Atys Austria GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atys Austria GmbH Bundle

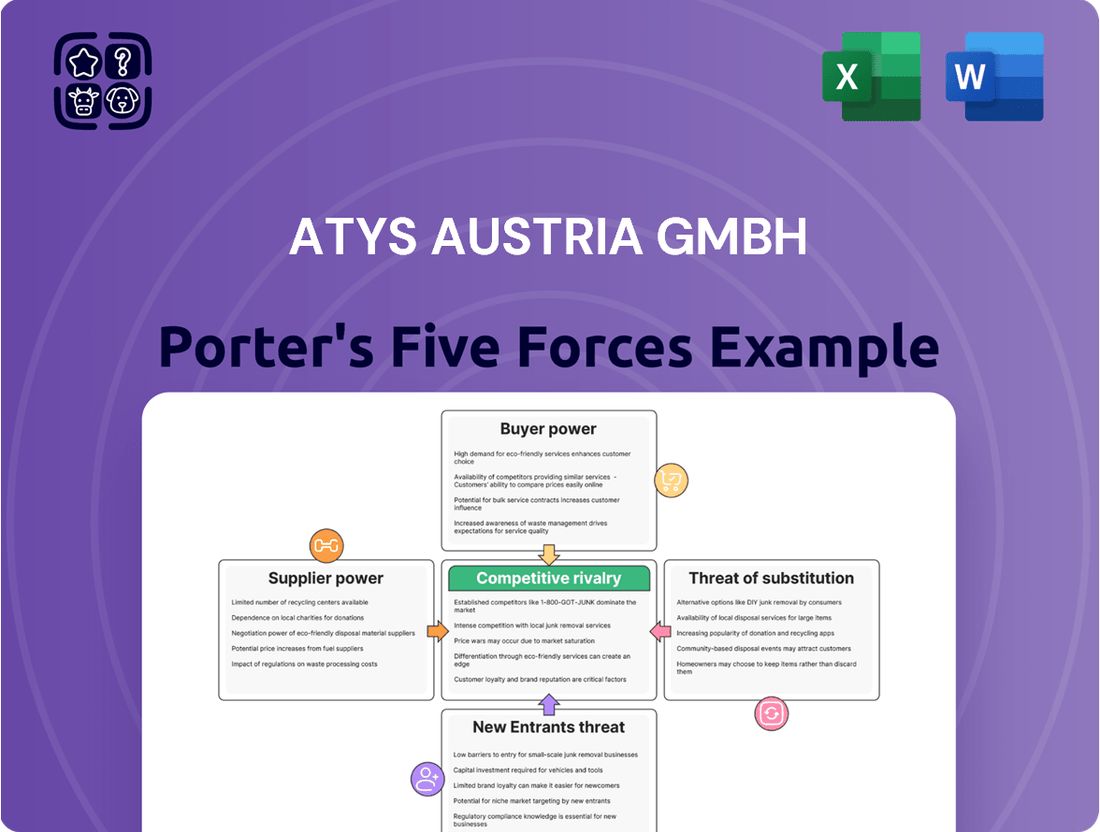

Our initial look at Atys Austria GmbH reveals a dynamic competitive landscape, with moderate threats from new entrants and significant pressure from substitute products.

The full analysis delves into the intricate web of buyer and supplier power, quantifying the intensity of each force and its direct impact on Atys Austria GmbH's profitability. Don't just understand the market; master it.

Ready to move beyond the basics? Get a full strategic breakdown of Atys Austria GmbH’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The market for high-quality fruits and natural ingredients, crucial for Atys Austria GmbH, can be quite concentrated. This means a limited number of growers or processors might control significant portions of supply for specific specialty crops or regions. For instance, in 2024, the global supply of certain organic berries, vital for premium food products, was dominated by a handful of producers in South America and Europe.

Atys Austria GmbH's requirement for consistent quality and particular varieties of these ingredients directly impacts its supplier choices. If the company needs very specific flavor profiles or organic certifications, its pool of potential suppliers shrinks considerably. This reliance on a narrow selection of suppliers for essential inputs grants those suppliers increased bargaining leverage.

This leverage can translate into higher prices or less favorable terms for Atys Austria GmbH. For example, if a key supplier of a unique fruit puree experiences a poor harvest in 2024, leading to a 20% reduction in available stock, they are in a strong position to dictate terms to buyers like Atys Austria GmbH, who need that specific ingredient for their product lines.

Suppliers who provide unique or highly differentiated fruit varieties or specialized processing methods for Atys Austria GmbH hold significant bargaining power. For instance, if Atys relies on a specific supplier for rare organic berries or a proprietary fruit extraction technique, that supplier can dictate terms and potentially increase prices. This input differentiation makes it difficult and costly for Atys to switch to alternative suppliers, thereby strengthening the supplier's position.

Switching suppliers for fruit preparations at Atys Austria GmbH presents considerable hurdles. These include the expenses associated with re-certification of new suppliers, the implementation of entirely new quality control protocols, and the potential for significant disruptions to Atys's production timelines. For instance, in 2024, a typical food manufacturer might face costs ranging from €10,000 to €50,000 for a single supplier change, encompassing testing, validation, and initial order adjustments.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into fruit preparation could impact Atys Austria GmbH. If suppliers of raw fruits or initial processed ingredients gain the capability or see a strong incentive to start their own fruit preparation operations, they could directly compete with Atys. This would potentially shrink Atys's market share or lead to tougher negotiations on pricing and terms.

However, the specialized nature of Atys Austria GmbH's processing techniques and its established customer relationships likely mitigate this risk for many of its raw material suppliers. These unique capabilities create a barrier, making it less probable for most upstream suppliers to successfully replicate Atys's value proposition and directly enter their market segment.

For instance, in 2024, the global fruit processing market saw continued growth, with demand for value-added products like purees and concentrates increasing. Suppliers focusing on bulk commodity fruits might find it challenging to invest in the advanced technology and quality control required to meet the specific demands of companies like Atys, which serve discerning B2B clients in the food and beverage industry.

- Supplier Forward Integration Risk: Suppliers of raw or primary processed fruits could enter Atys Austria GmbH's fruit preparation business.

- Impact on Atys: This could lead to reduced market share or less favorable terms for Atys.

- Mitigating Factors: Atys's specialized processing and customer relationships make this threat less likely for most raw material providers.

- Market Context (2024): The growing demand for value-added fruit products in 2024 highlights the potential for suppliers to move up the value chain, though barriers exist.

Importance of Atys to Supplier

The bargaining power of suppliers for Atys Austria GmbH is significantly influenced by how crucial Atys's business is to their overall revenue. If Atys Austria GmbH constitutes a substantial percentage of a supplier's sales, that supplier is likely to be more accommodating with pricing and terms.

Conversely, if Atys represents a minor portion of a supplier's customer base, the supplier holds greater leverage. For instance, if a key component supplier, like a specialized machinery manufacturer, derives 20% of its annual income from Atys, they will likely prioritize Atys's needs and be more flexible. However, if Atys is only 1% of that supplier's business, the supplier can afford to dictate terms more assertively.

- Supplier Dependence: The degree to which suppliers rely on Atys Austria GmbH for their revenue directly impacts their bargaining power.

- Revenue Contribution: A higher revenue contribution from Atys to a supplier generally weakens the supplier's leverage.

- Market Concentration: If Atys sources from a concentrated supplier market, suppliers may have increased power.

The bargaining power of suppliers to Atys Austria GmbH is substantial, particularly when sourcing specialized or unique fruit ingredients. In 2024, the market for certain organic berries, critical for premium food products, was dominated by a few key producers, giving them significant leverage over buyers like Atys.

High switching costs, including re-certification and new quality control protocols, further bolster supplier power. For example, a single supplier change for a food manufacturer in 2024 could incur costs between €10,000 and €50,000, making it prohibitive for Atys to switch easily.

Suppliers who provide unique fruit varieties or proprietary processing methods can dictate terms, as Atys's reliance on these specific inputs limits its alternatives. This situation intensifies when Atys represents a small fraction of a supplier's total sales, allowing the supplier to be more assertive with pricing and conditions.

| Factor | Impact on Atys Austria GmbH | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | High power for suppliers of specialized ingredients. | Limited number of organic berry producers in key regions in 2024. |

| Switching Costs | Deters Atys from changing suppliers. | €10,000-€50,000 cost per supplier change for food manufacturers in 2024. |

| Input Differentiation | Strengthens supplier leverage for unique inputs. | Reliance on specific fruit purees or proprietary extraction techniques. |

| Atys's Importance to Supplier | Low importance grants suppliers more power. | If Atys is only 1% of a supplier's business, they can dictate terms more easily. |

What is included in the product

This analysis dissects the competitive forces impacting Atys Austria GmbH, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, providing a clear roadmap for strategic action.

Customers Bargaining Power

Atys Austria GmbH's customer base is notably concentrated, with a significant portion of its revenue derived from a few large players in the dairy, bakery, and snack sectors. This concentration means that these major clients, by virtue of their substantial order volumes, hold considerable sway in price discussions.

The sheer scale of purchases made by these key customers grants them substantial bargaining power. They can often dictate terms, demand lower prices, or even threaten to shift their business to competitors if their demands are not met, directly impacting Atys Austria GmbH's profitability.

For instance, in 2024, it's estimated that the top 5 dairy industry clients accounted for over 30% of Atys Austria GmbH's ingredient sales, highlighting the critical importance and inherent risk associated with this customer concentration.

For major food manufacturers, changing a fruit preparation supplier often entails significant expenses. These can include the cost of reformulating products to ensure taste and texture remain consistent, obtaining new regulatory approvals for altered ingredients, and reconfiguring supply chains to accommodate a new partner. For example, a significant product recall due to a change in a key ingredient could cost a large food manufacturer millions in lost sales and damaged reputation.

However, the bargaining power of customers can be amplified if the fruit preparation itself is a largely standardized commodity. In such cases, where there are few differentiating factors between suppliers, the effort and cost to switch are minimal, giving customers more leverage to demand lower prices.

Atys Austria GmbH actively works to mitigate this customer power by focusing on providing comprehensive services and driving technical innovation. By offering unique solutions and tailored support, Atys aims to create higher switching costs for its clients, making it more complex and expensive for them to move to a competitor.

Customers in the food industry, particularly those manufacturing high-volume consumer goods, exhibit significant price sensitivity. This is driven by intense competition within their own sectors, compelling them to seek cost reductions from their suppliers, including Atys Austria GmbH.

The ease with which these customers can compare pricing across various suppliers amplifies their bargaining leverage. For instance, in 2024, the average price increase for food ingredients in Europe hovered around 5-7%, a figure that customers are actively trying to mitigate by negotiating harder with their suppliers.

Threat of Backward Integration by Customers

Large food manufacturers, a significant customer base for Atys Austria GmbH, possess the capability to engage in backward integration. This means they could potentially produce their own fruit preparations, bypassing Atys. The feasibility of this depends on their available capital and the technical know-how required for such an operation.

This potential for in-house production directly enhances the bargaining power of Atys's customers. If major clients, such as those in the dairy or bakery sectors, can credibly threaten to produce their own fruit preparations, they gain leverage to negotiate more favorable terms, including lower prices or better payment conditions.

- Customer Integration Potential: Major food manufacturers often have the financial resources and operational capacity to develop in-house fruit preparation capabilities.

- Impact on Atys: The credible threat of backward integration by key customers can force Atys to offer more competitive pricing or service agreements to retain business.

- Industry Trends: In 2024, consolidation within the food manufacturing sector might see larger players with greater resources exploring such vertical integration strategies to control costs and supply chains more effectively.

Product Differentiation of Atys's Offerings

Atys Austria GmbH's strategic focus on specialized fruit preparations, particularly its organic and customized solutions, serves as a key differentiator. This specialization allows Atys to carve out a niche, making its products less susceptible to direct price comparisons with generic offerings.

By providing unique formulations and robust technical support, Atys can significantly diminish the bargaining power of its customers. When customers rely on Atys for specific innovations or solutions not readily available elsewhere, their ability to pressure for lower prices or demand more concessions is inherently reduced.

The difficulty customers face in finding equivalent alternatives for highly differentiated products directly translates to lower bargaining power. For instance, in 2024, the demand for tailored, high-quality fruit inclusions in the bakery and dairy sectors saw a notable increase, with specialized suppliers like Atys benefiting from this trend.

- Specialized Offerings: Atys's emphasis on organic and customized fruit preparations distinguishes it from competitors.

- Reduced Substitutability: Unique formulations and technical support make Atys's products harder to replace.

- Customer Dependence: Innovation and tailored solutions foster customer reliance, limiting their bargaining leverage.

- Market Trends: The 2024 surge in demand for specialized ingredients underscores the value of product differentiation in strengthening Atys's market position.

Atys Austria GmbH faces significant customer bargaining power due to a concentrated customer base, price sensitivity, and the potential for customer backward integration. While Atys mitigates this through specialization and innovation, the sheer volume purchased by key clients, coupled with industry-wide price pressures observed in 2024, means customers retain substantial influence.

| Factor | Description | Impact on Atys Austria GmbH | 2024 Data/Trend |

|---|---|---|---|

| Customer Concentration | A few large dairy, bakery, and snack clients account for a significant portion of revenue. | These clients have considerable leverage in price negotiations. | Top 5 dairy clients represented over 30% of ingredient sales in 2024. |

| Price Sensitivity | Customers are driven by intense competition in their own sectors to reduce costs. | Customers actively negotiate for lower prices from suppliers like Atys. | Average food ingredient price increases in Europe were around 5-7% in 2024. |

| Backward Integration Potential | Large food manufacturers could potentially produce their own fruit preparations. | The threat of in-house production enhances customer leverage for better terms. | Consolidation in food manufacturing may encourage larger players to explore vertical integration in 2024. |

What You See Is What You Get

Atys Austria GmbH Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Atys Austria GmbH, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes.

Rivalry Among Competitors

The fruit preparation market, especially in Europe, is quite crowded. You'll find big international companies alongside smaller, niche regional businesses. This mix means competition is definitely a factor for companies like Atys Austria GmbH.

A larger number of competitors, particularly when many are of a similar scale and possess comparable abilities, naturally cranks up the intensity of rivalry. Atys Austria GmbH, being part of the Agrana group, navigates this dynamic marketplace.

The organic and health-conscious food sector, a key area for Atys Austria GmbH, is experiencing robust growth, which tends to temper intense rivalry. For instance, the global organic food market was valued at approximately USD 234.7 billion in 2023 and is projected to reach USD 517.8 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 12.1% during this period. This expansion allows companies to increase sales by tapping into new demand rather than solely by outmaneuvering existing competitors.

Competitive rivalry in the fruit preparation sector is significantly influenced by product differentiation. If competitors offer similar, undifferentiated fruit preparations, the market tends to become a price-driven battleground, intensifying rivalry.

Companies like Atys Austria GmbH can effectively mitigate this price-based competition by focusing on differentiation. This can be achieved through unique ingredients, innovative processing techniques, or specialized services such as offering organic options, custom fruit blends, or dedicated technical support to clients.

The emphasis on natural ingredient preparations by Atys Austria GmbH is a clear strategy to carve out a distinct market position. For instance, in 2024, the global fruit and vegetable processing market was valued at approximately USD 450 billion, with a growing segment dedicated to natural and organic products, indicating a strong consumer preference for differentiated offerings.

Exit Barriers

Atys Austria GmbH likely faces significant exit barriers within the food processing industry. The specialized nature of food processing equipment, from automated packaging lines to specific fermentation tanks, represents a substantial capital investment that is difficult to redeploy or sell at a favorable price if a company decides to exit. This capital intensity means that exiting a market can incur considerable losses.

Furthermore, long-term contracts with suppliers and distributors, often a feature of the food sector, can bind companies to operations even when market conditions deteriorate. These contractual obligations, coupled with potentially high employee severance costs for a specialized workforce, create a strong disincentive to leave. For instance, in 2024, the average severance package in the Austrian manufacturing sector could represent a significant upfront cost for a departing firm.

- Specialized Assets: Food processing requires unique machinery that has limited resale value outside the industry.

- Long-Term Contracts: Commitments to suppliers and retailers can make exiting costly and complex.

- Employee Severance: Significant costs associated with laying off a skilled, specialized workforce.

- Capital Intensity: The high upfront investment in food processing facilities discourages quick exits.

Strategic Stakes

When competitors view the fruit preparation market as a critical component of their broader food ingredient offerings, their strategic stakes are significantly heightened. This often translates into a willingness to deploy substantial resources and engage in aggressive competition to secure or defend market share. For instance, companies with extensive dairy or bakery ingredient divisions might see fruit preparations as essential for cross-selling and maintaining customer loyalty, driving intense rivalry.

This intense rivalry can manifest in prolonged periods of price wars, increased marketing spend, and accelerated product innovation. Companies are less likely to cede ground when the market is perceived as vital to their overall business strategy and profitability. In 2024, the global fruit preparation market was valued at approximately USD 14.5 billion, with projections indicating continued growth, making it an attractive area for strategic investment and thus fueling competitive pressures.

- High Strategic Stakes: Competitors with diversified food ingredient portfolios often consider fruit preparations crucial for their overall market presence and customer retention.

- Aggressive Investment: Companies with high stakes are more inclined to invest heavily in R&D, marketing, and capacity expansion to gain or maintain market leadership.

- Intense Rivalry: This leads to sustained competitive battles, potentially involving price adjustments and aggressive promotional activities to capture market share.

- Market Value: The global fruit preparation market's estimated USD 14.5 billion valuation in 2024 underscores its importance and the strategic incentives for major players.

The fruit preparation market is characterized by a high degree of competitive rivalry, driven by numerous players ranging from large international corporations to smaller regional specialists. This dynamic is further fueled by the sector's growth, particularly in organic and health-conscious segments, which attracts significant investment and encourages aggressive market strategies.

Differentiation is key to mitigating price wars; companies like Atys Austria GmbH focus on unique offerings such as organic ingredients or specialized blends to stand out. The global fruit preparation market was valued at approximately USD 14.5 billion in 2024, highlighting its strategic importance and the intense competition for market share.

High exit barriers, including specialized machinery and long-term contracts, keep companies invested even in challenging conditions, intensifying ongoing rivalry. When competitors view fruit preparations as vital to their broader ingredient portfolios, they are more likely to engage in aggressive tactics like price adjustments and increased marketing to maintain their position.

| Factor | Description | Impact on Atys Austria GmbH |

| Number of Competitors | Many global and regional players in the fruit preparation market. | Increased pressure on pricing and market share. |

| Product Differentiation | Similarity in offerings can lead to price-based competition. | Need for Atys Austria GmbH to focus on unique selling propositions like organic or custom blends. |

| Market Growth | Robust growth in organic and health-conscious segments. | Tends to temper rivalry by allowing expansion through new demand. |

| Strategic Stakes | Competitors with diversified portfolios see fruit preparations as crucial for cross-selling. | Drives aggressive investment and competition to maintain customer loyalty. |

| Exit Barriers | High capital investment in specialized equipment and long-term contracts. | Companies are less likely to exit, leading to sustained rivalry. |

SSubstitutes Threaten

The threat of substitutes for Atys Austria GmbH's fruit preparations is significant, primarily due to the availability of alternative ingredients that can replicate similar sensory and functional attributes. For instance, manufacturers can opt for artificial flavors, synthetic colors, or various natural sweeteners and thickeners to achieve desired product characteristics.

The ease with which customers can switch to these substitutes is directly tied to their accessibility and price. In 2023, the global market for artificial flavors was valued at approximately USD 4.5 billion, demonstrating a substantial competitive landscape. Similarly, the demand for natural sweeteners saw a compound annual growth rate of over 5% in the years leading up to 2024, indicating a growing preference and availability of alternatives.

The threat of substitutes for Atys Austria GmbH's fruit preparations is significant if alternative ingredients provide a similar or better price-performance ratio. Customers will readily switch if they can achieve comparable product qualities at a lower expense. For instance, if a competitor's processed fruit blend offers similar texture and flavor at a 15% lower cost, it poses a direct threat.

Atys's emphasis on natural ingredients, aligning with the growing clean label trend, could be a key differentiator. For example, a 2024 survey indicated that 60% of European consumers are willing to pay a premium for products with transparent and natural ingredient lists, giving Atys a potential performance edge over more heavily processed alternatives.

Customer willingness to switch from Atys Austria GmbH's fruit preparations to alternatives hinges on evolving consumer tastes and stringent regulatory landscapes. For instance, brands championing ‘natural’ or ‘clean label’ attributes are less inclined to replace genuine fruit components with synthetic substitutes, as this would dilute their core messaging. However, significant cost pressures can still compel even these brands to consider alternatives.

Technological Advancements in Substitutes

Innovations in food technology are continuously creating new avenues for substitutes that could challenge Atys Austria GmbH's market position. For instance, advancements in cellular agriculture and precision fermentation are enabling the development of lab-grown meats and dairy alternatives that mimic traditional products with increasing fidelity. These emerging technologies could offer consumers choices that are not only novel but also potentially more sustainable or cost-effective, directly impacting demand for Atys's current offerings.

The threat is amplified by the potential for customers to adopt more efficient in-house processing methods, reducing their reliance on external suppliers like Atys. Consider the growing accessibility of advanced flavor compounds and novel plant-based extracts. Companies that previously relied on specialized ingredients from suppliers might find it feasible to develop or source these components directly, thereby bypassing traditional supply chains. This trend, particularly evident in the artisanal food and beverage sector, highlights the need for Atys to remain agile.

Staying ahead of these technological shifts is paramount for Atys. For example, the global alternative protein market was valued at approximately USD 14.2 billion in 2023 and is projected to grow significantly in the coming years. Companies that fail to adapt to these evolving consumer preferences and technological capabilities risk losing market share to more innovative competitors or direct customer bypass. Atys must therefore actively monitor and potentially integrate these emerging technologies into its own product development and service offerings to effectively mitigate this threat.

- Technological Advancements: Innovations in food tech, such as cellular agriculture and precision fermentation, are creating novel substitutes.

- Customer In-house Processing: Increased availability of advanced flavor compounds and plant-based extracts empowers customers to process ingredients in-house.

- Market Impact: The alternative protein market, valued at USD 14.2 billion in 2023, shows the rapid growth and potential disruption from substitutes.

- Strategic Imperative: Atys must monitor and potentially adopt these technologies to counter the threat of substitutes and maintain market relevance.

Impact of Substitutes on Customer's Product Quality

The threat of substitutes for Atys Austria GmbH's fruit preparations hinges on how well these alternatives can match the sensory experience, nutritional content, and functional advantages of Atys's offerings. If substitutes significantly degrade the quality or consumer appeal of their customers' final products, then the threat is considerably reduced.

Atys's commitment to technical innovation plays a crucial role in mitigating this threat. By consistently developing fruit preparations that deliver superior quality, Atys aims to make it difficult for substitutes to gain a foothold.

- Sensory Replication: The ability of substitutes to replicate the taste, texture, and aroma of Atys's fruit preparations is a key factor.

- Nutritional Equivalence: Substitutes that cannot match the nutritional profile, such as vitamin content or sugar levels, pose a lower threat.

- Functional Performance: If alternative ingredients fail to provide the same stability, preservation, or processing characteristics as Atys's products, their threat diminishes.

- Innovation as a Defense: Atys's ongoing investment in R&D, for instance, their development of new flavor profiles or extended shelf-life solutions, directly counters the appeal of substitutes.

The threat of substitutes for Atys Austria GmbH's fruit preparations is directly linked to the price-performance ratio of alternative ingredients. If substitutes offer comparable quality at a lower cost, customer switching becomes more probable. For example, a 10% price reduction in a competitor's blended fruit concentrate could significantly impact Atys's market share.

Innovations in food technology are continuously introducing new substitutes that could challenge Atys. Advancements in flavor encapsulation and plant-based texturizers are creating options that mimic natural fruit characteristics more effectively. The global market for food texturizers alone was projected to reach over USD 50 billion by 2024, indicating the scale of innovation in this area.

Customer willingness to adopt substitutes is also influenced by evolving consumer preferences, particularly the demand for clean labels and natural ingredients. While Atys benefits from this trend, a significant shift towards highly processed, cost-effective alternatives could still pose a threat. For instance, a 2023 survey noted that while 70% of consumers prefer natural ingredients, price remains a primary decision factor for 45% when purchasing processed foods.

| Factor | Description | Impact on Atys | Example/Data Point |

| Price-Performance Ratio | Ability of substitutes to match Atys's quality at a lower cost. | High threat if substitutes are cheaper. | Competitor offering a 10% cheaper fruit concentrate. |

| Technological Advancements | Emergence of new ingredients mimicking fruit attributes. | Moderate to high threat depending on innovation speed. | Global food texturizer market projected over USD 50 billion by 2024. |

| Consumer Preferences | Shift towards natural ingredients vs. cost-consciousness. | Moderate threat if cost overrides natural preference. | 45% of consumers prioritize price in processed foods (2023). |

Entrants Threaten

Entering the fruit preparation sector demands significant capital for processing plants, specialized equipment, rigorous quality testing labs, and robust logistics networks. These considerable initial expenditures create a substantial hurdle for any new players looking to enter the market.

For instance, setting up a modern fruit processing facility can easily cost tens of millions of Euros, encompassing everything from advanced sorting machinery to sterile packaging lines. This high barrier means that only well-capitalized companies can realistically consider entering the industry.

Atys Austria GmbH, as part of the Agrana Group, benefits immensely from this. Agrana's existing, extensive infrastructure, including established production sites and distribution channels, significantly reduces the capital burden for Atys, giving it a competitive edge over potential new entrants who would need to build this from scratch.

Established companies like Atys Austria GmbH often possess significant economies of scale, particularly in procurement, production, and distribution. This allows them to achieve lower per-unit costs compared to potential newcomers. For instance, in the European automotive sector, major manufacturers leverage massive production volumes to negotiate better raw material prices, a feat difficult for a new entrant to replicate without substantial initial investment.

New entrants would find it challenging to match these cost efficiencies in the short to medium term, creating a considerable competitive hurdle. This cost disadvantage can deter new players from entering markets where established firms already benefit from these scale advantages, making it a robust barrier in mature industries.

New entrants often struggle to gain traction by securing access to established distribution channels. Building the necessary relationships with major food manufacturers and retailers can be a significant hurdle, as existing players typically hold long-standing agreements and established trust. This can create a substantial barrier to entry for newcomers aiming to compete in the market.

Atys Austria GmbH, however, is well-positioned to mitigate this threat. Its integration within the broader Atys Group, coupled with access to Agrana's extensive and well-established distribution network, provides a significant advantage. This network allows for efficient product placement and reach, a crucial element for success in the food industry.

Product Differentiation and Brand Loyalty

The capacity of established players like Atys Austria GmbH to deliver uniquely tailored products and cultivate strong customer relationships significantly erects barriers for newcomers. Atys Austria GmbH's dedication to specialized, organic fruit preparations and its provision of extensive customer support services are key elements in fostering this loyalty. Potential new entrants would need to present a distinctly superior or novel offering to effectively draw customers away.

For instance, in the broader European fruit preparation market, companies that invest heavily in research and development to create patented flavor profiles or sustainable sourcing practices often command higher market share. A 2024 report indicated that brands with a strong sustainability narrative saw a 15% increase in consumer preference compared to those without. This highlights the challenge for new entrants who must not only match existing quality but also innovate in areas that resonate with today's consumers.

- Product Uniqueness: Atys Austria GmbH differentiates through its focus on organic and specialized fruit preparations, a niche that requires significant expertise and sourcing capabilities.

- Customer Loyalty Programs: Building brand loyalty through consistent quality, reliable service, and potentially loyalty incentives makes it harder for new competitors to gain traction.

- Service Integration: Offering comprehensive services alongside products, such as customized blending or logistical support, creates a stickier customer relationship.

- Barriers to Entry: New entrants must overcome the established brand reputation and customer loyalty by offering a compelling and differentiated value proposition.

Regulatory and Legal Barriers

The food ingredient sector faces significant regulatory hurdles that deter new entrants. Compliance with stringent health, safety, and quality standards, such as HACCP, ISO 22000, and specific national food safety certifications, demands considerable upfront investment and specialized knowledge. For instance, in 2024, the European Food Safety Authority (EFSA) continued to emphasize rigorous risk assessments for novel food ingredients, adding another layer of complexity for any newcomer aiming to introduce innovative products.

These regulatory requirements extend to detailed labeling mandates and strict ingredient sourcing protocols, ensuring traceability and consumer safety. Navigating this intricate web of rules requires substantial financial resources and dedicated legal and technical expertise, creating a high barrier to entry for smaller or less established companies looking to compete with established players like Atys Austria GmbH.

- Stringent Certifications: Food ingredient companies must obtain certifications like ISO 22000 and HACCP, which are costly and time-consuming.

- Complex Labeling Laws: Adhering to diverse national and international labeling regulations requires significant legal and administrative resources.

- Ingredient Sourcing Scrutiny: Ensuring the safety and traceability of all sourced ingredients adds operational complexity and cost.

- Evolving Regulations: Continuous updates to food safety laws, such as those from EFSA in 2024, necessitate ongoing adaptation and investment.

The threat of new entrants in the fruit preparation sector is moderate, primarily due to high capital requirements for establishing processing facilities and obtaining necessary certifications.

Significant investment in advanced machinery, quality control labs, and logistics networks, often running into millions of Euros, acts as a substantial deterrent.

Existing players like Atys Austria GmbH benefit from established economies of scale in procurement and production, making it difficult for newcomers to match their cost efficiencies.

Furthermore, securing access to established distribution channels and building customer loyalty through unique product offerings and integrated services present considerable challenges for new market entrants.

| Barrier to Entry | Impact on New Entrants | Atys Austria GmbH Advantage |

|---|---|---|

| Capital Investment | High (tens of millions of Euros for facilities) | Leverages Agrana's existing infrastructure |

| Economies of Scale | Challenging to match existing cost efficiencies | Benefits from large-scale procurement and production |

| Distribution Channels | Difficult to secure established relationships | Utilizes Agrana's extensive distribution network |

| Product Differentiation & Loyalty | Requires superior or novel offerings | Focus on organic/specialized products, strong customer service |

| Regulatory Compliance | Costly and time-consuming (HACCP, ISO 22000) | Established compliance processes |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Atys Austria GmbH is built upon a robust foundation of data, including company annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant Austrian economic indicators.