sector, Auction Technology Group (ATG) operates under stringent competition and antitrust regulations across multiple global markets. These legal frameworks are designed to foster a level playing field and prevent any single company from dominating the market, which can impact ATG's strategic decisions regarding mergers, acquisitions, and general operational conduct. For instance, the European Commission actively scrutinizes market concentration, and in 2024, it continued its robust enforcement of competition rules, impacting various digital platforms.

These regulations directly influence ATG's approach to market expansion and potential consolidation. Any acquisition by ATG would likely undergo rigorous review to ensure it does not unduly stifle competition or create a monopolistic advantage. In the UK, the Competition and Markets Authority (CMA) also plays a crucial role, with its investigations in 2024 highlighting a focus on digital markets and potential anti-competitive practices.

- Regulatory Scrutiny: ATG's market share and business practices are subject to ongoing review by competition authorities like the CMA and the European Commission.

- Merger Control: Any significant acquisitions by ATG must pass antitrust reviews to ensure they do not harm competition.

- Market Conduct: ATG must ensure its operational strategies comply with laws preventing anti-competitive behavior, such as price-fixing or abuse of dominance.

- Global Compliance: Operating internationally means ATG must navigate a complex web of differing antitrust laws in each jurisdiction it serves.

Auction Technology Group (ATG) must navigate evolving employment laws, ensuring fair treatment and safe working conditions for its global workforce. This includes compliance with minimum wage laws, working hour regulations, and anti-discrimination statutes, with significant penalties for violations. For example, in the UK, the Employment Rights Act 1996 outlines key employee protections, while the US Fair Labor Standards Act sets federal standards for wages and overtime.

Compliance with these regulations impacts ATG's HR policies and operational costs. Recent trends show increased scrutiny on gig economy worker classification, which could affect ATG if it utilizes flexible labor models. Failure to adhere to these laws can lead to costly litigation and damage to employee morale.

The legal landscape surrounding online marketplaces, particularly concerning transaction integrity and buyer protection, directly impacts Auction Technology Group (ATG). Regulations often mandate clear dispute resolution mechanisms and robust seller vetting to prevent fraud. For instance, in 2024, consumer protection agencies globally continued to focus on online marketplaces, issuing guidance on best practices for platform operators.

Environmental factors

The global push towards a circular economy, emphasizing reuse and recycling, directly benefits Auction Technology Group (ATG). This trend supports ATG's business model by facilitating the resale of a wide array of assets, from industrial equipment to art. For instance, the Ellen MacArthur Foundation reported in 2024 that adopting circular economy principles could unlock €4.5 trillion in economic growth for the EU by 2030, highlighting the significant market potential.

Auction Technology Group's (ATG) digital operations, while inherently less resource-intensive than physical auctions, still generate a carbon footprint. This stems from the energy consumed by data centers, servers, and the network infrastructure required to run their online platforms.

Stakeholders, including investors and regulators, are increasingly demanding transparency and action on environmental impact. For instance, the tech sector's overall energy consumption is a growing concern, with data centers alone accounting for a significant portion of global electricity use. This pressure is driving companies like ATG to explore and invest in more sustainable IT solutions, such as cloud services powered by renewable energy and optimizing data center efficiency.

While Auction Technology Group (ATG) doesn't directly manage shipping, its platform facilitates the exchange of physical goods, creating indirect environmental impacts. Encouraging greener logistics, like consolidated shipping or the use of recycled packaging materials, can bolster ATG's environmental profile. For instance, the global logistics industry is a significant contributor to carbon emissions, with shipping alone accounting for approximately 2.5% of the world's total greenhouse gas emissions as of recent estimates.

Waste Reduction Through Asset Reuse

Auction Technology Group (ATG) plays a crucial role in environmental sustainability by facilitating the resale of used assets, thereby reducing waste. Their platforms enable the sale of industrial machinery, vehicles, and consumer goods, directly diverting these items from landfills and extending their useful life. This circular economy approach is a core positive environmental contribution of ATG's business model.

This direct contribution to waste reduction is increasingly important. For instance, in 2023, the UK generated approximately 11.8 million tonnes of waste from commercial and industrial sectors alone, highlighting the scale of the problem ATG's model helps address. By extending the lifecycle of these assets, ATG supports a more resource-efficient economy.

- Landfill Diversion: ATG's marketplace actively prevents usable goods from ending up in landfills.

- Resource Efficiency: By promoting reuse, ATG conserves the raw materials and energy required for new production.

- Circular Economy Support: The company's model is a practical embodiment of circular economy principles, fostering sustainability.

Environmental, Social, and Governance (ESG) Investor Scrutiny

Investors are placing significant emphasis on Environmental, Social, and Governance (ESG) factors when making investment decisions. Auction Technology Group's (ATG) commitment to environmental stewardship, including initiatives for reuse and minimizing its operational footprint, directly impacts its appeal to a growing segment of responsible investors. This focus is crucial for enhancing long-term sustainability and attracting capital from funds prioritizing ESG criteria.

The push for ESG integration is evident in the market. For instance, sustainable investment funds globally reached an estimated $3.9 trillion by the end of 2023, a notable increase from previous years, signaling strong investor demand for companies with robust ESG profiles. ATG's proactive approach to environmental management, such as reducing energy consumption in its data centers and promoting circular economy principles within its auction platforms, can therefore translate into a competitive advantage.

- Growing ESG Investment: Global sustainable investment funds saw substantial growth, reaching approximately $3.9 trillion by the end of 2023, highlighting investor preference for ESG-aligned companies.

- Environmental Stewardship: ATG's initiatives in promoting reuse and managing its operational carbon footprint are key differentiators for attracting responsible investors.

- Long-Term Sustainability: Demonstrating strong environmental performance enhances ATG's attractiveness to investors focused on long-term value creation and resilience.

- Operational Footprint: Efforts to reduce energy consumption and waste within ATG's operations directly contribute to its ESG credentials and investor appeal.

Auction Technology Group (ATG) directly supports environmental sustainability by facilitating the resale of used assets, significantly reducing waste and diverting items from landfills. This circular economy approach conserves raw materials and the energy needed for new production, a critical factor given the substantial waste generated by commercial and industrial sectors, which reached approximately 11.8 million tonnes in the UK in 2023 alone.

The increasing investor focus on Environmental, Social, and Governance (ESG) factors means ATG's environmental stewardship directly enhances its appeal. With sustainable investment funds globally reaching an estimated $3.9 trillion by the end of 2023, companies demonstrating robust environmental performance, like ATG's promotion of reuse and operational footprint management, gain a competitive advantage.

ATG's digital operations, while less resource-intensive than physical auctions, still carry a carbon footprint due to data center energy consumption. As global electricity use by data centers grows, ATG's investment in sustainable IT solutions, such as renewable energy-powered cloud services, becomes increasingly important for its ESG credentials and long-term investor attractiveness.

The company's platform indirectly impacts the environment through the logistics of physical goods exchanged. Encouraging greener shipping practices and recycled packaging materials can improve ATG's environmental profile, especially considering the significant carbon emissions from the global logistics industry, which shipping alone contributes around 2.5% of worldwide greenhouse gas emissions.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Auction Technology Group is built on a robust foundation of data from reputable sources, including global economic reports, government regulatory updates, and leading technology research firms. This ensures that every aspect of the macro-environment is thoroughly examined.