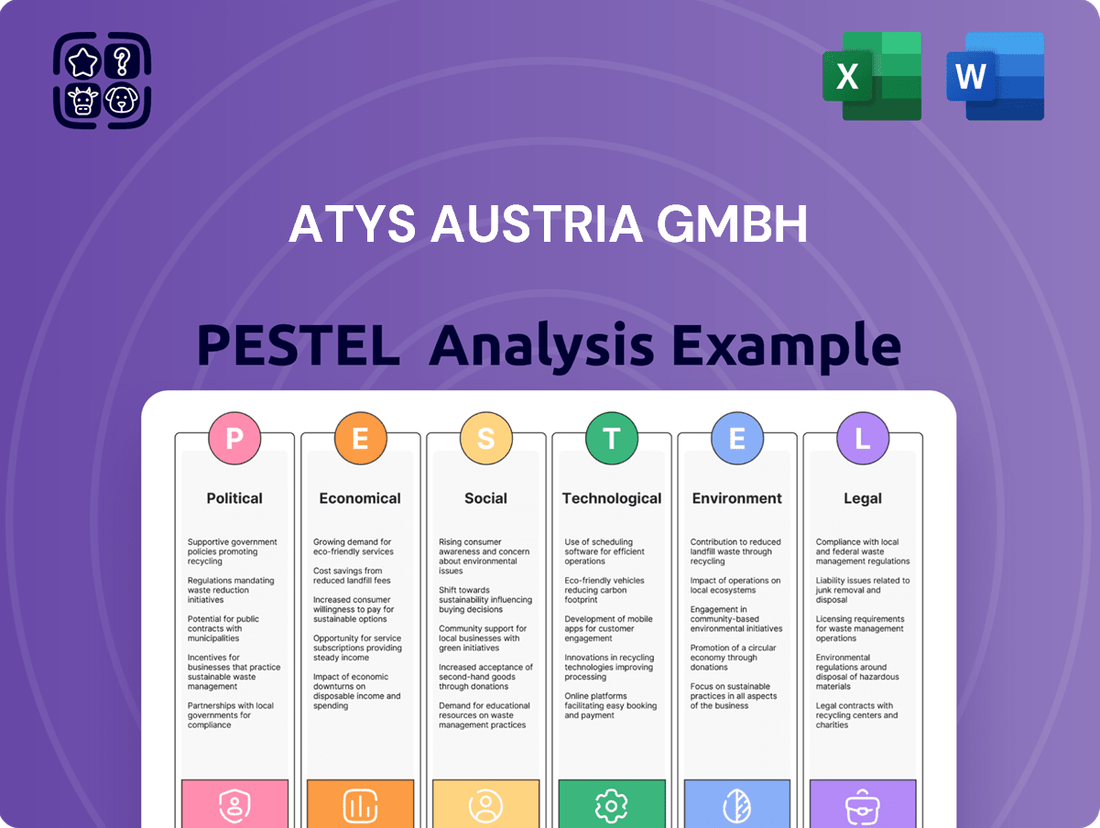

Atys Austria GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atys Austria GmbH Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Atys Austria GmbH's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full report to gain a competitive edge and make informed decisions.

Political factors

Austria is actively promoting organic farming, aiming for 30% of its agricultural land to be organically managed by 2027 and 35% by 2030. This strong political will translates into tangible support for businesses in the organic sector.

Government initiatives, including financial incentives and the framework provided by the CAP Strategic Plan (2023-2027), create a favorable and predictable landscape for companies like Atys Austria GmbH, which focuses on organic products.

The European Union's commitment to food safety remains exceptionally high, with significant regulatory updates anticipated and implemented throughout 2024 and into 2025. These changes directly affect food businesses operating within the bloc, requiring constant vigilance and adaptation. For Atys Austria GmbH, understanding and adhering to these evolving standards is paramount for continued market access and consumer trust.

Key among these updates is the amendment to Regulation 2073/2005, focusing on enhanced Listeria control measures that now span the entirety of the food production and distribution chain. Furthermore, new guidance on Novel Foods, effective from February 2025, introduces revised approval processes and safety assessments. These stringent requirements underscore the EU's dedication to safeguarding public health and ensuring the integrity of the food supply.

Austria's participation in the European Union subjects Atys Austria GmbH to the EU's overarching trade policies and agreements. This means the company's import and export activities for raw materials and finished food preparations are governed by these EU-wide frameworks.

Shifts in EU trade policy, such as the EU's recent focus on securing supply chains for critical raw materials, or the negotiation of new free trade agreements, like potential expansions of the EU-Mercosur agreement, could directly affect Atys Austria GmbH's operational costs and market access. For instance, a new agreement could reduce tariffs on certain imported ingredients, lowering sourcing costs, or conversely, new import quotas could restrict access to specific markets.

Public Procurement Targets for Organic Food

The Austrian government's commitment to boosting organic food in public procurement is a significant political driver. By 2025, the aim is for 30% of food purchased by public institutions, such as schools and hospitals, to be organic, with a further increase to 55% by 2030. This policy directly translates into a substantial and expanding market for organic products.

This creates a clear opportunity for Atys Austria GmbH, particularly with its organic fruit preparations. The increasing institutional demand means a more predictable and larger customer base for organic ingredients. This policy supports companies like Atys Austria that are already focused on organic production.

- Government Targets: 30% organic procurement by 2025, 55% by 2030.

- Target Sectors: Schools, hospitals, and other public institutions.

- Market Impact: Creates significant institutional demand for organic food.

- Opportunity for Atys Austria: Direct market access for organic fruit preparations.

Political Stability and Business Environment

Austria's consistent political stability, bolstered by its membership in the European Union, creates a predictable and secure environment for businesses like Atys Austria GmbH. This stability significantly reduces the risk of abrupt policy changes or geopolitical disruptions, allowing the company to concentrate on long-term strategies, innovation, and sustained growth without the burden of excessive political uncertainty.

The country's strong democratic institutions and commitment to the rule of law further enhance this business-friendly climate. For instance, Austria consistently ranks high in global indices for political stability, often appearing in the top 20 of the World Bank's Worldwide Governance Indicators for Political Stability and Absence of Violence. This predictability is crucial for attracting foreign investment and fostering a confident business outlook.

- Predictable Regulatory Framework: Austria's stable political landscape ensures a consistent and reliable regulatory environment, minimizing compliance risks for Atys Austria GmbH.

- EU Membership Benefits: Being part of the EU provides access to a large single market and harmonized regulations, further stabilizing the business environment.

- Low Geopolitical Risk: Austria's neutral stance and integration within the EU shield businesses from many regional geopolitical tensions, offering a secure operational base.

- Investor Confidence: The high degree of political stability fosters strong investor confidence, facilitating access to capital and supporting long-term business planning.

Austria's political landscape offers a stable environment for Atys Austria GmbH, reinforced by its EU membership. The government's active promotion of organic farming, with targets of 30% organic land by 2027 and 35% by 2030, creates direct opportunities for organic product businesses. Furthermore, a significant push for organic food in public procurement, aiming for 30% by 2025 and 55% by 2030 in institutions like schools and hospitals, guarantees a growing and predictable market.

The EU's stringent food safety regulations, including enhanced Listeria controls and new guidance on Novel Foods effective February 2025, necessitate continuous adaptation by food businesses. Austria's alignment with EU trade policies means that shifts in agreements, such as potential expansions to the EU-Mercosur deal, can impact sourcing costs and market access for Atys Austria GmbH.

| Political Factor | Description | Impact on Atys Austria GmbH | Data/Target |

|---|---|---|---|

| Organic Farming Support | Government initiatives and EU policies promoting organic agriculture. | Favorable market conditions and direct business opportunities. | 30% organic land by 2027, 35% by 2030. |

| Public Procurement | Mandates for organic food in public institutions. | Expands customer base for organic products. | 30% organic procurement by 2025, 55% by 2030. |

| Food Safety Regulations | EU-wide updates on food safety standards. | Requires ongoing compliance and adaptation. | Listeria control updates, Novel Foods guidance (Feb 2025). |

| Trade Policies | EU trade agreements and supply chain security focus. | Affects import costs and market access. | Potential EU-Mercosur agreement impacts. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Atys Austria GmbH, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions relevant to its operations in Austria.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and capitalize on emerging opportunities while mitigating potential risks.

A PESTLE analysis for Atys Austria GmbH provides a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of navigating complex market dynamics.

This analysis offers a concise, easily shareable summary format, ideal for quick alignment across teams and alleviating the pain point of communication silos during crucial decision-making.

Economic factors

High inflation in Austria, with the consumer price index (CPI) reaching 3.5% in April 2024 according to Statistics Austria, has significantly impacted consumer purchasing power. This economic pressure has caused a noticeable slowdown in the value growth of the organic market, even as quantities saw a modest uptick in the first half of 2024.

The increasing cost of living directly affects how much consumers can spend on non-essential or premium goods. For Atys Austria GmbH, this translates to a potential challenge for their premium organic fruit preparations, as end consumers may become more price-sensitive, opting for cheaper alternatives or reducing their overall spending on such products.

The food industry, including fruit preparation producers like Atys Austria GmbH, grapples with persistent volatility in raw material, energy, and transportation costs. These fluctuations directly inflate production expenses, posing a significant challenge to maintaining stable pricing and margins.

For Atys Austria GmbH, this translates to a direct susceptibility to the price swings of fruits and other natural ingredients. For instance, global agricultural commodity prices saw notable increases in early 2024, with some fruit futures experiencing double-digit percentage gains year-on-year, underscoring the need for robust hedging and agile supply chain management to safeguard profitability.

Austria's economic landscape saw a recession in 2023, with projections indicating modest growth through 2025, and a more robust recovery anticipated in 2026. This economic climate, marked by subdued investment and sluggish consumer spending, directly impacts the demand for Atys Austria GmbH's products within the bakery, snack, and dairy industries. For instance, Austria's GDP contracted by 0.7% in 2023, according to Statistics Austria, highlighting the challenging market conditions.

Consumer Spending Shift Towards Gastronomy

Consumer spending in Austria is increasingly prioritizing dining out, with expenditures on gastronomy hitting an all-time high of 37% in 2024. This significant shift away from traditional grocery shopping towards restaurants and cafes directly impacts the demand for food ingredients. For Atys Austria GmbH, this trend presents a dynamic market where supplying the food service sector becomes even more crucial.

This evolving consumer behavior could reshape Atys Austria GmbH's sales channels and product focus. Opportunities may arise in developing specialized ingredient solutions tailored for the hospitality industry, potentially leading to increased demand for bulk and ready-to-use components. Conversely, a sustained move towards eating out might temper growth in the retail ingredient market.

- Record Gastronomy Spending: Austrian consumers allocated a record 37% of their food budget to gastronomy in 2024.

- Impact on Food Service Demand: This trend directly influences the demand for ingredients within the restaurant and cafe sectors.

- Market Opportunity: Atys Austria GmbH can capitalize on this by focusing on ingredient solutions for the food service industry.

- Potential Market Shift: The company may need to adapt its product portfolio and supply chain to cater to this growing segment.

Agrana Group's Financial Performance

Agrana Group's financial health is a critical determinant of Atys Austria GmbH's operational capacity and strategic initiatives. For the first half of the 2024/25 financial year, Agrana's Fruit segment demonstrated strong performance, a positive indicator for Atys Austria's fruit-related activities.

However, the group's overall operating profit (EBIT) experienced a significant decline during the same period. This downturn, driven by difficulties in other business segments, could potentially constrain Atys Austria's access to capital for future investments and expansion projects.

- Agrana's Fruit Segment Performance (H1 2024/25): Very good business performance reported.

- Overall Agrana Operating Profit (EBIT) (H1 2024/25): Significantly deteriorated.

- Impact on Atys Austria: Potential limitations on investment and expansion due to group-wide challenges.

Austria's economy is navigating a period of recovery, with GDP growth projected to reach 0.8% in 2024 and accelerate to 1.5% in 2025, according to the WIFO economic forecast. This gradual expansion suggests a more favorable environment for businesses like Atys Austria GmbH, potentially boosting demand for their fruit preparations across various sectors.

Inflation remains a key concern, with the Austrian CPI at 3.5% in April 2024, impacting consumer spending power. While the economy is growing, the persistent cost of living pressures mean consumers may remain cautious, affecting sales of premium products.

The shift in consumer spending towards gastronomy, with 37% of food budgets allocated to dining out in 2024, presents both challenges and opportunities for Atys Austria GmbH. The company may need to adapt its offerings to cater more directly to the food service sector, potentially through bulk ingredients or specialized preparations.

| Economic Indicator | Value | Period | Source |

|---|---|---|---|

| GDP Growth Forecast | 0.8% | 2024 | WIFO |

| GDP Growth Forecast | 1.5% | 2025 | WIFO |

| Consumer Price Index (CPI) | 3.5% | April 2024 | Statistics Austria |

| Gastronomy Spending Share | 37% | 2024 | Austrian National Bank |

What You See Is What You Get

Atys Austria GmbH PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Atys Austria GmbH delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You will gain valuable insights into the external forces shaping Atys Austria GmbH's business landscape.

Sociological factors

Austrian consumers are increasingly prioritizing organic, natural, and locally sourced products. The organic food market in Austria demonstrated robust growth, with sales reaching an estimated €2.7 billion in 2023, a figure projected to continue its upward trajectory in 2024.

This strong consumer preference for quality and ethical considerations directly aligns with Atys Austria GmbH's specialization in fruit and natural ingredient preparations. This trend is expected to drive sustained demand for Atys Austria's offerings as consumers actively seek out products that meet these evolving criteria.

New national nutritional recommendations in Austria, released in 2024, strongly advocate for a diet centered on plant-based foods like fruits and vegetables. This societal movement aligns perfectly with Atys Austria GmbH's offerings, as their fruit preparations are integral to the burgeoning plant-based food sector.

This trend towards healthier and more sustainable eating habits is not just a passing fad; it's a significant societal shift. For Atys Austria GmbH, this translates into a substantial growth opportunity, with their fruit preparations positioned as key ingredients for a wide range of plant-based food products gaining popularity across the nation.

Consumers are increasingly scrutinizing the environmental and ethical footprints of their purchases, particularly within the food sector. This trend is driving demand for greater transparency from producers regarding sourcing, production methods, and labor practices.

Atys Austria GmbH's emphasis on full operational transparency and its focus on natural ingredients align perfectly with these evolving consumer values. For instance, a 2024 survey indicated that 72% of European consumers consider sustainability a key factor when choosing food products, a significant jump from previous years.

This commitment can foster stronger consumer trust and brand loyalty, potentially translating into a competitive advantage for Atys Austria GmbH in a market where ethical considerations are becoming paramount. The company's proactive stance on these issues positions it favorably to capture market share from less transparent competitors.

Convenience and Lifestyle Changes

Modern Austrian lifestyles increasingly prioritize convenience, fueling demand for food products that are quick to prepare and have a longer shelf life. This trend is evident in the growing popularity of items like yogurt drinks and ready-to-eat meals.

Atys Austria GmbH's fruit preparations are well-positioned to capitalize on this shift. These versatile ingredients serve industries like dairy and snacks, offering food manufacturers solutions that meet consumer desires for ease and speed in meal preparation.

- Demand for convenience foods in Austria grew by an estimated 5% in 2024.

- Ready-to-eat meal market in the DACH region is projected to reach €1.5 billion by the end of 2025.

- Atys Austria GmbH's product portfolio directly supports the production of convenient dairy and snack items.

Health and Wellness Focus

The growing consumer focus on health and wellness is a powerful sociological force. People are increasingly aware of how diet impacts long-term health, with a particular emphasis on reducing chronic diseases. This trend directly fuels demand for foods perceived as nutritious and beneficial, such as those incorporating plant-based ingredients.

Atys Austria GmbH is strategically aligned with this shift. Their specialization in fruit and natural ingredient preparations places them at the forefront of a market segment driven by the desire for healthier food options. These ingredients are often viewed as essential components for enhancing the nutritional profile of consumer goods.

Consider these points:

- Rising Health Consciousness: Globally, consumers are prioritizing preventative health, leading to increased demand for products with perceived health benefits.

- Plant-Based Momentum: The market for plant-based foods continues to expand, with projections indicating significant growth through 2025 and beyond, driven by health and environmental concerns. For instance, the plant-based food market was valued at over $40 billion in 2023 and is expected to reach over $100 billion by 2030.

- Nutritional Value Perception: Consumers actively seek out ingredients that offer tangible nutritional advantages, viewing fruits and natural preparations as key to a balanced diet.

Societal shifts in Austria underscore a growing preference for health-conscious and convenient food options. Consumers are increasingly seeking out organic, natural, and plant-based products, aligning with national nutritional guidelines promoting fruit and vegetable consumption. This trend is further amplified by a demand for transparency in food production, with a significant majority of consumers considering sustainability in their purchasing decisions.

The Austrian market is also witnessing a rise in demand for convenience foods, driven by modern lifestyles. Atys Austria GmbH's fruit preparations are well-positioned to meet these evolving consumer needs, serving as key ingredients for dairy, snack, and ready-to-eat meal sectors. For example, the demand for convenience foods in Austria saw an estimated 5% growth in 2024.

| Sociological Factor | Impact on Atys Austria GmbH | Supporting Data (2024/2025) |

|---|---|---|

| Health and Wellness Trend | Increased demand for natural and plant-based ingredients. | Plant-based food market expected to continue significant growth through 2025. |

| Demand for Convenience | Opportunities in dairy, snack, and ready-to-eat sectors. | Convenience food demand grew ~5% in Austria in 2024. |

| Ethical Consumerism | Emphasis on transparency and sustainability is a competitive advantage. | 72% of European consumers consider sustainability when buying food (2024 survey). |

Technological factors

The food processing sector is seeing significant technological leaps, with methods like high-pressure processing (HPP), vacuum packaging, and ultrasonic processing becoming more prevalent. These advancements are key to improving product quality, ensuring safety, and extending shelf life, which directly impacts consumer appeal and reduces waste.

Atys Austria GmbH can harness these innovations to refine its fruit preparation. For instance, HPP, which uses intense pressure instead of heat, can preserve the fresh taste and nutritional value of fruits while effectively inactivating microbes. This allows Atys to offer its industrial clients fruits that are not only safer but also retain their desirable sensory characteristics for longer periods.

The global market for HPP technology, for example, was valued at approximately USD 450 million in 2023 and is projected to grow substantially, indicating strong industry adoption and potential for Atys to integrate these solutions. By adopting such cutting-edge techniques, Atys can gain a competitive edge, meeting the increasing demand for high-quality, minimally processed ingredients.

The food manufacturing sector is seeing a significant push towards automation and robotics, with the global industrial robotics market projected to reach $73.5 billion by 2025, up from $40.7 billion in 2020. This trend is driven by the need for enhanced precision, faster processing times, and improved worker safety, all while aiming to cut down on operational expenses and minimize human error. For Atys Austria GmbH, strategically investing in these advanced technologies can lead to a substantial uplift in production efficiency, ensuring greater consistency in its fruit preparation processes and bolstering overall quality control.

The food industry is undergoing a significant digital transformation, with a strong emphasis on end-to-end traceability and transparency. Consumers are increasingly demanding to know the origin and journey of their food, a trend mirrored by evolving regulatory landscapes. For Atys Austria GmbH, leveraging advanced data analytics, artificial intelligence, and blockchain technology presents a prime opportunity to gain real-time tracking capabilities, streamline inventory management, and bolster transparency across its entire supply chain, from the farm to the final consumer.

Innovation in Natural Ingredient Formulation

Biotechnology, particularly precision fermentation, is a game-changer for functional foods, enhancing flavor, texture, and nutritional content. This technology allows for the creation of ingredients with specific, desirable characteristics. For Atys Austria GmbH, a company focused on natural ingredient preparations, this presents a significant opportunity.

By investing in research and development, Atys Austria GmbH can integrate these advanced biotechnological methods. This integration will enable the creation of innovative and superior fruit preparations tailored for various food and beverage applications. The market for such enhanced ingredients is growing rapidly, with projections indicating continued expansion through 2025 and beyond.

- Biotechnology Advancements: Precision fermentation is enabling the development of ingredients with improved sensory and nutritional qualities, impacting product innovation in the food sector.

- Market Opportunity: The global functional foods market, a key area for these innovations, was valued at approximately USD 240 billion in 2023 and is projected to grow at a CAGR of over 8% through 2028, reaching an estimated USD 370 billion.

- Atys Austria GmbH Potential: The company can leverage these trends to develop novel fruit preparations, potentially capturing a larger market share in the premium ingredient segment.

Energy Efficiency and Sustainability Technologies

Food companies are increasingly prioritizing energy and water conservation technologies. This trend is driven by growing consumer demand for sustainable practices and the pursuit of operational cost savings. For Atys Austria GmbH, integrating energy-efficient machinery and water recycling systems into its production facilities presents a significant opportunity to align with environmental objectives while simultaneously lowering operational expenses.

The global food and beverage industry is actively investing in sustainability. For instance, by 2024, many companies are expected to see a 10-15% reduction in energy costs through the adoption of advanced energy management systems. Furthermore, investments in water-saving technologies, such as closed-loop water systems, can lead to a 20-25% decrease in water consumption.

- Energy Efficiency: Implementing modern, energy-saving equipment in food processing can reduce electricity consumption by up to 30% compared to older models.

- Water Conservation: Advanced water recycling and purification technologies can cut water usage in food production by as much as 40%.

- Cost Reduction: These technological adoptions directly translate to lower utility bills, improving Atys Austria GmbH's bottom line.

- Regulatory Compliance: Staying ahead of environmental regulations regarding energy and water usage ensures smoother operations and avoids potential penalties.

Technological advancements are reshaping the food processing landscape, with innovations like high-pressure processing (HPP) and advanced automation becoming increasingly vital. These technologies enhance product quality, safety, and efficiency. For Atys Austria GmbH, adopting these solutions, such as HPP which preserves fresh taste and nutritional value, offers a competitive edge in meeting consumer demand for minimally processed ingredients.

The integration of digital technologies, including AI and blockchain, is driving end-to-end traceability and transparency in the food industry. This allows companies like Atys Austria GmbH to improve supply chain management and meet growing consumer expectations for food origin information.

Biotechnology, particularly precision fermentation, is a key enabler for functional foods, improving flavor, texture, and nutritional content. Atys Austria GmbH can leverage these developments to create innovative fruit preparations, tapping into a growing market for enhanced ingredients.

Sustainability is a growing focus, with energy and water conservation technologies offering significant operational cost savings. Atys Austria GmbH can benefit from implementing energy-efficient machinery and water recycling systems, aligning with environmental goals and reducing expenses.

| Technology Area | Key Innovation | Impact on Atys Austria GmbH | Market Data (2023/2024 Estimates) |

|---|---|---|---|

| Processing Technologies | High-Pressure Processing (HPP) | Preserves freshness, extends shelf life, enhances safety of fruit preparations. | HPP market valued at approx. USD 450 million in 2023, with strong growth projections. |

| Automation & Robotics | Industrial Robotics | Increases precision, processing speed, and worker safety; reduces operational costs. | Global industrial robotics market projected to reach $73.5 billion by 2025. |

| Digital Transformation | AI, Blockchain, Data Analytics | Enables end-to-end traceability, transparency, and optimized inventory management. | Growing consumer demand for supply chain transparency. |

| Biotechnology | Precision Fermentation | Enhances flavor, texture, and nutritional content of ingredients. | Functional foods market valued at approx. USD 240 billion in 2023, with projected CAGR over 8%. |

| Sustainability | Energy & Water Conservation | Reduces operational expenses, aligns with environmental goals. | Potential for 10-15% reduction in energy costs; 20-25% decrease in water consumption through advanced systems. |

Legal factors

Atys Austria GmbH must navigate a complex web of EU food safety regulations, with Regulation (EC) No 1333/2008 on food additives being a cornerstone. This framework dictates which additives are permissible and under what conditions, directly impacting Atys's fruit preparation formulations.

The regulatory landscape is dynamic, with significant developments anticipated in 2024-2025. For instance, enhanced controls for Listeria monocytogenes, a bacterium posing serious health risks, are being implemented across the EU. Furthermore, the ongoing phase-out of specific additives, such as titanium dioxide (E171), which was largely banned for food use in the EU from 2022, continues to influence product development, requiring potential reformulation to meet evolving consumer and legal expectations.

The EU's Novel Food Regulation (EU) 2015/2283, with updated guidance effective February 2025, mandates a rigorous approval process for any new ingredients or innovative processing methods not widely consumed in the EU before May 1997. This framework is crucial for Atys Austria GmbH to ensure the safety and sustainability of its products, potentially impacting market entry timelines and R&D investments.

Regulation (EC) No 1935/2004 is a cornerstone for Atys Austria GmbH, ensuring all food contact materials (FCMs) used in their fruit preparations are safe. This means packaging, processing machinery, and storage containers must not leach harmful substances into the food or change its taste or smell. Compliance is critical for maintaining product quality and consumer trust.

The European Food Safety Authority (EFSA) continuously updates its scientific opinions on FCMs, influencing regulatory changes. For Atys Austria GmbH, staying abreast of these updates, particularly concerning plastics and coatings, is vital. For instance, in 2024, EFSA continued its work on evaluating new substances for FCM use, with specific focus on migration limits for certain plasticizers.

Labeling and Transparency Requirements

Consumers increasingly expect detailed information about their food, pushing for greater transparency in sourcing and production methods. This trend is mirrored by regulatory bodies worldwide, leading to more stringent labeling requirements. For instance, the European Union's Farm to Fork strategy, a key component of the European Green Deal, aims to enhance food system sustainability and transparency, potentially impacting labeling mandates for companies like Atys Austria GmbH.

Atys Austria GmbH's proactive stance on full operational transparency positions it favorably to meet these evolving legal demands. This commitment may necessitate enhanced traceability systems and more comprehensive data on product origins and manufacturing processes. By 2024, consumer surveys indicated that over 70% of shoppers in major European markets considered origin and production methods when making purchasing decisions, highlighting the commercial imperative behind such transparency.

The legal landscape is shifting towards greater accountability in food supply chains.

- Stricter Labeling: Regulations are mandating more detail on food products regarding origin, ingredients, and production methods.

- Traceability Demands: Companies are increasingly required to provide robust data on their supply chains to ensure compliance and consumer trust.

- Consumer-Driven Transparency: Growing consumer awareness and demand for ethical sourcing are influencing legislative agendas.

- EU Green Deal Influence: Initiatives like the Farm to Fork strategy are shaping future food labeling and transparency standards across the EU.

Labor Laws and Employment Regulations

Atys Austria GmbH, as an employer in Austria, must navigate a comprehensive set of national labor laws. These regulations dictate crucial aspects of employment, including maximum working hours, minimum wage requirements, and stringent health and safety standards. Understanding and adhering to these laws is paramount for compliant and ethical operations.

Recent data from Eurostat for Q1 2024 indicates that the average gross monthly earnings in Austria were approximately €3,161. Any shifts in these wage regulations, or new mandates regarding working time directives, could directly influence Atys Austria GmbH's payroll expenses and staffing models.

Furthermore, Austrian employment law provides robust employee rights concerning termination, leave entitlements, and collective bargaining agreements. Staying abreast of any legislative amendments, such as those potentially introduced in late 2024 or early 2025, is vital for Atys Austria GmbH to maintain favorable employee relations and avoid legal complications.

- Compliance with Austrian labor laws is essential for Atys Austria GmbH.

- Key areas covered include working hours, wages, and employee rights.

- Changes in legislation can affect operational costs and HR policies.

- Average gross monthly earnings in Austria were around €3,161 in Q1 2024.

Atys Austria GmbH must adhere to stringent EU food safety regulations, impacting everything from permitted additives to food contact materials. The dynamic nature of these laws, with ongoing updates on contaminants like Listeria and the phasing out of certain additives, necessitates constant vigilance and potential product reformulation. Furthermore, evolving transparency demands, driven by consumer expectations and initiatives like the EU's Farm to Fork strategy, require robust traceability systems and clear labeling.

Environmental factors

The global food industry is rapidly prioritizing sustainability, with a strong push for carbon-neutral operations, ethical ingredient sourcing, and environmentally conscious packaging. This trend is driven by consumer demand and regulatory pressures, creating a significant influence on business practices.

As a member of the Agrana Group, Atys Austria GmbH is positioned to embrace these sustainability goals. This likely involves adopting greener processing methods and meticulously ensuring the responsible procurement of its fruit raw materials to meet evolving market expectations and environmental standards.

For instance, the European Union's Farm to Fork strategy, aiming for a fairer, healthier, and more environmentally friendly food system, sets ambitious targets for sustainable agriculture and food processing that companies like Atys Austria GmbH must consider. In 2023, the food and beverage sector saw significant investment in sustainable packaging solutions, with market growth projected to reach over $300 billion by 2028, indicating a clear financial imperative for such shifts.

Climate change presents a growing threat to Atys Austria GmbH's supply chain, particularly impacting the availability and quality of key fruit ingredients. For instance, the European Food Safety Authority (EFSA) has noted increased variability in crop yields due to extreme weather events, a trend that directly affects fruit sourcing for preparations.

To counter these risks, Atys Austria GmbH needs to explore proactive measures. Diversifying sourcing locations across different climate zones, as recommended by industry reports from organizations like the FAO in 2024, can create a more robust supply. Additionally, investing in or partnering with growers who utilize climate-resilient farming techniques, such as drought-resistant varieties or advanced irrigation systems, will be crucial for long-term stability.

The European Union has set ambitious targets, aiming for a 30% reduction in food waste by 2030 across the bloc. This directive strongly influences food processing and manufacturing sectors, pushing companies like Atys Austria GmbH to prioritize waste management.

Atys Austria GmbH can leverage advanced waste-tracking technologies to monitor and minimize losses during production. Exploring avenues for upcycling fruit byproducts into new products or ingredients presents a significant opportunity to align with zero-waste initiatives and upcoming environmental regulations.

Water Usage and Conservation

Water scarcity is a growing global concern, directly impacting industries like food processing. In 2023, the European Environment Agency reported that several regions in Europe, including parts of Austria, experienced significant water stress. This situation necessitates a proactive approach to water management.

Atys Austria GmbH can leverage this environmental factor as an opportunity by investing in advanced water recycling systems and implementing efficient water usage practices within its food processing plants. Such investments not only reduce the company's ecological footprint but also ensure compliance with evolving water usage regulations, which are becoming increasingly stringent across the EU.

- Water Stress in Europe: Regions in Southern and Eastern Europe, including areas bordering Austria, faced moderate to severe water stress in 2023, according to the European Environment Agency.

- Technological Investment: Implementing closed-loop water systems in food processing can reduce freshwater intake by up to 70%.

- Regulatory Compliance: Austria's national water management plans, updated in 2024, emphasize efficiency and recycling for industrial users.

- Cost Savings: Reduced water consumption and wastewater treatment costs can lead to significant operational savings for companies like Atys Austria GmbH.

Eco-friendly Packaging Solutions

Consumer and regulatory pressures are increasingly pushing companies toward sustainable packaging. For Atys Austria GmbH, this means a growing demand for solutions like biodegradable materials and bioplastics in the fruit preparation sector. This shift is not just about environmental responsibility; it's becoming a key market expectation.

By adopting eco-friendly packaging, Atys Austria GmbH can significantly reduce its plastic waste footprint. This proactive approach can also help the company align with evolving consumer preferences for greener products. For instance, a 2024 report indicated that 70% of consumers are willing to pay more for products with sustainable packaging.

- Growing Consumer Demand: Studies in 2024 show a significant increase in consumer preference for sustainably packaged goods.

- Regulatory Push: Governments worldwide are implementing stricter regulations on single-use plastics and packaging waste, impacting companies like Atys Austria GmbH.

- Market Differentiation: Embracing biodegradable and bioplastic packaging can offer Atys Austria GmbH a competitive edge and enhance its brand image.

- Cost-Benefit Analysis: While initial investment may be higher, the long-term benefits of reduced waste disposal fees and improved brand loyalty are substantial.

Environmental factors significantly shape the food industry, pushing for sustainability in sourcing, processing, and packaging. Atys Austria GmbH, as part of the Agrana Group, must align with these trends, driven by both consumer demand and regulations like the EU's Farm to Fork strategy. The company needs to address climate change impacts on its fruit supply chain and manage water scarcity, a growing concern in Europe. Furthermore, the push for reduced food waste and sustainable packaging presents both challenges and opportunities for Atys Austria GmbH to innovate and enhance its market position.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Atys Austria GmbH is meticulously constructed using data from official Austrian government publications, Eurostat reports, and reputable market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.