Atrys Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atrys Bundle

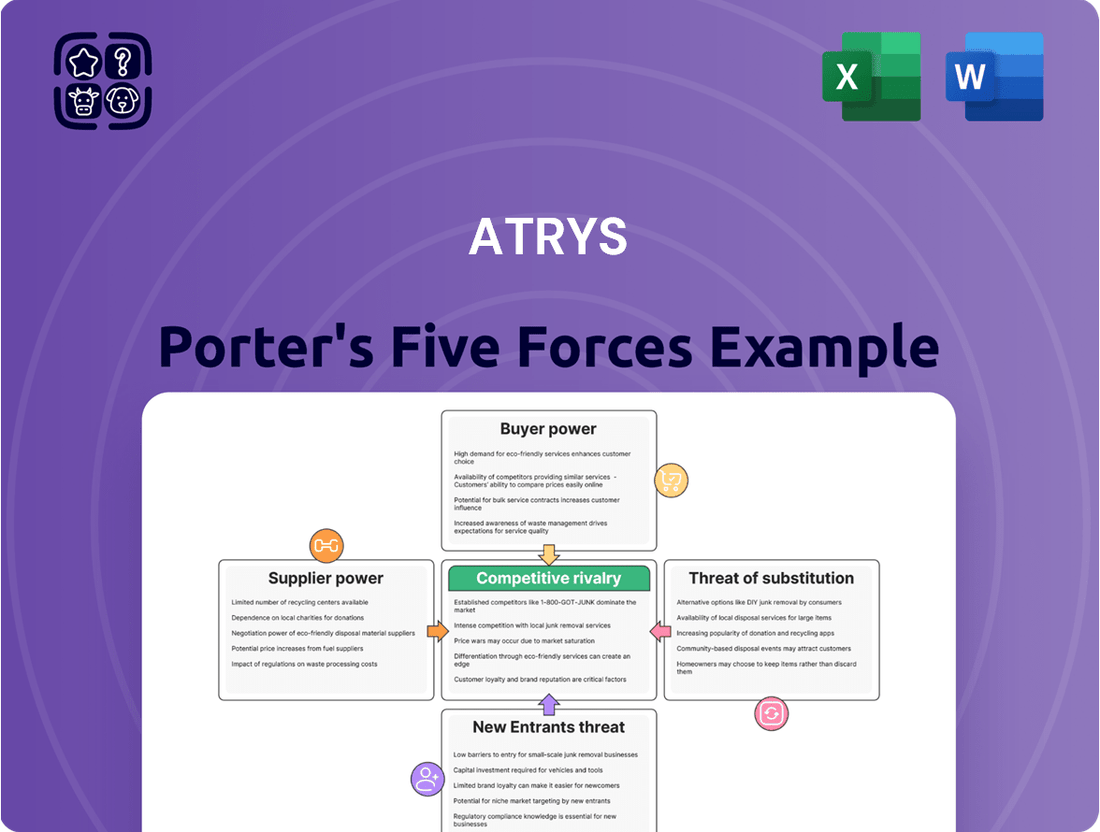

Understanding the competitive landscape is crucial for any business, and Atrys is no exception. Our Porter's Five Forces analysis meticulously dissects the key factors influencing Atrys's industry, from the bargaining power of its customers and suppliers to the intensity of rivalry among existing players and the constant threat of new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Atrys’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Atrys Health's reliance on highly specialized medical imaging, radiation oncology, and genomic sequencing technologies places significant bargaining power in the hands of their providers. These suppliers often possess proprietary knowledge and limited competition, allowing them to influence pricing and terms. For instance, the market for advanced linear accelerators used in radiation oncology is dominated by a few key players, meaning Atrys may face substantial costs and integration challenges when considering alternative vendors.

The bargaining power of suppliers for Atrys Health is significantly influenced by the availability of highly skilled medical and technical professionals. Oncologists, radiologists, geneticists, and AI specialists are essential inputs, and their scarcity can lead to increased leverage for these individuals. This translates into higher salary demands, more attractive benefit packages, and specific working condition requirements, directly impacting Atrys' operational costs and strategic growth plans.

Atrys faces intense competition to attract and retain this specialized talent. For instance, the demand for AI specialists in healthcare surged in 2024, with reported salary increases of up to 20% for experienced professionals in this field. This competitive landscape can escalate labor expenses, potentially creating bottlenecks for Atrys' expansion initiatives if the recruitment pipeline falters.

Atrys's reliance on AI and telemedicine platform developers means it depends on specialized software vendors and cloud infrastructure providers. These suppliers, especially those offering proprietary AI algorithms or unique platform functionalities, can hold significant bargaining power. This power translates into potential influence over licensing costs, ongoing maintenance fees, and the direction of future technological advancements.

The digital infrastructure underpinning Atrys's operations makes it susceptible to price hikes or service interruptions from these critical technology partners. For instance, the global cloud computing market, a key component for telemedicine platforms, was projected to reach over $1.3 trillion by 2024, indicating the substantial investment and dependence on these providers.

Data and Information Providers

Atrys, operating in precision medicine, relies heavily on data, including patient information, genomic libraries, and clinical studies. Suppliers of this essential data, such as research bodies, data aggregators, and other healthcare entities, can exert significant influence. The scarcity and proprietary characteristics of specific datasets can result in elevated procurement expenses or stringent usage limitations, potentially hindering Atrys's capacity to develop and enhance its diagnostic and therapeutic algorithms.

The bargaining power of data and information providers for Atrys is influenced by several factors:

- Data Uniqueness and Exclusivity: Proprietary datasets, particularly those with rare genetic markers or extensive longitudinal patient histories, command higher prices and can be subject to exclusive licensing agreements, limiting Atrys's access to competitive alternatives.

- Consolidation of Data Aggregators: As the market for health data matures, a few large data aggregators may emerge, consolidating vast amounts of information and increasing their leverage over companies like Atrys. In 2024, the global healthcare data analytics market was valued at approximately $20.1 billion and is projected to grow significantly, indicating increasing reliance on these providers.

- Regulatory Compliance Costs: Suppliers investing in robust data security and compliance with regulations like GDPR and HIPAA may pass these costs onto buyers, effectively increasing the cost of accessing quality data.

Pharmaceutical and Radiopharmaceutical Companies

Suppliers in the pharmaceutical and radiopharmaceutical sectors often wield significant bargaining power. This is largely due to patent protection that grants exclusivity for innovative drugs, coupled with the rigorous and lengthy regulatory approval pathways, like those overseen by the FDA and EMA. These factors create high barriers to entry, limiting the number of viable suppliers for specialized treatments. For companies like Atrys, which may require specific radiopharmaceuticals for its diagnostic and treatment planning services, this can translate into less favorable pricing and supply agreements, directly impacting the cost structure of their integrated care solutions.

The essential nature of pharmaceutical products for patient health further bolsters supplier leverage. When specific drugs or radiopharmaceuticals are critical for effective patient care, buyers have limited alternatives, making them more susceptible to supplier-dictated terms. This dynamic is particularly relevant in niche areas of oncology where specialized agents are required. For instance, the global radiopharmaceutical market was valued at approximately $5.6 billion in 2023 and is projected to grow, driven by advancements in diagnostic imaging and targeted therapies, indicating a strong demand that suppliers can capitalize on.

- Patent Protection: Exclusive rights for new drugs limit competition, giving patent holders pricing power.

- Regulatory Hurdles: Complex approval processes for pharmaceuticals create high barriers to entry for new suppliers.

- Essential Nature of Products: The critical role of medicines in healthcare reduces buyer negotiation power.

- Market Concentration: In specialized fields like radiopharmaceuticals, a few key suppliers may dominate, increasing their leverage.

Atrys Health's suppliers, particularly those providing specialized medical equipment and proprietary software, hold considerable bargaining power. This is due to factors like limited competition, high switching costs, and the essential nature of their offerings in advanced medical services. For instance, the market for advanced imaging equipment is often dominated by a few key manufacturers, allowing them to dictate terms and pricing.

The scarcity of highly skilled professionals, such as specialized oncologists and AI experts, also empowers suppliers of human capital. In 2024, the demand for AI specialists in healthcare saw significant salary increases, impacting Atrys's recruitment costs and operational expenses. This reliance on niche talent means these professionals, and the firms that can attract them, have substantial leverage.

Furthermore, Atrys's dependence on unique data sets and pharmaceutical products, especially radiopharmaceuticals, strengthens supplier bargaining power. Patent protection for drugs and the proprietary nature of specialized data limit alternatives, leading to higher procurement costs. The global radiopharmaceutical market, valued at approximately $5.6 billion in 2023, highlights the significant financial impact of these specialized suppliers.

| Supplier Category | Key Bargaining Factors | Impact on Atrys | Relevant Data/Trend (2024) |

|---|---|---|---|

| Specialized Medical Equipment | Limited competition, high switching costs | Higher equipment acquisition costs, potential integration challenges | Dominance of a few key manufacturers in radiation oncology equipment. |

| Skilled Medical/Technical Professionals | Scarcity of talent, high demand | Increased labor costs, potential recruitment bottlenecks | Up to 20% salary increases for AI specialists in healthcare. |

| Proprietary Software/AI Platforms | Unique functionalities, vendor lock-in | Higher licensing and maintenance fees, dependence on vendor roadmaps | Global cloud computing market projected over $1.3 trillion. |

| Data Providers | Data uniqueness, exclusivity, market consolidation | Elevated data procurement expenses, usage restrictions | Global healthcare data analytics market valued at $20.1 billion. |

| Pharmaceuticals/Radiopharmaceuticals | Patent protection, regulatory hurdles, essential nature | Less favorable pricing, supply chain vulnerabilities | Radiopharmaceutical market valued at $5.6 billion (2023). |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Atrys's specific position in the diagnostics and radiopharmacy market.

Swiftly identify and address competitive threats with a visual breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

Hospitals and clinical networks represent a significant customer segment for Atrys, particularly for its advanced diagnostics and treatment planning services. These large institutions often possess substantial purchasing power due to their high volume of needs and established vendor relationships. In 2024, the healthcare sector continued to see consolidation, with larger hospital systems wielding even more influence in procurement.

Their ability to negotiate favorable pricing and service terms is amplified by their potential to consolidate demand across multiple facilities or even explore in-house development of certain diagnostic capabilities. This leverage can put pressure on Atrys to offer competitive pricing and demonstrate clear value propositions to secure and retain these key clients.

In many healthcare systems, insurance companies and third-party payers act as the primary customers, wielding considerable influence over patient access and reimbursement levels. Their substantial market share allows them to dictate terms and significantly impact pricing for diagnostic and treatment services.

These powerful payers, due to their sheer size and ability to steer patient volume, possess immense bargaining power. This directly affects Atrys's revenue streams, as securing favorable contracts and reimbursement rates is crucial for maintaining profitability in a market where payers can exert downward pressure on prices.

For instance, in 2024, the average reimbursement rate for diagnostic imaging procedures saw a slight decrease in several key markets, underscoring the ongoing negotiation challenges faced by healthcare providers like Atrys when dealing with large insurance entities.

While individual patients might seem to have limited sway, their collective decisions and the recommendations they receive from doctors are incredibly important. For treatments like precision medicine, patients are often well-informed and can compare different healthcare providers, especially when seeking second opinions or specialized care. For example, a 2024 survey indicated that over 60% of patients actively research their treatment options online before consulting a doctor, highlighting their proactive engagement.

Atrys's success hinges on its ability to attract and retain these informed patients. Factors like the company's established reputation for positive clinical outcomes and the ease of accessing its telemedicine services directly impact patient preferences. If patients find it simple to switch to competing services that offer similar or better value, this indirectly gives them a degree of bargaining power.

Research Institutions and Pharma Companies

Research institutions and pharmaceutical companies represent a significant customer segment for Atrys, particularly given its advanced genomics and AI capabilities. These sophisticated clients often require specialized diagnostic support for complex projects like clinical trials and drug development. Their needs are typically high-volume and demand rigorous vetting of service providers.

The bargaining power of these customers is substantial. They can exert influence through their ability to switch to alternative service providers or even develop some analytical capabilities in-house. This leverage allows them to negotiate favorable contract terms with Atrys, impacting pricing and service level agreements.

- High Switching Costs for Atrys: While customers can switch, Atrys may face significant costs in acquiring and retaining these specialized clients, further empowering them.

- Due Diligence Intensity: Pharmaceutical and research clients conduct extensive due diligence, increasing the effort Atrys must expend to secure contracts.

- Volume-Based Negotiation: The high-volume nature of their needs often translates into significant purchasing power, enabling them to negotiate better rates.

- Internal Capability Development: The potential for these clients to develop internal genomics and AI analysis capabilities acts as a constant threat, limiting Atrys's pricing flexibility.

Availability of Alternative Providers

The sheer number of diagnostic labs and oncology centers available, even those not specializing in precision medicine, significantly amplifies customer bargaining power. If patients believe comparable or adequate services are accessible elsewhere at a better price or with more ease, they can effectively push Atrys on its pricing or choose alternative providers.

For instance, in 2024, the global in-vitro diagnostics market was valued at approximately $100 billion, indicating a highly competitive landscape with numerous established and emerging players offering a wide array of services. This broad availability means patients have options, forcing Atrys to demonstrate clear value.

- High Market Saturation: The presence of many diagnostic and oncology providers creates a buyer's market.

- Price Sensitivity: Customers can leverage alternative offerings to negotiate better prices with Atrys.

- Convenience Factor: Easier access to less specialized but still functional services can sway customer choice.

- Differentiation Imperative: Atrys's unique AI-driven precision medicine approach is crucial for retaining customers against these alternatives.

The bargaining power of customers for Atrys is substantial, driven by several key factors. Large hospital systems, insurance companies, and sophisticated research clients can leverage their volume and market influence to negotiate favorable terms, impacting Atrys's pricing and profitability. Even individual patients, empowered by information and access to alternatives, can exert pressure, particularly when Atrys's specialized services are compared against a broader market of diagnostic providers.

| Customer Segment | Source of Bargaining Power | Impact on Atrys | 2024 Data Point |

|---|---|---|---|

| Hospitals & Clinical Networks | High volume purchasing, consolidation of demand | Pressure on pricing and service terms | Healthcare sector consolidation continued |

| Insurance Companies & Payers | Market share, steering patient volume | Dictate reimbursement levels, downward price pressure | Average diagnostic imaging reimbursement rates saw slight decrease |

| Research Institutions & Pharma | High-volume needs, potential for in-house development | Negotiate favorable contract terms, limit pricing flexibility | Global in-vitro diagnostics market valued at ~$100 billion |

| Individual Patients | Information access, seeking second opinions, availability of alternatives | Indirect influence on provider choice and pricing perception | Over 60% of patients researched treatment options online |

Preview the Actual Deliverable

Atrys Porter's Five Forces Analysis

This preview shows the exact Atrys Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written document, complete with a thorough breakdown of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The precision medicine and advanced diagnostics field is a hotbed of innovation, drawing substantial capital and fostering a growing number of specialized competitors. This dynamic environment means Atrys is not operating in a vacuum; it's navigating a landscape populated by a diverse set of rivals.

Atrys contends with established diagnostic giants broadening their genomic capabilities, major hospital networks building out their own cutting-edge centers, and nimble AI-focused health tech startups entering the fray. For instance, in 2024, the global precision medicine market was valued at approximately $75.4 billion, with projections indicating robust growth, underscoring the intense interest and, consequently, the competitive pressures.

This influx of specialized players intensifies rivalry as they battle for crucial market share, top-tier talent, and strategic collaborations. Such competition can translate into downward pressure on pricing for services and necessitate increased investment in marketing and business development to stand out.

Atrys's competitive intensity is significantly shaped by its unique integration of medical imaging, radiation oncology, genomics, AI, and telemedicine. This comprehensive approach allows for a distinct value proposition compared to rivals offering only isolated services. For instance, in 2024, the global AI in healthcare market was projected to reach over $150 billion, highlighting the growing demand for advanced technological solutions that Atrys aims to capture through its integrated offerings.

Competitors providing similar or partially integrated services pose a direct challenge, necessitating Atrys's commitment to continuous innovation to sustain its technological advantage. The market for radiation oncology alone is expected to grow substantially, with various players vying for market share. Atrys must therefore consistently enhance its offerings, particularly its AI-driven diagnostic and treatment planning tools, to stay ahead.

The effectiveness of Atrys's AI platforms and the seamlessness of its telemedicine services are crucial differentiators in a market that is becoming increasingly crowded. As of early 2024, telemedicine adoption rates remained high, with patients and providers valuing convenience and accessibility. Atrys's ability to deliver these services efficiently and effectively, powered by its advanced AI, will be key to its success against competitors who may only offer one or two of these integrated components.

The precision medicine and advanced diagnostics market is experiencing robust growth, which can temper competitive rivalry by allowing multiple companies to expand without intense direct conflict. For instance, the global precision medicine market was valued at approximately $61.2 billion in 2023 and is projected to reach $125.7 billion by 2030, growing at a CAGR of 10.8%.

However, as the market matures, or in specific segments with slower growth, the battle for market share intensifies, forcing companies like Atrys to differentiate more aggressively. This dynamic means that while overall expansion is positive, the intensity of competition can vary significantly across different diagnostic areas.

Furthermore, the trend of industry consolidation, marked by mergers and acquisitions, directly impacts competitive intensity. Larger, consolidated entities often possess greater resources for research and development, sales, and marketing, presenting a more formidable competitive challenge to smaller or mid-sized players such as Atrys.

Exit Barriers and Industry Overcapacity

High exit barriers, like substantial investments in specialized medical equipment and long-term commitments, can trap less profitable companies in the healthcare sector. This situation often results in industry overcapacity, forcing businesses to engage in aggressive pricing to retain customers, thereby intensifying rivalry.

For Atrys, this means navigating a landscape where some competitors may be reluctant to leave, even when facing financial difficulties. This can lead to prolonged price wars and a constant pressure to maintain market share.

- High Capital Investments: The healthcare industry, particularly in specialized areas like oncology and radiology where Atrys operates, requires significant upfront investment in advanced technology and facilities. For instance, a single linear accelerator for radiotherapy can cost upwards of $1 million, and upgrading these systems is a continuous expense.

- Specialized Assets: Repurposing highly specialized healthcare assets, such as diagnostic imaging machines or treatment centers, for other industries is often impractical or impossible, creating a strong disincentive to exit.

- Long-Term Contracts: Healthcare providers often enter into long-term contracts with suppliers, insurers, and even patients, making a swift departure from the market complex and financially burdensome.

- Overcapacity Impact: In 2024, certain sub-sectors of diagnostic imaging in some European markets experienced utilization rates below 60%, a clear indicator of overcapacity, which fuels competitive pricing pressures.

Access to Talent and Strategic Partnerships

Competitive rivalry in the healthcare technology sector, particularly for companies like Atrys, extends significantly beyond service offerings to encompass the critical acquisition of top talent and the formation of strategic partnerships. This intense competition for skilled professionals, including leading medical experts, data scientists, and AI engineers, directly impacts a company's ability to innovate and deliver cutting-edge services.

Securing these vital alliances with prestigious research institutions, major hospital networks, and pioneering technology firms offers a substantial competitive edge. The ongoing pursuit of these collaborations intensifies the rivalry, as players vie for access to specialized knowledge, advanced research capabilities, and integrated healthcare systems. For instance, in 2024, the demand for AI specialists in healthcare saw a significant surge, with reported salary increases of up to 20% for experienced professionals in key markets.

- Talent Acquisition: Companies are increasingly investing in recruitment and retention strategies to attract scarce AI and medical expertise.

- Strategic Alliances: Partnerships with academic medical centers are crucial for clinical validation and market access.

- Innovation Hubs: The development of internal innovation hubs and partnerships with tech giants are key differentiators.

- Data Access: Exclusive partnerships with healthcare providers can grant access to valuable datasets for AI model training.

The competitive landscape for Atrys is characterized by intense rivalry from established diagnostic giants, expanding hospital networks, and innovative AI startups, all vying for market share in the rapidly growing precision medicine sector. This dynamic environment, underscored by the global precision medicine market's valuation of approximately $75.4 billion in 2024, necessitates continuous innovation and strategic differentiation.

Atrys differentiates itself through its integrated approach, combining medical imaging, radiation oncology, genomics, AI, and telemedicine, a stark contrast to competitors offering isolated services. The significant growth in the AI in healthcare market, projected to exceed $150 billion in 2024, highlights the demand for such advanced, integrated solutions.

The intensity of this rivalry is further amplified by high capital investments in specialized medical equipment and the difficulty of exiting the market due to specialized assets and long-term contracts. This can lead to overcapacity and aggressive pricing strategies, as seen in certain diagnostic imaging sub-sectors in 2024 with utilization rates below 60%.

Competition also extends to the critical acquisition of top talent, with a significant surge in demand for AI specialists in healthcare leading to salary increases of up to 20% for experienced professionals in key markets as of early 2024. Strategic alliances with academic medical centers and tech giants are crucial for clinical validation and market access, further intensifying the battle for competitive advantage.

| Key Competitor Type | Atrys's Integrated Offering | Competitive Factor | 2024 Market Insight |

| Established Diagnostic Giants | Comprehensive genomic capabilities | Market share, talent acquisition | Growing demand for integrated diagnostics |

| Hospital Networks | In-house advanced centers | Service integration, patient access | Increased investment in specialized facilities |

| AI Health Tech Startups | Nimble AI-focused solutions | Technological innovation, data analytics | AI in healthcare market projected over $150 billion |

| Radiation Oncology Providers | AI-driven treatment planning | Technological advantage, pricing | Substantial growth in radiation oncology market |

SSubstitutes Threaten

The most direct substitutes for Atrys's precision medicine offerings are traditional diagnostic tests like standard biopsies and conventional imaging, alongside established treatments such as general chemotherapy or broad-spectrum radiation. These methods, while less targeted, are often more accessible and can be more cost-effective, presenting a notable threat, particularly for patients or healthcare systems facing budget limitations or dealing with less complex medical conditions.

General healthcare providers and local clinics present a threat of substitutes for Atrys, particularly for less complex diagnostic needs. These facilities often offer more accessible and lower-cost services, making them an attractive option for initial screenings or routine medical issues. For instance, a 2024 report indicated that the average cost for a basic diagnostic imaging scan at a community clinic can be up to 30% lower than at a specialized center.

While these general providers may not possess Atrys's advanced capabilities in genomics or integrated oncology, their convenience and affordability can divert patients who don't immediately require highly specialized care. This is especially true in regions where access to advanced medical technology is limited or where cost is a primary concern for a significant portion of the population. This can impact Atrys's market share for services that have readily available, albeit less sophisticated, alternatives.

The rise of direct-to-consumer health tech, like simplified genetic testing kits and wearable health trackers, presents a potential substitute for certain Atrys services. These consumer-grade options, while not offering the clinical depth of professional diagnostics, might influence individuals to opt for basic health insights instead of more complex, professional pathways.

Alternative Therapies and Wellness Approaches

The threat of substitutes for Atrys, particularly in its diagnostic and treatment offerings, is present as patients increasingly explore alternative therapies and wellness approaches. For certain conditions, individuals might opt for holistic programs or lifestyle changes instead of or alongside conventional medical interventions. This is especially true for chronic disease management and preventative care where the focus is on overall well-being.

While Atrys is rooted in scientific and clinical advancements, the broader healthcare market includes options that can be seen as substitutes. For instance, the global wellness market was valued at approximately $5.6 trillion in 2023, indicating a significant consumer interest in non-traditional health solutions. This trend suggests that while Atrys offers advanced medical diagnostics, some patients may prioritize or supplement these with alternative methods.

These substitutes can range from dietary interventions and mindfulness practices to complementary and alternative medicine (CAM) modalities. For example, a significant portion of the population, estimated to be around 30-40% in many developed countries, utilizes some form of CAM annually. This broad adoption highlights the potential for these approaches to act as substitutes, impacting the demand for Atrys's specialized services.

The impact of these substitutes can vary depending on the specific condition being addressed. For less severe or chronic ailments, the appeal of alternative therapies might be higher. However, for acute conditions or those requiring sophisticated diagnostic tools like those Atrys provides, the substitutability is generally lower. Nevertheless, the growing acceptance and accessibility of wellness-focused alternatives represent a continuous factor that Atrys must consider in its strategic planning.

Evolving Pharmaceutical Solutions

The threat of substitutes in the pharmaceutical space is significant, particularly with advancements in broad-spectrum drug development. If new medications emerge that offer high efficacy without the need for complex, precision diagnostics, this could directly challenge Atrys's personalized treatment model. For instance, a hypothetical breakthrough in a universally effective antiviral that bypasses the need for specific genetic sequencing could reduce demand for Atrys's diagnostic services.

The pharmaceutical industry saw substantial growth in 2024, with global pharmaceutical market revenue projected to reach over $1.6 trillion. This expanding market, driven by innovation, presents opportunities for substitute therapies to gain traction. Atrys must continuously highlight the superior long-term outcomes and cost-effectiveness of its precision diagnostics and targeted therapies to counter this evolving threat.

- Broad-Spectrum Drugs: Development of highly effective, one-size-fits-all medications that reduce the need for personalized diagnostics.

- Diagnostic Bypass: New treatments that achieve desired outcomes without requiring the specific diagnostic pathways Atrys offers.

- Market Dynamics: The overall growth in the pharmaceutical sector (projected over $1.6 trillion in 2024) fuels innovation, potentially leading to more substitutable solutions.

- Competitive Imperative: Atrys must consistently prove the value and efficacy of its precision approach to maintain market share against these potential substitutes.

The threat of substitutes for Atrys's precision medicine services stems from accessible, lower-cost alternatives and evolving wellness trends. While less sophisticated, these options can divert patients, especially those with less complex needs or budget constraints. The growing wellness market and advancements in broad-spectrum pharmaceuticals also present significant competitive pressures.

| Substitute Type | Description | Potential Impact on Atrys | 2024 Data/Trend |

|---|---|---|---|

| Traditional Diagnostics/Treatments | Standard biopsies, conventional imaging, general chemotherapy. | Lower cost and higher accessibility can attract price-sensitive or less complex cases. | Community clinics offer scans up to 30% cheaper than specialized centers. |

| Wellness & Alternative Therapies | Dietary interventions, mindfulness, CAM. | Appeals to a segment prioritizing holistic health, potentially reducing demand for specialized interventions. | Global wellness market valued at $5.6 trillion in 2023; 30-40% of people in developed nations use CAM annually. |

| Direct-to-Consumer Health Tech | Simplified genetic testing kits, wearable trackers. | May satisfy basic health curiosity, potentially delaying or replacing professional diagnostic pathways. | Increasing consumer adoption of personal health monitoring devices. |

| Broad-Spectrum Pharmaceuticals | Highly effective, one-size-fits-all medications. | Could diminish the need for precise diagnostics if treatments become universally effective. | Global pharmaceutical market projected over $1.6 trillion in 2024, fueling innovation in drug development. |

Entrants Threaten

The precision medicine and advanced diagnostics sector demands massive capital outlays. Companies need to invest heavily in cutting-edge medical imaging, radiation therapy equipment, genomic sequencing technology, and robust IT systems for AI and telemedicine. For instance, a single advanced linear accelerator for radiation therapy can cost upwards of $2 million, and comprehensive genomic sequencing platforms represent millions more in initial investment.

The healthcare sector, particularly for advanced diagnostics and treatments like those offered by Atrys, is governed by a labyrinth of regulations. New companies must secure numerous licenses, certifications, and product approvals, a process that can stretch for years and incur substantial costs, potentially running into millions of dollars for clinical trials and regulatory submissions.

For instance, gaining approval from bodies like the FDA in the US or the EMA in Europe for novel medical devices or therapies is a rigorous and expensive undertaking. These requirements act as a significant deterrent to potential new entrants, creating a substantial barrier to entry that Atrys, as an established player, has already overcome.

Building a team that can effectively combine medical imaging, radiation oncology, genomics, AI, and telemedicine demands a unique blend of medical, scientific, and technological skills. This specialized talent is not readily available, making it a significant hurdle for newcomers.

Atrys has likely spent considerable time and resources cultivating its expert workforce. The difficulty in attracting and retaining such a diverse and highly specialized talent pool presents a substantial barrier to entry, as new companies would face immense challenges in replicating this human capital advantage.

Brand Reputation, Clinical Outcomes, and Trust

The threat of new entrants in the healthcare sector, particularly for companies like Atrys that focus on specialized diagnostics and treatments, is significantly mitigated by the critical importance of brand reputation, clinical outcomes, and patient trust. Established entities have cultivated these over years, making it a substantial barrier for newcomers.

In 2024, building trust in healthcare is even more crucial, with patient satisfaction scores and physician referrals acting as key performance indicators. For instance, a study by the National Institutes of Health in 2023 indicated that over 70% of patients consider a provider's reputation a primary factor in their decision-making. Atrys, having demonstrated consistent positive clinical outcomes, benefits from this established goodwill.

New entrants face a steep uphill battle in replicating this level of credibility. They would require substantial investment in demonstrating efficacy and safety, alongside extensive marketing efforts to reach patients, physicians, and crucial referring networks. This lengthy process, often taking many years, makes rapid market share acquisition by new players exceptionally challenging.

- Brand Reputation: Years of positive patient experiences and successful treatments are difficult to replicate quickly.

- Clinical Outcomes: Demonstrating consistent, high-quality results is paramount for patient and physician confidence.

- Trust Factor: Building deep trust with patients and referring healthcare professionals takes considerable time and proven reliability.

- Resource Intensive: New entrants need significant capital and time to establish credibility comparable to established players like Atrys.

Access to Data and Proprietary AI Models

Atrys's competitive edge is significantly bolstered by its proprietary artificial intelligence models and its access to vast troves of patient data. This data is crucial for the ongoing training and validation of these advanced AI systems.

New companies entering this space would encounter substantial hurdles in gathering enough high-quality, ethically sourced data. Without this critical data, developing AI algorithms that can compete with Atrys's offerings becomes exceedingly difficult.

The absence of proprietary data and well-established AI models acts as a considerable barrier to entry. This directly impedes a new entrant's capacity to deliver the sophisticated and accurate diagnostic and treatment solutions that are characteristic of market leaders like Atrys.

- Data Acquisition Costs: Building a comparable dataset could cost millions, potentially exceeding $10 million for a comprehensive medical AI training set.

- AI Model Development: Developing proprietary AI models requires significant investment in specialized talent and computational resources, often running into several million dollars annually.

- Regulatory Compliance: Navigating data privacy regulations like GDPR and HIPAA adds complexity and cost for new entrants.

The threat of new entrants for Atrys is relatively low due to the immense capital requirements for advanced medical technology and the lengthy, costly regulatory approval processes. For instance, establishing a new radiation oncology center can easily cost tens of millions of dollars, encompassing equipment, facility upgrades, and licensing.

Furthermore, the need for highly specialized talent, including oncologists, radiologists, and data scientists, presents a significant human capital barrier. Building a reputation for clinical excellence and patient trust, which Atrys has cultivated over years, is also a formidable challenge for newcomers, as demonstrated by patient satisfaction surveys where reputation is a key driver.

The proprietary AI models and vast datasets Atrys utilizes are also substantial entry barriers, requiring millions in investment for data acquisition and AI development, alongside navigating complex privacy regulations.

| Barrier Type | Estimated Cost/Timeframe for New Entrant | Impact on Atrys |

| Capital Requirements (Equipment & Facilities) | $20M - $50M+ | High |

| Regulatory Approvals | 2-5+ years, $1M - $5M+ | High |

| Specialized Talent Acquisition | Significant recruitment costs, long lead times | High |

| Brand Reputation & Trust Building | 5-10+ years, substantial marketing investment | High |

| Proprietary Data & AI Development | $5M - $15M+, ongoing R&D | High |

Porter's Five Forces Analysis Data Sources

Our Atrys Porter's Five Forces analysis leverages data from company financial reports, industry-specific market research, and publicly available regulatory filings to provide a comprehensive understanding of the competitive landscape.