Auction Technology Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auction Technology Group Bundle

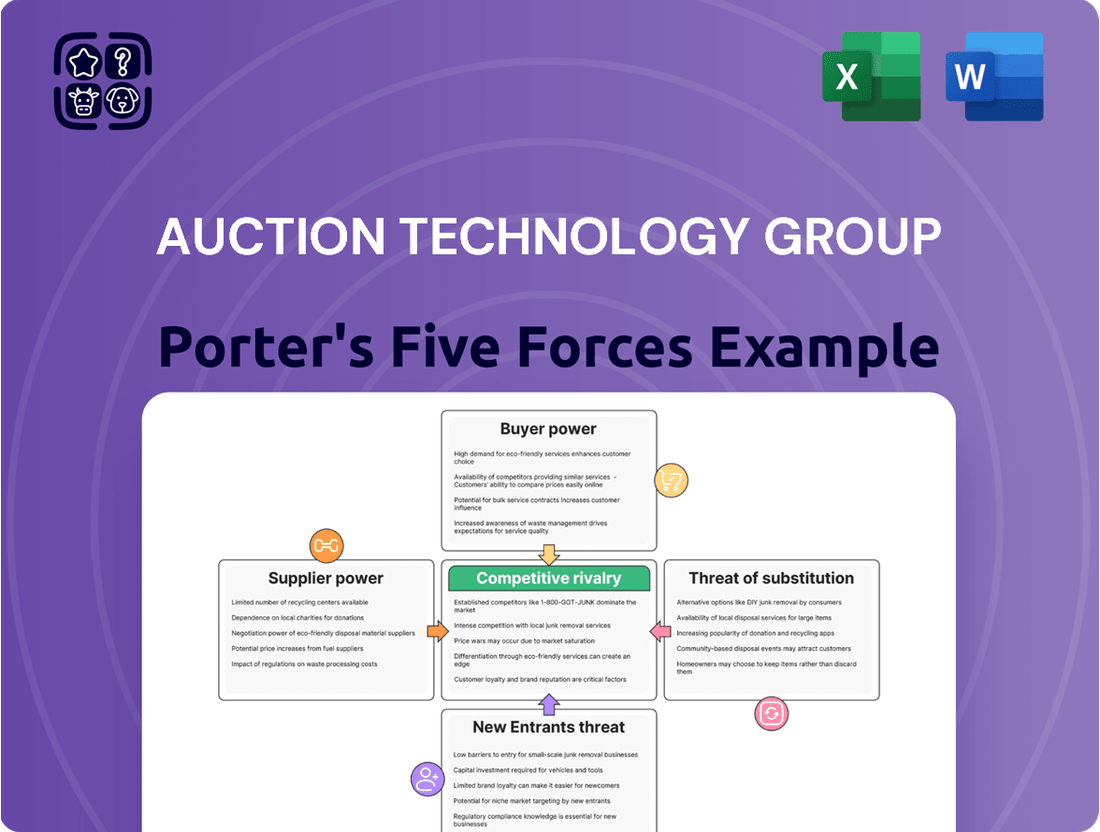

Auction Technology Group operates in a dynamic market shaped by several powerful forces. Understanding the intensity of buyer power, the threat of new entrants, and the influence of suppliers is crucial for navigating this landscape. The competitive rivalry within the auction technology sector also presents significant challenges.

The complete report reveals the real forces shaping Auction Technology Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The primary suppliers to Auction Technology Group (ATG) are the professional auctioneers who utilize its platforms to list and sell assets. ATG serves a substantial base of approximately 3,900 auctioneers, highlighting the breadth of its supplier network.

The platform's ability to connect auctioneers with a global network of bidders makes it a crucial sales channel, often creating a strong dependence. This dependence can limit the bargaining power of individual auctioneers, especially given ATG's established market presence.

High auctioneer retention rates, a testament to the value ATG provides, further suggest that individual auctioneers may have limited leverage. The costs and complexities associated with switching platforms, coupled with the loss of access to ATG's extensive bidder base, reinforce this dynamic.

Auction Technology Group's (ATG) development of proprietary auction platform technology significantly reduces its reliance on external software providers. This in-house capability directly curtails the bargaining power of potential technology suppliers, as ATG controls its core infrastructure.

By maintaining and enhancing its own technology, ATG minimizes the need for third-party software, thereby diminishing the leverage suppliers might otherwise wield. This strategic self-sufficiency is a key factor in managing supplier relationships.

ATG's ongoing investment in research and development, particularly in areas like AI-driven features, further solidifies its technological independence. This commitment to innovation strengthens its position against any potential technology suppliers, ensuring favorable terms.

Auction Technology Group (ATG) is strategically integrating value-added services such as atgShip for shipping and atgPay for payments into its core platform. This integration allows ATG to capture a larger portion of transaction value and lessen reliance on external logistics and payment providers. For example, in 2023, the global shipping market was valued at over $2 trillion, and payment processing services represent a significant portion of e-commerce costs.

Data and Content Providers

Auction Technology Group (ATG), as an online marketplace, depends heavily on the content provided by its auctioneer partners. This content includes auction listings, images, and detailed descriptions crucial for its operations. In 2023, ATG facilitated approximately 88,000 auctions, listing around 23.8 million lots across a wide array of categories, highlighting the extensive volume and diversity of content it aggregates.

The bargaining power of these data and content providers is relatively low. This is primarily due to the sheer scale of ATG's platform and the fragmented nature of its supplier base. No single auctioneer or content provider can significantly influence ATG's terms because the platform’s value lies in its aggregation of diverse offerings.

- Supplier Fragmentation: ATG works with a vast number of auctioneers, meaning individual suppliers have limited leverage.

- Platform Aggregation: ATG's strength comes from bringing together a large volume of diverse auction content, making it difficult for any single provider to replicate this reach independently.

- High Transaction Volume: With millions of lots listed annually, the reliance on any one provider is diminished.

- Switching Costs for Auctioneers: While auctioneers may seek alternatives, migrating their entire operation to a new platform can involve significant costs and effort, somewhat balancing the power dynamic.

Limited Specialised Input Suppliers

Auction Technology Group's (ATG) reliance on highly specialized input suppliers, beyond its core technology and auctioneer content, appears minimal. This is a significant factor in mitigating supplier bargaining power. For instance, in 2023, ATG's cost of revenue was £107.9 million, a figure largely driven by technology and personnel rather than specialized external inputs.

The company procures standard IT infrastructure, marketing services, and general business supplies from a broad base of vendors. The readily available nature of these commoditized inputs means that no single supplier holds substantial leverage. This competitive landscape for generic supplies helps ATG secure favorable pricing and ensures a stable supply chain, reinforcing its position.

- Limited Supplier Dependence: ATG's operational model is not heavily reliant on unique or scarce inputs from external suppliers.

- Commoditized Inputs: Standard IT, marketing, and general business supplies are widely available, reducing supplier leverage.

- Competitive Pricing: The commoditized nature of these inputs allows ATG to benefit from competitive pricing and multiple vendor options.

The bargaining power of suppliers for Auction Technology Group (ATG) is generally low, primarily due to the fragmented nature of its supplier base and ATG's strong market position. ATG serves approximately 3,900 auctioneers, meaning individual auctioneers have limited leverage over the platform.

ATG's proprietary technology development also significantly reduces reliance on external software providers, further diminishing supplier power. The company's integration of services like atgShip and atgPay also lessens dependence on third-party logistics and payment providers.

The company's operational model is not heavily reliant on unique inputs, and standard supplies are widely available from numerous vendors, allowing ATG to benefit from competitive pricing.

| Supplier Type | Dependence Level | Bargaining Power | Key Factors |

|---|---|---|---|

| Auctioneers (Content Providers) | High (for volume) | Low to Moderate | Platform aggregation, fragmentation, switching costs for auctioneers |

| Technology Providers | Low | Low | Proprietary technology, in-house development, R&D investment |

| Logistics & Payment Providers | Low (post-integration) | Low | Platform integration, capture of transaction value |

| General IT & Business Supplies | Low | Low | Commoditized inputs, broad vendor base, competitive pricing |

What is included in the product

This analysis dissects the competitive forces impacting Auction Technology Group, revealing the intensity of rivalry, the power of buyers and suppliers, and the threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Auction Technology Group.

Customers Bargaining Power

Bidders hold considerable sway when they can easily hop between various auction platforms. This is certainly true for Auction Technology Group's users. Imagine wanting to buy a collectible; you're not stuck with just one place to look. You can check out Auction Technology Group's offerings, but also easily browse sites like eBay or LiveAuctioneers, and even traditional auction houses that now have online presences.

This ease of comparison really puts power in the hands of the buyer. They can quickly see where the best deals are, forcing auction platforms to remain competitive on pricing and user experience. In 2023, the global online auction market was valued at over $5 billion, a figure expected to grow, highlighting the vast number of options available to bidders and thus their amplified bargaining power.

Professional auctioneers, a crucial customer segment for Auction Technology Group (ATG), wield moderate bargaining power. While ATG provides a robust global network and sophisticated tools, these auctioneers can opt for alternative online platforms or even invest in proprietary digital solutions.

ATG counters this by bundling essential value-added services, making its platform more attractive. The company's success in retaining auctioneers, with retention rates often cited as high, underscores the perceived value and integration of ATG's comprehensive suite of offerings, effectively increasing customer stickiness.

Customers, especially in areas like consumer goods and industrial equipment, often care a lot about price. This sensitivity means they have a good amount of sway. They might hold off for a better price, look for different ways to buy, or bid lower if they feel the cost is too much.

Auction Technology Group (ATG) is focused on boosting how often people actually make purchases. This means they need to carefully manage how engaged bidders are and what they believe the items are worth. Doing this helps keep people bidding, even when they're mindful of the price.

In 2024, for instance, many consumers reported delaying purchases of big-ticket items due to inflation concerns, a trend that directly impacts how willing bidders are to engage in auctions. This highlights the need for ATG to ensure its platforms offer compelling value propositions to overcome such price-driven hesitations.

Transparency in Online Bidding

Online auction platforms, like those operated by Auction Technology Group, inherently foster transparency. Bidders can readily access real-time bid histories and see the progression of pricing, which is a significant factor in their decision-making process. This visibility allows them to gauge demand and adjust their strategies accordingly, directly impacting their influence on final prices.

This transparency directly enhances the bargaining power of customers. Knowing the current highest bid and the bidding history allows them to assess the true market value and decide if a particular item is worth pursuing at a given price point. For instance, in 2024, the average winning bid on many online auction platforms reflected a keen awareness of item condition and comparable sales, demonstrating informed consumer behavior.

- Informed Bidding: Customers can see how much others are willing to pay, enabling them to set their own limits more effectively.

- Competitive Awareness: Real-time data on bids helps buyers understand the competitive landscape and avoid overpaying.

- Price Influence: Greater transparency can lead to more rational bidding, giving customers more power to influence the final sale price.

Network Effect for Customers

Auction Technology Group (ATG) actively cultivates a network effect, making its platform increasingly valuable as more participants join. This strategy aims to lock in customers, thereby diminishing their individual bargaining power. For instance, a larger pool of bidders naturally attracts more auctioneers seeking wider reach, and conversely, a greater variety of auctions draws in more potential buyers.

This symbiotic relationship strengthens ATG's position. By making its marketplaces more indispensable through this growing network, the company can gradually reduce the leverage customers might otherwise wield. The ability for auctioneers to cross-list items across various ATG-owned marketplaces further amplifies this utility, creating a more integrated and valuable ecosystem.

- Network Effect: ATG's core strategy to increase platform value through user growth.

- Reduced Bargaining Power: As the network grows, customers become more reliant on ATG's consolidated marketplace.

- Cross-Listing Benefits: Auctioneers gain efficiency and reach by listing across multiple ATG platforms, reinforcing customer loyalty.

Customers, particularly those seeking specific or niche items, possess significant bargaining power due to the ease of comparing offerings across multiple online auction platforms. This ability to easily switch between marketplaces like Auction Technology Group's sites and competitors forces platforms to maintain competitive pricing and user experience. In 2024, the continued growth of the online auction market, projected to exceed $6 billion, underscores the vast number of choices available to bidders, amplifying their influence.

Preview Before You Purchase

Auction Technology Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Auction Technology Group's Porter's Five Forces analysis, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of competitive rivalry within the auction technology sector. This comprehensive overview equips you with a thorough understanding of the strategic landscape.

Rivalry Among Competitors

The online auction landscape is fiercely competitive, featuring significant global players that directly challenge Auction Technology Group. Established platforms like eBay and LiveAuctioneers, alongside traditional powerhouses such as Sotheby's and Christie's that have robust online operations, vie for market share across different auction categories.

These major competitors often possess considerable brand equity and extensive customer networks, amplifying the pressure on Auction Technology Group to differentiate its offerings and maintain its competitive edge. For instance, in 2023, eBay reported over 130 million active buyers globally, underscoring the scale of user bases that Auction Technology Group's clients must contend with.

Beyond the dominant players, the auction technology market is notably fragmented. Numerous smaller online auction platforms thrive by focusing on specific asset categories, such as vintage cars or rare collectibles, or by targeting particular geographic regions. These niche operators can present a significant competitive challenge within their specialized domains, offering highly tailored user experiences that resonate deeply with their target audiences.

The competitive landscape for auction technology is intensely driven by a relentless technological race. Companies are pouring resources into areas like artificial intelligence (AI) for smarter bidding, real-time auction capabilities, and enhanced mobile accessibility to capture a wider user base. This constant innovation is key to staying ahead.

Significant investments are being made to develop cutting-edge features that improve user experience, bolster fraud prevention mechanisms, and streamline the bidding process for greater efficiency. For instance, many platforms are integrating advanced analytics to provide users with better insights during auctions.

Auction Technology Group's (ATG) strategic emphasis on proprietary technology and the development of AI-driven features is paramount. This focus allows ATG to differentiate itself and maintain a competitive advantage in a market where technological advancement dictates market share and user engagement.

Price and Commission Pressure

The auction technology sector faces significant pressure on pricing, with platforms constantly competing on listing fees and commission rates to attract both auctioneers and buyers. This intense rivalry means that companies like Auction Technology Group (ATG) must carefully manage their pricing strategies.

While ATG's strategy involves increasing its take rate through value-added services, the competitive landscape might necessitate price adjustments or substantial investment in unique features to maintain premium pricing. For instance, in 2023, the overall online auction market saw continued growth, but with increased competition from niche platforms, putting pressure on established players to innovate and justify their fee structures.

- Price Sensitivity: Bidders and auctioneers are often price-sensitive, seeking the most cost-effective solutions.

- Commission Rates: Competitors may offer lower commission percentages, forcing ATG to re-evaluate its own rates.

- Value-Added Services: Differentiation through services like enhanced analytics or marketing support becomes crucial to offset price competition.

Brand Reputation and Trust

In the online auction realm, brand reputation and trust are absolutely critical. This is because buyers are often concerned about issues like shill bidding, where fake bids are placed to inflate prices, and the authenticity of the items being sold. Auction Technology Group (ATG) benefits significantly from its established relationships with reputable auction houses, which in turn helps build strong bidder confidence.

Newcomers or platforms with less established reputations find it difficult to compete with companies that possess strong brand equity and a proven history of secure, reliable transactions. For instance, in 2023, ATG reported a 12% increase in its customer base, underscoring the value placed on its trusted platform.

- Brand Reputation: ATG's long-standing partnerships with established auction houses build inherent trust.

- Bidder Confidence: A proven track record in secure transactions is vital for attracting and retaining bidders.

- Competitive Advantage: Strong brand equity acts as a significant barrier to entry for less reputable online auction platforms.

The competitive rivalry for Auction Technology Group (ATG) is intense, with major global players like eBay and established auction houses such as Sotheby's and Christie's actively participating in the online space. These competitors leverage strong brand recognition and extensive user bases, creating significant pressure on ATG to continually innovate and differentiate its services.

The market is also populated by numerous niche platforms specializing in specific asset types or regions, offering tailored experiences that challenge larger players. This fragmentation necessitates a strategic focus on unique value propositions to retain market share.

Technological advancement is a key battleground, with companies investing heavily in AI, real-time capabilities, and mobile accessibility. ATG's own investment in proprietary technology and AI-driven features aims to secure its competitive edge in this rapidly evolving landscape.

Pricing remains a critical factor, as both auctioneers and buyers are price-sensitive, leading to competition on commission rates and listing fees. ATG's strategy to increase its take rate through value-added services is crucial, but the market's price pressures may require ongoing adjustments or substantial feature development to justify premium pricing.

| Competitor | Key Strengths | 2023 Market Presence Indicator |

|---|---|---|

| eBay | Massive active buyer base, brand recognition | 130+ million active buyers globally |

| LiveAuctioneers | Specialized auction platform, established user network | Significant presence in art and antiques |

| Sotheby's/Christie's | High-end brand, traditional auction house prestige | Robust online sales growth reported |

SSubstitutes Threaten

Direct e-commerce platforms like Amazon and Shopify present a significant substitute for online auctions. These channels allow sellers to list items at fixed prices, offering buyers a straightforward purchase without the uncertainty or competitive bidding inherent in auctions. In 2024, global e-commerce sales were projected to reach over $6 trillion, highlighting the sheer volume of transactions occurring outside of auction formats.

Online classifieds and peer-to-peer platforms like Facebook Marketplace present a significant threat of substitutes for Auction Technology Group. These platforms allow direct sales between individuals, bypassing traditional auction models and their associated fees. For instance, the sheer volume of transactions facilitated by platforms like eBay’s peer-to-peer segment, which saw a substantial increase in user-generated listings throughout 2024, highlights the growing consumer preference for direct engagement and potentially lower costs.

In the industrial and commercial spheres, rental and leasing models present a significant threat of substitutes to auction technology groups. Businesses often prefer leasing equipment for flexibility and to avoid the large upfront costs associated with purchasing assets, particularly when technology evolves rapidly. This can reduce the demand for auction-acquired machinery.

For instance, the global equipment rental market was valued at approximately $100 billion in 2023 and is projected to grow steadily. Companies like United Rentals, a major player in this sector, offer extensive rental fleets, providing a convenient alternative to buying used equipment through auctions. This accessibility and lower initial investment make leasing an attractive option, especially for projects with uncertain durations or for companies that want to stay on the cutting edge of technology without the burden of ownership.

Traditional Brokerage and Dealerships

For high-value assets like real estate, vehicles, and industrial equipment, traditional brokerage and specialized dealerships represent significant substitutes to auction platforms. These established channels provide personalized client services, expert appraisals, and a more curated sales experience that appeals to sellers and buyers prioritizing control and bespoke advice over broad market exposure.

These traditional methods can offer a more controlled and often private transaction environment. For instance, in the luxury car market, a dealership might offer a guaranteed sale price and handle all negotiations, whereas an auction's outcome is inherently uncertain. In 2024, the used car market saw continued strength, with many transactions still occurring through traditional dealerships, indicating a persistent preference for these established sales models.

- Personalized Service: Traditional brokers and dealers often build long-term relationships, offering tailored advice and handling all aspects of a sale.

- Expert Appraisals: Specialized knowledge allows them to provide accurate valuations, which can be crucial for unique or high-value assets.

- Controlled Sales Environment: These channels offer a more predictable and less volatile selling process compared to the dynamic nature of auctions.

- Established Trust: Many consumers and businesses have long-standing trust in established dealerships and brokerage firms.

Bartering and Direct Exchange

While not a direct competitor to Auction Technology Group's (ATG) core online auction services, the concept of bartering and direct exchange of goods and services represents a fundamental substitute for formal transactional platforms. This is particularly relevant in smaller, localized economies or within specific niche communities where trust and direct relationships facilitate the exchange of value without monetary intermediaries.

Although bartering is unlikely to displace ATG's digital marketplace for significant transactions, it highlights the underlying human impulse to exchange assets directly. This can be seen in the continued prevalence of local swap meets or informal online groups dedicated to trading goods. For instance, in 2023, the global informal economy was estimated to be worth trillions of dollars, demonstrating the scale of non-monetized exchange, though direct bartering constitutes only a fraction of this.

- Bartering's Limited Scale: Direct exchange is typically confined to smaller, often non-monetary transactions, making it a minor threat to ATG's revenue streams derived from commissions on larger sales.

- Niche Community Relevance: In specific subcultures or local areas, bartering can fulfill needs, bypassing the need for formal auction platforms for certain types of goods or services.

- Underlying Exchange Principle: Bartering represents an extreme form of bypassing formal systems, underscoring the broader availability of alternatives for asset exchange beyond traditional marketplaces.

The threat of substitutes for auction technology groups remains significant, encompassing direct e-commerce, peer-to-peer platforms, rental models, and traditional brokerage. These alternatives offer convenience, lower costs, or specialized services that can divert transactions away from auction formats.

For instance, global e-commerce sales were projected to exceed $6 trillion in 2024, indicating a vast market operating outside auction environments. Similarly, the equipment rental market, valued around $100 billion in 2023, provides businesses with flexible alternatives to purchasing assets through auctions.

| Substitute Type | Key Characteristics | Impact on Auction Technology Groups | Example Data (2024/2023) |

|---|---|---|---|

| Direct E-commerce | Fixed pricing, immediate purchase | Reduces demand for competitive bidding | Global e-commerce sales projected > $6 trillion |

| Peer-to-Peer Platforms | Direct sales, potentially lower fees | Bypasses traditional auction models | Significant user-generated listings growth |

| Rental/Leasing | Flexibility, lower upfront costs | Decreases demand for asset acquisition via auction | Equipment rental market ~$100 billion (2023) |

| Traditional Brokerage/Dealerships | Personalized service, expert appraisals | Appeals to those prioritizing control and advice | Continued strength in used car market via dealerships |

Entrants Threaten

Establishing a robust, scalable online auction platform with global reach, secure infrastructure, and advanced features like real-time bidding demands substantial capital. New entrants would need significant funding for technology development, marketing to attract both auctioneers and bidders, and establishing operational support across multiple geographies. For instance, building a platform comparable to Auction Technology Group's (ATG) sophisticated infrastructure, which processes billions in transaction value annually, could easily require tens of millions of dollars in upfront investment.

Auction Technology Group enjoys robust network effects, where a growing number of auctioneers naturally draws in more bidders, and a larger bidder pool incentivizes more auctioneers to join. This creates a virtuous cycle that is difficult for newcomers to break into.

For a new entrant to gain traction, they would need to attract a substantial number of both auctioneers and buyers simultaneously, a feat that is incredibly challenging given ATG's established market presence. In 2023, Auction Technology Group reported a significant increase in its customer base, further solidifying its network advantage.

Building a strong brand and earning trust in the auction sector is a long and costly process. Because of worries about authenticity, security, and the possibility of shill bidding in online auctions, buyers and sellers tend to favor established players like Auction Technology Group (ATG). Newcomers must make significant investments to establish credibility and address these perceived risks.

Regulatory and Legal Complexities

The online auction sector is heavily regulated, presenting significant hurdles for new players. Navigating diverse national and international laws covering consumer protection, cross-border sales, and payment systems requires substantial investment and expertise. For instance, in 2024, the European Union continued to emphasize stricter data privacy laws like GDPR, impacting how platforms handle user information, adding to compliance burdens.

These regulatory complexities translate into high upfront compliance costs and a constant risk of legal repercussions for any missteps. New entrants must allocate considerable resources to legal counsel and compliance officers to ensure adherence to varied requirements, from anti-money laundering checks to specific rules for auctioning certain goods like vehicles or antiques.

Failure to meet these stringent standards can lead to hefty fines and reputational damage, effectively deterring many potential competitors. The ongoing evolution of digital regulations, including those related to online marketplaces and financial transactions, means that staying compliant is a continuous and costly process.

- High Compliance Costs: New entrants must invest heavily in legal and compliance infrastructure to navigate varied national and international regulations.

- Risk of Legal Challenges: Non-compliance with consumer protection, payment processing, or asset-specific laws can result in significant legal penalties.

- Evolving Regulatory Landscape: Continuous updates to digital and financial regulations demand ongoing adaptation and resource allocation from market participants.

Technological Expertise and Innovation Pace

Developing and continuously innovating sophisticated auction technology, including AI-driven features for enhanced user experience and operational efficiency, demands specialized technical expertise and ongoing research and development investment. New entrants might struggle to match the technological capabilities and rapid innovation pace of established players like ATG, who are already investing in cutting-edge solutions. For instance, in 2024, many fintech companies are allocating significant portions of their budgets to AI and machine learning development, with some reports indicating R&D spending in this area exceeding 20% of revenue for leading innovators.

This high barrier to entry is further amplified by the need for substantial capital to fund the necessary talent acquisition and infrastructure. Established companies like Auction Technology Group have a significant head start, having already built robust platforms and accumulated valuable data insights. Their ongoing investment in areas like predictive analytics and personalized bidding experiences creates a moving target for any potential newcomer aiming to compete effectively in the digital auction space.

- High R&D Investment: Companies in the auction technology sector are investing heavily in R&D, with some dedicating over 20% of revenue to AI and machine learning in 2024.

- Specialized Talent: The development of advanced auction platforms requires highly skilled engineers and data scientists, a talent pool that is both expensive and competitive.

- Pace of Innovation: Established players continuously update their technology, making it challenging for new entrants to catch up without substantial resources and a clear technological edge.

- Capital Requirements: Significant upfront capital is needed to develop, deploy, and maintain sophisticated auction technology, acting as a deterrent for many potential new entrants.

The threat of new entrants for Auction Technology Group (ATG) is significantly mitigated by the immense capital required to build and launch a competitive online auction platform. Developing a secure, scalable, and feature-rich system comparable to ATG's, which facilitates billions in transactions, necessitates tens of millions in upfront investment for technology, marketing, and global operations. This high financial barrier effectively deters many potential market entrants.

Furthermore, ATG benefits from powerful network effects; more auctioneers attract more bidders, and vice versa, creating a self-reinforcing cycle that is exceptionally difficult for newcomers to penetrate. Successfully entering the market requires simultaneously attracting a critical mass of both auctioneers and buyers, a challenge compounded by ATG's established market dominance. In 2023, ATG saw continued growth in its user base, further strengthening this advantage.

The auction technology landscape also demands substantial investment in research and development, particularly in areas like AI and machine learning, with leading fintech firms reportedly allocating over 20% of revenue to R&D in 2024. This high pace of innovation, coupled with the need for specialized talent and continuous technological upgrades, creates a formidable obstacle for new players attempting to compete with established entities like ATG.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Auction Technology Group is built upon a foundation of publicly available financial reports, industry-specific market research, and reputable trade publications. This ensures a comprehensive understanding of the competitive landscape.